Internship Report on Janata Bank Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Country Wise List of Our Foreign Correspondents Sonali Bank Limited

Country wise list of our Foreign correspondents as on 31-12-2018. Prepared bv : Sonali Bank limited Foreign Remittance Management Division Head office.Dhaka. Courtesv : Sonali Bank limited (Product Development Team) Business Development Division Head office,Dhaka. E mail-dgmb ddp dt@s on aliban k. co m.b d Md Mizanur Rahman Md Zillur Rahman Sikder Senior Principal officer Senior ofl.icer Product Development Team. Product Der elopment Team. mob-01708159313. mob-019753621 15. Corp Bank Country dents as on 3ut2na18 Sl.No. Name ofCountry No. o No. of SI. No. Name ofCountry No. of No. of Corp. RMA Corn. RMA 01. Afganistan J I 45. Malaysia t2 12 02. Australia 8 7 46. Monaco I I 03. Algeria J 1 41. Malta 2 04. Argentina I Z I 48. Netherlands 8 7 , 05. Albenia i 49. New Zealand J J 06. Austria 7 6 50. Nepal 2 2 07. Balrain J J 51. Norway 2 I 08. Belgium 9 7 52. Nigeria I ) 09. Bhutan 2 53. Oman I q 2 10. Bulgaria 4 4 54. Pakistan 18 18 ll Brunei I 55, Poland 3 1 12. Brazrl 4 2 56. Philippines 5 5 lJ. Republic ofBelarus I 57. Portugal 4 J 14. Canada 8 7 58. Qatar 6 5 15. China 4 l3 59. Romania 1 1 16. Chile I I 60 Russia 9 8 17. Croatia I 61. SaudiArabia l6 t5 18. Cyprus I I o/.. Senegal 1 1 t 19. CzechRepublic 6 J 63. Serbia + J ,1 20. Denmark J J 64. Srilanka 5 21. -

Bank Code Br. Code Bank & Branch Name 01 INVESTMENT CORPORATION of BANGLADESH (ICB) 02 BRAC BANK LIMITED 03 EASTERN BANK

Bank Code Br. Code Bank & Branch Name 01 INVESTMENT CORPORATION OF BANGLADESH (ICB) 01 Head Office, Purana Paltan, Dhaka 02 Local Office, Nayapaltan, Dhaka 03 Chittagong Branch, Chittagong 04 Khulna Branch, Khulna 05 Rajshahi Branch, Rajshahi 06 Barisal Branch, Barisal 07 Sylhet Branch, Sylhet 08 Bogra Branch, Bogra 02 BRAC BANK LIMITED 01 Asad Gate Branch, Dhaka 02 Banani Branch, Dhaka 03 Bashundhara Branch, Dhaka 04 Donia Branch, Dhaka 05 Eskaton Branch, Dhaka 06 Graphics Building Branch, Motijheel, Dhaka 07 Uttara Branch, Dhaka 08 Shyamoli Branch, Dhaka 09 Gulshan Branch, Dhaka 10 Manda Branch, Dhaka 11 Mirpur Branch, , Dhaka 12 Nawabpur Branch, Dhaka 13 Rampura Branch, Dhaka 14 Narayanqani Branch, Narayanganj 15 Agrabad Branch, Chittagong 16 CDA Avenue Branch, Chittagong 17 Potia Branch, Chittagong 18 Halisohor Branch, Chittagong 19 Kazirdeuri Branch, Chittagong 20 Momin Road Branch, Chittagong 21 Bogra Branch, Bogra 22 Rajshahi Branch, Rajshahi 23 Jessore Branch, Jessore 24 Khulna Branch, Khulna 25 Barisal Branch, Barisal 26 Zindabazar Branch, Sylhet 03 EASTERN BANK LIMITED 01 Principal Branch, Dilkusha, Dhaka 02 Motijheel Branch, Dhaka 03 Mirpur Branch, Dhaka 04 Bashundhara Branch, Dhaka 05 Shyamoli Branch, Dhaka 06 Narayanganj Branch 07 Jessore Branch 08 Choumuhoni Branch 09 Agrabad Branch, Chittagong 10 Khatunganj Branch, Chittagong 11 Bogra Branch, Bogra 12 Khulna Branch, Khulna 13 Rajshahi Branch, Rajshahi 14 Savar Branch, Savar, Dhaka 15 Moulvi Bazar Branch, Sylhet Page # 1 Bank Code Br. Code Bank & Branch Name 04 BANK ASIA LIMITED 01 Principal Office , Motijheel C.A., Dhaka 02 Corporate Branch, Dhaka 03 Gulshan Branch, Dhaka 04 Uttara Branch, Dhaka 05 North South Rd. -

INTERNATIONAL FINANCE INVESTMENT and COMMERCE BANK LIMITED Audited Financial Statements As at and for the Year Ended 31 December 2019

INTERNATIONAL FINANCE INVESTMENT AND COMMERCE BANK LIMITED Audited Financial Statements as at and for the year ended 31 December 2019 INTERNATIONAL FINANCE INVESTMENT AND COMMERCE BANK LIMITED Consolidated Balance Sheet as at 31 December 2019 Amount in BDT Particulars Note 31 December 2019 31 December 2018 PROPERTY AND ASSETS Cash 18,056,029,773 16,020,741,583 Cash in hand (including foreign currency) 3.a 2,872,338,679 2,899,030,289 Balance with Bangladesh Bank and its agent bank(s) (including foreign currency) 3.b 15,183,691,094 13,121,711,294 Balance with other banks and financial institutions 4.a 5,637,834,204 8,118,980,917 In Bangladesh 4.a(i) 4,014,719,294 6,823,590,588 Outside Bangladesh 4.a(ii) 1,623,114,910 1,295,390,329 Money at call and on short notice 5 910,000,000 3,970,000,000 Investments 47,216,443,756 32,664,400,101 Government securities 6.a 41,369,255,890 27,258,506,647 Other investments 6.b 5,847,187,866 5,405,893,454 Loans and advances 232,523,441,067 210,932,291,735 Loans, cash credit, overdrafts etc. 7.a 221,562,693,268 198,670,768,028 Bills purchased and discounted 8.a 10,960,747,799 12,261,523,707 Fixed assets including premises, furniture and fixtures 9.a 6,430,431,620 5,445,835,394 Other assets 10.a 9,606,537,605 9,003,060,522 Non-banking assets 11 373,474,800 373,474,800 Total assets 320,754,192,825 286,528,785,052 LIABILITIES AND CAPITAL Liabilities Borrowing from other banks, financial institutions and agents 12.a 8,215,860,335 9,969,432,278 Subordinated debt 13 2,800,000,000 3,500,000,000 Deposits and other -

Final Forma 01.Ai

Mr. S M Aminur Rahman CEO & Managing Director Mr. S M Aminur Rahman hails from Sonargaon, under Narayangonj district. After completion of MBA from Institute of Business Administration (IBA), University of Dhaka in 1973, he started his banking career as a Senior Officer in Sonali Bank in 1976. Mr. Rahman is a well reputed progressive and dynamic banker. He has outstanding contribution in promoting the banking sector. Presently he is the chairman of BAFEDA (Bangladesh Foreign Exchange Dealers' Association), Administration & Finance Committee of IBB (Institute of Bankers Bangladesh), Audit Committee of IIDFC (Industrial and Infrastructure Development Company Limited) and JEC (Janata Exchange Company srl), Italy. Besides he is also the director of BCBL (Bangladesh Commerce Bank Limited), ICB (Investment Corporation of Bangladesh), JCIL (Janata Capital and Investment Limited), PDBL (Primary Dealers Bangladesh Limited) and IIDFC; Member of governing board of BIBM (Bangladesh Institute of Bank Management) and IBB (Institute of Bankers Bangladesh); Fellow Member of IBB and Committee Member of the Bretton Woods Committee, USA. He is also serving as an adjunct faculty in the department of business administration, East West University. Mr. Rahman was the Managing Director of the then Janata Bank and Sonali Bank and director of CDBL (Central Depository Bangladesh Limited). He is a Diplomaed Associate of the Institute of Bankers' Bangladesh and attended training on Small Scale Business Financing in India sponsored by the World Bank. Also attended seminar on Foreign Exchange Orientation in Newyork and workshop on correspondent banking in London. Also attended seminar on EURO & International Bankers, Newyork, USA. Attended workshop on International Banker's Seminar, Newyork and seminar for Executive in Newyork. -

Sena Kalyan Bhaban Branch

Sena Kalyan Bhaban Branch 9 Chapter 2: Banking Sector in Bangladesh 2.1 Definition of Bank: Generally speaking bank is referred to an organization that deals in money. The definition of bank can be as follows. Provided by Famous Encyclopedia: A commercial banker is a dealer in money in substitutes for money, such as check or bill of exchange. – New Encyclopedia Britannica Establishment for custody of money, which it pays out on customers order. – The New Oxford Encyclopedia Dictionary Provided by and Ordinances: Banker includes a body of person whether incorporated or not, who carry on the business of banking. – English Bills of Exchange Act - 1882 A bank is a person or corporation carrying on bonafide banking business. – English Finance Act Provided by Banking Institutes: A bank performs an essentially distributive task, service or acts as an intermediary between borrowers & lenders. In broader sense, however, a bank can be considered the heart of a complex financial structure. – American Institute of Banking Stated very simply, banks deal in money and in that connection offer certain related financial services. – Harold Wallgren for American Bankers Association The above-mentioned characteristics sketched to outline the definition of a “bank” are nowadays shared by a lot of different types of financial institution. Therefore, because banking activities now overlap many diverse businesses, we will consider a variety of modern financial institutions 10 – including commercial banks but also savings-and-loan associations, brokerage firms, and mutual funds – as “banks”. 2.2 Objectives of a Bank: The objectives of a bank can be looked at from three different perspectives of the three key parties to the banking activities: the bank owner, the Government, and the bank clients. -

Sl. Correspondent / Bank Name SWIFT Code Country

International Division Relationship Management Application( RMA ) Total Correspondent: 156 No. of Country: 36 Sl. Correspondent / Bank Name SWIFT Code Country 1 ISLAMIC BANK OF AFGHANISTAN IBAFAFAKA AFGHANISTAN 2 MIZUHO BANK, LTD. SYDNEY BRANCH MHCBAU2S AUSTRALIA 3 STATE BANK OF INDIA AUSTRALIA SBINAU2S AUSTRALIA 4 KEB HANA BANK, BAHRAIN BRANCH KOEXBHBM BAHRAIN 5 MASHREQ BANK BOMLBHBM BAHRAIN 6 NATIONAL BANK OF PAKISTAN NBPABHBM BAHRAIN 7 AB BANK LIMITED ABBLBDDH BANGLADESH 8 AGRANI BANK LIMITED AGBKBDDH BANGLADESH 9 AL-ARAFAH ISLAMI BANK LTD. ALARBDDH BANGLADESH 10 BANGLADESH BANK BBHOBDDH BANGLADESH 11 BANGLADESH COMMERCE BANK LIMITED BCBLBDDH BANGLADESH BANGLADESH DEVELOPMENT BANK 12 BDDBBDDH BANGLADESH LIMITED (BDBL) 13 BANGLADESH KRISHI BANK BKBABDDH BANGLADESH 14 BANK ASIA LIMITED BALBBDDH BANGLADESH 15 BASIC BANK LIMITED BKSIBDDH BANGLADESH 16 BRAC BANK LIMITED BRAKBDDH BANGLADESH 17 COMMERCIAL BANK OF CEYLON LTD. CCEYBDDH BANGLADESH 18 DHAKA BANK LIMITED DHBLBDDH BANGLADESH 19 DUTCH BANGLA BANK LIMITED DBBLBDDH BANGLADESH 20 EASTERN BANK LIMITED EBLDBDDH BANGLADESH EXPORT IMPORT BANK OF BANGLADESH 21 EXBKBDDH BANGLADESH LTD 22 FIRST SECURITY ISLAMI BANK LIMITED FSEBBDDH BANGLADESH 23 HABIB BANK LTD HABBBDDH BANGLADESH 24 ICB ISLAMI BANK LIMITED BBSHBDDH BANGLADESH INTERNATIONAL FINANCE INVESTMENT 25 IFICBDDH BANGLADESH AND COMMERCE BANK LTD (IFIC BANK) 26 ISLAMI BANK LIMITED IBBLBDDH BANGLADESH 27 JAMUNA BANK LIMITED JAMUBDDH BANGLADESH 28 JANATA BANK LIMITED JANBBDDH BANGLADESH 29 MEGHNA BANK LIMITED MGBLBDDH BANGLADESH 30 MERCANTILE -

DBBL's IT Infrastructure

automation of modern banking services. The mobile banking DBBL's IT infrastructure: Present system will be an 'open' system (similar to its ATM and Future network), which will give third party service providers unhindered access. Since the start of its operation, under the vision of Mr. M. Sahabuddin Ahmed -the founder chairman of the DBBL's current system already has the capability of Bank, Dutch-Bangla Bank has been continuously providing mobile banking services. The Bank is in the striving towards bringing world-class technology process of obtaining necessary permissions from driven banking services, and conveniences to its regulatory bodies and will launch a nationwide mobile- customers. As a result, DBBL is the first and only Bank banking revolution within 1 month of receiving the in Bangladesh to invest more than Taka 2 billion in regulatory permission. developing the largest ICT infrastructure in the banking sector of the Country. Bangladesh Automated Clearing House (BACH) Overview Bangladesh Bank is going to introduce first paperless DBBL owns and operates the largest ATM network of Automated Clearing House in the Country which is the Country comprising of 700 ATMs as of December called as Bangladesh Automated Cheque Processing 2009. The Bank is also the leader in POS terminal and System (BACPS) and Bangladesh Electronic Fund internet banking services. As a technology driven Transfer Network (BEFTN). Both the systems will be Bank, DBBL has implemented world reputed online implemented under Bangladesh Automated Clearing banking software at all its 79 branches and 10 SME House (BACH) project. These projects are being centers. DBBL also provides the following ancillary implemented under several reform measures taken by services: Bangladesh Bank to improve the safety and efficiency in the payment system. -

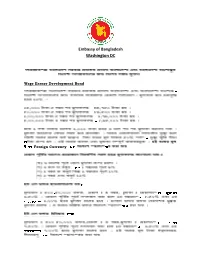

Procedure of Open Foreign Currency Account.Pdf

Embassy of Bangladesh Washington DC Wage Earner Development Bond Foreign Currency Foreign Currency Accounts Specimern Signature Specimern Signature FC Account Opening Form and Specimen Signature Extension [email protected] Diplomatic Bag /DHL/Fedex English Version The Government of the People’s Republic of Bangladesh have introduced special saving facilities for Non Resident Bangladeshis and also foreigner’s of Bangladeshi decent. Wage Earner Development Bond : Most profitable fixed deposit investment “Wage Earner Development Bond” for Non Resident Bangladeshi’s and Foreigners of Bangladeshi decent introduced by the Government of the People’s Republic of Bangladesh. Compound rate of profit is 12.00% per annum. Tk. 25,000 become Tk. 44,750 with profit after 5 years Tk. 50,000 become Tk. 89,500 with profit after 5 years Tk. 1,00,000 become Tk. 1,79,000 with profit after 5 years Tk. 5,00,000 become Tk. 8,95,000 with profit after 5 years Profits could be withdrawn at a rate of Tk. 1000.00 per month for every Tk. 100000.00. For withdrawal of profit simple rate is applicable. Nominee is entitled to 30% to 50% of invested amount as a death risk insurance at no extra charge in case of death of the bond owner. No income tax is levied on the initial investment or profits thereof. Initial investment amount could be transferred back in foreign currency. If encashed before maturity you will get interest at following rate : a. Before six month no interest b. After six month and before 1 year : 9% c. After 1 year and before 2 years : 10% d. -

Comparison and Analysis of Profitability of Top Three

Global Journal of Management and Business Research: C Finance Volume 19 Issue 3 Version 1.0 Year 2019 Type: Double Blind Peer Reviewed International Research Journal Publisher: Global Journals Online ISSN: 2249-4588 & Print ISSN: 0975-5853 Comparison and Analysis of Profitability of Top Three Nationalized Commercial Banks in Bangladesh By Saeed Sazzad Jeris Abstract- Banks are playing a vital role in the economic & financial development of Bangladesh. Profitability indicates the overall performance of the banks. In this study, it has been tried to compare the top three nationalized commercial banks by some financial parameters, and it relies on secondary sources of data. In this paper, I used statistical tool ANOVA for comparison. The result indicates the statistical difference among these banks and their performance is not stable. Keywords: bank, profitability, performance, ANOVA. GJMBR-C Classification: JEL Code: G21 ComparisonandAnalysisofProfitabilityofTopThreeNationalizedCommercialBanksinBangladesh Strictly as per the compliance and regulations of: © 2019. Saeed Sazzad Jeris. This is a research/review paper, distributed under the terms of the Creative Commons Attribution- Noncommercial 3.0 Unported License http://creativecommons.org/licenses/by-nc/3.0/), permitting all non-commercial use, distribution, and reproduction in any medium, provided the original work is properly cited. Comparison and Analysis of Profitability of Top Three Nationalized Commercial Banks in Bangladesh Saeed Sazzad Jeris Abstract- Banks are playing a vital role in the economic & III. Hypothesis financial development of Bangladesh. Profitability indicates the overall performance of the banks. In this study, it has been 1 2019 0 = There is an insignificant difference among Sonali tried to compare the top three nationalized commercial banks bank, Janata bank, and Agrani bank by on net worth. -

Janata Bank Limited Financial Statements As at and for the Year

Janata Bank Limited Financial Statements as at and for the year ended 31 December 2017 Syful Shamsul Alam & Co. Aziz Halim Khair Choudhury Chartered Accountants Chartered Accountants Paramount Heights (Level-6) Phulbari House, House # 25 65/2/1, Box Culvert Road Road # 1, Sector # 9 Purana Paltan Uttara Model Town Dhaka-1000, Bangladesh Dhaka-1230, Bangladesh Tel: +88 02 9555915 Tel: +88 02 8933357 Fax: +88 02 9560332 Fax: +88 02 8950995 Web: www.ssacbd.com Web: www.ahkcbd.com Syful Shamsul Alam & Co. Aziz Halim Khair Choudhury Chartered Accountants Chartered Accountants Paramount Heights (Level-6) Phulbari House 65/2/1 Purana Paltan House 25, Road 1, Dhaka – 1000. Sector 9, Uttara, Dhaka-1230. Independent Auditors' Report to the Shareholders of Janata Bank Limited We have audited the accompanying consolidated financial statements of Janata Bank Limited and its subsidiaries (the “Group") as well as the separate financial statements of Janata Bank Limited (the “Bank”), which comprise the consolidated balance sheet and the separate balance sheet as at 31 December 2017, and the consolidated and separate profit and loss accounts, consolidated and separate statements of changes in equity and consolidated and separate cash flow statement for the year then ended, and a summary of significant accounting policies and other explanatory information. Management’s Responsibility for the Financial Statements and Internal Controls Management is responsible for the preparation and fair presentation of consolidated financial statements of the Group and also separate financial statements of the Bank that give a true and fair view in accordance with Bangladesh Financial Reporting Standards as explained in note 2.01 and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements of the Group and also the separate financial statements of the Bank that are free from material misstatement, whether due to fraud or error. -

Internship Report: Profit Maximization and CSR Activities of NCC Bank

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by BRAC University Institutional Repository Internship Report: Profit Maximization and CSR activities of NCC Bank Submitted To Feihan Ahsan Lecturer, BRAC University Submitted By Rubaiyat Hossain ID: 13104255 Department: BBS Letter of Transmittal 16th May, 2016 Feihan Ahsan Lecturer, BRAC Business School Subject: Letter of Transmittal Dear Sir, With humble submission, I would like to state that I am Rubaiyat Hossain, (ID-13104255) have prepared the project report on “Profit Maximization and CSR Activities of NCC Bank” which was prepared based on my internship experience at NCC bank as a part of my final Project which is an essential part of my graduation program. I think it was a great opportunity for me to work in NCC bank as I got an idea about the overall banking activities. Though I joined as an HR intern but I had shuffled departments in every alternative week and have worked closely with all departments. I would like to express my gratitude to my Supervisor, Mr. Feihan Ahsan. Your steady thought and guidelines on the report helped me to structure the report and I would also like to thank, Md. Alauddin, Senior HR Officer at NCC Bank who allowed me his time, responded to my queries and also helped me in report preparation. It would be really grateful if you could provide your discreet approval on the report. Yours’ sincerely, Rubaiyat Hossain ID: 13104255 Department: BBS EXECUTIVE SUMMERY To provide a student with job acquaintance and a prospect of move of hypothetical learning into genuine experience, an entry level position is an absolute necessity. -

A Case of Banking Sector in Bangladesh

Jagannath University Journal of Business Studies, Vol. 4, No. 1 & 2, 25-34, December, 2014 REVIEW OF CSR PRACTICES IN EMERGING ECONOMY: A CASE OF BANKING SECTOR IN BANGLADESH Dr. Mohammad Bayezid Ali1 and Syed Omar Faruq2 Abstract This paper is intended to review the contemporary Corporate Social Responsibility (CSR) practices by the banking sector in Bangladesh and to examine its impact on the banks’ profitability and also in socio-economic development of Bangladesh. Yearly data from 2008 to 2013 has been used to examine whether the current practice of CSR could contribute to the profitability of the banking sector along with an enhancement in the socio-economic indicators of Bangladesh. It has been found that the total as well as sector-wise CSR Expenditure by the banking sector is increasing with having a positive linear trend. The association between banks’ CSR Expenditure and its profitability is positive but insignificant. In addition, banking sector contribution to CSR Expenditure significantly enhances the socio-economic indicators (i.e. HDI and Per Capita GDP) of Bangladesh. Key word: Corporate Social Responsibility, Per Capita GDP, HDI. 1.0 Introduction Corporate Social Responsibility (CSR) is a duty to every corporate entity to protect the interest of the society at large. Even though the motive of corporate houses is to earn profit, corporates should take initiatives for welfare of the society and should perform its activities within the framework of ethical, legal, social and environmental norms. The concept and practices of Corporate Social Responsibility (CSR) has been getting foundation during the last few years in Bangladesh and today it is undoubtedly seen as the integral part of doing business efficiently.