Annual Report 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cell Phone City Mobile Phone Use and the Hybridization of Space in Tokyo

Cell Phone City Mobile Phone Use and the Hybridization of Space in Tokyo PhD Thesis, Urban Studies Deirdre Aranka Lucia Sneep Universität Duisburg-Essen IN-EAST School of Advanced Studies Cell Phone City Mobile Phone Use and the Hybridization of Space in Tokyo Inaugural-Dissertation zur Erlangung des akademischen Grades Doktor der Philosophie (Dr. phil.) der Fakultät für Geisteswissenschaften der Universität Duisburg-Essen vorgelegt von Deirdre Aranka Lucia Sneep aus Mülheim (Ruhr) Gutachter/Betreuer: Prof. Dr. Jens Martin Gurr and Prof. Dr. Florian Coulmas, Universität Duisburg-Essen Duisburg, 8 September 2017 Disputation: Essen, den 12. Juni 2018 1 This PhD project has been a part of the ‘Urban Systems in East Asia’ cluster of the IN-EAST School of Advanced Studies, University of Duisburg-Essen. All photographs and images in this thesis belong to the author, unless otherwise stated in the caption. Do not reproduce without permission. Diese Dissertation wird über DuEPublico, dem Dokumenten- und Publikationsserver der Universität Duisburg-Essen, zur Verfügung gestellt und liegt auch als Print-Version vor. DOI: 10.17185/duepublico/71795 URN: urn:nbn:de:hbz:464-20200610-125905-4 Alle Rechte vorbehalten. 2 TABLE OF CONTENTS 1. Introduction ............................................................................................................................................................... 6 Smartphone Citizens................................................................................................................................................ -

International Exhibition Specialised in SMART GRID

Exhibiting Information Who is Finally Launched! Reed Exhibitions Japan Ltd. ? International exhibition specialised in SMART GRID Reed Exhibitions Japan Ltd. is the Japan branch of world’s leading trade fair organiser –Reed Exhibitions. By April 2010, Reed Exhibitions Japan Ltd. organises 53 exhibitions and conferences in Japan annually which all of them are in great success. Below are excerpt of some shows that Reed Exhibitions Japan Ltd. organises. 1st INTERNATIONAL ELECTRONICS Asia’s Largest Electronics Manufacturing Show INTERNEPCON JAPAN / CAR-ELE JAPAN / EV JAPAN / IC PACKAGING TECHNOLOGY EXPO Dates: March 2 [Wed] – 4 [Fri], 2011 1,025* Exhibitors 63,982* Trade Visitors *Figures of 2010 event / including all concurrent shows Venue: Tokyo Big Sight, Japan Organised by: Reed Exhibitions Japan Ltd. IT Japan’s Largest IT Solution Show GREEN IT EXPO / CLOUD COMPUTING EXPO / RFID SOLUTIONS EXPO / DATA STORAGE EXPO / SOFTWARE DEVELOPMENT EXPO 1,589* Exhibitors 75,266* Trade Visitors *Figures of 2009 event / including all concurrent shows Reed Exhibitions Japan Ltd. is the professional exhibition organiser with rich experiences in establishing an international business platform for non-Japanese companies to interact and expand business. With continuous growth in both exhibitors and visitors number, Reed Exhibitions Japan Ltd. holds strong database that fully covers the market in depth. Be confident and count on us. Looking forward to your active participation to INT’L SMART GRID EXPO! INT'L SMART GRID EXPO Show Management Attn: Takeshi HORIUCHI -

Toward a Society Where All People Live in Affluence

Toward a society NEC Group established its corporate philosophy in NEC Para-Sports Support Project 1990: “NEC strives through "C&C*" to help advance in which humanity prevails Taking advantage of its experience in supporting wheelchair tennis, societies worldwide toward deepened mutual and understanding of NEC supports Para-sports (sports for people with a disability) to understanding and the fulfillment of human potential. advance toward realizing a “universal society,” in which everyone lives ”NEC conduct social contribution activities based on each other deepens in peace as members of society regardless of dierences in age, the following three med-term themes. gender, nationality and disability. throughout the world NEC’s Social Contribution Activities * C&C : Computers & Communications (meaning the integration of Computers In cooperation with NPO STAND,etc. and communications) The NEC Group sets a basic guideline for developing long-standing and eective social contribution programs Three Med-Term Themes and evaluates them based on its basic policies. Toward a society for Social Contribution Activities Our policy toward social contribution programs focuses on the following where all people Welfare and • Effective utilization of management resources Diversity • Partnerships with NPOs and NGOs • Connections between Group companies and live in affluence employee participation • Contributing to improving our corporate value Education, Environment Culture and NEC is conducting social contribution activities that consider the interests and advancement of all stakeholders, including Sports local communities, as part of eorts to fulfill its corporate NEC Para-Sports Search http://www.nec.com/en/global/community/diversity/paraspo.html social responsibilities as a “good corporate citizen.” NEC “TOMONI” Project NEC Make-a-Dierence Drive (MDD) NEC Make-a-Dierence Drive (MDD) is the activity to contribute to local The entire NEC Group, in collabo- communities by NEC group employees worldwide. -

(Japan) № Company Name (Japan) № Company Name (Overseas) № Company Name (Overseas) 恩益禧数碼応用産品貿易(上海)有限公司 (NEC 1 NEC Corporation 29 NEC Embedded Technology, Ltd

Data Collection Scope: 92 Companies comprising NEC Corporation and NEC Group companies (41 in Japan and 51 overseas) № Company Name (Japan) № Company Name (Japan) № Company Name (Overseas) № Company Name (Overseas) 恩益禧数碼応用産品貿易(上海)有限公司 (NEC 1 NEC Corporation 29 NEC Embedded Technology, Ltd. 1 NEC Corporation of America 27 Information Systems (Shanghai), Ltd.) 2 ABeam Consulting Ltd. 30 NEC Fielding, Ltd. 2 NEC Canada, Inc. 28 NEC Hong Kong Limited 3 OCC Corporation 31 NEC Platforms, Ltd. 3 NEC Laboratories America, Inc. 29 NEC Taiwan Ltd. (台湾恩益禧股份有限公司) 4 NEC Nexsolutions, Ltd. 32 NEC Patent Service, Ltd. 4 Niteo Technologies, Private Limited 30 NEC Asia Pacific Pte. Ltd. 5 SHIMIZU SYNTEC Corporation 33 NEC Friendly Staff, Ltd. 5 NEC Energy Solutions, Inc. 31 NEC Corporation of Malaysia Sdn. Bhd. 6 Sunnet Corporation 34 NEC Management Partner, Ltd. 6 NEC Latin America S.A. 32 NEC Corporation (Thailand) Ltd. 7 Bestcom Solutions Inc. 35 NEC Livex, Ltd. 7 NEC Argentina S.A. 33 NEC Technologies India Private Limited Institute for International Socio-Economic 8 YEC Solutions Inc. 36 Studies 8 NEC Chile S.A. 34 NEC Philippines, Inc. 9 KIS Co., Ltd. 37 TAKASAGO, Ltd. 9 NEC de Colombia S.A. 35 NEC Vietnam Company Limited 10 NEC Space Technologies, Ltd. 38 NEC Display Solutions, Ltd. 10 NEC de Mexico, S.A.de C.V. 36 PT. NEC Indonesia 11 NEC Network and Sensor Systems, Ltd. 39 Showa Optronics Co., Ltd. 11 NEC Europe Ltd. 37 NEC Australia Pty Ltd 12 NEC Aerospace Systems, Ltd. *40 Nippon Avionics Co., Ltd. 12 NEC Deutschland GmbH 38 NEC New Zealand Limited 13 Cyber Defense Institute, Inc. -

Annual Report

VCCI Council VCCI VCCI Council April2018March 2018 - 2019 ANNUAL REPORT English This publication is printed on an environment-friendly ink. VCCI Council The purpose of this corporate body is to promote, in cooperation with related industries, the Greetings voluntary control of radio disturbances emitted from multimedia equipment (MME) on the one Thank you for your continuing support for the activities of VCCI. hand, and improvement of robustness of MME against radio disturbances on the other hand, so This is a report on our activities in FY 2018. that the interests of Japanese consumers are protected with respect to anxiety-free use of MME. At the world's largest CPS and IoT general exhibition, "CEATEC JAPAN 2018", held in October last year, Japan's growth strategy to achieve "Society 5.0" and its vision for the future were announced to the world based on the theme "Connecting Society, Co-Creating the Future". 5G Description mobile communications system services are planned to finally begin operation in Japan next year, and steady initiatives are underway to make "Society 5.0", a.k.a. a "super-smart society", a reality. Formulate…basic…policies… on… voluntary… control… of… electromagnetic… Hold …measurement…skills…courses…to…prepare…members’…engineers… 1 disturbances…emitted…by…multimedia…equipment 6 for…adequate…conformity…assessment We have high hopes for further developments in the IT and electronics industry, which holds deep ties to VCCI, as a key player in providing a platform for achieving "Society 5.0". By VCCI Council leveraging its growing technological prowess in an increasingly competitive world, the IT and Coordinate… the…interest… of…member… organizations… and…liaise… with… Study…trends…in…overseas…EMC…regulations…and…seek…opportunities… President: 2 the…government…and…related…agencies 7 for…mutual…recognition…agreement electronics industry will help solve a variety of social problems through collaborative creation. -

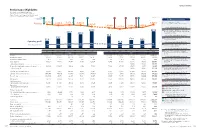

Performance Highlights

Performance Highlights Performance Highlights NEC Corporation and Consolidated Subsidiaries For the fiscal years ended or year-end as of March 31 * Figures for adjusted operating profit and adjusted net profit have not been audited by the accounting auditors Key (Billions of yen) Management 1 2 3 4 5 6 7 8 Measures Key Management Measures 3,115.4 l Measures to optimize business portfolio 3,036.8 3,071.6 3,043.1 3,095.2 l Measures to grow business and strengthen financial foundation Revenue 2,935.5 2,913.4 2,824.8 2,665.0 2,844.4 Fiscal year ended March 31, 2011 128.1 127.6 1 Made NEC Electronics Corporation, a semiconductor 114.6 business, currently Renesas Electronics Corporation, into 106.2 an equity-method affiliate 91.4 Fiscal year ended March 31, 2012 73.7 2 Made the consumer PC business into 57.8 63.9 58.5 an equity-method affiliate Operating profit 41.8 Fiscal year ended March 31, 2013 Operating profit ratio Acquired the business support system business of 3.7% 3.5% 4.4% 3.2% 4.1% 1.9% 2.4% 1.6% 2.2% 2.0% U.S.-based Convergys Corporation Fiscal year ended March 31, 2014 (Millions of yen) 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 3 Divested all of NEC’s stakes in NEC Mobiling, Ltd., JGAAP IFRS currently MX Mobiling Co., Ltd., a mobile phone sales business Revenue . ¥3,115,424 ¥3,036,836 ¥3,071,609 ¥3,043,114 ¥2,935,517 ¥2,824,833 ¥2,665,035 ¥2,844,447 ¥2,913,446 ¥3,095,234 International revenue . -

Integrated Report 2020 NEC Way

Integrated Report 2020 NEC Way The NEC Way is a common set of values that form the basis for how the entire NEC Group conducts itself. Within the NEC Way, the “Purpose” and “Principles” represents why and how as a company we conduct business, whilst the “Code of Values” and “Code of Conduct” embodies the values and behaviors that all members of the NEC Group must demonstrate. Putting the NEC Way into practice we will create social value. Editorial Policy Reporting Period NEC has published integrated annual reports containing both financial and non-financial information since 2013. Starting in April 1, 2019 to March 31, 2020 (hereinafter referred 2018, having defined its materiality, NEC has changed the name of the report to the“Integrated Report.” to as “Fiscal 2020.” Any other fiscal years are referred Integrated Report 2020 comprises four chapters, respectively titled Business Strategy and Vision, Business Activities, to similarly) This report also includes information Management Foundation, and Corporate Data. obtained after this reporting period. Business Strategy and Vision describes the progress of the Mid-term Management Plan 2020 and our initiatives to create value based on the NEC Way, such as implementation of our priority themes from an Environmental, Social and Governance Scope of Report (ESG) perspective, or “materiality.” Business Activities includes a message from the CFO and introduces the management NEC Corporation and its consolidated subsidiaries strategies for each of our segments. Management Foundation introduces the Company’s initiatives in support of sustainable management. NEC will keep endeavoring to provide increasingly transparent and continuous information while incorporating feedback from various stakeholders. -

Download Brochure for WTP2017

Wireless Technology Park (WTP) 2017 5G & IoT – Creating New Value Show Overview for Exhibitors ■Dates 24-26 May 2017 10:00~18:00 *Closed at 17:00 on final day ■Venue Tokyo Big Sight, West Hall 1 & Conference Tower ■Expected visitors 50,000 for all expos held simultaneously ■Expected exhibitors 300 for all expos held simultaneously ■Held with Expo COMM Wireless Japan 2017, Transport System EXPO2017, International Drone EXPO 2017 ■ Organizers National Institute of Information and Communications Technology (NICT), Yokosuka Research Park (YRP R&D Promotion Committee), YRP Academia Collaboration Network ■Show Management EJK Japan, Ltd. ■Website https://www.wt-park.com/eng/index.html Introduction What is WTP? - It’s a sole event that shows the future of the wireless technology in Japan. WTP is one of the biggest events for wireless technology in Japan, consisting of exhibition, seminars and academic sessions. WTP is planned and held under the collaboration of industry-academia- government, such as private companies, educational/research institutions and Exhibition central/local authorities. Mission Seminar Academia Introduction of the latest research results and trends in the wireless communications technology field. Expansion of business network for wireless communication technology through exchanging knowledge among international institutions for economy, education and government as well as promoting the latest research and development. WTP2017 History of WTP Feature exhibition/seminar(plan) WTP is held every year since 2006. ■5G generation -

Annual Report 2001 International (Int’L Access Code) 81-3-3454-1111 NEC Home Page: Investor Relations Home Page

NEC CORPORATION NEC CORPORATION NEC CORPORATION 7-1, Shiba 5-chome, Minato-ku, Tokyo 108-8001, Japan Telephone: Japan (03) 3454-1111 Annual Report 2001 International (Int’l Access Code) 81-3-3454-1111 NEC home page: http://www.nec.com Investor Relations home page: http://www.nec.co.jp/ir-e Annual Report 200 1 NEC SOLUTIONS NEC NETWORKS NEC ELECTRON DEVICES ISSN 0910-0229 ©NEC Corporation 2001 Printed in Japan on recycled paper NEC—THE INTERNET SOLUTION PROVIDER NEC FACTS (As of March 31, 2001) Opportunities spawned by the Internet’s growth appear to be limit- FACILITIES MAJOR CONSOLIDATED SUBSIDIARIES less. Many companies are targeting this market but few have NEC’s JAPAN JAPAN depth. NEC ranks among the world leaders in three fields critical to Consolidated Subsidiaries NEC Kansai, Ltd. The Company has 89 consolidated subsidiaries NEC Personal Systems, Ltd. the Internet age: computers, communications equipment and elec- throughout Japan. NEC Fielding, Ltd. tron devices. Continued growth in all three is assured as the NEC Kyushu, Ltd. Manufacturing Plants NEC Yonezawa, Ltd. Internet revolution gains momentum. To ensure its own prosperity, The Company has five major plants in or near NEC Shizuoka, Ltd. NEC is concentrating all three of these core businesses on Internet- Tokyo, and its consolidated subsidiaries NEC Tohoku, Ltd. maintain 53 plants throughout Japan. NEC Logistics, Ltd. related fields. This strategy will firmly position NEC as a key NEC Saitama, Ltd. Internet solution provider, creating greater value for customers and Marketing Network NEC Gunma, Ltd. The Company and its consolidated subsidiaries NEC Systems Integration & Construction, Ltd. -

NEC Vision 2017 Case Studies and Highlights Co-Creating Social Value Through Human-Digital Integration

Creating value together NEC Vision 2017 Case Studies and Highlights Co-creating social value through human-digital integration The increasing diversification and globalization of our society is giving rise to a range of complex social issues that are closely intertwined. As we look to address these issues, we must also find ways to respond to a fast-changing market environment. NEC is committed to helping solve the issues that society is facing so that we can realize a society that is brighter and more prosperous for all. We are doing this by bringing the world our cutting-edge Solutions for Society. These solutions leverage our information and communications technology (ICT) assets to provide our customers with the tools they need to quickly transform their organizations while at the same time creating the important social values of Safety, Security, Efficiency, and Equality. As we develop our Solutions for Society, we are “co-creating” with our customers and partners, as well as governments, local bodies, and international organizations, to devise new business models that will meet the needs of the future. Going forward, NEC will continue to take on the challenge of creating social value through human-digital integration, from the customer’s perspective and the perspective of society, as a partner who is trusted to the fullest. This booklet introduces some of the Solutions for Society businesses that NEC is involved in and examples of how we are working with our customers to create value for society. We have also issued “NEC Vision 2017 for Social Value Creation,” which describes the vision that we at NEC have for creating social value through our business activities. -

Annual Report 2000

NEC CORPORATION CORPORATION NEC NEC CORPORATION 7-1, Shiba 5-chome, Minato-ku, Tokyo 108-8001, Japan Telephone:Japan (03) 3454-1111 Annual Report 2000 International (Int’l Access Code) 81-3-3454-1111 Facsimile: (03) 3798-1510~1519 NEC home page: http://www.nec-global.com Investor Relations home page: http://www.nec.co.jp/ir-e Annual Report 2000 NEC SOLUTIONS NEC NETWORKS THE RIGHT STRENGTHS FOR THE INTERNET ERA NEC ELECTRON DEVICES ISSN 0910-0229 ©NEC Corporation 2000 Printed in Japan on recycled paper NEC—THE INTERNET SOLUTION PROVIDER Opportunities spawned by the Internet’s growth appear to be limitless. Many companies are targeting this market but few have NEC’s depth. NEC ranks among the world leaders in three fields critical to the Internet age: computers, communications equipment and electron devices. Continued growth in all three is assured as the Internet revolution gains momentum. To ensure its own prosperity, NEC is concentrating all three of these core businesses on Internet-related fields. This strategy will firmly position NEC as a key Internet solution provider, creating greater value for customers and shareholders alike. CONTENTS FINANCIAL HIGHLIGHTS 1 TO OUR SHAREHOLDERS 2 NEC LOOKS TO THE FUTURE 6 THE RIGHT STRENGTHS FOR THE INTERNET ERA 10 NEC SOLUTIONS 12 NEC NETWORKS 16 NEC ELECTRON DEVICES 20 FINANCIAL SECTION 24 DIRECTORS, CORPORATE AUDITORS AND CORPORATE OFFICERS 54 INVESTOR INFORMATION 55 NEC FACTS 56 Statements in this annual report with respect to NEC’s plans, strategies, and beliefs, as well as other statements that are not historical facts are forward-looking statements involving risks and uncertainties. -

The Right Strengths for the Internet Era

NEC CORPORATION CORPORATION NEC NEC CORPORATION 7-1, Shiba 5-chome, Minato-ku, Tokyo 108-8001, Japan Telephone:Japan (03) 3454-1111 Annual Report 2000 International (Int’l Access Code) 81-3-3454-1111 Facsimile: (03) 3798-1510~1519 NEC home page: http://www.nec-global.com Investor Relations home page: http://www.nec.co.jp/ir-e Annual Report 2000 NEC SOLUTIONS NEC NETWORKS THE RIGHT STRENGTHS FOR THE INTERNET ERA NEC ELECTRON DEVICES ISSN 0910-0229 ©NEC Corporation 2000 Printed in Japan on recycled paper NEC—THE INTERNET SOLUTION PROVIDER Opportunities spawned by the Internet’s growth appear to be limitless. Many companies are targeting this market but few have NEC’s depth. NEC ranks among the world leaders in three fields critical to the Internet age: computers, communications equipment and electron devices. Continued growth in all three is assured as the Internet revolution gains momentum. To ensure its own prosperity, NEC is concentrating all three of these core businesses on Internet-related fields. This strategy will firmly position NEC as a key Internet solution provider, creating greater value for customers and shareholders alike. CONTENTS FINANCIAL HIGHLIGHTS 1 TO OUR SHAREHOLDERS 2 NEC LOOKS TO THE FUTURE 6 THE RIGHT STRENGTHS FOR THE INTERNET ERA 10 NEC SOLUTIONS 12 NEC NETWORKS 16 NEC ELECTRON DEVICES 20 FINANCIAL SECTION 24 DIRECTORS, CORPORATE AUDITORS AND CORPORATE OFFICERS 54 INVESTOR INFORMATION 55 NEC FACTS 56 Statements in this annual report with respect to NEC’s plans, strategies, and beliefs, as well as other statements that are not historical facts are forward-looking statements involving risks and uncertainties.