Please Use the Green PRINT Button on Top of Page 1 to Print This Document

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Beijing Subway Map

Beijing Subway Map Ming Tombs North Changping Line Changping Xishankou 十三陵景区 昌平西山口 Changping Beishaowa 昌平 北邵洼 Changping Dongguan 昌平东关 Nanshao南邵 Daoxianghulu Yongfeng Shahe University Park Line 5 稻香湖路 永丰 沙河高教园 Bei'anhe Tiantongyuan North Nanfaxin Shimen Shunyi Line 16 北安河 Tundian Shahe沙河 天通苑北 南法信 石门 顺义 Wenyanglu Yongfeng South Fengbo 温阳路 屯佃 俸伯 Line 15 永丰南 Gonghuacheng Line 8 巩华城 Houshayu后沙峪 Xibeiwang西北旺 Yuzhilu Pingxifu Tiantongyuan 育知路 平西府 天通苑 Zhuxinzhuang Hualikan花梨坎 马连洼 朱辛庄 Malianwa Huilongguan Dongdajie Tiantongyuan South Life Science Park 回龙观东大街 China International Exhibition Center Huilongguan 天通苑南 Nongda'nanlu农大南路 生命科学园 Longze Line 13 Line 14 国展 龙泽 回龙观 Lishuiqiao Sunhe Huoying霍营 立水桥 Shan’gezhuang Terminal 2 Terminal 3 Xi’erqi西二旗 善各庄 孙河 T2航站楼 T3航站楼 Anheqiao North Line 4 Yuxin育新 Lishuiqiao South 安河桥北 Qinghe 立水桥南 Maquanying Beigongmen Yuanmingyuan Park Beiyuan Xiyuan 清河 Xixiaokou西小口 Beiyuanlu North 马泉营 北宫门 西苑 圆明园 South Gate of 北苑 Laiguangying来广营 Zhiwuyuan Shangdi Yongtaizhuang永泰庄 Forest Park 北苑路北 Cuigezhuang 植物园 上地 Lincuiqiao林萃桥 森林公园南门 Datunlu East Xiangshan East Gate of Peking University Qinghuadongluxikou Wangjing West Donghuqu东湖渠 崔各庄 香山 北京大学东门 清华东路西口 Anlilu安立路 大屯路东 Chapeng 望京西 Wan’an 茶棚 Western Suburban Line 万安 Zhongguancun Wudaokou Liudaokou Beishatan Olympic Green Guanzhuang Wangjing Wangjing East 中关村 五道口 六道口 北沙滩 奥林匹克公园 关庄 望京 望京东 Yiheyuanximen Line 15 Huixinxijie Beikou Olympic Sports Center 惠新西街北口 Futong阜通 颐和园西门 Haidian Huangzhuang Zhichunlu 奥体中心 Huixinxijie Nankou Shaoyaoju 海淀黄庄 知春路 惠新西街南口 芍药居 Beitucheng Wangjing South望京南 北土城 -

Analysis and Evaluation of the Beijing Metro Project Financing Reforms

Advances in Social Science, Education and Humanities Research, volume 291 International Conference on Management, Economics, Education, Arts and Humanities (MEEAH 2018) Analysis and Evaluation of the Beijing Metro Project Financing Reforms Haibin Zhao1,a, Bingjie Ren2,b, Ting Wang3,c 1Ministry of Transport Research Institute, Chaoyang, Beijing, China,100029; 2Beijing Urban Construction Design & Development Group Co., Limited, Xicheng, Beijing, China,100037; 3School of Civil Engineering, Beijing Jiaotong University, Haidian, Beijing, China, 100044. [email protected], [email protected], [email protected] Keywords: metro; financing; marketisation; reform Abstract. The construction and operation of a metro system are costly, and the sustainable development of a metro system is difficult using government funding alone, particularly for developing countries. The main source for metro system financing in China is, currently, government budget and bank debt. Many cities have begun to seek new ways to attract funds from finance markets, which is increasing the need for the evaluation of metro financing. This study uses Beijing as a case study that utilises various financing modes with impressive results. As participants of the financing reform, the authors collected all the relative government documents and interviewed stakeholders to accomplish this work. This article reviews the development of financing modes for the Beijing Metro system during the last four decades and analyses the role of the government in the reformed financing system within the Chinese social political environment. The study addresses the advantages and challenges of the reforms in this context. To further analyses the technical processes of typical financing modes, the public-private partnership mode of Line 4, the BT mode of Olympic Branch Line, the insurance claim mode of Line 10 and the failure of the market oriented financing for Capital Airport Line are analysed and evaluated in detail. -

(Presentation): Improving Railway Technologies and Efficiency

RegionalConfidential EST Training CourseCustomizedat for UnitedLorem Ipsum Nations LLC University-Urban Railways Shanshan Li, Vice Country Director, ITDP China FebVersion 27, 2018 1.0 Improving Railway Technologies and Efficiency -Case of China China has been ramping up investment in inner-city mass transit project to alleviate congestion. Since the mid 2000s, the growth of rapid transit systems in Chinese cities has rapidly accelerated, with most of the world's new subway mileage in the past decade opening in China. The length of light rail and metro will be extended by 40 percent in the next two years, and Rapid Growth tripled by 2020 From 2009 to 2015, China built 87 mass transit rail lines, totaling 3100 km, in 25 cities at the cost of ¥988.6 billion. In 2017, some 43 smaller third-tier cities in China, have received approval to develop subway lines. By 2018, China will carry out 103 projects and build 2,000 km of new urban rail lines. Source: US funds Policy Support Policy 1 2 3 State Council’s 13th Five The Ministry of NRDC’s Subway Year Plan Transport’s 3-year Plan Development Plan Pilot In the plan, a transport white This plan for major The approval processes for paper titled "Development of transportation infrastructure cities to apply for building China's Transport" envisions a construction projects (2016- urban rail transit projects more sustainable transport 18) was launched in May 2016. were relaxed twice in 2013 system with priority focused The plan included a investment and in 2015, respectively. In on high-capacity public transit of 1.6 trillion yuan for urban 2016, the minimum particularly urban rail rail transit projects. -

Campus Life Guide for International Students

CAMPUS LIFE GUIDE FOR INTERNATIONAL STUDENTS International Students & Scholars Center 4 Life at Tsinghua Contents Food and Drink 13 Shopping 15 Postal and Delivery Services 16 Transportation 16 Sports and Leisure 18 Student Associations 19 Important Dates and Holidays 20 5 Academics and Related Resources Teaching Buildings and Self-Study Rooms 21 Learning Chinese 21 Libraries 22 Important University Websites 22 Center for Psychological Development 23 Center for Student Learning and Development 23 Career Development Center 24 1 Welcome to Tsinghua Center for Global Competence Development 24 Welcome Message 01 About Tsinghua 02 6 Health and Safety Hospitals 25 Before You Leave Home Health Insurance 26 2 Campus Safety Tips 27 Important Documents 03 Visa 03 Physical Examination 05 Beijing and Surrounds Converting Money 05 7 What to Bring 06 Climate 29 Accommodation 06 Transportation 29 Wudaokou and Surrounds 30 Travel 30 3 Settling In Beijing Life Web Resources 30 Getting to Tsinghua 08 Housing Arrangements 08 Useful Information and Contacts University Registration 09 8 Local Sim Card 09 Emergency Contacts 31 Bank Card 10 On-Campus Important Contacts 31 Student IC Card 10 Off-Campus Important Contacts 31 Internet 11 Campus Map 32 Student Email Account 12 International Students & Scholars Center 33 Physical Examination Authentication 12 Orientation 12 Appendix Additional Information 12 Welcome to Tsinghua 欢迎来到清华 About Tsinghua Founded in 1911, Tsinghua University is a unique comprehensive university bridging China and the world, connecting ancient and modern society, and encompassing the arts and sciences. As one of China's most prestigious and influential universities, Tsinghua is committed to cultivating globally competent students who will thrive in today's world and become tomorrow's leaders. -

Fom, 990-EZ Return of Organization Exempt from Income Tax Under Section 501(C), 527, Or 4947(A)(1) of the Internal Revenue Code (Except Private Foundations) 20013

Short Form OMB No. 1545-1150 Fom, 990-EZ Return of Organization Exempt From Income Tax Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations) 20013 ► Do not enter Social Security numbers on this form as it may be made public. Department of the Treasury Internal Revenue Service ► Information about Form 990-EZ and its instructions is at www.irs.gov/form990. A For the 2013 calendar year, or tax year beginning July 1 , 2013, and ending June 30 , 20 14 B Check if applicable C Name of organization D Employer identification number q Address change Canyon Lake Noon Lions Club 74-2269289 q Name change Number and street (or P.O. box, if mail is not delivered to street address) Room/suite E Telephone number q Initial return P. O. Box 2027 (830 ) 905-4601 q Terminated City or town, state or province, country, and ZIP or foreign postal code q Amended return F Group Exemption Application pending Canon Lake , Texas 78133 Number ► 0239 q Other (specify) G Accounting Method- 0 Cash Accrual ► H Check ► 0 if the organization is not I Website: ► www.ctnoonlions .com required to attach Schedule B J Tax-exempt status (check only one) - q 501 c 3 501 c I Insert no.) q 4947(a)(1 ) or 0527 (Form 990, 990-EZ, or 990-PF). K Form of organization- q Corporation q Trust q Association [D Other Civic, Service & Social Organization L Add lines 5b, 6c, and 7b, to line 9 to determine gross receipts. If gross receipts are $200,000 or more, or if total assets (Part II, column (B) below) are $500,000 or more, file Form 990 instead of Form 990-EZ . -

MTR's Experiences in PPP for Railway Projects

MTR’s Experiences in PPP for Railway Projects Dr Jacob Kam Managing Director – Operations & Mainland Business 11 May 2017 MTR Businesses in China and Overseas 港铁公司在国内及海外的铁路业务 Line 4 & Daxing Line 1.881 Mil Line 14, Line 16 113.4 km Elizabeth Line Stockholm Metro 14.2k 1.228 mil 32.5 km 110km South Western rail Contract started MTR Express Hangzhou Metro Line 537k 53.7km from Aug 2017 455km(shared track) 1 and Ext Shenzhen Metro 550k Stockholm Hong Kong MTR Line 4 and Ext Commuter rail 20.5km 8.6 mil 34.3k 266 km 241 km Sydney Metro 36 km North West Under construction Melbourne Metro • Over 1,200km route length (exclude shared track) • Over 14 Million Passenger trips per weekday (using line based counting) 812k • Line based passenger trips do not match with the passenger trip data in annual report 390km MTR Corporation 5/16/2017 Page 2 Why cities need railways? • High capacity • High energy efficiency, low carbon emission In persons per hour in both direction Source: UITP MTR Corporation 5/16/2017 Page 3 Why cities need railways? Effective land use Modal Bus Rapid Bus Tram Light Rail Metro Characteristics Transit Max Flow 2,500 6,000 12,000 18,000 30,000 & above (per hour per direction) Average speed 10-14 15-22 15-22 18-40 18-40 (kph) Reliability Improving Good Medium to Good Good Very Good Mixed running Largely Road-space Mixed running Totally segregated and on-road tram segregated Totally segregated with traffic alignment Allocation lanes alignments All underground: Land Consumed 15 – 25 times 10 – 15 times 5 – 10 times 3 – 6 times 1 -

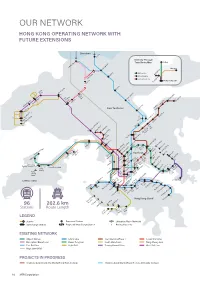

Our Network Hong Kong Operating Network with Future Extensions

OUR NETWORK HONG KONG OPERATING NETWORK WITH FUTURE EXTENSIONS Shenzhen Lo Wu Intercity Through Train Route Map Beijing hau i C Lok Ma Shanghai Sheung Shu g Beijing Line Guangzhou Fanlin Shanghai Line Kwu Tung Guangdong Line n HONG KONG SAR Dongguan San Ti Tai Wo Long Yuen Long t Ping 48 41 47 Ngau a am Tam i Sh i K Mei a On Shan a Tai Po Marke 36 K Sheungd 33 M u u ui Wa W Roa Au Tau Tin Sh 49 Heng On y ui Hung Shui Ki g ng 50 New Territories Tai Sh Universit Han Siu Ho 30 39 n n 27 35 Shek Mu 29 Tuen Mu cecourse* e South Ra o Tan Area 16 F 31 City On Tuen Mun n 28 a n u Sha Ti Sh n Ti 38 Wai Tsuen Wan West 45 Tsuen05 Wa Tai Wo Ha Che Kung 40 Temple Kwai Hing 07 i 37 Tai Wa Hin Keng 06 l Kwai Fong o n 18 Mei Fo k n g Yi Diamond Hil Kowloon Choi Wa Tsin Tong n i King Wong 25 Shun Ti La Lai Chi Ko Lok Fu d Tai Si Choi Cheung Sha Wan Hung Sau Mau Ping ylan n ay e Sham Shui Po ei Kowloon ak u AsiaWorld-Expo B 46 ShekM T oo Po Tat y Disn Resort m Po Lam Na Kip Kai k 24 Kowl y Sunn eong g Hang Ha Prince n Ba Ch o Sungong 01 53 Airport M Mong W Edward ok ok East 20 K K Toi ong 04 To T Ho Kwa Ngau Tau Ko Cable Car n 23 Olympic Yau Mai Man Wan 44 n a Kwun Ti Ngong Ping 360 19 52 42 n Te Ti 26 Tung Chung East am O 21 L Tung Austi Yau Tong Tseung Chung on Whampo Kwan Tung o n Jordan Tiu g Kowl loo Tsima Hung 51 Ken Chung w Sh Hom Leng West Hong Kong Tsui 32 t Tsim Tsui West Ko Eas 34 22 ha Fortress10 Hill Hong r S ay LOHAS Park ition ew 09 Lantau Island ai Ying Pun Kong b S Tama xhi aus North h 17 11 n E C y o y Centre Ba Nort int 12 16 Po 02 Tai -

Vietnamese Female Spouses' Language Use Patterns in Self Initiated Admonishment Sequences in Bilingual Taiwanese Families* L

Novitas-ROYAL (Research on Youth and Language), 2014, 8(1), 77-96. VIETNAMESE FEMALE SPOUSES’ LANGUAGE USE PATTERNS IN SELF INITIATED ADMONISHMENT SEQUENCES IN BILINGUAL TAIWANESE FAMILIES* Li-Fen WANG1 Abstract: This paper aims to identify how Taiwanese and Mandarin (the two dominant languages in Taiwan) are used as interactional resources by Vietnamese female spouses in bilingual Taiwanese families. Three Vietnamese-Taiwanese transnational families (a total of seventeen people) participated in the research, and mealtime talks among the Vietnamese wives and their Taiwanese family members were audio-/video-recorded. Conversation analysis (CA) was adopted to analyse the seven hours of data collected. It was found that the Vietnamese participants orient to Taiwanese and Mandarin as salient resources in admonishment sequences. Specifically, it was identified that the two languages serve as contextualisation cues and framing devices in the Vietnamese participants’ self-initiated admonishment sequences. Keywords: Conversation analysis, cross-border marriage, intercultural communication Özet: Bu çalışma, Tayvanca ve Çince’nin (Tayvan’daki yaygın iki dil) iki dil konuşan Tayvanlı ailelerdeki Vietnamlı kadın eşler tarafından etkileşimsel kaynak olarak nasıl kullanıldığını göstermeyi amaçlamaktadır. Üç Vietnamlı-Tayvanlı aile araştırmaya katılmıştır (toplamda on yedi kişi), ve Vietnamlı kadınlar ve onların Tayvanlı aile üyeleri arasındaki yemek zamanı konuşmaları sesli ve görüntülü olarak kaydedilmiştir. Toplanan yedi saatlik veriyi analiz etmek -

THE NEW FINANCIAL DESTINATION Beijing Lize Financial Business District Office Market Overview and Forecast COLLIERS RADAR OFFICE | RESEARCH | BEIJING | 11 JUNE 2019

COLLIERS RADAR OFFICE | RESEARCH | BEIJING | 11 JUNE 2019 Emily Cao Associate Director | Research | North China +86 10 8518 1633 [email protected] THE NEW FINANCIAL DESTINATION Beijing Lize Financial Business District Office Market Overview and Forecast COLLIERS RADAR OFFICE | RESEARCH | BEIJING | 11 JUNE 2019 Summary & Recommendations Geographical Green business As the final large scale development area between the 2nd and the 3rd Ring Road of advantage area Beijing, Lize Financial Business District has Lize has the shortest distance to the core office Lize is planned and constructed with high been considered as the 2nd Financial Street in areas among all the emerging office submarkets. standards as most projects are LEED certified. Beijing due to its prime location. With several Only 10+ minutes’ drive to West, South and Also, as the historic capital of the Jin Dynasty, prime office projects already completed, Lize is Fentai Railway Station from Lize. The city Lize has adopted a cultural and ecological fast developing into a new centre for the terminal of Daxing Int’l Airport to be inside Lize approach, making it a green business area that financial industry, especially with the release will largely improve the accessibility. embraces modern creativity and classical roots. of supporting policies in September 2018. Although the Lize office leasing market is still 2.19mn sq metres Competitive rent in the starting stage due to uncompleted infrastructure projects, we expect Lize to see Development of Lize is currently concentrated The net achievable rent in Lize is between rapid development during 2020-2022, after in the southern part. The office projects will be RMB180-210 per sq metre per month, lower rd the improvement of surrounding facilities. -

2020 Instructions for Form 1120

Userid: CPM Schema: instrx Leadpct: 100% Pt. size: 9 Draft Ok to Print AH XSL/XML Fileid: … ions/I1120/2020/A/XML/Cycle09/source (Init. & Date) _______ Page 1 of 30 22:04 - 8-Feb-2021 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. Department of the Treasury 2020 Internal Revenue Service Instructions for Form 1120 U.S. Corporation Income Tax Return Section references are to the Internal Revenue enacted after they were published, go to allowed a 100% deduction for certain Code unless otherwise noted. IRS.gov/Form1120. business meal expenses paid or incurred Contents Page in 2021 and 2022. See Travel, meals, and entertainment. Future Developments ............1 What’s New What’s New ..................1 New payroll credit for required paid Modifications to net operating losses. Photographs of Missing Children ....1 sick leave or family leave. Under the Losses that occurred in 2018, 2019, or The Taxpayer Advocate Service .....1 Families First Coronavirus Response Act 2020 generally can be carried back up to 5 Direct Deposit of Refund ..........2 (FFCRA), as amended, an eligible tax years preceding the year of the loss. Special rules apply to farming losses. See How To Make a Contribution To employer can take a credit against payroll Reduce Debt Held by the taxes owed for amounts paid for qualified the instructions for line 30. Public ...................2 sick leave or family leave if incurred during How To Get Forms and the allowed period. However, there is no Photographs of Publications ...............2 double tax benefit allowed and the Missing Children General Instructions .............2 amounts claimed are reportable as The Internal Revenue Service is a proud Purpose of Form ...............2 income on line 10. -

Powerpoint Eu2018.At

IOSH No Time to Lose How our supporters use tailored campaign resources and pledges to tackle occupational cancer Dr Vincent Ho President, Institution of Occupational Safety and Health (IOSH) Shared objectives: EU-OSHA Healthy Workplaces and IOSH No Time to Lose 2 No Time to Lose aims to: . raise awareness of occupational cancer – a significant health issue facing workers globally . provide free, practical, original materials to help organisations and individuals manage the risks . secure commitments from organisations to improve preventative measures 3 How we developed the campaign: . Surveyed our members . Held workshops with industry experts . Tested our resources . Developed a pledge committing organisations to improvements . Set key performance indicators . Planned a phased approach targeting biggest killers 4 The four phases of No Time to Lose Phase 1 – Phase 2 – Phase 3 – Phase 4 – Diesel Fumes Solar Radiation Respirable Asbestos Launched 2014 Launched 2015 crystalline silica - Launched 2018 Launched 2016 Free practical resources More than 100 businesses have pledged to take action They are now… ■ assessing the risks in their organisations ■ developing and delivering prevention strategies ■ briefing their managers ■ engaging with their employees ■ demanding the same standards from their supply chain ■ reporting on progress made Over 250 organisations in 33 countries are supporting the campaign Resources translated into different languages Good practice case studies from pledge signatories and supporters Working together to raise -

Annual Report 2020 Stock Code: 66

Keep Cities Moving Annual Report 2020 Stock code: 66 SUSTAINABLE CARING INNOVATIVE CONTENTS For over four decades, MTR has evolved to become one of the leaders in rail transit, connecting communities in Hong Kong, the Mainland of China and around the world with unsurpassed levels of service reliability, comfort and safety. In our Annual Report 2020, we look back at one of the most challenging years in our history, a time when our Company worked diligently in the midst of an unprecedented global pandemic to continue delivering high operational standards while safeguarding the well-being of our customers and colleagues – striving, as always, to keep cities moving. Despite the adverse circumstances, we were still able to achieve our objective of planning an exciting strategic direction. This report also introduces our Corporate Strategy, “Transforming the Future”, which outlines how innovation, technology and, most importantly, sustainability and robust environmental, social and governance practices will shape the future for MTR. In addition, we invite you Keep Cities to read our Sustainability Report 2020, which covers how relevant Moving and material sustainability issues are managed and integrated into our business strategies. We hope that together, these reports offer valuable insights into the events of the past year and the steps we plan on taking toward helping Hong Kong and other cities we serve realise a promising long-term future. Annual Report Sustainability 2020 Report 2020 Overview Business Review and Analysis 2 Corporate Strategy