Poe Wp 9 Behuria.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

RSE | Listing Energicotel on The

PRESS RELEASE: ENERGICOTEL ‘ECTL’ PLC CORPORATE BOND LISTING ON THE RWANDA STOCK EXCHANGE. TODAY, ENERGICOTEL PLC or ‘ECTL’ by trading name officially listed its First Tranche of the FRW 6,500,000,000 Long-term Fixed Rate Corporate Bond amounting to FRW 3,500,000,000 on the Rwanda Stock Exchange Bond Market. Rwanda’s Ministry of Infrastructure, Honorable Ambassador Claver Gatete, rang the bell to grace the occasion and mark commencement of ECTL trading on the RSE.The listing event marked yet another milestone especially this time as the Exchange celebrates its 10 years of operations. ECTL listing is particularly significant as ENERGICOTEL PLC becomes the first company among 12 SMEs under the 1st cohort of the capital market investment clinic project to raise funds and list its securities on the the stock exchange. By the same token, the company also becomes the first company in the energy sector to join the stock market. Presiding over the launch of the listing and trading of ENERGICOTEL PLC’s Corporate Bond, the Minister of Infrastructure Amb. Claver Gatete came back on the role of the Government of Rwanda in the development of the capital market where it uses the market for issuances. “By issuing treasury bonds to the public and privatizing a few of its own companies through the market, the Government has shown a good example to the private sector to follow suit”. The Minister also commended ENERGICOTEL PLC for taking the bold decision to be a pioneer in the energy sector to use capital market in issuing its maiden corporate bond. -

The Challenges of Emerging Stock Markets in Africa, a Case of Rwanda

East African Journal of Science and Technology, Vol.5, Issue 1, 2015 THE CHALLENGES OF EMERGING STOCK MARKETS IN AFRICA, A CASE OF RWANDA STOCK EXCHANGE Wilson KAZARWA The Independent Institute of Lay Adventists of Kigali, Box 6392, Kigali Rwanda E-mail: , Abstract A number of studies previously carried out indicate that capital market development of any economy is synonymous with the growth and economic development, and almost every African country has put an effort to establish a stock market, including Rwanda. This study focuses on the challenges faced by emerging stock markets in Africa, a case study of Rwanda Stock Exchange. The main objectives of this study include establishing the types of securities traded, rules governing the market, challenges facing the market and the suggested recommendations to counter these challenges. A population comprising of five listed companies and the Capital Market Authority were considered and in each case, one respondent was selected using purposive sampling technique. Although this research used more of secondary data that was obtained through literature review, primary data was also collected using an interview guide. The study has found that currently, the types of securities traded include three government bonds and one corporate bond, and stocks from five companies that have listed and cross-listed on the market. The study established that rules are provided and well adhered to and challenges facing the market include among others the general public which is not fully knowledgeable about trading in stocks, coupled with less skilled investment experts and lacking long-term credit, all this reduce profitability and thus limit the chances of listing stocks onto the stock market. -

Topic: Share Price Change and Investment Decision On

COLLEGE OF BUSINESS AND ECONOMICS (CBE) TOPIC: SHARE PRICE CHANGE AND INVESTMENT DECISION ON THE RWANDA STOCK EXCHANGE (2011 – 2016) Thesis submitted in partial fulfillment of the requirements for the award of the Degree of Masters of Business Administration specialized in Finance. Submitted by: KANSIIME Gloria Supervisor: Dr. BARAYANDEMA Jonas June, 2018 I DECLARATION I declare that an evaluation of SHARE PRICE CHANGE AND INVESTMENT DECISION ON THE RWANDA STOCK EXCHANGE IN RWANDA is my own work and that all the sources that I have used or quoted have been indicated and acknowledged by means of complete references. KANSIIME Gloria Reg. No: 214003207 MBA-Finance Signature: ……………………………………Date:……../……/2018 I certify that this project entitled “Share price change and investment decision on RSE” was carried out under my supervision. Supervisor name: Dr. BARAYANDEMA Jonas Signature………………………Date:……../………/2018 i COLLEGE OF BUSINESS AND ECONOMICS (CBE) Approval Sheet This thesis entitled SHARE PRICE CHANGE AND INVESTMENT DECISION ON THE RWANDA STOCK EXCHANGE IN RWANDA written and submitted by KANSIIME Gloria In partial fulfillment of the requirements for the degree of Master of finance is hereby accepted and approved. Supervisor Dr. BARAYANDEMA Jonas …………………………………… Date: ……………………… Member of the Jury Member of the Jury Dr. MUSEKURA Celestine Dr. BUSORO R. Theodore …………………………… …………………………… Date: ……………………… Date: ………………… Director of Graduate Studies Dr. NDIKUMANA Philippe ………………………………… Date ………………………… ii DEDICATION First and foremost, I dedicate my work to my beloved Aunt who toiled for my education and sacrificed the descent life they deserved to make sure I attained a bachelor’s degree without which I could not have enrolled for this Master’s Degree program. -

The Republic of Rwanda Us$620000000

THE REPUBLIC OF RWANDA U.S.$620,000,000 5.500 per cent. Notes due 2031 Issue Price: 100 per cent. The issue price of the U.S.$620,000,000 5.500 per cent. Notes due 2031 (the “Notes”) of the Republic of Rwanda (“Rwanda”, the “Republic” or the “Issuer”) is 100 per cent. of their principal amount. Unless previously redeemed or purchased and cancelled the Notes will be redeemed at their principal amount on 9 August 2031 (the “Maturity Date”). The Notes will bear interest from 9 August 2021 at the rate of 5.500 per cent. per annum payable semi-annually in arrear on 9 February and 9 August in each year commencing on 9 February 2022. Payments on the Notes will be made in US dollars without deduction for or on account of taxes imposed or levied by the Republic of Rwanda to the extent described under “Terms and Conditions of the Notes–Taxation”. This Offering Circular does not comprise a prospectus for the purposes of Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (“EUWA”) (the “UK Prospectus Regulation”). Application has been made to the United Kingdom Financial Conduct Authority in its capacity as competent authority under the Financial Services and Markets Act 2000 (as amended) (the “FCA”) for the Notes to be admitted to a listing on the Official List of the FCA (the “Official List”) and to the London Stock Exchange plc (the “London Stock Exchange”) for such Notes to be admitted to trading on the London Stock Exchange’s main market (the “Main Market”). -

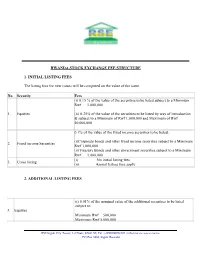

Rwanda Stock Exchange Fee Structure 1. Initial Listing

RWANDA STOCK EXCHANGE FEE STRUCTURE 1. INITIAL LISTING FEES The listing fees for new issues will be computed on the value of the issue. No. Security Fees (i) 0.15 % of the value of the securities to be listed subject to a Minimum Rwf 1,000,000 1. Equities (ii) 0.25% of the value of the securities to be listed by way of introduction & subject to a Minimum of Rwf 1,000,000 and Maximum of Rwf 50,000,000 0.1% of the value of the fixed income securities to be listed: (i)Corporate bonds and other fixed income securities subject to a Minimum 2. Fixed income Securities Rwf 1,000,000 (ii)Treasury Bonds and other government securities subject to a Minimum Rwf 1,000,000 (i) No initial listing fees 3. Cross listing (ii) Annual listing fees apply 2. ADDITIONAL LISTING FEES (i) 0.01% of the nominal value of the additional securities to be listed subject to: 3. Equities Minimum Rwf 500,000 Maximum Rwf 5,000,000 RSE Kigali City Tower, 1st Floor, KN81 ST, Tel : +(250)788516021 ; [email protected] www.rse.rw P O Box 3882, Kigali Rwanda (ii)0.05% of the value of the fixed income securities to be listed: (iii)Corporate bonds and other fixed income securities subject to a Minimum Rwf 1,000,000 4. Fixed income securities (iv) Treasury Bonds and other government securities subject to: Minimum Rwf 1,000,000 Maximum Rwf 10,000,000 The computation of the value of additional listings shall be based on the first date the securities trade ex entitlement after the additional offer. -

The Role of Stock Market on Economic Development of Rwanda; a Case Study of Rwanda Stock Exchange

International Journal of Science and Research (IJSR) ISSN: 2319-7064 Index Copernicus Value (2016): 79.57 | Impact Factor (2017): 7.296 The Role of Stock Market on Economic Development of Rwanda; A Case Study of Rwanda Stock Exchange Jerome Ndagijimana1, Dr. Patrick Mulyungi2 1Student, Jomo Kenyatta University of Agriculture and Technology 2Lecturer, Jomo Kenyatta University of Agriculture and Technology Abstract: In Rwanda there is need to provide funds to start new businesses and to expand existing businesses and industries. The stock market provides companies and the government with an avenue to raise Stock through the sale of shares and bonds to the public. The stock markets bring together those with surplus funds and those with a deficit and facilitate the exchange of the monies. This has however not gotten to its optimal level due to the following challenges facing the Rwanda stock market. First, in RSE there are a limited number of companies listed in the Rwanda Stock Exchange, the investors in Rwanda have limited investment portfolio and another challenge is the limited access to long term securities. The general objective of this study examined the role of stock market on economic development of Rwanda. This study was adopted descriptive research design. The target population of this study is 12 employees of Rwanda Stock Exchange. The researcher was used an open ended questionnaire as data collection. This means that that researcher collected the data through questionnaire. Researcher was used primary data. The Rwanda economic development has an overall correlation with stock market products of 0.776 which is strong and positive. -

The Status Quo of East African Stock Markets: Integration and Volatility

Vol. 13(5), pp. 176-187, 14 March, 2019 DOI: 10.5897/AJBM2019.8742 Article Number: 0976CEA60297 ISSN: 1993-8233 Copyright© 2019 Author(s) retain the copyright of this article African Journal of Business Management http://www.academicjournals.org/AJBM Full Length Research Paper The status quo of East African stock markets: Integration and volatility Marselline Kasiti Atenya Department of Economics, Faculty of Electrical Engineering, University of Applied Sciences, Soest in cooperation with the University of Bolton, UK. Received 16 January, 2019; Accepted 13 February, 2019 This paper presents the current stock markets’ situation of East African markets compared to Johannesburg Stock Exchange (JSE). The study uses weekly price indices of Kenya, Tanzania, Rwanda, and Uganda, South Africa as a performance benchmark for the African market. The period used is from 17th January 2008 to 31st March 2017. The stock indices’ returns results show in general that there is relatively moderate-to-low volatility. The Dar-es-Salaam stock index and the Johannesburg stock index show a higher volatility relative to the other stock market indices with the JSE showing the highest return of 0.117089 when compared to the East African market indices. The Vector Autoregressive (VAR) and Granger causality results capture the linear interdependencies among the given markets and illustrate that JSE has a low contributory impact on the returns on the East African markets. Besides, evidence shows that East African markets are independent, thus offering regional diversification benefits. However, integration is still underway. Key words: East African stock markets, stock market integration, vector autoregressive, Johannesburg stock exchange, correlation coefficient, volatility. -

Capital Structure and Company's Performance Of

CAPITAL STRUCTURE AND COMPANY’S PERFORMANCE OF LISTED COMPANIES IN RWANDA STOCK EXCHANGE, KIGALI, RWANDA KADINDA ACHENI EDWARD MBA/3793/13 A Research Project Submitted in Partial Fulfillment for the Requirement of the Award of the Degree of Master of Business Administration (Finance and Accounting Option) of Mount Kenya University OCTOBER 2016 i DECLARATION This research project is my original work and has not been presented for a degree in any other University, or for any other award. Students Name: Kadinda Acheni Edward MBA/3793/13 Sign ____________________ Date _____________ This research project has been submitted with my approval as the Mount Kenya University Supervisor Name: Mr. Osiemo Kengere Athanas Sign ____________________ Date _____________ ii DEDICATION I dedicate this study to my beloved parents, my wife and my children for allowing me to pursue my studies without pressure but rather giving me the much needed support. iii ACKNOWLEGEMENT First of all, I give glory to almighty God for his blessing in health, knowledge, determination and wisdom to cover this long journey. I would like to appreciate all the staff members of Mount Kenya University. Without their support I wouldn’t have produced this research project to the quality it deserves. Special thanks go to my supervisor who instructed and guided me throughout the writing of the research project; their advice has helped me greatly. Thanks a lot. iv ABSTRACT Choice of capital structure affects performance of firm. The general objective of the study was to assess the impact of capital structure on company performance. Specifically, the researcher sought to establish the importance of using capital structure to improve company financial performance, establish the importance of using capital structure to improve company operational performance and it contribution in risk management. -

Equity Market Performance and Its Effect on Economic Growth Af a Country- Rwanda Stock Exchange Dr

VOL. 2, NO. 3, May 2013 International Journal of Economics, Finance and Management ©2013. All rights reserved. http://www.ejournalofbusiness.org Equity Market Performance and its Effect on Economic Growth af a Country- Rwanda Stock Exchange Dr. Alfred Nuwagaba, PhD Senior lecturer, Mount Kenya University-Kigali campus, P.O. Box 5826, Kigali, Rwanda ABSTRACT Rwanda’s equity market analysis was analyzed in this study that covered a period of six months from November 2012 to April 2013. The study findings revealed only four firms have securities issued on the Rwanda. These firms are bank of Kigali, Bralirwa, Kenya commercial bank and Nation media group. It is only the local firms that have generated equity from the market amounting to $29,446,506.52 and the foreign firms only $310.92. The equity market is segmented and needs to be boosted with integration with regional partners. Rwanda’s economic growth rate is 8.2 percent average and can improve with development of its capital market. Keywords: Equity market, securities, liquidity, equity market liberalization and economic growth 1. INTRODUCTION country’s stock exchange. Some evidence exists that Equity markets do provide liquidity needed by qualifies the issue of efficient market operations being firms for short-to- medium term financial needs and these dependant on how freely information is available in the are instrument in the development of an economy as market for investors (Al Saad and Moosa, 2005). Rwanda investors are able to access funds (Lagoarde-Segot and still faces a challenge of low economic development Lucey, 2008). Rwanda equity market has only four firms though with great potential, and its stock market is still with listed securities and these are; Bank of Kigali underdeveloped with equity market having only four (BOK), Bralirwa (BLR), Kenya commercial bank (KCB) companies listed with their securities listed and fewer and Nation Media group (NMG) (RSE, 2012). -

The Effect of Automation on Stock Market Efficiency: a Case of Nairobi Securities Exchange

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by International Institute for Science, Technology and Education (IISTE): E-Journals Research Journal of Finance and Accounting www.iiste.org ISSN 2222-1697 (Paper) ISSN 2222-2847 (Online) Vol.5, No.17, 2014 The Effect of Automation on Stock Market Efficiency: A Case of Nairobi Securities Exchange Jonathan Ang’ani Omuchesi 1* , Mary Bosire 2, Monica Muiru 3 1.Department of Accounting & Finance, School of Business & Economics, Mount Kenya University P.O BOX 342-01000, THIKA-KENYA *Email: [email protected] 2.Department of Accounting, Finance and Management Science, Faculty of Commerce, Egerton University Nakuru Town Campus College P.O BOX 13357-20100, NAKURU-KENYA 3.Department of Accounting, Finance and Management Science, Faculty of Commerce, Egerton University Nakuru Town Campus College P.O BOX 13357-20100, NAKURU-KENYA Abstract The automation of the Nairobi Securities Exchange (NSE) in 2006 was expected as one of its objectives to improve market efficiency. The objective of the study was to determine the effect of automation on market efficiency. This study investigated the effect of the automation on market efficiency of the Nairobi Securities Exchange (NSE) using monthly market returns from the closing NSE 20-Share index and monthly closing equity price list from 2002 to 2012. Two study periods were considered pre-automation period (January 2002 to June 2006) and post-automation period (July 2008 to December 2012). The study adopted a longitudinal research design. The firms considered were listed and had data spanning the study period. -

The Determinants of Investment Decisions in the Rwanda Stock Exchange

East Africa Collaborative Ph.D. Program in Economics and Management East Africa Research Papers in Economics and Finance The Determinants of Investment Decisions in the Rwanda Stock Exchange Jonas BARAYANDEMA and Idrissa NDIZEYE East Africa Research Papers in Economics and Finance EARP-EF No. 2018:28 Jönköping International Business School (JIBS), Jönköping University, P.O. Box 1026, SE-551 11 Jönköping, Sweden, Web: http://www.ju.se/earp, E-mail: [email protected] Preface East Africa Research Papers in Economics and Finance is a series linked to the collaborative PhD program in Economics and Management among East Africa national universities. The program was initiated and is coordinated by the Jönköping International Business School (JIBS) at Jönköping University, Sweden, with the objective of increasing local capacity in teaching, supervision, research and management of PhD programs at the participating universities. The program is financed by the Swedish International Development Cooperation Agency (SIDA). East Africa Research Papers is intended to serve as an outlet for publishing theoretical, methodological and applied research covering various aspects of the East African economies, especially those related to regional economic integration, national and regional economic development and openness, movement of goods, capital and labor, as well as studies on industry, agriculture, services sector and governance and institutions. In particular, submission of studies analyzing state-of-the-art research in areas of labor, technology, education, -

African Capital Markets Challenges and Opportunities

CFA INSTITUTE RESEARCH FOUNDATION / BRIEF AFRICAN CAPITAL MARKETS CHALLENGES AND OPPORTUNITIES HEIDI RAUBENHEIMER, CFA EDITOR AFRICAN CAPITAL MARKETS Challenges and Opportunities Heidi Raubenheimer, CFA Editor Statement of Purpose CFA Institute Research Foundation is a not-for- profit organization established to promote the development and dissemination of relevant research for investment practitioners worldwide. Neither CFA Institute Research Foundation, CFA Institute, nor the publication’s edi- torial staff is responsible for facts and opinions presented in this publication. This publication reflects the views of the author(s) and does not represent the official views of CFA Institute Research Foundation. CFA®, Chartered Financial Analyst®, and GIPS® are just a few of the trademarks owned by CFA Institute. To view a list of CFA Institute trademarks and the Guide for the Use of CFA Institute Marks, please visit our website at www.cfainstitute.org. © 2019 CFA Institute Research Foundation. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of the copyright holder. This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional service. If legal advice or other expert assistance is required, the services of a competent professional should be sought. Cover credit: Jialiang Gao / Moment / Getty Images ISBN 978-1-944960-87-2 BIOGRAPHIES Badr Benyoussef is chief business develop- Ronak Gopaldas is a political economist, “pra- ment officer at the Casablanca Stock Exchange.