Inner 11 Equity PE Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 Azbil Telstar Tecnologies S.L.U

AZBIL TELSTAR TECHNOLOGIES, S.L.U. 1 www.telstar-lifesciences.com Tel/Fax: +34 937 361 600 / +34 937 861 380 AUDIT PLAN 2020 AZBIL TELSTAR TECNOLOGIES S.L.U Manufacturer Country Address AARTI INDUSTRIES LTD. India Unit IV - Plot No. E-50, MIDC, Tarapur, Tal-Palghar Dist. Thane, Maharashtra 401506 - India Commercial Hub road,Near APIIC Pump House,Plot No:2, Road No:21,J.N.Pharma City (Ramky),Tadi ACACIA LIFE SCIENCES Pvt. Ltd. (BIOCON) India Village, IDA Paravada,Visakhapatnam, India - 531 021 Unit-III Plot No. 842-843, Village-Karakhadi, Taluk-Padra, District-Panchmahal, Vadodara-391 450, ALEMBIC PHARMACEUTICALS LTD. India Gujarat, INDIA ALEMBIC PHARMACEUTICALS LTD. India Village Panelav, Near Baska. Taluka Halol, District Panchmahal - 389 350 Gujarat - India AMI LIFE SCIENCES PVT. LTD. India Block No 82/B, ECP Road, At & Post : Karakhadi-391 450 Ta: Padra, Dist. Baroda, Gujarat, INDIA. AMINO CHEMICALS (MOEHS) Malta MRA 050X, Industrial Estate. Marsa MRS 3000 Malta. AMINO CHEMICALS (MOEHS) Malta MRA 050X, Industrial Estate. Marsa MRS 3000 Malta. ANUGRAHA CHEMICALS India D-46-50 &C-62 & 63 KSSIDC Indl Estate Doddaballpura, Bangalore 561 203 INDIA Nº D47 to D50, C62 & C 63, KSSIDC Industrial State, Doddaballapur, Bangalore, Karnataka, 561203 ANUGRAHA CHEMICALS India INDIA ARCH UK BIOCIDES UK Wheldon Road, Castelford, West Yorkshire - WF 102JT, England Consultancy Department March_2020 AZBIL TELSTAR TECHNOLOGIES, S.L.U. 2 www.telstar-lifesciences.com Tel/Fax: +34 937 361 600 / +34 937 861 380 AURO LABORATORIES LIMITED India K-56, M.I.D.C. Tarapur, Boisar, Dist. Thane, Maharashtra – 401 506, INDIA AUROBINDO UNIT IX India Unit IX. -

Alembic Pharmaceuticals Limited

Placement Document Not for Circulation and Strictly Confidential Serial Number: ___ ALEMBIC PHARMACEUTICALS LIMITED Registered and Corporate Office: Alembic Road, Vadodara 390 003, Gujarat, India Telephone: +91 265 228 0550; Fax: +91 265 228 2506 E-mail: [email protected]; Website: www.alembicpharmacueticals.com; CIN: L24230GJ2010PLC061123 Alembic Pharmaceuticals Limited (our “Company" or the “Issuer”) was originally incorporated on June 16, 2010 as “Alembic Pharma Limited”, a public limited company under the Companies Act, 1956. Thereafter, our Company commenced its business on July 1, 2010, pursuant to a certificate of commencement of business issued to it by the Assistant Registrar of Companies, Gujarat, Dadra and Nagar Haveli. Subsequently, the name of our Company was changed to “Alembic Pharmaceuticals Limited”, pursuant to a fresh certificate of incorporation consequent upon change of name dated March 12, 2011, issued by the Assistant Registrar of Companies, Gujarat, Dadra and Nagar Haveli. For details with respect to changes to the name of our Company, see "General Information" on page 179. Our Company is issuing 80,47,210 Equity Shares (as defined below) at a price of ₹932.00 per Equity Share (the “Issue Price”), including a premium of ₹930.00 per Equity Share, aggregating to approximately ₹750.00 crore (the “Issue”). For further details, see “Summary of the Issue” on page 29. THIS ISSUE IS BEING UNDERTAKEN IN RELIANCE UPON CHAPTER VI OF THE SECURITIES AND EXCHANGE BOARD OF INDIA (ISSUE OF CAPITAL AND DISCLOSURE REQUIREMENTS) REGULATIONS, 2018, AS AMENDED (THE “SEBI REGULATIONS”) AND SECTION 42 OF THE COMPANIES ACT, 2013 AND OTHER APPLICABLE PROVISIONS OF THE COMPANIES ACT, 2013 AND THE RULES MADE THEREUNDER, EACH AS AMENDED (“COMPANIES ACT”) The equity shares of our Company, of face value of ₹ 2 each (the “Equity Shares”) are listed on BSE Limited (“BSE”) and the National Stock Exchange of India Limited (“NSE”, and together with BSE, the “Stock Exchanges”). -

Case 1:14-Cv-08074-JBS-KMW Document 186 Filed 09/25/15 Page

Case 1:14-cv-08074-JBS-KMW Document 186 Filed 09/25/15 Page 1 of 25 PageID: <pageID> IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF NEW JERSEY OTSUKA PHARMACEUTICAL CO., LTD., HONORABLE JEROME B. SIMANDLE Plaintiff, v. Civil Action Nos. TORRENT PHARMACEUTICALS LIMITED, 14-1078 (JBS/KMW) INC., TORRENT PHARMA INC., and HETERO LABS LIMITED, 14-2982 (JBS/KMW) Defendants. 14-3168 (JBS/KMW) 14-3306 (JBS/KMW) OTSUKA PHARMACEUTICAL CO., LTD., Plaintiff, 14-3996 (JBS/KMW) v. 14-4307 (JBS/KMW) ALEMBIC PHARMACEUTICALS LIMITED, 14-4508 (JBS/KMW) ALEMBIC LIMITED, ALEMBIC GLOBAL 14-4671 (JBS/KMW) HOLDING SA, and ALEMBIC 14-5537 (JBS/KMW) PHARMACEUTICALS INC., Defendants. 14-5876 (JBS/KMW) 14-5878 (JBS/KMW) OTSUKA PHARMACEUTICAL CO., LTD., 14-6158 (JBS/KMW) Plaintiff, 14-6397 (JBS/KMW) v. ZYDUS PHARMACEUTICALS USA, INC. and 14-6398 (JBS/KMW) CADILA HEALTHCARE LIMITED, 14-6890 (JBS/KMW) 14-7105 (JBS/KMW) Defendants. 14-7106 (JBS/KMW) OTSUKA PHARMACEUTICAL CO., LTD., 14-7252 (JBS/KMW) Plaintiff, 14-7405 (JBS/KMW) v. 14-8074 (JBS/KMW) AUROBINDO PHARMA LIMITED, AUROBINDO PHARMA USA, INC., and AUROLIFE PHARMA 14-8077 (JBS/KMW) LLC, 15-1585 (JBS/KMW) Defendants. 15-1716 (JBS/KMW) OTSUKA PHARMACEUTICAL CO., LTD., 15-161 (JBS/KMW) Plaintiff, v. INTAS PHARMACEUTICALS LIMITED, ACCORD MEMORANDUM OPINION REGARDING HEALTHCARE, INC., and HETERO LABS OTSUKA’s MOTIONS TO STRIKE LIMITED, Defendants. OTSUKA PHARMACEUTICAL CO., LTD., Plaintiff, v. SUN PHARMACEUTICAL INDUSTRIES LTD., SUN PHARMA GLOBAL INC., SUN PHARMA GLOBAL FZE, SUN PHARMA USA, SUN PHARMACEUTICALS INDUSTRIES, INC., and CARACO PHARMACEUTICAL LABORATORIES, Defendants. -

Alembic Pharmaceuticals

2QFY2018 Result Update | Pharmaceutical November 21, 2017 Alembic Pharmaceuticals BUY Performance Highlights CMP `514 Target Price ‘600 Y/E March (` cr) 2QFY2018 1QFY2018 % chg (qoq) 2QFY2017 % chg (yoy) Investment Period 12months Net Sales 789 648 21.8 879 (10.2) Other Income 8 0 0.0 0 19075.0 Operating Profit 178 101 75.8 177 0.7 Stock Info Interest 0 1 (60.7) 1 (63.5) Sector Pharmaceutical Adj. Net Profit 122 67 82.2 120 1.4 Market Cap (` cr) 9,681 Source: Company, Angel Research Net Debt (` cr) -9 Alembic Pharma posted marginally lower than expected sales for 2QFY2018. In Beta 0.3 Rupee terms, revenues de-grew by 10.2% yoy to `789cr (`980cr expected) v/s. 52 Week High / Low 709/470 `879cr in 2QFY2017. International formulation came in at `262cr v/s. `352cr in Avg. Daily Volume 19,513 2QFY2017, a yoy dip of 26.0%. Indian formulation sales came in at `385cr v/s. `363cr Face Value (`) 2 in 2QFY2017, a yoy growth of 6.0%. On the operating front, EBITDA margin came BSE Sensex 33,343 in at 22.6% (15.4% expected) v/s. 20.3% in 2QFY2017, an expansion of 230bps yoy. Nifty 10,284 Thus, PAT came in at `122cr (`108cr expected) v/s. `120cr in 2QFY2017, up 1.4% Reuters Code ALEM.BO yoy. We recommend a Buy rating. Bloomberg Code ALPM@IN Results Highlights: In Rupee terms, revenues de-grew by 10.2% yoy to `789cr (`980cr expected) v/s. `879cr in 2QFY2017. International formulation came in at Shareholding Pattern (%) `262cr v/s. -

Marketgrader India All-Cap Growth Leaders Index

Fact Sheet MarketGrader MarketGrader India All-Cap Growth Leaders Index RESEARCH & INDEXES The MarketGrader India All-Cap Growth Leaders Index consists of the 80 most fundamentally sound companies with the best growth prospects in India, whose shares are listed in the country’s national exchanges or in the United States. Its objective is to give investors access to the best companies in the world’s fastest growing large economy without overpaying for their shares. Constituents are selected across all market cap segments and all economic sectors after they have passed rigorous size and liquidity filters. Index Rules Performance Investable Universe IndiaCumulative Growth Leaders Total Return, Jan. 2008 - Oct. 2020* All data as of Oct 30, 2020 All companies domiciled in India that have 125% received a MarketGrader Score consistently for at least six months, whose shares are 100% listed on the National Stock Exchange, the Bombay Stock Exchange or on U.S. national 75% exchanges. 50% Regulatory Requirements 25% Stocks are ineligible for Index selection if 0% they are included in the ‘Red Flag List,’ maintained and published by the National -25% Securities Depository Limited (NDSL) of India, or on the ‘Breach List,’ maintained by the -50% Central Depository Services (India) Limited 10/30/2020 -75% (CDSL), both of which govern foreign own- 12/31/07 12/31/08 12/31/09 12/31/10 12/30/11 12/31/12 12/31/13 12/31/14 12/31/15 12/30/16 12/29/17 12/31/18 12/31/19 ership limits of Indian securities. MarketGrader India All-Cap Growth Leaders India S&P BSE SENSEX MSCI India Size Requirements All companies must have a minimum total Calendar Year Returns Annualized Returns market capitalization of USD 150 million on MG India India S&P BSE MSCI MG India India S&P MSCI the Index selection date. -

Investment Philosophy

** 1st NAV Date 6 Nov 2020 - quant ESG Fund; * NAV for For Both Growth & Direct Plan ,NAV Recorded on 08 January 2021 The date March 24, 2020 marks the bottom of the indices after the panic of the pandemic. Above is the performance of the schemes relative to their respective benchmarks since the bottom. With a maximum outperformance of 450bps and a relatively low beta, this is a glimpse of quant’s Equity based schemes performance. quant mutual fund FACTSHEET JANUARY 2021 Table of content quant’s VLRT Outlook 3 Scheme Details . quant Liquid Fund 6 . quant Active Fund 8 . quant Small Cap Fund 10 . quant Tax Plan 12 . quant Mid Cap Fund 14 . quant Large & Mid-Cap Fund 16 . quant Focused Fund 18 . quant Multi Asset Fund 20 . quant ESG Fund 22 . quant Absolute Fund 24 . quant Infrastructure Fund 26 . quant Consumption Fund 28 . quant Dynamic Bond 30 . quant Money Market Fund 32 Dividend History 34 Glossary 35 Point of Service (PoS) Location 37 Disclaimer: The Factsheet is for general reading purpose only and is not meant to serve as a professional guide. This document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The Sponsor, the Investment Manager, the Trustee or any of their respective directors, employees, affiliates or representatives (“entities & their affiliates”) do not assume any responsibility for, or warrant the authenticity, accuracy, completeness, adequacy and reliability of such information. Whilst no action has been solicited based upon the information provided herein; due care has been taken to ensure that the facts are accurate and opinions given are fair and reasonable. -

Annual Report

ANNUAL REPORT 2019 MARCH 2020 To Our Shareholders Alex Gorsky Chairman and Chief Executive Officer By just about every measure, Johnson & These are some of the many financial and Johnson’s 133rd year was extraordinary. strategic achievements that were made possible by the commitment of our more than • We delivered strong operational revenue and 132,000 Johnson & Johnson colleagues, who adjusted operational earnings growth* that passionately lead the way in improving the health exceeded the financial performance goals we and well-being of people around the world. set for the Company at the start of 2019. • We again made record investments in research and development (R&D)—more than $11 billion across our Pharmaceutical, Medical Devices Propelled by our people, products, and and Consumer businesses—as we maintained a purpose, we look forward to the future relentless pursuit of innovation to develop vital with great confidence and optimism scientific breakthroughs. as we remain committed to leading • We proudly launched new transformational across the spectrum of healthcare. medicines for untreated and treatment-resistant diseases, while gaining approvals for new uses of many of our medicines already in the market. Through proactive leadership across our enterprise, we navigated a constant surge • We deployed approximately $7 billion, of unique and complex challenges, spanning primarily in transactions that fortify our dynamic global issues, shifting political commitment to digital surgery for a more climates, industry and competitive headwinds, personalized and elevated standard of and an ongoing litigious environment. healthcare, and that enhance our position in consumer skin health. As we have experienced for 133 years, we • And our teams around the world continued can be sure that 2020 will present a new set of working to address pressing public health opportunities and challenges. -

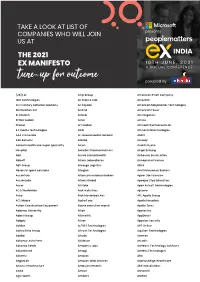

Partial List Ex Conference 20

Artemis Health Institute Bharat Serums & Vaccines Carrier CP Milk & Food Products Discovery FCDO GlaxoSmithkline Henkel India Shelter Finance Corporation Kadtech Infraprojects LSEG MIND NIIT Paytm Money PT Bank BTPN RTI Shyam Spectra Stryker ThoughtWorks ValueMined Technologies Y-Axis Solutions Arth Group Bharti Axa Life Insurance Cars24 CP Plus Dksh FE fundinfo Glenmark Pharmaceuticals Herbalife Nutition IndiaMART Kaivalya Educatiion Foundation LTI MindTickle Nineleaps technology solutions PayU PT. Media Indra Buana Ruby Seven Studios Shyam Spectra STT Global Data Centres Thryve Digital Valuex Technologies Yamaha Motor Arvind Fashions Bhel Caterpillar CP Wholesale DLF Fedex GlobalEdge Here Technologies Indigo Kalpataru Luminous Power Technologies Mindtree Nippon Koei PCCPL PTC Network Rustomjee Sidel Successive Technologies Tierra Agrotech Varroc Engineering Yanbal Asahi India Glass BIC CDK Global CPI DMD ADVOCATES Ferns n Petals GlobalLogic Herman Miller Indmoney Kama Ayurveda Luthra Group MiQ Digital NISA Global PCS Publicis Media S P Setia Siemens Sulzer Pumps Tifc Varuna Group Yanmar TAKE A LOOK AT LIST OF Ashirvad Pipes Bidgely Technologies CEAT Creditas Solutions DP World Ferrero GMR Hero Indofil industries Kanishk Hospital Luxury Personified Mizuho Bank Nissan Peak Infrastructure Management PUMA Group S&P Global Sigma AVIT Infra Services Summit Digitel Infrastructure TIL Vastu Housing Finance Corpora- Yara COMPANIES WHO WILL JOIN Asian paints Bigtree Entertainment Celio Cremica Dr Reddy's Ferring Pharmaceuticals Godrej & Boyce -

DCAT MEMBER COMPANY MEETING LOCATOR V. 6 the BENJAMIN Sri Krishna Pharmaceuticals Ltd

DCAT MEMBER COMPANY MEETING LOCATOR v. 6 THE BENJAMIN Sri Krishna Pharmaceuticals Ltd. Zydus Pharmaceuticals (USA) Inc. Amino Chemicals Ltd. Apogee Pharma, Inc. INTERCONTINENTAL BARCLAY C2 PHARMA AbbVie* Calyx Chemicals & Pharmaceuticals Ltd. ACIC Pharmaceuticals Inc. ChemCon GmbH Advitech SA Concord Biotech Limited Amneal Pharmaceuticals LLC Dipharma Francis Srl ALP Pharm DSM Sinochem Pharmaceuticals AMRI Emergent BioSolutions Asymchem Inc. F.I.S. - Fabbrica Italiana Sintetici S.p.A. Capsugel, Now a Lonza Company* Indena S.p.A. CBC AMERICAS Corp. Jost Chemical Co. CellMark USA, LLC Jubilant Pharma Charioteer Pharmaceutical Co., Ltd., Zhejiang PharmSource, A GlobalData Company Chemical and Pharmaceutical Solutions PolyPeptide Group Chiral Quest Corp. ROHNER Inc. Croda, Inc. SST Corporation DFE Pharma HOTEL 48LEX DPL-US EQ Esteve AB BioTechnologies, Inc. Evonik Corporation AGC Biologics FAREVA SA AiPing Pharmaceutical, Inc. Flavine North America, Inc. Almac Formosa Laboratories, Inc. Aptuit LLC Grifols International S.A. AZAD Fine Chemicals Ltd. Hainan Poly Pharm. Co., Ltd. Cambridge Isotope Laboratories, Inc. Harris Pharmaceutical Groupe Parima Helm AG Navin Fluorine International Limited Hetero USA, Inc. Qualicaps, Inc. Hikal, Ltd. RC2 Pharma Connect LLC Interchem Corporation Recipharm Inventia Healthcare PVT LTD Recro Gainesville LLC Johnson Matthey Reed-Lane, Inc. Kingchem Life Science LLC Sancilio Pharmaceuticals Company, Inc. Please note: Some DCAT member companies have requested not to be listed in the locator. (*) indicates member companies with Business Meeting Spaces in more than one hotel. INTERCONTINENTAL BARCLAY CONT'D LOTTE NY PALACE Legacy Pharmaceutical Packaging AbbVie* Lonza AG* Acella Pharmaceuticals Neuland Laboratories Ltd. Alcami Corporation Orion Group Alembic Pharmaceuticals Limited Par Pharmaceutical, Inc. Aphena Pharma Solutions PCI Pharma Services Aptar Pharma PHF SA Aristo Pharma Polymed Therapeutics, Inc. -

PGIM INDIA DIVERSIFIED EQUITY FUND Multi Cap Fund - an Open Ended Equity Scheme Investing Across Large Cap, Mid Cap, Small Cap Stocks

PGIM INDIA DIVERSIFIED EQUITY FUND Multi Cap Fund - An open ended equity scheme investing across large cap, mid cap, small cap stocks June 2020 Why invest in PGIM India Diversied Equity Fund? Portfolio Metrics PGIM India Diversied Equity Fund is a Go Anywhere Fund. It will scout for Portfolio Nifty 500 TR Investment opportunities across market capitalizations. Index Return on Equity 18.1% 9.2% Investment Strategy Debt / Equity (ex-nancials) 29.1% 63.8% The fund has a diversied portfolio of strong growth companies with sustainable business models spread over a range of industries, sectors and FY 22E Price / Earning Ratio 19.7 18.2 market capitalizations. Beta 0.95 1.00 Equity securities are selected on bottom up stock–by–stock basis across Source: Bloomberg and Internal Research. The above data as on June 30, 2020. market cap spectrum, with consideration given to valuation parameters as well as growth, margins, asset returns, and cash ows, amongst others. Portfolio Composition Portfolio Positioning* Portfolio Nifty 500 TR Index This Fund has a exibility to increase or decrease exposure to Large, Mid or Small Cap as per Market Cycles and Fund Manager's view of Markets. Number of stocks 43 500 The fund usually has between 50 and 70% in Large Caps and the balance is Portfolio overlap with — 34.7% invested in Mid Cap & Small Cap companies. Large caps (1st-100th stock) 56.5% 81.2% Who should invest? Mid caps (101st-250th stock) 17.4% 13.0% PGIM India Diversied Equity Fund is typically suited for Investors looking at Small caps (251st stock onwards) 17.6% 5.8% investing in diversied portfolio of equity and equity related instruments Cash 6.0% 0.0% including derivatives with a long term view. -

ATMANIRBAR in Study Report on - PHARMACEUTICAL INDUSTRY &

ATMANIRBAR IN Study report on - PHARMACEUTICAL INDUSTRY & MEDICAL DEVICES April 2021 Brickwork Ratings Pvt Ltd, Bangalore Investors and Media +91 95133 99706 /1-860-425-2742 [email protected] | [email protected] www.brickworkratings.com Ms. Parvathavardhini Natarajan, Associate Director-Ratings Atmanirbar in Pharma Industry - 2 - Introduction ‘Atmanirbharata’ (Self-sufficient in Hindi) is an attractive catchword. In fact, for almost half a century post-independence, India has been talking of self-sufficiency – in food, industrial inputs, key scientific and defence areas, etc. Given the foreign exchange position of India, the amount of money available for imports was anyway very limited. However, the policy makers were also aware of the limitations of such a policy, particularly in certain sophisticated technological fields. Later, in the 90s, as multilateralism became the mantra of a globalised world, India also had to make choices. With a gradual increase in the Forex kitty, thanks to increasing exports, software prowess post the Y2K phenomenon and large inflow of remittances by Indian diaspora, imports got liberalised. The flood- gates for the import of cheaper goods, particularly in certain fields like bulk drugs and consumer electronics, got opened. It is only in the context of Chinese aggression against India in the last couple of years that the policy makers have once again taken stock of the situation and started talking of ‘Atmanirbharata’. China has been a difficult country to deal with to most democracies in the world. It has problems with USA, Canada, Western Europe, Japan, India, ASEAN countries and Australia. As it has become the world’s manufacturing hub for a large number of items, the second largest economy, as also one of most powerful armies of the world, China is rewriting the rules of the game. -

United States Securities and Exchange Commission Form

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-Q X QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended July 2, 2017 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from _______ to _______ COMMISSION FILE NUMBER 1-3619 ---- PFIZER INC . (Exact name of registrant as specified in its charter) DELAWARE 13-5315170 (State of Incorporation) (I.R.S. Employer Identification No.) 235 East 42 nd Street, New York, New York 10017 (Address of principal executive offices) (zip code) (212) 733-2323 (Registrant’s telephone number) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. YES X NO ___ Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES X NO ___ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.