Identification of Other Systemically Important Institutions (2016)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lista Banków Przyjmujących Przelewy Europejskie (Stan Na 01.10.2010)

Lista banków przyjmujących przelewy Europejskie (stan na 01.10.2010) BELGIUM ING BELGIUM SA/NV BBRUBEBB FORTIS BANK NV/SA GEBABEBB DEXIA BANK BELGIUM N.V GKCCBEBB KBC BANK NV BRUSSELS KREDBEBB LA POST SA DE DROIT PUBLIC PCHQBEBB AACHENER BANK EG, FILIALE EUPEN AACABE41 ABN AMRO BANK (BRUSSELS BRANCH) BELGIUM ABNABEBR ABK ABERBE21 ANTWERPSE DIAMANTBANK NV ADIABE22 ARGENTA SPAARBANK NV ARSPBE22 AXA BANK NV AXABBE22 BANK OF BARODA BARBBEBB BANCO BILBAO VIZCAYA ARGENTARIA BRUSSELS BBVABEBB BANQUE CHAABI DU MAROC BCDMBEB1 BKCP BKCPBEB1 CREDIT PROFESSIONNEL SA (BKCP) BKCPBEBB BANCA MONTE PASCHI BELGIO BMPBBEBB DELTA LLOYD BANK SA BNAGBEBB BNP PARIBAS BELGIQUE BNPABEBB BANK OF AMERICA, ANTWERP BRANCH BOFABE3X BANK OF TOKYO MITSUBISHI NV BOTKBEBX BANK VAN DE POST BPOTBEB1 SANTANDER BENELUX BSCHBEBB BYBLOS BANK EUROPE BYBBBEBB JP MORGAN CHASE BANK BRUSSELS CHASBEBX CITIBANK INTERNATIONAL PLC CITIBEBX COMMERZBANK AG, ANTWERPEN COBA COBABEBB COMMERZBANK BELGIEN N.V/S.A. COBABEBB COMMERZBANK AG, BRUSSELS COBABEBX BANQUE CREDIT PROFESSIONEL DU HAINAUT SCRL CPDHBE71 CBC BANQUE SA BRUXELLES CREGBEBB CITIBANK BELGIUM SA CTBKBEBX BANK DEGROOF SA DEGRBEBB BANK DELEN NV DELEBE22 DEUTSCHE BANK BRUSSELS DEUTBEBE DRESDNER BANK BRUSSELS BRANCH DRESBEBX ETHIAS BANK NV ETHIBEBB EUROPABANK NV EURBBE99 VAN LANSCHOT BANKIERS BELGIË NV FVLBBE22 GOFFIN BANK NV GOFFBE22 HABIB BANK LTD BELGIUM HABBBEBB MERCATOR BANK NV HBKABE22 HSBC BANK PLC BRUSSELS HSBCBEBB THE BANK OF NEW YORK, BRUSSELS BRANCH IRVTBEBB BANK J. VAN BREDA JVBABE22 KBC ASSET MANAGEMENT KBCABEBB KBC FINANCIAL -

FHB Mortgage Bank Co. Plc. PUBLIC OFFERING the FHB Mortgage

FHB Mortgage Bank Co. Plc. PUBLIC OFFERING The FHB Mortgage Bank Co. Plc’s (registration number: 01-10-043638, date of registration: 18 March 1998, head office: 1082 Budapest, Üllői út 48.) (hereafter: “Issuer”, FHB Nyrt.” or “Bank”) Board of Directors has a regulation No. 89/2012. (14. December) to launch its Issue Program 2012-2013 with a HUF 200 billon total nominal value for issuance of Hungarian Covered Mortgage Bonds (jelzáloglevelek) and Notes, within the frameworks of it the Issuer is planning to issue different registered covered mortgage bonds’ and bonds’ series and within the series different tranches. Since there is no universal responsibility between the Issuer and the Managers, the securities issued under the auspices of the Base Prospectus have out of ordinary risks. The Issuer publishes its Base Prospectus on the website of its own and of the BSE the hard copies are available at the selling places. The number and date of the license granted by the Hungarian Financial Supervisory Authority (HFSA) to publish the Base Prospectus of the Issue Program and the disclosure of the public issue: KE-III-55/2012. 03. February 2012. The FHB Mortgage Bank Co. Plc’s (registration number: 01-10-043638, date of registration: 18 March 1998, head office: 1082 Budapest, Üllői út 48.) (hereafter: “Issuer”, FHB Nyrt.” or “Bank”) Board of Directors has a regulation No. 70/2012. (13. December) to launch its Issue Program 2013-2014 with a HUF 200 billon total nominal value for issuance of Hungarian Covered Mortgage Bonds (jelzáloglevelek) and Notes, within the frameworks of it the Issuer is planning to issue different registered covered mortgage bonds’ and bonds’ series and within the series different tranches. -

Standard Settlement Instructions of the MKB Bank

Standard settlement instructions of MKB Bank Zrt. for commercial transactions valid from December, 2017 Currency Name of the Bank & City SWIFT Code AUD Australia and New Zealand Banking Group Limited, ANZB AU 3M Melbourne BGN DSK Bank PLC, Sofia STSABGSF CAD Deutsche Bank AG, Frankfurt am Main DEUT DE FF CHF Zürcher Kantonalbank, Zürich ZKBK CH ZZ 80A CHF UBS AG, Zürich UBSW CH ZH 80A CZK Komercní Banka a.s., Prague KOMB CZ PP CNY Bank of China Limited, Budapest Branch BKCH HU HH DKK Danske Bank AS, Copenhagen DABA DK KK EUR Commerzbank AG, Frankfurt am Main COBA DE FF EUR Deutsche Bank AG, Frankfurt am Main DEUT DE FF EUR UniCredit Bank Austria AG, Vienna BKAU AT WW EUR Intesa Sanpaolo SpA, Milan BCIT IT MM EUR Société Générale, Paris SOGE FR PP GBP National Westminster Bank PLC, London NWBK GB 2L HRK Zagrebacka banka dd., Zagreb ZABA HR 2X JPY The Bank of Tokyo-Mitsubishi UFJ Ltd, Tokyo BOTK JP JT NOK DNB Bank ASA, Oslo DNBA NO KK PLN mBank S.A., Warsaw BREX PL PW RON Raiffeisen Bank S.A., Bucharest RZBR RO BU RUB AO Unicredit Bank, Moscow* IMBKRUMM SEK Skandinaviska Enskilda Banken AB, Stockholm ESSE SE SS TRY Akbank TAS, Istanbul AKBK TR IS USD JPMorgan Chase Bank NA, New York CHAS US 33 USD Deutsche Bank Trust Co. Americas, New York BKTR US 33 USD Citibank NA, New York CITI US 33 USD The Bank of New York Mellon, New York IRVT US 3N *Account details for RUB account: Account with AO Unicredit Bank (IMBKRUMM), account number 30111810700014652763, INN 9909336928, AO Unicredit Bank ’s account number with the Central Bank of the Russian Federation, Moscow,. -

Bad Bank Resolutions and Bank Lending by Michael Brei, Leonardo Gambacorta, Marcella Lucchetta and Bruno Maria Parigi

BIS Working Papers No 837 Bad bank resolutions and bank lending by Michael Brei, Leonardo Gambacorta, Marcella Lucchetta and Bruno Maria Parigi Monetary and Economic Department January 2020 JEL classification: E44, G01, G21 Keywords: bad banks, resolutions, lending, non-performing loans, rescue packages, recapitalisations BIS Working Papers are written by members of the Monetary and Economic Department of the Bank for International Settlements, and from time to time by other economists, and are published by the Bank. The papers are on subjects of topical interest and are technical in character. The views expressed in them are those of their authors and not necessarily the views of the BIS. This publication is available on the BIS website (www.bis.org). © Bank for International Settlements 2020. All rights reserved. Brief excerpts may be reproduced or translated provided the source is stated. ISSN 1020-0959 (print) ISSN 1682-7678 (online) Bad bank resolutions and bank lending Michael Brei∗, Leonardo Gambacorta♦, Marcella Lucchetta♠ and Bruno Maria Parigi♣ Abstract The paper investigates whether impaired asset segregation tools, otherwise known as bad banks, and recapitalisation lead to a recovery in the originating banks’ lending and a reduction in non-performing loans (NPLs). Results are based on a novel data set covering 135 banks from 15 European banking systems over the period 2000–16. The main finding is that bad bank segregations are effective in cleaning up balance sheets and promoting bank lending only if they combine recapitalisation with asset segregation. Used in isolation, neither tool will suffice to spur lending and reduce future NPLs. Exploiting the heterogeneity in asset segregation events, we find that asset segregation is more effective when: (i) asset purchases are funded privately; (ii) smaller shares of the originating bank’s assets are segregated; and (iii) asset segregation occurs in countries with more efficient legal systems. -

Standard Settlement Instructions for Foreign Exchange, Money Market and Commercial Payments

Standard Settlement Instructions For Foreign Exchange, Money Market and Commercial Payments CURRENCY CORRESPONDENT BANK S.W.I.F.T ADDRESS Australian Dollar Westpac Banking Corporation WPACAU2S AUD Sydney, Australia Barbados Dollar The Bank of Nova Scotia, Bridgetown NOCSBBBB BBD Barbados Bermudian Dollar The Bank of N. T. Butterfield & Son Ltd. BNTBBMHM BMD Hamilton, Bermuda Bahamian Dollar Scotiabank (Bahamas) Ltd. NOSCBSNS BSD Nassau, Bahamas Belize Dollar Scotiabank (Belize) Ltd., NOSCBZBS BZD Belize City, Belize Canadian Dollar The Bank of Nova Scotia NOSCCATT CAD Global Wholesale Services, Toronto Cyprus Pound Bank of Cyprus Public Company Ltd., BCYPCY2N010 CYP Nicosia, Cyrpus Czech Koruna Ceskolovenska Obchodni Banka A.S. CEKOCZPP CZK Prague Danish Krone Nordea Bank Danmark A/S NDEADKKK DKK Copenhagen, Denmark Euro Deutsche Bank AG DEUTDEFF EUR Frankfurt Fiji Dollar Wetspac Banking Corporation WPACFJFX FJD Suva, Fiji Guyana Dollar The Bank of Nova Scotia, Georgetown, NOSCGYGE GYD Guyana Hong Kong Dollar Standard Chartered Bank (Hong Kong) Limited, Hong SCBLHKHH HKD Kong Hungarian Forint MKB Bank ZRT MKKB HU HB HUF Indian Rupee The Bank of Nova Scotia NOSCINBB INR Mumbai Indonesian Rupiah Standard Chartered Bank SCBLIDJX IDR Jakarta, Indonesia Israeli Sheqel Bank Hapaolim BM POALILIT ILS Tel Aviv Jamaican Dollar The Bank of Nova Scotia Jamaica Ltd. NOSCBSNSKIN JMD Kingston, Jamaica Japanese Yen The Bank of Tokyo-Mitsubishi UFJ, Ltd. BOTKJPJT JPY Tokyo Cayman Islands Dollar Scotiabank and Trust (Cayman) Ltd. NOSCKYKX KYD Cayman Islands -

PUBLIC OFFERING the FHB Mortgage Bank Co. Plc's

PUBLIC OFFERING The FHB Mortgage Bank Co. Plc’s (registration number: 01-10-043028, date of registration: 4 December 2003, head office: 1132 Budapest, Váci út 20.) (hereafter: “Issuer”, FHB Nyrt.” or “Bank”) Board of Directors has a regulation No. 56/2007. (23. November) to launch its Issue Program 2007-2008 with a HUF 200 billon total nominal value for issuance of Hungarian Covered Mortgage Bonds (jelzáloglevelek) and Notes, within the frameworks of it the Issuer is planning to issue different registered covered mortgage bonds’ and notes’ series and within the series different tranches and to initiate to introduce the series into the Hungarian Stock Exchange (BSE). Since there is no universal responsibility between the Issuer and the Managers, the securities issued under the auspices of the Base Prospectus have out of ordinary risks. The Issuer publishes its Base Prospectus on the website of its own and of the BSE, the hard copies are available at the selling places. The number and date of the license granted by the Hungarian Financial Supervisory Authority (HFSA) to publish the Base Prospectus of the Issue Program and the disclosure of the public issue: E-III./10.355/2008. 29. January 2008. Pursuant to the Issue Program referred above the Issuer publicly offers to issue first part of FHB Bond series FK12NF01 and the FHB will initiate to introduce the series into the BSE. The base of the issue: the resolution No. 152/2009. (19. November) of the Assets/Liabilities Committee. 1. Issuer: FHB Mortgage Bank Co. Plc. (FHB Jelzálogbank Nyilvánosan Működő Részvénytársaság) 2. -

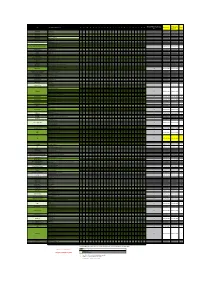

Updated As of 01/06/2017 Changes Highlighted in Yellow

NEW QUARTER TOTAL PDship per Previous Quarter Firm Legal Entity Holding Dealership AT BE BG CZ DE DK ES FI FR GR HU IE IT LV LT NL PL PT RO SE SI SK UK Current Quarter Changes Bank March 2016) ABLV Bank ABLV Bank, AS 1 bank customer bank customer 0 Abanka Vipa Abanka Vipa d.d. 1 bank customer bank customer 0 ABN Amro ABN Amro Bank N.V. 3 bank inter dealer bank inter dealer 0 Alpha Bank Alpha Bank S.A. 1 bank customer bank customer 0 Allianz Group Allianz Bank Bulgaria AD 1 bank customer bank customer 0 Banca IMI Banca IMI S.p.A. 3 bank inter dealer bank inter dealer 0 Banca Transilvania Banca Transilvania 1 bank customer bank customer 0 Banco BPI Banco BPI + 1 bank customer bank customer 0 Banco Comercial Português Millenniumbcp + 1 bank customer bank customer 0 Banco Cooperativo Español Banco Cooperativo Español S.A. + 1 bank customer bank customer 0 Banco Santander S.A. + Banco Santander / Santander Group Santander Global Banking & Markets UK 6 bank inter dealer bank inter dealer 0 Bank Zachodni WBK S.A. Bank Millennium Bank Millennium S.A. 1 bank customer bank customer 0 Bankhaus Lampe Bankhaus Lampe KG 1 bank customer bank customer 0 Bankia Bankia S.A.U. 1 bank customer bank customer 0 Bankinter Bankinter S.A. 1 bank customer bank customer 0 Bank of America Merrill Lynch Merrill Lynch International 9 bank inter dealer bank inter dealer 0 Barclays Barclays Bank PLC + 17 bank inter dealer bank inter dealer 0 Bayerische Landesbank Bayerische Landesbank 1 bank customer bank customer 0 BAWAG P.S.K. -

List of Market Makers and Authorised Primary Dealers Who Are Using the Exemption Under the Regulation on Short Selling and Credit Default Swaps

Last update 11 August 2021 List of market makers and authorised primary dealers who are using the exemption under the Regulation on short selling and credit default swaps According to Article 17(13) of Regulation (EU) No 236/2012 of the European Parliament and of the Council of 14 March 2012 on short selling and certain aspects of credit default swaps (the SSR), ESMA shall publish and keep up to date on its website a list of market makers and authorised primary dealers who are using the exemption under the Short Selling Regulation (SSR). The data provided in this list have been compiled from notifications of Member States’ competent authorities to ESMA under Article 17(12) of the SSR. Among the EEA countries, the SSR is applicable in Norway as of 1 January 2017. It will be applicable in the other EEA countries (Iceland and Liechtenstein) upon implementation of the Regulation under the EEA agreement. Austria Italy Belgium Latvia Bulgaria Lithuania Croatia Luxembourg Cyprus Malta Czech Republic The Netherlands Denmark Norway Estonia Poland Finland Portugal France Romania Germany Slovakia Greece Slovenia Hungary Spain Ireland Sweden Last update 11 August 2021 Austria Market makers Name of the notifying Name of the informing CA: ID code* (e.g. BIC): person: FMA ERSTE GROUP BANK AG GIBAATWW FMA OBERBANK AG OBKLAT2L FMA RAIFFEISEN CENTROBANK AG CENBATWW Authorised primary dealers Name of the informing CA: Name of the notifying person: ID code* (e.g. BIC): FMA BARCLAYS BANK PLC BARCGB22 BAWAG P.S.K. BANK FÜR ARBEIT UND WIRTSCHAFT FMA BAWAATWW UND ÖSTERREICHISCHE POSTSPARKASSE AG FMA BNP PARIBAS S.A. -

81-125 Peter Vass.Indd

DOI: 10.33908/EF.2019.1.5 MEMBER BANKS OF THE HUNGARIAN BANKING ASSOCIATION 81 MEMBER BANKS OF THE HUNGARIAN BANKING ASSOCIATION Péter Vass ABSTRACT In its 30 years of existence, the Hungarian Banking Association has witnessed an extraordinary evolution in the banking sector.1 During this period, a total of 93 banks were registered in Hungary (in the form of companies limited by shares or branches), typically 40 to 50 operating at the same time. It was only for special reasons that the number of banks exceeded that upper limit, while it fell below 40 only during the transformation spurt aft er the introduction of the two-tier banking system, during the post-transition bank foundation fever up until 1991, and – seemingly – by surprise, during the bank sector boom in the early 2000s. Th e development and the continuous change of the institutional background has been driven by domestic processes in the fi eld of banking, economy and regulation alike, by the consequences of international structural developments (mergers, strategic partnerships and their dissolution) at the level of Hungarian subsidiary banks as well as by the individual development paths of certain banks. Th e length of this paper does not allow for a comprehensive in-depth analysis of all these motivators, but we consider that presenting the development of each member bank of the Banking Association within a common framework, focussing mainly on current members, would be informative. JEL codes: G21, N94 Keywords: history of the banking sector, banking history, banking sector entries and exits, bank mergers, competition 1 For the purposes of this article, banks and specialised credit institutions under Act CXII of 1996 on Credit Institutions and Financial Enterprises are regarded as part of the banking sector, not including KELER, which performs non-banking activities. -

Is the Bank-Sovereign Link Truly Severed? Phedon NICOLAIDES and Tony O’CONNOR

Is the Bank-Sovereign Link Truly Severed? Phedon NICOLAIDES and Tony O’CONNOR DEPARTMENT OF EUROPEAN ECONOMIC STUDIES Bruges European Economic Policy Briefings 43 / 2016 About the authors Phedon Nicolaides is Director and Jan Tinbergen Chair in the Department of European Economic Studies at the College of Europe in Bruges, where he teaches several courses. He is also a Professor in economic law at Maastricht University and Academic Director of Lexxion Publishing, specialising on State aid law. He has acted as consultant to a number of public authorities in various EU Member States and to international institutions and organisations. Professor Nicolaides has published extensively on European integration, competition policy and state aid, and policy implementation. He is on the editorial boards of several journals. He holds a PhD in economics and a PhD in law. Tony O’Connor is an Academic Assistant in the Economics Department at the Bruges campus of the College of Europe. He obtained an M.A. from the College in 2016 with a focus on European Public Policy Analysis and also holds an M.Sc. in Economics from Trinity College Dublin. Tony has previously been a trainee in the Directorate General for Macroprudential Policy and Financial Stability of the European Central Bank. His fields of interest include financial regulation and macroeconomics. Addresses for Correspondence Prof. Phedon Nicolaides: [email protected] Mr. Tony O’Connor: [email protected] Disclaimer The views presented here are strictly those of the authors and do not reflect the views of the institutions with which they are affiliated. 0 Is the Bank-Sovereign Link Truly Severed? BEEP n°43 Phedon Nicolaides1 and Tony O’Connor2 Abstract This paper examines the degree to which the Banking Recovery and Resolution Directive and the Single Resolution Mechanism Regulation have severed the dependence of banks on sovereigns. -

Sharing Deal Insight European Financial Services M&A News And

www.pwc.com/financialservices SharingSharing dealdeal insightinsigghht EuEuropeanropean FiFinancialnancial SServiceservices MM&A&A nnewsews andand viewsviews This reepport provides perssppectives on the recent trends and ffuuture develooppments in the Eurooppean Financial Services M&A market and insights into emerrgging investment ooppportunities. October 2012 Contents 03 Welcome 04 Data analysis 08 Banking in Russia: Capitalising on resurgent growth in retail 12 Looking East: Market potential spurs renewed investor interest 16 Methodology 17 About PwC M&A advisory services in the financial services sector 18 Contacts €22.4bn of European financial services deals in the first half of 2012, up 36% on the same period in 2011 €2.8bn acquisition of Turkey’s Denizbank by Sberbank is the Russian group’s largest acquisition outside its home market 2 PwC Sharing deal insight Welcome to the third edition of Sharing deal insight for 2012. Sharing Deal Insight provides perspectives on the latest trends and future developments in the financial services M&A market including analysis of recent transactions and insights into emerging investment opportunities. and bolt-on deals within the mid and Russia’s leading financial institutions Nick Page lower end of the banking market, which have also set ambitious plans for regional PwC UK has helped to spur the increase in growth. As we examine in our second [email protected] volumes, looks set to continue. Further article, strong margins and buoyant drivers for a continued pickup in activity consumer demand in the financial include the gathering pressure for services sectors of a number of Central, consolidation within many of Europe’s Eastern and South Eastern European insurance and asset management sectors markets are attracting growing interest (see Data analysis section). -

Sharing Deal Insight European Financial Services M&A News And

www.pwc.com/financialservices SharingSharing dealdeal insightinsigghht EuEuropeanropean FiFinancialnancial SServiceservices MM&A&A nnewsews andand viewsviews This reepport provides perssppectives on the recent trends and ffuuture develooppments in the Eurooppean Financial Services M&A market and insights into emerrgging investment ooppportunities. October 2012 Contents 03 Welcome 04 Data analysis 08 Banking in Russia: Capitalising on resurgent growth in retail 12 Looking East: Market potential spurs renewed investor interest 16 Methodology 17 About PwC M&A advisory services in the financial services sector 18 Contacts €22.4bn of European financial services deals in the first half of 2012, up 36% on the same period in 2011 €2.8bn acquisition of Turkey’s Denizbank by Sberbank is the Russian group’s largest acquisition outside its home market 2 PwC Sharing deal insight Welcome to the third edition of Sharing deal insight for 2012. Sharing Deal Insight provides perspectives on the latest trends and future developments in the financial services M&A market including analysis of recent transactions and insights into emerging investment opportunities. and bolt-on deals within the mid and Russia’s leading financial institutions Nick Page lower end of the banking market, which have also set ambitious plans for regional PwC (UK) has helped to spur the increase in growth. As we examine in our second [email protected] volumes, looks set to continue. Further article, strong margins and buoyant drivers for a continued pickup in activity consumer demand in the financial include the gathering pressure for services sectors of a number of Central, consolidation within many of Europe’s Eastern and South Eastern European insurance and asset management sectors markets are attracting growing interest (see Data analysis section).