Inner 27 Quant Fund Low

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Details of Offmarket/Interdepository Debit/Credit Transactions for 50000 Or More Equity Shares in ISIN for the Period 01-Jun-2020 to 15-Jun-2020 Sr

Details of OffMarket/Interdepository debit/credit transactions for 50000 or more equity shares in ISIN for the period 01-Jun-2020 to 15-Jun-2020 Sr. No. Isin Isin_Short_Name Tran_Qty Tran_date 1 IN9002A01024 RELIANCE IND-PP EQ 266492 15-06-2020 2 IN9155A01020 TATA MOTOR-A-DVR EQ2 81364 06-06-2020 3 IN9155A01020 TATA MOTOR-A-DVR EQ2 178009 01-06-2020 4 IN9155A01020 TATA MOTOR-A-DVR EQ2 211342 15-06-2020 5 IN9155A01020 TATA MOTOR-A-DVR EQ2 239201 12-06-2020 6 IN9155A01020 TATA MOTOR-A-DVR EQ2 305800 08-06-2020 7 IN9155A01020 TATA MOTOR-A-DVR EQ2 348259 04-06-2020 8 IN9155A01020 TATA MOTOR-A-DVR EQ2 410219 05-06-2020 9 IN9155A01020 TATA MOTOR-A-DVR EQ2 520355 09-06-2020 10 IN9155A01020 TATA MOTOR-A-DVR EQ2 591155 11-06-2020 11 IN9155A01020 TATA MOTOR-A-DVR EQ2 716341 03-06-2020 12 IN9155A01020 TATA MOTOR-A-DVR EQ2 835762 13-06-2020 13 IN9155A01020 TATA MOTOR-A-DVR EQ2 1370395 10-06-2020 14 IN9155A01020 TATA MOTOR-A-DVR EQ2 2404661 02-06-2020 15 IN9175A01010 JAIN IRRIGATI EQ DVR 212299 09-06-2020 16 IN9175A01010 JAIN IRRIGATI EQ DVR 218576 11-06-2020 17 IN9274G01034 INDIABULLS VEN-PP EQ 147332 09-06-2020 18 IN9623B01058 FUTURE - EQ - DVR 2085510 09-06-2020 19 IN9623B01058 FUTURE - EQ - DVR 2085922 11-06-2020 20 INE0AEJ01013 BIRLA TYRES-EQ 56403 10-06-2020 21 INE0AEJ01013 BIRLA TYRES-EQ 68709 06-06-2020 22 INE0AEJ01013 BIRLA TYRES-EQ 107614 04-06-2020 23 INE0AEJ01013 BIRLA TYRES-EQ 115222 11-06-2020 24 INE0AEJ01013 BIRLA TYRES-EQ 2473057 15-06-2020 25 INE0AU701018 ICL ORGANIC DAIRY-EQ 78000 04-06-2020 26 INE00CX01017 MAHIP INDUSTRIES-EQ 2200000 -

List of Nodal Officer

List of Nodal Officer Designa S.No tion of Phone (With Company Name EMAIL_ID_COMPANY FIRST_NAME MIDDLE_NAME LAST_NAME Line I Line II CITY PIN Code EMAIL_ID . Nodal STD/ISD) Officer 1 VIPUL LIMITED [email protected] PUNIT BERIWALA DIRT Vipul TechSquare, Golf Course Road, Sector-43, Gurgaon 122009 01244065500 [email protected] 2 ORIENT PAPER AND INDUSTRIES LTD. [email protected] RAM PRASAD DUTTA CSEC BIRLA BUILDING, 9TH FLOOR, 9/1, R. N. MUKHERJEE ROAD KOLKATA 700001 03340823700 [email protected] COAL INDIA LIMITED, Coal Bhawan, AF-III, 3rd Floor CORE-2,Action Area-1A, 3 COAL INDIA LTD GOVT OF INDIA UNDERTAKING [email protected] MAHADEVAN VISWANATHAN CSEC Rajarhat, Kolkata 700156 03323246526 [email protected] PREMISES NO-04-MAR New Town, MULTI COMMODITY EXCHANGE OF INDIA Exchange Square, Suren Road, 4 [email protected] AJAY PURI CSEC Multi Commodity Exchange of India Limited Mumbai 400093 0226718888 [email protected] LIMITED Chakala, Andheri (East), 5 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 6 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 7 NECTAR LIFE SCIENCES LIMITED [email protected] SUKRITI SAINI CSEC NECTAR LIFESCIENCES LIMITED SCO 38-39, SECTOR 9-D CHANDIGARH 160009 01723047759 [email protected] 8 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 9 SMIFS CAPITAL MARKETS LTD. -

Sharekhan Special August 31, 2021

Sharekhan Special August 31, 2021 Index Q1FY2022 Results Review Automobiles • Capital Goods • Consumer Discretionary • Consumer Goods • Infrastructure/Cement/Logistics/Building Material • IT • Oil & Gas • Pharmaceuticals • Agri Inputs and Speciality Chemical • Miscellaneous • Visit us at www.sharekhan.com For Private Circulation only Q1FY2022 Results Review In-line quarter, healthy outlook Results Review Results Summary: After ending FY2021 on a strong note, Q1FY2022 earnings of broader indices showed a promising start (Nifty/ Sensex companies’ PAT rose 100%/66% y-o-y) in the new fiscal with strong growth momentum on low base. Management commentaries on earnings outlook remained positive, on improving economic activity post second COVID-19 wave and anticipation of strong demand revival. Demand recovery and ramp-up of vaccinations look encouraging. We expect economic activity to increase in the upcoming festive season. Nifty trades at 23x and 20x EPS based on FY2022E/FY2023E EPS, at a premium to mean average. Valuation gap between large and mid-caps has shrunk, we advise investors to focus on stocks with strong earnings growth potential with reasonable valuation. High-conviction investment ideas: o Large-caps: Infosys, ICICI Bank, M&M, L&T, UltraTech, SBI, HDFC Ltd, Godrej Consumer Products, Divis Labs and Titan. o Mid-caps: NAM India, BEL, Gland Pharma, Dalmia Bharat, Laurus Labs, Max Financial Services, LTI. o Small-caps: TCI Express, Kirloskar Oil, Suprajit Engineering, Repco Home Finance, PNC Infratech, Mahindra Lifespaces, Birlasoft. After ending FY2021 on a strong note, Q1FY2022 corporate earnings of broader indices showed a promising start with continued strong growth momentum on the low base of Q1FY2021, though it was along the expected lines. -

Press Release by BP and Reliance Industries Limited

Castrol India Limited Tel: (022) 6698 4100 Technopolis Knowledge Par1<, Fax: (022) 6698 4101 Mahakali Caves Road, www.castrol.co.in ~ Castrol / Chakala, Andheri (East), Mumbai - 400 093. CIN L23200MH1979PLC021359 6 August 2019 The Secretary National Stock Exchange of India Ltd The BSE Limited Exchange Plaza Phiroze Jeejeebhoy Towers Bandra Kurla Complex Dalal Street Plot No. C/1, 'G' Block Mumbai 400 001 Bandra {East) Mumbai 400051. Scrip Code: 500870 Symbol : CASTROLIND Dear Sirs, Sub: Press Release by BP and Reliance Industries Limited BP and Reliance Industries Limited today announced that they have agreed to form a new joint venture that will include a retail service station network and aviation fuels business across India. Lubricants manufactured by Castrol India Limited will also be available across the venture's network. Attached is a press release from BP and Reliance Industries Limited to this effect. This is for your information and dissemination. Yours faithfully, For Castrol India Limited Chandana Dhar Company Secretary and Compliance Officer Encl. As above Customer Service Toll Free No.: 1800 222 100 / 1800 209 8100 0 Reliance Industries Limited press release 6 August 2019 Reliance and BP to create major world-class fuels partnership for India’s fast-growing market • Expanding partnership into fuel and convenience retailing and aviation fuels in India • Rapidly expanding the existing nationwide network of fuel retailing outlets to 5,500 • Delivering high-quality, modern service for India’s consumers, with differentiated sites, fuels, and convenience offers. BP and Reliance Industries Limited (RIL) today announced that they have agreed to form a new joint venture that will include a retail service station network and aviation fuels business across India. -

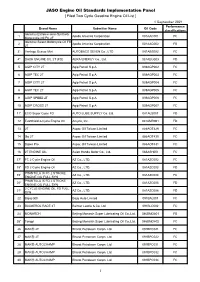

JASO Engine Oil Standards Implementation Panel

JASO Engine Oil Standards Implementation Panel [ Filed Two Cycle Gasoline Engine Oil List ] 1 September 2021 Performance Brand Name Submitter Name Oil Code classifications Idemitsu Extreme semi-Synthetic 1 Apollo America Corporation 001AAC001 FC Motorcycle Oil FC 2T Idemitsu Select Motorcycle Oil FB 2 Apollo America Corporation 001AAC002 FB 2T 3* Vantage Beaver Mini AUTOBACS SEVEN Co., LTD 081ABS002 FC 4* DASH ENGINE OIL 2T (FD) AERA ENERGY Co., Ltd. 081AEG003 FD 5 AGIP CITY 2T Agip Petroil S.p.A. 039AGP002 FC 6 AGIP TEC 2T Agip Petroil S.p.A. 039AGP003 FC 7 AGIP CITY 2T Agip Petroil S.p.A. 039AGP004 FC 8 AGIP TEC 2T Agip Petroil S.p.A. 039AGP005 FC 9 AGIP SPEED 2T Agip Petroil S.p.A. 039AGP006 FC 10 AGIP CROSS 2T Agip Petroil S.p.A. 039AGP007 FC 11* ECO Super Cycle FD AUTO LUBE SUPPLY Co. Ltd. 081ALS001 FD 12 EvoShield 2-Cycle Engine Oil Amyris, Inc. 001AMR001 FD 13 2T Aspac Oil Taiwan Limited 886AOT429 FC 14 Go 2T Aspac Oil Taiwan Limited 886AOT430 FC 15 Super Pro Aspac Oil Taiwan Limited 886AOT431 FC 16 2T ENGINE OIL Asian Honda Motor Co., Ltd. 066ASH001 FC 17* FC 2 Cycle Engine Oil AZ Co., LTD. 081AZC002 FC 18* FD 2 Cycle Engine Oil AZ Co., LTD. 081AZC003 FD PHANTULA IX FC 2 STROKE 19* AZ Co., LTD. 081AZC004 FC ENGINE OIL FULL SYN PHANTULA IX FD 2 STROKE 20* AZ Co., LTD. 081AZC005 FD ENGINE OIL FULL SYN 2 CYCLE ENGINE OIL FD FULL 21* AZ Co., LTD. 081AZC006 FD SYN 22 Bajaj GDI Bajaj Auto Limited 091BAL001 FC 23 BALMEROL RACE 2T Balmer Lawrie & Co. -

Annual Report 2015

Castrol India Limited Annual Report 2015 UNLEASHING THE POWER OF CORPORATE INFORMATION Board of Directors Bankers Mr. S. M. Datta Deutsche Bank Chairman HDFC Bank Ltd. Mr. R. Gopalakrishnan Independent Director The Hong Kong & Shanghai Banking Corporation Ltd. Mr. Uday Khanna State Bank of India Independent Director Citibank N.A. Mr. Ralph Hewins DBS Bank Ltd. Nominee Director J P Morgan Chase Bank N.A. Mr. Peter Weidner Nominee Director Registered Office Mr. Sashi Mukundan Nominee Director Technopolis Knowledge Park Mahakali Caves Road, Mr. Omer Dormen Managing Director Chakala, Andheri (East), Mumbai 400 093, INDIA. Ms. Rashmi Joshi Director - Finance (Chief Financial Officer) CIN: L23200MH1979PLC021359 Mr. Jayanta Chatterjee Telephone: 022-6698 4100 Director - Supply Chain Website: www.castrol.co.in Mr. Sandeep Deshmukh Company Secretary Registrar & Share Transfer Agents TSR Darashaw Limited Auditors Unit: Castrol India Limited 6-10, Haji Moosa Patrawala Industrial Estate, M/s. SRBC & Co. LLP 20, Dr. E. Moses Road, Mahalaxmi, Chartered Accountants Mumbai 400 011, INDIA. Telephone: 022-6656 8484 Website: [email protected] CONTENTS Financial Highlights 10 Board’s Report 13 Management Discussion & Analysis Report 44 Corporate Governance Report 55 Business Responsibility Report 68 Auditors’ Report 78 Balance Sheet 82 Statement of Profit and Loss83 Cash Flow Statement 84 Notes to Financial Statements 86 01 BOARD OF DIRECTORS Seated (l to r): Peter Weidner, Nominee Director; S. M. Datta, Chairman; R. Gopalakrishnan, Independent Director; -

Mf Movers & Shakers

MF MOVERS & SHAKERS MARCH 2021 DART Research Tel: +91 22 40969700 E-mail: [email protected] April 12, 2021 April 12, 2021 2 Top Five Buys & Sells Top Ten MF's March 2021 3 Top Five Buys & Sells of Top MFs for the month of March 2021 No of Shares No of Shares Highest Increase in Exposure Names Bought in Highest Decrease in Exposure (by nos of shares) Bought in (by nos of shares) March 2021 March 2021 Bharat Petroleum Corporation 4,547,448 The Indian Hotels 9,826,101 Steel Authority Of India 1,995,000 Vedanta 2,988,456 Axis MF Torrent Power 1,889,278 Tata Motors 2,574,406 Suryoday Small Finance Bank 1,887,039 EPL 2,572,954 Mahindra & Mahindra Financial Services 1,644,663 Wipro 2,226,978 Bank Of Baroda 36,590,405 Vodafone Idea 21,490,000 Steel Authority Of India 9,632,297 Vedanta 7,799,200 Birla SL MF National Aluminium 7,524,001 GMR Infrastructure 4,837,500 IDFC First Bank 3,122,875 Ashok Leyland 4,252,923 State Bank Of India 2,870,884 Bharti Airtel 3,662,791 Motherson Sumi Systems 6,769,756 Vodafone Idea 8,750,000 GAIL 3,502,259 Oil & Natural Gas Corporation 8,463,632 DSP BR MF Welspun Corp 2,559,989 Vedanta 7,199,288 ITC 2,520,668 Hindalco Industries 2,468,290 Prism Johnson 2,389,002 ICICI Prudential Life Insurance 2,343,372 Max Healthcare Institute 21,422,593 Vodafone Idea 18,830,000 Indian Railway Finance Corporation 13,939,480 Siti Networks 17,967,767 HDFC MF Oil & Natural Gas Corporation 7,327,497 Power Grid Corporation Of India 13,081,255 Varroc Engineering 6,735,218 State Bank Of India 12,478,973 Bharti Airtel 5,846,094 -

List of Exempted Establishment

LIST OF P.F. EXEMPTED ESTABLISHMENTS S.No Est. Id Est. Name 1 MHBAN0000024000 EMPIRE INDUSTRIES 2 MPJBP0001251000 UNIVERSAL CABLES LTD. 3 SRBRH0014401000 GUJARAT NARMADA VALLEY FERTILIZERS & CHEMICALS LIMITED 4 DLCPM0002805000 ALL INDIA MANAGEMENT ASSOCIATION 5 PYPNY0000964000 BHARAT ELECTRONICS LIMITED 6 SRSRT000523800B GUJARAT STATE FERTILISERS - CHEMICAL LTD 7 RJRAJ0005060000 BIRLA INSTITUTE OF TECHNOLOGY AND SCIENCE PILANI DISTT JHUNJHUNU 8 RJRAJ0001475000 RAJASTHAN STATE IND. DEV. - INVEST. CORPORATION 9 DLCPM0004398000 NESTLE INDIA LTD. 10 PYPNY0003435000 I P R I T I 11 PYKRP002341900X VOLVO INDIA PVT LTD 12 WBCAL002689100E WELLAND GOULDSMITH SCHOOL 13 PYKRP000986600X COATS INDIA LTD 14 WBPRB0028002000 STEEL AUTHORITY OF INDIA 15 DSNHP003369100E NIIT TECHNOLOGIES LTD 16 PUPUN0005674000 ATLAS COPCO [I] LTD 17 THTHA0001616000 CENTURY RAYON 18 WBCAL0026974000 WEST BENGAL POWER DEVELOPMENT CORPORATION LIMITED 19 GNGGN0009476000 DELPHI AUTOMOTIVE SYSTEM LIMITED 20 PUPUN0007319000 JAYA HIND INDUSTRIES LTD. 21 DSSHD0004360000 MOTHER DAIRY 22 PUPUN0002885000 J N MARSHALL PVT LTD 23 VDBRD0003574000 THE PANCHMAHAL DIST. CO-OP. MILK PRODUCERS 24 MHBAN000633300X HAWKINS COOKERS LIMITED 25 KRKCH0003188000 SUD-CHEMIE INDIA PVT. LIMITED 26 MRMRT0000227000 TRIVENI ENGG. - INDUSTRIES LTD. 27 VDBRD0005238000 GUJARAT STATE FERTILIZERS CO. LTD., 28 GJRAJ000523800A GSFC LTD. 29 DSNHP0007658000 NIIT LTD. 30 DSNHP0019614000 AMERICAN EXPRESS INDIA PVT LTD 31 MHBAN0020972000 HOUSING DEVELOPMENT FINANCE CORP LTD 32 GJAHD001692300E THE UMRETH URBAN CO-OPERATIVE BANK LTD. 33 MPBPL000344800A HINDUSTAN ELECTRO GRAPHITE LTD. 34 MHBAN000710800X THE MUNICIPAL CO-OP.BANK LTD. 35 BGBNG002411700X MERCEDES BENZ RESEARCH AND DEVELOPMENT INDIA PVT LTD 36 RJRAJ0001004000 GANDHI SEWA SADAN BAYANA BHARATPUR 37 UPLKO0000180000 BAJAJ HINDUSTAN LTD. 38 TNMAS0007835000 BHARAT HEAVY ELECTRICALS 39 NESHG0000941000 NORTH EASTERN ELECTRICAL POWER CORPORATION LTD 40 DSNHP0000932000 NATIONAL SMALL IND CORPN. -

Replacements in Indices

Date: 16 February 2017 PRESS RELEASE Replacements in Indices The Index Maintenance Sub-Committee (IMSC) has decided to make the following replacement of stocks in various indices as part of its periodic review. These changes shall become effective from March 31, 2017 (close of March 30, 2017). 1) NIFTY 50 Index The following companies are being excluded: Sr. Company Name Symbol No. 1 Bharat Heavy Electricals Ltd. BHEL 2 Idea Cellular Ltd. IDEA The following companies are being included: Sr. Company Name Symbol No. 1 Indiabulls Housing Finance Ltd. IBULHSGFIN 2 Indian Oil Corporation Ltd. IOC 2) NIFTY 500 Index The following companies are being excluded: Sr. Company Name Symbol No. 1 Alok Industries Ltd. ALOKTEXT 2 Bombay Rayon Fashions Ltd. BRFL 3 Brigade Enterprises Ltd. BRIGADE 4 Dynamatic Technologies Ltd. DYNAMATECH 5 Future Lifestyle Fashions Ltd. FLFL 6 Ingersoll Rand (India) Ltd. INGERRAND 7 International Paper APPM Ltd. IPAPPM 8 Jaiprakash Power Ventures Ltd. JPPOWER 9 Jaypee Infratech Ltd. JPINFRATEC 10 JSW Holdings Ltd. JSWHL 11 KSB Pumps Ltd. KSBPUMPS 12 La Opala RG Ltd. LAOPALA 13 Lanco Infratech Ltd. LITL 14 Linde India Ltd. LINDEINDIA 1 15 Mahindra Lifespace Developers Ltd. MAHLIFE 16 Mayur Uniquoters Ltd. MAYURUNIQ 17 Sequent Scientific Ltd. SEQUENT 18 Shoppers Stop Ltd. SHOPERSTOP 19 Simplex Infrastructures Ltd. SIMPLEXINF 20 Sintex Industries Ltd. SINTEX 21 Siti Networks Ltd. SITINET 22 State Bank of Bikaner & Jaipur Ltd. SBBJ 23 State Bank of Mysore MYSOREBANK 24 State Bank of Travancore SBT 25 Suprajit Engineering Ltd. SUPRAJIT The following companies are being included: Sr. Company Name Symbol No. -

Press Release February 23, 2021

Press Release February 23, 2021 Replacements in Indices The Index Maintenance Sub-Committee (Equity) has decided to make the following replacement of stocks in various indices as part of its periodic review. These changes shall become effective from March 31, 2021 (close of March 30, 2021). 1) NIFTY 50 The following company is being excluded: Sr. No. Company Name Symbol 1 GAIL (India) Ltd. GAIL The following company is being included: Sr. No. Company Name Symbol 1 Tata Consumer Products Ltd. TATACONSUM The above replacements will also be applicable to NIFTY50 Equal Weight Index. 2) NIFTY Next 50 The following companies are being excluded: Sr. No. Company Name Symbol 1 Bank of Baroda BANKBARODA 2 Container Corporation of India Ltd. CONCOR 3 General Insurance Corporation of India GICRE 4 Hindustan Zinc Ltd. HINDZINC 5 Oracle Financial Services Software Ltd. OFSS 6 Power Finance Corporation Ltd. PFC 7 Tata Consumer Products Ltd. TATACONSUM The following companies are being included: Sr. No. Company Name Symbol 1 Adani Enterprises Ltd. ADANIENT 2 Apollo Hospitals Enterprise Ltd. APOLLOHOSP 3 GAIL (India) Ltd. GAIL 4 Jubilant Foodworks Ltd. JUBLFOOD 5 MRF Ltd. MRF Sr. No. Company Name Symbol 6 Vedanta Ltd. VEDL 7 Yes Bank Ltd. YESBANK 3) NIFTY 500 The following companies are being excluded: Sr. No. Company Name Symbol 1 Bombay Dyeing & Manufacturing Co. Ltd. BOMDYEING 2 CARE Ratings Ltd. CARERATING 3 Chennai Petroleum Corporation Ltd. CHENNPETRO 4 D.B.Corp Ltd. DBCORP 5 ESAB India Ltd. ESABINDIA 6 Gujarat Mineral Development Corporation Ltd. GMDCLTD 7 Hathway Cable & Datacom Ltd. HATHWAY 8 Heritage Foods Ltd. -

List of Our Recruiters

LIST OF RECRUITERS List of Recruiters 0-9 E J R 3M India Eaton Technologies Pvt. Ltd. Janssen India Ranbaxy Laboratories A Emergent Ventures International J. L. Morison (India) Randstad India Limited Accenture Services Engage4more Pvt. Ltd. JM Financial Consultants Rashtriya Ispat Nigam Actis Technologies Ernst & Young JPMorgan Services India Reckitt Benckiser Aditya Birla Group eTail Networks Johnson Controls Reliance Industries Agro Tech Foods Executive Access (India) Jubiliant MotorWorks Pvt. Ltd. Reliance Power Aircel F Jumbo Electronics Religare Enterprises AkzoNobel India FactSet Systems India K RocSearch Alti Source and Ocwen India Fiat Motors Kellogg India Amazon Fidelity Business Services India Kimberly Clark Corporation Saint Gobain India Aon Hewitt First Energy Private Limited Kingfisher Training And Aviation Services Sanofi Arvind Mills Four-S Services Kotak Life Insurance Schneider Electric Asian Paints Ltd. Future Group Kotak Mahindra Bank SABMiller India Avalon Consulting Future Vista KPIT Cummins Infosystems SBI Capital Markets Aviva Life Insurance G KPMG Shalina Healthcare Avnash Industries Ghana Limited GAIL(India) KQ Infotech Sterlite Technologies Limited Axis Bank Ltd. GE India L Syngenta India Ltd. Axis Risk Consulting Services Genpact Limited Larsen & Toubro Infotech Syntel B Givaudan India Pvt Ltd Larsen & Toubro Bajaj Auto GlaxoSmithKline Consumer Healthcare Lenovo India Pvt. Ltd. Tata Communication Bajaj Allianz Life Insurance Company Ltd. Godfrey Phillips India L'Oréal India Tally Solutions Bayer Healthcare Godrej & Boyce Manufacturing M Tata Capital Bharti Airtel Godrej Industries Maersk Line India Private Limited Tata Motors Birla Sun Life Asset Management Goldman Sachs Services Mahindra & Mahindra Tata Sons Birlasoft (India) Google Mahindra Navistar Engines TCS eServe BMR Advisors Great Place to Work MAQ Software Teach for India BNY Mellon H Mercer Consulting (India) Texas Instruments BOB Capital Markets HCL Comnet METRO Cash & Carry India Pvt. -

CISRA Brochure

CISRA – Since 1984 ell for Industrial Safety & Risk Analysis hemical Engineering Department entral Leather Research Institute C ouncil of Scientific & Industrial Research The Genesis The rapid technological and industrial growth has its own disadvantages; the manufacture, storage and transport of man-made chemicals invariably pollute the atmosphere. The massive industrial complexes bring with them the palpable danger along with employment potential and modern consumer durable and other day-to-day comforts. The major examples are petrochemicals, drug and agrochemical industries. When the production is large, the problems created also turn large and so are the magnitude of the accidents. This seems to be a global phenomenon. Bhopal, Chernobyl, Mexico City, Three Mile Island and Seveso stand immortal testimony to the magnitude of the chemical industrial disasters and their immediate and after effects. The onus of identifying such disasters and use the same science and technology to prevent them fell on the scientists all over the world. The Cell for Industrial Safety and Risk Analysis (CISRA) is the brain-child of Dr. G. Thyagarajan, the then Director of the Central Leather Research Institute (CLRI), who was also in the investigation committee of the Bhopal Gas Tragedy in India. His vision and Dr. K.V. Raghavan’s efforts resulted into the setting up of CISRA as part of the Chemical Engineering Division of CLRI. It was initiated with senior scientists like Dr. M.M. Mallikarjunan and Dr. P.G. Rao and a host of young chemical engineers and