Display Winds of Change in the Touchscreen Industry

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download Exceeds 5 Million People - Established Game Duck, a Subsidiary for Game Play Storage and Sharing Service

1 Research on Promoting SMEs’ Participation in Global Value Chains – ICT/Electronic Industry Table of Contents Executive Summary ..................................................................................................................................1 1. Overview.................................................................................................................................................3 1.1. Background and Purpose .................................................................................................. 3 1.2. Scope of Study .................................................................................................................. 4 2. Concept of GVC and SMEs’ Participation in GVC .......................................................................5 2.1. Concept of GVC and SMEs’ Participation ....................................................................... 5 2.1.1. Concept and Significance of GVC ........................................................................ 5 2.1.2. Review of Precedent Studies on GVC ................................................................ 15 2.1.3. Patterns and Types of GVC Structure ................................................................. 17 2.1.4. Significance of SMEs’ Participation in GVC ..................................................... 22 2.2. Changes and Development of GVC Structure ................................................................ 25 2.2.1. Outlook of GVC Structure Changes .................................................................. -

Better Future

AN E VENT OF Cr eating a Be tter Future 2018 www.mobileworldcongress.com REPORT CONTENTS CONTENTS Mobile World Congress 2018 Creating a Better Future 1. Introduction 4 2. Results 6 3. Attendees 8 4. Conference 14 5. Exhibition 20 6. MWC Programmes 24 7. Event Highlights 26 8. Press Highlights 28 9. Sponsors and Partners 30 3 INTrOduCTION INTRODUCTION Widely considered the mobile industry’s “must-attend” annual event, the GSMA Mobile World Congress attracts executives from the world’s most influential mobile operators, device makers, infrastructure providers, software companies, internet companies and organisations across a wide range of vertical industry sectors, as well as government delegations from across the globe. Mobile World Congress includes an industry-leading conference with C-level speakers from around the world; an exhibition showcasing innovative mobile technologies, products and services; a government and ministerial programme; partner events and programmes; free seminars and many other activities. With more than 5 billion subscribers, mobile now connects over two-thirds of the world’s population. It is fuelling innovation, revolutionising industries and spurring exciting new opportunities, across developed and developing markets. Underscoring our industry’s commitment to the United Nations Sustainable Development Goals, mobile is providing lifelines to hope, reducing inequalities, preserving our world’s resources and changing lives. Throughout the conference, across the exhibition, and in the many partner programmes, events -

FTSE Global All Cap Ex Canada China a Inclusion

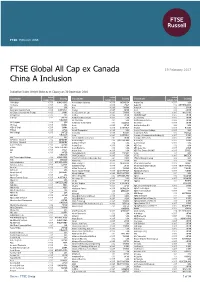

FTSE PUBLICATIONS FTSE Global All Cap ex Canada 19 February 2017 China A Inclusion Indicative Index Weight Data as at Closing on 30 December 2016 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 13 Holdings <0.005 HONG KONG Ace Hardware Indonesia <0.005 INDONESIA Aegion Corp. <0.005 USA 1st Source <0.005 USA Acea <0.005 ITALY Aegon NV 0.02 NETHERLANDS 2U <0.005 USA Acer <0.005 TAIWAN Aena S.A. 0.02 SPAIN 360 Capital Industrial Fund <0.005 AUSTRALIA Acerinox <0.005 SPAIN Aeon 0.02 JAPAN 361 Degrees International (P Chip) <0.005 CHINA Aces Electronic Co. Ltd. <0.005 TAIWAN Aeon (M) <0.005 MALAYSIA 3-D Systems <0.005 USA Achilles <0.005 JAPAN AEON DELIGHT <0.005 JAPAN 3i Group 0.02 UNITED Achillion Pharmaceuticals <0.005 USA Aeon Fantasy <0.005 JAPAN KINGDOM ACI Worldwide 0.01 USA AEON Financial Service <0.005 JAPAN 3M Company 0.26 USA Ackermans & Van Haaren 0.01 BELGIUM Aeon Mall <0.005 JAPAN 3S Korea <0.005 KOREA Acom <0.005 JAPAN AerCap Holdings N.V. 0.02 USA 3SBio (P Chip) <0.005 CHINA Aconex <0.005 AUSTRALIA Aeroflot <0.005 RUSSIA 77 Bank <0.005 JAPAN Acorda Therapeutics <0.005 USA Aerojet Rocketdyne Holdings <0.005 USA 888 Holdings <0.005 UNITED Acron JSC <0.005 RUSSIA Aeroports de Paris 0.01 FRANCE KINGDOM Acrux <0.005 AUSTRALIA Aerospace Communications Holdings (A) <0.005 CHINA 8x8 <0.005 USA ACS Actividades Cons y Serv 0.01 SPAIN Aerospace Hi-Tech (A) <0.005 CHINA A P Moller - Maersk A 0.02 DENMARK Actelion Hldg N 0.05 SWITZERLAND Aerosun (A) <0.005 CHINA A P Moller - Maersk B 0.02 DENMARK Activision Blizzard 0.06 USA AeroVironment <0.005 USA A.G.V. -

Company Vendor ID (Decimal Format) (AVL) Ditest Fahrzeugdiagnose Gmbh 4621 @Pos.Com 3765 0XF8 Limited 10737 1MORE INC

Vendor ID Company (Decimal Format) (AVL) DiTEST Fahrzeugdiagnose GmbH 4621 @pos.com 3765 0XF8 Limited 10737 1MORE INC. 12048 360fly, Inc. 11161 3C TEK CORP. 9397 3D Imaging & Simulations Corp. (3DISC) 11190 3D Systems Corporation 10632 3DRUDDER 11770 3eYamaichi Electronics Co., Ltd. 8709 3M Cogent, Inc. 7717 3M Scott 8463 3T B.V. 11721 4iiii Innovations Inc. 10009 4Links Limited 10728 4MOD Technology 10244 64seconds, Inc. 12215 77 Elektronika Kft. 11175 89 North, Inc. 12070 Shenzhen 8Bitdo Tech Co., Ltd. 11720 90meter Solutions, Inc. 12086 A‐FOUR TECH CO., LTD. 2522 A‐One Co., Ltd. 10116 A‐Tec Subsystem, Inc. 2164 A‐VEKT K.K. 11459 A. Eberle GmbH & Co. KG 6910 a.tron3d GmbH 9965 A&T Corporation 11849 Aaronia AG 12146 abatec group AG 10371 ABB India Limited 11250 ABILITY ENTERPRISE CO., LTD. 5145 Abionic SA 12412 AbleNet Inc. 8262 Ableton AG 10626 ABOV Semiconductor Co., Ltd. 6697 Absolute USA 10972 AcBel Polytech Inc. 12335 Access Network Technology Limited 10568 ACCUCOMM, INC. 10219 Accumetrics Associates, Inc. 10392 Accusys, Inc. 5055 Ace Karaoke Corp. 8799 ACELLA 8758 Acer, Inc. 1282 Aces Electronics Co., Ltd. 7347 Aclima Inc. 10273 ACON, Advanced‐Connectek, Inc. 1314 Acoustic Arc Technology Holding Limited 12353 ACR Braendli & Voegeli AG 11152 Acromag Inc. 9855 Acroname Inc. 9471 Action Industries (M) SDN BHD 11715 Action Star Technology Co., Ltd. 2101 Actions Microelectronics Co., Ltd. 7649 Actions Semiconductor Co., Ltd. 4310 Active Mind Technology 10505 Qorvo, Inc 11744 Activision 5168 Acute Technology Inc. 10876 Adam Tech 5437 Adapt‐IP Company 10990 Adaptertek Technology Co., Ltd. 11329 ADATA Technology Co., Ltd. -

Company Overview Valuation Data Source

Valuation Data Source company overview No. Company No. Company No. Company "Bank "Saint-Petersburg" Public 60 AbClon Inc. 117 Activision Blizzard, Inc. 1 Joint-Stock Company Abdullah Al-Othaim Markets 118 Actron Technology Corporation 61 2 1&1 Drillisch AG Company 119 Actuant Corporation 3 1-800-FLOWERS.COM, Inc. Abdulmohsen Al-Hokair Group for 120 Acuity Brands, Inc. 62 4 11 bit studios S.A. Tourism and Development Company 121 Acushnet Holdings Corp. 5 1st Constitution Bancorp 63 Abengoa, S.A. 122 Ad-Sol Nissin Corporation 6 1st Source Corporation 64 Abeona Therapeutics Inc. 123 Adairs Limited 7 21Vianet Group, Inc. 65 Abercrombie & Fitch Co. 124 ADAMA Ltd. 8 22nd Century Group, Inc. 66 Ability Enterprise Co., Ltd. 125 Adamas Pharmaceuticals, Inc. Ability Opto-Electronics Technology 126 Adamis Pharmaceuticals Corporation 9 2U, Inc. 67 Co.,Ltd. 127 Adani Enterprises Limited 10 3-D Matrix, Ltd. 68 Abiomed, Inc. 128 Adani Gas Limited 11 361 Degrees International Limited 69 ABIST Co.,Ltd. 129 Adani Green Energy Limited 12 3D Systems Corporation 70 ABL Bio Inc. Adani Ports and Special Economic 13 3i Group plc 130 71 Able C&C Co., Ltd. Zone Limited 14 3M Company 131 Adani Power Limited 72 ABM Industries Incorporated 15 3M India Limited 132 Adani Transmissions Limited 73 ABN AMRO Bank N.V. 16 3S KOREA Co., Ltd. 133 Adaptimmune Therapeutics plc 74 Aboitiz Equity Ventures, Inc. 17 3SBio Inc. 134 Adastria Co., Ltd. 75 Aboitiz Power Corporation 18 500.com Limited 135 ADATA Technology Co., Ltd. 76 Abraxas Petroleum Corporation 19 51 Credit Card Inc. -

BTP (Biometric Trackpad) Company Business Finance Appendix

First Mover Leading Total Input Solution (*As of May. 31, 2017) 1 Crucialtec (114120 KOSDAQ) - Quick Note The Only One-stop Fingerprint Solution Provider _ PKG & Coating, Algorithm, IC Company & Fingerprint Solution One-stop Solution Provider First Mover Advantage Crucialtec Global market leader BTP Adopted Major • The Only One-stop Fingerprint Solution Provider • One-stop Fingerprint Solution (PKG & Coating, Algo, IC) • 17 Customers / Around 89 Models • Supplied BTP to global major smartphone vendors as below, • 300 M units of OTP(Optical Trackpad) and 100M units of - LG, Huawei, Google, Fujitsu, OPPO, Meizu, Vivo, Sony…etc. BTP mass production experience with Global Handset - Many projects with various vendors beside above in process makers Possession of 400 intellectual properties Packaging, Coating G6 (Feb’17) Pixel (Oct’16) NOVA (Sep’16) BTP(Biometric TrackPad) : Mobile Fingerprint Solution - High Recognition, Customized Design for Customer - Coating (Material/Thickness/Hardness/Esthetics) - Various Materials (Tempered Glass, Ceramic, UV) Xperia XZ (Feb’ 17) MOTO Z Play(Sep’16) M6,M6+(Sep’16) Algorithm BTP Customers (17 Customers) - Algorithm for ultra small area size - Fast and accurate authentication with Low CPU Fingerprint Solution - Over 10 million algorithm supply experience ★ Better Security & Convenience China Korea USA IC XIAOMI - Create optimized solutions (PKG, Coating, Algo, IC) Japan by IC characteristics > - Under co-developing with IC suppliers at our IC Lab Taiwan - Launched co-developed IC with IDEX in 2Q, Plan -

Mobile & Wearable Biometrics Market Intelligence Forty Second Edition

Mobile & Wearable Biometrics Market Intelligence Forty Second Edition July 2017 Forty Second Edition July 2017 The views expressed in this report are not necessarily those of the © Goode Intelligence publisher. Whilst information, advice or comment is believed to be All Rights Reserved correct at time of publication, the publisher cannot accept any responsibility for its completeness or accuracy. Accordingly, the publisher, author, or distributor shall not be liable to any person or Published by: entity with respect to any loss or damage caused or alleged to be Goode Intelligence caused directly or indirectly by what is contained in or left out of United Kingdom this publication. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electrical, mechanical, photocopying and recording without www.goodeintelligence.com the written permission of Goode Intelligence. [email protected] Goode Intelligence Mobile & Wearable Biometrics Market Intelligence – Edition 42: July 2017 Table of Contents Industry Adoption ...................................................................................................................................... 3 Sport...................................................................................................................................................... 3 Banking and Finance ............................................................................................................................. 3 Mastercard -

Stoxx® Global Total Market Index

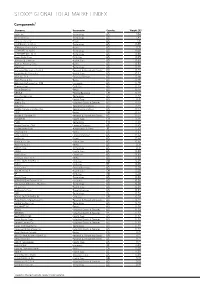

STOXX® GLOBAL TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) Apple Inc. Technology US 1.84 Microsoft Corp. Technology US 1.47 Amazon.com Inc. Retail US 1.31 FACEBOOK CLASS A Technology US 0.89 JPMorgan Chase & Co. Banks US 0.71 ALPHABET CLASS C Technology US 0.68 ALPHABET INC. CL A Technology US 0.66 Exxon Mobil Corp. Oil & Gas US 0.65 Johnson & Johnson Health Care US 0.63 Bank of America Corp. Banks US 0.53 Intel Corp. Technology US 0.49 Samsung Electronics Co Ltd Personal & Household Goods KR 0.49 UnitedHealth Group Inc. Health Care US 0.47 VISA Inc. Cl A Financial Services US 0.46 Wells Fargo & Co. Banks US 0.46 Berkshire Hathaway Inc. Cl B Insurance US 0.46 Chevron Corp. Oil & Gas US 0.45 Home Depot Inc. Retail US 0.44 NESTLE Food & Beverage CH 0.44 Cisco Systems Inc. Technology US 0.42 Pfizer Inc. Health Care US 0.41 Boeing Co. Industrial Goods & Services US 0.40 AT&T Inc. Telecommunications US 0.39 Verizon Communications Inc. Telecommunications US 0.37 HSBC Banks GB 0.37 Procter & Gamble Co. Personal & Household Goods US 0.37 NOVARTIS Health Care CH 0.36 TSMC Technology TW 0.35 MasterCard Inc. Cl A Financial Services US 0.35 Toyota Motor Corp. Automobiles & Parts JP 0.35 Citigroup Inc. Banks US 0.33 Coca-Cola Co. Food & Beverage US 0.32 Netflix Inc. Retail US 0.32 Merck & Co. Inc. Health Care US 0.32 Walt Disney Co. Media US 0.31 NVIDIA Corp. -

Crucialtec (114120 KS) Crucialt Ec

Korea Information Technology 15 February 2016 CrucialTec (114120 KS) CrucialT ec Target price: KRW24,000 Share price (15 Feb): KRW12,250 | Up/downside: +95.9% Initiation: a turnaround at its fingertips Benefiting from strong demand/tight supply for fingerprint sensors Kevin Jin (82) 2 787 9168 Entry of new competitors should be limited, at least in 2016 [email protected] Initiating with a Buy (1) rating and TP of KRW24,000; rerating likely Investment case: We see CrucialTec as an earnings recovery play for Share price performance 2016, following a switch in its business model at end-2013 which saw it (KRW) (%) move from being solely an optical trackpad (OTP) supplier for Blackberry to 17,000 190 becoming a fingerprint sensor (FPS) module supplier for some of China’s 15,000 165 leading smartphone makers (eg, Huawei, Meizu and OPPO Electronics). 13,000 140 11,000 115 Given the rising demand for FPS modules globally, we forecast the FPS 9,000 90 penetration rate among the top-10 China smartphone brands to rise from Feb-15 May-15 Aug-15 Nov-15 14-15% for 2015 to 30-35% for 2016, which would lead to tight supply and CrucialTec (LHS) Relative to KOSPI (RHS) strong demand for FPS modules in 2H16, pushing CrucialTec’s utilisation rate to close to 100% by the end of 2016, on our estimates. It should also 12-month range 9,190-17,000 result in a 4,591% rise in CrucialTec’s net profit, as the company is one of 2 Market cap (USDbn) 0.28 global leaders in this hard-to-enter segment of the smartphone value chain. -

Stoxx® Emerging Markets Total Market Index

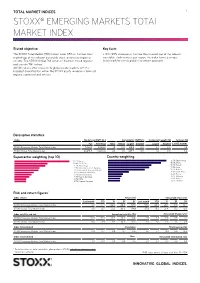

TOTAL MARKET INDICES 1 STOXX® EMERGING MARKETS TOTAL MARKET INDEX Stated objective Key facts The STOXX Total Market (TMI) Indices cover 95% of the free-float » With 95% coverage of the free-float market cap of the relevant market cap of the relevant investable stock universe by region or investable stock universe per region, the index forms a unique country. The STOXX Global TMI serves as the basis for all regional benchmark for a truly global investment approach and country TMI indices. All TMI indices offer exposure to global equity markets with the broadest diversification within the STOXX equity universe in terms of regions, currencies and sectors. Descriptive statistics Index Market cap (EUR bn.) Components (EUR bn.) Component weight (%) Turnover (%) Full Free-float Mean Median Largest Smallest Largest Smallest Last 12 months STOXX Emerging Markets Total Market Index 7,432.2 4,066.4 1.5 0.4 125.8 0.0 3.1 0.0 11.5 STOXX Global Total Market Index 41,428.5 33,610.4 4.6 1.0 469.2 0.0 1.4 0.0 3.4 Supersector weighting (top 10) Country weighting Risk and return figures1 Index returns Return (%) Annualized return (%) Last month YTD 1Y 3Y 5Y Last month YTD 1Y 3Y 5Y STOXX Emerging Markets Total Market Index 3.9 17.4 22.6 26.6 68.6 58.0 26.5 22.1 8.0 10.7 STOXX Global Total Market Index 3.9 12.7 21.8 63.3 94.6 57.6 19.2 21.4 17.3 13.9 Index volatility and risk Annualized volatility (%) Annualized Sharpe ratio2 STOXX Emerging Markets Total Market Index 10.9 10.4 10.4 13.2 13.9 2.8 2.3 2.0 0.6 0.7 STOXX Global Total Market Index 9.0 8.9 8.4 10.4 15.6 3.0 2.0 2.3 1.5 0.8 Index to benchmark Correlation Tracking error (%) STOXX Emerging Markets Total Market Index 0.9 0.7 0.6 0.7 0.5 5.7 7.7 8.3 9.5 14.3 Index to benchmark Beta Annualized information ratio STOXX Emerging Markets Total Market Index 1.0 0.8 0.8 0.9 0.5 0.7 0.7 0.2 -0.9 -0.3 1 For information on data calculation, please refer to STOXX calculation reference guide. -

Company Vendor ID (Decimal Format) (AVL)

Vendor ID Company (Decimal Format) (AVL) DiTEST Fahrzeugdiagnose GmbH 4621 @pos.com 3765 01dB-Stell 3151 0XF8 Limited 10737 103mm Tech 8168 1064138 Ontario Ltd. O/A UNI-TEC ELECTRONICS 8219 11 WAVE TECHNOLOGY, INC. 4375 1417188 Ontario Ltd. 4835 1C Company 5288 1MORE INC. 12048 2D Debus & Diebold Messsysteme GmbH 8539 2L international B.V. 4048 2N TELEKOMUNIKACE a.s. 7303 2-Tel B.V. 2110 2WCOM GmbH 7343 2Wire, Inc 2248 360 Electrical, LLC 12686 360 Service Agency GmbH 12930 360fly, Inc. 11161 3Brain GmbH 9818 3C TEK CORP. 9397 3Cam Technology, Inc 1928 3Com Corporation 1286 3D CONNEXION SAM 9583 3D Imaging & Simulations Corp. (3DISC) 11190 3D INNOVATIONS, LLC 7907 3D Robotics Inc. 9900 3D Systems Corporation 10632 3D Technologies Ltd 12655 3DM Devices Inc 2982 3DRUDDER 11770 3DSP 7513 3DV Systems Ltd. 6963 3eYamaichi Electronics Co., Ltd. 8709 3i Corporation 9806 3i techs Development Corp 4263 3layer Engineering 7123 3M Canada 2200 3M CMD (Communication Markets Division) 7723 3M Cogent, Inc. 7717 3M Germany 2597 3M Home Health Systems 2166 3M Library Systems 3372 3M Scott 8463 3M Touch Systems 1430 3Pea Technologies, Inc. 3637 3Shape A/S 6303 3T B.V. 11721 4G Systems GmbH 6485 4iiii Innovations Inc. 10009 4Links Limited 10728 4MOD Technology 10244 64seconds, Inc. 12215 77 Elektronika Kft. 11175 8086 Consultancy 12657 89 North, Inc. 12070 8D TECHNOLOGIES INC. 8845 8devices 9599 90meter Solutions, Inc. 12086 A & G Souzioni Digitali 4757 A & R Cambridge Ltd. 9668 A C S Co., Ltd. 9454 A Global Partner Corporation 3689 A W Electronics, Inc. -

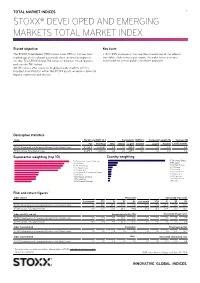

Stoxx® Developed and Emerging Markets Total Market Index

TOTAL MARKET INDICES 1 STOXX® DEVELOPED AND EMERGING MARKETS TOTAL MARKET INDEX Stated objective Key facts The STOXX Total Market (TMI) Indices cover 95% of the free-float » With 95% coverage of the free-float market cap of the relevant market cap of the relevant investable stock universe by region or investable stock universe per region, the index forms a unique country. The STOXX Global TMI serves as the basis for all regional benchmark for a truly global investment approach and country TMI indices. All TMI indices offer exposure to global equity markets with the broadest diversification within the STOXX equity universe in terms of regions, currencies and sectors. Descriptive statistics Index Market cap (EUR bn.) Components (EUR bn.) Component weight (%) Turnover (%) Full Free-float Mean Median Largest Smallest Largest Smallest Last 12 months STOXX Developed and Emerging Markets Total Market Index 41,234.4 33,535.7 4.8 1.0 469.2 0.0 1.4 0.0 3.4 STOXX Global Total Market Index 41,428.5 33,610.4 4.6 1.0 469.2 0.0 1.4 0.0 3.4 Supersector weighting (top 10) Country weighting Risk and return figures1 Index returns Return (%) Annualized return (%) Last month YTD 1Y 3Y 5Y Last month YTD 1Y 3Y 5Y STOXX Developed and Emerging Markets Total Market Index 3.9 12.7 21.9 64.1 0.0 57.5 19.2 21.4 17.5 0.0 STOXX Global Total Market Index 3.9 12.7 21.8 63.3 94.6 57.6 19.2 21.4 17.3 13.9 Index volatility and risk Annualized volatility (%) Annualized Sharpe ratio2 STOXX Developed and Emerging Markets Total Market Index 9.0 8.9 8.4 10.5 0.0 3.0 2.0 2.3 1.6 0.9 STOXX Global Total Market Index 9.0 8.9 8.4 10.4 15.6 3.0 2.0 2.3 1.5 0.8 Index to benchmark Correlation Tracking error (%) STOXX Developed and Emerging Markets Total Market Index 1.0 1.0 1.0 1.0 1.0 0.1 0.1 0.1 0.4 0.4 Index to benchmark Beta Annualized information ratio STOXX Developed and Emerging Markets Total Market Index 1.0 1.0 1.0 1.0 1.0 -0.2 -0.1 0.1 0.5 0.6 1 For information on data calculation, please refer to STOXX calculation reference guide.