State Support to the Air Transport Sector: Monitoring Developments Related to the Covid-19 Crisis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Policy Briefing No.3

policy briefing no.3 February 2011 Air Access and the Western Region A Regional Perspective WDC Policy Briefings: The Western Development Commission (WDC) is a statutory body promoting economic and social development in the Western Region of Ireland (counties Donegal, Sligo, Leitrim, Mayo, Roscommon, Galway and Clare). WDC Policy Briefings highlight and provide discussion and analysis of key regional policy issues. Introduction Contents Air travel is a particularly important transport mode for an island economy and for connecting geographically remote regions. In Ireland, government policy1 supports the development and expansion of regional airports in Introduction order to improve accessibility and promote balanced regional development. However, policy supports are being What is the role reviewed due to both budgetary constraints and the cessation of contracts supporting air routes between Dublin of air transport in 2 and regional airports. The Department of Transport has recently announced a reduction in future route support regional economic and has published a Value for Money Review of Exchequer Expenditure on the Regional Airports Programme which development? makes recommendations to also reduce other supports for regional airports. This WDC Policy Briefing examines the importance of air access to the Western Region and the role of regional Which airports serve airports. It will show that these airports are important to the region’s economy, improving accessibility for the Western Region? enterprises and tourists. Airports in the -

Investor Info August 2018

Investor Relations Investor Info August 2018 Lufthansa Group Month yoy Cumulative yoy Passengers in 1,000 13,755 +10.0% 94,840 +11.2% Available seat-kilometers (m) 32,925 +8.2% 232,705 +8.0% Revenue seat-kilometers (m) 28,434 +8.7% 189,951 +8.8% Total Lufthansa Group Passenger load-factor (%) 86.4 +0.5pts. 81.6 +0.6pts. Airlines Available Cargo tonne-kilometers (m) 1,416 +3.6% 10,782 +4.2% Revenue Cargo tonne-kilometers (m) 895 -0.7% 7,170 +1.7% Cargo load-factor (%) 63.2 -2.7pts. 66.5 -1.7pts. Number of flights 111,408 +10.0% 813,719 +8.7% Passengers in 1,000 6,509 +7.3% 46,708 +7.3% Available seat-kilometers (m) 18,087 +4.0% 131,537 +4.4% Lufthansa German Airlines* Revenue seat-kilometers (m) 15,571 +4.3% 107,345 +4.3% Passenger load-factor (%) 86.1 +0.3pts. 81.6 -0.1pts. Number of flights 50,832 +8.6% 383,883 +6.7% Passengers in 1,000 4,153 +5.0% 29,075 +5.0% Available seat-kilometers (m) 12,739 +1.1% 92,374 +1.8% thereof Hub FRA Revenue seat-kilometers (m) 10,982 +0.9% 75,672 +1.3% Passenger load-factor (%) 86.2 -0.2% 81.9 -0.4% Number of flights 30,902 +7.9% 226,998 +6.3% Passengers in 1,000 2,256 +11.2% 16,921 +10.9% Available seat-kilometers (m) 5,271 +11.3% 38,657 +11.0% thereof Hub MUC Revenue seat-kilometers (m) 4,538 +13.4% 31,338 +11.9% Passenger load-factor (%) 86.1 +1.6% 81.1 +0.7% Number of flights 18,620 +8.6% 147,417 +6.7% Passengers in 1,000 2,033 +10.6% 13,667 +9.4% Available seat-kilometers (m) 5,555 +9.0% 39,965 +7.7% SWISS Revenue seat-kilometers (m) 4,877 +9.4% 33,148 +9.1% Passenger load-factor (%) 87.8 +0.3pts. -

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

Edelweiss Presents New Aircraft Design

Press release Zurich Airport, 13 November 2015 Edelweiss presents new aircraft design In future, Edelweiss aircraft will be seen in a new design. The new look supports the leading Swiss leisure travel airline's growth course, and underscores its origins. As well as the new aircraft design, Edelweiss will also modernise the interior of its entire Airbus A320 fleet and install a Wireless Inflight Entertainment System. The Edelweiss aircraft will be seen in their new "clothes" in time for the airline's 20th anniversary. The current livery has remained the same since the company was founded. Bernd Bauer, CEO of Edelweiss: "We are proud of what we have achieved in the past, and we are taking this success with us into the future. We chose our new aircraft design to be an evolution, rather than a revolution." Familiar details such as the red noses on the aircraft will be left unchanged. The most eye-catching details are the oversized Edelweiss flower on the tail fin and the addition of the word "Switzerland" on the aircraft. "We want to clearly express our Swiss origins. We provide connections to the loveliest holiday destinations in Switzerland, and we delight people with Swiss quality. And we want our aircraft to reflect this," he adds. The first Airbus A320 in the new design will start travelling on the Edelweiss network at the end of November 2015. Wireless Inflight Entertainment System on the entire Airbus A320 fleet Over the coming months, Edelweiss will also convert all six of its Airbus A320s. They are all being given a new cabin, which will increase people's anticipation of their holiday as soon as they board. -

ECONOMIC DEVELOPMENT INITIATIVE ECONOMIC DEVELOPMENT INITIATIVE the Facts Ireland Northwest

Contents Preface 3 Preface Ireland Northwest, centred on the Derry-Letterkenny City Region, is exceptionally well 4 The facts placed as an investment hub for business and global companies seeking to establish a gateway to both the UK and EU markets. Ireland Northwest is renowned for its rich 6 Map tourism, its culture and its heritage offerings, with an established reputation as a 8 Why invest in Ireland Northwest? compelling investment proposition. 10 Growth sectors 12 Case study It is a perfect location for businesses to invest and We are an accessible, connected and business grow. As investors seek to form solid foundations friendly gateway region and have a vision for 14 Innovation, creativity and knowledge on which to base future investment decisions greater international impact. 16 Talent, skills & resources and with a foothold firmly in the EU and the UK, Ireland Northwest delivers a unique combination our clear message is that Ireland Northwest can 18 Investing in our future of benefits for relocating and expanding provide the stability and the options that your businesses, it has a proven track record in John Kelpie 19 Global research & technology centres business needs. of excellence hosting leading international companies such as Chief Executive Derry City and Strabane District and Donegal Pramerica, Seagate, Randox, DuPont, Allstate, Derry City and Strabane District Council 20 Business incubation County Councils are proactively taking a OneSourceVirtual, Zeus and Optum. These & co-working space leadership role to profile Ireland Northwest as companies are already reaping the benefits of 22 Cost of living an investment location and promote this cross- operating in Ireland Northwest and provide robust border gateway region’s unique economic, social, testimonies for the new companies that are cultural and environmental assets. -

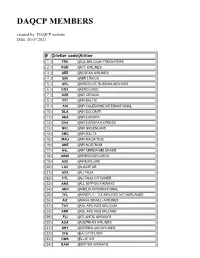

DAQCP MEMBERS Created By: DAQCP Website Date: 20.07.2021

DAQCP MEMBERS created by: DAQCP website Date: 20.07.2021 # 3-letter code Airline 1 FRH ACE BELGIUM FREIGHTERS 2 RUN ACT AIRLINES 3 AEE AEGEAN AIRLINES 4 EIN AER LINGUS 5 AFL AEROFLOT RUSSIAN AIRLINES 6 BOX AEROLOGIC 7 KZR AIR ASTANA 8 BTI AIR BALTIC 9 ACI AIR CALEDONIE INTERNATIONAL 10 DLA AIR DOLOMITI 11 AEA AIR EUROPA 12 OVA AIR EUROPA EXPRESS 13 GRL AIR GREENLAND 14 AMC AIR MALTA 15 MAU AIR MAURITIUS 16 ANE AIR NOSTRUM 17 ASL AIR SERBIA BELGRADE 18 ABW AIRBRIDGECARGO 19 AXE AIREXPLORE 20 LAV ALBASTAR 21 AZA ALITALIA 22 CYL ALITALIA CITYLINER 23 ANA ALL NIPPON AIRWAYS 24 AEH AMELIA INTERNATIONAL 25 TFL ARKEFLY - TUI AIRLINES NETHERLANDS 26 AIZ ARKIA ISRAELI AIRLINES 27 TAY ASL AIRLINES BELGIUM 28 ABR ASL AIRLINES IRELAND 29 FLI ATLANTIC AIRWAYS 30 AUA AUSTRIAN AIRLINES 31 AHY AZERBAIJAN AIRLINES 32 CFE BA CITYFLYER 33 BMS BLUE AIR 34 BAW BRITISH AIRWAYS 35 BEL BRUSSELS AIRLINES 36 GNE BUSINESS AVIATION SERVICES GUERNSEY LTD 37 CLU CARGOLOGICAIR 38 CLX CARGOLUX AIRLINES INTERNATIONAL S.A 39 ICV CARGOLUX ITALIA 40 CEB CEBU PACIFIC 41 BCY CITYJET 42 CFG CONDOR FLUGDIENST GMBH 43 CTN CROATIA AIRLINES 44 CSA CZECH AIRLINES 45 DLH DEUTSCHE LUFTHANSA 46 DHK DHL AIR LTD. 47 EZE EASTERN AIRWAYS 48 EJU EASYJET EUROPE 49 EZS EASYJET SWITZERLAND 50 EZY EASYJET UK 51 EDW EDELWEISS AIR 52 ELY EL AL 53 UAE EMIRATES 54 ETH ETHIOPIAN AIRLINES 55 ETD ETIHAD AIRWAYS 56 MMZ EUROATLANTIC 57 BCS EUROPEAN AIR TRANSPORT 58 EWG EUROWINGS 59 OCN EUROWINGS DISCOVER 60 EWE EUROWINGS EUROPE 61 EVE EVELOP AIRLINES 62 FIN FINNAIR 63 FHY FREEBIRD AIRLINES 64 GJT GETJET AIRLINES 65 GFA GULF AIR 66 OAW HELVETIC AIRWAYS 67 HFY HI FLY 68 HBN HIBERNIAN AIRLINES 69 HOP HOP! 70 IBE IBERIA 71 ICE ICELANDAIR 72 ISR ISRAIR AIRLINES 73 JAL JAPAN AIRLINES CO. -

Killybegs Harbour Centre & South West Donegal, Ireland Access To

Killybegs Harbour Centre & South West Donegal, Ireland Area Information Killybegs is situated on the North West Coast of Ireland with the newest harbour facility in the country which opened in 2004. The area around the deep fjord-like inlet of Killybegs has been inhabited since prehistoric times. The town was named in early Christian times, the Gaelic name Na Cealla Beaga referring to a group of monastic cells. Interestingly, and perhaps surprisingly in a region not short of native saints, the town’s patron saint is St. Catherine of Alexandria. St. Catherine is the patron of seafarers and the association with Killybegs is thought to be from the 15th Century which confirms that Killybeg’s tradition of seafaring is very old indeed. The area is rich in cultural & historical history having a long association with marine history dating back to the Spanish Armada. Donegal is renowned for the friendliness & hospitality of its people and that renowned ‘Donegal Welcome’ awaits cruise passengers & crew to the area from where a pleasant travel distance through amazing sea & mountain scenery of traditional picturesque villages with thatched cottages takes you to visit spectacular castles and national parks. Enjoy the slow pace of life for a day while having all the modern facilities of city life. Access to the area Air access Regular flights are available from UK airports and many European destinations to Donegal Airport which is approx an hour’s drive from Killybegs City of Derry Airport approx 1 hour 20 mins drive from Kilybegs International flights available to and from Knock International Airport 2 hours and 20 minutes drive with public transport connections. -

Ireland's Action Plan on Aviation Emissions Reduction

Principal contact/National Focal Point James Lavelle. Assistant Principal Officer Aviation Services and Security Division Department of Transport, Tourism and Sport 44 Kildare Street Dublin 2 IRELAND Telephone +353 1 604 1130 Fax +353 1 604 1699 Email: [email protected] Alternate contact Ivan Nolan. Executive Officer Aviation Services and Security Division Department of Transport, Tourism and Sport 44 Kildare Street Dublin 2 IRELAND Telephone +353 1 604 1248 Fax +353 1 604 1699 Email: [email protected] IRELAND’S ACTION PLAN ON AVIATION EMISSIONS REDUCTION- Contents INTRODUCTION ..................................................................................................................... 2 General approach .................................................................................................................... 2 Current State of aviation in Ireland ....................................................................................... 3 Air Traffic Control Service Provision ................................................................................. 4 Passenger and Freight Numbers ...................................................................................... 5 Main Air Routes ................................................................................................................... 7 Irish Aircraft Registrations .................................................................................................. 7 Main Irish Air Carriers and Fleet Characteristics ........................................................... -

Investor Info March 2016

Beispiel, keine realistischen Zahlen Investor Info March 2016 Lufthansa Group Month yoy (%) Cumulative yoy (%) Passengers in 1,000 8,418 +4.0 22,331 +3.6 Available seat-kilometers (m) 22,682 +6.8 62,785 +6.6 Revenue seat-kilometers (m) 17,350 +5.4 47,032 +5.2 Total Passenger load-factor (%) 76.5 -1.0pts. 74.9 -0.9pts. Lufthansa Group Available Cargo tonne-kilometers (m) 1,243 -3.8 3,425 -1.2 Airlines Revenue Cargo tonne-kilometers (m) 826 -10.5 2,264 -6.2 Cargo load-factor (%) 66.4 -5.0pts. 66.1 -3.5pts. Number of flights 82,536 +1.9 232,437 +2.8 Passengers in 1,000 4,937 +4.2 13,277 +3.1 Available seat-kilometers (m) 15,089 +6.0 41,531 +5.2 Lufthansa Passenger Revenue seat-kilometers (m) 11,537 +5.1 31,224 +4.2 Airlines Passenger load-factor (%) 76.5 -0.6pts. 75.2 -0.7pts. Number of flights 44,410 +1.7 126,188 +2.0 Passengers in 1,000 1,364 -0.6 3,698 -0.6 Available seat-kilometers (m) 4,053 +1.9 11,658 +2.1 SWISS Revenue seat-kilometers (m) 3,141 -2.9 8,848 -1.7 Passenger load-factor (%) 77.5 -3.8pts. 75.9 -2.9pts. Number of flights 13,541 +2.9 38,905 +3.3 Passengers in 1,000 819 +3.9 2,053 +3.7 Available seat-kilometers (m) 1,828 +8.7 4,926 +8.3 Austrian Airlines Revenue seat-kilometers (m) 1,341 +5.4 3,506 +5.4 Passenger load-factor (%) 73.3 -2.3pts. -

Donegal Prospectus.Pdf

DONEGAL IRELAND A great place to live, work & do business... DONEGAL_IRELAND_CONNECTED_TO_THE_WORLD PROJECT KELVIN Contents DONEGAL_IRELAND_ _CONNECTED_TO_THE_WORLD 4. Introduction 20. Killybegs 30. Culture, Heritage & Arts 42. Donegal Diaspora 5. Welcome to Donegal 22. Letterkenny / Derry Gateway 32. Scenic Donegal & Attractions 44. Location & Infrastructure 6. Doing Business in Donegal 24. Connectivity 34. An Ghaeltacht 46. Business Support Agencies in Donegal 14. Education 26. Health Services 36. Recreational & Sporting Activities 18. Gaoth Dobhair Business Park 28. Donegal & Its People 40. Good Food In Great Places 02 | DONEGAL IRELAND Front Cover Image: Fanad Head Lighthouse Photography supplied by Wallace Media, Donegal Tourism Ltd., Brian McElhinney & The Mary from Dungloe Festival DONEGAL IRELAND | 03 DONEGAL_IRELAND_CONNECTED_TO_THE_WORLD Réamhrá Cead Míle Fáilte go Dhún na nGall Introduction Welcome to Donegal Donegal situated in the North West of Ireland is a great place in which to live, Welcome to our Donegal Prospectus which will introduce you to our county to work and to do business. Our new Local Economic and Community Plan has Donegal as a great place to live, to work and to do business. Donegal, situated set out a range of goals which will consolidate and further develop Donegal in the North West of Ireland is one of the most scenic and culturally vibrant in this regard. As can be seen from this prospectus, Donegal is a place of places in Ireland with stunning land and seascapes, excellent recreational spectacular beauty with world class businesses, a skilled workforce and a amenities, world class employment and investment opportunities and the positive and supportive attitude to enterprise and innovation. -

World Air Transport Statistics, Media Kit Edition 2021

Since 1949 + WATSWorld Air Transport Statistics 2021 NOTICE DISCLAIMER. The information contained in this publication is subject to constant review in the light of changing government requirements and regulations. No subscriber or other reader should act on the basis of any such information without referring to applicable laws and regulations and/ or without taking appropriate professional advice. Although every effort has been made to ensure accuracy, the International Air Transport Associ- ation shall not be held responsible for any loss or damage caused by errors, omissions, misprints or misinterpretation of the contents hereof. Fur- thermore, the International Air Transport Asso- ciation expressly disclaims any and all liability to any person or entity, whether a purchaser of this publication or not, in respect of anything done or omitted, and the consequences of anything done or omitted, by any such person or entity in reliance on the contents of this publication. Opinions expressed in advertisements ap- pearing in this publication are the advertiser’s opinions and do not necessarily reflect those of IATA. The mention of specific companies or products in advertisement does not im- ply that they are endorsed or recommended by IATA in preference to others of a similar na- ture which are not mentioned or advertised. © International Air Transport Association. All Rights Reserved. No part of this publication may be reproduced, recast, reformatted or trans- mitted in any form by any means, electronic or mechanical, including photocopying, recording or any information storage and retrieval sys- tem, without the prior written permission from: Deputy Director General International Air Transport Association 33, Route de l’Aéroport 1215 Geneva 15 Airport Switzerland World Air Transport Statistics, Plus Edition 2021 ISBN 978-92-9264-350-8 © 2021 International Air Transport Association. -

Guidelines for the Release of Racing Pigeons for the Purpose of Ensuring Safety of Aircraft and Passengers and Crew Travelling Therein

GUIDELINES FOR THE RELEASE OF Issued by the Safety Regulation Division of the RACING PIGEONS Irish Aviation Authority Introduction The Safety Regulation Division of the Irish Aviation Authority has issued the following guidelines for the release of racing pigeons for the purpose of ensuring safety of aircraft and passengers and crew travelling therein. The guidelines are available to all Racing Pigeon Clubs and all owners of racing pigeons. Why are racing pigeons a hazard for aircraft? Racing pigeons are a predictable hazard to both civil and military aviation. There are four main reasons why they are hazardous to aircraft: (1) Racing pigeons are heavy birds - weighing at least 450g i.e. almost half a kilo; (2) Racing pigeons fly in flocks, which, in the case of pigeon races may involve 30,000 birds. Flocks cause multiple bird strikes i.e. where several or many birds strike an aircraft. This in turn increases the risk of a bird or birds entering the jet engine. Most commercial jets (e.g. Boeing 737, 777, Airbus A320, A330) have two very large diameter engine intakes, so the risk of birds entering both engines increases when a flock strikes the aircraft; (3) Racing pigeons travel at speeds of up to 70 mph, which means that there may be insufficient time for pilots and or birds to take evasive action thus increasing the risk of collision; (4) Racing pigeons fly at low altitudes of the order of 300ft and therefore if a collision occurs it happens as the aircraft is at a critical phase of flight having either just taken off or when it is about to land; In addition, racing pigeons do not usually respond to conventional bird control measures at airports and as they are wild animals, their behavior is predictable only to a limited extent.