I CORPORATE PLAN SUMMARY 2012–2013 to 2016–2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

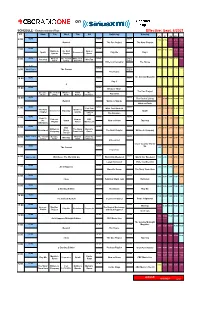

Siriusxm-Schedule.Pdf

on SCHEDULE - Eastern Standard Time - Effective: Sept. 6/2021 ET Mon Tue Wed Thu Fri Saturday Sunday ATL ET CEN MTN PAC NEWS NEWS NEWS 6:00 7:00 6:00 5:00 4:00 3:00 Rewind The Doc Project The Next Chapter NEWS NEWS NEWS 7:00 8:00 7:00 6:00 5:00 4:00 Quirks & The Next Now or Spark Unreserved Play Me Day 6 Quarks Chapter Never NEWS What on The Cost of White Coat NEWS World 9:00 8:00 7:00 6:00 5:00 8:00 Pop Chat WireTap Earth Living Black Art Report Writers & Company The House 8:37 NEWS World 10:00 9:00 8:00 7:00 6:00 9:00 World Report The Current Report The House The Sunday Magazine 10:00 NEWS NEWS NEWS 11:00 10:00 9:00 8:00 7:00 Day 6 q NEWS NEWS NEWS 12:00 11:00 10:00 9:00 8:00 11:00 Because News The Doc Project Because The Cost of What on Front The Pop Chat News Living Earth Burner Debaters NEWS NEWS NEWS 1:00 12:00 The Cost of Living 12:00 11:00 10:00 9:00 Rewind Quirks & Quarks What on Earth NEWS NEWS NEWS 1:00 Pop Chat White Coat Black Art 2:00 1:00 12:00 11:00 10:00 The Next Quirks & Unreserved Tapestry Spark Chapter Quarks Laugh Out Loud The Debaters NEWS NEWS NEWS 2:00 Ideas in 3:00 2:00 1:00 12:00 11:00 Podcast Now or CBC the Spark Now or Never Tapestry Playlist Never Music Live Afternoon NEWS NEWS NEWS 3:00 CBC 4:00 3:00 2:00 1:00 12:00 Writers & The Story Marvin's Reclaimed Music The Next Chapter Writers & Company Company From Here Room Top 20 World This Hr The Cost of Because What on Under the NEWS NEWS 4:00 WireTap 5:00 4:00 3:00 2:00 1:00 Living News Earth Influence Unreserved Cross Country Check- NEWS NEWS Up 5:00 The Current -

Canada's Public Space

CBC/Radio-Canada: Canada’s Public Space Where we’re going At CBC/Radio-Canada, we have been transforming the way we engage with Canadians. In June 2014, we launched Strategy 2020: A Space for Us All, a plan to make the public broadcaster more local, more digital, and financially sustainable. We’ve come a long way since then, and Canadians are seeing the difference. Many are engaging with us, and with each other, in ways they could not have imagined a few years ago. Our connection with the people we serve can be more personal, more relevant, more vibrant. Our commitment to Canadians is that by 2020, CBC/Radio-Canada will be Canada’s public space where these conversations live. Digital is here Last October 19, Canadians showed us that their future is already digital. On that election night, almost 9 million Canadians followed the election results on our CBC.ca and Radio-Canada.ca digital sites. More precisely, they engaged with us and with each other, posting comments, tweeting our content, holding digital conversations. CBC/Radio-Canada already reaches more than 50% of all online millennials in Canada every month. We must move fast enough to stay relevant to them, while making sure we don’t leave behind those Canadians who depend on our traditional services. It’s a challenge every public broadcaster in the world is facing, and CBC/Radio-Canada is further ahead than many. Our Goal The goal of our strategy is to double our digital reach so that 18 million Canadians, one out of two, will be using our digital services each month by 2020. -

Download Channel Lineup

Tbaytel Business TV Channel Lineup A&E HD 401 CTV Calgary HD 290 Global TV Toronto HD 216 A.Side HD 516 CTV Comedy Channel HD 501 Global TV Vancouver HD 217 ABC Grand Forks HD 232 CTV Drama Channel HD 404 Global TV Winnipeg HD 218 ABC Seattle HD 234 CTV Halifax HD 285 Golf Channel HD 730 ABC Spark HD 429 CTV Kitchener HD 279 GSN (Game Show Network) HD 449 addikTV HD 938 CTV Life Channel HD 439 HGTV Canada HD 434 Adult Swim HD 338 CTV Moncton HD 288 Historia HD 960 Al Jazeera English HD 671 CTV Montreal HD 281 History HD 607 AMC HD 405 CTV News Channel HD 655 History 2 HD 608 American Heroes Channel HD 611 CTV North Bay HD 278 HLN HD 668 AMI-audio 1112 CTV Ottawa HD 280 Hollywood Suite 70s HD 326 AMI-télé HD 1113 CTV Regina HD 289 Hollywood Suite 80s HD 327 AMI-tv HD 1111 CTV Sault Ste. Marie HD 275 Hollywood Suite 90s HD 328 Animal Planet HD 617 CTV Sci-Fi Channel HD 414 Hollywood Suite 2000s HD 329 CTV Sudbury HD 277 APTN (Aboriginal People’s TV) 227 ICI ARTV HD 947 CTV Sydney HD 284 APTN (Aboriginal People’s TV) HD 228 ICI Explora HD 961 CTV Thunder Bay HD 205 Aquarium Channel 105 ICI Radio-Canada Télé Toronto HD 931 CTV Timmins HD 276 ATN HD 910 ICI Radio-Canada Télé Winnipeg HD 930 CTV Toronto HD 206 AXS TV HD 517 ICI RDI HD 965 CTV Vancouver HD 207 BabyTV 542 ID (Investigation Discovery) HD 418 CTV Winnipeg HD 208 BBC Earth HD 604 La chaîne Disney HD 953 CTV2 Atlantic HD 212 BBC First HD 515 LCN HD 966 CTV2 Barrie HD 211 BBC World News HD 670 Lifetime HD 428 CTV2 London HD 296 beIN SPORTS HD 725 Love Nature HD 616 CTV2 Ottawa HD 295 -

In Indigeneity: the Musical Practices of Cris Derksen and Jeremy Dutcher

Contemporary Music Review ISSN: (Print) (Online) Journal homepage: https://www.tandfonline.com/loi/gcmr20 Reclaiming the ‘Contemporary’ in Indigeneity: The Musical Practices of Cris Derksen and Jeremy Dutcher Alexa Woloshyn To cite this article: Alexa Woloshyn (2020): Reclaiming the ‘Contemporary’ in Indigeneity: The Musical Practices of Cris Derksen and Jeremy Dutcher, Contemporary Music Review, DOI: 10.1080/07494467.2020.1806627 To link to this article: https://doi.org/10.1080/07494467.2020.1806627 Published online: 07 Sep 2020. Submit your article to this journal View related articles View Crossmark data Full Terms & Conditions of access and use can be found at https://www.tandfonline.com/action/journalInformation?journalCode=gcmr20 Contemporary Music Review, 2020 https://doi.org/10.1080/07494467.2020.1806627 Reclaiming the ‘Contemporary’ in Indigeneity: The Musical Practices of Cris Derksen and Jeremy Dutcher Alexa Woloshyn Indigenous musical modernities have thrived across centuries of innovation and mobilisation through both exchange and resistance. Settler colonialism seeks to deny Indigenous Peoples a ‘contemporary’ by asserting both a temporal and spatial boundary. The temporal and spatial boundaries intended for Indigenous Peoples foster expectations from the dominant white culture regarding Indigeneity. Cree Mennonite cellist Cris Derksen and Wolastoqi singer Jeremy Dutcher mobilise settler expectations and institutional opportunities in their distinctive musical practices. These musical practices are the results of exchange and dialogue between Euro-American classical music and Indigenous musics, resulting in what Dawn Avery calls ‘Native Classical Music’. Such dialogues are negotiated through these musicians’ resistance to Euro- American classical music hierarchies, settler logics about authenticity and their resourcefulness in navigating settler institutions. -

Channel Listing Satellite Tv Current As of February 11, 2021

CHANNEL LISTING SATELLITE TV CURRENT AS OF FEBRUARY 11, 2021. CLASSICAL 96FM TORONTO ...............963 N STINGRAY LOUD .........................................580 GOOD CLUB JUNIOR......................... (ON DEMAND) NEWSTALK 1010 ...........................................964 STINGRAY MUSIC STATIONS .......901-947 COUNTRY FM 105 .......................................968 NPR (NATIONAL PUBLIC RADIO) ........965 STINGRAY RETRO ........................................578 THE MAJOR NETWORKS, PLUS A SELECTION CTV - KINGSTON (CKWS) .......................233 O STINGRAY VIBE .............................................579 OF SPECIALTY CHANNELS. INCLUDES ALL OF CTV - OSHAWA (CHEX2).........................583 OZ-FM - ST. JOHN’S ....................................951 T THE CHANNELS IN THE STARTER PACKAGE. CTV - PETERBOROUGH (CHEX) ............217 P THE WEATHER NETWORK ......................505 # F PALMARÈSADISQ PAR STINGRAY .......187 TSC ......................................................................660 * 102.1 THE EDGE ............................................. 955 FAITHTV ...........................................................591 PLANETE JAZZ .............................................960 TSN RADIO 1050 ......................................... 995 104.5 CHUM FM ...........................................990 I PREMIÈRE CHAÎNE FM 97.7 TSN RADIO 1290 WINNIPEG ................. 984 680 NEWS ...................................................... 958 ICI MUSIQUE - MONTREAL (CBFX FM) .975 VANCOUVER (CBUF-FM) .........................977 -

Download the Complete Satellite TV Channel List

CHANNEL LISTING SATELLITE TV CURRENT AS OF JULY 5, 2021. CTV DRAMA CHANNEL ...........................620 NOOVO - MONTRÉAL HD* .................. 1803 TLN ......................................................................700 GOOD CTV DRAMA CHANNEL HD ..................1734 NOOVO - QUÉBEC* ....................................109 THE NEWS FORUM .....................................506 CTV NEWS CHANNEL................................501 NOOVO - SAGUENAY* ..............................104 THE WEATHER NETWORK ......................505 THE MAJOR NETWORKS, PLUS A SELECTION CTV NEWS CHANNEL HD .....................1562 NOOVO - SHERBROOKE* .......................106 TOON-A-VISION ..........................................567 OF SPECIALTY CHANNELS. INCLUDES ALL OF CTV SCI-FI CHANNEL ...............................627 NOOVO - TROIS-RIVIERES* .................540 TREEHOUSE ................................................... 553 THE CHANNELS IN THE STARTER PACKAGE. CTV SCI-FI CHANNEL HD ..................... 1746 NOOVO - VAL-D’OR* ................................ 544 TREEHOUSE HD .........................................1640 NPR (NATIONAL PUBLIC RADIO) ........965 TSC ......................................................................660 # D NTV ...................................................................... 199 TSN1 ....................................................................400 102.1 THE EDGE ............................................. 955 DAYSTAR CANADA .....................................650 NTV HD ...........................................................1008 -

John Beckwith Fonds CA OTUFM 10

University of Toronto Music Library John Beckwith fonds CA OTUFM 10 © University of Toronto Music Library 2020 Contents John Beckwith ................................................................................................................................................. 3 John Beckwith fonds .................................................................................................................................... 4 Series A : Compositions ...................................................................................................................... 4 Series B: Librettos, texts, performance records ........................................................................ 26 Series C: Other activities ................................................................................................................... 35 Series D: Other correspondence.................................................................................................... 39 Series E: Biographical ......................................................................................................................... 41 Series F: Recordings ........................................................................................................................... 43 John Beckwith fonds University of Toronto Music Library CA OTUFM 10 John Beckwith 1927- John Beckwith (born March 9, 1927 in Victoria, British Columbia) is a composer, pianist, author, and teacher. He moved to Toronto in 1945 to study piano with Alberto Guerrero at the Royal Conservatory. -

Download the Music Market Access Report Canada

CAAMA PRESENTS canada MARKET ACCESS GUIDE PREPARED BY PREPARED FOR Martin Melhuish Canadian Association for the Advancement of Music and the Arts The Canadian Landscape - Market Overview PAGE 03 01 Geography 03 Population 04 Cultural Diversity 04 Canadian Recorded Music Market PAGE 06 02 Canada’s Heritage 06 Canada’s Wide-Open Spaces 07 The 30 Per Cent Solution 08 Music Culture in Canadian Life 08 The Music of Canada’s First Nations 10 The Birth of the Recording Industry – Canada’s Role 10 LIST: SELECT RECORDING STUDIOS 14 The Indies Emerge 30 Interview: Stuart Johnston, President – CIMA 31 List: SELECT Indie Record Companies & Labels 33 List: Multinational Distributors 42 Canada’s Star System: Juno Canadian Music Hall of Fame Inductees 42 List: SELECT Canadian MUSIC Funding Agencies 43 Media: Radio & Television in Canada PAGE 47 03 List: SELECT Radio Stations IN KEY MARKETS 51 Internet Music Sites in Canada 66 State of the canadian industry 67 LIST: SELECT PUBLICITY & PROMOTION SERVICES 68 MUSIC RETAIL PAGE 73 04 List: SELECT RETAIL CHAIN STORES 74 Interview: Paul Tuch, Director, Nielsen Music Canada 84 2017 Billboard Top Canadian Albums Year-End Chart 86 Copyright and Music Publishing in Canada PAGE 87 05 The Collectors – A History 89 Interview: Vince Degiorgio, BOARD, MUSIC PUBLISHERS CANADA 92 List: SELECT Music Publishers / Rights Management Companies 94 List: Artist / Songwriter Showcases 96 List: Licensing, Lyrics 96 LIST: MUSIC SUPERVISORS / MUSIC CLEARANCE 97 INTERVIEW: ERIC BAPTISTE, SOCAN 98 List: Collection Societies, Performing -

Liste Des Canaux Télé Satellite

Liste des canaux Télé Satellite IMPORTANT TSN/TSN EXTRA 400 Global Montreal HD (CKMI-DT) 1032 Liste des canaux disponibles TSN2 401 Citytv Montreal HD (CJNT-DT) 1033 gratuitement avec l'achat d'un service TSN 3 402 CBC Ottawa HD (CBOT-DT) 1040 Internet Digicom. L'ajout de postes ou de TSN 4 403 CBC Toronto HD (CBLT-DT) 1050 télé à la carte n'est pas disponible. La liste est sujette à changement sans TSN5 404 CTV Toronto HD (CFTO-DT) 1051 préavis. Rogers Sportsnet - Ontario 405 Global -Toronto HD 1052 Accessible Media Inc TV 48 Rogers Sportsnet East 406 Citytv Toronto HD (CITY-DT) 1053 Accessible Media Inc Audio 49 Rogers Sportsnet - Pacific 407 CTV2 Toronto HD (CKVR-DT) 1054 AMI-télé 50 Rogers Sportsnet - West 408 OMNI Toronto HD (CFMT-DT) 1055 Citytv Toronto (DV) (CITY-TV) 57 Rogers Sportsnet One 409 OMNI 2 Toronto HD (CJMT-DT) 1056 Citytv Vancouver (DV) (CKVU-TV) 58 Sportsnet 410 CHCH TV HD 1057 Outdoor Lifestyle Network 411 Global Thunder Bay HD (CHFD- TVA Carlton-sur-mer (CHAU) 94 1065 DT) ICI Rimouski (CJBR-DT) 95 REV TV Canada 413 CBC Thunderbay HD (CKPR-DT) 1066 ICI Riviere-du-Loup (CKRT-DT) 96 Vu! Info Channel 414 CBC Winnipeg HD (CBWT-DT) 1090 ICI Saguenay (CKTV-DT) 97 NBA TV Canada 415 CTV Winnipeg HD (CKY-DT) 1091 ICI - Regina (CBKFT-TV) 98 The Golf Channel 416 Citytv Winnipeg HD (CHMI-DT) 1093 ICI Toronto (CBLFT-DT) 99 Sportsman Canada 419 CTV Regina HD (CKCK-DT) 1106 ICI - Moncton (CBAFT-TV) 100 Sportsnet Vancouver Hockey 436 CBC Edmonton HD (CBXT-DT) 1120 TVA Rimouski (CFRE) 101 Sportsnet Oilers 437 CTV Edmonton HD (CFRN-DT) -

Box # # of Items in Folder Name of Organization

Box # of Name of Organization (note: names that are underlined are filed by the underlined word in alphabetical order) Location # Items in Folder 1 1 Feike Asma. Organ recital. Toronto Toronto 1 ARS NOVA presents Theatre of Early Music presents "Star of Wonder" A Christmas Concert. Knox Presbyterian Church, Ottawa Ottawa. 1 ARS Omnia with Contemporary Music Projects presents The Inspiration of Greece and China. A trans-cultural Toronto contemporary music event. Kings College Circle, University of Toronto. 1 2 ARS Organi. Montreal 1 L'ARMUQ Quebec 1 1 A Benefit Concert for Women's College Hospital. John Arpin, [Pianist.]. Women's College Hospital 75th Anniversary, Toronto 1911-1986. Roy Thomson Hall, Toronto. 1 1 A Space - Toronto. Toronto 1 L'Academie Commerciale Catholique de Montreal. Montreal 1 1 L'Academie Des Lettres Et Des Sciences Humaine de la Society Royal Du Canada. [Ottawa?] 1 1 Academy of Dance. [Brantford, Ontario?] 2 Acadia University. Wolfville, Nova Scotia. Nova Scotia 1 2 ACME Theatre Company. Toronto 1 2 Acting Company. Toronto. Toronto 1 1 The Actors Workshop. Toronto. Toronto 1 1 Acustica International Montreal. Montreal 1 1 John Adams. New Music for synthesizers, solo bass and grand pianos by John Adams & Chan Ka Nin. Premiere Dance Toronto Theatre. New Music Concert. [Toronto.] 1 1 Adelaide Court Theatre. Toronto. Toronto 1 1 The Aeolian Town Hall. The London School Of Church Music. A Concert to honour the Silver Jubilee of Her Majesty London, Ontario Queen Elizabeth II. 1 Aetna Canada Young People's Concerts. Toronto. Toronto 1 2 Afternoon Concert Series. The Women's Musical Club of Toronto. -

CBC Unscripted Independent Producers' Handbook

TABLE OF CONTENTS Page 1) Introduction to Independent Producer’s Handbook 3-4 2) CBC Credit Policy 5-6 3) CBC Physical Production: Program Approvals and Delivery 7 4) CBC Code of Conduct 8-9 5) Talent Policies 10 6) CBC’s Inclusion & Diversity Protocol 11-13 7) CBC Communications, Marketing, Brand & Research Guidelines 14-24 CBC Communications, Marketing, Brand & Research Technical Specifications 8) CBC Social Media Activity Guidelines 25-29 Tips: CBC Social Media Guidelines for Cast Talent Corporate Policy 9) CBC Television Broadcast Standards & Practices 30-35 10) CBC Media Solutions Overview 36-43 Product Integration & Product Placement Guidelines 11) CBC Program Formats & Program Deliverables and Technical Specifications 44-56 Described Video CBC Technical Specifications for Program Delivery 1. Program File Delivery to CBC 2. CBC Gem, iTunes, Netflix, GooglePlay Delivery Checklist CBC Technical Specifications for Web/Digital File Format 12) APM Production Music Library Access 57 13) CBC Production Insurance Requirements 58 14) Appendix - Forms Diversity & Inclusion Plan Template 59-62 CBC Post Production + Delivery Schedule Template CBC Unscripted Content endeavours to ensure the information contained herein is as accurate and up-to-date as possible. If you find any errors or omissions within this Handbook, or wish to provide any comments or suggestions, please contact: [email protected] Unscripted Producer Handbook September 2019 2 INDEPENDENT PRODUCERS’ HANDBOOK INTRODUCTION This Independent Producers’ Handbook is compiled and created by CBC Unscripted Content to assist Producers in navigating the sometimes complex relationship with a broadcaster. The Handbook is designed to provide information on a wide range of Producer responsibilities and requirements, including production and promotional deliverables, broadcast standards, and policies applicable to most independently-produced programming for CBC. -

Box File No. Title Location Aca

BOX FILE NO. TITLE LOCATION A.C.A. Newsletter. Alberta Composers' Association Newsletter. Alberta A.S.O. Atlantic Symphony Orchestra. Newfoundland, New Brunswick, Nova Scotia …. Nova Scotia …. [Atlantic Provinces] A Benefit Concert for Women's College Hospital. John Arpin, [Pianist.]. Women's College Hospital 75th Anniversary, Toronto. 1911-1986. Roy Thomson Hall, Toronto. 1 1 A Space - Toronto. Toronto 1 2 L'Acadamie Des Lettres Et Des Sciences Humaine de la Society Royal Du Canada. [Ottawa?] 1 3 Academy of Dance. [Brantford, Ontario?] Acadia University. Wolfville, Nova Scotia. Nova Scotia 1 4 ACME Theatre Company. Toronto Acting Company. Toronto. Toronto 1 5 The Actors Workshop. Toronto. Toronto John Adams. New Music for synthesizers, solo bass and grand pianos by John Adams & Chan Ka Nin. Premiere Dance Toronto. Theatre. New Music Concert. [Toronto.] 1 6 Adelaide Court Theatre. Toronto. Toronto 1 7 The Aeolian Town Hall. The London School Of Church Music. A Concert to honour the Silver Jubilee of Her Majesty London, Ontario Queen Elizabeth II. 1 8 Aetna Canada Young People's Concerts. Toronto. Toronto African Theatre Ensemble. Toronto 1 9 AfriCanadian Playwrights Festival. Toronto. Toronto 1 10 Agnes Etherington Art Centre, Kingston. Kingston Aid to Artists. The Canada Council, 1978-79. Ottawa. Ottawa Air Command Band. Winnipeg 1 11 Alberta College. Alberta The Alberta Music Conference. Banff School of Fine Arts. Alberta 1 12 The Aldeburgh Connection. Concert Society. Toronto. Toronto Lenore Alford, orgue. Conseil Des Arts et Des Lettres Du Quebec. Quebec 1 13 Algoma Fall Festival. Saulte Ste. Marie, Ontario. Saulte Ste. Marie, Ontario Alianak Theatre.