The 2017 Good Governance Report the Great Governance Debate Continued

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TRICENTRIC® Triple Offset Butterfly Valves

TRICENTRIC® Excellent Triple Offset Butterfly Valves Power & Industrial Solutions Superior performance for a wide range of applications TRICENTRIC® Triple Offset Butterfly Valves TRICENTRIC® is a leading brand of triple offset butterfly valves manufactured by Weir Valves & Controls USA, Inc. (“Weir Valves & Controls”). Contents ® TRICENTRIC valves were the first triple offset butterfly valves to be introduced in Introduction 1 North America in the late 1970s. RAPID RESPONSE Program 1 Weir Valves & Controls is part of The Weir Group PLC’s Power & Industrial Division. The Weir Group PLC is a FTSE 100 engineering solutions company headquartered Quality Assurance 1 in Glasgow, Scotland. The Weir Group’s global footprint covers over 70 countries, Safety 2 employing over 13,000 people. The Weir Group provides engineering solutions with a focus on the minerals, oil & gas and power markets. Valve Testing 2 Our rich history of engineering excellence gives us the knowledge base necessary Conventional Power 3 to design valve products for the most demanding applications. Nuclear Power 4 We serve customers across a broad range of industries including: conventional Oil & Gas / Refining 5 power, nuclear power, oil & gas, refining, desalination, chemical processing, pulp & paper mills, municipal service and special applications. Chemical Processing 5 Pulp & Paper 6 Municipal Service 6 Special Applications 6 Performance 7 Principle of Operation 8 Triple Offset Sealing System 8 Features & Benefits 9 Accessories & Options 10 Lug/Wafer Dimensions 11 Double -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Sellafield What to Do in a Radiation Emergency Booklet

WHAT TO DO IN AN Emergency At Sellafield This information is prepared for everyone within the Detailed Emergency Planning Zone and the Inner Emergency Planning Zone for the Sellafield Site. EMERGENCY INFORMATION Listen to local radio. Monitor social media platforms. Dial the Sellafield Emergency Information Line on 29th September 2021 It is important that you study this booklet carefully and keep it in a safe and prominent place. WHAT TO DO IN AN EMERGENCY Introduction • This booklet gives advice on what to do in the event of an emergency at the Sellafield Site. • Sellafield is Europe’s largest single nuclear site and stores and handles industrial size quantities of radioactive material. Although unlikely, an emergency could occur involving material being stored and processed on the Site. In addition, Sellafield also holds a large inventory of other hazardous substances and again although unlikely an emergency could occur involving the chemicals being utilised on the Site. • It must be stressed that the possibility of such emergencies occurring is remote and that the design and operation of all plants on the site are independently monitored by the Office for Nuclear Regulation (ONR), Health and Safety Executive (HSE) and Environment Agency (EA). • Current assessments of the radiological hazards indicate that areas between 6.1km & 8km from the centre of the Sellafield Site could be the most likely areas to be directly affected during and following a radiation emergency, this area is referred to as the Detailed Emergency Planning Zone (DEPZ). To see its geographical extent please see map A (pg13) & C (pg20). • In addition, other assessments of the chemical hazards indicate that an area up to 2km from the centre of the Sellafield Site could be the most likely area to be directly affected during and following a chemical emergency, this area is referred to as the Inner Emergency Planning Zone (IEPZ). -

CLITHEROE ROAD, WHALLEY Utilities Study Commercial Estates Group 31/01/2013 Revised: 08/02/2013

CLITHEROE ROAD, WHALLEY Utilities Study Commercial Estates Group 31/01/2013 Revised: 08/02/2013 Quality Management Issue/revision Issue 1 Revision 1 Revision 2 Revision 3 Remarks DRAFT DRAFT Date 31/01/2013 08/02/2013 Prepared by C Scott C Scott Signature Checked by C Cozens C Cozens Signature Authorised by C Cozens C Cozens Signature Project number 50600485 50600485 File reference S:\50600485 - Clitheroe Road, S:\50600485 - Clitheroe Whalley\C Road, Whalley\C Documents\Reports\Working\ Documents\Reports\Working 2013 Utilities Study \2013 Utilities Study S:\50600485 - Clitheroe Road, Whalley\C Documents\Reports\Working\2013 Utilities Study Project number: 50600485 Dated: 31/01/2013 2 Revised: 08/02/2013 CLITHEROE ROAD, WHALLEY Utilities Study 31/01/2013 Client Commercial Estates Group Consultant WSP UK Limited Three White Rose Office Park Leeds LS11 0DL UK Tel: +44 (0)11 3395 6200 Fax: +44 (0)11 3395 6201 www.wspgroup.co.uk Registered Address WSP UK Limited 01383511 WSP House, 70 Chancery Lane, London, WC2A 1AF 3 Table of Contents Executive Summary........................................................................... 5 1 Introduction ............................................................................... 6 2 Existing Site .............................................................................. 7 3 Water Supply ............................................................................ 8 4 Gas Supply ............................................................................. 13 5 Electricity Supply .................................................................... -

Guidance for the Directors of Banks

IFC Corporate Governance Knowledge Publication 11 FOCUS Guidance for the Directors of Banks Richard Westlake, MA (Oxon.) Foreword by Léo Goldschmidt ©Copyright 2013. All rights reserved. International Finance Corporation 2121 Pennsylvania Avenue, NW, Washington, DC 20433 The conclusions and judgments contained in this report should not be attributed to, and do not necessarily represent the views of, IFC or its Board of Directors or the World Bank or its Executive Directors, or the countries they represent. IFC and the World Bank do not guarantee the accuracy of the data in this publication and accept no responsibility for any consequences of their use. The material in this work is protected by copyright. Copying and/or transmitting portions or all of this work may be a violation of applicable law. The International Finance Corporation encourages dissemination of its work and hereby grants permission to users of this work to copy portions for their personal, noncommercial use, without any right to resell, redistribute, or create derivative works there from. Any other copying or use of this work requires the express written permission of the International Finance Corporation. For permission to photocopy or reprint, please send a request with complete information to: The International Finance Corporation c/o the World Bank Permissions Desk Office of the Publisher 1818 H Street, NW Washington, DC 20433 All queries on rights and licenses, including subsidiary rights, should be addressed to: The International Finance Corporation c/o the Office of the Publisher World Bank 1818 H Street, NW Washington, DC 20433 Fax: (202) 522-2422 Guidance for the Directors of Banks Richard Westlake, MA (Oxon.) IFC Global Corporate Governance Forum Focus 11 About The Author Richard Westlake is based in New Zealand, where he established Westlake Governance, an international governance advisory business, in 1999. -

Annual-Report-And-Accounts-2019.Pdf

Satisfying the changing needs of our customers Enabling the transition to a lower carbon future Annual Report and Accounts 2019 Group Snapshot Centrica plc is a leading international energy services and solutions provider focused on satisfying the changing needs of our customers and enabling the transition to a lower carbon future. The world of energy is changing rapidly and Centrica is now equipped to help customers transition to a lower carbon future, with capabilities and technologies to allow them to reduce their emissions. Therefore, we announced in July 2019 our intention to complete the shift towards the customer, by exiting oil and gas production. The Company’s two customer-facing divisions, Centrica Consumer and Centrica Business, are focused on their strengths of energy supply and its optimisation, and on services and solutions, with a continued strong focus on delivering high levels of customer service. Centrica is well placed to deliver for our customers, our shareholders and for society. We aim to be a good corporate citizen and an employer of choice. Technology is increasingly important in the delivery of energy and services to our customers. We are developing innovative products, offers and solutions, underpinned by investment in technology. We are targeting significant cost efficiency savings by 2022 to position Centrica as the lowest cost provider in its markets, consistent with our chosen brand positioning and propositions. Alongside our distinctive positions and capabilities, this will be a key enabler as we target -

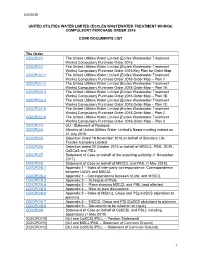

Compulsory Purchase Order 2016 Core Documents List

6/6/2018 UNITED UTILITIES WATER LIMITED (ECCLES WASTEWATER TREATMENT WORKS) COMPULSORY PURCHASE ORDER 2016 CORE DOCUMENTS LIST The Order CD/CPO/1 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 CD/CPO/2 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 Key Plan for Order Map CD/CPO/2.1 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 Order Map – Plan 1 CD/CPO/2.2 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 Order Map – Plan 1A CD/CPO/2.3 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 Order Map – Plan 1B CD/CPO/2.4 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 Order Map – Plan 1C CD/CPO/2.5 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 Order Map – Plan 2 CD/CPO/2.6 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 Order Map – Plan 3 CD/CPO/3 UU - Statement of Reasons CD/CPO/4 Minutes of United Utilities Water Limited's Board meeting extract on 21 July 2016 CD/CPO/5 Objection dated 18 November 2016 on behalf of Standard Life Trustee Company Limited CD/CPO/6 Objection dated 20 October 2016 on behalf of MSCCL, PINL, SCPL, CoSCoS and PSLL CD/CPO/7 Statement of Case on behalf of the acquiring authority (1 November -

Constituents & Weights

2 FTSE Russell Publications 19 August 2021 FTSE 100 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.59 UNITED GlaxoSmithKline 3.7 UNITED RELX 1.88 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 0.35 UNITED Glencore 1.97 UNITED Rentokil Initial 0.49 UNITED KINGDOM KINGDOM KINGDOM Anglo American 1.86 UNITED Halma 0.54 UNITED Rightmove 0.29 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.26 UNITED Hargreaves Lansdown 0.32 UNITED Rio Tinto 3.41 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.26 UNITED Hikma Pharmaceuticals 0.22 UNITED Rolls-Royce Holdings 0.39 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.41 UNITED HSBC Hldgs 4.5 UNITED Royal Dutch Shell A 3.13 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 6.02 UNITED Imperial Brands 0.77 UNITED Royal Dutch Shell B 2.74 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 0.32 UNITED Informa 0.4 UNITED Royal Mail 0.28 UNITED KINGDOM KINGDOM KINGDOM Avast 0.14 UNITED InterContinental Hotels Group 0.46 UNITED Sage Group 0.39 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 0.23 UNITED Intermediate Capital Group 0.31 UNITED Sainsbury (J) 0.24 UNITED KINGDOM KINGDOM KINGDOM Aviva 0.84 UNITED International Consolidated Airlines 0.34 UNITED Schroders 0.21 UNITED KINGDOM Group KINGDOM KINGDOM B&M European Value Retail 0.27 UNITED Intertek Group 0.47 UNITED Scottish Mortgage Inv Tst 1 UNITED KINGDOM KINGDOM KINGDOM BAE Systems 0.89 UNITED ITV 0.25 UNITED Segro 0.69 UNITED KINGDOM -

Portfolio Investment Report

December 2019 Bristol University Holdings as at 31st December 2019 Please note that the following information is valid as at 31/12/2019. The provision of this information does not constitute a recommendation, investment advice, nor financial promotion. Holdings are subject to change without notice and their accuracy and completeness cannot be guaranteed. No part of this document may be reproduced in any manner without Rathbones prior permission. As per the University’s Investment policy, the portfolio is moving to full fossil fuel divestment and a measurable reduction in the carbon intensity of the investments over time. To date, the only remaining direct position in the Oil & Gas sector is Equinor, representing approximately 0.78% of the portfolio. Direct investment in the Energy sector which is used to measure carbon intensity, includes Orsted, SSE and National Grid. These stocks represent approximately 4.94% of the portfolio. SECURITY NAME SECTOR TREASURY 1 7/8% I/L Stock 22/11/2022 UK Index Linked Government Bonds TREASURY 2 1/2% I/L Stock 17/07/2024 UK Index Linked Government Bonds RABOBANK NEDERLAND 2.25% Snr MTN 23/03/2022 UK Inv Grade Bonds - Higher Quality COVENTRY BUILDING SOCIETY 1.875% Bonds 24/10/2023 UK Inv Grade Bonds - Higher Quality KREDITANST FUR WIE 5.5% MTN 18/6/2025 UK Inv Grade Bonds - Higher Quality EURO INVESTMENT BANK 3.75% MTN 7/12/2027 UK Inv Grade Bonds - Higher Quality A2 DOMINION HOUSING GROUP LTD 3.5% Bonds 15/11/2028 UK Inv Grade Bonds - Higher Quality FIDELITY INTERNATIONAL 6.75% Notes 19/10/2020 UK Investment -

FTSE Publications

2 FTSE Russell Publications FTSE 100 Semi Annual Equally 19 August 2021 Weighted Net Tax Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.95 UNITED Fresnillo 0.86 UNITED Prudential 0.92 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 1.06 UNITED GlaxoSmithKline 1.08 UNITED Reckitt Benckiser Group 1.02 UNITED KINGDOM KINGDOM KINGDOM Anglo American 0.91 UNITED Glencore 0.94 UNITED RELX 1.05 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.91 UNITED Halma 1.05 UNITED Rentokil Initial 1.04 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.04 UNITED Hargreaves Lansdown 0.98 UNITED Rightmove 1.09 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.96 UNITED Hikma Pharmaceuticals 1.03 UNITED Rio Tinto 0.96 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 1.11 UNITED HSBC Hldgs 0.94 UNITED Rolls-Royce Holdings 0.9 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 1.15 UNITED Imperial Brands 0.98 UNITED Royal Dutch Shell A 0.56 UNITED KINGDOM KINGDOM KINGDOM Avast 1.07 UNITED Informa 0.94 UNITED Royal Dutch Shell B 0.49 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 1.08 UNITED InterContinental Hotels Group 0.97 UNITED Royal Mail 0.99 UNITED KINGDOM KINGDOM KINGDOM Aviva 1 UNITED Intermediate Capital Group 0.99 UNITED Sage Group 1.06 UNITED KINGDOM KINGDOM KINGDOM B&M European Value Retail 1.04 UNITED International Consolidated Airlines 0.85 UNITED Sainsbury (J) 1.03 UNITED KINGDOM Group KINGDOM KINGDOM BAE Systems 1 UNITED Intertek -

Ceca Pipeline

CECA North West: Infrastructure Vision A project map for contractors setting out the infrastructure pipeline to 2017 Contents 01 CONTENTS 02 INTRODUCTION 03 nortH west - nationaL inFrastructure PLan 08 LocaL autHorities 12 nationaL ParK autHorities 12 coMBined autHorities 14 LEPS 14 transPort 14 Ports 15 roads 16 raiL 17 aviation 17 deFence 18 oiL & Gas 19 eLectricitY coMPanies & renewaBLes 22 nucLear 23 water 23 EnvironMent 23 BroadBand 24 ceca contact addresses 01 Introduction of Moorside nuclear power station, as well as a new civil engineering framework for Greater Manchester. Given the many and complex routes to market, however, it is important than ever that CECA’s members have easy access to the information they need to take advantage of the opportunities that arise. Moreover, with increased workloads, clients need the region’s SMEs, as well as major contractors, to be equipped to meet their aspirations. The information in what follows is aimed at enabling smaller firms to identify workstreams where their specialist expertise and local workforce can bring real value. This publication has been prepared by CECA to help our members win work in the North West. Since 2010, the Government has sought to rebalance the nation’s economy Guy Lawson FCIM, MIED, Director, by focussing on the renewal of regional infrastructure. CECA North West CECA’s research has found that for each 1,000 jobs that are directly created in infrastructure construction, employment In the North West, the Civil Engineering Contractors’ as a whole rises by 3,053 jobs. Furthermore, every £1 billion Association (CECA) covers the five Local Enterprise of infrastructure construction increases overall economic Partnership (LEP) areas of Cheshire & Warrington, Cumbria, activity by £2.842 billion. -

Lake District Gas Pipe Move Planned to Minimise Disruption

Investors Home Press Releases Media Contacts Home / Press Releases / Lake District gas pipe move planned to minimise disruption National Grid Gas Distribution is moving its pipes to support a project to improve water quality in England's largest natural lake 28 Apr 2017 A six-month scheme to move gas pipes running under the A592, next to Lake Windermere, starts Monday 8 May, with bosses keen to stress that the area remains ‘open’ at all times. National Grid Gas Distribution must move its pipes so that United Utilities can continue its bigger scheme to install a new wastewater pipeline, to improve water quality in England’s largest natural lake. The gas pipes beneath the A592 are exactly where United Utilities needs its new pipe to be, so the gas network has agreed to move its pipes to the other side of the road. National Grid Gas Distribution can only do this work when United Utilities is clear of the area. It therefore has a window between 8 May and 31 October, when the water company returns to start phase two of its three-phase scheme. Traffic lights will be in place as gas teams work in stretches of up to 200m of the road, at any one time. They will start just after the entrance to Storrs Hall Hotel on 8 May and, once that area is completed, will begin moving north. They will finish at Ferry Nab in October. To keep vehicles moving, the lights have in-built technology that constantly monitor and adapt to traffic. There is also the option to manually control the lights at busy periods.