Introduction This Document Contains Country Specific Information from the 2013 Don’T Bank on the Bomb Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Name of the AMC : IIFL ASSET MANAGEMENT LIMITED All Figures

Name of the AMC : IIFL ASSET MANAGEMENT LIMITED All figures - Rs. in Lacs Sr. No. ARN Name of the ARN Holder Total Commission Total Expenses Total Commission + Gross Inflows Net Inflows Whether the Averge Assets under AUM as on Ratio of paid during paid during Expenses paid during distributor is an Management for FY 31-Mar-2019 AUM to FY 2018-19 FY 2018-19 FY 2018-19 associate or group 2018-19 Gross compnay of the Inflows sponsors of the Mutual Fund A B A+B 1 1 BNP Paribas - - - - - - - - 2 2 JM Financial Services Limited 0.01 - 0.01 3.73 3.73 1.52 4.01 1.08 3 5 HDFC Bank Limited - - - - - - - - 4 6 SKP Securities Limited - - - - - - - - 5 7 SPA Capital Services Limited - - - - - - - - 6 9 Way2Wealth Securities Private Limited - - - 2.52 2.52 1.92 2.61 1.04 7 10 Bajaj Capital Ltd. 6.44 - 6.44 540.91 540.29 479.55 564.07 1.04 8 11 SBICAP Securities Limited - - - - - - - - 9 14 Shubhangi Gopal Pai - - - - - - - - 10 16 Bluechip Corporate Investment Centre Ltd - - - - - - - - 11 17 Stock Holding Corporation of India Limited - - - - - - - - 12 18 Karvy Stock Broking Limited 12.23 - 12.23 1,435.72 981.98 915.16 1,022.93 0.71 13 19 Axis Bank Limited 0.08 - 0.08 10.03 10.03 6.43 10.42 1.04 14 20 ICICI Bank Limited 42.05 - 42.05 4,078.27 4,020.20 3,612.52 4,189.04 1.03 15 21 Tata Securities Limited - - - - - - - - 16 22 Hongkong & Shanghai Banking Corporation Ltd. -

Ref. No. SE/ 2020-21/73 June 22, 2020 BSE Limited P. J

HOUSING DEVELOPMENT FINANCE CORPORATION LIMITED www.hdfc.com Ref. No. SE/ 2020-21/73 June 22, 2020 BSE Limited National Stock Exchange of India Limited P. J. Towers, Exchange Plaz.a, Plot No. C/1, Block G, Dalal Street, Bandra-Kurla Complex, Bandra (East) Mumbai 400 001 . Mumbai 400 051. Kind Attn: - Sr. General Manager Kind Attn: Head - Listlng DCS - Listing Department Dear Sirs, Sub: Copy of Notice published in newspapers -Notice of Postal Ballot dated June 19, 2020. Pursuant to provisions of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, please find enclosed herewith copies of newspaper clippings containing the notice published by the Corporation with regard to captioned subject. The said newspaper clippings are also available on website of the Corporation, www.hdfc.com This is for your information and record. Thank you, Yours faith fully, F r Housing Development Finance Corporation Limited Encl: a/a Corporate Office:HDFC House, HT Parekh Marg, 165-166, Backbay Reclamation, Churchgate, Mumbai 400 020. Tel.: 66316000, 22820282. Fax: 022-22046834, 22046758. Regd. Office: Ramon House, HT Parekh Marg, 169, Backbay Reclamation, Churchgate, Mumbai 400 020. INDIA. Corporate Identity Number: L70100MH1977PLC019916 THE FREE PRESSJOURNAL 10 MUMBAI | MONDAY | JUNE 22, 2020 www. reepressjournal.in PUBLIC NOTICE SHIVOM INVESTMENT & CONSULTANCY LTD Hilton Metal Forging Limited NOTICE is hereby given to the General Public that We, M/s Accura 8, Shaniya Enclave, 4th Floor, V.P. Road, Vile Parle West, Regd Office: 701, Palm Spring, Link Road, Mumbai-400064 HDFC BANK Pharmaquip Pvt. Ltd., Intending to offer our property described here- Mumbai City, Maharashtra, 400056 http://www.hiltonmetal.com in below as a mortgage to HDFC Bank Ltd., Trade Star Building, We understand your world Email: [email protected], Website: www.shivominvestmentconsultancyltd.in Notice Andheri (E) Branch by way of security to secure the banking facility CIN: L74140MH1990PLC300881 HDFC Bank Limited granted to us by the said Bank. -

Capital Market Compendium

January 2012 CRISIL Insights Capital Market Entities Redesigning Strategies: Will They Succeed? CRISIL Insights Analytical Contacts Name Designation Email id Pawan Agrawal Director [email protected] Nagarajan Narasimhan Director [email protected] Rupali Shanker Head [email protected] Suman Chowdhury Head [email protected] Manoj Damle Senior Manager [email protected] Prachi Gupta Senior Manager [email protected] Gourav Gupta Manager [email protected] Subhasri Narayanan Manager [email protected] Abhishek Sonthalia Rating Analyst [email protected] Shailesh Sawant Rating Analyst [email protected] Prashant Mane Executive [email protected] Sahil Utreja Executive [email protected] FOREWORD I am delighted to present this compendium of articles on the India’s capital market entities (CMEs), titled ‘Capital Market Entities Redesigning Strategies: Will They Succeed?’ This compendium is part of our initiatives to share with you, the insights we have gained from our ongoing analysis of key developments and sectors, over the years. Capital market entities are primarily engaged in the business of broking (both retail as well as institutional) and investment banking. They also provide associated services like demat accounts, providing loans against shares, margin funding, etc. to their broking clients. In the financial system, they perform an important intermediary role: n As investment bankers, CMEs facilitate raising of capital (both equity and debt), which is critical raw material for growth. They also play an important role in mergers, acquisitions, and their funding n As brokers, CMEs enable equity investing culture, helping to expand the retail investor base. CRISIL has a strong and diverse rating coverage in this sector – CRISIL rates more than 50 companies engaged in capital market and related businesses, including domestic and foreign, as well as large and small. -

S.No. Broker Code Broker Name Contact Person Phone No. Mobile

Broker S.no. Broker Name Contact Person Phone No. Mobile No. Add 1 Add 2 Add 3 Pin Email Code [email protected]; RUCHIKA RAINA SINGH, 9899636606, 25, C BLOCK [email protected]; 011-45675504, 1 001 SPA CAPITAL ADVISORS LTD. VARUN KAUSHIK, 9873486360, COMMUNITY JANAK PURI NEW DELHI 110058 [email protected]; 45675588,45675528 SANJAY JAIN 9910234032 CENTRE [email protected]; [email protected]; HARISH 9999114500, SABHARWAL 5TH 97, NEHRU [email protected];aparnarazdan@ba 2 002 BAJAJ CAPITAL LTD. HARISH SABHARWAL 011-41693000 NEW DELHI 110019 9811121101 FLOOR, BAJAJ PLACE jajcapital.com HOUSE [email protected]; [email protected]; J. M. FINANCIAL SERVICES PRADYUMNA 022-30877349, PALM COURT, 4TH LINK ROAD [email protected]; 3 003 MUMBAI 400064 PVT LTD SATPATHY 30877000, 67617000 FLOOR, M WING MALAD WEST [email protected]; [email protected]; [email protected] 105-108, CONNAUGHT [email protected]; 011-61127438, 040- 9989836349, 19, BARAKHAMBA 4 004 KARVY STOCK BROKING LTD. B V R NAIDU ARUNACHAL PLACE, NEW 110001 [email protected]; [email protected]; 44677536 9177401508 ROAD BUILDING DELHI [email protected] R. R. FINANCIAL RAJEEV SAXENA, S K 47 M M ROAD, RANI [email protected]; [email protected]; 5 005 011-23636362-63 9717553830 JHANDEWALAN NEW DELHI 110055 CONSULTANTS LTD. SINGH JHANSI MARG [email protected] [email protected]; HSBC SECURITIES AND 52/60 M. G. ROAD [email protected]; 6 006 SHWETANK DEV 022-40854280 9811374741 MUMBAI 400001 CAPITAL MARKETS (I) P LTD FORT [email protected]; [email protected] MR. -

Knowledge Page

Knowledge Page Regulation of Credit Rating Agencies (CRAs) in India rising debt levels of IL&FS, and continued maintaining the rating assigned to IL&FS as AAA, indicating the highest level of creditworthiness. Introduction and Governance Following the default of IL&FS and its subsidiaries, contagion effect was witnessed in the entire NBFC space that led to an impairment in the Credit Rating Agencies (CRAs) assess creditworthiness of organizations demand for such issuers. This led to a sharp plunge in their share prices and rate their credit risk by analyzing their financial performance, level and discounted trade levels of their issuances, calling for heightened and type of debt, lending and borrowing history, ability to repay the debt, stringency in the norms followed by credit rating agencies to assess and the past debts of the entity into consideration. In India, CRAs are creditworthiness of the issuers. regulated as per the SEBI (Credit Rating Agencies) Regulations, 1999 which provide for eligibility criteria for registration of credit rating SEBI regulations on CRA’s | Proposed Changes agencies, monitoring and review of ratings, requirements for a proper rating process, avoidance of conflict of interest and inspection of rating In order to strengthen the regulatory practices governing CRA’s, SEBI has agencies by SEBI, amongst other matters. However, certain other issued the following detailed guidelines: regulatory agencies, such as the Reserve Bank of India (RBI), Insurance Regulatory and Development Authority (IRDA), and Pension Fund • Hike in the minimum net worth threshold for the rating agencies to INR Regulatory and Development Authority (PFRDA) also regulate certain 25 crore from the current level of INR 5 crore. -

N. L. Dalmia Institute of Management Studies and Research

Graded Programme: PGDM N. L. Dalmia Institute of Management Studies and Research CRISIL Grading: Srishti Road, Sector 1, Mahajan Wadi, Mira Road East, MMR, Maharashtra 401 104 National A https://www.nldalmia.in/ State MH A Valid upto: October 18, 2019 Report Date: October 19, 2018 N L Dalmia Institute of Management Studies and Research (NLDIMSR) is a business school in Mira Road,Mumbai, Maharashtra, India. The institute is part of N L Dalmia Educational Society. It is an autonomous institution awarding post graduate diplomas in management (PGDM) approved by the All India Council for Technical Education (AICTE), and accredited 'A grade' by National Assessment and Accreditation Council (NAAC), 'Premier College' status by Accreditation Service for International School, Colleges & Universities (ASIC), United Kingdom and is an ISO 9001:2008 certified Institute. NLDIMSR was set up in 1995. Its first batch of students passed in 1997. Best Practices Followed • Good profile of pemanent & visiting faculties • Significant industry interface through interaction with guest speakers • Affordable fee structure for students Areas of Excellence Areas of Strong Performance Areas of Good Performance Areas of Improvement • Good track record of the group in education • Affordable fee structure for students •Focus on improving student quality through • Improvement in work experience profile of • Strong vintage - 23 years • Good number and profiles of visiting faculty and various activities students • Industry interaction is strong adequate industry interface -

36Th-Annual-Report-2017-2018.Pdf

contents Corporate Chairman’s Operational 02 snapshot 06 overview 08 review Five years Business Industry financial model numbers 10 highlights 12 14 Management Risk man- Project discussion agement details 16 and analysis 22 23 Directors’ Corporate Financial report Governance statement 42 61 report 73 Forward looking statement This document contains statements about expected future events and fi- nancial and operating results of Poddar Housing and Development Limited, which are forward-looking. By their nature, forward-looking statements re- quire the Company to make assumptions and are subject to inherent risks and uncertainties. There is significant risk that the assumptions, predictions and other forward-looking statements will not prove to be accurate. Read- ers are cautioned not to place undue reliance on forward-looking state- ments as a number of factors could cause assumptions, actual future results and events to differ materially from those expressed in the forward-looking statements. Accordingly, this document is subject to the disclaimer and qualified in its entirety by the assumptions, qualifications and risk factors re- ferred to in the management’s discussion and analysis of the Poddar Hous- ing and Development Limited Annual Report 2017-18. Poddar Housing and Development Limited’s growth was muted across the last couple of years. This slowdown was the result of a sluggishness in the country’s real estate sector, delay in getting approvals for new project launches and the Company’s conscious decision to delay launches and let the GST and RERA-induced uncertainty to pass. The wait is over. The Company launched two projects in 2017-18 and expects to launch a handful of projects in FY2018-19. -

Statement of Additional Information

Statement of Additional Information NAME OF MUTUAL FUND Reliance Mutual Fund (RMF) NAME OF ASSET MANAGEMENT COMPANY Reliance Nippon Life Asset Management Limited (RNAM) (formerly Reliance Capital Asset Management Limited) CIN : U65910MH1995PLC220793 NAME OF TRUSTEE COMPANY Reliance Capital Trustee Co. Limited (RCTC) CIN : U65910MH1995PLC220528 Registered Office (RMF, RNAM, RCTC) Reliance Centre, 7th Floor South Wing, Off Western Express Highway, Santacruz (East), Mumbai - 400 055. Tel No. - 022- 33031000; Fax No. - 022- 33037662 Website : www.reliancemutual.com SPONSORS Reliance Capital Limited & Nippon Life Insurance Company For a free copy of the current Statement of Additional Information, please contact your nearest Investor Service Centre or log on to our website. Customer Care : 022-3030 1111 Toll free: 1800-300-11111 Email: [email protected] Website: www.reliancemutual.com Table of content Content Page No. I DEFINITIONS & ABBREVIATIONS 1 II INFORMATION ABOUT SPONSOR, AMC AND TRUSTEE COMPANIES 3 A. Constitution of the Mutual Fund 3 B. Sponsor 3 C. The Trustee 3 D. Asset Management Company 7 E. Service providers 22 F. Condensed financial information (CFI) 22 III HOW TO APPLY? 57 IV RIGHTS OF UNITHOLDERS OF THE SCHEME 75 V INVESTMENT VALUATION NORMS FOR SECURITIES AND OTHER ASSETS 75 VI TAX & LEGAL & GENERAL INFORMATION 84 This Statement of Additional Information contains details of Reliance Mutual Fund, its constitution and certain tax, legal and general information. It is incorporated by reference and is a part of Scheme Information Document of all the Schemes of Reliance Mutual Fund. This Statement of Additional Information is dated August 24, 2017. I. DEFINITIONS & ABBREVIATIONS Word/Abbreviation Definition/Expansion AMC AMC means Asset Management Company, formed and registered under the Companies Act, 1956 and approved as such by the SEBI under sub-regulation (2) of regulation 21. -

ICICI Bank Limited

This Offer Document is not intended to be an offer to the public Private Placement Offer Document Dated : January 6, 2011 ICICI Bank Limited Registered Office: ‘Landmark’, Race Course Circle, Vadodara 390 007 Corporate Office: ICICI Bank Towers, Bandra-Kurla Complex, Mumbai 400 051 Tel.: (022) 2653 1414 Fax: (022) 2653 1122 Contact Person: Sandeep Batra; E-mail: [email protected]; Website: www.icicibank.com (We were originally incorporated in Vadodara as ICICI Banking Corporation Limited on January 5, 1994 and subsequently renamed as ICICI Bank Limited on September 10, 1999) PRIVATE PLACEMENT OF UNSECURED SUBORDINATED BONDS IN THE NATURE OF DEBENTURES FOR INCLUSION AS LOWER TIER II CAPITAL OF THE ISSUER (HEREIN REFERRED TO AS THE “BONDS”). THE ISSUE AGGREGATES TO ` 2,000 CRORE (“ISSUE”) NOTE: This offer document (“Offer Document”) is for issue by way of private placement of unsecured subordinated bonds in the nature of debentures eligible for inclusion as lower tier II capital of the Issuer. Unless otherwise specified, information contained in this Offer Document is updated as of January 6, 2011. This Offer Document is not intended to constitute any offer to the public to subscribe to the Bonds. GENERAL RISKS: For taking an investment decision, investors must rely on their own examination of the Issuer and the Issue including the risks involved. The Bonds have not been recommended or approved by Securities and Exchange Board of India (“SEBI”) nor does SEBI guarantee the accuracy or adequacy of this document. Specific attention of investors is invited to the section titled “Risk Factors” on page 5 of the Offer Document which needs to be considered by the investors whie investing in the Bonds. -

List of Arrangers for Pfc Capital Gain Tax Exemption Bonds –Series V

LIST OF ARRANGERS FOR PFC CAPITAL GAIN TAX EXEMPTION BONDS –SERIES V S. Broker Arranger Name Contact Person Phone No. Mobile No. Email Address no. Code 1 KARVY STOCK BROKING P001 B V R NAIDU 011-61127438, 9989836349, [email protected]; 105-108, ARUNACHAL LTD. 040- 9177401508, [email protected]; BUILDING 19, BARAKHAMBA 44677536 9910052238 [email protected]; ROAD CONNAUGHT PLACE, [email protected]; NEW DELHI 110001 [email protected]; [email protected]; [email protected] 2 JM FINANCIAL SERVICES P002 Geeta Pillai, Vandana 022-30877349, [email protected]; 1st Floor, B Wing, Suashish IT LTD Thakkar, Pradyumana 30877000, [email protected]; Park, Plot No 68E, Off. Satpathy, Krishna 67617000 [email protected]; Dattapada Road, Opp. Tata Mattegunta [email protected]; Steel, Borivali (East), Mumbai – [email protected]; 400066 [email protected] 3 SMC CAPITALS LIMITED P003 NEERAJ KHANNA 011-40753333, 9810059041 [email protected]; 17, Netaji Subhash Marg, 011- [email protected]; Daryaganj, New Delhi 110002 30111000 [email protected]; [email protected]; [email protected]; [email protected] 4 RR INVESTORS CAPITAL P004 Mr. JEETESH KUMAR 011-23354802 9312940485 [email protected]; [email protected]; 412-422, 4th Floor, SERVICES PVT. LTD. [email protected]; Indraprakash Building, [email protected] Barakhamba Road, New Delhi 110001 LIST OF ARRANGERS FOR PFC CAPITAL GAIN TAX EXEMPTION BONDS –SERIES V S. Arranger Name Broker Contact Person Phone No. Mobile No. Email Address no. Code 5 BAJAJ CAPITAL LTD. P005 HARISH SABHARWAL 011-41693000 9999114500, [email protected]; HARISH SABHARWAL 5TH 9811121101 [email protected]; FLOOR, BAJAJ HOUSE 97, [email protected] NEHRU PLACE NEW DELHI 110019 6 STOCK HOLDING P006 PATRICIA HEREDIA / ANITA 022-61778100-09, [email protected]; PLOT NO. -

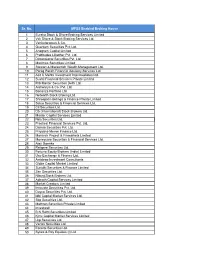

Sr. No. MFSS Enabled Broking House 1 Eureka Stock & Share Broking

Sr. No. MFSS Enabled Broking House 1 Eureka Stock & Share Broking Services Limited 2 Vck Share & Stock Broking Services Ltd. 3 Venkataraman & Co. 4 Quantum Securities Pvt. Ltd. 5 Anagram Capital Limited 6 Prabhudas Lilladher Pvt. Ltd. 7 Dimensional Securities Pvt. Ltd 8 Maximus Securities Limited 9 Stewart & Mackertich Wealth Management Ltd. 10 Parag Parikh Financial Advisory Services Ltd 11 Asit C Mehta Investment Interrmediates Ltd. 12 Sushil Financial Services Private Limited 13 Rrb Master Securities Delhi Ltd. 14 Aishwarya & Co. Pvt. Ltd. 15 Bonanza Portfolio Ltd. 16 Networth Stock Broking Ltd. 17 Shreepati Holdings & Finance Private Limited 18 Satco Securities & Financial Services Ltd. 19 Cil Securities Ltd. 20 Db (International) Stock Brokers Ltd. 21 Master Capital Services Limited 22 Nda Securities Ltd. 23 Practical Financial Services Pvt. Ltd. 24 Dalmia Securities Pvt. Ltd. 25 Priyasha-Meven Finance Ltd. 26 Monarch Project & Finmarkets Limited 27 Moneycare Securities & Financial Services Ltd. 28 Ajay Goenka 29 Religare Securities Ltd. 30 Fortune Equity Brokers (India) Limited 31 Uae Exchange & Finance Ltd. 32 Amideep Investment Consultants 33 Globe Capital Market Limited 34 Sunidhi Securities & Finance Limited 35 Zen Securities Ltd. 36 Nikunj Stock Brokers Ltd. 37 Adinath Capital Services Limited 38 Market Creators Limited 39 Innovate Securities Pvt. Ltd. 40 Dayco Securities Pvt. Ltd. 41 Idbi Capital Market Services Ltd. 42 Skp Securities Ltd. 43 Mathran Securities Private Limited 44 Investwell 45 B N Rathi Securities Limited 46 Kjmc Capital Market Services Limited 47 Lkp Securities Ltd. 48 Vertex Securities Ltd. 49 Escorts Securities Ltd. 50 Sykes & Ray Equities (I) Ltd. Sr. No. MFSS Enabled Broking House 51 Composite Investments Private Limited 52 Coimbatore Capital Limited 53 K & A Securities (P) Ltd. -

1 BNP Paribas 2.72 2 JM Financial Services Pvt. Ltd. 40.22 3 Aditya

Commission and Expenses paid to distributors for the period 01 April 2010 - 31 March 2011 Sr. No. Name of Distributor Rs in lakhs 1 BNP Paribas 2.72 2 JM Financial Services Pvt. Ltd. 40.22 3 Aditya Birla Money Mart Ltd 36.35 4 Cholamandalam Distribution Services Ltd 10.74 5 HDFC Bank Ltd 101.04 6 SKP Securities Limited 7.78 7 SPA Capital Services Ltd 18.10 8 Enam Securities Private Limited 9.04 9 Way2Wealth Securities Pvt Ltd 8.03 10 Bajaj Capital Ltd 73.67 11 SBICAP Securities Ltd. 0.42 12 Shubhangi Gopal Pai 0.93 13 Chetan Jaysingh Bhatia 0.23 14 Bluechip Corporate Investment Centre Ltd 20.54 15 Stock Holding Corporation of India Ltd 2.28 16 Karvy Stock Broking Limited 51.58 17 Axis Bank Limited 14.18 18 ICICI Bank Limited 38.96 19 Tata Securities Limited 2.03 20 Hongkong & Shanghai Banking Corporation Ltd 774.75 21 HSBC Investdirect Securities India Ltd 11.09 22 EFG Wealth Management (India) Private Limited. 1.33 23 Eastern Financiers Ltd 18.10 24 RR Investors Capital Services Pvt Ltd 20.58 25 ARN-0033 0.00 26 Bluechip Capital Services Pvt Ltd 6.38 27 Sanjeev Anand 0.08 28 CITIBANK NA 48.59 29 IDBI Bank Ltd 24.35 30 Chadha Investments 0.58 31 Geojit BNP Paribas Financial Services Limited 7.52 32 ITI Financial Services Limited 4.51 33 DSP Merrill Lynch Ltd. 11.67 34 NJ India Invest Pvt Ltd 59.59 35 Mata Securities India Private Limited 2.26 36 Ramkumar Harkishorbhai Barchha 0.23 37 Kotak Securities Limited 2.98 38 Zeenath S Jagan 1.82 39 Hexagon Capital Advisors Pvt Ltd 0.06 40 Anand Rathi Financial Services Ltd 18.61 41 Hero Honda Finlease Limited 0.05 42 Allegiance Advisors Pvt.