W JD Power Reports: Problems Experienced by Luxury Car Owners

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Special Power Report Kia Kia Leads All Industry Brands in 2016 Initial Quality Study Soul and Sportage Receive Initial Quality Awards

July 2016 J.D. POWER Special Power Report Kia Kia Leads All Industry Brands in 2016 Initial Quality Study Soul and Sportage Receive Initial Quality Awards ia ranks highest among all automotive industry nameplates in the J.D. Power 2016 U.S. Initial Quality StudySM (IQS). This significant milestone comes just one year after Kia ranked K In ranking highest second overall in the 2015 IQS. It also represents the first time in among all brands 27 years that a non-luxury brand has led the industry in the U.S. industry-wide, Initial Quality Study. In addition to its industry-leading performance Kia earns an this year, Kia produces two award-recognized models: the 2016 overall score of 83 Soul in the Compact MPV segment (second consecutive year) and problems per 100 the 2016 Sportage in the Small SUV segment. vehicles (PP100) in the 2016 U.S. IQS, which exceeds industry average by 22 PP100 and represents a 3-point improvement 2016 NAMEPLATE IQS RANKING from 86 PP100 in 2015. Problems per 100 Vehicles (PP100) • Lower Score = Higher Quality The 2016 U.S. IQS evaluates eight problem categories that Kia 83 Porsche 84 comprise initial quality: Hyundai 92 • Exterior Toyota 93 BMW 94 • Driving Experience Chevrolet 95 • Features/Controls/Displays (FCD) Buick 96 • Audio/Communication/Entertainment/Navigation (ACEN) Lexus 96 • Seats Lincoln 96 • Heating, Ventilation, and Air Conditioning (HVAC) Nissan 101 Ford 102 • Interior GMC 103 • Engine/Transmission Infiniti 103 Volkswagen 104 The IQS measures both defects/malfunctions and design- Industry Average 105 related problems—features that may be operating as intended but are poorly located or difficult to use. -

Installation Guide Thehkht1 Firmware for DBALL 2 Is an All-In-One Door Lock and Override Module Compatible with Specifichyundai and Kia Vehicles

Platform: DBALL2 Firmware: HKHT1 Rev.: 201 70 831 Update Alert: Firmware updates are postedon the web on a regular basis. We recommend that you check for firmware and/or install guide updates prior to installing this product. Installation Guide TheHKHT1 firmware for DBALL 2 is an all-in-one door lock and override module compatible with specificHyundai and Kia vehicles. This module can only be flashed and configured using XpressVIP at www.directechs.com or using the Directechs Mobile application for smartphones. Refer to the Module Programming sectionon page n for more information. Index Vehicle Application Guide................................... ......................................................................................................... 02 Installation(Wiring Diagram s & Vehicle Wiring Reference Chart s ) Type 1................................................................................................ ......................................................................... 03 Type 2................................................................................................ ......................................................................... 07 Type 3................................................................................................ ......................................................................... 11 Programming Type 1: Module Programming ... .................................................................................................................................. 14 Types. 2 & 3: -

BAIC Motor 2016 Annual Results Announcement 北京汽车股份有限公司2016年度业绩推介材料

BAIC Motor 2016 Annual Results Announcement 北京汽车股份有限公司2016年度业绩推介材料 2017.03 Hong Kong Stock Code: 1958.HK Statement This demonstration film and the information it contained do not constitute suggestions on the trading of any securities of BAIC Motor Corporation Ltd. (“the Company”) or offers on the trading of any Company securities, and do not constitute foundation or basis of any contract or commitment. As for the fairness, accuracy, completeness or correctness of the information or suggestions contained in this demonstration film, we do not make any explicit or inexplicit statement or guarantee, and shall not rely on the above-mentioned information or suggestions. As for the losses arising from using this demonstration film or its contents, or other reasons related to this demonstration film, regardless of the nature, the Company and any of its consultant or representative do not undertake any responsibilities or obligations (be it due to negligence or other reasons). Information contained in this demonstration film may be updated, reorganized, modified, verified and revised and the above-mentioned information may be subject to significant changes. This presentation contains predictive statements regarding the Company's financial condition, operating performances and business, and certain plans and objectives of the Company's management, which can involve predictable and unpredictable risks, uncertainties and other factors, and these risks, uncertainties and other factors can possibly lead to significant differences between the actual future performances of the Company and those explicitly or inexplicitly expressed in the above-mentioned predictive statements. The above predictive statements are based on the Company's current and future business strategies and various assumptions based on the political and economic environment in which the Company will conduct business in the future. -

2017 Passenger Vehicles Actual and Reported Fuel Consumption: a Gap Analysis

2017 Passenger Vehicles Actual and Reported Fuel Consumption: A Gap Analysis Innovation Center for Energy and Transportation December 2017 1 Acknowledgements We wish to thank the Energy Foundation for providing us with the financial support required for the execution of this report and subsequent research work. We would also like to express our sincere thanks for the valuable advice and recommendations provided by distinguished industry experts and colleagues—Jin Yuefu, Li Mengliang, Guo Qianli,. Meng Qingkuo, Ma Dong, Yang Zifei, Xin Yan and Gong Huiming. Authors Lanzhi Qin, Maya Ben Dror, Hongbo Sun, Liping Kang, Feng An Disclosure The report does not represent the views of its funders nor supporters. The Innovation Center for Energy and Transportation (iCET) Beijing Fortune Plaza Tower A Suite 27H No.7 DongSanHuan Middle Rd., Chaoyang District, Beijing 10020 Phone: 0086.10.6585.7324 Email: [email protected] Website: www.icet.org.cn 2 Glossary of Terms LDV Light Duty Vehicles; Vehicles of M1, M2 and N1 category not exceeding 3,500kg curb-weight. Category M1 Vehicles designed and constructed for the carriage of passengers comprising no more than eight seats in addition to the driver's seat. Category M2 Vehicles designed and constructed for the carriage of passengers, comprising more than eight seats in addition to the driver's seat, and having a maximum mass not exceeding 5 tons. Category N1 Vehicles designed and constructed for the carriage of goods and having a maximum mass not exceeding 3.5 tons. Real-world FC FC values calculated based on BearOil app user data input. -

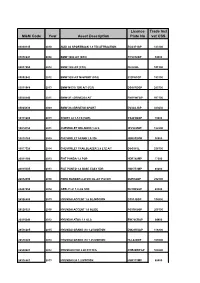

M&M Code Year Asset Description Licence Plate No Trade Incl Vat

Licence Trade Incl M&M Code Year Asset Description Plate No vat CSS 04030145 2010 AUDI A3 SPORTBACK 1.9 TDI ATTRACTION ZCG371GP 123100 05036241 2008 BMW 320d A/T (E90) YCV852GP 94000 05037059 2012 BMW 320i A/T (F30) DHJ286L 181300 05052042 2012 BMW 520i A/T M-SPORT (F10) 032PATGP 193190 05011968 2013 BMW M135i 3DR A/T (F21) DG66FDGP 285300 05020240 2011 BMW X1 sDRIVE20d A/T FM11WFGP 167100 05065430 2009 BMW X6 xDRIVE50i SPORT DV42SJGP 323630 10311200 2013 CHERY J2 1.5 TX (5DR) CS26YGGP 70600 10074150 2011 CHEVROLET ORLANDO 1.8LS JFV289NW 122900 10010160 2009 CHEVROLET SPARK LS 5Dr JBG852NW 36900 10077320 2014 CHEVROLET TRAILBLAZER 2.8 LTZ A/T DSG565L 236300 20011160 2013 FIAT PANDA 1.2 POP HDR742MP 77300 20015305 2013 FIAT PUNTO 1.4 BASE EASY 5DR HSH753MP 80200 22032690 2016 FORD RANGER 2.2TDCI XL A/T P/U D/C DUPHAGP 292100 23407050 2014 GEELY LC 1.0 GS 5DR DH19BSGP 60300 26526400 2015 HYUNDAI ACCENT 1.6 GL/MOTION DT93JBGP 154800 26526521 2016 HYUNDAI ACCENT 1.6 GLIDE FG31KSGP 208300 26515340 2012 HYUNDAI ATOS 1.1 GLS BW70CBGP 54400 26516285 2015 HYUNDAI GRAND i10 1.25 MOTION DW23RSGP 116800 26516285 2014 HYUNDAI GRAND i10 1.25 MOTION HLL648MP 103000 26530401 2012 HYUNDAI H100 2.6D F/C D/S CDE29WPGP 100800 26516461 2013 HYUNDAI i20 1.2 MOTION HSR315MP 88400 26516502 2016 HYUNDAI i20 1.4 FLUID DNW822L 183700 26569110 2012 HYUNDAI iX35 2.0 GLS/EXECUTIVE DT34DWGP 162400 26540102 2013 HYUNDAI MIGHTY HD72 F/C C/C CL95RFGP 191000 32125100 2016 KIA K 2500 P/U S/C NUR54345 200000 32160263 2015 KIA SPORTAGE 2.0 IGNITE DZ81MTGP 240600 41514110 -

Poland Regional Cities-Comfort-Vehicle-List

Make Model Year Oldsmobile 19 Oldsmobile Alero Oldsmobile Aurora Oldsmobile Bravada Oldsmobile Cutlass Supreme Oldsmobile Intrigue Oldsmobile Silhouette Dodge Attitude Dodge Avenger 2013 Dodge Caliber Dodge Caravan 2015 Dodge Challenger Dodge Charger 2013 Dodge Dakota Dodge Dart 2015 Dodge Durango 2013 Dodge Grand Caravan 2015 Dodge Intrepid Dodge JCUV Dodge Journey 2013 Dodge Magnum 2013 Dodge Neon 2015 Dodge Nitro 2013 Dodge Ram 1500 Dodge Ram 2500 Dodge Ram 3500 Dodge Ram 4500 Dodge Ram 700 Dodge Ram Van 2015 Dodge Sprinter Dodge Stratus 2015 Dodge Stretch Limo Dodge Viper Dodge Vision Dodge i10 Land Rover Defender 2013 Land Rover Discovery 2013 Land Rover Freelander 2013 Land Rover Freelander 2 Land Rover LR2 Land Rover LR3 Land Rover LR4 Land Rover Range Rover 2013 Land Rover Range Rover Evoque 2013 Land Rover Range Rover Sport 2013 Land Rover Range Rover Velar 2013 Land Rover Range Rover Vogue 2013 Chevrolet Agile Chevrolet Astra 2015 Chevrolet Astro Chevrolet Avalanche 2013 Chevrolet Aveo Chevrolet Aveo5 Chevrolet Beat Chevrolet Blazer Chevrolet Bolt Chevrolet CMV Chevrolet Camaro Chevrolet Caprice Chevrolet Captiva 2013 Chevrolet Cavalier Chevrolet Celta Chevrolet Chevy Chevrolet City Express Chevrolet Classic Chevrolet Cobalt 2015 Chevrolet Colorado Chevrolet Corsa Chevrolet Corsa Sedan Chevrolet Corsa Wagon Chevrolet Corvette Chevrolet Corvette ZR1 Chevrolet Cruze 2015 Chevrolet Cruze Sport6 Chevrolet Dmax Chevrolet Enjoy Chevrolet Epica 2013 Chevrolet Equinox 2013 Chevrolet Esteem Chevrolet Evanda 2013 Chevrolet Exclusive Chevrolet -

Chinese Auto Manufacturers Continue to Close Quality Gap in J.D

Chinese Auto Manufacturers Continue to Close Quality Gap in J.D. Power Vehicle Dependability Study Beijing Hyundai Receives Three of 12 Model-Level Awards; Porsche Ranks Highest in Vehicle Dependability among Luxury Brands; MINI and Volkswagen Rank Highest among Mass Market Brands Shanghai: 26 November 2015 — Vehicle dependability has improved this year, as long-term reliability and durability approach mature market levels in aggregate problems reported, according to the J.D. Power 2015 China Vehicle Dependability StudySM (VDS) released today. The rate of improvement in overall dependability is most pronounced among domestic Chinese brands, which have continued to narrow the quality gap with international brands in 2015. Now in its sixth year, the study measures problems experienced during the past six months by original owners of vehicles after 37 to 48 months of ownership. The study examines 202 problem symptoms across eight categories: engine and transmission; vehicle exterior; driving experience; features/ controls/ displays; audio/ entertainment/ navigation; seats; heating, ventilation and cooling (HVAC); and vehicle interior. Overall dependability is determined by the number of problems experienced per 100 vehicles (PP100), with a lower score reflecting higher quality. Key Findings: • Overall Dependability Improves to Mature Market Levels: Overall vehicle dependability improves significantly in 2015, with total reported problems per 100 vehicles (PP100) dropping to 156 PP100 from 193 PP100 in 2014. This continued improvement in vehicle dependability has put China more in line with other, more mature automotive markets, including the United States, which it lags by just 9 PP100. • Domestic Auto Brands Show Sharpest Improvement: Domestic brands improve the most among all brand origins (-48 PP100). -

QYT AUTO PARTS CO., LTD Email: [email protected] ; [email protected] Whatsapp: +86 13634216230 QYT No

QYT AUTO PARTS CO., LTD Email: [email protected] ; [email protected] WhatsApp: +86 13634216230 QYT no. Description Corss Ref. Application TOYOTA;LEXUS (SO0001‐SO0300) TOYOTA CAMRY ACV40 06‐12; SO0001 Steering Tie rod ends 45470‐09090 LEXUS LEXUS ES350/ES240 07‐ TOYOTA CAMRY ACV40 06‐12; SO0002 Steering Tie rod ends 45460‐09140 LEXUS LEXUS ES350/ES240 07‐ TOYOTA CAMRY SO0003 Steering Tie rod ends 45460‐09160 ACV50(2012‐) TOYOTA CAMRY SO0004 Steering Tie rod ends 45460‐09250 ACV50(2012‐) GEELY PANDA,HAIJING,GEELY YUANJING, YUANJING 18‐, SO0005 Steering Tie rod ends 45047‐49045 YUANJINGX3,GEELY EMGRAND EC7,GEELY ENGLON ,BINRUI;BYD F0,BYD F3/F3R/G3/G3R/L3;TOYOTA COROLLA;LIFAN LIFAN 620;JAC YUEYUE GEELY PANDA,HAIJING,GEELY YUANJING, YUANJING 18‐, SO0006 Steering Tie rod ends 45046‐49115 YUANJINGX3,GEELY EMGRAND EC7,GEELY ENGLON ,BINRUI;BYD F0,BYD F3/F3R/G3/G3R/L3;TOYOTA COROLLA;LIFAN LIFAN 620;JAC YUEYUE CHANGAN RAETON;TOYOTA CAMRY2.4/3.0 (03),PREVIA ACR30 (34M); SO0007 Steering Tie rod ends 45460‐39615 LEXUS ES300/MCV30 01‐06 CHANGAN RAETON;TOYOTA CAMRY2.4/3.0 (03),PREVIA ACR30 (34M); SO0008 Steering Tie rod ends 45470‐39215 LEXUS ES300/MCV30 01‐06 BYD SURUI,SONG MAX;ZOTYE Z300; SO0009 Steering Tie rod ends 45046‐09590 TOYOTA COROLLA 07‐/VERSO 11‐/LEVIN 14‐ BYD SURUI ,SONG MAX;ZOTYE Z300; SO0010 Steering Tie rod ends 45047‐09590 TOYOTA COROLLA 07‐/VERSO 11‐/LEVIN 14‐ SO0011 Steering Tie rod ends 45464‐30060 TOYOTA REIZ/CROWN;LEXUS LEXUS IS250/300 06‐,GS300/350/430 05‐ SO0012 Steering Tie rod ends 45463‐30130 TOYOTA REIZ/CROWN;LEXUS LEXUS -

Baic(1958.Hk)

EQUITY RESEARCH BAIC (1958.HK) Benefit from Benz`s new product cycle 17 Jul 2015 Hong Kong | Automobile | Initiation Report ·BAIC develops her own brands of economical vehicles (namely “Senova” series, “Beijing” BUY (Initiation) series and “Wevon” series) and also possesses the luxury vehicle brand of “Beijing Benz” as CMP HKD 7.82 well as the medium-high end brand of “Beijing Hyundai”. In 2009, Beijing Automotive (Closing price as at 15 July 2015) Industry Group acquired Saab Technology and applied them on her own brand of “Senova” TARGET HKD 13.23 (+69%) series passenger cars. COMPANY DATA ·Last year, the Company`s annual income demonstrated a growth of 3.4 times, to O/S SHARES (MN) : 6419 RMB56.37 billion. Such surge of income is mainly due to the acquisition of Beijing Benz and MARKET CAP (HKD MN) : 16427 the rapid growth of sales of newly launched vehicles. Gross profit margin also increased 52 - WK HI/LO (HKD): 11.5 / 7.14 from 3.2% in 2013 to 15.9% in 2014. Net profit attributable to parent company recorded RMB4.511 billion, up 66% yoy, with corresponding earning per share as RMB0.7 (RMB0.48 recorded in 2013). Boosted by the hot sales of Beijing Benz, its Q115 net profit surged to RMB1.63billion, up 104% yoy, and its gross margin climb to 22.3%. SHARE HOLDING PATTERN, % Beijing Automotive Group Co., Ltd 45.6 · Beijing Shougang Co., Ltd 13.7 Beijing Hyundai is the largest contributor of profit. Beijing Hyundai`s two new factories in Daimler AG 10.08 Cangzhou and Chongqing would commence operation next year, with preliminary planned PRICE PERFORMANCE, % annual production capacity as 300,000 vehicles each, and expected accomplishment by 2016 1M 3M 1Y year-end and 2017 year-end respectively. -

France En 2018, Groupe Psa a Contribué Pour Près De

ANALYSE DE PRESSE DE 14H00 22/02/2019 FRANCE EN 2018, GROUPE PSA A CONTRIBUÉ POUR PRÈS DE 5 MILLIARDS D’EUROS À LA BALANCE COMMERCIALE DE LA FRANCE L’an dernier, le Groupe PSA a contribué, grâce à un excédent de 4,9 milliards d’euros, à la balance commerciale de la France avec 362 000 véhicules exportés. Les cinq usines françaises d’assemblage de véhicules ont produit 1,2 million de véhicules, en hausse de 6,4 % par rapport à 2017, représentant près d’un tiers de la production mondiale de véhicules du constructeur. Ce niveau de production nationale dépasse ainsi les engagements pris dans le cadre de l’accord NEC (Nouvel Elan pour la Croissance), signé en juillet 2016 par cinq organisations syndicales sur six, représentant 80 % des salariés. Grâce à la forte implantation industrielle française du Groupe PSA, 14 véhicules des marques Peugeot, Citroën et DS ont été labellisés « Origine France Garantie » par l’association pro France. Source : COMMUNIQUE DE PRESSE GROUPE PSA (21/2/19) Par Alexandra Frutos RENAULT ET DACIA ANNONCENT LEUR PROGRAMME POUR LE SALON DE GENÈVE Renault présentera au Salon de l’Automobile de Genève la nouvelle Clio, cinquième génération de son icône déjà vendue à 15 millions d’exemplaires. Conçue sur le double principe « Evolution & Révolution », la Clio V bouleverse les codes : le style extérieur évolue vers plus de maturité, tandis que le design intérieur est entièrement repensé. Avec des lignes plus sculptées et une face avant plus affirmée, la nouvelle Clio gagne ainsi en dynamisme et modernité. Entièrement revu, l’habitacle s’inspire quant à lui des segments supérieurs, aussi bien en termes de qualité perçue que de technologies disponibles. -

Car Wars 2020-2023 the Rise (And Fall) of the Crossover?

The US Automotive Product Pipeline Car Wars 2020-2023 The Rise (and Fall) of the Crossover? Equity | 10 May 2019 Car Wars thesis and investment relevance Car Wars is an annual proprietary study that assesses the relative strength of each automaker’s product pipeline in the US. The purpose is to quantify industry product trends, and then relate our findings to investment decisions. Our thesis is fairly straightforward: we believe replacement rate drives showroom age, which drives market United States Autos/Car Manufacturers share, which drives profits and stock prices. OEMs with the highest replacement rate and youngest showroom age have generally gained share from model years 2004-19. John Murphy, CFA Research Analyst Ten key findings of our study MLPF&S +1 646 855 2025 1. Product activity remains reasonably robust across the industry, but the ramp into a [email protected] softening market will likely drive overcrowding and profit pressure. Aileen Smith Research Analyst 2. New vehicle introductions are 70% CUVs and Light Trucks, and just 24% Small and MLPF&S Mid/Large Cars. The material CUV overweight (45%) will likely pressure the +1 646 743 2007 [email protected] segment’s profitability to the low of passenger cars, and/or will leave dealers with a Yarden Amsalem dearth of entry level product to offer, further increasing an emphasis on used cars. Research Analyst MLPF&S 3. Product cadence overall continues to converge, making the market increasingly [email protected] competitive, which should drive incremental profit pressure across the value chain. Gwen Yucong Shi 4. -

China Autos Driving the EV Revolution

Building on principles One-Asia Research | August 21, 2020 China Autos Driving the EV revolution Hyunwoo Jin [email protected] This publication was prepared by Mirae Asset Daewoo Co., Ltd. and/or its non-U.S. affiliates (“Mirae Asset Daewoo”). Information and opinions contained herein have been compiled in good faith from sources deemed to be reliable. However, the information has not been independently verified. Mirae Asset Daewoo makes no guarantee, representation, or warranty, express or implied, as to the fairness, accuracy, or completeness of the information and opinions contained in this document. Mirae Asset Daewoo accepts no responsibility or liability whatsoever for any loss arising from the use of this document or its contents or otherwise arising in connection therewith. Information and opin- ions contained herein are subject to change without notice. This document is for informational purposes only. It is not and should not be construed as an offer or solicitation of an offer to purchase or sell any securities or other financial instruments. This document may not be reproduced, further distributed, or published in whole or in part for any purpose. Please see important disclosures & disclaimers in Appendix 1 at the end of this report. August 21, 2020 China Autos CONTENTS Executive summary 3 I. Investment points 5 1. Geely: Strong in-house brands and rising competitiveness in EVs 5 2. BYD and NIO: EV focus 14 3. GAC: Strategic market positioning (mass EVs + premium imported cars) 26 Other industry issues 30 Global company analysis 31 Geely Automobile (175 HK/Buy) 32 BYD (1211 HK/Buy) 51 NIO (NIO US/Buy) 64 Guangzhou Automobile Group (2238 HK/Trading Buy) 76 Mirae Asset Daewoo Research 2 August 21, 2020 China Autos Executive summary The next decade will bring radical changes to the global automotive market.