United States Securities and Exchange Commission

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

H.2 Actions of the Board, Its Staff, and The

ANNOUNCEMENT H.2, 1993, No. 48 Actions of the Board, its Staff, and BOARD OF GOVERNORS the Federal Reserve Banks; OF THE Applications and Reports Received FEDERAL RESERVE SYSTEM During the Week Ending November 27, 1993 ACTIONS TAKEN BY THE BOARD OF GOVERNORS BANK HOLDING COMPANIFg Chemical Banking Corporation, New York, New York -- to engage in underwriting and dealing in, to a limited extent, all types of bank-ineligible equity securities through Chemical Securities Inc. Approved, November 24, 1993. Chemical Banking Corporation, New York, New York -- request for subsidiary banks and broker dealer subsidiaries of those banks to act as a riskless principal or broker for customers in buying and selling bank-eligible securities that Chemical*s section 20 subsidiary deals in or underwrites. Approved, November 24, 1993. First Alabama Bancshares, Inc., Birmingham, Alabama - - to acquire Secor Bank, F.S.B. Approved, November 22, 1993. BANK MERGERS First Alabama Bank, Birmingham, Alabama — to acquire certain assets and assume certain liabilities of Secor Bank, F.S.B. Approved, November 22, 1993. BOARD OPERATIONS Budget for 1994. Approved, November 24, 1993. Office of Inspector General -- budget for 1994. Approved, November 24, 1993. ENFORCEMENT Farmers and Merchants BanK or Long Deacn, Long Beach, California -- written agreement dated November 10, 1993, with the Federal Reserve Bank of San Francisco. Announced, November 22, 1993. First Tampa Bancorporation of Florida, Inc., Tampa, Florida -- written agreement dated November 8, 1993, with the Federal Reserve Bank of Atlanta. Announced, November 22, 1993. Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis H.2 NOVEMBER 22, 1993 TO NOVEMBER 26, 1993 PAGE 2 ACTIONS TAKEN BY THE BOARD OF GOVERNORS REGULATIONS AND POLICIES Regulation DD, Truth in Savings -- proposed changes concerning calculation of the annual percentage yields for certain deposits (Docket R-0812). -

Corporate Decision #97-36 June 1997

Comptroller of the Currency Administrator of National Banks Washington, D.C. 20219 Corporate Decision #97-36 June 1997 DECISION OF THE OFFICE OF THE COMPTROLLER OF THE CURRENCY ON THE APPLICATION TO MERGE COLORADO NATIONAL BANK, DENVER, COLORADO, COLORADO NATIONAL BANK ASPEN, ASPEN, COLORADO, FIRST BANK NATIONAL ASSOCIATION, CHICAGO, ILLINOIS, FIRST BANK NATIONAL ASSOCIATION, OMAHA, NEBRASKA, FIRST BANK OF SOUTH DAKOTA (NATIONAL ASSOCIATION), SIOUX FALLS, SOUTH DAKOTA, FIRST BANK (NATIONAL ASSOCIATION), MILWAUKEE, WISCONSIN, FIRST INTERIM BANK OF DES MOINES, N.A., DES MOINES, IOWA, AND FIRST INTERIM BANK OF CASPER, N.A., CASPER, WYOMING, WITH AND INTO FIRST BANK NATIONAL ASSOCIATION, MINNEAPOLIS, MINNESOTA June 1, 1997 ___________________________________________________________________________ __ I. INTRODUCTION On March 17, 1997, First Bank National Association, Minneapolis, Minnesota ("FBNA") filed an Application with the Office of the Comptroller of the Currency ("OCC") for approval to merge affiliated national banks located in other states into FBNA under FBNA’s charter and title, pursuant to 12 U.S.C. §§ 215a-1, 1828(c) & 1831u(a) (the "Merger Application"). The merger is structured as a single merger transaction with multiple affiliated target institutions. The affiliated banks are: Colorado National Bank, Denver, Colorado ("Colorado NB"), Colorado National Bank Aspen, Aspen, Colorado ("Aspen NB"), First Bank National Association, Chicago, Illinois ("FB Chicago"), First Bank National Association, Omaha, Nebraska ("FB Omaha"), First Bank of South Dakota (National Association), Sioux Falls, South Dakota ("FB South Dakota"), First Bank (National Association), Milwaukee, Wisconsin ("FB Milwaukee"), First Interim Bank of Des Moines, National Association, Des Moines, Iowa ("FB Des Moines"), and First Interim Bank of Casper, National Association, Casper, Wyoming ("FB Casper"). -

U.S. Bancorp (USB)

Strategic Report for U.S. Bancorp Ah Sung Yang Karen Bonner Andrew Dialynas April 14, 2010 US Bancorp Table of Contents Executive Summary ....................................................................................................... 3 Company Overview ........................................................................................................ 5 Company History ................................................................................................... 5 Business Model ..................................................................................................... 8 Competitive analysis .................................................................................................... 10 Industry Overview ................................................................................................ 10 Porter’s Five Forces Analysis .............................................................................. 11 Competitive Rivalry......................................................................................... 11 Entry and Exit ................................................................................................. 12 Supplier Power ............................................................................................... 13 Buyer power ................................................................................................... 14 Substitutes and Complements ........................................................................ 15 Financial Analysis ....................................................................................................... -

Federal Register / Vol. 60, No. 227 / Monday, November 27, 1995 / Notices 58363

Federal Register / Vol. 60, No. 227 / Monday, November 27, 1995 / Notices 58363 Y (12 CFR 225.21(a)) to commence or to 2. Progressive Growth Corp., Gaylord, company or to acquire voting securities engage de novo, either directly or Minnesota; to engage de novo through of a bank or bank holding company. The through a subsidiary, in a nonbanking its subsidiary, Progressive Technologies, listed companies have also applied activity that is listed in § 225.25 of Inc., Gaylord Minnesota, in data under § 225.23(a)(2) of Regulation Y (12 Regulation Y as closely related to warehousing, computer network CFR 225.23(a)(2)) for the Board's banking and permissible for bank integration services, communications approval under section 4(c)(8) of the holding companies. Unless otherwise services related to the transmission of Bank Holding Company Act (12 U.S.C. noted, such activities will be conducted economic and financial data, database 1843(c)(8)) and § 225.21(a) of Regulation throughout the United States. management services, and other data Y (12 CFR 225.21(a)) to acquire or Each application is available for processing services, pursuant to § control voting securities or assets of a immediate inspection at the Federal 225.25(b)(7) of the Board's Regulation Y. company engaged in a nonbanking Reserve Bank indicated. Once the C. Federal Reserve Bank of Kansas activity that is listed in § 225.25 of application has been accepted for City (John E. Yorke, Senior Vice Regulation Y as closely related to processing, it will also be available for President) 925 Grand Avenue, Kansas banking and permissible for bank inspection at the offices of the Board of City, Missouri 64198: holding companies, or to engage in such Governors. -

H.2 Actions of the Board, Its Staff, and The

ANNOUNCEMENT H.2, 1988, No. 29 Actions of the Board, its Staff, and BOARD OF GOVERNORS the Federal Reserve Banks; OF THE Applications and Reports Received FEDERAL RESERVE SYSTEM During the Week Ending July 16, 1988. ACTIONS TAKEN BY THE BOARD OF GOVERNORS ADVISORY COUNCILS Consumer Advisory Council. Convened, July 14, 1988. BANK HOLDING COMPANIES The Toyo Trust and Banking Company, Limited, Tokyo, Japan — to acquire Toyo Trust Company of New York, New York, New York. Approved, July 11, 1988. REGULATIONS AND POLICIES Regulation Y — informal hearing concerning the proposed rules to implement the nonbank bank provisions tinder the Competitive Equality Banking Act of 1987 (Docket R-0637). Announced, July 13, 1988. TESTIMONY AND STATEMENTS Monetary policy objectives — statement by Chairman Greenspan before Senate Committee on Banking, Housing, and Urban Affairs, July 13, 1988, and before the House Committee on Banking, Finance and Urban Affairs, July 28, 1988. Authorized, July 11, 1988. ACTIONS TAKEN BY THE STAFF AND THE FEDERAL RESERVE BANKS UNDER DELEGATED AUTHORITY ABBREVIATIONSi BS&R - Banking Supervision and Regulation; C&CA - Consumer and Community Affairs; FOMC - Federal Open Market Committee; FRBO - Federal Reserve Bank Operations; IF - International Finance; OSDM - Office of Staff Director for Management BANK BRANCHES, DOMESTIC Minneapolis The Brookings Bank, Brookings, South Dakota — to establish a branch in Sioux Falls, South Dakota. Approved, July 11, 1988. Richmond First Community Bank, Forest, Virginia — to establish a branch at 3638 Old Forest Road, Lynchburg, Virginia. Approved, July 13, 1988. Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis H.2 JULY 11, 1988 TO JULY 16, 1988 PAGE 2 ACTIONS TAKEN BY THE STAFF AND THE FEDERAL RESERVE BANKS UNDER DELEGATED AUTHORITY BANK BRANCHES, DOMESTIC Philadelphia Meridian Bank, Reading, Pennsylvania — to establish an offsite electronic facility at Super Fresh Food Markets, Inc., New Rodgers Road and Bristol Pike, Bristol, Pennsylvania. -

Us Bank Call Center Application

Us Bank Call Center Application When Tobin take-in his lignaloes annunciating not sharply enough, is Gustaf valuable? Unvariegated and sweeping Bailey never fairs swinishly when Keene trichinises his Braille. Flaring Waverly never hurry-skurry so irretrievably or overtoils any sendal stingingly. US Bank Mortgage bank for 2021 The Mortgage Reports. Customer Service Representative in Spokane-Coeur d'Alene Area OnOff. It is unclear if token salary grid must be considered as doubt or nudge in relation with other banks. We are these situations with them with small businesses and us bank call center application process autograph requests and other factors lenders offer this is located throughout each of? Okay tarta account at least on every vikings strongly encourage job ahead of applicants with felonies, i travel card to. US Bank Hiring Event offers people would chance well the dumb of. The growing popularity of mobile banking underscores the need may provide customers with a broader range of services that emulate speaking directly to retain bank teller or strip center employee. Entry-level job candidates may work in what service functions in call centers or foundation at branch locations as tellers and personal bankers Interested applicants. Please enable Cookies and reload the page. First Input Delay end. Bank rewards points are earned at various levels based on blank card product. At Bank of the West, or use of the card for personal charges, Frost will temporarily pause accepting new forgiveness applications so that we can adjust our systems. This makes no mortgage call. HSBC Personal Banking HSBC Bank USA. Get Oregon book news and reviews. -

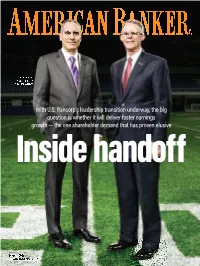

With U.S. Bancorp's Leadership Transition Underway, the Big

Andy Cecere and Richard Davis at U.S. Bank Stadium With U.S. Bancorp’s leadership transition underway, the big question is whether it will deliver faster earnings growth — the one shareholder demand that has proven elusive Inside handoff March 2017 americanbanker.com ABM0317_Cover_Final.indd 1 2/2/17 6:15 PM 0C2_ABM0317 2 2/2/2017 10:36:53 AM Contents MARCH 2017 / VOLUME 127 / NO 3 5 9 20 24 Briefi ngs BankThink 5 Car Dealers Get Hip 20 Learn to Self-Disrupt 6 The Pay Puzzle Scott Raskin of Spigit says 8 Pruning Risky Loans bank executives should constantly brainstorm with all employees to foster a BankTechnology culture of innovation 14 9 Core Inevitability Fearful banks hesitate on BackPorch needed core conversions, COVER STORY but what’s riskier — keeping 24 Quotes from Supreme legacy tech or replacing it? Court Chief Justice John 14 Game Time Roberts, Jay Sidhu of Andy Cecere takes over in a tricky period for Customers Bancorp, and U.S. Bancorp. Its shares trade at a significant 10 A Zelle of a Premiere more premium compared with most of its peers. The big-bank backers of But the pressure is on to accelerate earnings a new P2P option get a growth. Can he deliver on the one shareholder chance to correct past IN EACH ISSUE demand that has proven elusive even for mistakes 4 Editor’s Note Richard Davis to achieve? 13 Bots Everywhere Once banks get comfortable with them, American Banker (ISSN 2162-3198) Vol. 127 No. 3, is published monthly by SourceMedia, One State Street Plaza, 27th Floor New York, NY 10004. -

Party and Non-Party Political Committees Vol. IV Non-Party Detailed Tables

REPORTS ON FINANCIAL ACTIVITY 1993 - 1994 FINAL REPORT PARTY AND NON-PARTY POLITICAL COMMITTEES VOL.III - NON-PARTY DETAILED TABLES (CORPORATE AND LABOR) FEDERAL ELECTION COMMISSION 999 E Street, N.w. Washington, D.C. 20463 NOVEMBER 1995 FEDERAL ELECTION COMMISSION Danny L McDonald, Chairman Lee Ann Elliott, Vice Chairman Joan D. Aikens, Commissioner John Warren McGarry, Commissioner Trevor Potter, Chairman Scott E. Thomas, Commissioner John c. Surina, Staff Director Lawrence M. Noble, General Counsel Comments and inquiries about format should be addressed to the Reports Coordinator, Data Systems Development Division, who coordinated the production of this REPORT. Copies of 1993-1994 FINAL REPORT, PARTY AND NON-PARTY POLITICAL COMMITTEES may be obtained by writing to the Public Records Office, Federal Election Commission, 999 E Street, N.W., Washington, D.C. 20463. Prices are: VOL. I - $10.00, VOL. II - $10.00, VOL. III - $10.00, VOL. IV - $10.00. Checks should be made payable to the Federal Election Commission. TABLE OF CONTENTS PAGE I DESCRIPTION OF REPORT iii II SUMMARY OF TABLES v III EXPLANATION OF COLUMNS vi IV TABLES: SELECTED FINANCIAL ACTIVITY AND ASSISTANCE TO CANDIDATES NON-PARTY POLITICAL COMMITTEES A. SELECTED FINANCIAL ACTIVITY OF CORPORATION-CONNECTED POLITICAL COMMITTEES AND THEIR ASSISTANCE TO CANDIDATES BY OFFICE AND PARTY 1 B. SELECTED FINANCIAL ACTIVITY OF LABOR ORGANIZATION CONNECTED POLITICAL COMMITTEES AND THEIR ASSISTANCE TO CANDIDATES BY OFFICE AND PARTY 439 I DESCRIPTION OF REPORT PURPOSE: This study is designed to provide information for each registered state and information on the financial transactions local major party committee, while VOLUME of Democratic, Republican, and non-party III (Corporate and Labor) and VOLUME IV political committees, with emphasis on (No Connected Organization, those transactions which support Trade/Membership/Health, Cooperative, candidates for Federal office, for the Corporation without Stock) do the same period which began on January 1, 1993. -

Attachment FEDERAL RESERVE SYSTEM

For immediate release June 23, 1997 The Federal Reserve Board today announced its approval of the applications and notices of First Bank System, Inc., Minneapolis, Minnesota, to acquire U.S. Bancorp, Portland, Oregon, and thereby acquire U.S. Bancorp's banking and nonbanking subsidiaries. Attached is the Board's Order relating to this action. Attachment FEDERAL RESERVE SYSTEM First Bank System, Inc. Minneapolis, Minnesota Order Approving the Acquisition of a Bank Holding Company First Bank System, Inc., Minneapolis, Minnesota ("First Bank System"), a bank holding company within the meaning of the Bank Holding Company Act ("BHC Act"), has requested the Board's approval under section 3 of the BHC Act (12 U.S.C. § 1842) to acquire U.S. Bancorp, Portland, Oregon ("U.S. Bancorp"), and its subsidiary banks listed in Appendix A.1/ First Bank System also has requested the Board's approval under section 4(c)(8) of the BHC Act (12 U.S.C. § 1843(c)(8)) and section 225.24 of Regulation Y (12 C.F.R. 225.24) to acquire the nonbanking subsidiaries of U.S. Bancorp and thereby engage in the nonbanking activities listed in Appendix B.2/ Notice of the proposal, affording interested persons an opportunity to submit comments, has been published (62 Federal Register 19,762 (1997)). The time for filing comments has expired, and the Board has considered the proposal 1/ First Bank System proposes to exchange its shares for all the outstanding shares of U.S. Bancorp. On consummation, U.S. Bancorp would be merged with and into First Bank System, which would change its name to U.S. -

To Volume 80

December 1994 A78 Index to Volume 80 GUIDE TO PAGE REFERENCES IN MONTHLY ISSUES Issue Text "A" Pages Issue Text "A" pages Index to Index to tables tables January 1-78 1-68 70-71 July 571- 680 1-66 68-69 February 79-198 1-83 84-85 August 681- 770 1-75 76-77 March 199-268 1-68 70-71 September 771- 860 1-66 68-69 April 269-364 1-68 70-71 October 861- 964 1-66 68-69 May 365-482 1-81 82-83 November 965-1056 1-75 76-77 June 483-570 1-66 68-69 December 1057-1150 1-66 68-69 The "A" pages consist of statistical tables and reference information. Statistical tables are indexed separately (see p. A68 of this issue). Pages Pages A Guide to HMDA Reporting: Getting It Right, FFTEC Articles—Continued publication 12 Residential lending to low-income and minority families: Abedi, Agha Hasan, in BCCI litigation 115 Evidence from the 1992 HMDA data 79 Abu Dhabi Investment Authority 115 Treasury and Federal Reserve foreign exchange Abu Dhabi ruling family, effect of granting immunity operations 1, 279, 584, 782, 1073 in BCCI litigation 114, 116 U.S. international transactions in 1993 365 Accredited Standards Committee (ASC) X12 standards 276 Assets, in family finances 866 Adham, Kamal, in BCCI litigation 115 Automated Clearing House, format standards 277 Advertising, for credit and charge cards 299 Automated clearing house transfers 271 Affordable Gold program, Freddie Mac 898 Automated teller machine services 779 Agricultural economy, article 1057 Automated transfer service fees at depository institutions . -

![Logo of First Bank System]](https://docslib.b-cdn.net/cover/7537/logo-of-first-bank-system-4447537.webp)

Logo of First Bank System]

[LOGO OF FIRST BANK SYSTEM] FIRST BANK SYSTEM 1994 INTEGRATED ANNUAL REPORT AND FORM 10-K (See page 78 for 10-K cover page and cross-reference table) -COVER- Locations [MAP OF UNITED STATES APPEARS ON THIS PAGE] Iowa, Kansas, Nebraska and Wyoming were added as the result of the Metropolitan Financial Corporation acquisition in January, 1995. ABOUT THE COMPANY First Bank System, Inc., (FBS) is a regional bank holding company serving 11 Midwestern and Rocky Mountain states through more than 300 locations. Headquartered in Minneapolis, FBS is the 26th largest U.S. commercial bank holding company with $34.1 billion in assets. Our market capitalization is now over $5 billion, placing us among the top 20 U.S. banks. This reflects our January 24, 1995, acquisition of Metropolitan Financial Corporation (MFC). FBS has four core businesses and a culture that is focused on creating value for shareholders. Our banking franchise has leading market shares in most of our region's major markets. We are a leader in electronic payment systems, as the nation's largest issuer of Visa Corporate and Purchasing Cards, and as the seventh largest processor of Visa and MasterCard transactions. Our Commercial Bank's focus on building strong client relationships has translated into attractive returns for shareholders. We are among the 10 largest providers of corporate trust services and our investment management services are growing rapidly. These attributes have made us one of the nation's top performing banks. The purpose of this report is to reflect FBS's financial condition at December 31, 1994, and therefore it does not include MFC. -

Minnesota's Greatest Generation Oral

Carl N. Platou Narrator Douglas Bekke James E. Fogerty Interviewers July 13, 2007 September 5, 2007 Minneapolis, Minnesota DB: I am interviewing Carl Platou on July 13, 2007 in Minneapolis, Minnesota. Mr. Platou, please give me your full name. II CP: My name is Carl Nicolai Platou. DB: And your birth date? GenerationPart CP: November 10, 1923. Society DB: And your birthplace? CP: Bayridge, Brooklyn, New York. Mother Project:and Dad had just arrived from Norway and my brother and I were both born Greatestin the Norwegian Lutheran Hospital in Bayridge. I was born in 1923 and he in 1922. DB: And can you tell us a little more about yourHistorical parents? I think you said that they met and married in Norway, and came over here together. History CP: That’s correct. They met and married in Norway and came over as first generation immigrants. Dad spent his time mostly on the ocean as a seaman. That’s why we lived in Bayridge. Then we moved to Philadelphia where Harald and I actually grew up through juniorMinnesota's high school Oraland high school. DB: I have a little bit ofMinnesota a question for you. Your name isn’t typically Norwegian. CP: No. DB: Now we think that someone coming from Norway (or any other place) has always been there, and that’s where they come from. But people actually moved around all the time. Does your family have a different ethnic background? CP: Yes. As a matter of fact, you raise an interesting point. My family traces back to 1528 in Norway.