Post Holdings, Inc. 2016 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Post Holdings, Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 ______________________ FORM 8-K CURRENT REPORT Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934 Date of Report (Date of earliest event reported): October 1, 2018 Post Holdings, Inc. (Exact name of registrant as specified in its charter) Missouri 1-35305 45-3355106 (State or other jurisdiction of (Commission File (IRS Employer Identification incorporation) Number) No.) 2503 S. Hanley Road St. Louis, Missouri 63144 (Address, including Zip Code, of principal executive offices) Registrant’s telephone number, including area code: (314) 644-7600 Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. -

Campaign Book Example 1

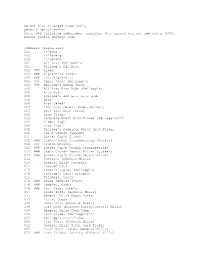

Easy. Accessible. Afordable. 1 ACCOUNT DIRECTOR MARC LANGENDORFF RESEARCH DIRECTOR MELISSA BEHLING This is a fictional CREATIVE DIRECTOR campaignMARISSA SUGRUE plan createdLAUREN for FAUST a class MEDIA DIRECTOR CHRISTY CADE PR DIRECTOR MARQUISE MAYS SITUATION ANALYSIS.............4-11 CAMPAIGN STRATEGY..........12-16 MEDIA PLAN.........................17-22 CREATIVE PLAN....................23-34 PUBLIC RELATIONS PLAN..35-44 SOURCES................................45-48 Situation Analysis 4 Company History In the early 1970s, Gayle and Phil Tauber created their own business called Plant Pusher. Te couple purchased plants and distributed them throughout the streets of La Jolla, California. Next the Taubers invested in Vince’s Gym, which was originally for males only, and convinced the owner to make it the frst co-ed bodybuilding facility. After dedicating his time to selling fresh plants and exercising religiously at the gym, Phil knew that diet and exercise together were the only way to positively impact the health industry. So Phil and Gayle founded Kashi in 1984, a company that uses “plant powered ingredients to help you live an active life.” Kashi prides itself on its natural ingredients – namely, their “seven whole grains on a mission.” It promotes its farmers and their dedication to sustainability. Te Taubers created the brand name by combining “Kashruth,” meaning ‘kosher or pure food,’ with “Kushi,” the founder of American macrobiotics. Tus, they say “Kashi” stands for “whole- some foods made with real nutrition.” Te Kellogg Company acquired Kashi in 2000. Will Keith Kellogg and his brother Dr. John Harvey Kellogg co-in- vented faked cereal in 1906 at a time when Americans were beginning to eat lighter, more grain-based meals. -

Low Sugar Breakfast Cereal Guide

ultimate guide to low-sugar breakfast cereals Make mornings fast, easy, AND healthy with cereal that has 6g (or less!) sugar per serving. Our favorites are in bold. Non-organic Post Shredded Wheat - 0g Barbara’s Puffins Cheerios, Original - 1g Original, Cinnamon, Multi-grain - 5g Weetabix - 2g Honey Rice - 5g Kix - 3g Peanut Butter - 6g Chex: Rice - 2g, Corn - 3g, Wheat - 5g Barbara's Multigrain Spoonfuls, Orig - 5g Wheaties - 4g Mom’s Best Total - 5g Oats and Honey Blend - 6g Honey Bunches of Oats Toasted Wheatfuls - 0g Honey Roasted, Banana Bunches - 5g Coconut Almond Granola - 5g Pecan Maple, Cinnamon Bunches - 6g Life: Original, Vanilla, Strawberry - 6g Cheerios, Multigrain - 6g Organic Arrowhead Mills Erewhon Sprouted Corn Flakes - 1g Crispy Brown Rice - 1g Shredded Wheat - 2g Cinnamon Crispy Brown Rice - 2g Flakes: Spelt, Multigrain, Kamut - 2g Peace Purple Corn Flakes - 5g Flakes: Oat Bran, Amaranth - 4g Uncle Sam Flakes: Maple Buckwheat - 5g Wheat Berry Flakes - 0g Cascadian Farms Purely O’s - 1g Skinner’s Raisin Bran - 0g added, 8g total Whole Foods 365 Nature’s Path Morning O’s, Corn Flakes -2g Heritage O’s - 3g Honey Flakes & Oat Clusters - 5g Fruit Juice Corn Flakes - 4g Kashi Millet Rice Flakes - 4g Whole Grain Puffs - 0g Grain Free Granola: Caramel Pecan, 7 Whole Grain Nuggets - 2g Maple Almond, Vanilla Poppy Seed - 4g H2H: Honey Toasted, Cinnamon Oat -5g Flax Plus Flakes: Multibran, Cinnamon - 5g Cinnamon French Toast - 6g Multigrain Oat Bran Flakes - 5g 7 Whole Grain Flakes - 6g Heritage Flakes - 5g Barbara’s Honey’d Corn Flakes - 5g Honest O’s Original - 1g Mesa Sunrise - 5g Corn Flakes - 3g Whole O’s - 5g Original Puffins - 5g Qi’a Super Flakes: Cocoa Coconut, Honest O’s Multigrain - 6g Coconut Chia, Honey Chia - 6g www.mamaknowsnutrition.com. -

Foods Suitable for a Vegetarian Diet

Vegetarian Updated May 2019 Nestlé UK Ltd Nutritional Information Nestlé Goods brought into the UK direct by retailers Nestlé UK Ltd is part of a large international company, which produces many different products world-wide. As a recipient of the enclosed nutritional information list you will be aware of our commitment to provide up to date and correct information about our products. Recently some UK retailers have been importing Nestlé products from both Europe and other countries without our knowledge and as a result we are unable to guarantee that these imported Nestlé products are suitable for your allergy/intolerance. While appearing to be superficially similar to their UK counterparts, there are often recipe and production differences according to the country of origin. For your own safety, please check the label of the product that you have purchased – even if you have eaten the product before If you are unsure please contact us and we will do our best to help you. You can contact us free on 00800 637 85385. Our website address is www.nestle.co.uk – you can email us from the ‘contact us’ screen. 1 Vegetarian Updated May 2019 Foods Suitable for a Vegetarian Diet Products listed in bold are recent additions/alterations. All products on this list are free from meat, fish and their derivatives. Please note: Some products on this list have been fortified with Vitamin D3 sourced from lanolin (sheep's wool). Recourse to that information should enable you to decide whether you wish to avoid any particular Nestle product. If you require any further information regarding any of our products, please contact: Consumer Services, Nestle UK Ltd, Freepost, York, YO91 1XY Tel: 00800 637 85385 Email: [email protected] Please check our website www.nestle.co.uk for regular updates. -

General Mills' 2005 Annual Report

General Mills 2005 Annual Report General Mills at a Glance Selected Brands Cheerios, Betty Crocker, Wheaties, Pillsbury, Gold Medal, Hamburger Helper, Old El Paso, Totino’s, Yoplait, Green Giant, Progresso, Bisquick, Nature Valley, Cascadian Farm, Grands!, Chex Mix, Lucky Charms, Pop.Secret, Bugles, Total, Häagen-Dazs, Chex, Muir Glen, Fruit Roll-Ups, Gardetto’s, Kix, Colombo, Wanchai Ferry, Latina, La Salteña, Forno de Minas, Frescarini, Nouriche, Cinnamon Toast Crunch U.S. Retail Bakeries and International Joint Ventures Foodservice Our U.S. Retail business This segment of our We market our products in We are partners in several segment includes the business generates over $1.7 more than 100 countries out- joint ventures around the six major marketing divisions billion in sales. We customize side the United States.Our world. Cereal Partners listed below. We market our packaging of our retail prod- largest international brands Worldwide is our joint venture products in a variety of ucts and market them to are Häagen-Dazs ice cream, with Nestlé. We participate domestic retail outlets includ- convenience stores and food- Old El Paso Mexican foods, in four Häagen-Dazs joint ing traditional grocery stores, service outlets such as Green Giant vegetables and ventures, the largest of which natural food chains, mass schools, restaurants and hotels. Pillsbury dough products. is in Japan. And we are merchandisers and member- We sell baking mixes and This business segment partners with DuPont in ship stores. This segment frozen dough-based products accounts for 15 percent of 8th Continent, which produces accounts for 69 percent of to supermarket, retail and total company sales. -

World Nutrition Volume 5, Number 3, March 2014

World Nutrition Volume 5, Number 3, March 2014 World Nutrition Volume 5, Number 3, March 2014 Journal of the World Public Health Nutrition Association Published monthly at www.wphna.org Processing. Breakfast food Amazing tales of ready-to-eat breakfast cereals Melanie Warner Boulder, Colorado, US Emails: [email protected] Introduction There are products we all know or should know are bad for us, such as chips (crisps), sodas (soft drinks), hot dogs, cookies (biscuits), and a lot of fast food. Nobody has ever put these items on a healthy list, except perhaps industry people. Loaded up with sugar, salt and white flour, they offer about as much nutritional value as the packages they’re sold in. But that’s just the tip of the iceberg, the obvious stuff. The reach of the processed food industry goes a lot deeper than we think, extending to products designed to look as if they’re not really processed at all. Take, for instance, chains that sell what many people hope and believe are ‘fresh’ sandwiches. But since when does fresh food have a brew of preservatives like sodium benzoate and calcium disodium EDTA, meat fillers like soy protein, and manufactured flavourings like yeast extract and hydrolysed vegetable protein? Counting up the large number of ingredients in just one sandwich can make you cross-eyed. I first became aware of the enormity of the complex field known as food science back in 2006 when I attended an industry trade show. That year IFT, which is for the Institute of Food Technologists, and is one of the food industry’s biggest gatherings, was held in New Warner M. -

Post Bowl Pack and Cup College Grab N Go Sell Sheet 2020 11-6

COLLEGE & UNIVERSITY FOODSERVICE GRAB-N-GO Morning favorites in convenient, on-the-go formats P U ® C 8 7 9 1 0 0 1 - W S H 8 0 9 1 1 5 6 3 3 C L L , S D N A R B R E ® M U S N O C T S O P © 17g or more per serving CEREAL with REAL STRAWBERRIES ® 17g or more per serving liﬞ here REALwith P STRAWBERRIES U C 8 7 9 1 0 ® 0 1 - W S H 8 0 9 1 1 5 6 3 3 C L L , S CEREAL D N A R B R E M U S N CO liﬞ here T OS P © Malt-O-Meal & Post Post Malt-O-Meal & Post Cereal Small Bowl Pack Cereal cups Cereal large Bowl Pack Case UPC Brand Product Pack Size ≤6g Sugar* POST CEREAL - CUPS 84912-34329 Cocoa Pebbles 12/2 oz 84912-34333 Fruity Pebbles 12/2 oz FOODSERVICE 84912-00112 Honey Bunches of Oats Almond - 88037 12/2.25 oz 84912-34334 Honey Bunches of Oats Honey Rstd 12/2 oz COLLEGE & 84912-28571 Assorted Cup Pack (HBOHR - HBOA - HBOS - CPeb - Fpeb - RB) 60/1 ct UNIVERSITY 84912-28055 Cocoa Pebbles 60/2 oz 84912-28054 Fruity Pebbles 60/2 oz Grab-n-Go 84912-27900 Honey Bunches of Oats Strawberry 60/2 oz Bowl Packs 84912-28056 Honey Bunches of Oats Honey Roasted 60/2 oz and Cups MALT-O-MEAL CEREAL - SMALL BOWL PACK (1 GRAIN) A Variety of Cereals in Large 42400-03815 Apple Zings™ 96/0.75 oz and Small Bowl Sizes plus Cups serving up convenience 42400-02415 Berry Colossal Crunch® 96/1 oz without sacrificing quality 42400-03915 Cinnamon Toasters® 96/1 oz 42400-01515 Coco-Roos® 96/0.88 oz 42400-00615 Corn Flakes 96/0.75 ct 42400-00542 Crispy Rice 96/0.63 oz 42400-01015 Frosted Flakes 96/1 oz 42400-04515 Honey Graham Toasters® 96/1 oz 42400-27597 Honey Scooters® -

2019 Annual Report

SOME OF THE PARTS Post Holdings, Inc. 2019 Annual Report NET SALES ADJUSTED EBITDA(1) OPERATING CASH FLOW (in millions) (in millions) (in millions) 718.6 688.0 6,257.2 1,230.7 1,210.4 5,681.1 989.1 5,225.8 933.9 5,026.8 502.4 4,648.2 457.7 386.7 657.4 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 NET SALES BY CATEGORY 15% Active Nutrition Post Consumer Brands 33% 16% Refrigerated Retail 29% Foodservice Weetabix 7% FINANCIAL HIGHLIGHTS 2015 2016 2017 2018 2019 (in millions except per share data) Net Sales $ 4,648.2 $ 5,026.8 $ 5,225.8 $ 6,257.2 $ 5,681.1 Gross Profit 1,180.0 1,550.5 1,570.8 1,854.0 1,792.1 Operating Profit 218.3 548.8 516.7 573.5 781.0 Net (Loss) Earnings Available to Common Shareholders (132.3) (28.4) 34.8 457.3 121.7 Diluted (Loss) Earnings per Common Share $ (2.33) $ (0.41) $ 0.50 $ 6.16 $ 1.66 Operating Cash Flow 457.7 502.4 386.7 718.6 688.0 Adjusted EBITDA(1) 657.4 933.9 989.1 1,230.7 1,210.4 Adjusted Net Earnings Available to Common Shareholders(1) 35.7 205.8 211.0 318.9 368.8 Adjusted Diluted Earnings per Common Share(1) $ 0.62 $ 2.59 $ 2.67 $ 4.20 $ 4.91 ACTIVELY POSITIONED FOR FUTURE GROWTH BellRing Brands Well positioned as a leader in convenient nutrition, Post’s historical Active Nutrition business, now named BellRing Brands, completed its initial public offering in October 2019 and now trades under the ticker symbol “BRBR” on the New York Stock Exchange. -

Company's Reportable

Post Holdings, Inc. 2020 Annual Report Thank You Net Sales This year revealed (in millions) the strength of the 800 construction of our 600 portfolio, and our 400 6,257.2 5,681.1 5,698.7 5,225.8 results give us further 5,026.8 confidence moving 200 forward. However, none 0 of this would have been 2016 2017 2018 2019 2020 possible without the Adjusted EBITDA(1) courage and dedication (in millions) of our people. 1,500 1,200 900 1,230.7 1,210.4 1,140.5 989.1 600 933.9 300 0 2016 2017 2018 2019 2020 Operating Cash Flow (in millions) 800 600 718.6 688.0 625.6 400 502.4 200 386.7 0 2016 2017 2018 2019 2020 Net Sales by Segment 17% BellRing Brands 34% Post Consumer Brands 17% Refrigerated Retail 8% Weetabix 24% Foodservice Financial Highlights (in millions except per share data) 2016 2017 2018 2019 2020 Net Sales $ 5,026.8 $ 5,225.8 $ 6,257.2 $ 5,681.1 $ 5,698.7 Gross Profit 1,550.5 1,570.8 1,854.0 1,792.1 1,787.4 Operating Profit 548.8 516.7 573.5 781.0 700.5 Net (Loss) Earnings Available to Common Shareholders (28.4) 34.8 457.3 121.7 0.8 Diluted (Loss) Earnings per Common Share $ (0.41) $ 0.50 $ 6.16 $ 1.66 $ 0.01 Operating Cash Flow 502.4 386.7 718.6 688.0 625.6 Adjusted EBITDA(1) 933.9 989.1 1,230.7 1,210.4 1,140.5 Adjusted Net Earnings Available to Common Shareholders(1) 205.8 211.0 318.9 378.0 189.8 Adjusted Diluted Earnings per Common Share(1) $ 2.59 $ 2.67 $ 4.20 $ 5.03 $ 2.71 Post Holdings, Inc. -

Cereal List Arranged Numerically Generic Default=***** Note: ### Following Codenumber Signifies That Cereal Was Not Updated in 2001, Please Choose Another Code

Cereal List arranged numerically generic default=***** Note: ### following codenumber signifies that cereal was not updated in 2001, please choose another code COMPLETE CEREAL LIST 000 ***None 000 ***Rarely 000 ***Seldom 001 All Bran (Kellogg's) 001 Kellogg's All Bran 002 ### Alpen 003 ### Alpha-Bits (Post) 003 ### Post Alpha-Bits 004 ### Apple Jacks (Kellogg's) 004 ### Kellogg's Apple Jacks 005 All Bran Bran Buds (Kellogg's) 005 Bran Buds 005 Kellogg's All Bran Bran Buds 006 Bran 006 Bran Cereal 007 100% Bran Cereal (Nabisco/Post) 007 Post 100% Bran Cereal 009 Bran Flakes 009 Complete Wheat Bran Flakes (Kellogg's)*** 009 Fiber, High 009 High Fiber 009 Kellogg's Complete Wheat Bran Flakes 011 Cap'n Crunch (Quaker) 011 Quaker Cap'n Crunch 012 ### Cap'n Crunch Crunchberries (Quaker) 012 ### Crunch Berries 012 ### Quaker Cap'n Crunch Crunchberries 013 ### Cap'n Crunch Peanut Butter (Quaker) 013 ### Quaker Cap'n Crunch Peanut Butter 014 Cheerios (General Mills) 014 General Mills Cheerios 014 Toasted Oats 015 Cocoa Krispies (Kellogg's) 015 Kellogg's Cocoa Krispies 015 Krispies, Cocoa 016 ### Cocoa Pebbles (Post) 016 ### Pebbles, Cocoa 016 ### Post Cocoa Pebbles 017 Cocoa Puffs (General Mills) 017 General Mills Cocoa Puffs 017 Puffs, Cocoa 019 Chex, Corn (General Mills) 019 Corn Chex (Ralston Purina/General Mills) 019 General Mills Corn Chex 020 Corn Flakes (Kellogg's)*** 020 Kellogg's Corn Flakes 022 Corn Total (General Mills) 022 General Mills Total Corn Flakes 022 Total Corn Flakes (General Mills) 023 ### Corn Flakes, Country (General Mills) -

Low Fat Diet

Low fat diet • Low fat meal ideas Breakfast • Include cereals such as Rice Krispies®, Corn Flakes®, Corn Pops® or Special K® with skim milk, 1% milk or fat free soy milk. • Top your cereal with fresh fruit. • Add jam or jelly to toast or a bagel. • Cut up fruit and mix in fat free or 1% yogurt. • Make an egg white omelette – use a non-stick pan and beat liquid egg whites with fat free ham and minced vegetables such as tomatoes, peppers or mushrooms. • Use a blender to make a smoothie: 1 cup frozen or fresh fruit 1/2 cup fat free or 1% yogurt or sorbet 1/2 cup skim milk, 1 % milk, fat free soy milk or juice Low fat diet • Drink skim milk, 1% milk, fat free chocolate milk, fat free soy milk or fruit juice. Lunch • Make a deli sandwich – use fat free luncheon meat, bagel or bread, What is a low fat diet? vegetables (lettuce, tomatoes or cucumbers) and condiments like fat free mayonnaise, fat free mustard, salt and pepper. A low fat diet has limited amounts of fat. It includes: • Make a salad with a fat free dressing – use ½ cup of beans or chickpeas • most fruits • pasta with your favourite vegetables (lettuce, spinach, peppers, tomatoes). Add fresh berries or dried fruits for more variety. • vegetables • rice • Drink skim milk, 1% milk, fat free chocolate milk, fat free soy milk or fruit juice. • lean meats • cereals • fish • low fat dairy products Supper • poultry • Add 4 oz of cooked chicken breast in tomato sauce over I cup cooked macaroni. -

Post Holdings Annual Report 2019

Post Holdings Annual Report 2019 Form 10-K (NYSE:POST) Published: November 22nd, 2019 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 _______________________ FORM 10-K _______________________ (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended September 30, 2019 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number: 1-35305 ______________________ POST HOLDINGS, INC. (Exact name of registrant as specified in its charter) _______________________ Missouri 45-3355106 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 2503 S. Hanley Road St. Louis Missouri 63144 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (314) 644-7600 _______________________ Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock, $0.01 par value POST New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None _______________________ Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.