ACQUISITION of RIP CURL and EQUITY RAISING Transaction Summary 1 October 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SNSW & Independant Surfing Events Calendar 17

SNSW & Independant Surfing Events Calendar 17 Wahu/Ripcurl/ ABB: These dates will be released & announced by Surfing Australia throughout the year. Current SNSW members will be personally notified of these event opening dates. Event Date Event Status: Event Name Location Discipline Entry Opening Dates Entry via Web Jan-17 6-8 Jan Confirmed Surfarama Pres. By Brian Hilton Toyota & Slimes Surf & Skate Avoca Shortboard 7/11/16 Yes 4-13 Jan Confirmed WSL World Juniors Kiama Shortboard WSL WSL 16-18 Jan Confirmed Rip Curl Gromsearch National Final North Narrabeen Shortboard Open Online Yes 19-22 Jan Confirmed Carve Pro - WSL QS1000 Mens & Womens Maroubra Shortboard WSL Nov WSL 21-Jan Confirmed SURFEST- Maitland and Port Stephens Toyota Surfest Wildcard Trials Birubi Point Beach Shortboard See official Website WSL 23-25 Jan Confirmed Subway Pro Junior - WSL JQS Mens & Womens Cronulla Shortboard WSL Nov WSL 26th Jan Confirmed Every Man & His Dog Australia Day SUP Watsons Bay SUP See official Website No 28-Jan Confirmed Stomp NSW Old Mal Titles Bellambi Reef Longboard See official Website No 28-29 Jan Confirmed Surfarama Pres. By Wicks Long Reef Shortboard Open Online Yes 28-29 Jan Confirmed SURFEST -Lake Mac Festival of Surfing - Shortboard Titles Redhead Beach Shortboard See official Website No 28-29 Jan Confirmed SURFEST -Lake Mac Festival of Surfing -SUP Classic Redhead Beach SUP See official Website No 28-29 Jan Confirmed SURFEST - Lake Mac Festival of Surfing - Longboard Classic Redhead Beach Longboard See official Website No Feb-17 1-5 Feb Confirmed Telstra Stores Tweed Coast Pro - WSL QS1000 Mens & Womens Cabarita Shortboard WSL Nov 16 WSL 4-5 Feb Confirmed SURFEST - Orica Surfboard Club Team Challenge 2017 North Stockton Shortboard See official Website No 7-11 Feb Confirmed Komunity Project Great Lakes Pro Pres. -

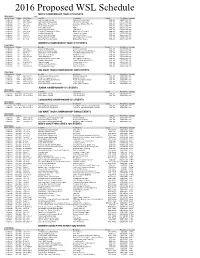

2016 Proposed WSL Schedule

2016 Proposed WSL Schedule MEN'S CHAMPIONSHIP TOUR (CT) EVENTS Event Status 2016 Tent/Confirmed Rating EventDates EventSite EventName Region PrizeMoney closedate Confirmed CT Mar 10-21 Gold Coast,Qld-Australia Quiksilver Pro Gold Coast WSL Int'l US$551,000 N/A Confirmed CT Mar 24-Apr 5 Bells Beach,Victoria-Australia Rip Curl Pro Bells Beach WSL Int'l US$551,000 N/A Confirmed CT Apr 8-19 Margaret River-West Australia Drug Aware Margaret River Pro WSL Int'l US$551,000 N/A Confirmed CT May 10-21 Rio de Janeiro,RJ-Brazil Rio Pro WSL Int'l US$551,000 N/A Confirmed CT Jun 5-17 Tavarua/Namotu-Fiji Fiji Pro WSL Int'l US$551,000 N/A Confirmed CT Jly 6-17 Jeffreys Bay-South Africa J Bay Open WSL Int'l US$551,000 N/A Confirmed CT Aug 19-30 Teahupo'o,Taiarapu Ouest-Tahiti Billabong Pro Teahupoo WSL Int'l US$551,000 N/A Confirmed CT Sep 7-18 Trestles,California-USA Hurley Pro at Trestles WSL Int'l US$551,000 N/A Confirmed CT Oct 4-15 Landes, South West France Quiksilver Pro France WSL Int'l US$551,000 N/A Confirmed CT Oct 18-29 Peniche/Cascais-Portugal Moche Rip Curl Pro Portugal WSL Int'l US$551,000 N/A Confirmed CT Dec 8-20 Banzai Pipeline,Oahu-Hawaii Billabong Pipe Masters WSL Int'l US$551,000 N/A WOMEN'S CHAMPIONSHIP TOUR (CT) EVENTS Event Status Tent/Confirmed Rating EventSite EventName Region PrizeMoney closedate Confirmed CT Mar 10-21 Gold Coast,Qld-Australia Roxy Pro Gold Coast WSL Int'l US$275,500 N/A Confirmed CT Mar 24-Apr 5 Bells Beach,Victoria-Australia Rip Curl Women's Pro Bells Beach WSL Int'l US$275,500 N/A Confirmed CT Apr 8-19 Margaret -

The Most Important Dates in the History of Surfing

11/16/2016 The most important dates in the history of surfing (/) Explore longer 31 highway mpg2 2016 Jeep Renegade BUILD & PRICE VEHICLE DETAILS ® LEGAL Search ... GO (https://www.facebook.com/surfertoday) (https://www.twitter.com/surfertoday) (https://plus.google.com/+Surfertodaycom) (https://www.pinterest.com/surfertoday/) (http://www.surfertoday.com/rssfeeds) The most important dates in the history of surfing (/surfing/10553themost importantdatesinthehistoryofsurfing) Surfing is one of the world's oldest sports. Although the act of riding a wave started as a religious/cultural tradition, surfing rapidly transformed into a global water sport. The popularity of surfing is the result of events, innovations, influential people (http://www.surfertoday.com/surfing/9754themostinfluentialpeopleto thebirthofsurfing), and technological developments. Early surfers had to challenge the power of the oceans with heavy, finless surfboards. Today, surfing has evolved into a hightech extreme sport, in which hydrodynamics and materials play vital roles. Surfboard craftsmen have improved their techniques; wave riders have bettered their skills. The present and future of surfing can only be understood if we look back at its glorious past. From the rudimentary "caballitos de totora" to computerized shaping machines, there's an incredible trunk full of memories, culture, achievements and inventions to be rifled through. Discover the most important dates in the history of surfing: 30001000 BCE: Peruvian fishermen build and ride "caballitos -

EVENT PROGRAM TRUFFLE KERFUFFLE MARGARET RIVER Manjimup / 24-26 Jun GOURMET ESCAPE Margaret River Region / 18-20 Nov WELCOME

FREE EVENT PROGRAM TRUFFLE KERFUFFLE MARGARET RIVER Manjimup / 24-26 Jun GOURMET ESCAPE Margaret River Region / 18-20 Nov WELCOME Welcome to the 2016 Drug Aware Margaret River Pro, I would like to acknowledge all the sponsors who support one of Western Australia’s premier international sporting this free public event and the many volunteers who give events. up their time to make it happen. As the third stop on the Association of Professional If you are visiting our extraordinary South-West, I hope Surfers 2016 Samsung Galaxy Championship Tour, the you take the time to enjoy the region’s premium food and Drug Aware Margaret River Pro attracts a competitive field wine, underground caves, towering forests and, of course, of surfers from around the world, including Kelly Slater, its magnificent beaches. Taj Burrow and Stephanie Gilmore. SUNSMART BUSSELTON FESTIVAL The Hon Colin Barnett MLA OF TRIATHLON In fact the world’s top 36 male surfers and top 18 women Premier of Western Australia Busselton / 30 Apr-2 May will take on the world famous swell at Margaret River’s Surfer’s Point during the competition. Margaret River has become a favourite stop on the world tour for the surfers who enjoy the region’s unique forest, wine, food and surf experiences. Since 1985, the State Government, through Tourism Western Australia, and more recently with support from Royalties for Regions, has been a proud sponsor of the Drug Aware Margaret River Pro because it provides the CINÉFESTOZ FILM FESTIVAL perfect platform to show the world all that the Margaret Busselton / 24-28 Aug River Region has to offer. -

Nsn 09-14-16

IS BUGG • D AH “E Ala Na Moku Kai Liloloa” S F W R In This Issue: E E E N ! The Adornment of Ka‘ena E • Malia K. Evans R S Page 12 & 13 O I N H Waialua High School C S E Food For Thought H 1 Page 14 T 9 R 7 Menehune Surfing Championship O 0 N Entry Form Page 16 NORTH SHORE NEWS September 14, 2016 VOLUME 33, NUMBER 19 Cover Story & Photo by: Janine Bregulla St. Michael School Students Bless the North Shore Food Bank With a new school year upon the opportunity to teach a lesson distributed at the North Shore Food us, it is a challenge of every edu- that emphasizes the importance of Bank to those in need. Based upon cator to find ways to engage their community, they along with the a well-received response this will be students in activities that have the parents rose to the challenge. The an ongoing project throughout the power to become lifelong lessons. families, faculty and students col- school year that hopefully inspires So when the faculty of St. Mi- lected enough hygiene products to others. chael's School was presented with assemble 87 care packages that were PROUDLY PUBLISHED IN Permit No. 1479 No. Permit Hale‘iwa, Hawai‘i Honolulu, Hawaii Honolulu, U.S. POSTAGE PAID POSTAGE U.S. Home of STANDARD Hale‘iwa, HI 96712 HI Hale‘iwa, Menehune Surfing PRE-SORTED 66-437 Kamehameha Hwy., Suite 210 Suite Hwy., Kamehameha 66-437 Championships Page 2 www.northshorenews.com September 14, 2016 North Shore Neighborhood Board #27 Tuesday, September 27, 2016 7 p.m. -

Strategic Management at Mormaii - the Brazilian Surf Industry Leader

BBR Special Issues Vitória-ES, 2017 p. 110-129 ISSN 1808-2386 DOI: http://dx.doi.org/10.15728/edicaoesp.2017.6 Strategic Management at Mormaii - the Brazilian Surf Industry Leader Marcos Abilio Bosquetti† Federal University of Santa Catarina - UFSC Gabriela Gonçalves Silveira FiatesΩ Federal University of Santa Catarina - UFSC Jess Ponting¥ San Diego State University ABSTRACT The sport of surfing has been growing rapidly in popularity worldwide and Brazil is among the countries with the largest surfing population, behind the United States and Australia, however, multinational surf companies are rushing in emerging markets like Brazil to find new opportunities for growth. This paper intends to provide insights on how local companies in these markets can overcome and even take advantage of differences with global competitors by re-thinking their core competencies and business models. Therefore, empirical research applying qualitative case study methodology was developed to investigate the role of strategy in the surf industry - a fairly unexplored research topic. Semi-structured in-depth interviews with the founder and CEO and the executive directors at the Brazilian surf industry leader - Mormaii, were conducted to understand how the 4-decade local company found its way to success. Although the theories: RBV, Core Competencies, and Dynamic Capabilities complement each other and help to explain firms’ performance and strategic choices, in empirical studies strategy has been analyzed only by one or another theory. Therefore, the simultaneous use of these three theories intended to fill this gap in the literature and bring more consistency to the discussion of this case study. As a result, this empirical study illustrates the RBV perspective, which stems from the principle that the source of firms’ competitive advantage lies in their internal resources and capabilities, rather than simply evaluating environmental opportunities and threats in conducting business. -

Wilco Prins Rip Curl Ceo Skateboarding's Lost

ISSUE #078. AUGUST/ SEPTEMBER 2015. €5 WILCO PRINS RIP CURL CEO SKATEBOARDING’S LOST GENERATION SUP FOCUS & RED PADDLE’S JOHN HIBBARD BRAND PROFILES, BUYER SCIENCE & MUCH MORE. TREND REPORTS: ACTION CAMS & ACCESSORIES, ACTIVEWEAR, LONGBOARDS, LUGGAGE & RUCKSACKS, SUNGLASSES, SUP, SURF APPAREL, WATCHES, WETSUITS. US HELLO #78 The boardsports industry has been through searching for huge volumes, but are instead Editor Harry Mitchell Thompson a time of change and upheaval since the looking for quality and repeat custom. And if a [email protected] global financial crisis coincided with brands customer buys a good technical product from a realizing the volume of product they had been brand, this creates loyalty. Surf & French Editor Iker Aguirre manufacturing was far too large. [email protected] Customer loyalty also extends to retail, where Since then it has been sink or swim, and one retailer’s satisfaction with a wetsuit, a Snowboard Editor Rémi Forsans Rip Curl are a brand who has come out with sunglass, SUP or longboard can equate to [email protected] their head well above water. For this issue large orders and given the right sales support of SOURCE, Rip Curl’s European CEO Wilco and payment terms will be the beginning (or Skate Editor Dirk Vogel Prins tells us how the company has thinned continuation) of a fruitful relationship. [email protected] its product lines by 50% and has executed a strategy, segmenting their lines to fit their SOURCE #78’s trend reports break down the German Editor Anna Langer consumer with a high amount of technical ever increasing amount of product information [email protected] innovation, guaranteed quality and with the available, as our experts review what’s worth stories being told by some of the finest athletes a punt for SS16 in everything from wetsuits SUP Editor Robert Etienne in their field. -

Membership, Event, Pathways, General Information & Q/A's

Membership, Event, Pathways, General Information & Q/A’s Updated: 16th November 2015 1 WSL Company & General Information 2 Q: What is the World Surf League? A: The World Surf League (WSL) organizes the annual tour of professional surf competitions and broadcasts events live at www.worldsurfleague.com where you can experience the athleticism, drama and adventure of competitive surfing -- anywhere and anytime it's on. Travel alongside the world's best male and female surfers to the most remote and exotic locations in the world. Fully immerse yourself in the sport of surfing with live event broadcasts, social updates, event highlights and commentary on desktop and mobile. The World Surf League is headquartered in Los Angeles, California with offices throughout the globe, and is dedicated to: • Bringing the athleticism, drama and adventure of pro surfing to fans worldwide • Promoting professional surfers as world-class athletes • Celebrating the history, elite athletes, diverse fans and dedicated partners who together embody professional surfing. Q: What is the World Surf League Pathway? A: The below is the basic pathway for a surfer to flow from Surfing NSW or other state bodies through to the WSL. 1. Compete in State Body grassroots pathway o Including Boardrider clubs events, Regional, State & Australian Titles events 2. Compete in WSL Regional Pro Junior Qualifying Events 3. Compete in WSL QS1000 Events 4. Compete in WSL QS1500 Events 5. Compete in WSL QS3000 Events 6. Compete in WSL QS6000 Events 7. Compete in WSL QS10000 Events 8. Compete on the WSL World Championship Tour Q: When was the WSL founded? A: The original governing body of professional surfing, the International Professional Surfers (IPS), was founded in 1976 and spearheaded by Hawaiian surfers Fred Hemmings and Randy Rarick. -

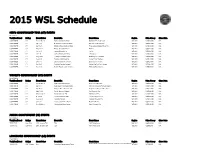

2015 WSL Schedule

2015 WSL Schedule MEN'S CHAMPIONSHIP TOUR (CT) EVENTS Event Status Tent/Confirmed Rating Event Dates Event Site Event Name Region Prize Money Close Date CONFIRMED CT Feb 28-Mar 11 Gold Coast,Qld-Australia Quiksilver Pro Gold Coast WSL Int'l US$525,000 N/A CONFIRMED CT Apr 1-12 Bells Beach,Victoria-Australia Rip Curl Pro Bells Beach WSL Int'l US$525,000 N/A CONFIRMED CT Apr 15-26 Margaret River-West Australia Drug Aware Margaret River Pro WSL Int'l US$525,000 N/A CONFIRMED CT May 11-22 Rio de Janeiro,RJ-Brazil Rio Pro WSL Int'l US$525,000 N/A CONFIRMED CT Jun 7-19 Tavarua/Namotu-Fiji Fiji Pro WSL Int'l US$525,000 N/A CONFIRMED CT Jul 8-19 Jeffreys Bay-South Africa J-Bay Open WSL Int'l US$525,000 N/A CONFIRMED CT Aug 14-25 Teahupoo,Taiarapu-Tahiti Billabong Pro Teahupoo WSL Int'l US$525,000 N/A CONFIRMED CT Sep 9-20 Trestles,California-USA Hurley Pro at Trestles WSL Int'l US$525,000 N/A CONFIRMED CT Oct 6-17 Landes, South West France Quiksilver Pro France WSL Int'l US$525,000 N/A CONFIRMED CT Oct 20-31 Peniche/Cascais-Portugal Moche Rip Curl Pro Portugal WSL Int'l US$525,000 N/A CONFIRMED CT Dec 8-20 Banzai Pipeline,Oahu-Hawaii Billabong Pipe Masters WSL Int'l US$525,000 N/A WOMEN'S CHAMPIONSHIP (CT) EVENTS Event Status Tent/Confirmed Rating Event Dates Event Site Event Name Region Prize Money Close Date CONFIRMED CT Feb 28-Mar 11 Gold Coast,Qld-Australia Roxy Pro Gold Coast WSL Int'l US$262,500 N/A CONFIRMED CT Apr 1-12 Bells Beach,Victoria-Australia Rip Curl Women's Pro Bells Beach WSL Int'l US$262,500 N/A CONFIRMED CT Apr 15-26 Margaret -

Big Wig Hurley Emea Covid-19 Biz Strategies June 2020 €5 #101

BIG WIG HURLEY EMEA COVID-19 BIZ STRATEGIES JUNE 2020 €5 #101 RETAIL BUYER’S GUIDES SURFBOARDS, SUNGLASSES, SUP, LONGBOARDS, IMPACT VESTS, KITES DURA-CORD WITH SPEED POCKETS ZERO DISTRACTION ANKLE CUFF CLOSURE SILICONE ANKLE GRIPS INTRODUCING THE INFINITE FLEX KAIMANA 360° LEASH ENDS The ultimate fusion of strength, comfort, and ingenuity, delivering the freedom of a leash-less feel. THIN LINE RAILSAVER SYSTEM ALWAYS TRUSTED. EVER PROGRESSING. DAKINE.COM 2 3 4 5 Reduce your impact by making one. Every Dragon Upcycled frame is made from the waste of 5 plastic bottles. cycled #GetUp ©2020 Marchon Eyewear Inc. Style Shown: DR RENEW LL ION 6 7 which ultimately help you diversity to be a flash in EDITORIAL do your job better, will be the pan and while our plan CONTENT behind a paywall. and learnings continue to SOURCE#101 P.08 Contents evolve, we can promise P.36 Retail Buyer’s Guide: P.78 Market Insight: This issue contains our our readership that in the P.10 News SUP 2020 Austrian + Italian usual Retail Buyer’s future we will do better at Guides to help retailers showcasing our industry’s P.14 How COVID-19 Affected P.48 Retail Expertise: Blue P.80 Brand Profile: see what’s trending in people of colour, the Euro Boardsport Industry Tomato CEO Adam Ellis Landyachtz summer 2020 categories, COVID-19’s effect on the brands they work for and P.18 Market Insight: German boardsports industry has but we also speak with the art they do. We’ll also P.52 Retail Buyer’s Guide: P.75 Retail Buyer’s Guide: been seismic and combining retailers, distributors -

THE SUSTAINABILITY of SURFING TOURISM DESTINATIONS a Case Study of Peniche, Portugal

THE SUSTAINABILITY OF SURFING TOURISM DESTINATIONS A Case Study of Peniche, Portugal Afonso Gonçalves Teixeira 2017 THE SUSTAINABILITY OF SURFING TOURISM DESTINATIONS A Case Study of Peniche, Portugal Afonso Gonçalves Teixeira A dissertation submitted to the School of Tourism and Maritime Technology of the Polytechnic Institute of Leiria in partial fulfillment of the requirements for the degree of Master in Sustainable Tourism Management Supervision João Costa, PhD Co-supervision Jess Ponting, PhD João Vasconcelos, PhD 2017 This page was intentionally left blank. ii THE SUSTAINABILITY OF SURFING TOURISM DESTINATIONS A Case Study of Peniche, Portugal COPYRIGHT Afonso Gonçalves Teixeira, student of the School of Tourism and Maritime Technology of the Polytechnic Institute of Leiria. A Escola Superior de Turismo e Tecnologia do Mar e o Instituto Politécnico de Leiria têm o direito, perpétuo e sem limites geográficos, de arquivar e publicar esta dissertação/trabalho de projeto/relatório de estágio através de exemplares impressos reproduzidos em papel ou de forma digital, ou por qualquer outro meio conhecido ou que venha a ser inventado, e de a divulgar através de repositórios científicos e de admitir a sua cópia e distribuição com objetivos educacionais ou de investigação, não comerciais, desde que seja dado crédito ao autor e editor. iii This page was intentionally left blank. iv ACKNOWLEDGMENTS The current thesis is the result of my involvement with several people, all of which made determinant contributions along the way to the accomplishment -

Surfing History Project of Dana Point

____________________________________ Oceanic Heritage Outline Surfing & Oceanic Heritage Projects of Dana Point The Dana Point Historical Society Produced & Written by Bruce Beal with an assist from Marlene Beal Revision Date: September 21, 2016 ____________________________________ Surfing & Oceanic Heritage Projects of Dana Point ~ Page 1 of 66 Copyright 2003~2016 Bruce Beal, Marlene Beal & the Dana Point Historical Society See Copyright Notice and Restrictions on Final Page ____________________________________ Oceanic Heritage Outline Surfing & Oceanic Heritage Projects of Dana Point The Dana Point Historical Society Produced & Written by Bruce Beal with an assist from Marlene Beal Revision Date: September 21, 2016 ____________________________________ Objective: Preserve Dana Point’s unique and legendary surfing, sailing and other oceanic histories, including the persons, cultures and industries associated therewith (“Oceanic Heritage Projects”). Commencing in the 1930’s, the area now known as Dana Point increasingly became populated by persons, originally known as “Watermen,” defined as those who were “comfortable in a wide variety of ocean conditions and had a broad store of oceanic knowledge; more specifically applied to those who are accomplished at a particular set of surfing-related activities, including diving, swimming, sailing, bodysurfing, fishing, spearfishing, surf canoeing, and oceangoing rescue work.”1 This Oceanic Heritage Outline of the Surfing and Oceanic Heritage Projects of the Dana Point Historical Society commemorates