A Comparative Study Between Sonali Bank Limited and Agrani Bank Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Country Wise List of Our Foreign Correspondents Sonali Bank Limited

Country wise list of our Foreign correspondents as on 31-12-2018. Prepared bv : Sonali Bank limited Foreign Remittance Management Division Head office.Dhaka. Courtesv : Sonali Bank limited (Product Development Team) Business Development Division Head office,Dhaka. E mail-dgmb ddp dt@s on aliban k. co m.b d Md Mizanur Rahman Md Zillur Rahman Sikder Senior Principal officer Senior ofl.icer Product Development Team. Product Der elopment Team. mob-01708159313. mob-019753621 15. Corp Bank Country dents as on 3ut2na18 Sl.No. Name ofCountry No. o No. of SI. No. Name ofCountry No. of No. of Corp. RMA Corn. RMA 01. Afganistan J I 45. Malaysia t2 12 02. Australia 8 7 46. Monaco I I 03. Algeria J 1 41. Malta 2 04. Argentina I Z I 48. Netherlands 8 7 , 05. Albenia i 49. New Zealand J J 06. Austria 7 6 50. Nepal 2 2 07. Balrain J J 51. Norway 2 I 08. Belgium 9 7 52. Nigeria I ) 09. Bhutan 2 53. Oman I q 2 10. Bulgaria 4 4 54. Pakistan 18 18 ll Brunei I 55, Poland 3 1 12. Brazrl 4 2 56. Philippines 5 5 lJ. Republic ofBelarus I 57. Portugal 4 J 14. Canada 8 7 58. Qatar 6 5 15. China 4 l3 59. Romania 1 1 16. Chile I I 60 Russia 9 8 17. Croatia I 61. SaudiArabia l6 t5 18. Cyprus I I o/.. Senegal 1 1 t 19. CzechRepublic 6 J 63. Serbia + J ,1 20. Denmark J J 64. Srilanka 5 21. -

Sl. Correspondent / Bank Name SWIFT Code Country

International Division Relationship Management Application( RMA ) Total Correspondent: 156 No. of Country: 36 Sl. Correspondent / Bank Name SWIFT Code Country 1 ISLAMIC BANK OF AFGHANISTAN IBAFAFAKA AFGHANISTAN 2 MIZUHO BANK, LTD. SYDNEY BRANCH MHCBAU2S AUSTRALIA 3 STATE BANK OF INDIA AUSTRALIA SBINAU2S AUSTRALIA 4 KEB HANA BANK, BAHRAIN BRANCH KOEXBHBM BAHRAIN 5 MASHREQ BANK BOMLBHBM BAHRAIN 6 NATIONAL BANK OF PAKISTAN NBPABHBM BAHRAIN 7 AB BANK LIMITED ABBLBDDH BANGLADESH 8 AGRANI BANK LIMITED AGBKBDDH BANGLADESH 9 AL-ARAFAH ISLAMI BANK LTD. ALARBDDH BANGLADESH 10 BANGLADESH BANK BBHOBDDH BANGLADESH 11 BANGLADESH COMMERCE BANK LIMITED BCBLBDDH BANGLADESH BANGLADESH DEVELOPMENT BANK 12 BDDBBDDH BANGLADESH LIMITED (BDBL) 13 BANGLADESH KRISHI BANK BKBABDDH BANGLADESH 14 BANK ASIA LIMITED BALBBDDH BANGLADESH 15 BASIC BANK LIMITED BKSIBDDH BANGLADESH 16 BRAC BANK LIMITED BRAKBDDH BANGLADESH 17 COMMERCIAL BANK OF CEYLON LTD. CCEYBDDH BANGLADESH 18 DHAKA BANK LIMITED DHBLBDDH BANGLADESH 19 DUTCH BANGLA BANK LIMITED DBBLBDDH BANGLADESH 20 EASTERN BANK LIMITED EBLDBDDH BANGLADESH EXPORT IMPORT BANK OF BANGLADESH 21 EXBKBDDH BANGLADESH LTD 22 FIRST SECURITY ISLAMI BANK LIMITED FSEBBDDH BANGLADESH 23 HABIB BANK LTD HABBBDDH BANGLADESH 24 ICB ISLAMI BANK LIMITED BBSHBDDH BANGLADESH INTERNATIONAL FINANCE INVESTMENT 25 IFICBDDH BANGLADESH AND COMMERCE BANK LTD (IFIC BANK) 26 ISLAMI BANK LIMITED IBBLBDDH BANGLADESH 27 JAMUNA BANK LIMITED JAMUBDDH BANGLADESH 28 JANATA BANK LIMITED JANBBDDH BANGLADESH 29 MEGHNA BANK LIMITED MGBLBDDH BANGLADESH 30 MERCANTILE -

Procedure of Open Foreign Currency Account.Pdf

Embassy of Bangladesh Washington DC Wage Earner Development Bond Foreign Currency Foreign Currency Accounts Specimern Signature Specimern Signature FC Account Opening Form and Specimen Signature Extension [email protected] Diplomatic Bag /DHL/Fedex English Version The Government of the People’s Republic of Bangladesh have introduced special saving facilities for Non Resident Bangladeshis and also foreigner’s of Bangladeshi decent. Wage Earner Development Bond : Most profitable fixed deposit investment “Wage Earner Development Bond” for Non Resident Bangladeshi’s and Foreigners of Bangladeshi decent introduced by the Government of the People’s Republic of Bangladesh. Compound rate of profit is 12.00% per annum. Tk. 25,000 become Tk. 44,750 with profit after 5 years Tk. 50,000 become Tk. 89,500 with profit after 5 years Tk. 1,00,000 become Tk. 1,79,000 with profit after 5 years Tk. 5,00,000 become Tk. 8,95,000 with profit after 5 years Profits could be withdrawn at a rate of Tk. 1000.00 per month for every Tk. 100000.00. For withdrawal of profit simple rate is applicable. Nominee is entitled to 30% to 50% of invested amount as a death risk insurance at no extra charge in case of death of the bond owner. No income tax is levied on the initial investment or profits thereof. Initial investment amount could be transferred back in foreign currency. If encashed before maturity you will get interest at following rate : a. Before six month no interest b. After six month and before 1 year : 9% c. After 1 year and before 2 years : 10% d. -

Comparison and Analysis of Profitability of Top Three

Global Journal of Management and Business Research: C Finance Volume 19 Issue 3 Version 1.0 Year 2019 Type: Double Blind Peer Reviewed International Research Journal Publisher: Global Journals Online ISSN: 2249-4588 & Print ISSN: 0975-5853 Comparison and Analysis of Profitability of Top Three Nationalized Commercial Banks in Bangladesh By Saeed Sazzad Jeris Abstract- Banks are playing a vital role in the economic & financial development of Bangladesh. Profitability indicates the overall performance of the banks. In this study, it has been tried to compare the top three nationalized commercial banks by some financial parameters, and it relies on secondary sources of data. In this paper, I used statistical tool ANOVA for comparison. The result indicates the statistical difference among these banks and their performance is not stable. Keywords: bank, profitability, performance, ANOVA. GJMBR-C Classification: JEL Code: G21 ComparisonandAnalysisofProfitabilityofTopThreeNationalizedCommercialBanksinBangladesh Strictly as per the compliance and regulations of: © 2019. Saeed Sazzad Jeris. This is a research/review paper, distributed under the terms of the Creative Commons Attribution- Noncommercial 3.0 Unported License http://creativecommons.org/licenses/by-nc/3.0/), permitting all non-commercial use, distribution, and reproduction in any medium, provided the original work is properly cited. Comparison and Analysis of Profitability of Top Three Nationalized Commercial Banks in Bangladesh Saeed Sazzad Jeris Abstract- Banks are playing a vital role in the economic & III. Hypothesis financial development of Bangladesh. Profitability indicates the overall performance of the banks. In this study, it has been 1 2019 0 = There is an insignificant difference among Sonali tried to compare the top three nationalized commercial banks bank, Janata bank, and Agrani bank by on net worth. -

Md. Abdus Salam

Md. Abdus Salam CEO and MD, Janata Bank Limited Mr. Md. Abdus Salam joined as the CEO & Managing Director of Janata Bank Limited on 28 October, 2014. Before joining here, he served as the Managing Director of Bangladesh Krishi Bank. He was born on 1st December, 1956 in a respectable family of late Ahmed Ali and Mrs. Rabeya Ahmed. Mr. Salam studied at Dhaka College, Dhaka for his higher secondary education, followed by his graduate and postgraduate studies at the Department of Accounting of the University of Dhaka where he obtained his B.Com. (Hons.) and M. Com. in Accounting. He is a Fellow of Chartered Accountant (FCA) from the Institute of Chartered Accountants of Bangladesh (ICAB). Mr. MD. Abdus Salam, FCA started his banking career in 1983 as Principal Officer of Bangladesh Krishi Bank. Before adorned the position of CEO & MD of Janata Bank Limited, he served as Deputy Managing Director in Agrani Bank Limited & Janata Bank Limited and as General Manager in Sonali Bank Limited & Karmasangsthan Bank. On his initiative Bangladesh Krishi Bank, for the first time, acted as ‘Banker to the Issue’ and also introduced Mobile Banking & On-line Banking in the same Bank. His notable and luminous works were- preparation of Asset Liability Management Manual, Risk Management Manual and implementation of automated foreign remittance distribution system in Sonali Bank Limited. He also contributed his effort to introducing On-line Banking in Agrani Bank Limited. He developed an Accounting System for Bangladesh Computer Council in 1990 while he was on deputation. He attended various workshops, seminars and received different training in home and abroad. -

Dutch - Bangla Bank Limited

DUTCH - BANGLA BANK LIMITED UN-AUDITED FINANCIAL STATEMENTS For the Third Quarter ended 30 September 2019 Dutch-Bangla Bank Limited Consolidated Balance Sheet As at 30 September 2019 PROPERTY AND ASSETS Notes 30-Sep-19 31-Dec-18 30-Sep-18 Taka (Un-audited) Taka (Audited) Taka (Un-audited) Cash In hand (including foreign currencies) 4 13,588,077,031 17,419,869,741 13,424,335,615 Balance with Bangladesh Bank and its agent bank (s) (including foreign currencies) 5 21,515,865,165 32,728,425,040 25,272,773,773 35,103,942,197 50,148,294,781 38,697,109,388 Balance with other banks and financial institutions 6 In Bangladesh 13,775,674,405 6,715,668,728 19,872,111,450 Outside Bangladesh 138,592,298 656,896,195 2,646,119,188 13,914,266,703 7,372,564,923 22,518,230,638 Money at call on short notice 7 13,170,000,000 - 2,670,000,000 Investments 8 Government 43,878,875,002 31,457,164,331 25,593,984,526 Others 1,411,283,434 751,283,434 251,283,434 45,290,158,436 32,208,447,765 25,845,267,960 Loans and advances 9 Loans, cash credits, overdrafts, etc. 228,437,319,738 209,463,408,465 196,168,533,474 Bills purchased and discounted 17,168,958,714 22,090,531,874 21,013,792,031 - - 245,606,278,452 231,553,940,339 217,182,325,505 Fixed assets including land, building, furniture and fixtures 10 5,483,822,895 5,737,308,593 5,129,942,207 Other assets 11 21,613,894,320 19,448,234,568 19,350,180,886 Non-banking assets - - - TOTAL ASSETS 380,182,363,003 346,468,790,969 331,393,056,584 LIABILITIES AND CAPITAL Liabilities Borrowings from other banks, financial institutions -

Premittances.Pdf

BANGLADESH BANK Statistics Department (BOP Division) Wage Earners’ Remittance during the month of September’2021 (Million USD) Sl. Bank Sep,2021 no State Owned Commercial Banks 01-02,Sep 05-09,Sep 12-16,Sep 19-23,Sep 01-23,Sep 1 Agrani Bank 8.88 46.99 40.12 25.57 121.56 2 Janata Bank 5.30 18.30 14.79 10.40 48.79 3 Rupali Bank 3.72 11.14 8.91 10.13 33.90 4 Sonali Bank 11.93 18.33 29.07 17.47 76.80 5 BASIC Bank 0.01 0.05 0.03 0.02 0.11 6 BDBL 0.00 0.00 0.00 0.00 0.00 Sub Total 29.84 94.81 92.92 63.59 281.16 Specialized Banks 7 Bangladesh Krishi Bank 2.67 11.59 10.17 5.99 30.42 8 RAKUB. 0.00 0.00 0.00 0.00 0.00 Sub Total 2.67 11.59 10.17 5.99 30.42 Private Commercial Banks 9 AB Bank Ltd. 1.70 4.04 2.81 2.52 11.07 10 Al-Arafah Islami Bank Ltd. 3.41 10.83 11.82 10.58 36.64 11 Bangladesh Commerce Bank Ltd. 0.14 0.35 0.27 0.20 0.96 12 Bank Asia Ltd. 9.42 24.57 19.44 15.83 69.26 13 BRAC Bank Ltd. 2.14 9.40 6.76 5.03 23.33 14 Community Bank Bangladesh Ltd. 0.00 0.00 0.00 0.00 0.00 15 Dhaka Bank Ltd. -

Table of Contents SL NO Particulars Page NO 1.0 Introduction 1.1 1.2 1.3 1.4 1.5 1.6 2.0 Overview of Banking Industry 3.0 Compan

Table of Contents SL NO Particulars Page NO 1.0 Introduction 1.1 Introduction of the Study 1.2 Background of the Study 1.3 Objectives of the study 1.4 Scope of the Study 1.5 Methodologies 1.6 Limitation of the study 2.0 Overview of Banking Industry 2.1 Origin of the word “Bank” 2.2 Definition of Bank 2.3 History of Bank 2.4 Types of Bank 2.5 Banking scenario in BD 2.6 Banking structure in BD 2.7 Development of Banking in BD 2.8 Hierarchy Analysis 3.0 Company Profile of Shahjalal Islami Bank 3.1 About Shahjalal Islami Bank Limited 3.2 Profile of Shahjalal Islami Bank Limited. (SJIBL) 3.3 MISSION 3.4 VISION 3.5 Slogan of the Bank 3.6 Strategies 3.7 Organizational Structure 3.8 Shariah council of SJIBL 3.9 Conventional VS Islamic Banking 4.0 Project Part (Foreign Exchange) 4.1 Definition of Foreign Exchange 4.2 International regulations of foreign exchange 4.3 Foreign Exchange Mechanism 4.4 Graphical representation of Foreign Exchange Mechanism 4.5 Activities of foreign exchange 5.0 Overview of Import 5.1 Defining Import 5.2 Main Features of Import Policy 5.3 Import Mechanism 5.4 L/C Opening 5.5 Procedure involved in L/C opening 6.0 Overview of Export 6.1 Defining Export 6.2 Activities done here 6.3 Export Bill Scrutiny 6.4 Export Finance 6.5 Export L/C 7.0 Foreign Remittance 7.1 Defining Foreign Remittance 7.2 Inward Remittance 7.3 Outward Remittance 8.0 Findings & Analysis 8.1 Performance appraisal 8.2 Findings from Observation 8.3 SWOT Analysis 8.4 Problems of Foreign Exchange Mechanism 9.0 Recommendation & Conclusion 9.1 Recommendation 9.2 Conclusion 9.3 Reference 1.1 Introduction of the study Now the world is very much competitive and the banking sector of Bangladesh has grown day by day. -

Sonali Bank Limited and Its Subsidiaries Bakertitly

Sonali Bank Limited and its Subsidiaries IndePendent Auditors' RePort and Audited Consolidated and Separate Flnancial Statements For the Year ended 31 DecemberZ0t9 ACI,IABIN trFgH<,EE.E. @ furtefldArcMlanlt Aztz Halim lftair ChoudhurY ACNABIN Chartered Accountants Chartered Accountants Phulbari House, House 25, BDBL Bhaban (Level-13), Bazar C/ A, Road 01, Sector 09, 12 Kawran Uttara Model Town Dhaka-1215, Bangladesh. -Dhaka-1230, Bangladesh. Tel.: +88-02-41020030 Tel.: +88-02-55080235 Fax:+88-02-41020036 Fax: +88-02-55080235 A member firm of A member firm of G bakertitly PKr ,1, INTEFINATIONAL Aziz Hdim lGair Choudhury ACNABIN Chartered Accountants Chartered Accoutrtants Phulbari House, House 25, BDBL Bhaban (Level-13), Road 01, Sector 09, 12 lGwran Bazar C/A, Uttara Model Town Dhaka-1215, Bangladesh. Dhaka-1230, Bangladesh. Tel.: +88-02-41020030 Tel.: +88-02-55080235 Fax:+88-02-41020036 Fax: +88-02-55080236 Independent Auditors' Report To the Shareholders ofSonali Bank Llmited Report on the Audit of the Consolldated and Separate Fimncid Statements Opinion We have audited the consolidated financial statements ofSonali Bank Limited and its subsidiaries (the "GroupJ as well as the separate financial statements of Sonali Bank Limited (the 'BankJ, which comprise the consolidated and separate balance sheets as at 31 December 2019 and the consolidated and separate profit and loss accounts, consolidated and separate statements of changes in equity and consolidated and separate cash flows statement for the year then ended, and notes to the consolidated -

Ecais Credit Rating of Scheduled Banks for 2020-21 (As of Financial Statements 2019) Sl

ECAIs Credit Rating of Scheduled Banks for 2020-21 (As of Financial Statements 2019) Sl. Long Term Equivalent BB No. Name Name of ECAI Rating Rating Short Term Rating Date of Rating SCBs(04) 1 Sonali Bank Limited CRISL A(AAA) 2 ST-2(ST-1) Nov 26, 2020 2 Janata Bank Limited CRISL A(AAA) 2 ST-2(ST-1) July 18, 2020 3 Agrani Bank Limited Alpha A+(AAA) 2 ST-2(ST-1) July 26, 2020 4 Rupali Bank Limited ECRL A-(AAA) 2 ST-3(ST-1) Sept 21, 2020 PCBs (23) 5 Mercantile Bank Limited ECRL AA 1 ST-2 May 22, 2020 6 AB Bank Limited Argus A+ 2 ST-2 Dec 19, 2019 7 One Bank Limited ECRL AA 1 ST-2 Mar 10, 2020 8 Eastern Bank Ltd CRISL AA+ 1 ST-2 June 22, 2020 9 Standard Bank Limited CRISL AA 1 ST-2 June 28, 2020 10 Uttara Bank Limited ECRL AA 1 ST-2 July 01, 2020 11 Dutch-Bangla Bank Limited CRISL AA+ 1 ST-1 July 16, 2020 12 Pubali Bank Limited NCRL AA+ 1 ST-1 June 30, 2020 13 Dhaka Bank Limited ECRL AA 1 ST-2 April 8, 2020 14 Jamuna Bank Limited CRAB AA2 1 ST-2 June 30, 2020 15 The City Bank Limited CRAB AA2 1 ST-2 May 29, 2020 16 United Commercial Bank Ltd ECRL AA 1 ST-2 May 07, 2020 17 Bank Asia Limited CRAB AA2 1 ST-2 June 30, 2020 18 IFIC Bank Limited ECRL AA 1 ST-2 July 01, 2020 19 BRAC Bank Limited CRAB AA1 1 ST-1 June 28, 2020 20 Premier Bank Limited Argus AA+ 1 ST-1 May 30, 2020 21 Prime Bank Limited ECRL AA 1 ST-2 July 01, 2020 22 Mutual Trust Bank Ltd. -

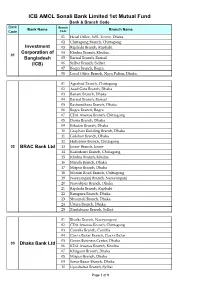

SBLFMF Bank and Branch Code

ICB AMCL Sonali Bank Limited 1st Mutual Fund Bank & Branch Code Bank Branch Bank Name Branch Name Code Code 01 Head Office, NSC Tower, Dhaka. 02 Chittagong Branch, Chittagong. Investment 03 Rajshahi Branch, Rajshahi. Corporation of 04 Khulna Branch, Khulna. 01 Bangladesh 05 Barisal Branch, Barisal. (ICB) 06 Sylhet Branch, Sylhet. 07 Bogra Branch, Bogra. 08 Local Office Branch, Naya Paltan, Dhaka. 01 Agrabad Branch, Chittagong 02 Asad Gate Branch, Dhaka 03 Banani Branch, Dhaka 04 Barisal Branch, Barisal 05 Bashundhara Branch, Dhaka 06 Bogra Branch, Bogra 07 CDA Avenue Branch, Chittagong 08 Donia Branch, Dhaka 09 Eskaton Branch, Dhaka 10 Graphics Building Branch, Dhaka 11 Gulshan Branch, Dhaka 12 Halisohor Branch, Chittagong 02 BRAC Bank Ltd 13 Jessor Branch, Jessor 14 Kazirdeuri Branch, Chittagong 15 Khulna Branch, Khulna 16 Manda Branch, Dhaka 17 Mirpur Branch, Dhaka 18 Momin Road Branch, Chittagong 19 Narayanganj Branch, Narayanganj 20 Nawabpur Branch, Dhaka 21 Rajshahi Branch, Rajshahi 22 Rampura Branch, Dhaka 23 Shyamoli Branch, Dhaka 24 Uttara Branch, Dhaka 25 Zindabazar Branch, Sylhet 01 Bhulta Branch, Narayangonj 02 CDA Avenue Branch, Chittagong 03 Comilla Branch, Comilla 04 Coxs Bazar Branch, Coxs Bazar 05 Goran Business Center, Dhaka 03 Dhaka Bank Ltd 06 KDA Avenue Branch, Khulna 07 Khilgaon Branch, Dhaka 08 Mirpur Branch, Dhaka 09 Savar Bazar Branch, Dhaka 10 Uposhahar Branch, Sylhet Page 1 of 9 01 B.B. Road Branch, Narayangonj 02 Baburhat Branch, Narsingdi 03 Bandura Branch, Dhaka 04 Barisal Branch, Barisal 05 Basundhara Branch, -

Rqhffi<Ttqoftfrfu

\ -IF Head Office, Motijheel C/A., rqHffi<TtqoFTFrFu Dhaka- I 000. Bangladesh. SONALI BANK LIMITED Phone : 88-02-9564515 (DGM) & : 88-02-47 115437 (AGM) HUMAN RESOURCE MANAGEMENT DIVISION Fax :88-02-9573765 (SECTTON-5) Email : [email protected] [email protected] - I .' .i;'l i No. HRMD/SEC-5/PF/OC-8036/1 51 39 ?li;i:.:'r,, I I ,r,4.3r[l Dated: 27 November 2018 i ) MD GIAS N fficer \s 8X0655731) Limited Pri ffi ce, Chittagong-South, Subject: Sanction of 15 (Fifteen) days leave (Outside Bangladesh) with full pay to Visit United Arab Emirates : Md Gias Uddin (G-28030. Officer Cash, Sonali Bank Limited. Principal Office. Chittasonq-South. Chittaqons. Dear Sir, Reference letter N0.4281 dated the 11t'November,2018 of General Manageds Office, Chittagong on the captioned subject. It may kindly be advised that in consideration of your prayer and recommendation of General Manage/s Office, Chittagong, the authority has sanctioned 15 (Fifteen) days full pay leave (Outside Bangladesh)from the date of 02.12,2018 lo 16.12.2018 with a permission to visit United Arab Emirates under the following terms & conditions: Conditions: 1) You have to bear all expenses of the proposed visit. There will be no financial involvement of Sonali Bank Limited / Govt. of Bangladesh. 2) This sanctioned leave will be treated as 'Leave outside Bangladesh'. 3) Over staying is strictly prohibited, Yours faithfully, sd/- (Md, Delowar Hossain Sarder) Assistant General Manager 01 General Manager, Sonali Bank Limited, General Manage/s Office, Chittagong. Deputy General Manager, lnformation Technology Division- Business lT, Sonali Bank Limited, Head Office, Dhaka.