The Government's Misplaced Confidence in the Benefit

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

OFFICIAL REPORT (Hansard)

Committee for Social Development OFFICIAL REPORT (Hansard) Welfare Reform Bill: Universal Credit (Clauses 1-44) 10 October 2012 NORTHERN IRELAND ASSEMBLY Committee for Social Development Welfare Reform Bill: Universal Credit (Clauses 1-44) 10 October 2012 Members present for all or part of the proceedings: Mr Alex Maskey (Chairperson) Mr Mickey Brady (Deputy Chairperson) Ms Paula Bradley Ms Pam Brown Mr Gregory Campbell Mrs Judith Cochrane Mr Michael Copeland Mr Sammy Douglas Mr Mark Durkan Mr Fra McCann Witnesses: Ms Martina Campbell Department for Social Development Ms Anne McCleary Department for Social Development Mr Michael Pollock Department for Social Development Ms Margaret Stitt Social Security Agency The Chairperson: I welcome formally officials Anne McCleary, Michael Pollock, Martina Campbell and Margaret Stitt. Thank you very much for being here. You are very welcome. I hope that you get home a wee bit earlier this evening. Obviously, the purpose of today's session is to deal with all matters that relate to universal credit, which is covered by clauses 1 to 44 of the Welfare Reform Bill. During this session, officials will outline that particular part in as much detail as they can. I remind members that the purpose of the session is not to debate the issues, but to have the Bill and that particular set of clauses explained and for members to explore the detail of that. On that basis, members may raise any specific issues with the officials. As per our schedule, which members have agreed, we intend to have a number of these sessions to work our way through the Bill clause by clause. -

The Smokescreen Budget in the House of Commons Library George Osborne’S Claim That His Is a One Nation Budget Should Ensure Its Being Placed in the Fiction Section

The Smokescreen Budget In the House of Commons Library George Osborne’s claim that his is a One Nation budget should ensure its being placed in the Fiction Section. Low-paid basic workers did not (for political purposes) exist, or had no right to exist, or could live on thin air. Yet it is on these that the world’s life finally depends. In the book of Ecclesiasticus, 38, the honour due to the doctor and the intellectual are duly acknowledged. The question is then raised ‘whose work sustains the fabric of the world’ – keeps its essential life going from one day to another. The answer is the basic worker. It is a twisted society which does not acknowledge and honour that. Osborne’s is the budget of a twisted society, as far from reality as is Alice in Wonderland. When, in a budget speech, a smokescreen is deliberately put in place, the wise will peer underneath to see what realities are being concealed. How is this done? Osborne used shock tactics. A Tory budget anticipating a living wage of £9 an hour! – enough to distract the attention of the unwary from the nitty-gritty substance! Yet, even at that point, awkward thoughts might have caused the wary to pause. One is that this will cost the government nothing. Another is that, if, at one fell swoop, the government could establish a living wage in the future why was this not done when basic wages were so low as to leave workers living on the margins. A third is that the target is distant enough, so that, by the time the date is reached, it may amount to no more than a minimum wage arrangement. -

Factsheet 14: Benefit Cap

Factsheet 14: Benefit Cap What is the benefit cap? From summer 2013 a limit will be put on the total amount of benefits that most people aged 16 to 64 can get. This is called a benefit cap. This aim of the benefit cap is to ensure that workless households do not receive more in benefit payments than the average earnings of a working household. What benefits will get capped? The cap will apply to the total amount that the people in your household get from the following benefits: Bereavement Allowance Carer’s Allowance Child Benefit Child Tax Credit Employment and Support Allowance (unless you get the support component) Guardian’s Allowance Housing Benefit Incapacity Benefit Income Support Jobseeker’s Allowance Maternity Allowance Severe Disablement Allowance Widowed Parent’s Allowance (or Widowed Mother’s Allowance or Widows Pension you started getting before 9 April 2001) Who won’t be affected? You won’t be affected by the benefit cap if you qualify for Working Tax Credit (whether or not you claim it), or if you get any of the following benefits: Disability Living Allowance Personal Independence Payment (from April 2013) Attendance Allowance Industrial Injuries Benefits (and equivalent payments as part of a war disablement pension or the Armed Forces Compensation Scheme) Employment and Support Allowance, if you get the support component War Widow’s or War Widower’s Pension How much is the benefit cap? The level of the cap will be: £500 a week for couples (with or without children living with them) £500 a week for single parents whose children live with them £350 a week for single adults who don’t have children, or whose children don’t live with them 1 How will I be affected? You can use the calculator on the Government’s Directgov website is available which can be used to get an estimate of how your Housing Benefit might be impacted. -

The Lost Decade Updating Austerity in the United Kingdom

The Lost Decade Updating Austerity in the United Kingdom Simon Lee University of Hull, England December, 2016 www.altausterity.mcmaster.ca | @altausterity ABOUT US Austerity and its Alternatives is an international knowledge mobilization project committed to expanding discussions on alternatives to fiscal consolidation and complimentary policies among policy communities and the public. To learn more about our project, please visit www.altausterity.mcmaster.ca. Austerity and its Alternatives is funded through the Partnership Development stream of the Social Sciences and Humanities Research Council (SSHRC). About the Authors Dr. Simon Lee ([email protected]) Dr. Lee is a Senior Lecturer in Politics and International Relations at the University of Hull in the UK. Report designed by the Centre for Communicating Knowledge at Ryerson University (excluding cover page). www.altausterity.mcmaster.ca Updating Austerity in the United Kingdom | Introduction Superficially, all appears well with the United Kingdom (UK) economy. The International Monetary Fund (IMF) has forecast the UK to be the fastest growing economy among the Group of Seven (G7) major industrialised economies in 2016, with growth of 1.8%, slightly above the G7 average of 1.6%. In the three months to August 2016, there were 31.81 million people in work, including 3.45 million non‐UK nationals, or 74.5% of the 16‐64 population eligible for employment, the joint highest figure since comparable records began in 1971. Unemployment is 4.9% of the workforce, or technically full employment. In August 2016, 1000 people took strike action, the lowest figure since records began in January 1986. -

Mundella Papers Scope

University of Sheffield Library. Special Collections and Archives Ref: MS 6 - 9, MS 22 Title: Mundella Papers Scope: The correspondence and other papers of Anthony John Mundella, Liberal M.P. for Sheffield, including other related correspondence, 1861 to 1932. Dates: 1861-1932 (also Leader Family correspondence 1848-1890) Level: Fonds Extent: 23 boxes Name of creator: Anthony John Mundella Administrative / biographical history: The content of the papers is mainly political, and consists largely of the correspondence of Mundella, a prominent Liberal M.P. of the later 19th century who attained Cabinet rank. Also included in the collection are letters, not involving Mundella, of the family of Robert Leader, acquired by Mundella’s daughter Maria Theresa who intended to write a biography of her father, and transcriptions by Maria Theresa of correspondence between Mundella and Robert Leader, John Daniel Leader and another Sheffield Liberal M.P., Henry Joseph Wilson. The collection does not include any of the business archives of Hine and Mundella. Anthony John Mundella (1825-1897) was born in Leicester of an Italian father and an English mother. After education at a National School he entered the hosiery trade, ultimately becoming a partner in the firm of Hine and Mundella of Nottingham. He became active in the political life of Nottingham, and after giving a series of public lectures in Sheffield was invited to contest the seat in the General Election of 1868. Mundella was Liberal M.P. for Sheffield from 1868 to 1885, and for the Brightside division of the Borough from November 1885 to his death in 1897. -

Citizens Advice Camden, GOSH Information Sheet 4: the Benefit Cap 020 7829 8896

Citizens Advice Camden, GOSH Information Sheet 4: The Benefit Cap 020 7829 8896 Take home message • The Benefit Cap is intended as a maximum amount of benefit that anyone will be able to get • There are exemptions, e.g. for people who get disability benefits or work full-time and claim Working Tax Credit • The Benefit Cap mainly affects large families and families living in London What is the Benefit Cap? • The Benefit Cap is the maximum amount a person should receive in benefits. The cap depends on each claimant’s circumstances. • The Cap works by adding up a person’s total benefit income. Note that not all benefits are counted in this. If the total income is above the Cap, then their Housing Benefit (HB) or Universal Credit (UC) will be reduced to bring their income to the level of the Cap. • It only applies if a person is getting HB or UC. • It mainly affects families in London where rents are high. What are the ways around it? • The Cap does not apply if: • A member of the household is working full-time and has claimed Working Tax Credit (WTC). This applies even if they earn too much to actually get WTC. • If someone has stopped working having worked 50 weeks of the past 52, then the Cap will not be applied for 39 weeks. • If someone in the household gets a disability benefit such as Disability Living Allowance (DLA – see Sheet 1). This applies even if DLA payments stop because the child is an inpatient. • Someone affected can claim discretionary housing payments from their council, though such help is not guaranteed or indefinite. -

Benefits Rates and Income/Savings Thresholds

alzheimers.org.uk Benefits rates and income/ savings thresholds This factsheet provides details of benefits rates and savings thresholds as of April 2016. It is designed to be used in conjunction with various Alzheimer’s Society factsheets about benefits and how to apply for them, especially factsheet 413, ‘Benefits’ (see list in ‘Further reading’ section at the end of this factsheet.) Care and mobility benefits Attendance allowance Higher rate £82.30 weekly Lower rate £55.10 weekly Disability living allowance Personal care component Higher rate £82.30 weekly Middle rate £55.10 weekly Lower rate £21.80 weekly Mobility component Higher rate £57.45 weekly Lower rate £21.80 weekly 1 Personal independence payment Personal independence payment (PIP) has replaced Disability living allowance for all new claims after June 2013. Daily living component Enhanced rate £82.30 weekly Standard rate £55.10 weekly Mobility component Enhanced rate £57.45 weekly Standard rate £21.80 weekly Paying for care NHS-funded nursing care The standard rate in England is £112.00 per week. In Wales, the rate is £140.90 per week. In Northern Ireland, the rate is £100 per week. Payment of home care and care home fees Upper savings threshold in England (above which the person has to pay all their costs) is £23,250. Lower savings threshold in England (below which a person’s savings are no longer taken into account, although all other income including benefits and pensions is still counted) is £14,250. In Wales, the upper savings threshold is £24,000. There is no lower savings threshold. -

Web of Power

Media Briefing MAIN HEADING PARAGRAPH STYLE IS main head Web of power SUB TITLE PARAGRAPH STYLE IS main sub head The UK government and the energy- DATE PARAGRAPH STYLE IS date of document finance complex fuelling climate change March 2013 Research by the World Development Movement has Government figures embroiled in the nexus of money and revealed that one third of ministers in the UK government power fuelling climate change include William Hague, are linked to the finance and energy companies driving George Osborne, Michael Gove, Oliver Letwin, Vince Cable climate change. and even David Cameron himself. This energy-finance complex at the heart of government If we are to move away from a high carbon economy, is allowing fossil fuel companies to push the planet to the government must break this nexus and regulate the the brink of climate catastrophe, risking millions of lives, finance sector’s investment in fossil fuel energy. especially in the world’s poorest countries. SUBHEAD PARAGRAPH STYLE IS head A Introduction The world is approaching the point of no return in the Energy-finance complex in figures climate crisis. Unless emissions are massively reduced now, BODY PARAGRAPH STYLE IS body text Value of fossil fuel shares on the London Stock vast areas of the world will see increased drought, whole Exchange: £900 billion1 – higher than the GDP of the countries will be submerged and falling crop yields could whole of sub-Saharan Africa.2 mean millions dying of hunger. But finance is continuing to flow to multinational fossil fuel companies that are Top five UK banks’ underwrote £170 billion in bonds ploughing billions into new oil, gas and coal energy. -

94 Spring 2017 Journal of Liberal History Issue 94: Spring 2017 the Journal of Liberal History Is Published Quarterly by the Liberal Democrat History Group

For the study of Liberal, SDP and Issue 94 / Spring 2017 / £7.50 Liberal Democrat history Journal of LiberalHI ST O R Y War authors Alan Mumford Churchill and Lloyd George Liberal authors on the First World War? David Dutton Sir Walter Runciman and the Runciman papers at Elshieshields Tower Neil Stockley Coalition: Could Liberal Democrats have handled it better? Meeting report J. Graham Jones Liberal archives at the Churchill Archives Centre Michael Meadowcroft The Lib–Lab Pact Book review Liberal Democrat History Group Liberal History 350 years of party history in 32 pages The Liberal Democrat History Group’s pamphlet, Liberal History: A concise history of the Liberal Party, SDP and Liberal Democrats, has been revised and updated to include the coalition and its impact and the 2015 election and its aftermath. The essential introduction to Liberal history, now updated to March 2017. Liberal History is available to Journal of Liberal History subscribers for the special price of £2.40 (normal price £3.00) plus £0.60 P&P. Order via our online shop (www.liberalhistory.org.uk/shop/), or by post from LDHG, 54 Midmoor Road, London SW12 0EN (cheque payable at ‘Liberal Democrat History Group’). The booklet makes an ideal gift for new party members; we can offer a 50 per cent discount for bulk orders of 40 or more copies. Contact the Editor on [email protected]. Journal of Liberal History: special issues The Liberal Party and the First World War Journal 87 (summer 2015) Includes: Did the Great War really kill the Liberal Party?; The long shadow of war; The Liberal Party, the Labour Party and the First World War; John Morley’s resignation in August 1914; Gilbert Murray v. -

The Power of the Prime Minister

Research Paper Research The Power of the Prime Minister 50 Years On George Jones THE POWER OF THE PRIME MINISTER 50 YEARS ON George Jones Emeritus Professor of Government London School of Economics & Political Science for The Constitution Society Based on a lecture for the Institute of Contemporary British History, King’s College, London, 8 February 2016 First published in Great Britain in 2016 by The Constitution Society Top Floor, 61 Petty France London SW1H 9EU www.consoc.org.uk © The Constitution Society ISBN: 978-0-9954703-1-6 © George Jones 2016. All rights reserved. Without limiting the rights under copyright reserved above, no part of this publication may be reproduced, stored or introduced into a retrieval system, or transmitted, in any form or by any means (electronic, mechanical, photocopying, recording or otherwise), without the prior written permission of both the copyright owner and the publisher of this book. THE POWER OF THE PRIME MINISTER 3 Contents About the Author 4 Foreword 5 Introduction 9 Contingencies and Resource Dependency 11 The Formal Remit and Amorphous Convention 13 Key Stages in the Historical Development of the Premiership 15 Biographies of Prime Ministers are Not Enough 16 Harold Wilson 17 Tony Blair – almost a PM’s Department 19 David Cameron – with a department in all but name 21 Hung Parliament and Coalition Government 22 Fixed-term Parliaments Act, 2011 25 Party Dynamics 26 Wilson and Cameron Compared 29 Enhancing the Prime Minister 37 Between Wilson and Cameron 38 Conclusions 39 4 THE POWER OF THE PRIME MINISTER About the Author George Jones has from 2003 been Emeritus Professor of Government at LSE where he was Professor of Government between 1976 and 2003. -

5.2 Relationship Between Benefits and Social Housing (2016)

5.2 Relationship between benefits and social housing There have been a number of major changes to the Housing Benefit Scheme since April 2013. Changes in April 2013 included the introduction of the new under occupation rules that affects tenants living in Social Housing. The amount of Housing Benefit that council tenants and housing association tenants can get if their home is considered too large for their needs has been cut. The rules only affect people of working age (pensioners are not affected). It is commonly referred to as the 'bedroom tax'. Housing Benefit is based on the number of bedrooms a household needs. The new rules allow one bedroom for: a couple (married or unmarried) any person aged 16 or over two children under 16 of the same sex two children aged under 10 regardless of gender any other child (other than a child whose main home is elsewhere) people who need an overnight carer adult children in the Armed Forces (they are treated as living at home even if deployed on operations) disabled children who are unable to share a bedroom with a sibling due to a severe disability. This has meant that tenants may get less help towards rent and service charges if tenants are assessed under these rules as having more bedrooms than the household needs. The rent allowed will be reduced by: 14 per cent if there is one extra bedroom 25 per cent if there are two or more extra bedrooms. The other major change that impacted on housing benefit claimants was the introduction of the Benefit Cap in August 2013. -

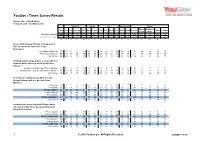

Survey Report

YouGov / Times Survey Results Sample Size: 1688 GB Adults Fieldwork: 20th - 21st March 2016 Vote 2015 Gender Age Social Grade Region Rest of Midlands / Total Con Lab Lib Dem UKIP Male Female 18-24 25-49 50-64 65+ ABC1 C2DE London North Scotland South Wales Weighted Sample 1688 476 393 102 164 817 871 196 722 415 354 962 726 202 560 363 408 156 Unweighted Sample 1688 479 425 116 162 726 962 198 648 430 412 1043 645 182 562 360 417 167 % % % % % % % % % % % % % % % % % % Do you think George Osborne is doing a good job or a bad job as Chancellor of the Exchequer? He is doing a good job 17 41 3 14 6 21 13 19 14 17 20 20 13 15 20 16 15 15 He is doing a bad job 58 31 82 68 75 60 56 49 55 64 64 59 57 51 55 58 63 66 Don't know 25 29 15 19 19 19 31 32 31 19 16 21 30 34 25 27 22 19 Thinking about George Osborne, do you think he would or would not be up to the job of Prime Minister? Would be up to the job of Prime Minister 8 14 3 10 2 9 7 8 8 7 8 8 8 12 7 7 8 8 Would not be up to the job of Prime Minister 73 66 86 79 86 78 69 65 70 78 79 76 70 62 75 73 76 75 Don't know 19 20 11 10 13 13 25 27 23 15 12 16 22 25 18 20 16 17 How likely or unlikely do you think it is that George Osborne will ever become Prime Minister? Very likely 1 1 1 0 1 2 1 1 2 1 1 1 1 2 1 1 1 2 Fairly likely 12 14 11 22 7 15 9 11 11 14 12 14 8 14 12 11 11 14 TOTAL LIKELY 13 15 12 22 8 17 10 12 13 15 13 15 9 16 13 12 12 16 Fairly unlikely 37 46 38 44 34 39 36 35 30 44 44 40 33 32 38 42 36 29 Very unlikely 30 23 34 25 41 31 28 26 31 25 33 26 34 23 31 26 33 31 TOTAL UNLIKELY 67 69