Winners and Losers: Fallout from KKR’S Race for Profit Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ENERGY FUTURE HOLDINGS CORP., Aka TXU Corp.; Aka TXU Corp; Aka Texas Utilities, Et Al., Debtors

PRECEDENTIAL UNITED STATES COURT OF APPEALS FOR THE THIRD CIRCUIT __________ No. 19-3492 __________ IN RE: ENERGY FUTURE HOLDINGS CORP., aka TXU Corp.; aka TXU Corp; aka Texas Utilities, et al., Debtors NextEra Energy, Inc., Appellant __________ On Appeal from the District Court for the District of Delaware (D.C. No. 1-18-cv-01253) District Judge: Hon. Richard G. Andrews __________ Argued July 2, 2020 Before: KRAUSE, PHIPPS, Circuit Judges, and BEETLESTONE,* District Judge. (Filed: March 15, 2021) * Honorable Wendy Beetlestone, United States District Court for the Eastern District of Pennsylvania, sitting by designation. __________ OPINION __________ James P. Bonner [ARGUED] Joshua D. Glatter Fleischman Bonner & Rocco 447 Springfield Avenue 2nd Floor Summit, NJ 07901 Keith M. Fleischman Fleischman Bonner & Rocco 81 Main Street Suite 515 White Plains, NY 10601 Matthew B. McGuire Landis Rath & Cobb 919 Market Street Suite 1800, P.O. Box 2087 Wilmington, DE 19801 Counsel for Appellant NextEra Energy Inc. Daniel G. Egan Gregg M. Galardi [ARGUED] Ropes & Gray 1211 Avenue of the Americas New York, NY 10036 Jonathan R. Ference-Burke Douglas H. Hallward-Driemeier 2 Ropes & Gray 2009 Pennsylvania Avenue, N.W. Suite 1200 Washington, DC 20006 Counsel for Appellees Elliott Associates LP, Elliott International LP, Liverpool Limited Partnership, UMB Bank NA Daniel J. DeFranceschi Jason M. Madron Richards Layton & Finger 920 North King Street One Rodney Square Wilmington, DE 19801 Mark E. McKane [ARGUED] Kirkland & Ellis 555 California Street Suite 2700 San Francisco, CA 94104 Counsel for Appellee EFH Plan Administrator Board BEETLESTONE, District Judge. This case arises from the bankruptcy of Energy Future Holdings and its affiliates (“EFH” or “Debtors”). -

ANGEBOTSUNTERLAGE Freiwilliges Öffentliches

Pflichtveröffentlichung gemäß §§ 34, 14 Abs. 2 und 3 Wertpapiererwerbs- und Übernahmegesetz (WpÜG) Aktionäre der WMF Württembergische Metallwarenfabrik Aktiengesellschaft, insbesondere mit Wohnsitz, Sitz oder gewöhnlichem Aufenthalt außerhalb der Bundesrep ublik Deutschland, sollten die Hinweise in Abschnitt 1 "Allgemeine Hinweise, insbesondere für Aktionäre mit Wohnsitz, Sitz oder gewöhnlichem Aufenthalt außerhalb der Bundesrepublik Deutschland" auf den Seiten 4 ff. dieser Angebotsunterlage sowie in Abschnitt 23 "Wichtige Hinweise für US-Aktionäre" auf den Sei- ten 48 ff. dieser Angebotsunterlage besonders beachten. ANGEBOTSUNTERLAGE Freiwilliges öffentliches Übernahmeangebot (Barangebot) der Finedining Capital GmbH Leopoldstraße 8-10, 80802 München, Deutschland an die Aktionäre der WMF Württembergische Metallwarenfabrik Aktiengesellschaft Eberhardstraße 17-47, 73309 Geislingen an der Steige, Deutschland zum Erwerb ihrer auf den Inhaber lautenden Stammaktien und ihrer auf den Inhaber lautenden Vor- zugsaktien an der WMF Württembergische Metallwarenfabrik Aktiengesellschaft gegen Zahlung einer Geldleistung in Höhe von EUR 47,00 je Stammaktie und EUR 31,80 je Vorzugsaktie der WMF Württembergische Metallwarenfabrik Aktiengesellschaft Die Annahmefrist läuft vom 16. August 2012 bis 20. September 2012, 24:00 Uhr (Ortszeit Frankfurt am Main) / 18:00 Uhr (Ortszeit New York) Aktien der WMF Württembergische Metallwarenfabrik Aktiengesellschaft: International Securities Identification Number (ISIN) DE0007803009 (Stammaktien) und DE0007803033 (Vorzugsaktien) -

Download 2015 Annual Report

A Decade of Providing Excellence in Health Care for the Communities We Serve. In this report, which spans a decade from 2006 through 2015, you will learn of ways United Regional has elevated the quality of health care for the communities we serve. Our programs and services have been awarded nationally-recognized certifications for meeting or exceeding the most stringent quality standards. Our safety and quality initiatives have resulted in achieving the highest benchmarking levels. Our highly skilled physicians and staff have the expertise to treat complex medical conditions and perform the latest surgical procedures. Our financial strength has allowed us to reinvest in the most advanced technologies to benefit patient outcomes, build modern and more accessible facilities, bring needed primary care and specialty physicians to the area, and fulfill our strong commitment to provide care for the under and uninsured. Although our accomplishments have been significant, we will never be satisfied with the status quo. United Regional will continue to bring new and better ways to deliver compassionate, quality care for our patients today and well into the future. our passion To provide excellence in health care for the communities we serve. our purpose To make a positive difference in the lives of others. PEOPLE PEOPLE During the past decade, United Regional has developed a culture that embraces our passion of providing excellence in health care for the communities we We are all serve – care that is both high quality and compassionate. It starts with recruiting patients skilled staff and physicians and attracting dedicated volunteers. Then we dedicate resources to help ensure that our people stay committed, engaged, passionate, highly capable and healthy. -

Court Confirms Energy Future Holdings'ʹ Plan of Reorganization

Court Confirms Energy Future Holdings' Plan of Reorganization Upon Regulatory Approvals and Emergence, EFH to Benefit from Strengthened Balance Sheet and Strong Position in Texas' Competitive Energy Market DALLAS, Dec. 3, 2015 /PRNewswire/ -- Energy Future Holdings today announced that the United States Bankruptcy Court for the District of Delaware has confirmed the company's plan of reorganization. The plan contemplates a tax-free spin of the company's competitive businesses, including Luminant and TXU Energy, and the sale of its holdings in Oncor to a consortium of investors. "We are pleased to have reached this critical milestone on the road to emergence," said John Young, chief executive officer of EFH. "We can now begin, in earnest, to build for the future, with a strong capital structure, excellent assets and a singular commitment to delivering for our customers, employees and business partners in Texas' growing, competitive market. Our financial restructuring has been among the most complex in history, and it is a credit to our entire team and our outside advisors that the company has reached this point while maintaining stellar customer service and operational excellence." Following the court's confirmation, the company must also receive regulatory approvals and satisfy various other closing conditions in order to emerge from chapter 11. The regulatory process is expected to extend into the spring of 2016, though final timing is subject to modification. About Energy Future Holdings EFH is a Dallas-based holding company engaged in competitive and regulated energy market activities in Texas. Its portfolio of competitive businesses consists primarily of Luminant, which is engaged largely in power generation and related mining activities, wholesale power marketing and energy trading, and TXU Energy, a retail electricity provider with 1.7 million residential and business customers in Texas. -

United States District Court District of Massachusetts

UNITED STATES DISTRICT COURT DISTRICT OF MASSACHUSETTS * * * * * * * * * * * * * * * * * * * * * * * * * * KIRK DAHL, ET AL., Individually and on Behalf of All Others Similarly Situated, Plaintiffs v. CIVIL ACTION NO.: 07-12388-EFH BAIN CAPITAL PARTNERS, LLC, ET AL., Defendants. * * * * * * * * * * * * * * * * * * * * * * * * * * MEMORANDUM AND ORDER March 13, 2013 This matter comes before the Court on thirteen motions for summary judgment. The motions consist of one omnibus motion for summary judgment as to Count One of the Fifth Amended Complaint filed jointly by the Defendants, one motion for summary judgment as to Count Two filed by the Defendants named in that Count,1 and eleven separate motions for summary judgment filed by each Defendant individually as to both counts. I. Background. The Claims. The Plaintiffs are former shareholders of a number of large public companies that were subject to leverage buyout transactions (the “LBOs”)2 between 2003 and 2007. The Defendants 1 The Defendants named in Count Two are Bain, Blackstone, Carlyle, Goldman Sachs, KKR, and TPG. Bain and KKR have been released. 2 The Fifth Amended Complaint states that: are financial firms which were involved with those transactions. The Defendants include ten large private equity firms, including Apollo Global Management LLC (“Apollo”), Bain Capital Partners, LLC (“Bain”), The Blackstone Group L.P. (“Blackstone”), The Carlyle Group, LLC (“Carlyle”), Goldman Sachs Group, Inc. (“Goldman Sachs” or “Goldman”)3, Kohlberg Kravis Roberts & Company, L.P. (“KKR”), Providence Equity Partners, Inc. (“Providence”)4, Silver Lake Technology Management, L.L.C. (“Silver Lake”)5, TPG Capital L.P. (“TPG”), Thomas H. Lee Partners, L.P. (“THL”). These firms are in the business of purchasing publicly-traded companies. -

Who Is Most Impacted by the New Lease Accounting Standards?

Who is Most Impacted by the New Lease Accounting Standards? An Analysis of the Fortune 500’s Leasing Obligations What Do Corporations Lease? Many companies lease (rather than buy) much of the equipment and real estate they use to run their business. Many of the office buildings, warehouses, retail stores or manufacturing plants companies run their operations from are leased. Many of the forklifts, trucks, computers and data center equipment companies use to run their business is leased. Leasing has many benefits. Cash flow is one. Instead of outlaying $300,000 to buy five trucks today you can make a series of payments over the next four years to lease them. You can then deploy the cash you saved towards other investments that appreciate in value. Also, regular replacement of older technology with the latest and greatest technology increases productivity and profitability. Instead of buying a server to use in your data center for five years, you can lease the machines and get a new replacement every three years. If you can return the equipment on time, you are effectively outsourcing the monetization of the residual value in the equipment to an expert third-party, the leasing company. Another benefit of leasing is the accounting, specifically the way the leases are reported on financial statements such as annual reports (10-Ks). Today, under the current ASC 840 standard, leases are classified as capital leases or operating leases. Capital leases are reported on the balance sheet. Operating leases are disclosed in the footnotes of your financial statements as “off balance sheet” operating expenses and excluded from important financial ratios such as Return on Assets that investors use to judge a company’s performance. -

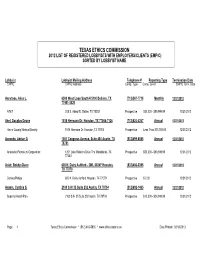

Texas Ethics Commission 2012 List of Registered Lobbyists with Employers/Clients (Emp/C) Sorted by Lobbyist Name

TEXAS ETHICS COMMISSION 2012 LIST OF REGISTERED LOBBYISTS WITH EMPLOYERS/CLIENTS (EMP/C) SORTED BY LOBBYIST NAME Lobbyist Lobbyist Mailing Address Telephone # Reporting Type Termination Date EMP/C EMP/C Address Comp. Type Comp. Level EMP/C Term. Date Aanstoos, Alice L. 6500 West Loop South # 5100 Bellaire, TX (713)567-7718 Monthly 12/31/2012 77401-3520 AT&T 208 S. Akard St. Dallas, TX 75202 Prospective $50,000 - $99,999.99 12/31/2012 Abel, Douglas Deane 1515 Hermann Dr. Houston, TX 77004-7126 (713)524-4267 Annual 12/31/2012 Harris County Medical Society 1515 Hermann Dr. Houston, TX 77004 Prospective Less Than $10,000.00 12/31/2012 Acevedo, Adrian G. 1001 Congress Avenue, Suite 400 Austin, TX (512)499-8085 Annual 12/31/2012 78701 Anadarko Petroleum Corporation 1201 Lake Robbins Drive The Woodlands, TX Prospective $50,000 - $99,999.99 12/31/2012 77380 Adair, Bobby Glenn 600 N. Dairy Ashford - 2WL 8024F Houston, (832)486-3395 Annual 12/31/2012 TX 77079 ConocoPhillips 600 N. Dairy Ashford Houston, TX 77079 Prospective $ 0.00 12/31/2012 Adams, Cynthia S. 2100 S IH 35 Suite 202 Austin, TX 78704 (512)692-1465 Annual 12/31/2012 Superior HeatlhPlan 2100 S IH 35 Suite 202 Austin, TX 78704 Prospective $10,000 - $24,999.99 12/31/2012 Page: 1 Texas Ethics Commission * (512) 463-5800 * www.ethics.state.tx.us Date Printed: 02/13/2013 Lobbyist Lobbyist Mailing Address Telephone # Reporting Type Termination Date EMP/C EMP/C Address Comp. Type Comp. Level EMP/C Term. -

Final Environmental Assessment for the Proposed Contract Detention

DEPARTMENT OF HOMELAND SECURITY U.S. IMMIGRATION AND CUSTOMS ENFORCEMENT ENVIRONMENTAL ASSESSMENT FOR THE PROPOSED CONTRACT DETENTION FACILITY IN THE HOUSTON, TEXAS AREA OF OPERATIONS 29 December 2016 Lead Agency: Department of Homeland Security U.S. Immigration and Customs Enforcement 500 12th Street Southwest Washington, DC 20536 Points of Contact: Trina Fisher Contracting Officer, Detention Compliance and Removals Division DHS ICE Office of Acquisition Management 801 I Street NW, Room 9143 Washington, DC 20536-5750 Elizabeth Kennett Energy, Environmental, and Sustainability Program Manager DHS ICE Office of Asset and Facilities Management 500 12th Street SW, Mail Stop 5703 Washington, DC 20536 1 EXECUTIVE SUMMARY 6 ACRONYMS AND ABBREVIATIONS 8 PROJECT BACKGROUND 11 1.1 Introduction 11 1.2 Purpose and Need 11 1.3 Scope and Content of the Analysis 12 1.4 Interagency Coordination, Consultation and Public Involvement 12 1.5 Description of the Proposed Action and Alternatives 13 1.5.1 Proposed Action 13 1.5.2 No Action Alternative 13 1.5.3 Proposed Action Alternative 1 – Renovations to HPC 14 1.5.4 Proposed Action Alternative 2 – New Facility in Montgomery County 15 1.5.5 Summary of Alternatives Considered but Eliminated 15 AFFECTED ENVIRONMENT AND ENVIRONMENTAL CONSEQUENCES 17 2.1 Geology, Soils, Topography and Seismicity 21 2.1.1 Affected Environment 21 2.1.2 Environmental Consequences 24 2.1.3 Mitigation and BMPs 25 2.2 Hydrology and Water Resources 25 2.2.1 Affected Environment 25 2.2.2 Environmental Consequences 28 2.2.3 Mitigation -

Bilancio Di Sostenibilità 2020

Bilancio di Sostenibilità 2020 Fondo Pensione Nazionale BCC/CRA Contenuti Discorso Direttore Generale pag. 3 Fondo Pensione Nazionale BCC/CRA in numeri pag. 4 I Fondi contattati per l’analisi pag. 11 Come leggere l’analisi pag. 13 Highlights ESG pag. 14 Analisi Sustainable Development Goals pag. 15 Analisi ESG pag. 16 Risultati di sostenibilità pag. 26 La nostra metodologia di valutazione ESG pag. 28 Business Cases pag. 29 Appendice pag. 35 2 Nel lontano 2009, quando non era ancora di moda Tutti i futuri sforzi del Fondo Pensione il trend dell’ESG e la giurisdizione italiana ed proseguiranno in questa direzione, con europea guardavano ancora da lontano una l’obiettivo non solo di implementare un numero eventuale introduzione di normative volte a sempre crescente di metriche di rilevazione ESG, regolamentare tali aspetti all’interno del processo ma anche di estendere le stesse a tutti gli asset decisionale degli investitori istituzionali, il Fondo detenuti, liquidi ed illiquidi. A tal proposito si Pensione Nazionale BCC/CRA, grazie alla visione evidenzia che i mandati di gestione presenti in lungimirante del Direttore Generale Sergio Carfizzi, portafoglio, pur non prevedendo ancora del tutto nonché al costante appoggio e sostegno da parte nelle attuali convenzioni delle specifiche della Governance, iniziava a muovere i primi passi strategie a benchmark ESG, stanno verso la tematica della sostenibilità. progressivamente introducendo tali parametri La forte diversificazione del portafoglio dispiegata nel loro processo strategico grazie ad esempio nel corso degli anni ed i conseguenti investimenti all’adozione di Exclusion Policies legate al rischio nel “decorrelato” hanno consentito al Fondo di far climatico o a Standard ESG proprietari estesi sentire la propria voce in merito alle tematiche anche nell’ambito del processo di selezione dei ambientali, sociali e di governance, alimentando titoli detenuti in nome e per conto del Fondo un graduale processo di sensibilizzazione ed Pensione. -

US Mainstream Media Index May 2021.Pdf

Mainstream Media Top Investors/Donors/Owners Ownership Type Medium Reach # estimated monthly (ranked by audience size) for ranking purposes 1 Wikipedia Google was the biggest funder in 2020 Non Profit Digital Only In July 2020, there were 1,700,000,000 along with Wojcicki Foundation 5B visitors to Wikipedia. (YouTube) Foundation while the largest BBC reports, via donor to its endowment is Arcadia, a Wikipedia, that the site charitable fund of Lisbet Rausing and had on average in 2020, Peter Baldwin. Other major donors 1.7 billion unique visitors include Google.org, Amazon, Musk every month. SimilarWeb Foundation, George Soros, Craig reports over 5B monthly Newmark, Facebook and the late Jim visits for April 2021. Pacha. Wikipedia spends $55M/year on salaries and programs with a total of $112M in expenses in 2020 while all content is user-generated (free). 2 FOX Rupert Murdoch has a controlling Publicly Traded TV/digital site 2.6M in Jan. 2021. 3.6 833,000,000 interest in News Corp. million households – Average weekday prime Rupert Murdoch Executive Chairman, time news audience in News Corp, son Lachlan K. Murdoch, Co- 2020. Website visits in Chairman, News Corp, Executive Dec. 2020: FOX 332M. Chairman & Chief Executive Officer, Fox Source: Adweek and Corporation, Executive Chairman, NOVA Press Gazette. However, Entertainment Group. Fox News is owned unique monthly views by the Fox Corporation, which is owned in are 113M in Dec. 2020. part by the Murdoch Family (39% share). It’s also important to point out that the same person with Fox News ownership, Rupert Murdoch, owns News Corp with the same 39% share, and News Corp owns the New York Post, HarperCollins, and the Wall Street Journal. -

A Comparative Examination of Private Equity in the United States and Europe: Accounting for the Past and Predicting the Future of European Private Equity

Fordham Journal of Corporate & Financial Law Volume 18 Issue 3 Article 7 2013 A Comparative Examination of Private Equity in the United States and Europe: Accounting for the Past and Predicting the Future of European Private Equity Alexandros Seretakis [email protected] Follow this and additional works at: https://ir.lawnet.fordham.edu/jcfl Recommended Citation Alexandros Seretakis, A Comparative Examination of Private Equity in the United States and Europe: Accounting for the Past and Predicting the Future of European Private Equity, 18 Fordham J. Corp. & Fin. L. 613 (2013). Available at: https://ir.lawnet.fordham.edu/jcfl/vol18/iss3/7 This Article is brought to you for free and open access by FLASH: The Fordham Law Archive of Scholarship and History. It has been accepted for inclusion in Fordham Journal of Corporate & Financial Law by an authorized editor of FLASH: The Fordham Law Archive of Scholarship and History. For more information, please contact [email protected]. A Comparative Examination of Private Equity in the United States and Europe: Accounting for the Past and Predicting the Future of European Private Equity Cover Page Footnote Research Fellow, New York University Pollack Center for Law and Business, 2012; LL.M., NYU School of Law, 2011; LL.M., University College of London, 2009; L.L.B., Aristotle University of Thessaloniki, 2007. This article was written during the author’s stay at the Pollack Center for Law and Business. I would like to express my gratitude to the Pollack Center of Law and Business for their continued research and academic support during the course of my fellowship in 2011–2012. -

Deutsche Bank AG, London Branch

Securities Note & Summary 18 January 2008 Deutsche Bank AG, London Branch Issue of U.S.$30,000,000 108% Capital Protected Notes due 2021 linked to the KKR Protected Private Equity Index (to be consolidated and form a single series with the existing U.S.$10,000,000 108% Capital Protected Notes due 2021 linked to the KKR Protected Private Equity Index issued on 30 November 2007) Issue Price 100% The issuer (the “Issuer”) of the securities described in the “Prospectus” (consisting of a registration document dated 3 May 2007 (the “Registration Document”) and this Securities Note & Summary) is Deutsche Bank Aktiengesellschaft, acting through its London branch (“Deutsche Bank AG, London Branch”). Application has been made to the Commission de Surveillance du Secteur Financier (the "CSSF") in its capacity as competent authority under the Luxembourg Act relating to prospectuses for securities (Loi relative aux Prospectus pour valeurs mobilières) to approve the Prospectus as a prospectus for the purposes of Directive 2003/71/EC (the "Prospectus Directive"). Application has also been made to the Luxembourg Stock Exchange for the admission to trading on the Bourse de Luxembourg (“Regulated Market”) of the Luxembourg Stock Exchange and the listing on the Official List of the Luxembourg Stock Exchange of the Notes (as defined below) which are to be issued by the Issuer pursuant to its U.S.$40,000,000,000 Global Structured Note Programme (the “Programme”). This is an offering of U.S.$30,000,000 in aggregate principal amount of 108% Capital Protected Notes due 2021 issued on 12 December 2007 (the “Notes”, ) linked to the KKR Protected Private Equity Index (the “Index”), which is an index established and administered by Deutsche Bank AG, London Branch as index sponsor (the “Index Sponsor”) and index administrator (the “Index Administrator”) and managed by Kohlberg Kravis Roberts & Co.