WEEKLY MARKET REVIEW 8 March 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ecobank Group Annual Report 2018 Building

BUILDING AFRICA’S FINANCIAL FUTURE ECOBANK GROUP ANNUAL REPORT 2018 BUILDING AFRICA’S FINANCIAL FUTURE ECOBANK GROUP ANNUAL REPORT 2018 ECOBANK GROUP ANNUAL REPORT CONTENTS 05 Performance Highlights 08 Ecobank is the leading Pan-African Banking Institution 09 Business Segments 10 Our Pan-African Footprint 15 Board and Management Reports 16 Group Chairman’s Statement 22 Group Chief Executive’s Review 32 Consumer Bank 36 Commercial Bank 40 Corporate and Investment Bank 45 Corporate Governance 46 Board of Directors 48 Directors’ Biographies 53 Directors’ Report 56 Group Executive Committee 58 Corporate Governance Report 78 Sustainability Report 94 People Report 101 Risk Management 141 Business and Financial Review 163 Financial Statements 164 Statement of Directors’ Responsibilities 165 Auditors’ Report 173 Consolidated Financial Statements 178 Notes to Consolidated Financial Statements 298 Five-year Summary Financials 299 Parent Company’s Financial Statements 305 Corporate Information 3 ECOBANK GROUP ANNUAL REPORT 3 PERFORMANCE HIGHLIGHTS 5 ECOBANK GROUP ANNUAL REPORT PERFORMANCE HIGHLIGHTS For the year ended 31 December (in millions of US dollars, except per share and ratio data) 2018 2017 Selected income statement data Operating income (net revenue) 1,825 1,831 Operating expenses 1,123 1,132 Operating profit before impairment losses & taxation 702 700 Impairment losses on financial assets 264 411 Profit before tax 436 288 Profit for the year 329 229 Profit attributable to ETI shareholders 262 179 Profit attributable per share ($): Basic -

2016 Ghana Banking Survey How to Win in an Era of Mobile Money

2016 Ghana Banking Survey How to win in an era of mobile money August 2016 www.pwc.com/gh Contents A message from our CSP 2 A message from the Executive Secretary of Ghana Association of Bankers 4 Comments on 2016 Ghana Banking Survey 6 A message from our Tax Leader 8 1 How to win in an era of mobile money 10 2 Overview of the economy 26 3 Overview of the banking industry 32 4 Quartile analysis 36 5 Market share analysis 48 6 Profitability and efficiency 56 7 Return to shareholders 64 8 Liquidity 68 9 Asset quality 74 A List of participants 77 B Glossary of key financial terms, equations and ratios 78 C List of abbreviations 79 D Our profile 80 E Our leadership team 84 PwC 2016 Ghana Banking Survey 1 A message from our CSP for consumer banking. Besides, it offers in designing a practical and forward huge cheap deposits that banks could looking regulation that will streamline use to create money in the economy. It operations in the mobile money market. is against this backdrop that we focused This will require extensive consultation this year’s banking survey on “How to win locally and leveraging the experience of in an era of mobile money”. other countries such as Kenya that are advanced in the delivery of the service. Unlike the 2015 banking survey that sought responses from bank executives In addition to regulations and as well as bank customers, this year’s partnerships, the other critical success survey was based on responses from factors which we discussed with bank bank executives only. -

Gcb Bank Limited Annual Report 2017 2

1 GCB BANK LIMITED ANNUAL REPORT 2017 2 VISION We aspire to be Ghana’s favorite Bank and one of the most recognised and preferred fi nancial service brands in Africa and beyond MISSION Our mission is to provide friendly, helpful and accessible banking services, combined with expert fi nancial solutions that help people and businesses realize their goals. GCB BANK LIMITED ANNUAL REPORT 2017 3 CONTENTS 4 Corporate Information 5 Notice of Annual General Meeting 7 Board of Directors 8 Profi les of the Board of Directors 12 Financial Highlights 13 Five Year Financial Summary 16 Chairman’s Statement 20 Managing Director’s Review 24 Report of the Directors 28 Corporate Governance 33 Independent Auditor’s Report 37 Statements of Comprehensive Income 39 Statements of Financial Position 40 Statements of Changes in Equity 43 Statements of Cash Flows 45 Notes to the Financial Statements 130 Appendix 1 - Value Added Statement 131 Appendix 2 - Shareholder Information 134 List of Branches 145 Invitation and Form of Proxy GCB BANK LIMITED ANNUAL REPORT 2017 CORPORATE INFORMATION 4 Corporate Information BOARD OF DIRECTORS Mr. Jude Kofi Arthur (Chairman) Mr Anselm Ransford Adzete Sowah (Managing) Mr. Socrates Afram Mr. Samuel Amankwah Appointed 25/10/17 Mrs. Lydia Gyamera Essah Mr. Nik Amarteifi o Appointed 07/06/17 Mr. Richard Oppong Appointed 07/06/17 Nana Ama Ayensua Saara III Appointed 07/06/17 Mr. Francis Arthur-Collins Appointed 25/10/17 Mr. Osmani Aludiba Ayuba Appointed 25/10/17 Mr. Ray Ankrah Appointed 25/10/17 Mr. Kofi Worlanyo Resigned 03/04/17 Mr. -

Abdul-Nashiru Issahaku: Developing Ghana's Banking System

Abdul-Nashiru Issahaku: Developing Ghana’s banking system Speech by Dr Abdul-Nashiru Issahaku, Governor of the Bank of Ghana, at the inauguration of the Sunyani regional office building, Sunyani, 30 June 2016. * * * Nananom Board of Directors of Bank of Ghana Representatives of Banks in the Brong-Ahafo Region Representatives of Security Agencies in the Brong -Ahafo Region Heads of Departments Regional Managers My cherished members of staff Distinguished ladies and gentlemen Good morning I am delighted to welcome you all to the inauguration of our new Sunyani Regional Office building. Let me sincerely thank the Chiefs and people of Sunyani, in fact, the Brong Ahafo Region for making the land available to us. This is a clear indication of the support and collaboration between the Bank and the Chiefs. And let me also take this opportunity to thank the immediate past Governor of the Bank of Ghana Dr. Henry Kofi Wampah for spearheading this project and seeing to its completion. As we may all be aware, prior to the construction of this ultra-modern office complex, the Sunyani Regional Office had operated from the second floor of a building whose lower floors were occupied by GCB Bank. The regulator sharing office with the client is not ethically sound and exposes the Bank to familiarity threats. In addition, the former Office did not have a banknote processing capacity and depended on the Kumasi Regional Office for the processing of its deposits as well as fit-sorting banknotes for re-issuance to banks and other financial institutions in its catchment area. -

The Determinants of Bank's Profitability in Ghana, The

The Determinants of Bank’s Profitability in Ghana, The Case of Merchant Bank Ghana Limited (MBG) and Ghana Commercial Bank (GCB) By Anthony Kofi Krakah & Aaron Ameyaw Henrik Sällberg (Supervisor) Master’s Thesis in Business Administration, MBA programme 2010 Table of Contents Table of Contents ............................................................................................................................................ i ABSTRACT ...................................................................................................................................................... v ACKNOWLEDGEMENT ........................................................................................................................................ vi CHAPTER ONE ............................................................................................................................................... 1 1.0 INTRODUCTION ...................................................................................................................................... 1 An overview of the banking industry in Ghana ..................................................................................................... 3 1.2 Background of the banks ......................................................................................................................... 6 Global Banking Industry .................................................................................................................. 12 Statement of the problem .......................................................................................................................... -

Management and Staff of Societe Generale Ghana Support the Ghana Heart Foundaton with Ghs 160,000.00

Accra – Ghana, 20th March, 2019 MANAGEMENT AND STAFF OF SOCIETE GENERALE GHANA SUPPORT THE GHANA HEART FOUNDATON WITH GHS 160,000.00 Fig 1. Management, Staff Representatives of Societe Generale Ghana with Members of the Ghana Heart Foundation Management and Staff of Societe Generale Ghana, TOGETHER made a donation amount of GHS 160,000.00 to the Ghana Heart Foundation to support the Foundation in the area of health care delivery. Receiving Societe Generale Ghana, Prof. Dr. Mark Tettey, Cardiothoracic Surgeon of the National Cardiothoracic Centre at Korle-Bu Teaching Hospital and Representative for the Ghana Heart Foundation at the ceremony expressed their heartfelt gratitude to Management and Staff of the bank for their continued and loyal support to the Foundation over the years to date. Prof. Dr. Tettey stated that the Ghana Heart Foundation (GHF) of the Korle-Bu Teaching Hospital is a charity organization dedicated to saving lives and improving health care by informing the public on heart or cardiovascular related diseases. He said the Foundation also assisted people with cardiovascular disease by providing for cardiovascular research and training for health workers involved in cardiovascular care. 1 Speaking at the event, Mr Hakim Ouzzani; Managing Director of Societe Generale Ghana noted the very successful administration of funds received by GHF to the extent that every Ghanaian patient undergoing heart surgery receives 50% subsidy from the Trust Fund. He mentioned the values of the bank which encompass; Responsibility, Team Spirit, Commitment, Innovation and consequently, the bank’s presence at the centre for the donation which is an expression of Team Spirit aimed at preserving the lives. -

Societe Generale Ghana 2019 Annual Report

ANNUAL REPORT 2019 2019 ANNUAL REPORT AND FINANCIAL STATEMENTS 2019 Major Events WE INTRODUCED NEW INNOVATIONS Electronic billboard to communicate Our 24/7 drive-in ATM to the public about our product offers at Achimota branch & Our solar project. A cleaner, more effective energy source at our head office WE LAUNCHED NEW SERVICES 2019 Major Events WE LAUNCHED EXCITING COMMERCIAL PROMOTIONS & CAMPAIGNS Loans Promotion Deposit and Win Promotion WE OPENEDM ORE OUTLETS Achimota Branch Osu Branch TABLE OF CONTENTS Overview 02 Notice and agenda for annual general meeting Corporate Governance 03 Corporate information 04 Profile of the board of directors 07 Key management personnel Strategic report 10 Chairman's statement 13 Managing director’s review Financial statements 16 Report of the directors 31 Statement of directors responsibilities 32 Independent report of the auditors 36 Financial highlights 38 Statement of profit or loss and other comprehensive income 39 Statement of financial position 40 Statement of changes in equity 41 Statement of cash flows 42 Notes to financial statement 94 Proxy form 95 Resolutions 97 Branch network 2019 ANNUAL REPORT & FINANCIAL STATEMENTS 1 Notice and Agenda NOTICE AND AGENDA FOR ANNUAL GENERAL MEETING NOTICE IS HEREBY GIVEN THAT the 40th Annual General Meeting of Societe Generale Ghana Limited (the “Company”) will be held on Thursday, 26 March 2020 at 11am at the Alisa Hotel, Ridge Arena, Accra Ghana for the following purpose:- Ordinary Business: Ordinary Resolutions 1. To elect Directors, the following directors appointed 5. To approve Directors’ fees. during the year and retiring in accordance with Section 72(1) of the Company’s Regulations: 6. -

PRESS RELEASE PR. No 105/2020 SOCIETE

PRESS RELEASE PR. No 105/2020 SOCIETE GENERALE GHANA LIMITED (SOGEGH) - 2019 ANNUAL REPORT SOGEGH has released its Annual Report for the year ended 31 December, 2019 as per the attached. Issued in Accra, this 18th day of March, 2020. - E N D – att’d. Distribution: 1. All LDMs 2. General Public 3. Company Secretary, SOGEGH 4. NTHC Registrars, (Registrars for SOGEGH shares) 5. GSE Securities Depository 6. Securities & Exchange Commission 7. Custodian 8. GSE Council Members 9. GSE Notice Board For enquiries, contact: Head of Listings, GSE on 0302 669908, 669914, 669935 *GA ANNUAL REPORT 2019 2019 ANNUAL REPORT AND FINANCIAL STATEMENTS 2019 Major Events WE INTRODUCED NEW INNOVATIONS Electronic billboard to communicate Our 24/7 drive-in ATM to the public about our product offers at Achimota branch & Our solar project. A cleaner, more effective energy source at our head office WE LAUNCHED NEW SERVICES 2019 Major Events WE LAUNCHED EXCITING COMMERCIAL PROMOTIONS & CAMPAIGNS Loans Promotion Deposit and Win Promotion WE OPENEDM ORE OUTLETS Achimota Branch Osu Branch TABLE OF CONTENTS Overview 02 Notice and agenda for annual general meeting Corporate Governance 03 Corporate information 04 Profile of the board of directors 07 Key management personnel Strategic report 10 Chairman's statement 13 Managing director’s review Financial statements 16 Report of the directors 31 Statement of directors responsibilities 32 Independent report of the auditors 36 Financial highlights 38 Statement of profit or loss and other comprehensive income 39 Statement of financial position 40 Statement of changes in equity 41 Statement of cash flows 42 Notes to financial statement 94 Proxy form 95 Resolutions 97 Branch network 2019 ANNUAL REPORT & FINANCIAL STATEMENTS 1 Notice and Agenda NOTICE AND AGENDA FOR ANNUAL GENERAL MEETING NOTICE IS HEREBY GIVEN THAT the 40th Annual General Meeting of Societe Generale Ghana Limited (the “Company”) will be held on Thursday, 26 March 2020 at 11am at the Alisa Hotel, Ridge Arena, Accra Ghana for the following purpose:- Ordinary Business: Ordinary Resolutions 1. -

National Pensions Regulatory Authority

NATIONAL PENSIONS REGULATORY AUTHORITY NPRA PUBLIC NOTICE á LIST OF REGISTERED PENSIONS FUND CUSTODIANS THAT HAVE FULFILLED THE PRESCRIBED REQUIREMENTS OF THE AUTHORITY FOR THE 2020 AUTHORISATION PROCESS. THE LICENCES ARE VALID UNTIL 31ST JULY, 2021 LICENCE / TELEPHONE NO. NAME OF SERVICE PROVIDER REGISTRATION PHYSICAL ADDRESS CONTACT PERSON NUMBERS NO. 1. Prudential Bank Limited FC12007 8 John Hammond Seth Kyeremeh 0244-762652 Street, Ring Road Central, Accra 2. Access Bank Ghana Limited FC20002 Starlets '91 Road Franklin Ayensu- 0244-128163 Opposite Accra Nyarko Sports Stadium, Osu 3. First National Bank Ghana FC20001 6th Floor Accra Hilda Esenam 0242-435156 Limited Financial Centre, Odame-Gyenti 0501-632441 Liberia Road. 4. Agricultural Development FC12005 Accra Financial Elorm Aidam 0244-253181 Bank Centre, 3rd Ambassadorial Development Area, Ridge-Accra 5. GCB Bank Limited FC18002 No. 2 Thorpe Road, John Ekow 0557-410577 Accra Appiah-Sam 6. Ecobank Ghana Limited FC12001 Ecobank Ghana Albert Amekugee 0244-427476 Head Office, Accra 7. Zenith Bank Ghana Limited FC12013 31 Independence Alvin Abbah-Foli 0242-729012 Avenue, Accra Website: www.npra.gov.gh , e-mail: [email protected] “Ensuring Retirement Income Security” NATIONAL PENSIONS REGULATORY AUTHORITY NPRA PUBLIC NOTICE á LICENCE / TELEPHONE NO. NAME OF SERVICE PROVIDER REGISTRATION PHYSICAL ADDRESS CONTACT PERSON NUMBERS NO. 8. Republic Bank Ghana FC12006 No 48A Sixth Audrey Smith 0208-737616 Limited Avenue, North Dadzie Ridge, Accra 9. Fidelity Bank Ghana Limited FC12011 1st Floor, Ridge Rebecca Gyebi 0544-338784 Towers, Accra Elias Augustine 0576-036467 Dey 10. Guaranty Trust Bank FC12008 25A Castle Road Michael Yevu 0504-100158 (Ghana) Limited Ambassadorial Area, Ridge, Accra 11. -

Databank Weekly Market Watch

March 3, 2017 GSE MARKET STATISTICS SUMMARY Weekly Stock Market Review SCB Tops Gainers Chart for 3rd Consecutive Week: The bulls maintained their Current Previous % Change hold on the equities market this week, supported by price gains in 7 counters. Databank Stock Index 24,460.95 24,329.82 0.54 The Ghana Stock Exchange’s Composite Index (GSE-CI) increased by 11.09 points GSE-CI Level 1,868.19 1,857.10 0.60 w/w to ~1,868 points, while the Databank Stock Index advanced by 131.13 points Market Cap (GH¢ m) 49,147.28 52,310.92 -6.05 w/w to ~24,461 points. The year to date returns of the GSE-CI and the Databank YTD Return DSI 9.53% 8.94% Stock Index thus increased to 10.60% and 9.53% respectively. YTD Return GSE-CI 10.60% 9.95% Market activity was vibrant this week. A block trade in Guinness Ghana Weekly Volume Traded (Shares) 3,567,878 921,507 287.18 Breweries pushed up the volume of shares traded by ~% w/w to ~3.57 million Weekly Turnover (GH¢) 4,603,367 4,555,231 1.06 shares, with a value of ~GH¢4.60 million. Out of the 25 counters that traded this Avg. Weekly Volume Traded (Shares) 878,352 861,281 1.98 week, Guinness Ghana Breweries emerged the most active counter, accounting Avg. Weekly Value Traded (GH¢) 1,268,601 1,246,575 1.77 for 56% of aggregate trade volumes. No. of Counters Traded 25 23 The market breath of the Ghana Stock Exchange was positive this week, with 7 No. -

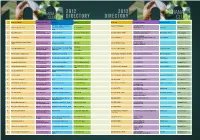

2012-Edition-GC100-Directory.Pdf

2012 2012 DIRECTORY DIRECTORY NAME OF COMPANY BUSINESS CATEGORY LOCATION ADDRESS TELEPHONE FAX/E-MAIL/WEBSITE CONTACT PERSON TITLE 7 Dr. Amilcar Cabral Road, Accra (233-302) 770189/90/91 “(233-302) 770187 1 Abosso GoldFields Limited Mining Institution Airport Residential Area P. O. Box KA 30742 www.goldfields.co.za” Alfred Baku Managing Director Accra Banking Services [email protected] Head, Corporate 2 Acces Bank (Ghana) (Commercial & Merchant) “Starlets ‘91 Road “P. O. Box GP 353 Osu- Accra” (233-302) 684860 / 742699 www.accessbankplc.com/gh Matilda Asante-Aseidu Communications (233-302) 2688960 3 Accra Brewery Manufacturing - Beverages Opp. Ohene Djan Staduim” P. O. Box GP351 (233-302) 688851-6 [email protected] Gregory Metcalf Managing Director www.sabmiller.com (233-302) 685176 4 Activa International Insurance Company Non-Banking-Insurance Graphic Road, Adabraka PMB KA 85 (233-32) 686352 / 672145 [email protected] Limited www.group-activa.com “P. O. Box 35 Banking Service-Rural & 3rd Floor Heritage Tower, 6th Ave. West (233-322) 420926 / 90099 Lucy Opoku-Arthur Ag General Manager 5 Adansi Rural Bank Limited Community Banking Ridge, Accra Fomena-Adansi” Banking Services-Rural & 6 Adonten Community Bank Limited Community Banking Head Office: Fomena - Adansi P.O.Box 140 3420-24109/027-895636/027-7609343 3420-26780 [email protected] Mr.Francis Mensah Senior Manager Banking Services-Rural & 7 Ahantaman Rural Bank Limited Community Banking New Tafo, Akyem, Eastern Region P. O. Box 41, Ahanta (233-312) 23431 / 21016 (233-312)29116 David Bampoe General Manager Banking Services-Rural & 8 Amanano Rural Bank Limited Community Banking Agona Ahanta,Western Region P. -

A Study of Ecobank Ghana Limited and the Trust Bank

Texila International Journal of Management Volume 3, Issue 2, Nov 2017 Synergies from Mergers and Acquisitions: A Study of Ecobank Ghana Limited and the Trust Bank Article by Daniel Kwabla- King Management, Texila American University, Ghana E-mail: [email protected] Abstract The Social Security and National Insurance Trust (SSNIT) the national Pension Scheme managers in Ghana with significant stake in the Ghanaian banking industry, in the year 2011 made a strategic move to drive bank consolidation in Ghana through the swapping of its shares in The Trust Bank (TTB) for ETI’s shares in Ecobank Ghana Limited (EBG). This study was set examine whether synergies were derived from the merger. It also examined whether the objectives set by SSNIT were met and finally determine whether the bank has remained competitive after the merger. The approach used for the study was quantitative technique and case study which concluded that the merger of Ecobank Ghana Limited and TTB achieved the intended results for SSNIT. Keywords: Synergies, Merger, Acquisition, Ecobank Ghana Limited, the Trust Bank, SSNIT, Ghana. Introduction The Social Security and National Insurance Trust (SSNIT) which had shares in most banks with controlling interest in TTB, in line with realigning its investments portfolio to achieve maximum returns, decided to drive bank consolidation through the swapping of its shares in The Trust Bank (TTB) for ETI’s shares in Ecobank Ghana Limited (EBG). The objective of the merger was to take advantage of efficiencies and synergies leading to enhanced shareholder value. Making a case for the merger, it was established that the core business of TTB was Commercial and retail banking with their focus on Small and Medium Scale Enterprises (SMEs).