Parveen IFCI Annual Report 2015-16.Indb

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Unique Design of R.C.C. Bridge on Godavari River at Sironcha Dist

ICSESD May 2017 IRA-International Journal of Technology & Engineering ISSN 2455-4480 Proceedings of the International Conference on Science & Engineering for Sustainable Development (2017) Pg. no.148-159 Published by: Institute of Research Advances https://research-advances.org/index.php/IRAJTE A Unique Design of R.C.C. Bridge on Godavari River at Sironcha Dist. Gadchiroli - India Ram Vighe Member, Institution of Engineers(India) Type of Review: Originality Check & Peer Review under the responsibility of the Scientific Committee of the Conference and The Institution of Engineers (India). DOI: http://dx.doi.org/10.21013/jte.ICSESD201715 How to cite this paper: Vighe, R. (2017). A Unique Design of R.C.C. Bridge on Godavari River at Sironcha Dist. Gadchiroli -India. Proceedings of the International Conference on Science & Engineering for Sustainable Development (2017), 148-159. doi: http://dx.doi.org/10.21013/jte.ICSESD201715 © International Conference on Science & Engineering for Sustainable Development & The Institution of Engineers (India). This work is licensed under a Creative Commons Attribution-Non Commercial 4.0 International License subject to proper citation to the publication source of the work. Disclaimer: The conference papers as published by the Institute of Research Advances (IRA) are the views and opinions of their respective authors and are not the views or opinions of the IRA. The IRA disclaims of any harm or loss caused due to the published content to any party. 148 ICSESD- 2017 Proceedings IRA-International Journal of Technology & Engineering ABSTRACT Reinforced concrete bridges may have various systems: Beam (with simply supported or continuous beams), Frame, Arch, or combined of it. -

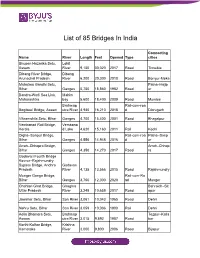

List of 85 Bridges in India

List of 85 Bridges In India Connecting Name River Length Feet Opened Type cities Bhupen Hazarika Setu, Lohit Assam River 9,150 30,020 2017 Road Tinsukia Dibang River Bridge, Dibang Arunachal Pradesh River 6,200 20,300 2018 Road Bomjur-Meka Mahatma Gandhi Setu, Patna–Hajip Bihar Ganges 5,750 18,860 1982 Road ur Bandra-Worli Sea Link, Mahim Maharashtra bay 5,600 18,400 2009 Road Mumbai Brahmap Rail-cum-roa Bogibeel Bridge, Assam utra River 4,940 16,210 2018 d Dibrugarh Vikramshila Setu, Bihar Ganges 4,700 15,400 2001 Road Bhagalpur Vembanad Rail Bridge, Vembana Kerala d Lake 4,620 15,160 2011 Rail Kochi Digha–Sonpur Bridge, Rail-cum-roa Patna–Sonp Bihar Ganges 4,556 14,948 2016 d ur Arrah–Chhapra Bridge, Arrah–Chhap Bihar Ganges 4,350 14,270 2017 Road ra Godavari Fourth Bridge Kovvur–Rajahmundry Bypass Bridge, Andhra Godavari Pradesh River 4,135 13,566 2015 Road Rajahmundry Munger Ganga Bridge, Rail-cum-Ro Bihar Ganges 3,750 12,300 2020 ad Munger Chahlari Ghat Bridge, Ghaghra Bahraich–Sit Uttar Pradesh River 3,249 10,659 2017 Road apur Jawahar Setu, Bihar Son River 3,061 10,043 1965 Road Dehri Nehru Setu, Bihar Son River 3,059 10,036 1900 Rail Dehri Kolia Bhomora Setu, Brahmap Tezpur–Kalia Assam utra River 3,015 9,892 1987 Road bor Korthi-Kolhar Bridge, Krishna Karnataka River 3,000 9,800 2006 Road Bijapur Netaji Subhas Chandra Kathajodi Bose Setu, Odisha River 2,880 9,450 2017 Road Cuttack Godavari Bridge, Andhra Godavari Rail-cum-roa Pradesh River 2,790 1974 d Rajahmundry Old Godavari Bridge Now decommissioned, Godavari Andhra Pradesh -

Godavari Bridge 1 Godavari Bridge

Godavari Bridge 1 Godavari Bridge Godavari Bridge The Godavari Bridge across Godavari River Other name(s) Rajahmundry-Kovur Bridge Carries Two lanes of Road and Single Railway line. Crosses Godavari River Locale Rajahmundry Engineering design Braithwaite, Burn & Jessop Construction Company Design Truss Bridge Total length 2.7 kilometres (1.7 mi) Longest span 97.5 metres (320 ft) Opened August 16, 1974 Preceded by Godavari Arch Bridge Followed by The Havelock Bridge Coordinates 16°59′52″N 81°45′21″E The Godavari Bridge or Kovvur-Rajahmundry Bridge is a truss bridge spanning Godavari river in Rajahmundry, India. It is Asia's second longest road-cum-rail bridge crossing a water body, after the Sky Gate Bridge in Kansai International Airport, Osaka. It is second of the three bridges that span the Godavari River at Rajahmundry. The Havelock Bridge being the earliest, was built in 1897, and having served its full utility, was decommissioned in 1997. The latest bridge is the Godavari Arch Bridge, a bowstring-girder bridge, built in 1997 and presently in service. The bridge is 2.7 kilometers long consisting of 27 spans of 91.4 m and 7 spans of 45.72 m of which 6 spans of 45.72m are in 6 deg. curve at long Rajahmundry end to make up for the built up area. The bridge has a road deck over the single track rail deck, similar to the Grafton Bridge in New South Wales, Australia. This bridge, in addition to Godavari Arch Bridge, has been widely used to represent Rajahmundry in arts, media, and culture. -

Freshwater Crabs (Crustacea: Decapoda: Brachyura: Gecarcinucidae) in the Collection of the Western Regional Centre, Pune

Occasional Paper No. 363 FRESHWATER CRABS (CRUSTACEA: DECAPODA: BRACHYURA: GECARCINUCIDAE) IN THE COLLECTION OF THE WESTERN REGIONAL CENTRE, PUNE S.K. PATI R.M. SHARMA Zoological Survey of India, Western Regional Centre, Pune- 411 044 Edited by the Director, Zoological Survey of India, Kolkata Zoological Survey of India Kolkata CITATION Editor : Director, 2014. Freshwater Crabs (Crustacea: Decapoda: Brachyura: Gecarcinucidae) in the collection of the Western Regional Centre, Pune, Occasional Paper No., 363 : 1-44 (Published by the Director, Zool. Surv. India, Kolkata). Published : August, 2014 ISBN 978-81-8171-383-4 © Govt. of India, 2014 ALL RIGHTS RESERVED ■ No part of this publication may be reproduced, stored in a retrieval system or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise without the prior permission of the publisher. ■ This book is sold subject to the condition that it shall not, by way of trade, be lent, re-sold hired out or otherwise disposed of without the publishers consent, in any form of binding or cover other than that in which it is published. ■ The correct price of this publication is the price printed on this page. Any revised price indicated by a rubber stamp or by a sticker or by any other means is incorrect and should be unacceptable. PRICE India Rs. 385.000 Foreign $ 20; £ 15 Published at the Publication Division by the Director, Zoological Survey of India, M- Block, New Alipore, Kolkata-700 053 and printed at Calcutta Repro Graphics, Kolkata700 006. RECORDS -

List of Water Projects in 2005

PPI data update note 47 December 2010 India drove private activity in infrastructure in South Asia to a new peak in 2009 In 2009, 53 infrastructure projects with private participation reached financial or contractual closing in 4 low- and middle-income countries in South Asia, involving investment commitments of US$27.5 billion (table 1).1 Infrastructure projects implemented in the 1990–2008 period attracted new investment of US$12.4 billion, bringing total investment commitments (hereafter, investment) to infrastructure sectors to US$39.9 billion in 2009. The activity in 2009 represents an increase of 19% by investment and 23% by number of projects compared with 2008. Investment in new projects grew by 50% from 2008. By contrast, investment in projects implemented in previous years fell by 17%. Private activity in the region, however, shows marked differences across countries. In India, private activity is vibrant. This country implemented 38 of the 53 new projects in 2009 and saw investment grow by 27%. India accounted for 90% of the regional investment. In the other countries, private activity is sporadic and in many cases aims at easing crisis situations such as power outages. Most of the PPI activity was directed to greenfield projects (BOT, BOO, merchant, and rental), which attracted 89% of regional investment and 80% of new projects. The rest was distributed between concessions and divestitures. Energy had 38 projects in 4 countries and investment of US$24.6 billion. That represents a 20% increase from 2008, and the highest PPI investment level ever in the sector. Energy accounted for 62% of regional investment in 2009. -

Report on Corporate Governance

CHALLENGING TIMES. RESILIENT RESPONSE. GAMMON INFRASTRUCTURE PROJECTS LIMITED 15TH ANNUAL REPORT For October 2014 to March 2016 (FYE MAR’16) Difficult times are not yet over for the engaged in responding to all the challenges Infrastructure sector. Failures on the part of thrown at it in a systematic manner. the authorities to fulfill their obligations and To begin with, the Company laid strong focus a very limited support from capital markets towards getting the existing value-accretive and lenders have effected the performance and under-construction projects on stream of the sector. All of this also resulted in which will go a long way in improving the delays in the execution of projects leading to confidence of all its stakeholders. With our severe financial stress adversely affecting the sustained efforts, five of our projects have viability of the projects and their operations. been made operational during the last few These factors have contributed to a lower years inspite of delays in each and every than expected revenue generation for most project which was beyond the control of the of the players in the industry. With operating Company. The Company is also seeking to revenues not being sufficient to service debts find innovative solutions for the languishing and with losses widening endlessly, the projects by closely working with project sector is unable to recover faster. authorities. Gammon Infrastructure was no exception to this scenario. Over half a dozen of our projects got delayed by more than three years in last five years. Realizing that the sector is caught in headwinds, the Company pro-actively CHALLENGING TIMES. -

District Census Handbook, East Godavari, Part XII-A & B, Series-2

CENSUS OF INDIA 1981 SERIES 2 ANDHRA PRADESH DISTRICT CENSUS HANDBOOK EAST GODAVARI PARTS XIU-A & B VILLAGE & TOWN DIRECTORY VILLAGE & TOWNWISE PRIMARY CENSteJS ABSTRACT S. S. JAYA RAO OF THE INDIAN ADMINISTRATIVE SERVICE DIRECTOR OF CENSUS OPERATIONS ANDHRA PRADESH PUBUSHED BY THE GOVERNMENT OF ANDHRA PRADESH 1985 RAIL·CUM·ROAD BRIDGE ACROSS RIVER GODAVARI AT RAJAHMUNDRY The motif on the cover page represents the longest rail-cum-road bridge in Asia built across the river Godavari at Rajahmundry. Godavari is the most important river in Andhra Pradesh often referred to as 'Dakshina .. Ganga'. Taking its origin in the Western ::--~<. - .." -~~-~~ojL;~ Ghats near Nasik and after cutting across the r. ",.~:#. -;'~~~~'IIi!~~~~ Eastern Ghats through the magnificent Papi Hills gorge, Godavari emerges at Polavaram into the coastal plain. From hereon, the river widens and assumes majestic proponions of about 3 kms. at Rajahmundry and nearly 6 kms. at Do wleshwaram, before it flows into the Bay 01 Bengal near Kakinada on the East Coast. At Rajahmundry, the vital Madr~s-Howrah East-Coast line crosses the Godavari and a single line bridge constructed in 1900 A. D. at a cost of Rs. 48 lakhs. spans the river. The old bridge consists of 56 span~ of 45.7 metres (150 ft.) and a land span of 12 metres (40 ft.) totalling 2,771 metres (9,096 ft.) between the abutments. The Howrah-Madras line is one of the vital Railway trunk-routes in the country carrying principally coal, steel and surplus food grains from the rich agricultural lands of coastal Andhra Pradesh to the south. -

Available Information Memorandum

Available Information Memorandum Sale of 10,00,000 (Ten Lakh) Equity Shares, representing 8.26% of the Paid-Up Equity Share Capital of MITCON Consultancy & Engineering Services Ltd November 2018 IDBI Capital Markets & Securities Limited (Formerly IDBI Capital Market Services Limited) 1 Limitations and Disclaimers 1. This Available Information Memorandum (“AIM”) is being provided in connection with the proposed sale of 10,00,000 (Ten Lakh) Equity Shares aggregating to 8.26% of total equity shares of MITCON Consultancy & Engineering Services Ltd. (“MITCON”) by Small Industries Development Bank of India (herein after referred to as “SIDBI” or “the Client” or “our Client”). 2. IDBI Capital Markets & Securities Ltd. has been appointed as the Advisor (herein after referred to as “the Advisor” or “IDBI Capital”) for the proposed offer of Equity sale process by the Client. 3. The sole purpose of this document is to collate and provide information from publicly available sources to the bidder(s) and is not intended to form the basis of any investment decision or any decision to purchase the equity shares of MITCON (“Shares”) being offered for sale by our client. This AIM shall be construed as an invitation to offer and shall not be interpreted as an offer or recommendation for the sale or purchase of shares described herein. The sale of equity shares held by SIDBI is on “AS IS WHERE IS BASIS”, “AS IS WHAT IS BASIS”, “WHATEVER THERE IS BASIS” and “NO RECOURSE BASIS”. 4. This AIM does not imply to be all-inclusive or contain all the information about MITCON or be the basis of any contract. -

MAY 2020 INDIAN RAILWAYS May 2020 Vol

MAY 2020 INDIAN RAILWAYS May 2020 Vol. 64 No. 2 In this issue 4 Indian Railways’ March against Covid Pandemic Editorial Board Vinod Kumar Yadav Chairman 6 Mrs. Manjula Rangarajan 3840 Shramik Financial Commissioner (Rlys.) Special Trains have been Operationalized Sushant Kumar Mishra from Various States Secretary across the Country Rajesh Dutt Bajpai Executive Director (I&P) 18 Railways Minister Holds A Marathon Meeting with Captains of Sudipta Sen Logistics Industry to Transform Freight Operations Editor Editorial Assistance 19 Prashant Kumar Pattnaik Indian Railways Geared up to Provide COVID Care Centers to State Authorities Editorial Correspondence EDITOR, Indian Railways, Room No. 411, Rail Bhawan, New Delhi-110001. Tel. : 47845374, 23383540, 23385072 43416, 43628 (Rly.) Email : [email protected] 20 Railways in Parliament Business Communications Prashant Kumar Pattnaik Business Manager Indian Railways, Room No. 310, Rail Bhawan, New Delhi-110001. Tel : 47845378, 45378 (Rly.). 43 Email : [email protected] Covid News Cover Photo : Shramik Special Train Unless specifically mentioned, the articles and statements published in this journal do not 54 necessarily reflect the views and policies of the Infrastructure and Maintenance Ministry of Railways (Railway Board) Annual Subscription India 64 Zonal Railway News ` 100 (`90 for Railwaymen) 67 Foreign RDSO Develops ` 500 (Sea Mail) ` 1000 (Air Mail) World’s Most Powerful Single Copy : ` 10 12000 HP WAG 12B ` Special Issue : 40 Locomotive MAY 2020 Editorial Dear readers, Like last month this editorial letter also is being written under the lengthening shadow of the Covid crisis. Despite Government of India’s all-out efforts the pandemic is showing little signs of relenting and at the time of writing this editorial the official death toll figure stands at a whopping 4000 plus. -

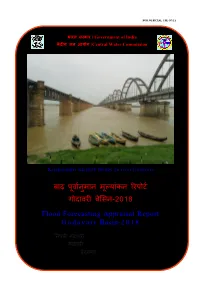

Flood Forecasting Appraisal Report G O D a V a R I Basin-201 8

FOR OFFICIAL USE ONLY भारत सरकार / Government of India कᴂ द्रीय जल आयोग /Central Water Commission Rajahmundry Railway Bridge on river Godavari बा褼 पू셍ाानुमान मूल्ा車कन रिपो셍ा गोदा셍िी बेसिन-2018 Flood Forecasting Appraisal Report G o d a v a r i Basin-201 8 ननचली गोदा셍िी म車डल/ Lower Godavari Division गोदा셍िी परिम車डल/ Godavari Circle हैदिाबाद/ Hyderabad Index FOREWORD .......................................................................................................................................... i Chapter-1 ............................................................................................................................................... 1 River Godavari and its Flood Problem ................................................................................................ 1 1.1 Godavari River System ......................................................................................................... 1 1.2 Physiography of the Basin ................................................................................................... 2 1.3 Rainfall Pattern ..................................................................................................................... 3 1.4 Flood problem: ...................................................................................................................... 4 1.5 Importance of Flood Forecasting in Godavari Basin ......................................................... 5 Chapter-2 .............................................................................................................................................. -

Chapter - 3 Compliance Audit Chapter - 3

Chapter - 3 Compliance Audit Chapter - 3 Compliance Audit Transport, Roads and Buildings Department 3.1 Public Private Partnership (PPP) Projects in Road Sector 3.1.1 Introduction Public Private Partnerships (PPPs) are aimed at involving private sector in raising capital required for public sector projects, build the projects and deliver quality goods and services at competitive costs. In road sector, there are two variants of PPP projects – (i) Build, Operate and Transfer (BOT) – Toll and (ii) BOT-Annuity. BOT-Toll: The concessionaire or private partner finances, constructs, operates the project and recovers its investment by collecting toll fees from road users during concession period. Concessionaire offering highest premium or seeking lowest grant is selected through competitive bidding. In this mode, commercial risks are generally borne by concessionaire. BOT-Annuity: In this mode also, private partner finances, constructs and operates the project during concession period. However, concessionaire receives a fixed sum of annuity payments (determined through competitive bidding) from employer. 3.1.2 Audit scope and objectives In Andhra Pradesh, there were 33 PPP projects1 in roads sector being implemented by Transport, Roads and Buildings (TR&B) Department with an estimated project cost of `8349.73 crore. Out of these, nine projects2 with a total project cost of `5379.63 crore were test checked (during July 2012 - January 2013) in audit. Implementation of these projects was examined in audit by scrutinizing records in Secretariat and offices of Chief Engineer (PPP), Andhra Pradesh Road Development Corporation (APRDC)3 and Divisions concerned. Audit objective was to assess whether (i) selection of projects for PPP was based on proper techno-economic assessment; (ii) procurement process was transparent and ensured economy; (iii) contract management was sound and safeguarded public/Government interest; and (iv) project execution was effective and achieved timely completion of projects and delivery of services to public. -

East Godavari Site Location:- Gogullanka(V), I

District:- East Godavari Site Location:- Gogullanka(V), I. Polavaram (M) Site Area (in Acres) 13.62 Survey Number 759 Latitude & Longitude 16°41'46.9"N 82°16'54.9"E Classification as per Revenue Land Details Govt. Lanka Lands records Landuse Tourism - (Barn) Classification as per CRZ Norms N/A Site Map By Road Gugullanka Bus stop Connectivity By Rail 42 km Kakinada Town Railway Station By Air 95 Km Rajhmundry Airport Rajahmundry – Indian City on the Godavari River with the Godavari Bridge plus ISKCON & Kotiligeshwara temples, Bandrachalam – Indian Hindu pilgrimage town on the Godavari River with Bandrachlam & Abhaya Anjaneya Temples, Kakinada – Beaches and Romantic place, and Temples, Maredumilli – Eco Tourism, Forests water falls , Annavaram – Shrines and Temple , Drakashramam - Temples Buddhism , Hope Island, Antervide Pallipalem – Beaches and Temples, Dindi – Rivers, Amalapuram, Pithapuram - Temple and History, Samaralakota – Temple, Tuni, Nearby Tourist Korangi Forest wildlife refuge sanctuary, Razole, Rampachodavaram water falls , Uppada, destinations Pattiseema, Mandapeta, Ramachandrapuram Temple History, Kovvur, Ravulapalem Nature,Chaparai water falls, Peddapuram Temple History, Muramalla, Kolluru Camping Rivers, Kotipalli Rivers, Bikkavolu Temple History, Kadiypulanka, Ainavili, Sirivaka – Camping, Ryali History, Chinturu waterfalls and Forest, Malikipuram Bench, Prakasam Nagar, Vadapalli Temple History, Appannapalli Temple History, Dowleswaram, Dwarapudi villag, Kadiam, Jaggampeta Shopping and nature, Coringa wildlife sanctuary, Adurru – Buddhism, G.mamidada, Anaparthy, Atreyapuram, Yeleswaram, Gokavaram USP Riverine Island, River cruise Indicative Tourism Eco-Resort, Water villas, Water Sports, Theme park Projects Indicative Project Rs.20 to 30 Crores Cost Mode of execution Land Lease (PPP) Land Allotment Open tenders- Single Stage- 2covers Procedure Lease period & Time period for Lease period of 33 years (Plus) 3 Years for Construction completion of the project 1) 100% reimbursement of SGST for 5 years subject to CAPEX.