Economics: a Very Short Introduction Very Short Introductions Are for Anyone Wanting a Stimulating and Accessible Way in to a New Subject

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nhbs Annual New and Forthcoming Titles Issue: 2000 Complete January 2001 [email protected] +44 (0)1803 865913

nhbs annual new and forthcoming titles Issue: 2000 complete January 2001 [email protected] +44 (0)1803 865913 The NHBS Monthly Catalogue in a complete yearly edition Zoology: Mammals Birds Welcome to the Complete 2000 edition of the NHBS Monthly Catalogue, the ultimate Reptiles & Amphibians buyer's guide to new and forthcoming titles in natural history, conservation and the Fishes environment. With 300-400 new titles sourced every month from publishers and research organisations around the world, the catalogue provides key bibliographic data Invertebrates plus convenient hyperlinks to more complete information and nhbs.com online Palaeontology shopping - an invaluable resource. Each month's catalogue is sent out as an HTML Marine & Freshwater Biology email to registered subscribers (a plain text version is available on request). It is also General Natural History available online, and offered as a PDF download. Regional & Travel Please see our info page for more details, also our standard terms and conditions. Botany & Plant Science Prices are correct at the time of publication, please check www.nhbs.com for the Animal & General Biology latest prices. Evolutionary Biology Ecology Habitats & Ecosystems Conservation & Biodiversity Environmental Science Physical Sciences Sustainable Development Data Analysis Reference Mammals Activity Patterns in Small Mammals 318 pages | 59 figs, 11 tabs | Springer An Ecological Approach Hbk | 2000 | 354059244X | #109391A | Edited by S Halle and NC Stenseth £100.00 BUY Links chronobiology with behavioural and evolutionary ecology, drawing on research on mammals ranging from mongooses and civets to weasels, martens and shrews. .... African Rhino 92 pages | B/w photos, figs, tabs | IUCN Status Survey and Conservation Action Plan Pbk | 1999 | 2831705029 | #106031A | Richard Emslie and Martin Brooks £15.00 BUY Action plan aimed at donors, government and non-government organisations, and all those involved in rhino conservation. -

RELS102 HAM World Religions: Contemporary Life and Practice | University of Waikato

09/25/21 RELS102 HAM World Religions: Contemporary Life and Practice | University of Waikato RELS102 HAM World Religions: View Online Contemporary Life and Practice Amore, R. C., Oxtoby, W. G., & Hussain, A. (Eds.). (2014). World religions: Eastern traditions (Fourth edition). Oxford University Press. Armstrong, K. (2000). Islam: a short history: Vol. Modern Library chronicles (Modern Library ed). Modern Library. Armstrong, K. (2001). Buddha: Vol. A Penguin life. Penguin Putnam. Aslan, R. (2011). No God but God: The origins, evolution, and future of Islam (Rev Ed). RANDOM HOUSE. Bowker, J. W. (2002). The Cambridge illustrated history of religions: Vol. Cambridge illustrated history. Cambridge University Press. Burke, T. P. (2004). The major religions: an introduction with texts (2nd ed). Blackwell Pub. Carrithers, M. (2001). The Buddha: a very short introduction. Oxford University Press. http://site.ebrary.com/lib/waikato/Top?id=10460701 Cheetham, D., Pratt, D., & Thomas, D. (2013). Understanding interreligious relations (1st ed). Oxford University Press. Connolly, P. (1998). Approaches to the study of religion. Cassell. Cook, M. A. (1983). Muhammad: Vol. Past masters. Oxford University Press. De Lange, N. (2010). Introduction to Judaism: Vol. INTRODUCTION TO RELIGION. (2ND ED.). CAMBRIDGE UNIV PRESS. Dosick, W. D. (1995). Living Judaism: the complete guide to Jewish belief, tradition, and practice. HarperSan Francisco. http://www.loc.gov/catdir/description/hc044/95022260.html Eck, D. L. (1998). Darsan: Seeing the Divine Image in India (3rd ed.). Columbia University Press. http://ebook.stepor.com/book/darsan-seeing-the-divine-image-in-india-61008-pdf.html Ellwood, R. S. (2003). Cycles of faith: the development of the world’s religions. -

The Ancient World 1.800.405.1619/Yalebooks.Com Now Available in Paperback Recent & Classic Titles

2017 The Ancient World 1.800.405.1619/yalebooks.com Now available in paperback Recent & Classic Titles & Pax Romana Augustus War, Peace and Conquest in the Roman World First Emperor of Rome ADRIAN GOLDSWORTHY ADRIAN GOLDSWORTHY Renowned scholar Adrian Goldsworthy Caesar Augustus’ story, one of the most turns to the Pax Romana, a rare period riveting in western history, is filled with when the Roman Empire was at peace. A drama and contradiction, risky gambles vivid exploration of nearly two centuries and unexpected success. This biography of Roman history, Pax Romana recounts captures the real man behind the crafted real stories of aggressive conquerors, image, his era, and his influence over two failed rebellions, and unlikely alliances. millennia. “An excellent book. First-rate.” Paper 2015 640 pp. 43 b/w illus. + 13 maps —Richard A. Gabriel, Military History 978-0-300-21666-0 $20.00 Paper 2016 528 pp. 36 b/w illus. Cloth 2014 624 pp. 43 b/w illus. + 13 maps 978-0-300-23062-8 $22.00 978-0-300-17872-2 $35.00 Hardcover 2016 528 pp. 36 b/w illus. 978-0-300-17882-1 $32.50 Caesar Life of a Colossus Recent & Classic Titles ADRIAN GOLDSWORTHY This major new biography by a distin- guished British historian offers a remark- In the Name of Rome ably comprehensive portrait of a leader The Men Who Won the Roman Empire whose actions changed the course of ADRIAN GOLDSWORTHY; WITH A NEW PREFACE Western history and resonate some two A world-renowned authority offers a thousand years later. -

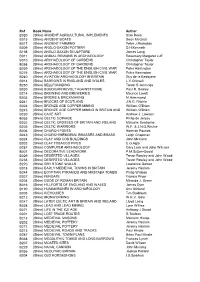

2013 CAG Library Index

Ref Book Name Author B020 (Shire) ANCIENT AGRICULTURAL IMPLEMENTS Sian Rees B015 (Shire) ANCIENT BOATS Sean McGrail B017 (Shire) ANCIENT FARMING Peter J.Reynolds B009 (Shire) ANGLO-SAXON POTTERY D.H.Kenneth B198 (Shire) ANGLO-SAXON SCULPTURE James Lang B011 (Shire) ANIMAL REMAINS IN ARCHAEOLOGY Rosemary Margaret Luff B010 (Shire) ARCHAEOLOGY OF GARDENS Christopher Taylor B268 (Shire) ARCHAEOLOGY OF GARDENS Christopher Taylor B039 (Shire) ARCHAEOLOGY OF THE ENGLISH CIVIL WAR Peter Harrington B276 (Shire) ARCHAEOLOGY OF THE ENGLISH CIVIL WAR Peter Harrington B240 (Shire) AVIATION ARCHAEOLOGY IN BRITAIN Guy de la Bedoyere B014 (Shire) BARROWS IN ENGLAND AND WALES L.V.Grinsell B250 (Shire) BELLFOUNDING Trevor S Jennings B030 (Shire) BOUDICAN REVOLT AGAINST ROME Paul R. Sealey B214 (Shire) BREWING AND BREWERIES Maurice Lovett B003 (Shire) BRICKS & BRICKMAKING M.Hammond B241 (Shire) BROCHS OF SCOTLAND J.N.G. Ritchie B026 (Shire) BRONZE AGE COPPER MINING William O'Brian B245 (Shire) BRONZE AGE COPPER MINING IN BRITAIN AND William O'Brien B230 (Shire) CAVE ART Andrew J. Lawson B035 (Shire) CELTIC COINAGE Philip de Jersey B032 (Shire) CELTIC CROSSES OF BRITAIN AND IRELAND Malcolm Seaborne B205 (Shire) CELTIC WARRIORS W.F. & J.N.G.Ritchie B006 (Shire) CHURCH FONTS Norman Pounds B243 (Shire) CHURCH MEMORIAL BRASSES AND BRASS Leigh Chapman B024 (Shire) CLAY AND COB BUILDINGS John McCann B002 (Shire) CLAY TOBACCO PIPES E.G.Agto B257 (Shire) COMPUTER ARCHAEOLOGY Gary Lock and John Wilcock B007 (Shire) DECORATIVE LEADWORK P.M.Sutton-Goold B029 (Shire) DESERTED VILLAGES Trevor Rowley and John Wood B238 (Shire) DESERTED VILLAGES Trevor Rowley and John Wood B270 (Shire) DRY STONE WALLS Lawrence Garner B018 (Shire) EARLY MEDIEVAL TOWNS IN BRITAIN Jeremy Haslam B244 (Shire) EGYPTIAN PYRAMIDS AND MASTABA TOMBS Philip Watson B027 (Shire) FENGATE Francis Pryor B204 (Shire) GODS OF ROMAN BRITAIN Miranda J. -

The Iron Age Tom Moore

The Iron Age Tom Moore INTRODUCfiON In the twenty years since Alan Saville's (1984) review of the Iron Age in Gloucestershire much has happened in Iron-Age archaeology, both in the region and beyond.1 Saville's paper marked an important point in Iron-Age studies in Gloucestershire and was matched by an increasing level of research both regionally and nationally. The mid 1980s saw a number of discussions of the Iron Age in the county, including those by Cunliffe (1984b) and Darvill (1987), whilst reviews were conducted for Avon (Burrow 1987) and Somerset (Cunliffe 1982). At the same time significant advances and developments in British Iron-Age studies as a whole had a direct impact on how the period was viewed in the region. Richard Hingley's (1984) examination of the Iron-Age landscapes of Oxfordshire suggested a division between more integrated unenclosed communities in the Upper Thames Valley and isolated enclosure communities on the Cotswold uplands, arguing for very different social systems in the two areas. In contrast, Barry Cunliffe' s model ( 1984a; 1991 ), based on his work at Danebury, Hampshire, suggested a hierarchical Iron-Age society centred on hillforts directly influencing how hillforts and social organisation in the Cotswolds have been understood (Darvill1987; Saville 1984). Together these studies have set the agenda for how the 1st millennium BC in the region is regarded and their influence can be felt in more recent syntheses (e.g. Clarke 1993). Since 1984, however, our perception of Iron-Age societies has been radically altered. In particular, the role of hillforts as central places at the top of a hierarchical settlement pattern has been substantially challenged (Hill 1996). -

Pandemics: a Very Short Introduction VERY SHORT INTRODUCTIONS Are for Anyone Wanting a Stimulating and Accessible Way Into a New Subject

Pandemics: A Very Short Introduction VERY SHORT INTRODUCTIONS are for anyone wanting a stimulating and accessible way into a new subject. They are written by experts, and have been translated into more than 40 different languages. The series began in 1995, and now covers a wide variety of topics in every discipline. The VSI library now contains over 450 volumes—a Very Short Introduction to everything from Indian philosophy to psychology and American history and relativity—and continues to grow in every subject area. Very Short Introductions available now: ACCOUNTING Christopher Nobes ANAESTHESIA Aidan O’Donnell ADOLESCENCE Peter K. Smith ANARCHISM Colin Ward ADVERTISING Winston Fletcher ANCIENT ASSYRIA Karen Radner AFRICAN AMERICAN RELIGION ANCIENT EGYPT Ian Shaw Eddie S. Glaude Jr ANCIENT EGYPTIAN ART AND AFRICAN HISTORY John Parker and ARCHITECTURE Christina Riggs Richard Rathbone ANCIENT GREECE Paul Cartledge AFRICAN RELIGIONS Jacob K. Olupona THE ANCIENT NEAR EAST AGNOSTICISM Robin Le Poidevin Amanda H. Podany AGRICULTURE Paul Brassley and ANCIENT PHILOSOPHY Julia Annas Richard Soffe ANCIENT WARFARE ALEXANDER THE GREAT Harry Sidebottom Hugh Bowden ANGELS David Albert Jones ALGEBRA Peter M. Higgins ANGLICANISM Mark Chapman AMERICAN HISTORY Paul S. Boyer THE ANGLO-SAXON AGE AMERICAN IMMIGRATION John Blair David A. Gerber THE ANIMAL KINGDOM AMERICAN LEGAL HISTORY Peter Holland G. Edward White ANIMAL RIGHTS David DeGrazia AMERICAN POLITICAL HISTORY THE ANTARCTIC Klaus Dodds Donald Critchlow ANTISEMITISM Steven Beller AMERICAN POLITICAL PARTIES ANXIETY Daniel Freeman and AND ELECTIONS L. Sandy Maisel Jason Freeman AMERICAN POLITICS THE APOCRYPHAL GOSPELS Richard M. Valelly Paul Foster THE AMERICAN PRESIDENCY ARCHAEOLOGY Paul Bahn Charles O. -

The Aristocratic Warlike Ethos of Indo-Europeans and the Primordial Origins of Western Civilization—Part Two Ricardo Duchesne [email protected]

Comparative Civilizations Review Volume 61 Article 3 Number 61 Fall 2009 10-1-2009 The Aristocratic Warlike Ethos of Indo-Europeans and the Primordial Origins of Western Civilization—Part Two Ricardo Duchesne [email protected] Follow this and additional works at: https://scholarsarchive.byu.edu/ccr Recommended Citation Duchesne, Ricardo (2009) "The Aristocratic Warlike Ethos of Indo-Europeans and the Primordial Origins of Western Civilization—Part Two," Comparative Civilizations Review: Vol. 61 : No. 61 , Article 3. Available at: https://scholarsarchive.byu.edu/ccr/vol61/iss61/3 This Article is brought to you for free and open access by the All Journals at BYU ScholarsArchive. It has been accepted for inclusion in Comparative Civilizations Review by an authorized editor of BYU ScholarsArchive. For more information, please contact [email protected], [email protected]. Duchesne: The Aristocratic Warlike Ethos of Indo-Europeans and the Primordi The Aristocratic Warlike Ethos of Indo-Europeans and the Primordial Origins of Western Civilization—Part Two1 Ricardo Duchesne [email protected] Western civilization has been the single most war-ridden, war- dominated, and militaristic civilization in all human history. Robert Nisbet [Mycenaean] society was not the society of a sacred city, but that of a military aristocracy. It is the heroic society of the Homeric epic, and in Homer's world there is no room for citizen or priest or merchant, but only for the knight and his retainers, for the nobles and the Zeus born kings, 'the sackers of cities.' Christopher Dawson [T]he Greek knows the artist only in personal struggle... What, for example, is of particular importance in Plato's dialogues is mostly the result of a contest with the art of orators, the Sophists, the dramatists of his time, invented for the purpose of his finally being able to say: 'Look: I, too, can do what my great rivals can do; yes, I can do it better than them. -

TRINITY COLLEGE Cambridge Trinity College Cambridge College Trinity Annual Record Annual

2016 TRINITY COLLEGE cambridge trinity college cambridge annual record annual record 2016 Trinity College Cambridge Annual Record 2015–2016 Trinity College Cambridge CB2 1TQ Telephone: 01223 338400 e-mail: [email protected] website: www.trin.cam.ac.uk Contents 5 Editorial 11 Commemoration 12 Chapel Address 15 The Health of the College 18 The Master’s Response on Behalf of the College 25 Alumni Relations & Development 26 Alumni Relations and Associations 37 Dining Privileges 38 Annual Gatherings 39 Alumni Achievements CONTENTS 44 Donations to the College Library 47 College Activities 48 First & Third Trinity Boat Club 53 Field Clubs 71 Students’ Union and Societies 80 College Choir 83 Features 84 Hermes 86 Inside a Pirate’s Cookbook 93 “… Through a Glass Darkly…” 102 Robert Smith, John Harrison, and a College Clock 109 ‘We need to talk about Erskine’ 117 My time as advisor to the BBC’s War and Peace TRINITY ANNUAL RECORD 2016 | 3 123 Fellows, Staff, and Students 124 The Master and Fellows 139 Appointments and Distinctions 141 In Memoriam 155 A Ninetieth Birthday Speech 158 An Eightieth Birthday Speech 167 College Notes 181 The Register 182 In Memoriam 186 Addresses wanted CONTENTS TRINITY ANNUAL RECORD 2016 | 4 Editorial It is with some trepidation that I step into Boyd Hilton’s shoes and take on the editorship of this journal. He managed the transition to ‘glossy’ with flair and panache. As historian of the College and sometime holder of many of its working offices, he also brought a knowledge of its past and an understanding of its mysteries that I am unable to match. -

Hunting and Social Change in Late Saxon England

Eastern Illinois University The Keep Masters Theses Student Theses & Publications 2016 Butchered Bones, Carved Stones: Hunting and Social Change in Late Saxon England Shawn Hale Eastern Illinois University This research is a product of the graduate program in History at Eastern Illinois University. Find out more about the program. Recommended Citation Hale, Shawn, "Butchered Bones, Carved Stones: Hunting and Social Change in Late Saxon England" (2016). Masters Theses. 2418. https://thekeep.eiu.edu/theses/2418 This is brought to you for free and open access by the Student Theses & Publications at The Keep. It has been accepted for inclusion in Masters Theses by an authorized administrator of The Keep. For more information, please contact [email protected]. The Graduate School� EASTERNILLINOIS UNIVERSITY " Thesis Maintenance and Reproduction Certificate FOR: Graduate Candidates Completing Theses in Partial Fulfillment of the Degree Graduate Faculty Advisors Directing the Theses RE: Preservation, Reproduction, and Distribution of Thesis Research Preserving, reproducing, and distributing thesis research is an important part of Booth Library's responsibility to provide access to scholarship. In order to further this goal, Booth Library makes all graduate theses completed as part of a degree program at Eastern Illinois University available for personal study, research, and other not-for-profit educational purposes. Under 17 U.S.C. § 108, the library may reproduce and distribute a copy without infringing on copyright; however, professional courtesy dictates that permission be requested from the author before doing so. Your signatures affirm the following: • The graduate candidate is the author of this thesis. • The graduate candidate retains the copyright and intellectual property rights associated with the original research, creative activity, and intellectual or artistic content of the thesis. -

Part I Officers in Institutions Placed Under the Supervision of the General Board

2 OFFICERS NUMBER–MICHAELMAS TERM 2009 [SPECIAL NO.7 PART I Chancellor: H.R.H. The Prince PHILIP, Duke of Edinburgh, T Vice-Chancellor: 2003, Prof. ALISON FETTES RICHARD, N, 2010 Deputy Vice-Chancellors for 2009–2010: Dame SANDRA DAWSON, SID,ATHENE DONALD, R,GORDON JOHNSON, W,STUART LAING, CC,DAVID DUNCAN ROBINSON, M,JEREMY KEITH MORRIS SANDERS, SE, SARAH LAETITIA SQUIRE, HH, the Pro-Vice-Chancellors Pro-Vice-Chancellors: 2004, ANDREW DAVID CLIFF, CHR, 31 Dec. 2009 2004, IAN MALCOLM LESLIE, CHR, 31 Dec. 2009 2008, JOHN MARTIN RALLISON, T, 30 Sept. 2011 2004, KATHARINE BRIDGET PRETTY, HO, 31 Dec. 2009 2009, STEPHEN JOHN YOUNG, EM, 31 July 2012 High Steward: 2001, Dame BRIDGET OGILVIE, G Deputy High Steward: 2009, ANNE MARY LONSDALE, NH Commissary: 2002, The Rt Hon. Lord MACKAY OF CLASHFERN, T Proctors for 2009–2010: JEREMY LLOYD CADDICK, EM LINDSAY ANNE YATES, JN Deputy Proctors for MARGARET ANN GUITE, G 2009–2010: PAUL DUNCAN BEATTIE, CC Orator: 2008, RUPERT THOMPSON, SE Registrary: 2007, JONATHAN WILLIAM NICHOLLS, EM Librarian: 2009, ANNE JARVIS, W Acting Deputy Librarian: 2009, SUSANNE MEHRER Director of the Fitzwilliam Museum and Marlay Curator: 2008, TIMOTHY FAULKNER POTTS, CL Director of Development and Alumni Relations: 2002, PETER LAWSON AGAR, SE Esquire Bedells: 2003, NICOLA HARDY, JE 2009, ROGER DERRICK GREEVES, CL University Advocate: 2004, PHILIPPA JANE ROGERSON, CAI, 2010 Deputy University Advocates: 2007, ROSAMUND ELLEN THORNTON, EM, 2010 2006, CHRISTOPHER FORBES FORSYTH, R, 2010 OFFICERS IN INSTITUTIONS PLACED UNDER THE SUPERVISION OF THE GENERAL BOARD PROFESSORS Accounting 2003 GEOFFREY MEEKS, DAR Active Tectonics 2002 JAMES ANTHONY JACKSON, Q Aeronautical Engineering, Francis Mond 1996 WILLIAM NICHOLAS DAWES, CHU Aerothermal Technology 2000 HOWARD PETER HODSON, G Algebra 2003 JAN SAXL, CAI Algebraic Geometry (2000) 2000 NICHOLAS IAN SHEPHERD-BARRON, T Algebraic Geometry (2001) 2001 PELHAM MARK HEDLEY WILSON, T American History, Paul Mellon 1992 ANTHONY JOHN BADGER, CL American History and Institutions, Pitt 2009 NANCY A. -

American Slavery: a Very Short Introduction PDF Book

AMERICAN SLAVERY: A VERY SHORT INTRODUCTION PDF, EPUB, EBOOK Heather Andrea Williams | 160 pages | 03 Nov 2014 | Oxford University Press | 9780199922680 | English | Oxford, United Kingdom American Slavery: A Very Short Introduction PDF Book Do be advised that shipments may be delayed due to extra safety precautions implemented at our centers and delays with local shipping carriers. Other Editions 1. There are no customer reviews for this item yet. Thanks for shopping indie! These laws reflected the contradiction of America's moral and philosophical ideology that valorized freedom on one hand and justified the enslavement of a population deemed inferior on another. Surviving slavery. Sign in to annotate. Tells you about the important facts. This is such an important text, and one I would recommend to anyone as important reading of an embedded history of oppression whose legacies still reach into our present. Very Short Introductions. Welcome back. I had to read this for my U. We're experiencing an enormous and unprecedented order volume at this time. Advanced Search. Williams examines legislation that differentiated American Indians and Africans from Europeans as the ideology of white supremacy flourished and became an ingrained feature of the society. Showing Why were Africans enslaved in America? Thanks for telling us about the problem. View 2 comments. Despite being comprehensive, Williams infuses this history with specific examples, some of which I had never learned of before, and the prose is approachable, unlike some of the textbooks I've read in the past. Paperback , pages. This includes details about the first slaves, the "middle passage This "short introduction" is packed full of interesting information and fine points about American slavery. -

Books Added to Benner Library from Estate of Dr. William Foote

Books added to Benner Library from estate of Dr. William Foote # CALL NUMBER TITLE Scribes and scholars : a guide to the transmission of Greek and Latin literature / by L.D. Reynolds and N.G. 1 001.2 R335s, 1991 Wilson. 2 001.2 Se15e Emerson on the scholar / Merton M. Sealts, Jr. 3 001.3 R921f Future without a past : the humanities in a technological society / John Paul Russo. 4 001.30711 G163a Academic instincts / Marjorie Garber. Book of the book : some works & projections about the book & writing / edited by Jerome Rothenberg and 5 002 B644r Steven Clay. 6 002 OL5s Smithsonian book of books / Michael Olmert. 7 002 T361g Great books and book collectors / Alan G. Thomas. 8 002.075 B29g Gentle madness : bibliophiles, bibliomanes, and the eternal passion for books / Nicholas A. Basbanes. 9 002.09 B29p Patience & fortitude : a roving chronicle of book people, book places, and book culture / Nicholas A. Basbanes. Books of the brave : being an account of books and of men in the Spanish Conquest and settlement of the 10 002.098 L552b sixteenth-century New World / Irving A. Leonard ; with a new introduction by Rolena Adorno. 11 020.973 R824f Foundations of library and information science / Richard E. Rubin. 12 021.009 J631h, 1976 History of libraries in the Western World / by Elmer D. Johnson and Michael H. Harris. 13 025.2832 B175d Double fold : libraries and the assault on paper / Nicholson Baker. London booksellers and American customers : transatlantic literary community and the Charleston Library 14 027.2 R196L Society, 1748-1811 / James Raven.