The S&P 500 Ended Just Slightly in the Red On

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Renewables DEBT PRESENTATION

Renewables Adani Green Energy Limited DEBT PRESENTATION September 2020 1 CONTENTS Adani Group AGEL - Portfolio and 04-07 09-21 Growth Strategy AGEL: COVID–19 Update 09 Adani: World class infrastructure AGEL : Leading Renewable Player AGEL- Replicating Adani Group Case Study: 570 MW RG2 Bond & utility portfolio 04 in India… 10 Business Model: O&M Philosophy 14 Issuance 18 Adani Group: Repeatable, robust & AGEL: Large, Geographically AGEL- Replicating Adani Group Case Study: Strategic Sale to proven model of infrastructure Diversified Portfolio 11 Business Model: Capital TOTAL SA - De-risking through development 05 Management Philosophy 15 Capital Management 19 AGEL: Locked-in Growth with Adani Group: Repeatable, robust improving counterparty mix 12 Pillars for Capital Management AGEL- Capital Management: business model applied to drive Plan 16 Journey so far & Next Steps 20 AGEL- Replicating Adani Group value 06 Business Model: Development Case Study: 930 MW RG1 Bond Global Benchmarking: Adani AGEL: Robust Business Model Philosophy 13 Issuance 17 Energy Portfolio vs. Global peers 21 with Rapid Growth & Predictable Returns.. 07 AGEL - ESG 23-27 Conclusion 28 Appendix 31-45 2 AGEL ESG Philosophy 23 AGEL: ESG performance for FY20 24 AGEL Project Details, Financials, Environment awareness and Strategic Priorities 31-35 initiatives 25 Attractive Industry Outlook, Technology intervention enabling AGEL: A Compelling Investment Case 28 Regulatory Landscape 37-39 effective management of resource 26 RG1 & RG2 Financial & Operational AGEL’s Governance: -

Media Release Adani Transmission Ltd Consolidated EBIDTA Stands at Rs

Media Release Adani Transmission Ltd consolidated EBIDTA stands at Rs. 1504 Crore & Consolidated PAT stands at Rs 262 Crore for Nine Months ended FY16 Editor’s Synopsis • Tariff & Incentive Income remains Steady at Rs. 494 Crore in Q3FY16 vs Q2FY16 • Systems Availability is above normative level for all the four lines as follows: o 765 kV Tiroda to Aurangabad System achieves average availability of 99.84% for Nine months ended Dec. FY16 against 98% of normative availability o 400 kV Tiroda to Warora System achieves average availability of 99.96% for Nine months ended Dec. FY16 against 98% of normative availability. o 400 kV Mundra to Dehgam System achieves average availability of 99.91% for Nine months ended Dec. FY16 against 98% of normative availability o 500 kV HVDC Mundra to Mohindergarh System achieves average availability of 99.52% for Nine months ended Dec. FY16 against 95% of normative availability. • The Company has won three Interstate transmission projects of 1384 Ckt Km under Tariff Based Competitive Bidding Route on BOOM basis for 35 years. The company is confident to commission these projects well ahead of the schedule. With completion of these new projects, Adani transmission network will increase from 5051 Ckt Km to 6435 Ckt Km & Adani Transmission Limited continues to be largest Private Transmission company in the country. Ahmedabad, February 02, 2016: Adani Transmission Ltd, part of the Adani Group, today announced its results for the third quarter ended December 31, 2015. Financial Highlights: The Total Income for Q3FY16 stood at Rs 529 crore. EBIDTA stood at Rs 477 crore and consolidated PAT is Rs 80 crore. -

Exclusion List

Exclusion list ROBECO INSTITUTIONAL ASSET MANAGEMENT 1 Sustainability Inside Excluded companies: 61 Rimbunan Sawit Bhd 15 Bots Inc 62 Riverview Rubber Estates BHD 16 Bright Packaging Industry Bhd Controversial behavior 63 Salim Ivomas Pratama Tbk PT 17 Brilliant Circle Holdings International Ltd 1 G4S International Finance PLC 64 Sarawak Oil Palms Bhd 18 British American Tobacco Bangladesh Co Ltd 2 G4S PLC 65 Sarawak Plantation Bhd 19 British American Tobacco Chile Operaciones SA 3 Korea Electric Power Corp 66 Scope Industries Bhd 20 British American Tobacco Holdings The Netherlands BV 4 Oil & Natural Gas Corp Ltd1 67 Sin Heng Chan Malaya Bhd 21 British American Tobacco Kenya PLC 5 ONGC Nile Ganga BV 68 Sinar Mas Agro Resources & Technology Tbk PT 22 British American Tobacco Malaysia Bhd 6 ONGC Videsh Ltd 69 Socfin 23 British American Tobacco PLC 7 Vale Indonesia Tbk PT 70 Socfinasia SA 24 British American Tobacco Uganda Ltd 8 Vale SA2 71 Societe Camerounaise de Palmeraies 25 British American Tobacco Zambia PLC 72 Societe des Caoutchoucs de Grand-Bereby 26 British American Tobacco Zimbabwe Holdings Ltd Palm oil 73 SSMS Plantation Holdings Pte Ltd 27 Bulgartabac Holding AD 1 A Brown Co Inc 74 Sterling Plantations Ltd 28 Carreras Ltd/Jamaica 2 Agalawatte Plantations PLC 75 Subur Tiasa Holdings Bhd 29 Casey’s General Stores Inc 3 Anglo-Eastern Plantations PLC 76 Sungei Bagan Rubber Co Malaya Bhd 30 Cat Loi JSC 4 Astra Agro Lestari Tbk PT 77 Sunshine Holdings PLC 31 Ceylon Tobacco Co PLC 5 Astral Asia Bhd 78 Ta Ann Holdings Bhd 32 Champion -

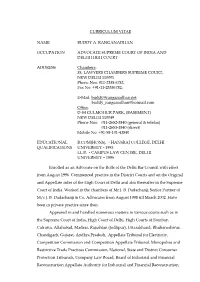

Curriculum Vitae Name Buddy A

CURRICULUM VITAE NAME BUDDY A. RANGANADHAN OCCUPATION ADVOCATE SUPREME COURT OF INDIA AND DELHI HIGH COURT ADDRESS Chambers: 38, LAWYERS CHAMBERS SUPREME COURT, NEW DELHI 110001 Phone Nos: 011-2338 6782, Fax No: +91-11-23386782; E-Mail: [email protected] [email protected] Office: D-84 GULMOHUR PARK, (BASEMENT) NEW DELHI 110049 Phone Nos: 011-2652-3840 (general & telefax) 011-2653-3840 (direct) Mobile No: +91-98-101-43840 EDUCATIONAL B.COM(HONS), - HANSRAJ COLLEGE, DELHI QUALIFICATIONS UNIVERSITY - 1993 LL.B. - CAMPUS LAW CENTRE, DELHI UNIVERSITY – 1996 Enrolled as an Advocate on the Rolls of the Delhi Bar Council with effect from August 1996. Commenced practice in the District Courts and on the Original and Appellate sides of the High Court of Delhi and also thereafter in the Supreme Court of India. Worked in the chambers of Mr J. B. Dadachanji, Senior Partner of M/s J. B. Dadachanji & Co, Advocates from August 1998 till March 2002. Have been in private practice since then. Appeared in and handled numerous matters in various courts such as in the Supreme Court of India, High Court of Delhi, High Courts of Bombay, Calcutta, Allahabad, Madras, Rajashtan (Jodhpur), Uttarakhand, Bhubaneshwar, Chandigarh, Gujarat, Andhra Pradesh, Appellate Tribunal for Electricity, Competition Commission and Competition Appellate Tribunal, Monopolies and Restrictive Trade Practices Commission, National, State and District Consumer Protection Tribunals, Company Law Board, Board of Industrial and Financial Reconstruction Appellate Authority for -

ACWV Ishares MSCI Global Minimum Volatility Factor ETF Gray

ETF Risk Report: ACWV Buyer beware: Every ETF holds the full risk of its underlying equities Disclosures in the best interest of investors iShares MSCI Global Minimum Volatility Factor ETF Gray Swan Event Risks exist for every equity held by ACWV. Gray swan events include accounting fraud, management failures, failed internal controls, M&A problems, restatements, etc. These risks occur Gray Swan Event Factor for ACWV 1.26% infrequently, but consistently for all equities. Equities account for 94.99% of ACWV’s assets. Most investors ignore these risks until after they are disclosed; whereupon a stock’s price drops precipitously. Just as insurance companies can predict likely costs for a driver’s future car accidents based on the driver’s history, Watchdog Research contacts each ETF asking how they notify investors about we predict the likely cost (price drop) for ACWV following accounting governance risks in equities in their fund. We will publish their response gray swan disclosures within its holdings. The expected when received. price decrease across the ACWV equity portfolio is 1.26%. However, individual equity risks vary signicantly. This report helps investors know their risk exposure. Inception Date: 10/18/2020 Year-to-Date Return: 1.81% The iShares MSCI Global Minimum Volatility Factor ETF tracks the investment results of the MSCI ACWI Minimum Net Assets: $5.18b 1-Year Return: 25.13% Volatility Index, composed of large- and mid-capitalization developed and emerging market equities with lower Price: $98.66 3-Year Return: 7.98% volatility. The Fund uses a passive or indexing approach Net Asset Value (NAV): $98.67 5-Year Return: 8.42% and invests by sampling the Index, holding a collection of securities that approximates the full Index in key Net Expense Ratio: 0.20% Yield: 1.73% investment characteristics (such as market capitalization and industry weightings), fundamentals (such as return As of: 03/31/2021 variability and yield), and liquidity. -

Adani Enterprises Limited Investor Presentation Thinking Big Doing Better July 2018 Legal Disclaimer

Adani Enterprises Limited Investor Presentation Thinking big Doing better July 2018 Legal Disclaimer Certain statements made in this presentation may not be based on AEL assumes no responsibility to publicly amend, modify or revise any historical information or facts and may be “forward-looking forward looking statements, on the basis of any subsequent statements,” including those relating to general business plans and development, information or events, or otherwise. Unless otherwise strategy of Adani Enterprises Limited (“AEL”), its future outlook and stated in this document, the information contained herein is based on growth prospects, and future developments in its businesses and management information and estimates. The information contained competitive and regulatory environment, and statements which herein is subject to change without notice and past performance is contain words or phrases such as ‘will’, ‘expected to’, etc., or similar not indicative of future results. AEL may alter, modify or otherwise expressions or variations of such expressions. Actual results may differ change in any manner the content of this presentation, without materially from these forward-looking statements due to a number of obligation to notify any person of such revision or changes. factors, including future changes or developments in its business, its No person is authorized to give any information or to make competitive environment, its ability to implement its strategies and any representation not contained in and not consistent with this initiatives and respond to technological changes and political, presentation and, if given or made, such information economic, regulatory and social conditions in India. This presentation or representation must not be relied upon as having been authorized does not constitute a prospectus, offering circular or offering by or on behalf of AEL. -

NSE Symbol NSE 6 Month Avg Total Market

Average Market Cap of 200 listed companies on BSE & NSE for the six months ended 30 June 2021 BSE 6 month Avg NSE 6 month Avg Average of BSE and NSE 6 Total Market Cap Total Market Cap month Avg Total Market Cap S.No. Company Name ISIN BSE SYMBOL (Rs. In Crs.) NSE Symbol (Rs. In Crs.) (Rs. in Crs.) 1 Reliance Industries Ltd INE002A01018 RELIANCE 1338017.01 RELIANCE 1355067.509 1346542.26 Tata Consultancy Services 2 Ltd. INE467B01029 TCS 1169783.56 TCS 1173068.166 1171425.86 3 HDFC Bank Ltd. INE040A01034 HDFCBANK 819037.95 HDFCBANK 818713.671 818875.81 4 Infosys Ltd INE009A01021 INFY 579784.19 INFY 579697.3885 579740.79 5 Hindustan Unilever Ltd., INE030A01027 HINDUNILVR 549336.78 HINDUNILVR 549358.908 549347.84 Housing Development 6 Finance Corp.Lt INE001A01036 HDFC 462288.58 HDFC 461373.1089 461830.84 7 ICICI Bank Ltd. INE090A01021 ICICIBANK 416645.51 ICICIBANK 416389.0234 416517.27 8 Kotak Mahindra Bank Ltd. INE237A01028 KOTAKBANK 361640.52 KOTAKBANK 361438.6361 361539.58 9 State Bank Of India, INE062A01020 SBIN 329767.32 SBIN 329789.268 329778.29 10 Bajaj Finance Limited INE296A01024 BAJFINANCE 324996.53 BAJFINANCE 324843.5005 324920.02 11 Bharti Airtel Ltd. INE397D01024 BHARTIARTL 299981.36 BHARTIARTL 299955.7729 299968.57 12 HCL Technologies Ltd INE860A01027 HCLTECH 261400.46 HCLTECH 261392.0109 261396.24 13 Wipro Ltd., INE075A01022 WIPRO 258617.45 WIPRO 261102.3994 259859.92 14 ITC Ltd INE154A01025 ITC 259423.16 ITC 259396.0648 259409.61 15 Asian Paints Ltd. INE021A01026 ASIANPAINT 253487.28 ASIANPAINT 253454.4536 253470.87 16 AXIS Bank Ltd. -

Joindre Capital Services Ltd. Sebi Regn No

JOINDRE CAPITAL SERVICES LTD. SEBI REGN NO. INH000002061 / INZ000174034 DAILY REPORT 28th May 2019 RBI to hold state bonds, term repo auctions; Sun Pharmaceutical, Punjab National Bank, Aurobindo Pharma, NMDC, Pfizer India, SpiceJet, among companies reporting earnings. WHAT TO WATCH: India Shadow Lenders Face a Margin Squeeze From RBI Guidelines Jet Airways Creditors Set Two-Week Deadline: Mint Modi Election Sweep Could Help Rupee Buck Its May Curse: Chart Day After Modi Was Re-Elected, Foreign Funds Buy Indian Bonds Arcelor, Resurgent Said to Mull Joint Bid for Essar Power Plant Bharat Heavy Debt Risk Rises 5 Levels in Bloomberg Model Modi, Resist the Urge to Be India’s Xi Jinping: Andy Mukherjee India’s NTPC Studying Buying 700 MW Coal-Power Project: Official India’s April Crude Oil Output Declines 6.9% Y/y; Gas Dips 0.3% India Regulator Tightens Disclosure Rules for Listed Corp Bonds Anil Ambani to Sell Big FM Radio Unit for at Least $151 Million Billionaires Differ Over ‘One Issue’ at Top Asian Budget Airline o IndiGo CEO Dutta doesn’t elaborate on what the issue is IndiGo Sees Capacity Rising 30% After Profit Jumps Fivefold Gail Investing 550B Rupees in Pipelines, Petrochem, City Gas India Sugar Prices Seen Stable as State Support Seen Continuing Sell the Rally in India Stocks as Headwinds Persist: BofAML India Corp Bond Issuances Seen at INR7 Trillion in FY20: Care Siemens COO Sees No Impact From U.S. Ban on Huawei As of Now Global Funds Buy Net 4.61b of India Equity Derivatives Monday o Global Funds Buy Net INR12.2b India Stocks Monday: NSE o Foreign Investors Buy Net INR3.92B Indian Equities May 24 MEDIA REPORTS: Ficci demands stimulus package to pump-prime slowing economy: PTI India Ratings Expects India GDP Growth At 6.9% In FY19, Lower Than CSO Estimate: PTI RBI May Ease Voting Rules on Debt Workouts: Business Standard GOVERNMENT: 3pm: New Delhi. -

Bank Nifty Chart

WEALTH MANAGEMENT WEEKLY REPORT 5th OCTOBER 2020 10th OCTOBER 2020 WEEKLY 01 WEALTH MANAGEMENT REPORT Weekly Market Update By Rishabh Wealth Management Pvt Ltd (5th October TO 10th October 2020) MAJOR INDICES WEEK INDEX CLOSE PERFORMANCE Sensex 40,509.49 4.7% Nifty 11,914.20 4.4% Dow Jones 28,586.90 3.3% S&P 500 Index 3,477.13 3.8% NASDAQ Composite 11,579.94 4.6% Hang Seng 24,119.13 2.8% The equity markets continued their winning streak and rallied for the seventh straight session on this week. Market participants say the accommodative stance from the Reserve Bank of India (RBI), strong lows from foreign players and positive global markets were the key reasons for the rally. The Sensex rallied 326.82 points, or 0.81%, to close at 40,509.49, while the Nifty was up by 79.60 points, or 0.67%, to end the day at 11,914.20. In the last seven session, Among the 19 sectoral indices complied by BSE, the BSE Bankex index rallied the most with a gain of 2.64%, followed by the BSE Finance index, which up by 1.82%. The stocks that helped the Sensex move up were from the banking sector. ICICI Bank, Axis Bank, SBI and HDFC Bank were the top performer in the Sensex. “This week was marked with strong out-performance by inancials, with accommodative RBI policy measures and further evidence of rebound in economic activity driving optimism on the asset quality front. As Nifty approaches lifetime high, we can expect rotation of performance among sectors with sideways movement in broader indices and a consolidation of strong market performance.” Rishabh Wealth Management Pvt Ltd WEEKLY 02 WEALTH MANAGEMENT REPORT WEEKLY TOP GAINERS AND LOSERS GAINERS LOSSERS % % COMAPNY NAME LTP DAILY COMAPNY NAME LTP DAILY CHANGES CHANGES LARSEN & TOUBRO INFOTECH 2861 7.29% VEDANTA INDIA 118 -4.42% WIPRO 359 7.20% GAIL 84 -2.94% CIPLA 811 4.89% ONGC 68 -2.91% BIOCON 469 3.76% BOSCH 12842 -2.88% ADANI TRANSMISSION 282 3.51% HINDUSTAN ZINC 205 -2.73% BANK NIFTY CHART On Weekly Chart Data of Bank Nifty Suggest That For This Week 22300 Works As Resistance & 22180 As Support. -

Please Find Enclosed Herewith Two Press Releases on the Following Subjects

pt August. 2019 BSE Limited National Stock Exchange of India Limited P J Towers. Exchange plaza. Dalal Street, Bandra-Kurla Complex, Mumbai - 400001 Sandra (E) Mumbai - 400051. Scrip Code: 539254 Scrip Code: ADANITRANS Dear Sir, Sub: Submission of Press Releases on receipt of Letter of Intents for two new Transmission Projects, Please find enclosed herewith two Press Releases on the following subjects: a) Letter of Intent (LOI) for Centre Sector Transmission Project linked to Renewable sector in Rajasthan and b) Letter of Intent (LOI) for Centre Sector Transmission Project in Gujarat linked to Renewable Energy evacuation You are requested to take the same on your record. Thanking you, Yours faithfully, For Adani Transmission Limited ~Jaladhi Shukla Company Secretary Encl: a/a Adani Transmission Ltd Tel +91 79 2555 7555 Adani House Fax +91 79 2555 7177 Shantigram. Near Vaishnodevi Circle. [email protected] Ahmedabad 382 421 www.adani.com Gujarat. India CIN: L40300GJ2013PLC077803 Registered Office: Adani House. Nr Mithakhali Six Roads, Navrangpura, Ahmedabad 380 009, Gujarat. India Adani Transmission receives Letter of Intent (LOI) for Centre Sector Transmission Project linked to Renewable sector in Rajasthan Adani Transmission Ltd (ATL). the largest private sector power transmission company operating in India. has received the LOI from PFC Consulting Limited (A wholly owned subsidiary of PFC Corporation Limited) to build, own. operate and maintain the transmission project in the state of Rajasthan for a period of 35 years. The project "Bikaner - Khetri Transmission Limited" consists of approximately 480 ckt kms of 765kV line along with associated transmission system. This project is primarily being constructed to establish Transmission System associated with Long Term Applications from Rajasthan Solar Energy Zone (SEZ) Part-D. -

Adani Transmission Ltd Consolidated EBIDTA Stands at Rs. 2001 Crore & Consolidated PAT Stands at Rs 358 Crore for the Year Ended FY16

Media Release Adani Transmission Ltd consolidated EBIDTA stands at Rs. 2001 Crore & Consolidated PAT stands at Rs 358 Crore for the year ended FY16 EDITOR’S SYNOPSIS Tariff & Incentive Income remains ste ady at Rs. 494 Crore in Q4FY16 and Q3FY16. The company has achieved the operation al EBIDTA margin of 94.70% on an annual basis & in Q4 96.03% vs Q3 93.61% The consolidated PAT rose by 19.19% to Rs.95.28 cr. in Q4FY16 against Rs. 79.94 Cr in Q3FY16. Systems Availability is above normative level for all the four lines as follows: 765 kV Tiroda to Aurangabad System achieves average availability of 99.84% for the year ended March 2016 against 98% of normative availability 400 kV Tiroda to Warora System achieves average availability of 99.94% for the year ended March 2016 against 98% of normative availability. 400 kV Mundra to Dehgam System achieves average availability of 99.85% for the year ended March 2016 against 98% of normative availability 500 kV HVDC Mundra to Mohindergarh System achieves average availability of 99.57% for the year ended March 2016 against 95% of normative availability. The Company has won intrastate transmission project (Suratgarh to Bikaner) of around 300 Ckt Km under Tariff Based Competitive Bidding Route for 35 years apart from three interstate transmission projects under execution covering around 1400 Ckt Km namely Sipat, Rajnandgaon and Morena. With completion of all ongoing projects, Adani transmission network will increase from 5050 Ckt Km to 6750 Ckt Km & it will maintain its Leadership position as the leading Private Transmission Company in the country. -

Adani Transmission Limited Equity Presentation

Adani Transmission Limited Equity Presentation MAY 2020 CONTENTS Adani Group ATL – Company Profile Investment Strategy, 04-07 09-12 14-23 Value creation and Outlook ADANI: World class infrastructure ATL: Manifesting Adani’s Infrastructure ATL: Key Highlights and Objectives of 14 Excellence in T&D business & utility portfolio 04 09 Capital Management Program ATL: Reduced Dev. and Capex risk with High ADANI: Repeatable, robust & ATL at a Glance 10 Credit Discipline and no Equity Dilution 15 proven model to deliver RoE 05 Contracted Assets at a Glance 11 Case Study: Dev., O&M Effic. and Capital ADANI: Repeatable, robust 16 Management to create shareholder value business model applied Integrated Utility at a Glance 12 consistently to drive value 06 AEML (Integrated Utility): Significant De risking through Capital Management 17 ATL: A platform well-positioned To leverage growth opportunities in ATL: Strategic Objectives 18 T&D business 07 Transmission and Distribution businesses 19-20 growth opportunities ATL: Update on Covid-19 21 ATL: Outlook and Key Focus Areas 22-23 Regulatory Landscape Global Benchmarking Annexure 25-32 And ESG and Investment Case 33-35 37-46 ATL: Emulating Group’s Core Infra ATL: Regulatory Framework 25 Global Benchmarking: Adani Utility Philosophy at every phase 37 Portfolio vs. Global Utility peers 33 ATL: ESG Performance Capital Management Program 27 Demonstrating Global Excellence 38-39 Global Benchmarking: Regulatory ATL: Integrated ESG Framework Framework 34 Credit Rating 40 for enhanced value creation 28 ATL’s Evolution and Portfolio 41-42 ATL: Compelling Investment Case 35 ATL: Key ESG Metrics and Initiatives 29 Sector Outlook: Indian Transmission Sector Poised for Significant Growth 43 ATL: Environment awareness Size of Opportunity: Investment of and Initiatives 30 44 Rs.