Congo Brazzaville

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Middle East Oil Pricing Systems in Flux Introduction

May 2021: ISSUE 128 MIDDLE EAST OIL PRICING SYSTEMS IN FLUX INTRODUCTION ........................................................................................................................................................................ 2 THE GULF/ASIA BENCHMARKS: SETTING THE SCENE...................................................................................................... 5 Adi Imsirovic THE SHIFT IN CRUDE AND PRODUCT FLOWS ..................................................................................................................... 8 Reid l'Anson and Kevin Wright THE DUBAI BENCHMARK: EVOLUTION AND RESILIENCE ............................................................................................... 12 Dave Ernsberger MIDDLE EAST AND ASIA OIL PRICING—BENCHMARKS AND TRADING OPPORTUNITIES......................................... 15 Paul Young THE PROSPECTS OF MURBAN AS A BENCHMARK .......................................................................................................... 18 Michael Wittner IFAD: A LURCHING START IN A SANDY ROAD .................................................................................................................. 22 Jorge Montepeque THE SECOND SPLIT: BASRAH MEDIUM AND THE CHALLENGE OF IRAQI CRUDE QUALITY...................................... 29 Ahmed Mehdi CHINA’S SHANGHAI INE CRUDE FUTURES: HAPPY ACCIDENT VERSUS OVERDESIGN ............................................. 33 Tom Reed FUJAIRAH’S RISE TO PROMINENCE .................................................................................................................................. -

089 La Politique Idigene in the History of Bangui.Pdf

La polit...iq,u:e indigene in t...he history o£ Bangui William J. Samarin impatltntly awaiting tht day when 1 Centrlllfricu one wHI bt written. But it must bt 1 history, 1 rtlltned argument biSed 01 Peaceful beginnings carefully sifted fact. Fiction, not without its own role, ciMot be No other outpost of' European allowtd to rtplace nor be confused with history. I mm ne colonization in central Africa seems to have atttmpt at 1 gentral history of the post, ner do I inttgratt, had such a troubled history as that of' except in 1 small way, the history of Zongo, 1 post of the Conge Bangui, founded by the French in June 1889. Frte State just across tht river ud foundtd around the nme Its first ten or fifteen years, as reported by timt. Chronolo;cal dttlils regarding tht foundation of B~ngui ll't the whites who lived them, were dangerous to be found in Cantoumt (1986),] and uncertain, if' not desperate) ones. For a 1 time there was even talk of' abandoning the The selection of' the site for the post. that. Albert Dolisie named Bangui was undoubtedly post or founding a more important one a little further up the Ubangi River. The main a rational one. This place was not, to beiin problem was that of' relations with the local with, at far remove from the last. post at. Modzaka; it. was crucial in those years to be people •. The purpose of' the present study is able to communicate from one post to to describe this turbulent period in Bangui's another reasonably well by canoe as well as history and attempt to explain it. -

Cameroon's Infrastructure: a Continental Perspective

Public Disclosure Authorized COUNTRY REPORT Cameroon’s Infrastructure: Public Disclosure Authorized A Continental Perspective Carolina Dominguez-Torres and Vivien Foster Public Disclosure Authorized JUNE 2011 Public Disclosure Authorized © 2011 The International Bank for Reconstruction and Development / The World Bank 1818 H Street, NW Washington, DC 20433 USA Telephone: 202-473-1000 Internet: www.worldbank.org E-mail: [email protected] All rights reserved A publication of the World Bank. The World Bank 1818 H Street, NW Washington, DC 20433 USA The findings, interpretations, and conclusions expressed herein are those of the author(s) and do not necessarily reflect the views of the Executive Directors of the International Bank for Reconstruction and Development / The World Bank or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of The World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. Rights and permissions The material in this publication is copyrighted. Copying and/or transmitting portions or all of this work without permission may be a violation of applicable law. The International Bank for Reconstruction and Development / The World Bank encourages dissemination of its work and will normally grant permission to reproduce portions of the work promptly. For permission to photocopy or reprint any part of this work, please send a request with complete information to the Copyright Clearance Center Inc., 222 Rosewood Drive, Danvers, MA 01923 USA; telephone: 978-750-8400; fax: 978-750-4470; Internet: www.copyright.com. -

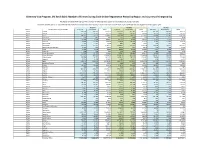

Diversity Visa Program, DV 2019-2021: Number of Entries During Each Online Registration Period by Region and Country of Chargeability

Diversity Visa Program, DV 2019-2021: Number of Entries During Each Online Registration Period by Region and Country of Chargeability The totals below DO NOT represent the number of diversity visas issued nor the number of selected entrants Countries marked with a "0" indicate that there were no entrants from that country or area. Countries marked with "N/A" were typically not eligible for that program year. FY 2019 FY 2020 FY 2021 Region Foreign State of Chargeabiliy Entrants Derivatives Total Entrants Derivatives Total Entrants Derivatives Total Africa Algeria 227,019 123,716 350,735 252,684 140,422 393,106 221,212 129,004 350,216 Africa Angola 17,707 25,543 43,250 14,866 20,037 34,903 14,676 18,086 32,762 Africa Benin 128,911 27,579 156,490 150,386 26,627 177,013 92,847 13,149 105,996 Africa Botswana 518 462 980 552 406 958 237 177 414 Africa Burkina Faso 37,065 7,374 44,439 30,102 5,877 35,979 6,318 2,591 8,909 Africa Burundi 20,680 16,295 36,975 22,049 19,168 41,217 12,287 11,023 23,310 Africa Cabo Verde 1,377 1,272 2,649 894 778 1,672 420 312 732 Africa Cameroon 310,373 147,979 458,352 310,802 165,676 476,478 150,970 93,151 244,121 Africa Central African Republic 1,359 893 2,252 1,242 636 1,878 906 424 1,330 Africa Chad 5,003 1,978 6,981 8,940 3,159 12,099 7,177 2,220 9,397 Africa Comoros 296 224 520 293 128 421 264 111 375 Africa Congo-Brazzaville 21,793 15,175 36,968 25,592 19,430 45,022 21,958 16,659 38,617 Africa Congo-Kinshasa 617,573 385,505 1,003,078 924,918 415,166 1,340,084 593,917 153,856 747,773 Africa Cote d'Ivoire 160,790 -

The DRC Seed Sector

A Quarter-Billion Dollar Industry? The DRC Seed Sector BRIEF DESCRIPTION: Compelling investment opportunities exist for seed companies and seed start-ups in the Democratic Republic of the Congo (DRC). This document outlines the market potential and consumer demand trends in the DRC and highlights the high potential of seed production in the country. 1 Executive Summary Compelling investment opportunities exist for seed companies and seed start-ups in the Democratic Republic of the Congo (DRC). This document outlines the market potential and consumer demand trends in the DRC and highlights the high potential of seed production in the country. The DRC is the second largest country in Africa with over 80 million hectares of agricultural land, of which 4 to 7 million hectares are irrigable. Average rainfall varies between 800 mm and 1,800 mm per annum. Bimodal and extended unimodal rainfall patterns allow for two agricultural seasons in approximately 75% of the country. Average relative humidity ranges from 45% to 90% depending on the time of year and location. The market potential for maize, rice and bean seed in the DRC is estimated at $191 million per annum, of which a mere 3% has been exploited. Maize seed sells at $3.1 per kilogramme of hybrid seed and $1.6 per kilogramme of OPV seed, a higher price than in Tanzania, Kenya, Uganda and Zambia. Seed-to-grain ratios are comparable with regional benchmarks at 5.5:1 for hybrid maize seed and 5.0:1 for OPV maize seed. The DRC is defined by four relatively distinct sales zones, which broadly coincide with the country’s four principal climate zones. -

The West African Oil & Gas Market 2013-2023

The West African Oil & Gas Market 2013-2023 Table 4.28 Exploration Fields that Gabon Oil Company is Involved in Fields Operator MAGHENA Addax AGALI Anadarko NKANI Atas E2 Eni D3 Eni D4 Eni F2 Eni F3 Eni F7 Eni EPAEMENO GGPC EOV GGPC DUSSAFU Harvest ETEKAMBA Maurel & Prom OMOUEYI Maurel & Prom NYANGA MAYOMBE Maurel & Prom KARI Maurel & Prom MOABI MPDC NGUMA MPDC SHAKTHI Oil India MBELI Ophir Gabon NTSINA Ophir Gabon MANGA Ophir Gabon GNONDO Ophir Gabon NZIEMBOU Perenco OGUEYI Perenco DE 7 Perenco AROUWE Perenco DUSSAFU Sasol IGOUMOU MARIN Shell Gabon BC9 Shell Gabon BCD10 Shell Gabon SALSICH Sino Gabon LOTUS Sinopec MBINDA Total Gabon ALOUMBE Total Gabon DIABA Total Gabon AZOBE Tullow Oil AKOUM Tullow Oil KIARSSENY Tullow Oil Source: Gabon Oil Company 4.7.5.3 Prospects for Pre-Salt Development As with Angola and several other West African countries, the rapid development of Brazil’s pre-salt formations has sparked considerable interest in the prospects for Gabon’s pre-salt regions, which were part of the same prehistoric supercontinent, Pangea. Gabon’s pre-salt regions had been www.visiongain.com Page 99 The West African Oil & Gas Market 2013-2023 4.8 Republic of the Congo Oil & Gas Market Forecast 2013-2023 Table 4.31, Figure 4.32 and Figure 4.33 show visiongain’s forecast for Republic of Congo’s oil & gas market over the next ten years. Table 4.31 Republic of the Congo Oil & Gas Market Forecast 2013-2023 ($bn, AGR %, CAGR%, Cumulative) 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2013-23 Capex $bn 1.55 1.70 2.57 4.15 4.55 2.70 2.50 1.80 1.87 2.10 2.40 2.80 29.14 AGR (%) 9.8 50.9 61.6 9.6 -40.7 -7.4 -28.0 3.9 12.3 14.3 16.7 CAGR (%) 2013-18 8.0 2018-23 2.3 CAGR (%) 2013-23 5.1 Source: Visiongain 2013 Figure 4.32 Republic of the Congo Oil & Gas Market Forecast 2013-2023 ($bn, AGR%) 5.0 80% 4.5 60% 4.0 3.5 40% 3.0 20% 2.5 $Bn AGR 0% 2.0 1.5 -20% 1.0 -40% 0.5 0.0 -60% 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Year Source: Visiongain 2013 www.visiongain.com Page 103 The West African Oil & Gas Market 2013-2023 6. -

Mauritania - Senegal: an Emerging New African Gas Province – Is It Still Possible?

October 2020 Mauritania - Senegal: an emerging New African Gas Province – is it still possible? OIES PAPER: NG163 Mostefa Ouki, Senior Research Fellow, OIES The contents of this paper are the author’s sole responsibility. They do not necessarily represent the views of the Oxford Institute for Energy Studies or any of its members. Copyright © 2020 Oxford Institute for Energy Studies (Registered Charity, No. 286084) This publication may be reproduced in part for educational or non-profit purposes without special permission from the copyright holder, provided acknowledgment of the source is made. No use of this publication may be made for resale or for any other commercial purpose whatsoever without prior permission in writing from the Oxford Institute for Energy Studies. ISBN 978-1-78467-165-5 DOI: https://doi.org/10.26889/9781784671655 i Contents Contents .................................................................................................................................................. ii Tables ...................................................................................................................................................... ii Preface .................................................................................................................................................... 1 INTRODUCTION ..................................................................................................................................... 3 NATURAL GAS POTENTIAL ................................................................................................................. -

Redstone Commodity Update Q3

Welcome to the Redstone Commodity Update 2020: Q3 Welcome to the Redstone Commodity Moves Update Q3 2020, another quarter in a year that has been strongly defined by the pandemic. Overall recruitment levels across the board are still down, although we have seen some pockets of hiring intent. There appears to be a general acknowledgement across all market segments that growth must still be encouraged and planned for, this has taken the form in some quite senior / structural moves. The types of hires witnessed tend to pre-empt more mid-junior levels hires within the same companies in following quarters, which leaves us predicting a stronger than expected finish to Q4 2020 and start to Q1 2021 than we had previously planned for coming out of Q2. The highest volume of moves tracked fell to the energy markets, notably, within power and gas and not within the traditional oil focused roles, overall, we are starting to see greater progress towards carbon neutrality targets. Banks such as ABN, BNP and SocGen have all reduced / pulled out providing commodity trade finance, we can expect competition for the acquiring of finance lines to heat up in the coming months until either new lenders step into the market or more traditional lenders swallow up much of the market. We must also be aware of the potential impact of the US elections on global trade as countries such as Great Britain and China (amongst others) await the outcome of the impending election. Many national trade strategies and corporate investment strategies will hinge on this result in a way that no previous election has. -

The Chair of the African Union

Th e Chair of the African Union What prospect for institutionalisation? THE EVOLVING PHENOMENA of the Pan-African organisation to react timeously to OF THE CHAIR continental and international events. Th e Moroccan delegation asserted that when an event occurred on the Th e chair of the Pan-African organisation is one position international scene, member states could fail to react as that can be scrutinised and defi ned with diffi culty. Its they would give priority to their national concerns, or real political and institutional signifi cance can only be would make a diff erent assessment of such continental appraised through a historical analysis because it is an and international events, the reason being that, con- institution that has evolved and acquired its current trary to the United Nations, the OAU did not have any shape and weight through practical engagements. Th e permanent representatives that could be convened at any expansion of the powers of the chairperson is the result time to make a timely decision on a given situation.2 of a process dating back to the era of the Organisation of Th e delegation from Sierra Leone, a former member African Unity (OAU) and continuing under the African of the Monrovia group, considered the hypothesis of Union (AU). the loss of powers of the chairperson3 by alluding to the Indeed, the desirability or otherwise of creating eff ect of the possible political fragility of the continent on a chair position had been debated among members the so-called chair function. since the creation of the Pan-African organisation. -

Financing Options in the Oil and Gas Industry, Practical Law UK Practice Note

Financing options in the oil and gas industry, Practical Law UK Practice Note... Financing options in the oil and gas industry by Suzanne Szczetnikowicz and John Dewar, Milbank, Tweed, Hadley & McCloy LLP and Practical Law Finance. Practice notes | Maintained | United Kingdom Scope of this note Industry overview Upstream What is an upstream oil and gas project? Typical equity structure Relationship with the state Key commercial contracts in an upstream project Specific risks in financing an upstream project Sources of financing in the upstream sector Midstream, downstream and integrated projects Typical equity structures What is a midstream oil and gas project? Specific risks in financing a midstream project What is a downstream oil and gas project? Specific risks in financing a downstream project Integrated projects Sources of financing in midstream, downstream and integrated projects Multi-sourced project finance Shareholder funding Equity bridge financing Additional sources of financing Other financing considerations for the oil and gas sectors Expansion financings Hedging Refinancing Current market trends A note on the structures and financing options and risks typically associated with the oil and gas industry. © 2018 Thomson Reuters. All rights reserved. 1 Financing options in the oil and gas industry, Practical Law UK Practice Note... Scope of this note This note considers the structures, financing options and risks typically associated with the oil and gas industry. It is written from the perspective of a lawyer seeking to structure a project that is capable of being financed and also addresses the aspects of funding various components of the industry from exploration and extraction to refining, processing, storage and transportation. -

2017 Corporate Responsibility Report

EMBRACING INNOVATION KOSMOS ENERGY 2017 CORPORATE RESPONSIBILITY REPORT 2 Letter to Stakeholders 19 Project Lifecycle and 36 Morocco Operations Map 4 Company Overview/ 38 São Tomé and Príncipe Financial Highlights 20 Côte d’Ivoire 42 Senegal 5 Business Principles 22 Equatorial Guinea in Action 46 Suriname - Responsibilities to Stakeholders 24 Ghana - Ethical Conduct 50 Western Sahara - Our Workplaces 29 Special Feature - Kosmos and the Environment Kosmos Innovation Center 54 IPIECA/API/IOGP - Kosmos in Society Content Index - Commercial Responsibilities 32 Mauritania 57 2017 Performance Data ABOUT KOSMOS ENERGY Kosmos is a well-capitalized, pure play deepwater oil and gas company with growing production, a pipeline of development opportunities and a balanced exploration portfolio along the Atlantic Margins. Our assets include growing production offshore Ghana and Equatorial Guinea, a competitively positioned Tortue gas project in Mauritania and Senegal and a sustainable exploration program balanced between proven basins (Equatorial Guinea), emerging basins (Mauritania, Senegal and Suriname) and frontier basins (Côte d’Ivoire and São Tomé and Príncipe). As an ethical and transparent company, Kosmos is committed to doing things the right way. Our Business Principles articulate the company’s commitment to transparency, ethics, human rights, safety, and the environment. Kosmos Energy is listed on the New York Stock Exchange and London Stock Exchange, traded under the ticker symbol KOS. For additional information, visit our website www.kosmosenergy.com. Whether it’s through incremental improvement or fundamentally challenging conventional wisdom, Kosmos Energy embraces creativity and maintains an open, responsive, and entrepreneurial spirit. For host countries, our relentless pursuit of innovation focuses on being a long-term partner that aims to help them build a brighter future. -

UK/Netherlands SNS Hackathon Output Report

UK/Netherlands SNS Hackathon Output Report April 2019 Contents Foreword ............................................................................................................................................................. 3 Executive Summary ............................................................................................................................................. 4 Introduction ......................................................................................................................................................... 4 How Does a Hackathon Event Work? ................................................................................................................... 5 Findings ............................................................................................................................................................... 6 Operator Challenges ............................................................................................................................................ 7 Operator 1: Shell .......................................................................................................................................... 7 Operator2: Oranje Nassau Energie B.V. ........................................................................................................ 8 Operator 3: Spirit Energy .............................................................................................................................. 9 Operator 4: Neptune Energy ......................................................................................................................