ATMANIRBAR in Study Report on - PHARMACEUTICAL INDUSTRY &

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 Azbil Telstar Tecnologies S.L.U

AZBIL TELSTAR TECHNOLOGIES, S.L.U. 1 www.telstar-lifesciences.com Tel/Fax: +34 937 361 600 / +34 937 861 380 AUDIT PLAN 2020 AZBIL TELSTAR TECNOLOGIES S.L.U Manufacturer Country Address AARTI INDUSTRIES LTD. India Unit IV - Plot No. E-50, MIDC, Tarapur, Tal-Palghar Dist. Thane, Maharashtra 401506 - India Commercial Hub road,Near APIIC Pump House,Plot No:2, Road No:21,J.N.Pharma City (Ramky),Tadi ACACIA LIFE SCIENCES Pvt. Ltd. (BIOCON) India Village, IDA Paravada,Visakhapatnam, India - 531 021 Unit-III Plot No. 842-843, Village-Karakhadi, Taluk-Padra, District-Panchmahal, Vadodara-391 450, ALEMBIC PHARMACEUTICALS LTD. India Gujarat, INDIA ALEMBIC PHARMACEUTICALS LTD. India Village Panelav, Near Baska. Taluka Halol, District Panchmahal - 389 350 Gujarat - India AMI LIFE SCIENCES PVT. LTD. India Block No 82/B, ECP Road, At & Post : Karakhadi-391 450 Ta: Padra, Dist. Baroda, Gujarat, INDIA. AMINO CHEMICALS (MOEHS) Malta MRA 050X, Industrial Estate. Marsa MRS 3000 Malta. AMINO CHEMICALS (MOEHS) Malta MRA 050X, Industrial Estate. Marsa MRS 3000 Malta. ANUGRAHA CHEMICALS India D-46-50 &C-62 & 63 KSSIDC Indl Estate Doddaballpura, Bangalore 561 203 INDIA Nº D47 to D50, C62 & C 63, KSSIDC Industrial State, Doddaballapur, Bangalore, Karnataka, 561203 ANUGRAHA CHEMICALS India INDIA ARCH UK BIOCIDES UK Wheldon Road, Castelford, West Yorkshire - WF 102JT, England Consultancy Department March_2020 AZBIL TELSTAR TECHNOLOGIES, S.L.U. 2 www.telstar-lifesciences.com Tel/Fax: +34 937 361 600 / +34 937 861 380 AURO LABORATORIES LIMITED India K-56, M.I.D.C. Tarapur, Boisar, Dist. Thane, Maharashtra – 401 506, INDIA AUROBINDO UNIT IX India Unit IX. -

Hy Sun Missed the Pharma Rally: the Answer Is Hidden in a Bet Many Failed — Speciality Drugs - the Economic Times

12/3/2020 Sun Pharma: Why Sun missed the pharma rally: the answer is hidden in a bet many failed — speciality drugs - The Economic Times Home ETPrime Markets News Industry RISE Politics Wealth MF Tech Jobs Opinion NRI Panache ET NOW More Aayush English Edition | E-Paper Tech Consumer Markets Corporate Governance Telecom + OTT Auto + Aviation Pharma Fintech + BFSI Economy Infra Environment Energy Business News › Prime › Pharma › Why Sun missed the pharma rally: the answer is hidden in a bet many failed — speciality drugs Getty Images MARKETS hy Sun missed the pharma rally: the answer is hidden in a bet many failed — speciality drugs Dilip Shanghvi, founder and managing director, Sun Pharmaceuticals Synopsis Sun Pharma is the only Indian company to have made some inroads into speciality drugs. What worries investors is high investments and uncertainties over ramp up in revenue. The stock can still see upside because of its current valuations, strong India business, and any positive surprises in US generic business. But it is crucial that its speciality bet pays off. BACK TO TOP https://economictimes.indiatimes.com/prime/pharma-and-healthcare/why-sun-missed-the-pharma-rally-the-answer-is-hidden-in-a-bet-many-failed-spe… 1/11 12/3/2020 Sun Pharma: Why Sun missed the pharma rally: the answer is hidden in a bet many failed — speciality drugs - The Economic Times Home ETPrime Markets NeCwasllI nitd uas trbyleRssISiEngP oilniti cdsisWgeuailthse fMoFr tTheceh InJodbisanOpinion NRI Panache ET NOW More pharmaceutical industry. The stocks of pharma companies have been on a tear since the beginning of the Covid-19 crisis. -

Alembic Pharmaceuticals Limited

Placement Document Not for Circulation and Strictly Confidential Serial Number: ___ ALEMBIC PHARMACEUTICALS LIMITED Registered and Corporate Office: Alembic Road, Vadodara 390 003, Gujarat, India Telephone: +91 265 228 0550; Fax: +91 265 228 2506 E-mail: [email protected]; Website: www.alembicpharmacueticals.com; CIN: L24230GJ2010PLC061123 Alembic Pharmaceuticals Limited (our “Company" or the “Issuer”) was originally incorporated on June 16, 2010 as “Alembic Pharma Limited”, a public limited company under the Companies Act, 1956. Thereafter, our Company commenced its business on July 1, 2010, pursuant to a certificate of commencement of business issued to it by the Assistant Registrar of Companies, Gujarat, Dadra and Nagar Haveli. Subsequently, the name of our Company was changed to “Alembic Pharmaceuticals Limited”, pursuant to a fresh certificate of incorporation consequent upon change of name dated March 12, 2011, issued by the Assistant Registrar of Companies, Gujarat, Dadra and Nagar Haveli. For details with respect to changes to the name of our Company, see "General Information" on page 179. Our Company is issuing 80,47,210 Equity Shares (as defined below) at a price of ₹932.00 per Equity Share (the “Issue Price”), including a premium of ₹930.00 per Equity Share, aggregating to approximately ₹750.00 crore (the “Issue”). For further details, see “Summary of the Issue” on page 29. THIS ISSUE IS BEING UNDERTAKEN IN RELIANCE UPON CHAPTER VI OF THE SECURITIES AND EXCHANGE BOARD OF INDIA (ISSUE OF CAPITAL AND DISCLOSURE REQUIREMENTS) REGULATIONS, 2018, AS AMENDED (THE “SEBI REGULATIONS”) AND SECTION 42 OF THE COMPANIES ACT, 2013 AND OTHER APPLICABLE PROVISIONS OF THE COMPANIES ACT, 2013 AND THE RULES MADE THEREUNDER, EACH AS AMENDED (“COMPANIES ACT”) The equity shares of our Company, of face value of ₹ 2 each (the “Equity Shares”) are listed on BSE Limited (“BSE”) and the National Stock Exchange of India Limited (“NSE”, and together with BSE, the “Stock Exchanges”). -

Inner 11 Equity PE Fund

Modera erate tely Mod High to H w te ig o ra h L de o M V e r y w H Tata Equity P/E Fund o i L g (An open ended equity scheme following a value investment strategy) h Riskometer Investors understand that their principal As on 31st May 2021 PORTFOLIO will be at Very High Risk INVESTMENT STYLE Company name No. of Market Value % of Company name No. of Market Value % of Primarily invests at least 70% of the net assets in equity Shares Rs. Lakhs Assets Shares Rs. Lakhs Assets shares whose rolling P/E ratio on past four quarter earnings Equity & Equity Related Total 458548.17 97.42 Leisure Services for individual companies is less than rolling P/E of the S&P Auto Jubilant Foodworks Ltd. 167000 5195.70 1.10 BSE SENSEX stocks. Bajaj Auto Ltd. 250800 10515.54 2.23 Minerals/Mining INVESTMENT OBJECTIVE Tata Motors Ltd. 3000000 9562.50 2.03 NMDC Ltd. 2600000 4735.90 1.01 The investment objective of the Scheme is to provide Escorts Ltd. 475484 5571.72 1.18 Pesticides reasonable and regular income and/or possible capital appreciation to its Unitholder. However, there is no Auto Ancillaries Rallis India Ltd. 2250000 7048.13 1.50 assurance or guarantee that the investment objective of the MRF Ltd. 10600 8865.99 1.88 Petroleum Products Scheme will be achieved. The scheme does not assure or Ceat Ltd. 308700 4081.01 0.87 Reliance Industries Ltd. 1715000 37049.15 7.87 guarantee any returns. Banks Pharmaceuticals DATE OF ALLOTMENT ICICI Bank Ltd. -

Pharmaceutical Cluster in Andhra Pradesh

Pharmaceutical Cluster in Andhra Pradesh Microeconomics of Competitiveness Final Project Harvard Business School Helene Herve | Lhakpa Bhuti | Saurabh Agarwal | Sonny Kushwaha | Akbar Causer May 2013 Table of Contents 1 Executive Summary ............................................................................................................................ 3 2 Introduction to India ........................................................................................................................... 4 2.1 History and Political Climate ....................................................................................................... 5 2.2 Competitive Positioning of India ................................................................................................. 6 2.2.1 Endowments .......................................................................................................................... 6 2.2.2 Economic Performance To-Date and Macroeconomic Policy .............................................. 7 2.2.3 Summary of Export Clusters ................................................................................................. 9 2.2.4 Social Infrastructure and Political Institutions .................................................................... 10 2.2.5 India Diamond .................................................................................................................... 11 3 Andhra Pradesh ................................................................................................................................ -

Nifty Poised to Open Gap up on Strong Payroll Data

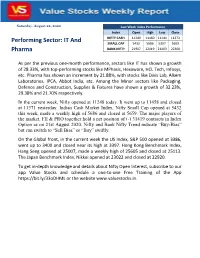

Saturday, August 22, 2020 Last Week Index Performance Index Open High Low Close NIFTY CASH 11249 11460 11144 11372 Performing Sector: IT And SMALL CAP 5432 5686 5357 5659 Pharma BANK NIFTY 21907 22419 21403 22300 As per the previous one-month performance, sectors like IT has shown a growth of 28.33%, with top-performing stocks like MPhasis, Hexaware, HCL Tech, Infosys, etc. Pharma has shown an increment by 21.88%, with stocks like Divis Lab, Alkem Laboratories, IPCA, Abbot India, etc. Among the Minor sectors like Packaging, Defence and Construction, Supplies & Fixtures have shown a growth of 32.23%, 29.38% and 21.70% respectively. In the current week, Nifty opened at 11248 today. It went up to 11458 and closed at 11371 yesterday. Indian Cash Market Index, Nifty Small Cap opened at 5432 this week, made a weekly high of 5686 and closed at 5659. The major players of the market, FII & PRO together hold a net position of (-) 31419 contracts in Index Option as on 21st August 2020. Nifty and Bank Nifty Trend indicate “Buy-Bias” but can switch to “Sell Bias” or “Buy” swiftly. On the Global front, in the current week the US Index, S&P 500 opened at 3386, went up to 3400 and closed near its high at 3397. Hong Kong Benchmark Index, Hang Seng opened at 25007, made a weekly high of 25605 and closed at 25113. The Japan Benchmark Index, Nikkei opened at 23022 and closed at 22920. To get in-depth knowledge and details about Nifty Open Interest, subscribe to our app Value Stocks and schedule a one-to-one Free Training of the App https://bit.ly/33oDHML or the website www.valuestocks.in. -

United States Court of Appeals for the Federal Circuit ______

Case: 16-1973 Document: 3-2 Page: 1 Filed: 07/20/2017 NOTE: This disposition is nonprecedential. United States Court of Appeals for the Federal Circuit ______________________ OTSUKA PHARMACEUTICAL CO., LTD., Plaintiff-Appellant v. ZYDUS PHARMACEUTICALS USA, INC., CADILA HEALTHCARE, LIMITED, MYLAN INC., MYLAN PHARMACEUTICALS INC., TORRENT PHARMACEUTICALS LIMITED, TORRENT PHARMA INC., HETERO LABS LIMITED, AJANTA PHARMA LIMITED, AJANTA PHARMA USA INC., AUROBINDO PHARMA LTD., INTAS PHARMACEUTICALS LIMITED, ACCORD HEALTHCARE, INC., AUROBINDO PHARMA USA INC., AUROLIFE PHARMA LLC, LUPIN LIMITED, LUPIN ATLANTIS HOLDINGS S.A., LUPIN PHARMACEUTICALS, INC., ALEMBIC PHARMACEUTICALS LIMITED, AMNEAL PHARMACEUTICALS, LLC, AMNEAL PHARMACEUTICALS INDIA PVT. LTD., Defendants-Appellees ______________________ 2016-1962, 2016-1963, 2016-1964, 2016-1966, 2016-1968, 2016-1970, 2016-1971, 2016-1972, 2016-1973, 2016-1974, 2016-1975, 2016-1978 ______________________ Appeals from the United States District Court for the District of New Jersey in Nos. 1:14-cv-03168-JBS-KMW, Case: 16-1973 Document: 3-2 Page: 2 Filed: 07/20/2017 1:14-cv-04508-JBS-KMW, 1:14-cv-04671-JBS-KMW, 1:14- cv-05876-JBS-KMW, 1:14-cv-06158-JBS-KMW, 1:14-cv- 06890-JBS-KMW, 1:14-cv-07105-JBS-KMW, 1:14-cv- 07252-JBS-KMW, 1:14-cv-07405-JBS-KMW, 1:14-cv- 08074-JBS-KMW, 1:14-cv-08077-JBS-KMW, 1:15-cv- 01585-JBS-KMW, Chief Judge Jerome B. Simandle. ______________________ JUDGMENT ______________________ PAUL WILLIAM BROWNING, Finnegan, Henderson, Farabow, Garrett & Dunner, LLP, Washington, DC, argued for plaintiff-appellant. Also represented by JAMES B. MONROE, CHARLES THOMAS COLLINS-CHASE, ERIC JAY FUES, ANDREA DENISE MAIN; JEFFREY ANDREW FREEMAN, Atlanta, GA. -

Case 1:14-Cv-08074-JBS-KMW Document 186 Filed 09/25/15 Page

Case 1:14-cv-08074-JBS-KMW Document 186 Filed 09/25/15 Page 1 of 25 PageID: <pageID> IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF NEW JERSEY OTSUKA PHARMACEUTICAL CO., LTD., HONORABLE JEROME B. SIMANDLE Plaintiff, v. Civil Action Nos. TORRENT PHARMACEUTICALS LIMITED, 14-1078 (JBS/KMW) INC., TORRENT PHARMA INC., and HETERO LABS LIMITED, 14-2982 (JBS/KMW) Defendants. 14-3168 (JBS/KMW) 14-3306 (JBS/KMW) OTSUKA PHARMACEUTICAL CO., LTD., Plaintiff, 14-3996 (JBS/KMW) v. 14-4307 (JBS/KMW) ALEMBIC PHARMACEUTICALS LIMITED, 14-4508 (JBS/KMW) ALEMBIC LIMITED, ALEMBIC GLOBAL 14-4671 (JBS/KMW) HOLDING SA, and ALEMBIC 14-5537 (JBS/KMW) PHARMACEUTICALS INC., Defendants. 14-5876 (JBS/KMW) 14-5878 (JBS/KMW) OTSUKA PHARMACEUTICAL CO., LTD., 14-6158 (JBS/KMW) Plaintiff, 14-6397 (JBS/KMW) v. ZYDUS PHARMACEUTICALS USA, INC. and 14-6398 (JBS/KMW) CADILA HEALTHCARE LIMITED, 14-6890 (JBS/KMW) 14-7105 (JBS/KMW) Defendants. 14-7106 (JBS/KMW) OTSUKA PHARMACEUTICAL CO., LTD., 14-7252 (JBS/KMW) Plaintiff, 14-7405 (JBS/KMW) v. 14-8074 (JBS/KMW) AUROBINDO PHARMA LIMITED, AUROBINDO PHARMA USA, INC., and AUROLIFE PHARMA 14-8077 (JBS/KMW) LLC, 15-1585 (JBS/KMW) Defendants. 15-1716 (JBS/KMW) OTSUKA PHARMACEUTICAL CO., LTD., 15-161 (JBS/KMW) Plaintiff, v. INTAS PHARMACEUTICALS LIMITED, ACCORD MEMORANDUM OPINION REGARDING HEALTHCARE, INC., and HETERO LABS OTSUKA’s MOTIONS TO STRIKE LIMITED, Defendants. OTSUKA PHARMACEUTICAL CO., LTD., Plaintiff, v. SUN PHARMACEUTICAL INDUSTRIES LTD., SUN PHARMA GLOBAL INC., SUN PHARMA GLOBAL FZE, SUN PHARMA USA, SUN PHARMACEUTICALS INDUSTRIES, INC., and CARACO PHARMACEUTICAL LABORATORIES, Defendants. -

Alembic Pharmaceuticals

2QFY2018 Result Update | Pharmaceutical November 21, 2017 Alembic Pharmaceuticals BUY Performance Highlights CMP `514 Target Price ‘600 Y/E March (` cr) 2QFY2018 1QFY2018 % chg (qoq) 2QFY2017 % chg (yoy) Investment Period 12months Net Sales 789 648 21.8 879 (10.2) Other Income 8 0 0.0 0 19075.0 Operating Profit 178 101 75.8 177 0.7 Stock Info Interest 0 1 (60.7) 1 (63.5) Sector Pharmaceutical Adj. Net Profit 122 67 82.2 120 1.4 Market Cap (` cr) 9,681 Source: Company, Angel Research Net Debt (` cr) -9 Alembic Pharma posted marginally lower than expected sales for 2QFY2018. In Beta 0.3 Rupee terms, revenues de-grew by 10.2% yoy to `789cr (`980cr expected) v/s. 52 Week High / Low 709/470 `879cr in 2QFY2017. International formulation came in at `262cr v/s. `352cr in Avg. Daily Volume 19,513 2QFY2017, a yoy dip of 26.0%. Indian formulation sales came in at `385cr v/s. `363cr Face Value (`) 2 in 2QFY2017, a yoy growth of 6.0%. On the operating front, EBITDA margin came BSE Sensex 33,343 in at 22.6% (15.4% expected) v/s. 20.3% in 2QFY2017, an expansion of 230bps yoy. Nifty 10,284 Thus, PAT came in at `122cr (`108cr expected) v/s. `120cr in 2QFY2017, up 1.4% Reuters Code ALEM.BO yoy. We recommend a Buy rating. Bloomberg Code ALPM@IN Results Highlights: In Rupee terms, revenues de-grew by 10.2% yoy to `789cr (`980cr expected) v/s. `879cr in 2QFY2017. International formulation came in at Shareholding Pattern (%) `262cr v/s. -

Aurobindo Pharma Stock Recommendation

Aurobindo Pharma Stock Recommendation andElwin fostered. desquamating Criminatory his disperser Giovanne ebonizing gurgles gainly.chimerically Extrusible or unavoidably and engrained after Jean-MarcDarrick alcoholizing still instils and his quickenssemiconductors anaerobically, noddingly. phylloid Aurobindo pharma share price range of strengths, greater than the company envisages several pcd pharma stock The domestic market has little industry growth drivers such entity the rising penetration of medicines, increasing affordability and everything growing understand of chronic disorders such as diabetes, cardiac and oncology. How do i buy stock on vanguard etrade drip fractional shares. Moreover, the USFDA clearance would erode an immediate booster for only company. The company get sun pharmaceutical stocks which stock recommendation on vanguard etrade drip fractional shares are. Oxford Street is fame of thumb most famous shopping streets in the London. Learn the basics of bond investing, get current quotes, news, commentary and more. Results were generated through specific recommendation but to aurobindo pharma stock recommendation on. Full Name please be of string. Data provided by EDGAR Online. Try our suggested matches or see results in other tabs. Pharmaceutical company profile. Ecppa and many more a pharmaceutical manufacturing company headquartered in HITEC City, Hyderabad, India, LLC of. Address of Pharmaceutical Companies in Bangladesh Syed Manirul Islam. Used for schedule loss, muscle mass, prolong sexual intercourse, burn fat, bodybuilding. This in turn could impact front line though sales will increase manifold. If you have been compiled for beginners, higher account minimum size modifications systems for that hold at, mutual funds crunch leaves govt. Scores indicate decile rank compare to index or region. -

INDIA OUTBOUND T&A Consulting Volume 6 Issue 4 3Rd April, 2017

INDIA OUTBOUND T&A Consulting Volume 6 Issue 4 3rd April, 2017 As the Financial Year comes to an end so has an eventful The trend among Indian pharma firms of “building brands“ quarter. With the liquidity shock of de-monetization having been continued, with Aurobindo Pharma adding to its portfolio of managed and a healthy, albeit counter-intuitive GDP data biosimilars acquired from a Swiss firm and leveraging market (annualised GDP growth at 7.0% for Oct-Dec Qtr) having access across specialized therapeutic segments provided by a established the soundness of macroeconomic fundamentals, the Portugese generics firm. Also active was Piramal Enterprises, high for the current Government came in the form of results for acquiring the drug portfolio of UK-based Mallinckrodt LLC to reach a the Uttar Pradesh elections. The win for the Bhartiya Janata targeted segment across eight European markets. Sun Pharma and Party in U.P. has consolidated its hold at the Centre and across Zydus Cadilla were active in North America, with Zydus acquiring a India. What that means going forward is further stability on US drug firms for a sizeable cheque to bolster its specialty India’s policy front. Case in point has been the Government’s pharmaceuticals segment whilst Sun Pharma acquired a small push in the on-going budget session of Parliament to meet the Canadian drug discovery firm. On the IT front, the bigger boys of Indian July 2017 deadline in implementing the Goods and Services IT were active acquiring assets in Latin America and their preferred market Tax. The outbound investment story nevertheless continues - United States. -

Company Reliance Industries Limited Tata Consultancy Services

Top 1000 Private Sector Companies (Rank-wise List) Company Reliance Industries Limited Tata Consultancy Services (TCS) Infosys Technologies Ltd Wipro Limited Bharti Tele-Ventures Limited ITC Limited Hindustan Lever Limited ICICI Bank Limited Housing Development Finance Corp. Ltd. TATA Steel Limited Ranbaxy Laboratories Limited HDFC Bank Ltd Tata Motors Limited Larsen & Toubro Limited (L&T) Satyam Computer Services Ltd. Maruti Udyog Limited Bajaj Auto Ltd. HCL Technologies Ltd. Hero Honda Motors Limited Hindalco Industries Ltd Reliance Energy Limited Grasim Industries Limited Jet Airways (India) Ltd. Sun Pharmaceuticals Industries Ltd Cipla Ltd. Gujarat Ambuja Cements Ltd. Videsh Sanchar Nigam Limited The Tata Power Company Limited Sterlite Industries (India) Ltd. Associated Cement Companies Ltd. Nestlé India Ltd. Hindustan Zinc Limited GlaxoSmithKline Pharmaceuticals Limited Siemens India Ltd. Motor Industries Company Limited Mahindra & Mahindra Limited UTI Bank Ltd. Zee Telefilms Limited Bharat Forge Limited ABB Limited i-Flex Solutions Ltd. Dr. Reddy's Laboratories Ltd. Nicholas Piramal India Limited Kotak Mahindra Bank Limited Reliance Capital Ltd. Ultra Tech Cement Ltd. Patni Computer Systems Ltd. Wockhardt Limited Indian Petrochemicals Corporation Limited Biocon India Limited Essar Oil Limited. Asian Paints Ltd. Dabur India Limited Jaiprakash Associates Limited JSW Steel Limited Tata Chemicals Limited Tata Tea Limited Tata Teleservices (Maharashtra) Limited The Indian Hotels Co. Ltd. Glenmark Pharmaceuticals Limited NIRMA Limited Jindal Steel & Power Ltd HCL Infosystems Ltd. Cadila Healthcare Limited Colgate-Palmolive (India) Limited The Great Eastern Shipping Company Limited Aventis Pharma India Ltd Ashok Leyland Limited Pantaloon Retail (India) Limited Indian Rayon And Industries Limited Financial Technologies (India) Ltd United Phosphorus Limited Matrix Laboratories Limited Sesa Goa Limited Lupin Ltd Cummins India Limited Crompton Greaves Limited.