The Faster Payments Task Force Approach

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

How Can Private Sector Systems Achieve Public Policy Goals?

Faster Payments in the United States: How Can Private Sector Systems Achieve Public Policy Goals? Fumiko Hayashi June 2015 RWP 15-03 Faster Payments in the United States: How Can Private Sector Systems Achieve Public Policy Goals?∗ Fumiko Hayashi† June 2015 Abstract Consumers and businesses are increasingly expecting faster payments. While many countries have already developed or are in process of developing faster payments, the availability of these payments is fragmented in the United States. The recently released paper by the Federal Reserve encourages private sector participants to provide faster payment services. However, private- sector faster payments systems will face significant challenges in achieving public policy goals of ubiquity, safety, and efficiency unless system governance represents broad public interests. One way to better align private-sector interests with those of the public is for the Federal Reserve to influence governance of the private-sector systems through its leadership role. JEL Classification: L5; L88; M14 Keywords: Faster payments, System governance, Public interest ∗ The author thanks Kelly Edmiston and Richard J. Sullivan for valuable comments, and Elizabeth Cook for editorial suggestions. The views expressed herein are those of the author and do not necessarily reflect the views of the Federal Reserve Bank of Kansas City or the Federal Reserve System. † Fumiko Hayashi is a senior economist at the Federal Reserve Bank of Kansas City. E-mail: [email protected]. 1 1. Introduction In the wake of technological innovations such as high-speed data networks and sophisticated mobile computing devices, consumers and businesses have raised their expectations for faster payments. Payment users increasingly expect electronic payment products to be accessible through mobile and online channels at any time. -

Vocalink and BGC Application Failover

VocaLink and BGC Application Failover Martin McGeough Database Technical Architect VocaLink: at the heart of the transaction A specialist provider of payment transaction services Our history Driving automated payments for more than 40 years From domestic supplier to large-scale international provider of modern payment services Our scale We securely process over 9 billion payments a year, including 15% of all European bank-to-bank payments On a peak day the payment platform processes over 90 million transactions and its switching technology powers the world's busiest network of over 60,000 ATMs Our customers The world’s top banks, their corporate customers and Government departments Sterling Cards and Our services Real-Time Euro clearing Connectivity ATM Payments Services services services 2009 awards Best payment system deployment (Faster Payments Service) Best outsourcing partnership (BGC) Overall winner (Faster Payments Service) 3 VocaLink’s history with Oracle • In 2007 VocaLink initiated a joint programme with BGC – the Swedish clearing house - to renew the BGC Service – the goal was to replace the heritage mainframe technology with a highly scalable, highly available and modular infrastructure that would reduce costs while simultaneously improving performance. • Main Architecture requirements − High Availability – No single points of failure − Disaster Recovery – remote site with zero data loss − Site Failover – Site failover SLA is 15 minutes − High Throughput – Process payments within very tight SLA’s − Manageability – Ability to manage independent payments services 4 VocaLink’s history with Oracle contd. • Technology − WebLogic Server was chosen to provide the Application Server software − Sun/Oracle was chosen to provide the hardware. − Oracle Database was chosen to provide the Database software using RAC (Real Application Cluster) for a solution that provided high availability and performance and Data Guard + Data Guard Broker provided an easily managed DR solution. -

Mastercard Announces Acquisition of Vocalink Enhancing Choice, Driving Innovation Across All Payment Types and Payment Flows

MasterCard Announces Acquisition of VocaLink Enhancing Choice, Driving Innovation Across All Payment Types and Payment Flows PURCHASE, N.Y. – July 21, 2016 – MasterCard Incorporated (NYSE: MA) today announced that it has entered into a definitive agreement to acquire 92.4 percent of VocaLink Holdings Limited for about £700 million (approximately US$920 million), after adjusting for cash and certain other estimated liabilities. VocaLink’s existing shareholders have the potential for an earn-out of up to an additional £169 million (approximately US$220 million), if performance targets are met. This transaction is subject to regulatory approval and other customary closing conditions. Under the agreement, a majority of VocaLink’s shareholders will retain 7.6 percent ownership for at least three years. Based in London, VocaLink operates key payments technology platforms on behalf of UK payment schemes, including: BACS – the Automated Clearing House (ACH) enabling direct credit and direct debit payments between bank accounts Faster Payments – the real-time account-to-account service enabling payments via mobile, internet and telephone LINK – the UK ATM network In addition, VocaLink offers innovative products with global potential, including ZAPP, a mobile payments app that leverages Fast ACH technology, and licenses its software and provides services to support ACH activities in Sweden, Singapore, Thailand and the United States. In 2015, the company reported revenues of £182 million as it processed more than 11 billion transactions. This acquisition accelerates MasterCard’s efforts to be an active participant in all types of electronic payments and payment flows and to enhance its services for the benefit of customers and partners. -

Visa's Annual Report

Annual Report 2017 Annual Report 2017 Mission Statement To connect the world through the most innovative, reliable and secure digital payment network that enables individuals, businesses and economies to thrive. Financial Highlights (GAAP) In millions (except for per share data) FY 2015 FY 2016 FY 2017 Operating revenues $13,880 $15,082 $18,358 Operating expenses $4,816 $7,199 $6,214 Operating income $9,064 $7, 883 $12,144 Net income $6,328 $5,991 $6,699 Stockholders' equity $29,842 $32,912 $32,760 Diluted class A common stock earnings per share $2.58 $2.48 $2.80 Financial Highlights (ADJUSTED)1 In millions (except for per share data) FY 2015 FY 2016 FY 2017 Operating revenues $13,880 $15,082 $18,358 Operating expenses $4,816 $5,060 $6,022 Operating income $9,064 $10,022 $12,336 Net income $6,438 $6,862 $8,335 Diluted class A common stock earnings per share $2.62 $2.84 $3.48 Operational Highlights² 12 months ended September 30 (except where noted) 2015 2016 2017 Total volume, including payments and cash volume³ $7.4 trillion $8.2 trillion $10.2 trillion Payments volume³ $4.9 trillion $5.8 trillion $7.3 trillion Transactions processed on Visa's networks 71.0 billion 83.2 billion 111.2 billion Cards⁴ 2.4 billion 2.5 billion 3.2 billion Stock Performance The accompanying graph and chart compares the cumulative total return on $350 Visa’s common stock with the cumulative total return on Standard & Poor’s 500 Index and the Standard & Poor’s 500 Data Processing Index from September 30, $300 2012 through September 30, 2016. -

Contactless Operating Mode Requirements Clarification Whitepaper

Contactless Operating Mode Requirements Clarification Whitepaper Version 1.0 Publication Date: February 2020 U.S. Payments Forum ©2020 Page 1 About the U.S. Payments Forum The U.S. Payments Forum, formerly the EMV Migration Forum, is a cross-industry body focused on supporting the introduction and implementation of EMV chip and other new and emerging technologies that protect the security of, and enhance opportunities for payment transactions within the United States. The Forum is the only non-profit organization whose membership includes the entire payments ecosystem, ensuring that all stakeholders have the opportunity to coordinate, cooperate on, and have a voice in the future of the U.S. payments industry. Additional information can be found at http://www.uspaymentsforum.org. EMV ® is a registered trademark in the U.S. and other countries and an unregistered trademark elsewhere. The EMV trademark is owned by EMVCo, LLC. Copyright ©2020 U.S. Payments Forum and Smart Card Alliance. All rights reserved. The U.S. Payments Forum has used best efforts to ensure, but cannot guarantee, that the information described in this document is accurate as of the publication date. The U.S. Payments Forum disclaims all warranties as to the accuracy, completeness or adequacy of information in this document. Comments or recommendations for edits or additions to this document should be submitted to: [email protected]. U.S. Payments Forum ©2020 Page 2 Table of Contents 1. Introduction .......................................................................................................................................... 4 2. Contactless Operating Modes ............................................................................................................... 5 2.1 Impact of Contactless Operating Mode on Debit Routing Options .............................................. 6 3. Contactless Issuance Requirements ..................................................................................................... 7 4. -

Press Release Livi Bank Teams up with Unionpay International to “Shake Up

11 August 2020 Press Release livi bank teams up with UnionPay International to “shake up” payments in Hong Kong livi customers to benefit from fun and exclusive ‘Shake Shake’ rewards livi bank and UnionPay International announced today an exciting new partnership which integrates UnionPay QR Payment into livi’s virtual banking app, which will be available for download tomorrow. livi is an easy, rewarding and lifestyle-driven banking experience, delivered through a simple and stylish mobile app. Through the partnership, livi customers can use the banking app’s digital payment function, the widely accepted UnionPay QR Payment, across 40,000 acceptance points in Hong Kong and gain access to lots of special offers at selected merchants. Probably the most exciting way to unlock everyday monetary rewards in Hong Kong During the promotional period, livi customers can get instant monetary rewards to put towards their next purchase by simply shaking their phones after using UnionPay QR Payment on purchases. This fun and innovative “Shake Shake” feature is a first in the banking world in Hong Kong and aims to make shopping that little bit more rewarding. “We’re thrilled to be joining hands with UnionPay International to offer a fun and innovative payment experience for our customers.” said David Sun, Chief Executive of livi. “Our mission is to give people in Hong Kong an everyday boost to their lives, with a banking experience they will enjoy. Our collaboration strives to achieve this by bringing attractive benefits designed around our customers’ everyday needs.” “UnionPay International is honoured to partner with livi to pioneer the very first QR Payment function in virtual banking in Hong Kong, by issuing the first UnionPay virtual debit cards for livi customers. -

Chip Cards and EMV: Coming Soon

What are the benefits? Chip cards and Chip cards offer a more secure way to process card transactions. The secure microchip contains security EMV: coming soon data and software – because it is more difficult to fraudulently copy the details of the card, security is increased. Accepting chip cards therefore helps you reduce the risk of processing a counterfeit, lost or stolen card. And better card security means fewer disputed transactions. ADB3492 110908 We’re here to help You can find more information about EMV at www.commbank.com.au/emv If you have any further queries about EMV, you can email [email protected] or call our Merchant Help Desk on 1800 022 966, 24 hours, Important information about 7 days a week. your EFTPOS terminal inside What is EMV? What do you need to do? EMV (Europay MasterCard Visa) is the global All you need to do is leave your terminal switched ON electronic transaction standard named after the three overnight from 08 October, and we’ll do the rest. organisations that established it. The EMV standard enables EFTPOS terminals worldwide to process chip-based debit and credit cards. How do you know when To meet EMV standards, the Commonwealth Bank the upgrade is complete? is planning upgrades to its EFTPOS terminals so they can process chip cards. Once you swipe a card that has a chip, your EFTPOS Please note that after the upgrade, you will still be able terminal will prompt you to ‘insert card’ rather than to process cards using the magnetic strip, including ‘swipe card’. -

April 2021 the Monthly Newsletter of Covenant Lutheran Church, ELCA

The Promise The People of Covenant are called to: gather, grow and go serve…With God’s Love! April 2021 The Monthly Newsletter of Covenant Lutheran Church, ELCA Inside This Issue 2. Message from Pastor Sara 3. Message from Council President 4. Congregational Life 5. Education 7. Money Matters 8. Memorials Maundy Thursday: Livestream Youtube 9. Health Topics worship. 7pm https://youtu.be/ 11. Blood Drive sIHdrKS8VvE 12. Foundation Scholarships 13. Property News 15. Covenant News 16. Social Justice 17. Thank yous Co mm 18. Contact Information Easter Worship: Livestream Youtube worship. 9:30am https://youtu.be/kZc_3dBCTpE 1 Covenant Lutheran Church, 1525 N. Van Buren St., Stoughton, WI 53589 Message from Pastor Sara Easter always falls on the first Sunday after the first full moon following the spring equinox. “Easter” seems to go back to the name of a pre-Christian goddess in England, Eostre, who was celebrated at beginning of spring and fertility. The only reference to this goddess comes from the writings of the Venerable Bede, a British monk who lived in the late seventh and early eighth century. Christians observed the day of the Crucifixion on the same day that Jews celebrated the Passover offering—that is, on the 14th day of the first full moon of spring. The Resurrection, then, was observed two days later, on 16 Nisan, regardless of the day of the week. In the West the Resurrection of Jesus was celebrated on the first day of the week, Sunday, when Jesus had risen from the dead. Consequently, Easter was always celebrated on the first Sunday. -

EMF Implementing EMV at The

Implementing EMV®at the ATM: Requirements and Recommendations for the U.S. ATM Community Version 2.0 Date: June 2015 Implementing EMV at the ATM: Requirements and Recommendations for the U.S. ATM Community About the EMV Migration Forum The EMV Migration Forum is a cross-industry body focused on supporting the EMV implementation steps required for global and regional payment networks, issuers, processors, merchants, and consumers to help ensure a successful introduction of more secure EMV chip technology in the United States. The focus of the Forum is to address topics that require some level of industry cooperation and/or coordination to migrate successfully to EMV technology in the United States. For more information on the EMV Migration Forum, please visit http://www.emv- connection.com/emv-migration-forum/. EMV is a trademark owned by EMVCo LLC. Copyright ©2015 EMV Migration Forum and Smart Card Alliance. All rights reserved. The EMV Migration Forum has used best efforts to ensure, but cannot guarantee, that the information described in this document is accurate as of the publication date. The EMV Migration Forum disclaims all warranties as to the accuracy, completeness or adequacy of information in this document. Comments or recommendations for edits or additions to this document should be submitted to: ATM- [email protected]. __________________________________________________________________________________ Page 2 Implementing EMV at the ATM: Requirements and Recommendations for the U.S. ATM Community TABLE OF CONTENTS -

Delivery and Regulation of the New Payments Architecture LINK’S Response to the Payment Systems Regulator’S Consultation Paper, February 2021

Delivery and Regulation of the New Payments Architecture LINK’s response to the Payment Systems Regulator’s consultation paper, February 2021 8th March 2021 Contact: John Howells, LINK CEO e-mail: [email protected] Mobile: 07974 326 390 Web: www.link.co.uk Classification: “Public” and available at www.link.co.uk LINK’s Experience of Competitive Infrastructure Tenders 1. On 5 February 2021 the PSR issued a consultation paper on the renewal of the UK’s interbank payment infrastructure. This consultation covers the PSR’s Specific Directions 2 and 3 (SDs). These require Pay.UK to run a competitive procurement for the central infrastructure for Bacs and Faster Payment Service (FPS) respectively. The PSR notes in its consultation paper that “In the light of our conclusions, we will consider whether the directions should be varied, revoked or replaced”. 2. LINK has recently conducted its own competitive tender for its central infrastructure service under a PSR SD (SD4), similar to those now being considered by Pay.UK for Bacs and FPS. LINK is therefore responding because its experience is directly relevant to the PSR’s deliberations. 3. Although the consultation paper poses a number of detailed questions, LINK is providing this single overall response which it believes best summarises its experience. 4. LINK’s recent competitive tender and the resulting Vocalink contract are subject to extensive commercial confidentiality constraints. Therefore, it is not possible to include commercial details in this public document. However, all the key points are set out. The PSR has already been provided with great detail relating to these events in its role as one of LINK’s regulators and therefore has access to other evidence. -

ANNUAL REPORT Hon

PRESIDENT EXECUTIVE DIRECTOR Margaret MacPherson Terri Ross FIRST VICE PRESIDENT DIRECTOR OF FISCAL SERVICES Hon. Raymond J. Irrera Bonnie Ng VICE PRESIDENTS DIRECTOR OF CHILDREN’S SERVICES Nancy Glass Joseph A. Cristiano, Esq. ANNUAL REPORT Hon. David Elliot DIRECTOR OF ADULT SERVICES Hon. Tarek M. Zeid Edward T. Weiss 2019-20 ACTIVE PAST PRESIDENTS DIRECTOR OF RESIDENTIAL SERVICES Hon. George E. Berger Stacy Accardi John J. Governale Ending 6/30/2020 DIRECTOR OF CLINICAL SERVICES Michael J. Macaluso Marisa Fojas, LCSW Hon. Natalie Rogers Jack M. Weinstein, Esq. DIRECTOR OF DEVELOPMENT Wendy Phaff Gennaro SECRETARY DIRECTOR OF HUMAN RESOURCES Patricia Coulaz Harriet L. Perry TREASURER DIRECTOR OF BELLEROSE DAY SERVICES Thomas N. Toscano, Esq. Geraldine Feretic BOARD OF DIRECTORS DIRECTOR OF 164TH ST. DAY SERVICES Gerald J. Caliendo Josie Davide Raymond Chan Anthony S. Cosentino DIRECTOR OF VOCATIONAL SERVICES Kate Valli Franz Gritsch Hon. James Kilkenny DIRECTOR OF QUALITY IMPROVEMENT & William D. Martin SYSTEMS INTEGRATION Nancy Vargas Ellen J. Arocho DIRECTOR OF INFORMATION TECHNOLOGY Syed Asif QCP Adult Center QCP Bellerose Center QCP Children's Center 81-15 164th Street 249-16 Grand 82-25 164th Street 81-15 164 Street, Jamaica NY 11432 Jamaica, NY 11432 Central Parkway Jamaica, NY 11432 Bellerose, NY 11426 Telephone: (718) 380-3000 Tel. 718-380-3000 Tel. 718-279-9404 Tel. 718-374-0002 Visit our website: www.queenscp.org Fax 718-380-0483 Fax 718-423-1404 Fax 718-380-3214 Like us on Facebook: Facebook.com/QueensCP A MESSAGE FROM THE EXECUTIVE DIRECTOR And BOARD PRESIDENT SERVICES Our lives changed in mid-March 2020. -

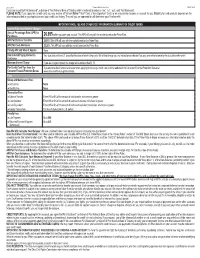

How We Will Calculate Your Balance:We Use a Method Called “Average Daily Balance (Including New Purchases)”. Index and When

232 - 121144 Platinum Edition® Visa® Card T-GULF-2005 Cards are issued by First Bankcard®, a division of First National Bank of Omaha, which is referred to below as “we”, “us”, “our”, and “First Bankcard”. PLEASE NOTE: If you apply for a credit card, you may receive a Platinum Edition® Visa® Card, a Visa Signature® Card, or we may decline to open an account for you. Eligibility for card products depends on the information provided in your application and your credit card history. The card you are approved for will determine your Visa benefits. IMPORTANT RATE, FEE AND OTHER COST INFORMATION (SUMMARY OF CREDIT TERMS) Interest Rates and Interest Charges Annual Percentage Rate (APR) for Purchases 26.99% when you open your account. This APR will vary with the market based on the Prime Rate. APR for Balance Transfers 26.99% This APR will vary with the market based on the Prime Rate. APR for Cash Advances 25.24%. This APR will vary with the market based on the Prime Rate. Penalty APR and When it Applies None How to Avoid Paying Interest on Your due date is at least 21 days after the close of each billing cycle. We will not charge you any interest on purchases if you pay your entire balance by the due date each month.1 Purchases Minimum Interest Charge If you are charged interest, the charge will be no less than $1.75. For Credit Card Tips from the To learn more about factors to consider when applying for or using a credit card, visit the website of the Consumer Financial Protection Bureau at Consumer Financial Protection Bureau www.consumerfinance.gov/learnmore.