MTR Nordic 2017-05-31

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chapter 2 Existing Conditions Summary

Final Report New Haven Hartford Springfield Commuter Rail Implementation Study 2 Existing Conditions Chapter 2 Existing Conditions Summary This chapter is a summary of the existing conditions report, necessary for comprehension of the remaining chapters. The entire report can be found in Appendix B of this report. 2.1 Existing Passenger Services on the Line The only existing passenger rail service on the Springfield Line is a regional service operated by Amtrak. Schedules for alternatives in Chapter 3 and the Recommended Action in Chapter 4 include current Amtrak service. Most Amtrak service on the line is shuttle trains, running between Springfield and New Haven, where they connect with other Amtrak Northeast Corridor trains. One round-trip train each day operates through the corridor to Boston to the north and Washington to the south. One round trip train each day operates to and from St. Albans, Vermont from New Haven. The trains also permit connections at New Haven with Amtrak’s Northeast Corridor (Washington to Boston) service, as well as Metro North service to New York, and Shore Line East local commuter service to New London. Departures are spread throughout the day, with trains typically operating at intervals of two to three hours. Springfield line services are designed as extensions of Amtrak’s Northeast Corridor service, and are not scheduled to serve local commuter trips (home to work trips). The Amtrak fare structure was substantially reduced in price since this study began. The original fare structure from November 2002 was shown in the existing conditions report, which can be found in Appendix B. -

Northeast Corridor Chase, Maryland January 4, 1987

PB88-916301 NATIONAL TRANSPORT SAFETY BOARD WASHINGTON, D.C. 20594 RAILROAD ACCIDENT REPORT REAR-END COLLISION OF AMTRAK PASSENGER TRAIN 94, THE COLONIAL AND CONSOLIDATED RAIL CORPORATION FREIGHT TRAIN ENS-121, ON THE NORTHEAST CORRIDOR CHASE, MARYLAND JANUARY 4, 1987 NTSB/RAR-88/01 UNITED STATES GOVERNMENT TECHNICAL REPORT DOCUMENTATION PAGE 1. Report No. 2.Government Accession No. 3.Recipient's Catalog No. NTSB/RAR-88/01 . PB88-916301 Title and Subtitle Railroad Accident Report^ 5-Report Date Rear-end Collision of'*Amtrak Passenger Train 949 the January 25, 1988 Colonial and Consolidated Rail Corporation Freight -Performing Organization Train ENS-121, on the Northeast Corridor, Code Chase, Maryland, January 4, 1987 -Performing Organization 7. "Author(s) ~~ Report No. Performing Organization Name and Address 10.Work Unit No. National Transportation Safety Board Bureau of Accident Investigation .Contract or Grant No. Washington, D.C. 20594 k3-Type of Report and Period Covered 12.Sponsoring Agency Name and Address Iroad Accident Report lanuary 4, 1987 NATIONAL TRANSPORTATION SAFETY BOARD Washington, D. C. 20594 1*+.Sponsoring Agency Code 15-Supplementary Notes 16 Abstract About 1:16 p.m., eastern standard time, on January 4, 1987, northbound Conrail train ENS -121 departed Bay View yard at Baltimore, Mary1 and, on track 1. The train consisted of three diesel-electric freight locomotive units, all under power and manned by an engineer and a brakeman. Almost simultaneously, northbound Amtrak train 94 departed Pennsylvania Station in Baltimore. Train 94 consisted of two electric locomotive units, nine coaches, and three food service cars. In addition to an engineer, conductor, and three assistant conductors, there were seven Amtrak service employees and about 660 passengers on the train. -

Reservations PUBLISHED Overview 30 March 2015.Xlsx

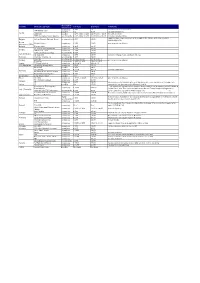

Reservation Country Domestic day train 1st Class 2nd Class Comments Information compulsory € 8,50 n.a. on board only; free newspaper WESTbahn trains possible n.a. € 5,00 via www.westbahn.at Austria ÖBB trains possible € 3,00 online / € 3,50 € 3,00 online / € 3,50 free wifi on rj-trains ÖBB Intercitybus Graz-Klagenfurt recommended € 3,00 online / € 3,50 € 3,00 online / € 3,50 first class includes drinks supplement per single journey. Can be bought in the station, in the train or online: Belgium to/from Brussels National Airport no reservation € 5,00 € 5,00 www.belgianrail.be Bosnia- Regional trains compulsory € 1,50 € 1,50 price depends on distance Herzegovina (ZRS) Bulgaria Express trains compulsory € 0,25 € 0,25 IC Zagreb - Osijek/Varazdin compulsory € 1,00 € 1,00 Croatia ICN Zagreb - Split compulsory € 1,00 € 1,00 IC/EC (domestic journeys) recommended € 2,00 € 2,00 Czech Republic SC SuperCity compulsory € 8,00 € 8,00 includes newspaper and catering in 1st class Denmark InterCity / InterCity Lyn recommended € 4,00 € 4,00 InterCity recommended € 1,84 to €5,63 € 1,36 to € 4,17 Finland price depends on distance Pendolino recommended € 3,55 to € 6,79 € 2,63 to € 5,03 France TGV and Intercités compulsory € 9 to € 18 € 9 to € 18 FYR Macedonia IC 540/541 Skopje-Bitola compulsory € 0,50 € 0,50 EC/IC/ICE possible € 4,50 € 4,50 ICE Sprinter compulsory € 11,50 € 11,50 includes newspapers Germany EC 54/55 Berlin-Gdansk-Gdynia compulsory € 4,50 € 4,50 Berlin-Warszawa Express compulsory € 4,50 € 4,50 Great Britain Long distance trains possible Free Free Greece Inter City compulsory € 7,10 to € 20,30 € 7,10 to € 20,30 price depends on distance EC (domestic jouneys) compulsory € 3,00 € 3,00 Hungary IC compulsory € 3,00 € 3,00 when purchased in Hungary, price may depend on pre-sales and currency exchange rate Ireland IC possible n/a € 5,00 reservations can be made online @ www.irishrail.ie Frecciarossa, Frecciargento, → all compulsory and optional reservations for passholders can be purchased via Trenitalia at compulsory € 10,00 € 10,00 Frecciabianca "Global Pass" fare. -

Intercity High-Speed Railway Systems • Economic Growth and Increased Employment

Low Carbon Green Growth Roadmap for Asia and the Pacific FACT SHEET If designed well, high-speed railway systems contribute towards: • Improved air quality and lower greenhouse gas emissions4 Intercity high-speed railway systems • Economic growth and increased employment Challenges to using high-speed railway High-speed railway explained • Estimating annual ridership during feasibility stage analysis (and thus returns, including greenhouse gas Definitions of a high-speed railway system vary, but a common one is a rail system designed for maximum train reduction) can be difficult, especially when developments in other transportation modes (air and auto speeds that exceed 200 km per hour for upgraded tracks and 250 km per hour for new tracks. High-speed rail is mobile) are uncertain generally used for intercity transport rather than urban transport. • High investment costs for buying the needed land and building the lines and trains • Long period of construction time and for reaping payback Performance, evaluated Limitations Capacity Approximately 1,000 persons per vehicle. Double-decker trains • High-speed rail lines, once built, are very inflexible. Corridors to be developed must be heavily studied to increase the capacity but also increase drag, and thus increase the determine if the return is likely to be eco-efficient. amount of energy needed. • Increasing train speed requires considerably more electricity. If power is sourced from polluting technologies and/or if load factors are low, high-speed rail can actually exacerbate rather than mitigate Geographical range There is no limit in expanding the line, as long as the demand is high. Generally, high-speed rail can compete with airplane trips of greenhouse gas emissions. -

Why Some Airport-Rail Links Get Built and Others Do Not: the Role of Institutions, Equity and Financing

Why some airport-rail links get built and others do not: the role of institutions, equity and financing by Julia Nickel S.M. in Engineering Systems- Massachusetts Institute of Technology, 2010 Vordiplom in Wirtschaftsingenieurwesen- Universität Karlsruhe, 2007 Submitted to the Department of Political Science in partial fulfillment of the requirements for the degree of Master of Science in Political Science at the MASSACHUSETTS INSTITUTE OF TECHNOLOGY February 2011 © Massachusetts Institute of Technology 2011. All rights reserved. Author . Department of Political Science October 12, 2010 Certified by . Kenneth Oye Associate Professor of Political Science Thesis Supervisor Accepted by . Roger Peterson Arthur and Ruth Sloan Professor of Political Science Chair, Graduate Program Committee 1 Why some airport-rail links get built and others do not: the role of institutions, equity and financing by Julia Nickel Submitted to the Department of Political Science On October 12, 2010, in partial fulfillment of the Requirements for the Degree of Master of Science in Political Science Abstract The thesis seeks to provide an understanding of reasons for different outcomes of airport ground access projects. Five in-depth case studies (Hongkong, Tokyo-Narita, London- Heathrow, Chicago- O’Hare and Paris-Charles de Gaulle) and eight smaller case studies (Kuala Lumpur, Seoul, Shanghai-Pudong, Bangkok, Beijing, Rome- Fiumicino, Istanbul-Atatürk and Munich- Franz Josef Strauss) are conducted. The thesis builds on existing literature that compares airport-rail links by explicitly considering the influence of the institutional environment of an airport on its ground access situation and by paying special attention to recently opened dedicated airport expresses in Asia. -

Effects of Strong Cross Winds on High-Speed Trains: a Methodol- Ogy for Risk Assessment and Development of Countermeasures

Effects of Strong Cross Winds on High-Speed Trains: A methodol- ogy for risk assessment and development of countermeasures Gerd Matschke, Peter Deeg, Burkhard Schulte-Werning FTZ, Aerodynamik und Klimatechnik Deutsche Bahn AG, Research & Technology Centre Völckerstrasse 5, 80939 München 1 INTRODUCTION The effect of side winds on rail transport has been investigated since the 1970s by interna- tional research, especially by the railways in Germany, England and Japan. For the DB the subject of side winds only became important with the introduction of the ICE2 with its fast, light driving trailer. Since then DB has been involved in intensive interdisciplinary co- operation to develop a generally valid method for rail transport to guarantee that railways can operate safely with a strong side wind. A basic procedure was described and discussed in 1997 at the World Congress for Railway Research [17]. This paper describes the methodology derived from its continuous further development, as summarised in the Draft Code of Practice Ril 401 of Deutsche Bahn pub- lished in May 2000. The procedure specified in Code of Practice Ril 401 was recognised in May 2000 by the Eisenbahn-Bundesamt (Federal Railway Office - EBA) as a means of proving that railway traffic can run safely when there is a side wind and has since then be- come part of the vehicle acceptance procedure used by the EBA. 2 BASIC PRINCIPLES AND PROCEDURE The effect of side wind on rail vehicles is basically determined by the following parameters: The vehicle properties such as shape, weight, position of centre of gravity, running gear properties, etc. -

Living in Korea

A Guide for International Scientists at the Institute for Basic Science Living in Korea A Guide for International Scientists at the Institute for Basic Science Contents ⅠOverview Chapter 1: IBS 1. The Institute for Basic Science 12 2. Centers and Affiliated Organizations 13 2.1 HQ Centers 13 2.1.1 Pioneer Research Centers 13 2.2 Campus Centers 13 2.3 Extramural Centers 13 2.4 Rare Isotope Science Project 13 2.5 National Institute for Mathematical Sciences 13 2.6 Location of IBS Centers 14 3. Career Path 15 4. Recruitment Procedure 16 Chapter 2: Visas and Immigration 1. Overview of Immigration 18 2. Visa Types 18 3. Applying for a Visa Outside of Korea 22 4. Alien Registration Card 23 5. Immigration Offices 27 5.1 Immigration Locations 27 Chapter 3: Korean Language 1. Historical Perspective 28 2. Hangul 28 2.1 Plain Consonants 29 2.2 Tense Consonants 30 2.3 Aspirated Consonants 30 2.4 Simple Vowels 30 2.5 Plus Y Vowels 30 2.6 Vowel Combinations 31 3. Romanizations 31 3.1 Vowels 32 3.2 Consonants 32 3.2.1 Special Phonetic Changes 33 3.3 Name Standards 34 4. Hanja 34 5. Konglish 35 6. Korean Language Classes 38 6.1 University Programs 38 6.2 Korean Immigration and Integration Program 39 6.3 Self-study 39 7. Certification 40 ⅡLiving in Korea Chapter 1: Housing 1. Measurement Standards 44 2. Types of Accommodations 45 2.1 Apartments/Flats 45 2.2 Officetels 46 2.3 Villas 46 2.4 Studio Apartments 46 2.5 Dormitories 47 2.6 Rooftop Room 47 3. -

Alignment Design for Citybanan in Stockholm

Alignment design for Citybanan in Stockholm B. Kufver Halcrow, Vineyard House, 44 Brook Green, Hammersmith, London W6 7BY, United Kingdom Abstract The Western Main Line into Stockholm Central Station was brought into use in 1871 with 10 trains per day. Nowadays, there are more than 500 trains per day on the twin-track between Stockholm Central and Stockholm South, and there is a demand for even more trains. Hence, Banverket (the Swedish National Rail Administration) is planning for a new twin-track railway, Citybanan, through central Stockholm. The capacity will increase with 24 to 30 trains per hour in each direction. All types of trains (commuter, regional, Intercity and freight) will benefit from the increase in capacity. A feasibility study for the 6 km long tunnel railway was conducted during 2002-2003. Detailed design started in 2004 and the construction work is scheduled to start in 2006 and finish in 2011. The tracks will be constructed with UIC60 rails, concrete sleepers or slab track, and high-quality elastic rail fastenings. The new railway is expected to survive several generations of signalling systems. Hence, the alignment will constitute the binding constraint for permissible train speeds, both in the short and long term. This is the reason why various alignment options were calculated in detail (including all S&C work) and permissible train speeds were quantified in detail at the feasibility study stage. This paper presents the track standards from Banverket and the general approach in alignment design of Citybanan. It describes the criteria adopted for locations where margins exist to the minimum requirements, highlights certain detailed layouts and comments on a draft CEN standard for alignment design. -

Safety-First Culture Bringing MTR to Continuous & Global Excellence

Safety-First Culture Bringing MTR to Continuous & Global Excellence Dr. Jacob Kam Managing Director – Operations & Mainland Business 23 October 2017 Agenda ▪ Introducing MTR ▪ Safety First Culture ▪ Global Operational Safety ▪ Future Challenges MTR Corporation 1/15/2018 Page 2 MTR Operations in Hong Kong Heavy Rail Airport Express Light Rail Intercity Guangzhou-Shenzhen- Bus Hong Kong Express Rail Link To be opened in Q3 2018 MTR Corporation 1/15/2018 Page 3 MTR Network in HK is Expanding 1980 * 2016 Total Route Length in HK 14.8x 15.6 km 230.9 km MTR established in 1975 2 rail projects completed in 2016; MTR is present in all 18 districts in Hong Kong 2 rail projects totally 43km under construction * First network (Modified Initial System) commenced Source: MTR Sustainability Report in 1979 with its full line opening in 1980. MTR Corporation 1/15/2018 Page 4 MTR Network in HK is Expanding Source: MTR Annual Report 2016 MTR Corporation 1/15/2018 Page 5 MTR Network outside HK is also Expanding 2004 2016 Global Network 13.5x 88 km 1,192 km Stockholm Metro (MTR Tunnelbanen) MTR Tech (renamed from TBT) London Crossrail Stockholm Commuter Rail (MTR Pendeltågen) EM Tech AB South Western Railway MTR Express Beijing Line 4 Beijing Daxing Line Beijing Line 14 Beijing Line 16 (Phase 2 Sweden under construction) UK Beijing Hangzhou Line 1 + Extension Hangzhou Hangzhou Line 5 (being constructed) Shenzhen Shenzhen Line 4 Sydney Sydney Metro Northwest Melbourne As of 30 Jun 2017 Average Weekday Patronage Route Length (in operation) Mainland of China & Metro Trains Melbourne 5.79 M >2,000 km* International MTR Corporation 1/15/2018 Page 6 MTR Corporation 1/15/2018 Page 7 MTR Runs Very Well in HK – Safety Performance achieved a high level and continuous improvement in Operational Safety worse Fatalities per Billion Passenger Journeys better include suicide, accidents & illegal activities, 10-year average Source : CoMET 2016 Interim KPI Database AS – Asian Metros NA – North American Metros (2015 data). -

The Impact of Intercity Passenger Rails on Population and Employment Change in the United States, 2000–2010

Economic and Demographic Impacts of Passenger Rail Systems: The Impact of Intercity Passenger Rails on Population and Employment Change in the United States, 2000–2010 by Guangqing Chi, Ph.D. Department of Agricultural Economics, Sociology, and Education, Population Research Institute, and Social Science Research Institute Pennsylvania State University 112E Armsby University Park, PA 16802 Bishal Kasu, M.S. Department of Sociology and Rural Studies South Dakota State University Scobey Hall 224 Brookings, SD 57007 NCITEC Project No. 13-008 Conducted for NCITEC December 2015 DISCLAIMER The contents of this report reflect the views of the authors, who are responsible for the facts and the accuracy of the information presented herein. This document is disseminated under the sponsorship of the Department of Transportation University Transportation Centers Program, in the interest of information exchange. The U.S. Government assumes no liability for the contents or use thereof. ii ABSTRACT This research examines the impact of intercity passenger rails on change in population and employment at the county level in the continental United States from 2000 to 2010. This research adopts an integrated spatial regression approach that incorporates both spatial lag and spatial error dependence. The data come from the U.S. Census Bureau, the Bureau of Transportation Statistics, the National Land Developability Index, and the National Atlas of the United States. Population and employment change are regressed on intercity passenger rails, controlling for 14 socioeconomic variables. Intercity passenger rails are measured by the number of intercity passenger rail terminals in each county. The results suggest that the impacts of intercity passenger rails on population and employment change are both direct and indirect. -

Amtrak CEO Flynn House Railroads Testimony May 6 20201

Testimony of William J. Flynn Chief Executive Officer National Railroad Passenger Corporation Before the United States House of Representatives House CommiFee on Transportation & Infrastructure SubcommiFee on Railroads, Pipelines, and Hazardous Materials When Unlimited Potential Meets Limited Resources: The Benefits and Challenges of High-Speed Rail and Emerging Rail Technologies Thursday, May Q, RSRT TT:SS a.m. Rayburn House Office Building, Room RTQU Amtrak T MassachuseFs Avenue, N.W. Washington, DC RSSST-TYST (RSR) \SQ-]\T^ WHEN UNLIMITED POTENTIAL MEETS LIMITED RESOURCES: THE BENEFITS AND CHALLENGES OF HIGH-SPEED RAIL AND EMERGING RAIL TECHNOLOGIES Introduction Good morning, Chairman Payne, Ranking Member Crawford, and Members of this SubcommiFee. Thank you for inviting me to testify at this hearing on behalf of Amtrak. My name is William Flynn, and I am Amtrak’s Chief Executive Officer. I am particularly honored to be representing Amtrak at this hearing. It takes place six days after Pres- ident Biden traveled to Philadelphia to join us in celebrating Amtrak’s fiftieth anniversary. The American Jobs Plan he has proposed, which would provide $^S billion for Amtrak and high- speed and intercity passenger rail, is an important first step in developing an improved passenger rail system that would enhance mobility by serving more communities; provide more frequent and more equitable service; generate significant economic benefits; and reduce greenhouse gas emissions. Amtrak has accomplished a great deal since we began service on May T, T\UT with a mandate to transform unprofitable intercity passenger rail services operated by private railroads into “a modern, efficient intercity railroad passenger service”1 – with an initial appropriation of only $YS million. -

Metro User Evaluation of Crowding During Rush Hours KTH 2015 TSC-MT 15-006 TSC-MT

An A Degree Project in traffic anD transPortPlanning T A r stockholm, sweden 2015 A zon A Ibáñez Metro user evaluation of crowding during rush hours Metro user evaluation of crowding during rush hours Case study: Stockholm ANA TARAZONA IBÁÑEZ TSC-MT 15-006 KTH2015 KTH royal insTiTuTe of TecHnology www.kth.se School of architecture and the built environment Metro user evaluation of crowding during rush hours Case Study: Stockholm Ana Tarazona Ibáñez Master Thesis in Transport Science KTH – Royal Institute of Technology Department of Transport Science Division of Transport Planning, Economy and Engineering Stockholm 2015 TSC – MT 15-006 3 4 ABSTRACT Millions of people use public transport daily. Specifically, 1,204,000 is approximately the number of boardings per contract area a winter's day in Stockholm. Since the capacity and frequency of the metro service are already quite good in this city, this thesis does not focus on improve that. Its aim is to know the assessment made by metro users of the crowding produced during rush hour. This evaluation is performed by two questionnaires, one shorter that is carried out on board and one longer, online. But before starting with the surveys, this work introduces some general information about public transport in Stockholm and it distinguishes capacity and crowding concepts. Any human behavior begins with the attitudes and perceptions that people show to any particular aspect, from which and through their preferences, they define their behavior acting in one way or another. And once they have made their decision and have chosen to use a service, they will be able to evaluate it by their satisfaction level.