SACUBITRIL/VALSARTAN) MDL No

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Inner 20 Ethical Fund Low

Tata Ethical Fund (An open ended equity scheme following Shariah principles) As on 30th June 2020 PORTFOLIO No. of Market Value % of No. of Market Value % of INVESTMENT STYLE Company name Company name An equity scheme which invests primarily in equities of Shares Rs. Lakhs Assets Shares Rs. Lakhs Assets Shariah compliant companies and other instrument if Equity & Equity Related Total 49401.57 90.21 Oil allowed under Shariah principles. Auto Oil & Natural Gas Co. 925000 752.49 1.37 INVESTMENT OBJECTIVE Hero Motocorp Ltd. 31300 797.20 1.46 Pesticides To provide medium to long- term capital gains by investing Auto Ancillaries Rallis India Ltd. 502000 1366.95 2.50 in Shariah compliant equity and equity related instruments Wabco India Ltd. 15800 1087.06 1.99 Petroleum Products of well-researched value and growth - oriented companies. Sundram Fasteners Ltd. 267000 999.38 1.83 Bharat Petroleum Corporation Ltd. 435000 1626.90 2.97 Tata Ethical Fund aims to generate medium to long term Amara Raja Batteries Ltd. 116849 759.99 1.39 Castrol India Ltd. 505000 634.79 1.16 capital growth by investing in equity and equity related Cement Pharmaceuticals instruments of shariah compliant companies. Shree Cement Ltd. 3800 875.94 1.60 Alkem Laboratories Ltd. 83000 1965.69 3.59 DATE OF ALLOTMENT Commercial Services Ipca Laboratories Ltd. 93750 1569.75 2.87 May 24,1996 3M India Ltd. 4500 845.79 1.54 Lupin Ltd. 145000 1322.11 2.41 Consumer Durables Software FUND MANAGER Titan Company Ltd. 113000 1073.33 1.96 Tata Consultancy Services Ltd. -

Pharma Limited. Lupin Limited, Lupin

Case 8:15-cv-03437-GJH Document 1 Filed 11/10/15 Page 1 of 17 UNITED STATES DISTRICT COURT FOR THE DISTRICT OF MARYLAND SHIRE PHARMACEUTICAL DEVELOPMENT INC., SHIRE DEVELOPMENT LLC, COSMO TECHNOLOGIES LIMITED, and NOGRA Civil Action No. PHARMA LIMITED. Plaintiffs, v. LUPIN LIMITED, LUPIN PHARMACEUTICALS INC., LUPIN INC., and LUPIN ATLANTIS HOLDINGS SA Defendants. COMPLAINT Plaintiffs Shire Pharmaceutical Development Inc., Shire Development LLC (collectively, "Shire"), Cosmo Technologies Limited ("Cosmo"), and Nogra Pharma Limited ("Nogra") (collectively, "Plaintiffs") by their undersigned attomeys, for their Complaint against defendants Lupin Limited ("Lupin Ltd."), Lupin Pharmaceuticals Inc. ("LPI"), Lupin Inc. ("Lupin Inc."), and Lupin Atlantis Holdings SA ("Lupin Atlantis") (collectively "Lupin" or "Defendants") herein, allege as follows: NATURE OF THE ACTION l. This is a civil action for patent infringement arising under the patent laws of the United States, Title 35, United States Code, involving United States Patent No.6,773,720 ("the '720 patent" or "the patent-in-suit"), attached hereto as Exhibit A. Case 8:15-cv-03437-GJH Document 1 Filed 11/10/15 Page 2 of 17 THE PARTIES 2. Plaintiff Shire Pharmaceutical Development Inc. is a corporation organized and existing under the laws of the state of Maryland, having its principal place of business at 1200 Morris Drive, Wayne, PA 19087. 3. Plaintiff Shire Development LLC is a limited liability company organized and existing under the laws of the State of Delaware, having its principal place of business at735 Chesterbrook Boulevard and 1200 Monis Drive, Wayne, Pennsylvania 19087. 4. Plaintiff Cosmo is a company organized and existing under the laws of Ireland, having its principal place of business at The Connolly Building, 42-43 Amiens Street, Dublin l, Ireland. -

Daiichi Sankyo Move Could Spark Copycats

June 12, 2008 Daiichi Sankyo move could spark copycats Lisa Urquhart Daiichi Sankyo’s surprise move yesterday on Ranbaxy sparked not only a flurry of news about the $4.1bn deal, but has also got many in the market wondering who else might be on the shopping list of other big pharma companies looking to snap up an Indian generics firm. Those excited by the acquisition are pointing to the attractions of these companies, which include the increasing moves by governments to use generics to reduce healthcare costs, and in the case of Indian generic companies, their access to the fast growing, developing markets that big pharma has already expressed an interest in. With Ranbaxy now out of the picture, according to the EvaluatePharma’s Peer Group Analyzer Glenmark would be one of the most attractive in terms of future growth. The company may not be in the top three of the biggest Indian generics, but it is forecast to report an impressive 38% compound annual growth in unbranded generic sales in the five years to 2012. WW Unbranded Generic Sales WW annual sales ($m) CAGR (07-12) Market Rank 2007 2012 2007 2012 Glenmark Pharmaceuticals 244 1,211 38% 30 16 Wockhardt 357 764 16% 25 20 Lupin 303 647 16% 27 26 Aurobindo Pharma 165 334 15% 31 31 Matrix Laboratories 131 265 15% 34 35 Cipla 872 1,656 14% 14 11 Ranbaxy Laboratories 1,496 2,827 14% 9 6 Torrent Pharmaceuticals 300 543 13% 28 29 Piramal Healthcare 418 756 13% 20 21 Zydus Cadila 395 697 12% 22 24 Sun Pharmaceutical Industries 775 1,332 11% 15 15 Dr. -

1 Azbil Telstar Tecnologies S.L.U

AZBIL TELSTAR TECHNOLOGIES, S.L.U. 1 www.telstar-lifesciences.com Tel/Fax: +34 937 361 600 / +34 937 861 380 AUDIT PLAN 2020 AZBIL TELSTAR TECNOLOGIES S.L.U Manufacturer Country Address AARTI INDUSTRIES LTD. India Unit IV - Plot No. E-50, MIDC, Tarapur, Tal-Palghar Dist. Thane, Maharashtra 401506 - India Commercial Hub road,Near APIIC Pump House,Plot No:2, Road No:21,J.N.Pharma City (Ramky),Tadi ACACIA LIFE SCIENCES Pvt. Ltd. (BIOCON) India Village, IDA Paravada,Visakhapatnam, India - 531 021 Unit-III Plot No. 842-843, Village-Karakhadi, Taluk-Padra, District-Panchmahal, Vadodara-391 450, ALEMBIC PHARMACEUTICALS LTD. India Gujarat, INDIA ALEMBIC PHARMACEUTICALS LTD. India Village Panelav, Near Baska. Taluka Halol, District Panchmahal - 389 350 Gujarat - India AMI LIFE SCIENCES PVT. LTD. India Block No 82/B, ECP Road, At & Post : Karakhadi-391 450 Ta: Padra, Dist. Baroda, Gujarat, INDIA. AMINO CHEMICALS (MOEHS) Malta MRA 050X, Industrial Estate. Marsa MRS 3000 Malta. AMINO CHEMICALS (MOEHS) Malta MRA 050X, Industrial Estate. Marsa MRS 3000 Malta. ANUGRAHA CHEMICALS India D-46-50 &C-62 & 63 KSSIDC Indl Estate Doddaballpura, Bangalore 561 203 INDIA Nº D47 to D50, C62 & C 63, KSSIDC Industrial State, Doddaballapur, Bangalore, Karnataka, 561203 ANUGRAHA CHEMICALS India INDIA ARCH UK BIOCIDES UK Wheldon Road, Castelford, West Yorkshire - WF 102JT, England Consultancy Department March_2020 AZBIL TELSTAR TECHNOLOGIES, S.L.U. 2 www.telstar-lifesciences.com Tel/Fax: +34 937 361 600 / +34 937 861 380 AURO LABORATORIES LIMITED India K-56, M.I.D.C. Tarapur, Boisar, Dist. Thane, Maharashtra – 401 506, INDIA AUROBINDO UNIT IX India Unit IX. -

Alembic Pharmaceuticals Limited

Placement Document Not for Circulation and Strictly Confidential Serial Number: ___ ALEMBIC PHARMACEUTICALS LIMITED Registered and Corporate Office: Alembic Road, Vadodara 390 003, Gujarat, India Telephone: +91 265 228 0550; Fax: +91 265 228 2506 E-mail: [email protected]; Website: www.alembicpharmacueticals.com; CIN: L24230GJ2010PLC061123 Alembic Pharmaceuticals Limited (our “Company" or the “Issuer”) was originally incorporated on June 16, 2010 as “Alembic Pharma Limited”, a public limited company under the Companies Act, 1956. Thereafter, our Company commenced its business on July 1, 2010, pursuant to a certificate of commencement of business issued to it by the Assistant Registrar of Companies, Gujarat, Dadra and Nagar Haveli. Subsequently, the name of our Company was changed to “Alembic Pharmaceuticals Limited”, pursuant to a fresh certificate of incorporation consequent upon change of name dated March 12, 2011, issued by the Assistant Registrar of Companies, Gujarat, Dadra and Nagar Haveli. For details with respect to changes to the name of our Company, see "General Information" on page 179. Our Company is issuing 80,47,210 Equity Shares (as defined below) at a price of ₹932.00 per Equity Share (the “Issue Price”), including a premium of ₹930.00 per Equity Share, aggregating to approximately ₹750.00 crore (the “Issue”). For further details, see “Summary of the Issue” on page 29. THIS ISSUE IS BEING UNDERTAKEN IN RELIANCE UPON CHAPTER VI OF THE SECURITIES AND EXCHANGE BOARD OF INDIA (ISSUE OF CAPITAL AND DISCLOSURE REQUIREMENTS) REGULATIONS, 2018, AS AMENDED (THE “SEBI REGULATIONS”) AND SECTION 42 OF THE COMPANIES ACT, 2013 AND OTHER APPLICABLE PROVISIONS OF THE COMPANIES ACT, 2013 AND THE RULES MADE THEREUNDER, EACH AS AMENDED (“COMPANIES ACT”) The equity shares of our Company, of face value of ₹ 2 each (the “Equity Shares”) are listed on BSE Limited (“BSE”) and the National Stock Exchange of India Limited (“NSE”, and together with BSE, the “Stock Exchanges”). -

Inner 11 Equity PE Fund

Modera erate tely Mod High to H w te ig o ra h L de o M V e r y w H Tata Equity P/E Fund o i L g (An open ended equity scheme following a value investment strategy) h Riskometer Investors understand that their principal As on 31st May 2021 PORTFOLIO will be at Very High Risk INVESTMENT STYLE Company name No. of Market Value % of Company name No. of Market Value % of Primarily invests at least 70% of the net assets in equity Shares Rs. Lakhs Assets Shares Rs. Lakhs Assets shares whose rolling P/E ratio on past four quarter earnings Equity & Equity Related Total 458548.17 97.42 Leisure Services for individual companies is less than rolling P/E of the S&P Auto Jubilant Foodworks Ltd. 167000 5195.70 1.10 BSE SENSEX stocks. Bajaj Auto Ltd. 250800 10515.54 2.23 Minerals/Mining INVESTMENT OBJECTIVE Tata Motors Ltd. 3000000 9562.50 2.03 NMDC Ltd. 2600000 4735.90 1.01 The investment objective of the Scheme is to provide Escorts Ltd. 475484 5571.72 1.18 Pesticides reasonable and regular income and/or possible capital appreciation to its Unitholder. However, there is no Auto Ancillaries Rallis India Ltd. 2250000 7048.13 1.50 assurance or guarantee that the investment objective of the MRF Ltd. 10600 8865.99 1.88 Petroleum Products Scheme will be achieved. The scheme does not assure or Ceat Ltd. 308700 4081.01 0.87 Reliance Industries Ltd. 1715000 37049.15 7.87 guarantee any returns. Banks Pharmaceuticals DATE OF ALLOTMENT ICICI Bank Ltd. -

ANNUAL REPORT 2018-19 2 Notice

CONTENTS Corporate Information ............................................................................................................ 02 Notice .................................................................................................................................... 03 Directors’ Report .................................................................................................................... 14 Annexures to Directors’ Report .............................................................................................. 25 Management Discussion and Analysis .................................................................................. 53 Business Responsibility Report ............................................................................................. 69 Report on Corporate Governance ......................................................................................... 80 Standalone Financial Statements .......................................................................................... 99 Consolidated Financial Statements ....................................................................................... 154 Financial Highlights - 5 years ................................................................................................. 212 CORPORATE INFORMATION BOARD OF DIRECTORS STATUTORY AUDITORS 1. Shri Sudhir Mehta B S R & Co. LLP Chairman Emeritus Chartered Accountants 2. Shri Samir Mehta Executive Chairman REGISTERED OFFICE 3. Shri Shailesh Haribhakti Torrent House, 4. Shri Haigreve -

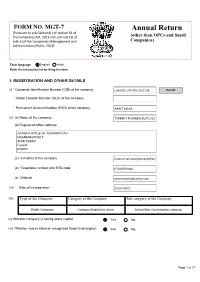

Annual Return

FORM NO. MGT-7 Annual Return [Pursuant to sub-Section(1) of section 92 of the Companies Act, 2013 and sub-rule (1) of (other than OPCs and Small rule 11of the Companies (Management and Companies) Administration) Rules, 2014] Form language English Hindi Refer the instruction kit for filing the form. I. REGISTRATION AND OTHER DETAILS (i) * Corporate Identification Number (CIN) of the company Pre-fill Global Location Number (GLN) of the company * Permanent Account Number (PAN) of the company (ii) (a) Name of the company (b) Registered office address (c) *e-mail ID of the company (d) *Telephone number with STD code (e) Website (iii) Date of Incorporation (iv) Type of the Company Category of the Company Sub-category of the Company (v) Whether company is having share capital Yes No (vi) *Whether shares listed on recognized Stock Exchange(s) Yes No Page 1 of 17 (a) Details of stock exchanges where shares are listed S. No. Stock Exchange Name Code 1 2 (b) CIN of the Registrar and Transfer Agent Pre-fill Name of the Registrar and Transfer Agent Registered office address of the Registrar and Transfer Agents (vii) *Financial year From date 01/04/2020 (DD/MM/YYYY) To date 31/03/2021 (DD/MM/YYYY) (viii) *Whether Annual general meeting (AGM) held Yes No (a) If yes, date of AGM 27/07/2021 (b) Due date of AGM 30/09/2021 (c) Whether any extension for AGM granted Yes No II. PRINCIPAL BUSINESS ACTIVITIES OF THE COMPANY *Number of business activities 1 S.No Main Description of Main Activity group Business Description of Business Activity % of turnover Activity Activity of the group code Code company C C6 III. -

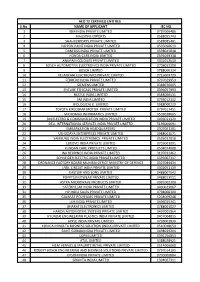

S.No. NAME of APPLICANT IEC NO. 1 IBM INDIA PRIVATE LIMITED 0797006486 2 MAGSONS EXPORTS 0588055743 3 SHAHI EXPORTS PRIVATE LIMI

AEO T2 CERTIFIED ENTITIES S.No. NAME OF APPLICANT IEC NO. 1 IBM INDIA PRIVATE LIMITED 0797006486 2 MAGSONS EXPORTS 0588055743 3 SHAHI EXPORTS PRIVATE LIMITED 0588085481 4 NIPPON PAINT INDIA PRIVATE LIMITED 0505090619 5 DANFOSS INDIA PRIVATE LIMITED 0598045848 6 HONDA CARS INDIA LIMITED 0595049338 7 ANUPAM COLOURS PRIVATE LIMITED 0301012610 8 BOSCH AUTOMOTIVE ELECTRONICS INDIA PRIVATE LIMITED 0708022308 9 BOSCH LIMITED 0788000314 10 VELANKANI ELECTRONICS PRIVATE LIMITED 0715009729 11 FERRERO INDIA PRIVATE LIMITED 0707029953 12 SIEMENS LIMITED 0388070005 13 ENCUBE ETHICALS PRIVATE LIMITED 0396057993 14 NESTLE INDIA LIMITED 0588000531 15 3M INDIA LIMITED 0793012112 16 BIOLOGICAL E. LIMITED 0988000229 17 TOYOTA KIRLOSKAR MOTOR PRIVATE LIMITED 0797012451 18 MICROMAX INFORMATICS LIMITED 0503028665 19 3M ELECTRO & COMMUNICATION INDIA PRIVATE LIMITED 0493021329 20 DELL INTERNATIONAL SERVICES INDIA PRIVATE LIMITED 5196000691 21 EMBARKATION HEADQUARTERS 0307061281 22 USHODAYA ENTERPRISES PRIVATE LIMITED 0988001071 23 SAMSUNG INDIA ELECTRONICS PRIVATE LIMITED 0595032818 24 LENOVO INDIA PRIVATE LIMITED 0705001091 25 KUNDAN CARE PRODUCTS LIMTED 0504074008 26 INA BEARINGS INDIA PRIVATE LIMITED 3197032462 27 SCHNEIDER ELECTRIC INDIA PRIVATE LIMITED 0595007317 28 ORDNANCE FACTORY BOARD MUMBAI OFFICE MINISTRY OF DEFENCE 0307084434 29 JABIL CIRCUIT INDIA PRIVATE LIMITED 0302051139 30 KASTURI AND SONS LIMITED 0488007542 31 POPPYS KNITWEAR PRIVATE LIMITED 0488013011 32 ASTRA MICROWAVE PRODUCTS LIMITED 0991002300 33 CATERPILLAR INDIA PRIVATE LIMITED 0400023067 -

Lupin Limited: Rating Removed from Watch with Developing Implications

November 20, 2019 Lupin Limited: Rating removed from watch with developing implications Summary of rating action Instrument* Previous Rated Amount Current Rated Amount Rating Action (Rs. crore) (Rs. crore) Short-term Fund-based 1,100.0 1,100.0 [ICRA]A1+, removed from Limits rating watch with developing implications Short-term Non-fund 400.0 400.0 [ICRA]A1+; removed from Based Limits rating watch with developing implications Total 1,500.0 1,500.0 *Instrument details are provided in Annexure-1 Material event Lupin Limited, on November 11, 2019, announced that it has approved the divestment of its entire equity interest (representing 99.82% of the issued and paid-up capital) of Kyowa Pharmaceutical Industry Co. Ltd (Kyowa) by way of sale of shares to Plutus Limited (an entity affiliated with Unison Capital partners) at an enterprise value (EV) of JPY 57,361 million (Rs.3702 crore), subject to necessary approvals including Japan Fair Trade Commission and shareholders of the company. The proposed transaction is an all cash-transaction, valued at EV/sales of 2 times and will result in post- tax net cash inflow of ~JPY 32,596 million (Rs. 2,104 crore). The transaction is expected to be concluded within FY2020. Impact of material event ICRA has a short-term rating of [ICRA]A1+ (pronounced ICRA A one plus) assigned to the Rs. 1,100-crore short-term fund- based limits and Rs. 400-crore short-term non-fund based limits. The rating has been removed from watch with developing implications. Rationale The removal of the rating watch factors in the expected strengthening of the credit profile of Lupin Limited, following the divestment of Kyowa (which accounted for 10.6% of consolidated operating income (OI) and 9.1% of OPBDITA of Lupin in FY2019), along with receipt of post-tax cash proceeds of JPY 32,596 million (Rs.2,104 crore). -

In the United States District Court for the District of New Jersey

Case 1:19-md-02875-RBK-JS Document 121 Filed 06/17/19 Page 1 of 130 PageID: 1141 IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF NEW JERSEY IN RE: VALSARTAN PRODUCTS LIABILITY LITIGATION No. 1:19-md-2875-RBK Hon. Robert Kugler Hon. Joel Schneider Jury Trial Demanded Consolidated Amended Class Action Complaint CONSOLIDATED AMENDED ECONOMIC LOSS CLASS ACTION COMPLAINT 1. COME NOW, the Consumer and Third Party Payor (“TPP”) Plaintiffs (collectively the “Class Plaintiffs”), who file this Consolidated Amended Economic Loss Class Action Complaint (“Master Class Complaint”)1 against the below-enumerated Defendants. I. INTRODUCTION 2. This case arises from adulterated, misbranded, and unapproved valsartan- containing drugs (“VCDs”) that were designed, manufactured, marketed, distributed, packaged, and sold by Defendants (identified and defined infra at Part II.C-H) in the United States, and which have been and remain the subject of one of the largest ongoing contaminated drug recalls ever in the United States. These VCDs are non-merchantable, and are not of the quality represented by Defendants named herein. 3. Valsartan and its combination therapy with hydrochlorothiazide are the generic versions of the registered listed drugs (“RLDs”) Diovan® (“DIOVAN”) and Diovan HCT® (“DIOVAN HCT”), respectively. Amlodipine-valsartan and its combination therapy with hydrochlorothiazide are the generic versions of the RLDs of Exforge® (“EXFORGE”) and 1 This is one of three master complaints being filed in this multi-district litigation. The filing of three master complaints is to streamline the pleadings and issues for the parties’ mutual convenience only. Consumer Class Plaintiffs do not waive any claims that are not raised herein, or that are asserted in another master complaint. -

United States Court of Appeals for the Federal Circuit ______

Case: 16-1973 Document: 3-2 Page: 1 Filed: 07/20/2017 NOTE: This disposition is nonprecedential. United States Court of Appeals for the Federal Circuit ______________________ OTSUKA PHARMACEUTICAL CO., LTD., Plaintiff-Appellant v. ZYDUS PHARMACEUTICALS USA, INC., CADILA HEALTHCARE, LIMITED, MYLAN INC., MYLAN PHARMACEUTICALS INC., TORRENT PHARMACEUTICALS LIMITED, TORRENT PHARMA INC., HETERO LABS LIMITED, AJANTA PHARMA LIMITED, AJANTA PHARMA USA INC., AUROBINDO PHARMA LTD., INTAS PHARMACEUTICALS LIMITED, ACCORD HEALTHCARE, INC., AUROBINDO PHARMA USA INC., AUROLIFE PHARMA LLC, LUPIN LIMITED, LUPIN ATLANTIS HOLDINGS S.A., LUPIN PHARMACEUTICALS, INC., ALEMBIC PHARMACEUTICALS LIMITED, AMNEAL PHARMACEUTICALS, LLC, AMNEAL PHARMACEUTICALS INDIA PVT. LTD., Defendants-Appellees ______________________ 2016-1962, 2016-1963, 2016-1964, 2016-1966, 2016-1968, 2016-1970, 2016-1971, 2016-1972, 2016-1973, 2016-1974, 2016-1975, 2016-1978 ______________________ Appeals from the United States District Court for the District of New Jersey in Nos. 1:14-cv-03168-JBS-KMW, Case: 16-1973 Document: 3-2 Page: 2 Filed: 07/20/2017 1:14-cv-04508-JBS-KMW, 1:14-cv-04671-JBS-KMW, 1:14- cv-05876-JBS-KMW, 1:14-cv-06158-JBS-KMW, 1:14-cv- 06890-JBS-KMW, 1:14-cv-07105-JBS-KMW, 1:14-cv- 07252-JBS-KMW, 1:14-cv-07405-JBS-KMW, 1:14-cv- 08074-JBS-KMW, 1:14-cv-08077-JBS-KMW, 1:15-cv- 01585-JBS-KMW, Chief Judge Jerome B. Simandle. ______________________ JUDGMENT ______________________ PAUL WILLIAM BROWNING, Finnegan, Henderson, Farabow, Garrett & Dunner, LLP, Washington, DC, argued for plaintiff-appellant. Also represented by JAMES B. MONROE, CHARLES THOMAS COLLINS-CHASE, ERIC JAY FUES, ANDREA DENISE MAIN; JEFFREY ANDREW FREEMAN, Atlanta, GA.