You Are Cordially Invited to Attend the 2014 Annual Meeting of Shareholders of IDACORP, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ENERGY FUTURE HOLDINGS CORP., Aka TXU Corp.; Aka TXU Corp; Aka Texas Utilities, Et Al., Debtors

PRECEDENTIAL UNITED STATES COURT OF APPEALS FOR THE THIRD CIRCUIT __________ No. 19-3492 __________ IN RE: ENERGY FUTURE HOLDINGS CORP., aka TXU Corp.; aka TXU Corp; aka Texas Utilities, et al., Debtors NextEra Energy, Inc., Appellant __________ On Appeal from the District Court for the District of Delaware (D.C. No. 1-18-cv-01253) District Judge: Hon. Richard G. Andrews __________ Argued July 2, 2020 Before: KRAUSE, PHIPPS, Circuit Judges, and BEETLESTONE,* District Judge. (Filed: March 15, 2021) * Honorable Wendy Beetlestone, United States District Court for the Eastern District of Pennsylvania, sitting by designation. __________ OPINION __________ James P. Bonner [ARGUED] Joshua D. Glatter Fleischman Bonner & Rocco 447 Springfield Avenue 2nd Floor Summit, NJ 07901 Keith M. Fleischman Fleischman Bonner & Rocco 81 Main Street Suite 515 White Plains, NY 10601 Matthew B. McGuire Landis Rath & Cobb 919 Market Street Suite 1800, P.O. Box 2087 Wilmington, DE 19801 Counsel for Appellant NextEra Energy Inc. Daniel G. Egan Gregg M. Galardi [ARGUED] Ropes & Gray 1211 Avenue of the Americas New York, NY 10036 Jonathan R. Ference-Burke Douglas H. Hallward-Driemeier 2 Ropes & Gray 2009 Pennsylvania Avenue, N.W. Suite 1200 Washington, DC 20006 Counsel for Appellees Elliott Associates LP, Elliott International LP, Liverpool Limited Partnership, UMB Bank NA Daniel J. DeFranceschi Jason M. Madron Richards Layton & Finger 920 North King Street One Rodney Square Wilmington, DE 19801 Mark E. McKane [ARGUED] Kirkland & Ellis 555 California Street Suite 2700 San Francisco, CA 94104 Counsel for Appellee EFH Plan Administrator Board BEETLESTONE, District Judge. This case arises from the bankruptcy of Energy Future Holdings and its affiliates (“EFH” or “Debtors”). -

Download 2015 Annual Report

A Decade of Providing Excellence in Health Care for the Communities We Serve. In this report, which spans a decade from 2006 through 2015, you will learn of ways United Regional has elevated the quality of health care for the communities we serve. Our programs and services have been awarded nationally-recognized certifications for meeting or exceeding the most stringent quality standards. Our safety and quality initiatives have resulted in achieving the highest benchmarking levels. Our highly skilled physicians and staff have the expertise to treat complex medical conditions and perform the latest surgical procedures. Our financial strength has allowed us to reinvest in the most advanced technologies to benefit patient outcomes, build modern and more accessible facilities, bring needed primary care and specialty physicians to the area, and fulfill our strong commitment to provide care for the under and uninsured. Although our accomplishments have been significant, we will never be satisfied with the status quo. United Regional will continue to bring new and better ways to deliver compassionate, quality care for our patients today and well into the future. our passion To provide excellence in health care for the communities we serve. our purpose To make a positive difference in the lives of others. PEOPLE PEOPLE During the past decade, United Regional has developed a culture that embraces our passion of providing excellence in health care for the communities we We are all serve – care that is both high quality and compassionate. It starts with recruiting patients skilled staff and physicians and attracting dedicated volunteers. Then we dedicate resources to help ensure that our people stay committed, engaged, passionate, highly capable and healthy. -

Court Confirms Energy Future Holdings'ʹ Plan of Reorganization

Court Confirms Energy Future Holdings' Plan of Reorganization Upon Regulatory Approvals and Emergence, EFH to Benefit from Strengthened Balance Sheet and Strong Position in Texas' Competitive Energy Market DALLAS, Dec. 3, 2015 /PRNewswire/ -- Energy Future Holdings today announced that the United States Bankruptcy Court for the District of Delaware has confirmed the company's plan of reorganization. The plan contemplates a tax-free spin of the company's competitive businesses, including Luminant and TXU Energy, and the sale of its holdings in Oncor to a consortium of investors. "We are pleased to have reached this critical milestone on the road to emergence," said John Young, chief executive officer of EFH. "We can now begin, in earnest, to build for the future, with a strong capital structure, excellent assets and a singular commitment to delivering for our customers, employees and business partners in Texas' growing, competitive market. Our financial restructuring has been among the most complex in history, and it is a credit to our entire team and our outside advisors that the company has reached this point while maintaining stellar customer service and operational excellence." Following the court's confirmation, the company must also receive regulatory approvals and satisfy various other closing conditions in order to emerge from chapter 11. The regulatory process is expected to extend into the spring of 2016, though final timing is subject to modification. About Energy Future Holdings EFH is a Dallas-based holding company engaged in competitive and regulated energy market activities in Texas. Its portfolio of competitive businesses consists primarily of Luminant, which is engaged largely in power generation and related mining activities, wholesale power marketing and energy trading, and TXU Energy, a retail electricity provider with 1.7 million residential and business customers in Texas. -

Who Is Most Impacted by the New Lease Accounting Standards?

Who is Most Impacted by the New Lease Accounting Standards? An Analysis of the Fortune 500’s Leasing Obligations What Do Corporations Lease? Many companies lease (rather than buy) much of the equipment and real estate they use to run their business. Many of the office buildings, warehouses, retail stores or manufacturing plants companies run their operations from are leased. Many of the forklifts, trucks, computers and data center equipment companies use to run their business is leased. Leasing has many benefits. Cash flow is one. Instead of outlaying $300,000 to buy five trucks today you can make a series of payments over the next four years to lease them. You can then deploy the cash you saved towards other investments that appreciate in value. Also, regular replacement of older technology with the latest and greatest technology increases productivity and profitability. Instead of buying a server to use in your data center for five years, you can lease the machines and get a new replacement every three years. If you can return the equipment on time, you are effectively outsourcing the monetization of the residual value in the equipment to an expert third-party, the leasing company. Another benefit of leasing is the accounting, specifically the way the leases are reported on financial statements such as annual reports (10-Ks). Today, under the current ASC 840 standard, leases are classified as capital leases or operating leases. Capital leases are reported on the balance sheet. Operating leases are disclosed in the footnotes of your financial statements as “off balance sheet” operating expenses and excluded from important financial ratios such as Return on Assets that investors use to judge a company’s performance. -

Winners and Losers: Fallout from KKR’S Race for Profit Contents

Winners and Losers: Fallout from KKR’s Race for Profit Contents Introduction ......................................................................................5 The U.S. Economy .............................................................................9 The KKR Workforce ........................................................................13 Consumers .....................................................................................17 Environment ...................................................................................23 Conclusion .....................................................................................27 Appendices ....................................................................................28 Endnotes ........................................................................................32 Introduction KKR’s Race for Profit 5 Winners and Losers: Fallout from KKR’s Race for Profit The buyout industry and its harmful practices are receiving greater scrutiny as Americans struggle with a growing sense of anxiety over the state of the economy and the expanding income gap between the richest 10th of Americans and those in the middle class. How does the buyout industry’s “see no evil, accept no responsibility” approach to business really impact Main Street America? With hundreds of thousands of employees, KKR portfolio companies together employ one of the largest private workforces of any U.S.-based firm. While recent reports have focused on the net job loss resulting from leveraged buyouts, there -

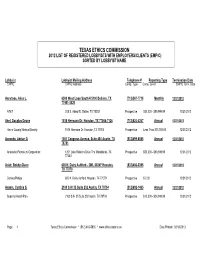

Texas Ethics Commission 2012 List of Registered Lobbyists with Employers/Clients (Emp/C) Sorted by Lobbyist Name

TEXAS ETHICS COMMISSION 2012 LIST OF REGISTERED LOBBYISTS WITH EMPLOYERS/CLIENTS (EMP/C) SORTED BY LOBBYIST NAME Lobbyist Lobbyist Mailing Address Telephone # Reporting Type Termination Date EMP/C EMP/C Address Comp. Type Comp. Level EMP/C Term. Date Aanstoos, Alice L. 6500 West Loop South # 5100 Bellaire, TX (713)567-7718 Monthly 12/31/2012 77401-3520 AT&T 208 S. Akard St. Dallas, TX 75202 Prospective $50,000 - $99,999.99 12/31/2012 Abel, Douglas Deane 1515 Hermann Dr. Houston, TX 77004-7126 (713)524-4267 Annual 12/31/2012 Harris County Medical Society 1515 Hermann Dr. Houston, TX 77004 Prospective Less Than $10,000.00 12/31/2012 Acevedo, Adrian G. 1001 Congress Avenue, Suite 400 Austin, TX (512)499-8085 Annual 12/31/2012 78701 Anadarko Petroleum Corporation 1201 Lake Robbins Drive The Woodlands, TX Prospective $50,000 - $99,999.99 12/31/2012 77380 Adair, Bobby Glenn 600 N. Dairy Ashford - 2WL 8024F Houston, (832)486-3395 Annual 12/31/2012 TX 77079 ConocoPhillips 600 N. Dairy Ashford Houston, TX 77079 Prospective $ 0.00 12/31/2012 Adams, Cynthia S. 2100 S IH 35 Suite 202 Austin, TX 78704 (512)692-1465 Annual 12/31/2012 Superior HeatlhPlan 2100 S IH 35 Suite 202 Austin, TX 78704 Prospective $10,000 - $24,999.99 12/31/2012 Page: 1 Texas Ethics Commission * (512) 463-5800 * www.ethics.state.tx.us Date Printed: 02/13/2013 Lobbyist Lobbyist Mailing Address Telephone # Reporting Type Termination Date EMP/C EMP/C Address Comp. Type Comp. Level EMP/C Term. -

Final Environmental Assessment for the Proposed Contract Detention

DEPARTMENT OF HOMELAND SECURITY U.S. IMMIGRATION AND CUSTOMS ENFORCEMENT ENVIRONMENTAL ASSESSMENT FOR THE PROPOSED CONTRACT DETENTION FACILITY IN THE HOUSTON, TEXAS AREA OF OPERATIONS 29 December 2016 Lead Agency: Department of Homeland Security U.S. Immigration and Customs Enforcement 500 12th Street Southwest Washington, DC 20536 Points of Contact: Trina Fisher Contracting Officer, Detention Compliance and Removals Division DHS ICE Office of Acquisition Management 801 I Street NW, Room 9143 Washington, DC 20536-5750 Elizabeth Kennett Energy, Environmental, and Sustainability Program Manager DHS ICE Office of Asset and Facilities Management 500 12th Street SW, Mail Stop 5703 Washington, DC 20536 1 EXECUTIVE SUMMARY 6 ACRONYMS AND ABBREVIATIONS 8 PROJECT BACKGROUND 11 1.1 Introduction 11 1.2 Purpose and Need 11 1.3 Scope and Content of the Analysis 12 1.4 Interagency Coordination, Consultation and Public Involvement 12 1.5 Description of the Proposed Action and Alternatives 13 1.5.1 Proposed Action 13 1.5.2 No Action Alternative 13 1.5.3 Proposed Action Alternative 1 – Renovations to HPC 14 1.5.4 Proposed Action Alternative 2 – New Facility in Montgomery County 15 1.5.5 Summary of Alternatives Considered but Eliminated 15 AFFECTED ENVIRONMENT AND ENVIRONMENTAL CONSEQUENCES 17 2.1 Geology, Soils, Topography and Seismicity 21 2.1.1 Affected Environment 21 2.1.2 Environmental Consequences 24 2.1.3 Mitigation and BMPs 25 2.2 Hydrology and Water Resources 25 2.2.1 Affected Environment 25 2.2.2 Environmental Consequences 28 2.2.3 Mitigation -

Board of Directors' Pay up from Last Year

Published By 200 Business Park Drive Armonk, NY 10504 Phone: 914.730.7300 Fax: 914.730.7303 www.total-comp.com 2017 / 2018 BOARD OF DIRECTORS COMPENSATION REPORT January 2018 All rights reserved. © 2018 Total Compensation Solutions, LLC. Printed in the United States of America. This publication of the 2017/2018 Board of Directors Compensation Report may not be reproduced, stored in a retrieval system, or transmitted in whole or in part, in any form or by any means (electronic, mechanical, photocopying, recording or otherwise) without the prior written permission of Total Compensation Solutions, LLC. 200 Business Park Drive, Armonk, NY 10504. The information provided in this report is confidential and for the use of the subscribing organization only. By accepting this material, you agree that it will not be reproduced, copied, transmitted or disclosed to organizations or persons outside of your organization. Table of Contents Section Page I. Executive Summary Introduction ------------------------------------------------------------------- 2 Company Demographics -------------------------------------------------- 5 Findings and Observations ----------------------------------------------- 8 II. Data Analysis Board Structure -------------------------------------------------------------- 13 Committee Structure ------------------------------------------------------- 16 Board Compensation ------------------------------------------------------ 19 III. Board Compensation All Companies -------------------------------------------------------------- -

Corporate Sponsors

CORPORATE SPONSORS • 3Com Corporation • AFAEAT • 3M Company • Affinion Group • 7-Eleven • Affinity Federal Credit Union • A. Teichert & Son • Aflac • A1 Labour Training Services • Afro-Canadian Caribbean Association of • AAA Hamilton and District, Inc. [ACCA] • AARP • AG Communications • Abbott Diabetes Care • Agape Family Worship Center • Abbott Laboratories • AGCO Corporation • Abdul Latif Jameel Company, Ltd. • Age Management N Enrichment • Abe Lee Realty • Agee Chiropractic • Aboitiz & Company, Inc. • AGFA Healthcare • Aboitiz Transport System Corporation • AgFirst Farm Credit Bank • Absolute Software • Agilent Technologies • Abu Dhabi Oil Refinery Company (Takreer) • AGL Resources, Inc. • ABX Air • AgResearch • AC Transit • Agricorp • Accenture • AIA • Access Sacramento - Channel 17 Television • AIG • Accident Fund Insurance • Air International • Achievement Awards Group • Air Products & Chemicals • ACS • Airline Retiree’s Pass Bureau • Actel Corporation • Airline Tariff Publishing Company • ACTS Retirement-Life Communities, Inc. • AISH Hatorah Learning Centre • Acxiom Corporation • Akamai Management Group • Adamson University • AKQA • ADI Group • Akzonobel Paints • Adidas Group • A1 Ain Municipality • Administaff, Inc. • A1 Elm Information Security • Adobe Systems • A1 Khozama International School • ADP • A1 Mulla Group • Advance Auto Parts • A1 Tatweer Company • Advanced Business Consultants • Alabama Power Company • Advanced MED Corporation • Alaska USA Federal Credit Union • Advanced Medical Optics • Al-Banush Club • Advanced -

The Energy and Infrastructure Group 2009 Representative Transactions

The Energy and Infrastructure Group 2009 Representative Transactions Mergers and Acquisitions COMPANY TYPE OF TRANSACTION AND REPRESENTATION ACADIA POWER PARTNERS Representation of Acadia Power Partners, LLC (APP) and its parent companies in connection with the sale of its electric generating facility, located near Eunice, Louisiana, to two separate buyers. In the first sale, executed in July 2009, Cleco Power LLC (a Louisiana public utility and an affiliate of APP) acquired one of the facility’s two power blocks (each rated at 580 MW) and a 50% interest in related common facilities. In the second sale, executed in October 2009, Entergy Louisiana, LLC (an unaffiliated Louisiana public utility) acquired the facility’s remaining power block and 50% interest in the common facilities. As part of the transactions, the parties negotiated a joint ownership agreement, operating and maintenance agreement, and other arrangements to govern the joint ownership and operation of the newly-separated power blocks and jointly-owned common facilities. BORREGO SOLAR SYSTEMS, INC. Representation of Walsin Lihwa Corporation in connection with its $9 million investment in Borrego Solar Systems, Inc. Borrego Solar specializes in every aspect of solar design and construction in commercial and public sector turnkey, grid– connected solar electric systems. Walsin Lihwa manufactures bare copper wire, wire and cable, and specialty steel in the Greater China region, and has expanded into high-tech industries. DENBURY RESOURCES INC. Representation of J.P. Morgan Securities, financial advisor to Denbury Resources in connection with its $4.5 billion acquisition of Encore Acquisition Company. Texas-based Denbury is an independent oil and gas company and the leading oil and natural gas operator in Mississippi. -

Lenders: the New Owners Year in Review Keep the Receipt

News for People Tracking Distressed Businesses DECEMBER 2017 VOLUME 31, NUMBER 11 Latest Reports: Year in Review • Bankruptcy Professionals by Julie Schaeffer Refl ect on 2017 There were 6,016 Chapter 11 filings through November 2017, versus 6,179 at the same • Third Circuit Says Received point in 2016. But beyond the numbers, how did 2017 restructuring activity compare to prior years? What were the significant events? And what sectors dominated? Equals Physical Possession We asked six bankruptcy professionals: Thomas Califano, co-chair of DLA Piper’s • Lenders Increasingly U.S. restructuring practice; Benjamin D. Feder, special counsel at Kelley Drye & Become Troubled Retailers’ Warren LLP; Harve Light, a managing director at Conway MacKenzie; Michael J. Musso, a managing director at Conway MacKenzie; Paul Share, a managing director at New Owners ConwayMacKenzie; and Michael J. Venditto, a partner in the financial industry group continued on page 2 Research Report: Who’s Who in Toys-R-Us Keep The Receipt Third Circuit Courts Defi ne Receipt for § 503(b)(9) Purposes Special Report: by Randall Reese Sources of Debtor-in- Those shipping goods to companies in distress are entitled to administrative expense Possession Financing status for the value of goods “received by the debtor within 20 days before” the debtor’s bankruptcy filing pursuant to § 503(b)(9) of the Bankruptcy Code. The question of Worth Reading: precisely when goods are deemed to be “received” for the purposes of determining whether a creditor is permitted to recover the value of the goods as an allowed administrative One Hundred Years of Land expense claim under § 503(b)(9) was addressed in a recent U.S. -

2016 Ten-Year Site Plans of Florida’S Electric Utilities

APPENDIX A REVIEW OF THE 2016 TEN-YEAR SITE PLANS OF FLORIDA’S ELECTRIC UTILITIES NOVEMBER 2016 Ten-Year Site Plan Comments State Agencies Fish and Wildlife Conservation Commission- General Fish and Wildlife Conservation Commission- Gulf Department of Environmental Protection Regional Planning Councils Treasure Coast Regional Planning Council Water Management Districts Southwest Florida Water Management District St. Johns Water Management District Local Governments Charlotte County Environmental Groups Southern Alliance for Clean Energy Sierra Club 1 2 June 21, 2016 Moniaishi Mtenga Division of Engineering Public Service Commission Florida Fish 2540 Shumard Oak Boulevard and Wildlife Tallahassee, FL 32399-0850 Conservation [email protected] Commission Commissioners RE: 2016 Ten-Year Power Plant Site Plans Brian Yablonski Chairman Tallahassee Dear Mr. Mtenga: Aliese P. “Liesa” Priddy Vice Chairman Immokalee Florida Fish and Wildlife Conservation Commission (FWC) staff has reviewed the 2016 Ten- Ronald M. Bergeron Year Power Plant Site Plans submitted to the Public Service Commission (PSC). We will be Fort Lauderdale providing comments on the Gulf Power Company (GULF) Ten-Year Site Plan in a subsequent Richard Hanas letter. However, we are submitting this letter to notify you that we have reviewed the following Oviedo plans and have no comments regarding fish and wildlife resources: Bo Rivard Panama City Charles W. Roberts III Gainesville Regional Utilities (GRU) Tallahassee Orlando Utilities Commission (OUC) Robert A. Spottswood City of Tallahassee Utilities (TAL) Key West Jacksonville Energy Authority (JEA) Florida Municipal Power Agency (FMPA) Florida Power and Light Company (FPL) Executive Staff Seminole Electric Cooperative (SEC) Nick Wiley Executive Director Lakeland Electric (LAK) Eric Sutton Tampa Electric Company (TECO) Assistant Executive Director Duke Energy Florida (DEF) Jennifer Fitzwater Chief of Staff We appreciate the opportunity to review the Ten-Year Site Plans, as provided by the PSC.