Front Cover Page

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Renewables DEBT PRESENTATION

Renewables Adani Green Energy Limited DEBT PRESENTATION September 2020 1 CONTENTS Adani Group AGEL - Portfolio and 04-07 09-21 Growth Strategy AGEL: COVID–19 Update 09 Adani: World class infrastructure AGEL : Leading Renewable Player AGEL- Replicating Adani Group Case Study: 570 MW RG2 Bond & utility portfolio 04 in India… 10 Business Model: O&M Philosophy 14 Issuance 18 Adani Group: Repeatable, robust & AGEL: Large, Geographically AGEL- Replicating Adani Group Case Study: Strategic Sale to proven model of infrastructure Diversified Portfolio 11 Business Model: Capital TOTAL SA - De-risking through development 05 Management Philosophy 15 Capital Management 19 AGEL: Locked-in Growth with Adani Group: Repeatable, robust improving counterparty mix 12 Pillars for Capital Management AGEL- Capital Management: business model applied to drive Plan 16 Journey so far & Next Steps 20 AGEL- Replicating Adani Group value 06 Business Model: Development Case Study: 930 MW RG1 Bond Global Benchmarking: Adani AGEL: Robust Business Model Philosophy 13 Issuance 17 Energy Portfolio vs. Global peers 21 with Rapid Growth & Predictable Returns.. 07 AGEL - ESG 23-27 Conclusion 28 Appendix 31-45 2 AGEL ESG Philosophy 23 AGEL: ESG performance for FY20 24 AGEL Project Details, Financials, Environment awareness and Strategic Priorities 31-35 initiatives 25 Attractive Industry Outlook, Technology intervention enabling AGEL: A Compelling Investment Case 28 Regulatory Landscape 37-39 effective management of resource 26 RG1 & RG2 Financial & Operational AGEL’s Governance: -

Media Release Adani Transmission Ltd Consolidated EBIDTA Stands at Rs

Media Release Adani Transmission Ltd consolidated EBIDTA stands at Rs. 1504 Crore & Consolidated PAT stands at Rs 262 Crore for Nine Months ended FY16 Editor’s Synopsis • Tariff & Incentive Income remains Steady at Rs. 494 Crore in Q3FY16 vs Q2FY16 • Systems Availability is above normative level for all the four lines as follows: o 765 kV Tiroda to Aurangabad System achieves average availability of 99.84% for Nine months ended Dec. FY16 against 98% of normative availability o 400 kV Tiroda to Warora System achieves average availability of 99.96% for Nine months ended Dec. FY16 against 98% of normative availability. o 400 kV Mundra to Dehgam System achieves average availability of 99.91% for Nine months ended Dec. FY16 against 98% of normative availability o 500 kV HVDC Mundra to Mohindergarh System achieves average availability of 99.52% for Nine months ended Dec. FY16 against 95% of normative availability. • The Company has won three Interstate transmission projects of 1384 Ckt Km under Tariff Based Competitive Bidding Route on BOOM basis for 35 years. The company is confident to commission these projects well ahead of the schedule. With completion of these new projects, Adani transmission network will increase from 5051 Ckt Km to 6435 Ckt Km & Adani Transmission Limited continues to be largest Private Transmission company in the country. Ahmedabad, February 02, 2016: Adani Transmission Ltd, part of the Adani Group, today announced its results for the third quarter ended December 31, 2015. Financial Highlights: The Total Income for Q3FY16 stood at Rs 529 crore. EBIDTA stood at Rs 477 crore and consolidated PAT is Rs 80 crore. -

Front Cover Page

SCHEME INFORMATION DOCUMENT Motilal Oswal Nifty Smallcap 250 Index Fund (MOFSMALLCAP) (An open ended scheme replicating / tracking Nifty Smallcap 250 Index) This product is suitable for investors who are seeking* Return that corresponds to the performance of Nifty Smallcap 250 Index subject to tracking error Equity and equity related securities covered by Nifty Smallcap 250 Index Long term capital growth *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. Scheme re- Continuous Offer of Units at NAV based prices Name of Mutual Fund Motilal Oswal Mutual Fund Name of Asset Management Motilal Oswal Asset Management Company Limited (MOAMC) Company (AMC) Name of Trustee Company Motilal Oswal Trustee Company Limited Address Registered Office: 10th Floor, Motilal Oswal Tower, Rahimtullah Sayani Road, Opp. Parel ST Depot, Prabhadevi, Mumbai-400025 Website www.motilaloswalmf.com The particulars of the Scheme have been prepared in accordance with the Securities and Exchange Board of India (Mutual Funds) Regulations 1996, (herein after referred to as SEBI (MF) Regulations) as amended till date, and filed with SEBI, along with a Due Diligence Certificate from the AMC. The units being offered for public subscription have not been approved or recommended by SEBI nor has SEBI certified the accuracy or adequacy of the Scheme Information Document (SID). The SID sets forth concisely the information about the Scheme that a prospective investor ought to know before investing. Before investing, investors should also ascertain about any further changes to this SID after the date of this Document from the Mutual Fund / Investor Service Centres / Website / Distributors or Brokers. -

KPMG FICCI 2013, 2014 and 2015 – TV 16

#shootingforthestars FICCI-KPMG Indian Media and Entertainment Industry Report 2015 kpmg.com/in ficci-frames.com We would like to thank all those who have contributed and shared their valuable domain insights in helping us put this report together. Images Courtesy: 9X Media Pvt.Ltd. Phoebus Media Accel Animation Studios Prime Focus Ltd. Adlabs Imagica Redchillies VFX Anibrain Reliance Mediaworks Ltd. Baweja Movies Shemaroo Bhasinsoft Shobiz Experential Communications Pvt.Ltd. Disney India Showcraft Productions DQ Limited Star India Pvt. Ltd. Eros International Plc. Teamwork-Arts Fox Star Studios Technicolour India Graphiti Multimedia Pvt.Ltd. Turner International India Ltd. Greengold Animation Pvt.Ltd UTV Motion Pictures KidZania Viacom 18 Media Pvt.Ltd. Madmax Wonderla Holidays Maya Digital Studios Yash Raj Films Multiscreen Media Pvt.Ltd. Zee Entertainmnet Enterprises Ltd. National Film Development Corporation of India with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. entity. (“KPMG International”), a Swiss with KPMG International Cooperative © 2015 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated and a member firm of the KPMG network of independent member firms Partnership KPMG, an Indian Registered © 2015 #shootingforthestars FICCI-KPMG Indian Media and Entertainment Industry Report 2015 with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. entity. (“KPMG International”), a Swiss with KPMG International Cooperative © 2015 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated and a member firm of the KPMG network of independent member firms Partnership KPMG, an Indian Registered © 2015 #shootingforthestars: FICCI-KPMG Indian Media and Entertainment Industry Report 2015 Foreword Making India the global entertainment superpower 2014 has been a turning point for the media and entertainment industry in India in many ways. -

Details of Offmarket/Interdepository Debit/Credit Transactions for 50000 Or More Equity Shares in ISIN for the Period 01-Jun-2020 to 15-Jun-2020 Sr

Details of OffMarket/Interdepository debit/credit transactions for 50000 or more equity shares in ISIN for the period 01-Jun-2020 to 15-Jun-2020 Sr. No. Isin Isin_Short_Name Tran_Qty Tran_date 1 IN9002A01024 RELIANCE IND-PP EQ 266492 15-06-2020 2 IN9155A01020 TATA MOTOR-A-DVR EQ2 81364 06-06-2020 3 IN9155A01020 TATA MOTOR-A-DVR EQ2 178009 01-06-2020 4 IN9155A01020 TATA MOTOR-A-DVR EQ2 211342 15-06-2020 5 IN9155A01020 TATA MOTOR-A-DVR EQ2 239201 12-06-2020 6 IN9155A01020 TATA MOTOR-A-DVR EQ2 305800 08-06-2020 7 IN9155A01020 TATA MOTOR-A-DVR EQ2 348259 04-06-2020 8 IN9155A01020 TATA MOTOR-A-DVR EQ2 410219 05-06-2020 9 IN9155A01020 TATA MOTOR-A-DVR EQ2 520355 09-06-2020 10 IN9155A01020 TATA MOTOR-A-DVR EQ2 591155 11-06-2020 11 IN9155A01020 TATA MOTOR-A-DVR EQ2 716341 03-06-2020 12 IN9155A01020 TATA MOTOR-A-DVR EQ2 835762 13-06-2020 13 IN9155A01020 TATA MOTOR-A-DVR EQ2 1370395 10-06-2020 14 IN9155A01020 TATA MOTOR-A-DVR EQ2 2404661 02-06-2020 15 IN9175A01010 JAIN IRRIGATI EQ DVR 212299 09-06-2020 16 IN9175A01010 JAIN IRRIGATI EQ DVR 218576 11-06-2020 17 IN9274G01034 INDIABULLS VEN-PP EQ 147332 09-06-2020 18 IN9623B01058 FUTURE - EQ - DVR 2085510 09-06-2020 19 IN9623B01058 FUTURE - EQ - DVR 2085922 11-06-2020 20 INE0AEJ01013 BIRLA TYRES-EQ 56403 10-06-2020 21 INE0AEJ01013 BIRLA TYRES-EQ 68709 06-06-2020 22 INE0AEJ01013 BIRLA TYRES-EQ 107614 04-06-2020 23 INE0AEJ01013 BIRLA TYRES-EQ 115222 11-06-2020 24 INE0AEJ01013 BIRLA TYRES-EQ 2473057 15-06-2020 25 INE0AU701018 ICL ORGANIC DAIRY-EQ 78000 04-06-2020 26 INE00CX01017 MAHIP INDUSTRIES-EQ 2200000 -

List of Nodal Officer

List of Nodal Officer Designa S.No tion of Phone (With Company Name EMAIL_ID_COMPANY FIRST_NAME MIDDLE_NAME LAST_NAME Line I Line II CITY PIN Code EMAIL_ID . Nodal STD/ISD) Officer 1 VIPUL LIMITED [email protected] PUNIT BERIWALA DIRT Vipul TechSquare, Golf Course Road, Sector-43, Gurgaon 122009 01244065500 [email protected] 2 ORIENT PAPER AND INDUSTRIES LTD. [email protected] RAM PRASAD DUTTA CSEC BIRLA BUILDING, 9TH FLOOR, 9/1, R. N. MUKHERJEE ROAD KOLKATA 700001 03340823700 [email protected] COAL INDIA LIMITED, Coal Bhawan, AF-III, 3rd Floor CORE-2,Action Area-1A, 3 COAL INDIA LTD GOVT OF INDIA UNDERTAKING [email protected] MAHADEVAN VISWANATHAN CSEC Rajarhat, Kolkata 700156 03323246526 [email protected] PREMISES NO-04-MAR New Town, MULTI COMMODITY EXCHANGE OF INDIA Exchange Square, Suren Road, 4 [email protected] AJAY PURI CSEC Multi Commodity Exchange of India Limited Mumbai 400093 0226718888 [email protected] LIMITED Chakala, Andheri (East), 5 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 6 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 7 NECTAR LIFE SCIENCES LIMITED [email protected] SUKRITI SAINI CSEC NECTAR LIFESCIENCES LIMITED SCO 38-39, SECTOR 9-D CHANDIGARH 160009 01723047759 [email protected] 8 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 9 SMIFS CAPITAL MARKETS LTD. -

Inner 27 Quant Fund Low

Tata Quant Fund (An Open Ended Equity Scheme following quant based investing theme) As on 31st May 2020 PORTFOLIO INVESTMENT STYLE Primarily focuses on investing in equity and equity related Company name No. of Market Value % of Company name No. of Market Value % of instruments following quant based investing theme. Shares Rs. Lakhs Assets Shares Rs. Lakhs Assets INVESTMENT OBJECTIVE Equity & Equity Related Total 9103.72 94.70 Pharmaceuticals The investment objective of the scheme is to generate Auto Cipla Ltd. 52242 338.61 3.52 medium to long-term capital appreciation by investing in Hero Motocorp Ltd. 12845 303.25 3.15 Torrent Pharmaceuticals Ltd. 13914 328.73 3.42 equity and equity related instruments selected based on a Auto Ancillaries Ajanta Pharma Ltd. 19417 295.91 3.08 quantitative model (Quant Model). Motherson Sumi Systems Ltd. 382196 364.23 3.79 Syngene International Ltd. 82231 293.65 3.05 However, there is no assurance or guarantee that the Amara Raja Batteries Ltd. 53772 330.48 3.44 Cadila Healthcare Ltd. 82364 283.83 2.95 investment objective of the Scheme will be achieved. The scheme does not assure or guarantee any returns. Balkrishna Industries Ltd. 30195 325.77 3.39 Divi Laboratories Ltd. 11650 278.45 2.90 MRF Ltd. 429 253.60 2.64 Sanofi India Ltd. 3579 276.75 2.88 DATE OF ALLOTMENT Consumer Durables Abbott India Ltd. 1489 249.01 2.59 January 22, 2020 Whirlpool Of India Ltd. 12930 251.44 2.62 Pfizer Ltd. 6095 246.15 2.56 FUND MANAGER Consumer Non Durables Alkem Laboratories Ltd. -

Exclusion List

Exclusion list ROBECO INSTITUTIONAL ASSET MANAGEMENT 1 Sustainability Inside Excluded companies: 61 Rimbunan Sawit Bhd 15 Bots Inc 62 Riverview Rubber Estates BHD 16 Bright Packaging Industry Bhd Controversial behavior 63 Salim Ivomas Pratama Tbk PT 17 Brilliant Circle Holdings International Ltd 1 G4S International Finance PLC 64 Sarawak Oil Palms Bhd 18 British American Tobacco Bangladesh Co Ltd 2 G4S PLC 65 Sarawak Plantation Bhd 19 British American Tobacco Chile Operaciones SA 3 Korea Electric Power Corp 66 Scope Industries Bhd 20 British American Tobacco Holdings The Netherlands BV 4 Oil & Natural Gas Corp Ltd1 67 Sin Heng Chan Malaya Bhd 21 British American Tobacco Kenya PLC 5 ONGC Nile Ganga BV 68 Sinar Mas Agro Resources & Technology Tbk PT 22 British American Tobacco Malaysia Bhd 6 ONGC Videsh Ltd 69 Socfin 23 British American Tobacco PLC 7 Vale Indonesia Tbk PT 70 Socfinasia SA 24 British American Tobacco Uganda Ltd 8 Vale SA2 71 Societe Camerounaise de Palmeraies 25 British American Tobacco Zambia PLC 72 Societe des Caoutchoucs de Grand-Bereby 26 British American Tobacco Zimbabwe Holdings Ltd Palm oil 73 SSMS Plantation Holdings Pte Ltd 27 Bulgartabac Holding AD 1 A Brown Co Inc 74 Sterling Plantations Ltd 28 Carreras Ltd/Jamaica 2 Agalawatte Plantations PLC 75 Subur Tiasa Holdings Bhd 29 Casey’s General Stores Inc 3 Anglo-Eastern Plantations PLC 76 Sungei Bagan Rubber Co Malaya Bhd 30 Cat Loi JSC 4 Astra Agro Lestari Tbk PT 77 Sunshine Holdings PLC 31 Ceylon Tobacco Co PLC 5 Astral Asia Bhd 78 Ta Ann Holdings Bhd 32 Champion -

Sharekhan Special August 31, 2021

Sharekhan Special August 31, 2021 Index Q1FY2022 Results Review Automobiles • Capital Goods • Consumer Discretionary • Consumer Goods • Infrastructure/Cement/Logistics/Building Material • IT • Oil & Gas • Pharmaceuticals • Agri Inputs and Speciality Chemical • Miscellaneous • Visit us at www.sharekhan.com For Private Circulation only Q1FY2022 Results Review In-line quarter, healthy outlook Results Review Results Summary: After ending FY2021 on a strong note, Q1FY2022 earnings of broader indices showed a promising start (Nifty/ Sensex companies’ PAT rose 100%/66% y-o-y) in the new fiscal with strong growth momentum on low base. Management commentaries on earnings outlook remained positive, on improving economic activity post second COVID-19 wave and anticipation of strong demand revival. Demand recovery and ramp-up of vaccinations look encouraging. We expect economic activity to increase in the upcoming festive season. Nifty trades at 23x and 20x EPS based on FY2022E/FY2023E EPS, at a premium to mean average. Valuation gap between large and mid-caps has shrunk, we advise investors to focus on stocks with strong earnings growth potential with reasonable valuation. High-conviction investment ideas: o Large-caps: Infosys, ICICI Bank, M&M, L&T, UltraTech, SBI, HDFC Ltd, Godrej Consumer Products, Divis Labs and Titan. o Mid-caps: NAM India, BEL, Gland Pharma, Dalmia Bharat, Laurus Labs, Max Financial Services, LTI. o Small-caps: TCI Express, Kirloskar Oil, Suprajit Engineering, Repco Home Finance, PNC Infratech, Mahindra Lifespaces, Birlasoft. After ending FY2021 on a strong note, Q1FY2022 corporate earnings of broader indices showed a promising start with continued strong growth momentum on the low base of Q1FY2021, though it was along the expected lines. -

Curriculum Vitae Name Buddy A

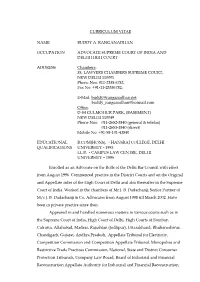

CURRICULUM VITAE NAME BUDDY A. RANGANADHAN OCCUPATION ADVOCATE SUPREME COURT OF INDIA AND DELHI HIGH COURT ADDRESS Chambers: 38, LAWYERS CHAMBERS SUPREME COURT, NEW DELHI 110001 Phone Nos: 011-2338 6782, Fax No: +91-11-23386782; E-Mail: [email protected] [email protected] Office: D-84 GULMOHUR PARK, (BASEMENT) NEW DELHI 110049 Phone Nos: 011-2652-3840 (general & telefax) 011-2653-3840 (direct) Mobile No: +91-98-101-43840 EDUCATIONAL B.COM(HONS), - HANSRAJ COLLEGE, DELHI QUALIFICATIONS UNIVERSITY - 1993 LL.B. - CAMPUS LAW CENTRE, DELHI UNIVERSITY – 1996 Enrolled as an Advocate on the Rolls of the Delhi Bar Council with effect from August 1996. Commenced practice in the District Courts and on the Original and Appellate sides of the High Court of Delhi and also thereafter in the Supreme Court of India. Worked in the chambers of Mr J. B. Dadachanji, Senior Partner of M/s J. B. Dadachanji & Co, Advocates from August 1998 till March 2002. Have been in private practice since then. Appeared in and handled numerous matters in various courts such as in the Supreme Court of India, High Court of Delhi, High Courts of Bombay, Calcutta, Allahabad, Madras, Rajashtan (Jodhpur), Uttarakhand, Bhubaneshwar, Chandigarh, Gujarat, Andhra Pradesh, Appellate Tribunal for Electricity, Competition Commission and Competition Appellate Tribunal, Monopolies and Restrictive Trade Practices Commission, National, State and District Consumer Protection Tribunals, Company Law Board, Board of Industrial and Financial Reconstruction Appellate Authority for -

Indian Institute of Management (IIM) Lucknow

Indian Institute Of Management (IIM) Lucknow MARKETING PROJECT ON ““EMERGENCE OF PVR IN INDIA”” Syndicate -3 (DGMP - 13) XXXX XXXX XXXX 1 Introduction 1. 1. In the literal sense, aa multiplex can be defined as a ““single complex with multiple screens.”” They are built in specifically-designed buildings and as per its capacity, it can accommodate numerous people. Origins around the world 2. 2. In December 1947, Nat Taylor, and operator of a theatre called ““Elgin Theatre”” inin Ottawa, Canada, opened a smaller second theater named "Little Elgin", right next door to his first theater. However, it was only in 1957 that he started to run different movies in each theater. Later in 1962, he opened dual-screen theaters in Montreal and then in 1964, in Ontario. In Apr 79, he opened an 18-screen multiplex under one roof in Toronto's Eaton Centre. Later in Dec 96, AMC Ontario Mills 30, opened a 30-screen theater in California that became the theater with the largest number of screens in the world. Today, Kinepolis Madrid in Spain is the world's largest cinema complex with 25 screens and a total seating capacity of 9,200. Early Years of Multiplex Cinema in India 3. 3. Movie-exhibition till the mid-90s was dominated predominantly by the single screen halls. Also, the surge of customers to watch movies was mostly during holidays, on weekends or around festivals. In India, the multiplex culture started to bloom in the mid-90s. It enticed the customers with not only the prospect of upgrading the concept of watching movies but transformed it into a whole new experience. -

ACWV Ishares MSCI Global Minimum Volatility Factor ETF Gray

ETF Risk Report: ACWV Buyer beware: Every ETF holds the full risk of its underlying equities Disclosures in the best interest of investors iShares MSCI Global Minimum Volatility Factor ETF Gray Swan Event Risks exist for every equity held by ACWV. Gray swan events include accounting fraud, management failures, failed internal controls, M&A problems, restatements, etc. These risks occur Gray Swan Event Factor for ACWV 1.26% infrequently, but consistently for all equities. Equities account for 94.99% of ACWV’s assets. Most investors ignore these risks until after they are disclosed; whereupon a stock’s price drops precipitously. Just as insurance companies can predict likely costs for a driver’s future car accidents based on the driver’s history, Watchdog Research contacts each ETF asking how they notify investors about we predict the likely cost (price drop) for ACWV following accounting governance risks in equities in their fund. We will publish their response gray swan disclosures within its holdings. The expected when received. price decrease across the ACWV equity portfolio is 1.26%. However, individual equity risks vary signicantly. This report helps investors know their risk exposure. Inception Date: 10/18/2020 Year-to-Date Return: 1.81% The iShares MSCI Global Minimum Volatility Factor ETF tracks the investment results of the MSCI ACWI Minimum Net Assets: $5.18b 1-Year Return: 25.13% Volatility Index, composed of large- and mid-capitalization developed and emerging market equities with lower Price: $98.66 3-Year Return: 7.98% volatility. The Fund uses a passive or indexing approach Net Asset Value (NAV): $98.67 5-Year Return: 8.42% and invests by sampling the Index, holding a collection of securities that approximates the full Index in key Net Expense Ratio: 0.20% Yield: 1.73% investment characteristics (such as market capitalization and industry weightings), fundamentals (such as return As of: 03/31/2021 variability and yield), and liquidity.