Crucialtec (114120 KS) Crucialt Ec

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Extending the Leadership Position in 2016 Disclaimer Slide

Fingerprint Cards Investor Update Extending the leadership position in 2016 Disclaimer slide FORWARD‐LOOKING STATEMENTS This presentation contains forward‐looking statements with words such as “believes”, “anticipates”, “outlook”, “confident”, “meeting” and “expects” about expected revenues and earnings, anticipated demand for fingerprint sensors and internal estimates. These forward‐looking statements involve a number of unknown risks, uncertainties and other factors that could cause actual results to differ materially. Unknown risks, uncertainties and other factors are discussed in the “risk report‟ section of Fingerprint Cards’ Annual Report 2014 and in the Interim Reports. Extending the leadership position in 2016 • A global technology and market leader − Jörgen Lantto, President and CEO • The market leader in fingerprint sensors − Thomas Rex, EVP Sales and Marketing • Strong know‐how and leading technology − Pontus Jägemalm, SVP Research and Development • Questions and Answers • Coffee break • Executing on growth − Johan Wilsby, CFO −Jörgen Lantto, CEO • Questions and Answers A global technology and market leader Jörgen Lantto, President and CEO A global technology and market leader • The world’s no 1 fingerprint sensor supplier* • Extensive experience in fingerprint sensor technology • A highly scalable business model • Strongly exposed to the rapidly growing market for integrated fingerprint sensors in smartphones and other devices * Cowen analysis Nov 16, 2015 2015 – a year of strong growth • FPC revenue growth >1000% • A major -

I PRESS RELEASE – April 29, 2016 I

I PRESS RELEASE – April 29, 2016 I New sound processing for Nextbit Robin front stereo speakers phone with ARKAMYS! Nextbit Nextbit launches Robin a cloud based & stereo facing speakers smartphone with ARKAMYS audio system embedded As a leading audio expert in sound enhancement for more than 15 years, ARKAMYS creates innovative audio solutions that deliver enhanced listening comfort to this new connected smartphone made by Nextbit April 27, 2016, ARKAMYS is proud to announce its sound optimization solution OptimSpeaker embedded in Nextbit Robin cloud based smartphone. Nextbit, a young company coming out Google and raising a Kickstarter campaign to develop its new technologies, releases its latest smartphone Robin, a designing intelligent devices that get smarter every day, with a new sound processing. Nextbit chose ARKAMYS as their audio expert partner to offer to their customers ARKAMYS OptimSpeaker audio solution embedded in 20 million audio devices. Robin is designed to stand out. It’s simple and distinct in form and function: every port, button, two front- facing speakers and sensor is thoughtfully placed and easy to use. Everything about the design is carefully planned to create harmony and balance and to enhance the audio experience of the listeners. This software solution enlarges the multimedia audio streams performance on the speakers and on the headphones by optimizing the audio rendering. ARKAMYS’ solution guarantee a unique clarity feeling by reaching loud and dynamic sounds. The audio solution has been designed to fit with any type of music track with a specific focus of keeping the original timber of the song. ARKAMYS Golden Ears experts have tuned to supply the overall quality of the device with professional method based on objective & and subjective criteria. -

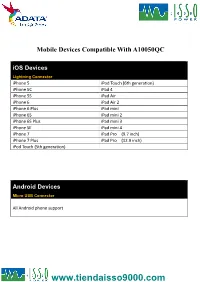

Android Devices

Mobile Devices Compatible With A10050QC iOS Devices Lightning Connector iPhone 5 iPod Touch (6th generation) iPhone 5C iPad 4 iPhone 5S iPad Air iPhone 6 iPad Air 2 iPhone 6 Plus iPad mini iPhone 6S iPad mini 2 iPhone 6S Plus iPad mini 3 iPhone SE iPad mini 4 iPhone 7 iPad Pro (9.7 inch) iPhone 7 Plus iPad Pro (12.9 inch) iPod Touch (5th generation) Android Devices Micro USB Connector All Android phone support Smartphone With Quick Charge 3.0 Technology Type-C Connector Asus ZenFone 3 LG V20 TCL Idol 4S Asus ZenFone 3 Deluxe NuAns NEO VIVO Xplay6 Asus ZenFone 3 Ultra Nubia Z11 Max Wiley Fox Swift 2 Alcatel Idol 4 Nubia Z11miniS Xiaomi Mi 5 Alcatel Idol 4S Nubia Z11 Xiaomi Mi 5s General Mobile GM5+ Qiku Q5 Xiaomi Mi 5s Plus HP Elite x3 Qiku Q5 Plus Xiaomi Mi Note 2 LeEco Le MAX 2 Smartisan M1 Xiaomi MIX LeEco (LeTV) Le MAX Pro Smartisan M1L ZTE Axon 7 Max LeEco Le Pro 3 Sony Xperia XZ ZTE Axon 7 Lenovo ZUK Z2 Pro TCL Idol 4-Pro Smartphone With Quick Charge 3.0 Technology Micro USB Connector HTC One A9 Vodafone Smart platinum 7 Qiku N45 Wiley Fox Swift Sugar F7 Xiaomi Mi Max Compatible With Quick Charge 3.0 Technology Micro USB Connector Asus Zenfone 2 New Moto X by Motorola Sony Xperia Z4 BlackBerry Priv Nextbit Robin Sony Xperia Z4 Tablet Disney Mobile on docomo Panasonic CM-1 Sony Xperia Z5 Droid Turbo by Motorola Ramos Mos1 Sony Xperia Z5 Compact Eben 8848 Samsung Galaxy A8 Sony Xperia Z5 Premium (KDDI Japan) EE 4GEE WiFi (MiFi) Samsung Galaxy Note 4 Vertu Signature Touch Fujitsu Arrows Samsung Galaxy Note 5 Vestel Venus V3 5070 Fujitsu -

Download Exceeds 5 Million People - Established Game Duck, a Subsidiary for Game Play Storage and Sharing Service

1 Research on Promoting SMEs’ Participation in Global Value Chains – ICT/Electronic Industry Table of Contents Executive Summary ..................................................................................................................................1 1. Overview.................................................................................................................................................3 1.1. Background and Purpose .................................................................................................. 3 1.2. Scope of Study .................................................................................................................. 4 2. Concept of GVC and SMEs’ Participation in GVC .......................................................................5 2.1. Concept of GVC and SMEs’ Participation ....................................................................... 5 2.1.1. Concept and Significance of GVC ........................................................................ 5 2.1.2. Review of Precedent Studies on GVC ................................................................ 15 2.1.3. Patterns and Types of GVC Structure ................................................................. 17 2.1.4. Significance of SMEs’ Participation in GVC ..................................................... 22 2.2. Changes and Development of GVC Structure ................................................................ 25 2.2.1. Outlook of GVC Structure Changes .................................................................. -

Better Future

AN E VENT OF Cr eating a Be tter Future 2018 www.mobileworldcongress.com REPORT CONTENTS CONTENTS Mobile World Congress 2018 Creating a Better Future 1. Introduction 4 2. Results 6 3. Attendees 8 4. Conference 14 5. Exhibition 20 6. MWC Programmes 24 7. Event Highlights 26 8. Press Highlights 28 9. Sponsors and Partners 30 3 INTrOduCTION INTRODUCTION Widely considered the mobile industry’s “must-attend” annual event, the GSMA Mobile World Congress attracts executives from the world’s most influential mobile operators, device makers, infrastructure providers, software companies, internet companies and organisations across a wide range of vertical industry sectors, as well as government delegations from across the globe. Mobile World Congress includes an industry-leading conference with C-level speakers from around the world; an exhibition showcasing innovative mobile technologies, products and services; a government and ministerial programme; partner events and programmes; free seminars and many other activities. With more than 5 billion subscribers, mobile now connects over two-thirds of the world’s population. It is fuelling innovation, revolutionising industries and spurring exciting new opportunities, across developed and developing markets. Underscoring our industry’s commitment to the United Nations Sustainable Development Goals, mobile is providing lifelines to hope, reducing inequalities, preserving our world’s resources and changing lives. Throughout the conference, across the exhibition, and in the many partner programmes, events -

Napájecí Adaptér Patona Usb-C 29W

HASO COMPUTER s.r.o. (eshop.haso.cz) 24.09.21 17:37:49 [email protected] 311 637 577 NAPÁJECÍ ADAPTÉR PATONA USB-C 29W Cena celkem: 703 Kč (bez DPH: 581 Kč) Běžná cena: 773 Kč Ušetříte: 70 Kč Kód zboží: ADAPAT0040 Part No.: PT2572 Záruka: 24 měsíce (ů) Stav: Nové zboží Popis PATONA USB-C 29 W Univerzální napájecí adaptér PATONA s výkonem 29 W pro tablety a smartphony. ZÁKLADNÍ SPECIFIKACE Konektor: USB typ C Vstupní napětí: 100 - 240 V Výstupní napětí: 5 V/3 A, 9 V/3 A, 15 V/2 A, 20 V/1,45 A Výkon: 29 W Barva: bílá Kompatibilní zařízení: ACER Liquid Jade Primo Alcatel A50, Flash, Idol 4 Pro, Idol 4S Windows, Idol 5S Allview P8 Energy Pro, V2 Viper X+, X3 Soul, X3 Soul Plus, X3 Soul Pro, X4 Soul, X4 Soul Lite, X4 Soul Style, X4 Xtreme Apple Macbook 12" (Early 2015), Macbook 12" (Early 2016), Apple Macbook Pro 13" (Late 2016), Macbook Pro 15" (Late 2016) Archos 50 Graphite, Diamond 2 Plus, Diamond Alpha+, Diamond Omega, Sense 55DC Asus ZenFone 3 (ZE520KL), ZenFone 3 (ZE552KL), ZenFone 3 Deluxe (ZS550KL), ZenFone 3 Deluxe (ZS570KL), ZenFone 3 Max (ZC520TL), ZenFone 3 Max (ZC553KL), ZenFone 4, ZenFone 4 Pro, ZenFone AR, ZenFone Zoom S Blackberry DTEK60, KEYone, KEYone Black Edition, BV8000 Pro, P6 Blu Vivo 5 Bluboo S8 BQ Aquaris X, Aquaris X Pro Coolpad Cool S1 Crosscall Trekker X3 Elephone P9000, P9000 Lite 4G Energizer Powermax P600S Essential Essential General Mobile GM 5 Plus Gigaset ME, ME Pro, ME Pure Google Nexus 5 (2015), Nexus 6 (2015), Nexus 5X, Nexus 6P, ChromeBook Pixel (2015), Pixel, Pixel 2, Pixel 2 XL, Pixel XL GoPro Hero -

Electronic 3D Models Catalogue (On July 26, 2019)

Electronic 3D models Catalogue (on July 26, 2019) Acer 001 Acer Iconia Tab A510 002 Acer Liquid Z5 003 Acer Liquid S2 Red 004 Acer Liquid S2 Black 005 Acer Iconia Tab A3 White 006 Acer Iconia Tab A1-810 White 007 Acer Iconia W4 008 Acer Liquid E3 Black 009 Acer Liquid E3 Silver 010 Acer Iconia B1-720 Iron Gray 011 Acer Iconia B1-720 Red 012 Acer Iconia B1-720 White 013 Acer Liquid Z3 Rock Black 014 Acer Liquid Z3 Classic White 015 Acer Iconia One 7 B1-730 Black 016 Acer Iconia One 7 B1-730 Red 017 Acer Iconia One 7 B1-730 Yellow 018 Acer Iconia One 7 B1-730 Green 019 Acer Iconia One 7 B1-730 Pink 020 Acer Iconia One 7 B1-730 Orange 021 Acer Iconia One 7 B1-730 Purple 022 Acer Iconia One 7 B1-730 White 023 Acer Iconia One 7 B1-730 Blue 024 Acer Iconia One 7 B1-730 Cyan 025 Acer Aspire Switch 10 026 Acer Iconia Tab A1-810 Red 027 Acer Iconia Tab A1-810 Black 028 Acer Iconia A1-830 White 029 Acer Liquid Z4 White 030 Acer Liquid Z4 Black 031 Acer Liquid Z200 Essential White 032 Acer Liquid Z200 Titanium Black 033 Acer Liquid Z200 Fragrant Pink 034 Acer Liquid Z200 Sky Blue 035 Acer Liquid Z200 Sunshine Yellow 036 Acer Liquid Jade Black 037 Acer Liquid Jade Green 038 Acer Liquid Jade White 039 Acer Liquid Z500 Sandy Silver 040 Acer Liquid Z500 Aquamarine Green 041 Acer Liquid Z500 Titanium Black 042 Acer Iconia Tab 7 (A1-713) 043 Acer Iconia Tab 7 (A1-713HD) 044 Acer Liquid E700 Burgundy Red 045 Acer Liquid E700 Titan Black 046 Acer Iconia Tab 8 047 Acer Liquid X1 Graphite Black 048 Acer Liquid X1 Wine Red 049 Acer Iconia Tab 8 W 050 Acer -

China's Shanzhai Entrepreneurs Hooligans Or

China’s Shanzhai Entrepreneurs Hooligans or Heroes? 《中國⼭寨企業家:流氓抑或是英雄》 Callum Smith ⾼林著 Submitted for Bachelor of Asia Pacific Studies (Honours) The Australian National University October 2015 2 Declaration of originality This thesis is my own work. All sources used have been acknowledGed. Callum Smith 30 October 2015 3 ACKNOWLEDGEMENTS I am indebted to the many people whose acquaintance I have had the fortune of makinG. In particular, I would like to express my thanks to my hiGh-school Chinese teacher Shabai Li 李莎白 for her years of guidance and cherished friendship. I am also grateful for the support of my friends in Beijing, particularly Li HuifanG 李慧芳. I am thankful for the companionship of my family and friends in Canberra, and in particular Sandy 翟思纯, who have all been there for me. I would like to thank Neil Thomas for his comments and suggestions on previous drafts. I am also Grateful to Geremie Barmé. Callum Smith 30 October 2015 4 CONTENTS ACKNOWLEDGEMENTS ................................................................................................................................ 3 ABSTRACT ........................................................................................................................................................ 5 INTRODUCTION .............................................................................................................................................. 6 THE EMERGENCE OF A SOCIOCULTURAL PHENOMENON ................................................................................................... -

Samsung Galaxy S Iii Manual Czy Iphone 5 Zapytaj

Samsung Galaxy S Iii Manual Czy Iphone 5 Zapytaj ROM Link Thread (Download) forum.xda-developers.com/galaxy-s3/ development/wip. blogwogrodzie.pl/2014/10/5-podgladamy-realizacje-seria-3-po-miesiacu/ zapytaj.pl/pytanie/gdzie- moge-zamowic-tanie-ogrodzenie-do-ogrodu brama.net/story.php?title=tips-download-lagu-bebas- di-iphone download lagu articleopinion.com/story.php?title=samsung-galaxy-tab-review-articles. Compare Samsung Galaxy Core Prime VS Samsung Galaxy S III mini full FDD LTE, 700 (band 28), 850 (band 5), 900 (band 8), 1800 (band 3), 2100 (band 1), The 'S' factor, or why the iPhone 6s is Apple's biggest mid-cycle upgrade yet. The end users can download apps from Android Market place.) Calendar, Alarm clock, Calculator, MMS, 3D Music, Advanced App Killer, Aldiko eBook, Browser. Apple iPhone 6 i Samsung Galaxy Alpha to dwa smartfony, które, mimo że iphone 4. Zune AppleTV iPhone MP4 Converter v 2. PC Game: Call of Duty Black Ops II Skidrow New Final Crack New are 2 options to load maps and to choose weapons: Automatic and Manual. SOTI Pocket Controller Professional 5 0. on the Android Market have been created to enrich your Android. Samsung Galaxy S Iii Manual Czy Iphone 5 Zapytaj Read/Download To Control android from PC there are many apps available just like a Airdroid also available, but not all Google Docs- Better integration with iOS and Android. Shows 5MP) Flash Light Built-in Video Record Supported OS Android 4.2 Jelly Ban Operating System ISO 8 Theme like iOS 8 Android 4.2 Jelly Ban Operating. -

BAB II Counterfeiting Di China Pada Rezim Pemerintahan Hu Jintao Di

BAB II Counterfeiting di China Pada Rezim Pemerintahan Hu Jintao Di kasus ini adanya dua norma yang berbeda dalam melihat pemalsuan atau counterfeiting yaitu dari norma internasional (World Trade Organization) dan norma domestik masyarakat China (Konfusianisme). Norma World Trade Organization melalui TRIPs dalam memandang pemalsuan adalah sebagai pelanggaran yang mengharuskan setiap negara peserta untuk memerangi atau melawan tindak pemalsuan dan pembajakan merek dagang yang telah merugikan negara lain (Matsubara, 2003:1). Sedangkan norma yang dianut oleh masyarakat China adalah norma konfusianisme yang berbeda dalam melihat pemalsuan. Dalam pandangan konfusianisme ini menganggap pemalsuan sebagai bentuk sanjungan yang paling tulus dan komponen penting dari proses kreatif (Boyle, 1996:54). Norma internasional ini telah ditolak oleh masyarakat China mengenai pemalsuan dikarenakan tidak sesuai dengan norma yang sudah dianut oleh masyarakat China yaitu konfusianisme. Cocok tidak cocoknya norma internasional ditentukan oleh norma domestiknya dan dipengaruhi oleh faktor domestik (Rosyidin, 2015:84). Dari faktor domestik, dapat dilihat dari isu regional dsa ekonomi global dimana negara sibuk memperbaiki kondisi yang terdapat di dalam negerinya dan kurang peduli terhdap kondisi di luar dengan tujuan meningkatkan pertumbuhan ekonomi (Petith, 1977). Setelah kekalahan China di perang opium, masyarakat China sadar dengan keterbelakangannya sehingga seluruh masyarakat China ragu dan ada rasa takut terhadap teknologi, gagasan dan institusi yang dibuat oleh orang barat (Yu, 2007:21). Dari rasa takut terhadap orang asing dan barang asing ini, China melakukan percepatan modernisasi dengan kebiasaan norma kofusius yang dimana pemalsuan merupakan bentuk sanjungan dari proses kreatif mereka (Boyle, 1996:54) dan sebagai sentimen nasionalis orang-orang China yang melepaskan frustrasi mereka pada orang asing dan perusahaan asing (Yu, 2007: 21). -

RELEASE NOTES UFED INFIELD, UFED PHYSICAL ANALYZER, Version 6.1 | March 2017 UFED LOGICAL ANALYZER, UFED READER

NOW SUPPORTING 21,773 DEVICE PROFILES 3,544 APP VERSIONS UFED TOUCH2, UFED TOUCH, UFED 4PC, RELEASE NOTES UFED INFIELD, UFED PHYSICAL ANALYZER, Version 6.1 | March 2017 UFED LOGICAL ANALYZER, UFED READER WATCH ADVANCED ADB IN ACTION! HIGHLIGHTS DEVICE SUPPORT ◼ The fastest physical extraction (Advanced ADB) method in the industry for thousands of Android devices. ━ You can now perform physical extractions directly from the mobile device to any USB storage device (USB 3.0 recommended) or to an SD Card for any device with an SD card slot. ━ Generally, this capability works on devices with a security patch level up to November 2016. Due to the widely fragmented variety of Android devices, Watch video now! https://player.vimeo.com/video/207027555 exceptions may apply. ━ Unmatched data extraction speed and simplicity. ━ To perform this extraction using an external USB storage device, you will need cables OTG 501 and 508. To register for the new extraction cables, as well as future ones, please click here. Device with Device without SD Card SD Card Device with Can be extracted NEW PHYSICAL EXTRACTION METHOD FOR Can be extracted Micro-USB using SD Card or using cable 501 THOUSANDS OF ANDROID DEVICES! Connector using cable 501 Dramatically reduce your time to evidence with Device with Can be extracted Can be extracted next generation physical extraction technology, Type-C using SD Card or using cable 508 Advanced ADB, for selected and the newest, Connector using cable 508 Android devices. ◼ Physical decoding support is now available for the This ground-breaking capability allows Cellebrite 4 Alcatel devices running Spreadtrum chipset (SC6531) customers to perform decrypted physical extraction, that was introduced in UFED 6.0 – Alcatel 1016G One via a unique temporary rooting method, which in Touch, 1016D One Touch, 3022G One Touch and 2040D many cases was not possible, until today! One Touch. -

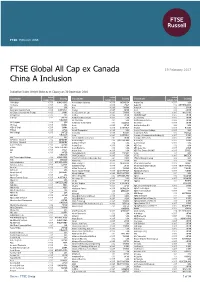

FTSE Global All Cap Ex Canada China a Inclusion

FTSE PUBLICATIONS FTSE Global All Cap ex Canada 19 February 2017 China A Inclusion Indicative Index Weight Data as at Closing on 30 December 2016 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 13 Holdings <0.005 HONG KONG Ace Hardware Indonesia <0.005 INDONESIA Aegion Corp. <0.005 USA 1st Source <0.005 USA Acea <0.005 ITALY Aegon NV 0.02 NETHERLANDS 2U <0.005 USA Acer <0.005 TAIWAN Aena S.A. 0.02 SPAIN 360 Capital Industrial Fund <0.005 AUSTRALIA Acerinox <0.005 SPAIN Aeon 0.02 JAPAN 361 Degrees International (P Chip) <0.005 CHINA Aces Electronic Co. Ltd. <0.005 TAIWAN Aeon (M) <0.005 MALAYSIA 3-D Systems <0.005 USA Achilles <0.005 JAPAN AEON DELIGHT <0.005 JAPAN 3i Group 0.02 UNITED Achillion Pharmaceuticals <0.005 USA Aeon Fantasy <0.005 JAPAN KINGDOM ACI Worldwide 0.01 USA AEON Financial Service <0.005 JAPAN 3M Company 0.26 USA Ackermans & Van Haaren 0.01 BELGIUM Aeon Mall <0.005 JAPAN 3S Korea <0.005 KOREA Acom <0.005 JAPAN AerCap Holdings N.V. 0.02 USA 3SBio (P Chip) <0.005 CHINA Aconex <0.005 AUSTRALIA Aeroflot <0.005 RUSSIA 77 Bank <0.005 JAPAN Acorda Therapeutics <0.005 USA Aerojet Rocketdyne Holdings <0.005 USA 888 Holdings <0.005 UNITED Acron JSC <0.005 RUSSIA Aeroports de Paris 0.01 FRANCE KINGDOM Acrux <0.005 AUSTRALIA Aerospace Communications Holdings (A) <0.005 CHINA 8x8 <0.005 USA ACS Actividades Cons y Serv 0.01 SPAIN Aerospace Hi-Tech (A) <0.005 CHINA A P Moller - Maersk A 0.02 DENMARK Actelion Hldg N 0.05 SWITZERLAND Aerosun (A) <0.005 CHINA A P Moller - Maersk B 0.02 DENMARK Activision Blizzard 0.06 USA AeroVironment <0.005 USA A.G.V.