Gbh-Form-990-Fy2020.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nhptv Prime Schedule Members and Viewers About April 2017 Our Programs

TELL US WHAT YOU THINK! WE LOVE TO HEAR FROM OUR NHPTV PRIME SCHEDULE MEMBERS AND VIEWERS ABOUT APRIL 2017 OUR PROGRAMS. DROP US A LINE AT ALPHABETICAL LIST OF PROGRAMS [email protected] OR CALL US AT 603-868-1100. THANKS! 10 PARKS THAT CHANGED AMERICA HOW TO FIND LOVE ONLINE 4/6 at 9p; 4/9 at 1p TAVIS SMILEY Tue - Fri at 12:30a 4/13 at 10p; 4/16 at 11:03p INDEPENDENT LENS THIS OLD HOUSE HOUR ALVIN AILEY AMERICAN DANCE 4/14 at 9p 4/3 at 9p; 4/17 at 10p; 4/24 at 10p 4/1, 4/8, 4/15 at 5p; 4/22 & 4/29 at 4:30p AMERICA’S TEST KITCHEN FROM IS YOUR BRAIN MALE OR FEMALE? 4/6 at 10p TO WALK INVISIBLE: THE BRONTE SISTERS COOK’S ILLUSTRATED ON MASTERPIECE 4/7 & 4/28 at 5a & 5:30a; 4/8, 4/15 & 4/29 at 5a; KATE 4/1 & 4/15 at 11:30p; 4/8 at 11:35p 4/1 at 8p Sat at 3p LAST DAYS OF JESUS 4/4 at 8p; 4/9 at 2p TRAVELSCOPE Sun at 5:30p ANTIQUES ROADSHOW Mon at 8p; 4/24 at 9p; 4/1 & 4/15 at 10p LET THERE BE LIGHT Thu 4/6 at 8p VERA Tue at 2a ASK THIS OLD HOUSE LIDIA’S KITCHEN Sat at 1:30p WATER WORKS Tue at 5p; Thu at 5p; 4/5 & 4/7 at 5p; 4/12, 4/13 & 4/17 at 9:30p; 4/22 at 5:30a; 4/23 at 1p 4/19 at 5:30a; 4/2 at 11:07p & 11:34p MARTHA BAKES Sat at 11:30a WEEKENDS WITH YANKEE 4/23 & 4/30 at 12:30p AUDUBON 4/23 at 11:32p MIDSOMER MURDERS Tue at 1a WILD WEATHER 4/30 at 11:03p BASIC BLACK 4/7 & 4/14 at 7:30p MIND OF A CHEF Sat at 2:30p WINDOWS TO THE WILD BBC WORLD NEWS AMERICA MOVEABLE FEAST WITH FINE COOKING 4/1 at 11p; Sun at 11a & 6p; 4/5 & 4/12 at 7:30p; 4/8 Weeknights at 5:30p Sat at 1p at 11:02p; 4/15 at 11p BORN TO EXPLORE WITH RICHARD WIESE NATURE -

WORLD and PBS Ed Release

FOR IMMEDIATE RELEASE MEDIA CONTACTS Erin Callanan 617-905-6866 (m) [email protected] Lubna Abuulbah [email protected] PBS and WGBH to Provide At-Home Learning Programs for Students and Educators Nationwide During School Closures Through WORLD Channel BOSTON (MarCh 26, 2020) – As schools across the country close in response to the COVID-19 virus, PBS and WGBH Boston have partnered to support distance learning. Beginning on Monday, March 30, the public media WORLD Channel from WGBH will provide a daily, five-hour At-Home Learning Service, for students in grades 6-12, to PBS stations nationwide. From 12 noon – 5 pm EDT weekdays, WORLD will offer programs on science, history and English language arts, and include related learning resources from PBS LearningMedia, a free online service of thousands of educational resources. (Check local listings for channel information and times.) “With WORLD channel available free over the air, these educational programs can reach all families, including those who do not have internet access or computers at home,” said Liz Cheng, general manager of television at WGBH and WORLD Channel. “We are proud to work with PBS stations across the country to make this service widely available.” The new broadcast programming will be supplemented with additional resources from PBS LearningMedia, which is partnering with the WORLD Channel. The resources in PBS LearningMedia, which were developed based on feedback from educators, are aligned to curriculum standards in every state and contextualized for educational use. These resources include grab-and-go activities, lesson plans, interactive lessons, and media that illustrate specific topics or themes and support materials across subjects. -

On Air, Online, on the Go Member Guide | October 2018 Advertisement Advertisement

American Experience/The Circus | 10 Nova/Addiction | 15 National Association of Black Journalists Awards | 26 ON AIR, ONLINE, ON THE GO MEMBER GUIDE | OCTOBER 2018 ADVERTISEMENT ADVERTISEMENT photography by Nat Rea CELEBRATING 40 YEARS IN BUSINESS 617-876-8286 www.shconstruction.com BEST OF BOSTON HOME 2017, 2016, 2015, 2012, 2011, 2010, 2008 / BEST OF BOSTON 2017, 2007 From the President Where to Tune in Issues of our Times TV Facebook has been an extraordinary innovation, allowing us to connect with friends and family across distance and time. But that personal sharing platform Digital broadcast FiOS RCN Cox Charter (Canada) Bell ExpressVu also has been used to exploit our private data and spread misinformation. Comcast Opioids offered great promise as pain-relieving medication. But their WGBH 2 2.1 2 2 2 2 2 284 widespread use and highly addictive nature have led to the deadliest drug WGBH 2 HD 2.1 802 502 602 1002 782 819 epidemic in US history. WGBX 44 44.1 16 44 14 804 21 n/a This month, WGBH examines these two major issues facing our society with unflinching focus and the in-depth reporting that is the hallmark of our WGBX 44 HD 44.1 801 544 n/a n/a n/a n/a public media documentary work. World 2.2 956 473 94 807 181 n/a In The Facebook Dilemma, Frontline investigates a series of warnings to Create 44.3 959 474 95 805 182 n/a Facebook as the company grew from a dorm room project to a global empire. -

A Roundtable Discussion of Emerging Recommendations for Principles, Policies, and Practices Roundtable Participants

A Roundtable Discussion of Emerging Recommendations for Principles, Policies, and Practices October 24 – 25, 2011 Madison, WI Roundtable Participants Malcolm Brett Malcolm Brett is Director of Broadcast and Media Innovations of Wisconsin Public University of Wisconsin Extension. He is responsible for Wisconsin Television and Radio Public Television, Wisconsin Public Radio and Media Innovations applied to broadcasting and education. Media Innovations includes research involving interactive/enhanced television, video delivery over Internet 2 and media asset management. Brett previously held the position of director of television for WPT. During the past two decades at WPT, Brett also has served as a production manager for the national program New Tech Times, corporate development manager, director of development and executive director of Friends of WHA-TV. His extensive knowledge of television production includes strategic planning, budgeting, government relations and community relations. He was named PBS Development Professional of the Year in 1998 for his involvement and expertise in corporate development and fundraising. Brett has spearheaded WPT's digital conversion, and has helped guide, design, fund or implement various WPT national public television models, including Evolving the Links, Best Practices in Journalism, Portal Wisconsin, Wisconsin Stories and SafeNight USA. In 2008, he was elected for a three-year term to the PBS board of directors. Editorial Integrity for Public Media: Roundtable Participants – 2 Clifford Christians Clifford Christians is the former director of the Institute of University of Illinois Communications Research and chair of the doctoral program in communications, a position he also held from 1987 to 2001. He has been a visiting scholar in philosophical ethics at Princeton University and in social ethics at the University of Chicago, and a PEW fellow in ethics at Oxford University. -

ON AIR, ONLINE, on the GO JANUARY 2018 | MEMBER GUIDE ADVERTISEMENTS from the President Where to Tune In

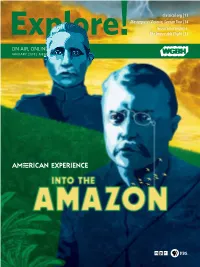

Classical.org | 13 Masterpiece/Victoria, Season Two | 14 Nova/Solar Impulse: The Impossible Flight | 21 ON AIR, ONLINE, ON THE GO JANUARY 2018 | MEMBER GUIDE ADVERTISEMENTS From the President Where to Tune in In with the New! TV We begin the new year in a spirit of exploration and adventure as we head into a new season of programming at WGBH. This month, WGBH brings you a host of inspiring, Digital broadcast FiOS RCN Cox Charter (Canada) Bell ExpressVu entertaining and educational premieres from Masterpiece, American Comcast Experience, Nova, Antiques Roadshow and more! WGBH 2 2.1 2 2 2 2 2 284 American Experience’s Into the Amazon (pg. 12) tells the remarkable WGBH 2 HD 2.1 802 502 602 1002 782 819 story of the 1914 journey taken by President Theodore Roosevelt (left) and WGBX 44 44.1 16 44 14 804 21 n/a Brazilian explorer Candido Rondon into the heart of the South American rainforest. With a crew of more than WGBX 44 HD 44.1 801 544 n/a n/a n/a n/a 140 Brazilians, Roosevelt and Rondon World 2.2 956 473 94 807 181 n/a set out to explore an uncharted Create 44.3 959 474 95 805 182 n/a Amazon tributary, along the way WGBH Kids 44.4 958 472 93 n/a 180 n/a battling the unforgiving landscape, Boston Kids & n/a 22 n/a 3 n/a n/a n/a disease and countless other dangers. Family (Boston only) “Like all great journeys, the story Channel numbers and availability may vary by community. -

The Geographies of the Black Henna Meme Organism and the Epidemic

THE GEOGRAPHIES OF THE BLACK HENNA MEME ORGANISM AND THE EPIDEMIC OF PARA-PHENYLENEDIAMINE SENSITIZATION: A QUALITATIVE HISTORY A dissertation submitted To Kent State University in partial fulfillment of the requirements for the degree of Doctor of Philosophy by Catherine Cartwright-Jones May, 2015 Copyright All rights reserved Except for previously published materials Dissertation written by Catherine Cartwright-Jones B.A. UCLA, 1972 M.A., Kent State University, 2006 Ph. D., Kent State University, 2015 Approved by ___________________________________________________ James Tyner, Full Professor, Ph.D., Geography, Doctoral Advisor ________________________________________________ Mandy Munro-Stasiuk, Chair and Full Professor, Ph.D., Geography ___________________________________________________ Scott Sheridan, Professor, Ph.D., Geography ___________________________________________________ Elizabeth Howard, Professor, Ph.D., , English Accepted by ___________________________________________________ Mandy Munro-Stasiuk, Chair, Ph.D., Department of Geography ___________________________________________________ James L. Blank, Ph.D., Interim Dean, College of Arts and Sciences TABLE OF CONTENTS Preface: Definitions and Style .....................................................................................................xxx I: Introduction to the Qualitative History of ‘Black Henna’ and the Epidemic of Para- phenylenediamine Sensitization…………………………………………………………...1 Two Case Studies of ‘Black Henna’ in the Third Space of Tourism: Camilla and Spider -

Noteworthy in July

Radio & TV Program Guide | July12 Noteworthy in July n WKAR-TV Celebrates the Jubilee with Programs on Britain n Reporter Gretchen Millich Retires n Come to our July Screenings! n Highlights from WKAR’s Events “Scrapbook.” College of Communication Arts and Sciences July12 July Screening Events WKAR will host two screenings this month at the station. These free events are a wonderful way to get a sneak preview of an upcoming WKAR program and hear a speaker who adds insight into the program. On Our Cover Celebrate the Fourth of July with a grand display of fire- works and music from the U.S. Capitol on A Capitol Fourth. (July 4, 8 & 9:30 p.m.) Mark Your Calendars! Old Town Jazz Fest Great Performances The Small Matter August 3-4 at the Met of Big Science The Great Lakes Wednesday, July 25, 7 p.m. at WKAR Monday, July 30, 7 p.m. at WKAR Folk Festival August 10-12 WKAR will host a sneak preview of the The Small Matter of Big Science is upcoming Great Performances at the a two-part video series exploring the WKAR will be at the Met production of Satyagraha. Preview evolution of science through the lens of Jazz Fest recording guest Molly Fillmore, an associate pro- nuclear physics. The first episode takes upcoming programs fessor of voice in the College of Music viewers from mankind’s basic curiosity about our origins all the way to modern for the new season at Michigan State University, appears isotope research at the National Super- of BackStage Pass. -

EXPLORE GBH NOVEMBER 2020 Crime May Not Pay, but Politics Sure Does

EXPLORE GBH NOVEMBER 2020 Crime may not pay, but politics sure does. Premiering Sun, 11/1 at 9pm GBH 2 and GBH Passport INSIDE 2 3 4 6 7 8 CONSIDER THIS DON’T MISS HIDDEN GEMS DRAMA JOURNALISM SCIENCE Celebrating diversity There’s something New England gets A new MASTERPIECE GBH News explores Rebuilding Notre is a core part of public for everyone in this top billing in this mix series stars Hugh the impact of the Dame is a challenge media’s mission month’s 4 Cool Things of local productions Laurie as a politician pandemic on for engineers and with a secret Massachusetts scientists students 9 10 11 13 14 FOR KIDS LIVING HISTORY MEMBERS COVER STORY Join Arthur and his From GBH WORLD: & CULTURE MATTER Discover how Native American women inspired family for a holiday a 24-hour binge- Delve into the Virtual events give the suffrage movement celebration a-thon of extra- unexpected richness members even more ordinary of Fiddler to explore stories on the Roof 17 18 20 TAKE TWO LEARNING ALL EARS A local man brings TOGETHER Enjoy a musical mix LOOK FOR a message of Molly of Denali of top artists and + 22 HAPPENINGS NATIONAL hope after life in models Alaska Native performances on 23 DONOR PATHWAYS NATIVE a concentration values while teaching Jazz 24/7 24 WHAT’S ON AMERICAN HERITAGE camp literacy skills 28 SAVOR MONTH 29 CALENDAR OF EVENTS PROGRAMS TELEVISION RADIO GBH PASSPORT GBH 89.7, GBH Passport is our newest member benefit Boston’s Local NPR® and your easy-access, on-demand library of wgbhnews.org public television favorites. -

Basic Black Premiere09 Vl

October 7, 2009 Press Contact: Karen Frascona 617.300.5465 [email protected] WGBHʼs Basic Black launches 2009-2010 season with 26 live episodes and new, interactive web portal Live, half-hour panel discussions air Thursdays on WGBH 2/HD beginning October 22 at 7:30pm and stream live at www.basicblack.org WGBH announced today that Basic Black returns for its 42nd season on the airwaves with 26 new episodes, premiering on Thursday, October 22 at 7:30pm on WGBH 2/HD. The new season features live panel discussions in a provocative and fresh examination of the black experience and an in-depth look at local and national current events. Simultaneously, the program streams online at its new companion web portal (www.basicblack.org), in concert with a live chat, so that the general public can join the discussion or comment online in real time. Each program features a core of rotating panelists, including: Callie Crossley, media analyst; Kim McLarin, writer; Latoyia Edwards, reporter, NECN; and Peniel Joseph, Professor of History, Tufts University. A fourth guest panelist, selected based on the topic of discussion, rounds out the weekly conversations. “By providing our audience with different perspectives on todayʼs hot topics, we hope to thoroughly engage our local and surrounding communities on multiple platforms,” says series producer Valerie Linson. In addition to the live stream of programs, the new Basic Black web portal offers visitors access to three distinct experiences, as well as interaction with other visitors and the opportunity to share views and opinions. The “Say Brother Collection” offers a look back into the history books, featuring exclusive, one-of-a-kind archival video segments from programs dating back to the sixties. -

2020 CPB Report

Local Content and Service 2020 GBH exists to engage, illuminate and inspire. Our vision is to be a pioneering leader in media that strengthens, includes and serves our diverse community, fostering growth and empowering individuals. INTRODUCTION 2020 In Service to the Community in a Year Like No Other 2020 was a year unlike any other, requiring all of us to recalibrate. The COVID-19 lockdown prompted a rapid pivot across all of GBH’s programs, events and services in order to continue to provide engaging and inspiring resources for our community. GBH worked to engage in new ways during this challenging time by: • Creating a new daily call-in radio program that focused on the impact of COVID-19 in our neighborhoods and fielded questions from listeners across the state • Airing and streaming musical performances when concert halls were closed • Providing broadcast and online resources for remote learning across the Commonwealth • Producing a virtual graduation ceremony for our high school seniors • Partnering with local community organizations and institutions to create dozens of new virtual events and forums including our first community book club and our monthly multiplatform community dialogue on The State of Race The State of Race panel © GBH Throughout the year we partnered with local organizations and community groups including the NAACP, Handel and Haydn Society, Boston Public Library, the Museum of Fine Arts, the cross-cultural professional organization Get Konnected, the Martin Luther King, Jr., legacy nonprofit King Boston, the Huntington Theatre Company and more to help amplify and support their efforts. Our nation’s reckoning with racism prompted us to deeply reflect and commit to making meaningful changes in how we operate and to offer new programming. -

WORLD Channel and Link TV Content Partnership Will Bring Award-Winning Programming to 100 Million+ Homes

For Immediate Release Contact: Erin Callanan JP Shields [email protected] [email protected] (617) 300-3270 (747) 201-5886 WORLD Channel and Link TV Content Partnership Will Bring Award-Winning Programming to 100 Million+ Homes January 22, 2020 -- WORLD Channel, a national public media broadcast and web-based platform that shares news and documentaries humanizing complex issues from across the globe, and Link TV, the independent non-commercial satellite TV network that connects U.S. viewers to the world, today announced a content-sharing partnership beginning in February. With a shared commitment to bringing the best in news, documentaries and fact-base information programming from around the world, the collaboration will launch with several titles including WORLD’s multicultural storytelling show Stories from the Stage, the duPont-Columbia Award-winning documentary series America ReFramed, Link TV’s acclaimed original environmental program Earth Focus co-produced with the Thomson Reuters Foundation, the award-winning series The Migrant Kitchen co-produced with Life & Thyme, and daily international newscasts from France 24. The content sharing will allow viewers of both networks to better understand perspectives and cultures around the globe while examining issues too often ignored by mainstream media. WORLD is a growing public media broadcast channel carried by 165 partner public media stations in markets representing more than 66% of US TV households and also is available via WORLDChannel.org and on social media platforms. Link TV reaches 30 million U.S. satellite households nationally on DIRECTV channel 375 and DISH Network channel 9410, and many of its programs are available for streaming on linktv.org as well as on Apple TV, YouTube and Roku platforms. -

ON AIR, ONLINE, on the GO MEMBER GUIDE | NOVEMBER 2018 ADVERTISEMENT from the President Where to Tune In

Nova/Thai Cave Rescue | 15 Keepers of the Light | 16 WGBH News: The Scrum politics podcast | 26 ON AIR, ONLINE, ON THE GO MEMBER GUIDE | NOVEMBER 2018 ADVERTISEMENT From the President Where to Tune in Our Past, TV Our Future In November, we are celebrating Native American Heritage Month with pro- Digital broadcast FiOS RCN Cox Charter (Canada) Bell ExpressVu grams that give recognition to the significant contributions of America’s First Comcast Peoples, many of them calling Massachusetts their home. WGBH 2 2.1 2 2 2 2 2 284 Native America (page 14) challenges everything we thought we knew WGBH 2 HD 2.1 802 502 602 1002 782 819 about the Americas before and since contact with Europe. It travels through WGBX 44 44.1 16 44 14 804 21 n/a 15,000 years to showcase massive cities, unique systems of science, art and writing, and 100 million people connected WGBX 44 HD 44.1 801 544 n/a n/a n/a n/a by social networks and spiritual beliefs World 2.2 956 473 94 807 181 n/a spanning two continents. Create 44.3 959 474 95 805 182 n/a Made with the active participation of WGBH Kids 44.4 958 472 93 n/a 180 n/a Native American communities, this four- Boston Kids & n/a 22 n/a 3 n/a n/a n/a part series features sacred rituals filmed for Family (Boston only) the first time, history-changing scientific Channel numbers and availability may vary by community. Contact your provider for discoveries, and rarely heard voices from the more information.