Gcb Bank Limited Annual Report 2017 2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Abdul-Nashiru Issahaku: Developing Ghana's Banking System

Abdul-Nashiru Issahaku: Developing Ghana’s banking system Speech by Dr Abdul-Nashiru Issahaku, Governor of the Bank of Ghana, at the inauguration of the Sunyani regional office building, Sunyani, 30 June 2016. * * * Nananom Board of Directors of Bank of Ghana Representatives of Banks in the Brong-Ahafo Region Representatives of Security Agencies in the Brong -Ahafo Region Heads of Departments Regional Managers My cherished members of staff Distinguished ladies and gentlemen Good morning I am delighted to welcome you all to the inauguration of our new Sunyani Regional Office building. Let me sincerely thank the Chiefs and people of Sunyani, in fact, the Brong Ahafo Region for making the land available to us. This is a clear indication of the support and collaboration between the Bank and the Chiefs. And let me also take this opportunity to thank the immediate past Governor of the Bank of Ghana Dr. Henry Kofi Wampah for spearheading this project and seeing to its completion. As we may all be aware, prior to the construction of this ultra-modern office complex, the Sunyani Regional Office had operated from the second floor of a building whose lower floors were occupied by GCB Bank. The regulator sharing office with the client is not ethically sound and exposes the Bank to familiarity threats. In addition, the former Office did not have a banknote processing capacity and depended on the Kumasi Regional Office for the processing of its deposits as well as fit-sorting banknotes for re-issuance to banks and other financial institutions in its catchment area. -

National Pensions Regulatory Authority

NATIONAL PENSIONS REGULATORY AUTHORITY NPRA PUBLIC NOTICE á LIST OF REGISTERED PENSIONS FUND CUSTODIANS THAT HAVE FULFILLED THE PRESCRIBED REQUIREMENTS OF THE AUTHORITY FOR THE 2020 AUTHORISATION PROCESS. THE LICENCES ARE VALID UNTIL 31ST JULY, 2021 LICENCE / TELEPHONE NO. NAME OF SERVICE PROVIDER REGISTRATION PHYSICAL ADDRESS CONTACT PERSON NUMBERS NO. 1. Prudential Bank Limited FC12007 8 John Hammond Seth Kyeremeh 0244-762652 Street, Ring Road Central, Accra 2. Access Bank Ghana Limited FC20002 Starlets '91 Road Franklin Ayensu- 0244-128163 Opposite Accra Nyarko Sports Stadium, Osu 3. First National Bank Ghana FC20001 6th Floor Accra Hilda Esenam 0242-435156 Limited Financial Centre, Odame-Gyenti 0501-632441 Liberia Road. 4. Agricultural Development FC12005 Accra Financial Elorm Aidam 0244-253181 Bank Centre, 3rd Ambassadorial Development Area, Ridge-Accra 5. GCB Bank Limited FC18002 No. 2 Thorpe Road, John Ekow 0557-410577 Accra Appiah-Sam 6. Ecobank Ghana Limited FC12001 Ecobank Ghana Albert Amekugee 0244-427476 Head Office, Accra 7. Zenith Bank Ghana Limited FC12013 31 Independence Alvin Abbah-Foli 0242-729012 Avenue, Accra Website: www.npra.gov.gh , e-mail: [email protected] “Ensuring Retirement Income Security” NATIONAL PENSIONS REGULATORY AUTHORITY NPRA PUBLIC NOTICE á LICENCE / TELEPHONE NO. NAME OF SERVICE PROVIDER REGISTRATION PHYSICAL ADDRESS CONTACT PERSON NUMBERS NO. 8. Republic Bank Ghana FC12006 No 48A Sixth Audrey Smith 0208-737616 Limited Avenue, North Dadzie Ridge, Accra 9. Fidelity Bank Ghana Limited FC12011 1st Floor, Ridge Rebecca Gyebi 0544-338784 Towers, Accra Elias Augustine 0576-036467 Dey 10. Guaranty Trust Bank FC12008 25A Castle Road Michael Yevu 0504-100158 (Ghana) Limited Ambassadorial Area, Ridge, Accra 11. -

WEEKLY MARKET REVIEW 8 March 2019

DATABANK RESEARCH WEEKLY MARKET REVIEW 8 March 2019 ANALYST CERTIFICATE & REQUIRED DISCLOSURE BEGINS ON PAGE 4 GSE MARKET STATISTICS SUMMARY Current Previous % Change Weekly Market Review Databank Free Float Index (DSI-20) 111.92 111.68 0.21% At the end of this week’s trading sessions, the Ghana GSE-CI Level 2,476.55 2,482.10 -0.22% Stock Exchange (GSE) recorded 10 price changes: 4 Market Cap (GH¢ m) 59,971.27 60,227.38 -0.43% YTD Return DSI-20 -4.88% -5.08% advancers and 6 decliners. The gainers for the week were YTD Return GSE-CI -3.72% -3.50% Ecobank Ghana (+10.24% w/w, GH¢7.75), GCB Bank Weekly Volume Traded (Shares) 4,899,415 1,963,159 149.57% (+8.26% w/w, GH¢3.80), Enterprise Group (+2.29% w/w, Weekly Turnover (GH¢) 3,905,685 12,076,818 -67.66% GH¢2.23) and Camelot (+11.11% w/w, GH¢0.10). Societe Avg. Daily Volume Traded (Shares) 372,148 290,938 27.91% Generale (-8.16% w/w, GH¢0.90), Total Petroleum (- Avg. Daily Value Traded (GH¢) 778,082 759,192 2.49% 1.53% w/w, GH¢4.52), Cal Bank (-2.91% w/w, GH¢1.00) No. of Counters Traded 16 22 and MTN Ghana (-2.70% w/w, GH¢0.72) were the top No. of Gainers 4 5 laggards. No. of Laggards 6 6 Trading activity slackened this week. Total Market Turnover for the week slowed ~68% w/w to ~GH¢3.91 KEY ECONOMIC INDICATORS million. -

WEEKLY MARKET REVIEW 3 November 2017

DATABANK RESEARCH WEEKLY MARKET REVIEW 3 November 2017 ANALYST CERTIFICATE & REQUIRED DISCLOSURE BEGINS ON PAGE 4 GSE MARKET STATISTICS SUMMARY Current Previous % Change Market Indices Maintain Bullish Performance (w/w): Databank Stock Index 30,388.18 30,209.24 0.59% By the end of this week’s trading session, the Ghana Stock Exchange’s Composite Index GSE-CI Level 2,367.28 2,352.11 0.64% increased by 15.15 points w/w to ~2,367 points while the Databank Stock Index (DSI) surged by 178.94 points w/w to 30,388 points. The year-to-date returns of the GSE-CI Market Cap (GH¢ m) 58,057.10 58,497.34 -0.75% and the DSI are recorded at 40.15% and 36.07% respectively. YTD Return DSI 36.07% 35.27% Market activity improved by ~32% w/w to 5.37 million shares on the back of block trades YTD Return GSE-CI 40.15% 39.25% in Cal Bank and Total Petroleum. The total volume of shares traded were valued at Weekly Volume Traded (Shares) 5,365,067 941,100 470.08% GH¢8.97 million. Cal Bank and Total Petroleum accounted for ~94% of the aggregate volume of shares traded. Weekly Turnover (GH¢) 8,973,736 3,004,202 198.71% Avg. Weekly Volume Traded The market breadth of the bourse was negative (w/w) with 6 gainers and 7 laggards. 1,443,315 1,417,645 1.81% Unilever Ghana was the best performer (w/w), surging by 39Gp to GH¢10.99. -

1 CONTACT DETAILS of PENSION FUND CUSTODIANS No. Company

CONTACT DETAILS OF PENSION FUND CUSTODIANS No. Company Name & Address Location Company Company Email & Website Contact Telephone # Person/Mobile 1. ECOBANK GHANA LIMITED Ecobank Ghana 0302-681146–8 [email protected] Vera-Marie Ayitey- PMB, GPO, Accra. Head Office. 0302-680869 Smith 0244-483036 2. STANDARD CHARTERED BANK High Street, 0302-664591–8, [email protected] Beverly Firmpong GHANA LTD. Accra 0302-769210–22 [email protected] 0302-633569 P. O. Box 768, Accra. 0202-023933 3. STANBIC BANK GHANA Stanbic Heights, 0302-610690 [email protected] Eunice Amoo- LIMITED Airport City, www.stanbic.com.gh Mensah P. O. Box CT 2344, Accra. Accra [email protected] 0244-333145 4. CAL BANK LIMITED No. 23 0302798334/5 [email protected] Nan Opoku (Ms.) P. O. Box 14596, Accra- Ghana. Independence www.calbank.net 0244-601170 Avenue-Ridge, [email protected] Accra 5. GUARANTY TRUST BANK 25A, Castle 0302-611560 [email protected] Solace Fiadjoe (GHANA) LTD. Road, 0302-662727 [email protected] 0504-100263 P. O. Box CT 416, Cantonment Ambassadorial www.gtbghana.com Area, Ridge, Accra. 6. AGRICULTURAL ADB House, 0302-770403 [email protected] Elorm Aidem DEVELOPMENT BANK Independent 0302-762104 www.agricbank.com 0244-253181 P. O. Box 4191, Accra. Avenue, 0302-783123 [email protected] Accra. 0302-784394 0302-262085 7. REPUBLIC BANK GHANA #48A, Sixth 0302-664372 www.republicghana.com Audrey Smith LIMITED Avenue, North 0302-668890 [email protected] Dadzie Head of Custody Services Ridge, Accra [email protected] 0208-737616 Department P. O. Box CT4603, Cantonment, Accra. -

Survey of Bank Charges Second Quarter, 2019

Survey of Bank Charges Second Quarter, 2019 Financial Stability Department Contents Abbreviations ............................................................................................................................................................................................................................................. 3 DOMESTIC BANKING PRODUCTS AND SERVICES ....................................................................................................................................................................... 5 Savings account: E-banking Product and Services Fees ............................................................................................................................................................... 6 Initial Deposit Required for Savings Accounts ................................................................................................................................................................................. 7 Minimum Operating Balance Required for Saving Accounts ......................................................................................................................................................... 8 Current Account: Initial Deposit Required (IDR) and Minimum Operating Balance (MOB) ...................................................................................................... 9 Current Account Charges: Commission on Turnover (COT) ...................................................................................................................................................... -

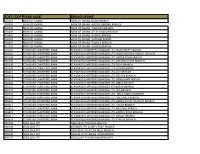

Sort Code Bank Name Branch Name

SORT CODE BANK NAME BRANCH NAME 010101 BANK OF GHANA BANK OF GHANA ACCRA BRANCH 010303 BANK OF GHANA BANK OF GHANA -AGONA SWEDRU BRANCH 010401 BANK OF GHANA BANK OF GHANA -TAKORADI BRANCH 010402 BANK OF GHANA BANK OF GHANA -SEFWI BOAKO BRANCH 010601 BANK OF GHANA BANK OF GHANA -KUMASI BRANCH 010701 BANK OF GHANA BANK OF GHANA -SUNYANI BRANCH 010801 BANK OF GHANA BANK OF GHANA -TAMALE BRANCH 011101 BANK OF GHANA BANK OF GHANA - HOHOE BRANCH 020101 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-HIGH STREET BRANCH 020102 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD- INDEPENDENCE AVENUE BRANCH 020104 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-LIBERIA ROAD BRANCH 020105 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-OPEIBEA HOUSE BRANCH 020106 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-TEMA BRANCH 020108 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-LEGON BRANCH 020112 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-OSU BRANCH 020118 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-SPINTEX BRANCH 020121 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-DANSOMAN BRANCH 020126 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-ABEKA BRANCH 020127 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH)-ACHIMOTA BRANCH 020129 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD- NIA BRANCH 020132 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD- TEMA HABOUR BRANCH 020133 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD- WESTHILLS BRANCH 020436 -

First National Bank Ghana

First National Bank Online Banking Enterprise™ - Payment Cut-Off Times Direct Payment Express Payment Instant Payment Service Service Service Service Anytime during the day Monday - Friday Anytime (including Saturdays, Sundays within the allowed cut-off and Public Holidays) processing times. In accordance with the cut-off Submission times below. Payments submitted after the cut-off times below will be processed on the next business day. Monday to Friday To First National Bank: To Participating Banks n/a No cut-off time between 09h15 and 11h35 Cut-off To other banks: 09h00 - Times 18h00 Saturdays, Sundays and Public Holidays Payments to both First National Bank and to other banks will n/a only be submitted for processing on the next business day. Any payment processed to a Any payment processed to a Participating Any payment authorised Bank through the Instant Payment service and fully processed to a Participating Bank through the Express service type within the type will be cleared within 1 minute of it Participating Bank being authorised and fully processed on Clearing allowed cut-off processing through the Direct the same day. Times: Payment service type times will be cleared within 6 within the allowed cut-off hours of it being authorised and processing times will be fully processed on the same cleared on the next day. business day. Express payments are Instant payments are posted to the posted to the recipient’s recipient’s account on the same business All payments are posted account on the same day. to the recipient’s account business day. on the next business day. -

Ghana-Banking-Survey-2019.Pdf

Banking reforms so far: topmost issues on the minds of bank CEOs August 2019 www.pwc.com/gh Table of contents CSP’s message 2 GAB CEO’s message 4 Tax Leader’s message 5 1 Economy of Ghana 7 2 Survey analysis 12 3 Banking industry overview 35 4 Total operating assets 39 5 Market share analysis 44 6 Profitability and efficiency 56 7 Return to shareholders 64 8 Liquidity 69 9 Asset quality 79 Appendices 84 PwC 2019 Ghana Banking Survey 1 CSP’s message their banks thus far, as well as the those related to the new minimum challenges and opportunities that capital requirement: they foresee. Heritage Bank Limited (HBL) and Highlights of the Premium Bank Ghana Limited (PBG) had their licences revoked. banking sector The reasons provided by BoG for the revocation of their licences reforms were insolvency in the case of Perhaps, one of the most significant Premium bank and questionable components of the banking sector source of capital for Heritage reforms is the new minimum capital bank. directive issued on 11 September Bank of Baroda (BoB) “closed 2017. The directive required shop” and exited the market on universal banks operating in Ghana their own volition also for reasons Vish Ashiagbor to increase their minimum stated related to the new minimum capital to GHS400 million by the capital requirement. Country Senior Partner end of 2018. BoG approved three mergers Following the deadline for involving six banks, effectively Background to this compliance, the changes in the accounting for three more exits. year’s survey banking sector have largely gone in The approved mergers are: 1. -

Bank of Ghana Closes Seven Banks in Banking Crisis

ECONOMY Bank of Ghana closes seven banks in banking crisis Ghana has over the past one year been embroiled in a banking crisis with the closure of seven banks, the assumption of two by GCB Bank Ltd and the consolidation of the others into a new one, writes *Etornam Nyalatorgbi. UT Bank (one of the defunct banks) Insert: Dr. Addison, Governor of Bank of Ghana hana is licking the wounds from ``Poor banking practices, coupled ``There was unusual forbearance by the its worst banking crisis ever. with weak supervision and regulation by Bank of Ghana, which resulted in the ex- Seven bank closures within the the Bank of Ghana has significantly un- tension of significant amounts of emer- Gspace of one year, about 2,700 jobs on dermined the stability of the banking and gency liquidity assistance to these ailing the line and government piling onto its other non-bank financial institutions,’’ banks.’’ debt 7.9 billion cedis ($1.7 billion) to Central Bank Governor Dr. Ernest Ad- It is not abnormal for banks to fall pay for the difference between liabilities dison, said in March when he placed the on the Central Bank’s Emergency Li- and assets of the collapsed banks to allow now defunct uniBank Ltd. under the ad- quidity Assistance when they are short of other lenders take them over. ministration of accounting firm KPMG. cash to meet depositors’ demands once Vol. 21 No. 3 African Agenda 33 ECONOMY “GCB Bank has sacked 450 staff of the two de- funct banks it took over with plans to cut 250 more. -

Inflation Rates and GDP Growth Rate on the Banking Sector

University of Ghana http://ugspace.ug.edu.gh UNIVERSITY OF GHANA EFFECTS OF MONETARY POLICY RATE ON INTEREST RATE AND LEVEL OF CUSTOMER BORROWING BY JOSEPH BOAMAH (10700605) THIS LONG ESSAY PRESENTED IS SUBMITTED TO THE UNIVERSITY OF GHANA LEGON IN PARTIAL FULFILMENT OF THE REQUIREMENT FOR THE AWARD OF THE DEGREE OF MASTER OF SCIENCE IN ACCOUNTING AND FINANCE AUGUST, 2019 University of Ghana http://ugspace.ug.edu.gh DECLARATION 1 the undersigned hereby declare that this Long Essay is the result of my own original work towards the degree of Master of Science in Accounting and Finance and that no part of it to the best of my knowledge has been presented for another degree in this university or elsewhere except where acknowledgement has been made in the text. ……………………………………. …………………………… JOSEPH BOAMAH DATE (10700605) i University of Ghana http://ugspace.ug.edu.gh CERTIFICATION I hereby certify that this long essay was supervised in accordance with the procedures laid down by the University. …………………………………………………………. ………………………………… DR. CLETUS AGYENIM-BOATENG DATE (SUPERVISOR) ii University of Ghana http://ugspace.ug.edu.gh DEDICATION I devote this project to Almighty God for Bestowing on me the grace, favour, opportunity and making this project a success. I dedicate this work also to my family especially my parents, Mr. Samuel Kofi Adu (late), Deaconess Comfort Yaa Asor, Mr. Nimako Siaw Richard and Mr. Adu Reynolds Addo and to all sundries whose names could not be mentioned for their profound love and support throughout my stay in school. iii University of Ghana http://ugspace.ug.edu.gh ACKNOWLEDGEMENT I express my heartfelt gratitude to God Almighty for giving me the grace to commence and complete this thesis successfully. -

PDF the Role of Commercial Bank in Financing Small Scale Industries

The Role of Commercial Bank in Financing Small Scale Industries A Case Study of Assin Fosu and Suame Ruth Asantewaa Owusu Saint Mary’s University, 923 Robie Street, Halifax Nova Scotia, Canada, B3h 3c3, [email protected] Abstract: Bank finance has been found as an important source of funds for most firms in Ghana. The study assessed the impact of GCB SME LOAN on the activities of Small Scale Industries. The study used primary data which were designed and administered to SMEs customers of GCB and staff of GCB. A sample size of 170 made up of 20 staff of GCB bank and 150 owners of SME customers who deal with the bank and have benefited from the SME LOAN SUITE. The study concluded that with the use of GCB SME LOAN, there has been improvement in the profits of both the customers and bank. Also, the study identified four main challenges which were; increased in the amount of money, reduce interest rate, advertisement and extend the period of bridge loan that militate against the GCB SME LOAN of GCB bank. It was recommended that since GCB bank is contributing more to SMEs, they should give in their best to increase the amount of the loan and to extend the period of bridge loan to help boost their outreach. Key words: SMEs, Economic Development, Bank finance 1. Introduction 1.1 Background of the study Entrepreneurship is as old as Ghana and had contributed to the growth of the economy. Presently in Ghana, Small Scale Industries assist in promoting the growth of the country’s economy, hence commercial banks and all levels of government at different times have policies which promote growth and sustenance of Small Scale Industries.