Consultation Paper (November 2008)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AIRROC / Cavell Commutations & Networking Event 2007 Delegate List

AIRROC / Cavell Commutations & Networking Event 2007 Delegate List Total Number Of Delegates 385 * = New for 2007 Phone Number Fax Number Email ACE Group USA Chris Coelho +1 212 504 6262 [email protected] Addleshaw Goddard UK Michael Green +44 (0) 20 7788 5062 +44 (0) 20 7606 4390 [email protected] Richard Leedham +44 (0) 20 7788 5157 +44 (0) 20 7606 4390 [email protected] AIG USA Mindy Kipness +1 212 266 6300 +1 212 266 5703 [email protected] AIG / Global Reinsurance Services Division USA George Mitchell +1 212 266 5845 +1 212 266 5703 [email protected] AIRROC USA Trish Getty +1 770 664 7219 +1 425 468 8573 [email protected] Alan Gray Inc USA Richard Grant +1 617 598 1501 +1 617 542 4155 [email protected] Alea Group Holdings USA * John Hitchcock +1 860 258 6721 [email protected] * Mark Cloutier +44 7834 350 811 [email protected] Alea London Limited UK * Clive O'Donnell +44 (0) 20 7621 3140 +44 (0) 20 7621 3150 [email protected] Allegient Systems USA * Francis Melaragni +1 781 648 1826 [email protected] * Wayne Nykyforchyn +1 203 834 9188 [email protected] Allstate Insurance Company USA Bill Littel +1 847 551 2841 +1 847 551 2068 [email protected] Diane Werner +1 847 551 2584 +1 847 551 2190 [email protected] Henry Mc Grier +1 847 551 2612 +1 847 551 2068 [email protected] American United Life R/I Mgmt Services Ltd USA * Damian Salonick +1 609 747 8708 [email protected] Ameya Consulting USA -

Actuarial Studies in Non-Life Insurance 37 International ASTIN

Actuarial Studies in Non-Life Insurance 37th International ASTIN Colloquium Disney’s Contemporary Resort ~ Lake Buena Vista, Florida 19-22 June 2007 LIST OF ATTENDEES This list was created on 8 June 2007 with all registrations received by the CAS Office to date. This list will not be modified as future registrations are received. NAME COMPANY ACCOM. PERSON AUSTRALIA Krvavych, Yuriy Insurance Australia Group Taylor, Greg Taylor Fry Consulting Actuaries Rhonda Taylor BELGIUM Chenut, Xavier Secura Belgian Re De Longueville, Philippe Secura Belgian Re Desmedt, Stijn Secura Insurance Goovaerts, Marc K.U. Leuven Henry, Marc Lemaire, Jean The Wharton School BERMUDA Dougherty, John Chris Axis Specialty Limited Martin, Peter R. Axis Specialty Insurance BULGARIA Ignatov, Tzvetan Sofia University CANADA Cheng, Joseph S. J.S. Cheng & Partners, Inc. Gilbert, Gregory Evan Aviva Canada, Inc. Goulet, Vincent Ecole d'Actuariat L'Esperance, Andre Canadian Medical Protective Association Panjer, Harry H. University of Waterloo Seguin, Louis Gilbert Desjardins Groupe d'assurances generales Tsai, Chi-Liang Simon Frasier University CAYMAN ISLANDS Norris, James L. Greenlight Reinsurance LTD NAME COMPANY ACCOM. PERSON CHINA Tao, Qian Renmin University of China Xie, Zhigang Shanghai University of Finance & Ecomonics Yao, Rui Renmin University of China Yugu, Xiao Renmin University of China Zhou, Christina Tieyan PricewaterhouseCoopers CZECH REPUBLIC Jedlicka, Petr Charles University/CKP Strnad, Jakub Kooperativa, pojistovna, a.s. Svab, Jan Kooperativa, pojistovna, -

Islamicfinance.De Executive News 2007, Issue No

IslamicFinance.de Executive News 2007, Issue No. 25 Islamic Finance in Minority Areas British Islamic Insurance Holding, Qatar Islamic Bank, European Finance House, Dubai Investments, Islamic Bank of Asia, Canada mortgage preferences, Absa Islamic Bank, First Community Bank Islamic Banking Global Banking Corporation, Masrafy, Investment Dar, Dubai Bank, Sakana, Amlak, Dar Al Istithmar, BMB, Bosna Bank, Venture Capital Bank, IDB, ABN Amro, Qatar Islamic Bank, Al Salam Bank, Kuwait Finance House (Bahrain), International Investment Bank, Ewaan Capital, Gulf Finance House, Albaraka Türk, Standard Chartered, Dubai Islamic Bank, Kuwait Finance House, Central Bank Iran, Habib Bank, General Electric, Airbus, Dubai Financial Market, Indonesia, Michael Gassner Eoncap, Kuwait Finance House (Malaysia) Consultancy Ltd. Fixed Income (Sukuk, Syndication) Editorial DP World, DIFC Investments, Saudi Electricitiy, Dana Gas, Dubai Aerospace, Egyptian Fertilisers, Dar Al Arkan, Thani Investments, Emirates Islamic Bank, Sokouk Exchange Centre, Adeem Investment Co., Qatar Real Estate Co., Salam Bounian Development Co., Dear Readers, International Investment Group, Tamweel, Amlak, Dubai Islamic As salamu alaikum, Pakistan, Emirates Global Islamic Bank, Wapda, Khazanah, Plus Syndication: Commodity Murabaha Program, Amlak Finance, Aldar, Substantial Sukuk activity is said to Saudi Water, Sipchem prevent bankers from holiday. Beyond Sukuk a variety of wealth Wealth Management management products went live. BNP Paribas, Merrill Lynch, Ernst & Young, Bear Stearns, -

Cadenza Document

LISTE DES ORGANISMES AGREES CLASSES PAR PAYS 15/06/2010 A la suite d'un changement d'application informatique, certaines informations ont pu être perdues ou erronées ; dans ce cas veuillez prévenir s'il vous plaît M. Nouazé-Priet par courriel à l'adresse suivante : [email protected] ALLEMAGNE Début Fin Siren Nom Sigle Activité RD CP Ville Téléphone 3S PHARMACOLOGICAL CONSULTATION & Sciences 2008 2010 3S 27243 HARPSTEDT 49424495083 RESEARCH pharmacologiques 2007 2010 AAIPHARMA DEUTSCHLAND Sciences médicales 89231 NEU ULM 497319840110 2008 2009 ACAM-MESSELELCTRONIC GMBH Electronique 76297 STUTENSEE 2009 2010 ACTO 52070 AACHEN 492419974180 Sciences Agronomiques et 2007 2009 AGROSTAT 74572 HERRENTIERBACH 079361206 alimentaires 2009 2010 ALGOMED Biologie 38486 KLOTZE 03909472614 VATERSTTEN 2009 2009 AMADEUS HOSPITALITY AH Informatique 85591 4981063210 B.MÜNCHEN Sciences 2008 2010 AMAREG GMBH 93055 REGENSBURG 499414601711 pharmacologiques 2009 2011 A. RAYMOND Electronique 79539 LORRACH (+49)76216683073 2007 2009 ARCHOS Electronique 64283 DARMSTADT 0169331690 2009 2012 AREVA NP GMBH 91052 ERLANGEN 49091319005809 2006 2008 ARVINMERITOR Genie des matériaux 63128 DIETZENBACH 2009 2011 ARVINMERITOR Genie des matériaux 63128 DIETZENBACH 00495371894453 2007 2009 ASTRIUM Télécommunications D 81643 MÜNCHEN 498960728352 2010 2012 ASTRIUM Télécommunications D 81643 MÜNCHEN 498960728352 2008 2009 ATOS WORDLINE Informatique 52076 AACHEN 0320607829 2008 2009 ATOS WORDLINE PROCESSING Informatique D 60528 FRANKFURT/MAIN 0320607829 2009 -

AIRROC / Cavell Commutations & Networking Event 2009 Delegate List

AIRROC / Cavell Commutations & Networking Event 2009 Delegate List Total Number Of Delegates 424 * = New for 2009 Phone Number Mobile Number Email ACE Group USA Chris Coelho +1 215 640 1844 [email protected] Addleshaw Goddard UK Michael Green +44 (0) 20 7788 5041 [email protected] Richard Leedham +44 (0) 20 7788 5041 [email protected] AIG USA George Mitchell +1 646 433 5718 [email protected] Michael Zeller +1 646 433 5600 [email protected] Mindy Kipness +1 212 266 6300 [email protected] AIRROC USA Trish Getty +1 770 664 7219 [email protected] Alan Gray Inc USA Richard Grant +1 617 598 1501 +1 508 873 1108 [email protected] Alea London Limited UK Clive O’Donnell +44 (0) 20 7265 5039 [email protected] Alea North America USA * Suzanne Fetter +1 860 258 6512 +1 860 306 2356 [email protected] Allstate Insurance Company USA Bill Littel +1 847 551 2841 [email protected] Diane Werner +1 847 551 2584 [email protected] Henry McGrier +1 847 551 2612 [email protected] Terry Kelaher +1 847 551 2400 [email protected] American Conference Institute USA * Brett Brumberger +1 212 352 3220 [email protected] Ameya Consulting USA Bina Dagar +1 973 716 9496 [email protected] Arbitration, Mediation & Expert Witness Services USA Jonathan Rosen +1 646 330 5128 +1 917 626 2645 [email protected] Argo Group US USA Chris Hollender +1 312 977 3250 [email protected] Rhonda Ijams +1 928 525 1714 [email protected] 27 October 2009 -

Human Capital Management

Human Capital Management September 2016 SECTOR REPORT INSIDE THIS ISSUE 1. Introduction Human Capital Management 2. Market Update Introduction This report provides a snapshot of trends in the recruiting and onboarding sub-segment of the talent management 3. General HCM Market Update sector of the Human Capital Management (HCM) market. In addition to reviewing market activity, we highlight a sampling of up and coming startups and growth stage companies that focus on recruiting and onboarding. Later 4. Public-Market Valuation in the report, we have updated broader HCM market M&A activity, private financings, and sector public equity Trends performance since our last publication in September 2015. 5. Private Financing Recruiting and onboarding is a key component of talent management, which as defined by Gartner also includes: performance management, career and succession management, compensation planning, learning and development and workforce planning. Market Update Mobile & Cloud-based Capabilities Increasingly Important and Portals Playing a Growing Role in Talent Acquisition As is the case in the broader HCM market, cloud based SaaS models continue to dominate next generation suites and individual offerings. Similarly, analytics, reporting and dash boards have made their way into talent acquisition offerings, while social recruiting and recruitment marketing have also increased in their importance. In addition to the large firms in the space such as Oracle Taleo, SAP SuccessFactors, PeopleFluent, Lumesse and others, there are many innovative and differentiated players in recruiting and onboarding. With nearly every employee having access to a smart phone and connectivity through mobile apps, HR departments are being challenged in ways to innovate their overall operations to accommodate the digital and mobile app age. -

AIRROC / Cavell Commutations & Networking Event 2008 Delegate List

AIRROC / Cavell Commutations & Networking Event 2008 Delegate List Total Number Of Delegates 464 * = New for 2008 Phone Number Mobile Number Email ACE Group USA Chris Coelho +1 215 640 1844 [email protected] Addleshaw Goddard UK Michael Green +44 (0) 20 7788 5062 +44 (0) 7881 506 089 [email protected] Richard Leedham +44 (0) 20 7788 5157 +44 (0) 7740 768 370 [email protected] Afinia Capital Group UK Nick Eddery-Joel +44 (0) 203 008 4939 +44 (0) 7771 624 958 [email protected] AIG USA * Eric Kobrick +1 212 770 7725 [email protected] Michael Zeller [email protected] Mindy Kipness +1 212 266 6300 [email protected] AIG / Global Reinsurance Services Division USA George Mitchell +1 212 266 5845 [email protected] AIRROC USA Trish Getty +1 770 664 7219 [email protected] Alan Gray Inc USA Richard Grant +1 617 598 1501 [email protected] Alea Group Holdings Switzerland Detlef Huber +41 (0) 61 268 2211 [email protected] Alea London Limited UK Clive O'Donnell +44 (0) 20 7265 5039 [email protected] Alea North America USA John Hitchcock +1 860 258 6721 [email protected] Allstate Insurance Company USA Bill Littel +1 847 551 2841 [email protected] Diane Werner +1 847 551 2584 [email protected] Henry McGrier +1 847 551 2612 [email protected] Terry Kelaher +1 847 551 2400 [email protected] Ameya Consulting USA Bina Dagar +1 973 716 9496 [email protected] Aon Limited UK Vijay Mavani +44 (0) 207 505 7278 [email protected] -

Exposure Draft: Modelling

BOARD FOR ACTUARIAL STANDARDS EXPOSURE DRAFT: MODELLING MAY 2009 BOARD FOR ACTUARIAL STANDARDS MAY 2009 • EXPOSURE DRAFT: MODELLING CONTENTS Page Analysis of Responses and Invitation to Comment 3 Introduction 4 2 Responses to consultation questions 7 3 Proposals 20 4 Invitation to comment 22 Exposure Draft 23 Appendices 35 A Members of the Board and of Working Groups 35 B List of respondents 37 2 BOARD FOR ACTUARIAL STANDARDS MAY 2009 • EXPOSURE DRAFT: MODELLING ANALYSIS OF RESPONSES AND INVITATION TO COMMENT 3 BOARD FOR ACTUARIAL STANDARDS MAY 2009 • EXPOSURE DRAFT: MODELLING 1 INTRODUCTION CONSULTATION AND RESPONSES 1.1 The Board for Actuarial Standards (BAS) is responsible for setting technical actuarial standards in the UK: it is an operating body of the Financial Reporting Council (the FRC)1. In November 2008, it published a consultation paper on its Generic Technical Actuarial Standard (Generic TAS)2 on Modelling (TAS M). 1.2 The consultation period ended on 23 February 2009. A total of 27 public responses3 were received (see Appendix B). A number of meetings with practitioners and other stakeholders were held and the proposals were discussed with the FRC’s Actuarial Stakeholder Interests Working Group. During the preparation of the consultation paper we were assisted by a Working Group and an Advisory Group,4 and they also provided valuable input as we considered the responses and drafted the proposed text of TAS M. We thank all those who contributed. SUMMARY 1.3 In drafting the proposed text of TAS M we have taken account of the comments we received in response to the consultation paper, as well as other comments that have been made to us in meetings. -

Annual Report.Indd

Institute of Actuaries of India INDIAN ACTUTIAL PROFESSION Serving the Cause of Public Interest INSTITUTE OF ACTUARIES OF INDIA Annual Report & Accounts 2009 - 2010 Annual Report & Accounts / 1 Institute of Actuaries of India CONTENTS Subject Page No • Notice and Agenda for the AGM on 28.08.2010 3 • Minutes of 3rd Annual General Meeting held on 28.08.2009 4 President’s statement on the State of the Institute 5 Fourth Report of the Council for the year ended 31.03.2010 1. Environment 8 2. Membership 8 3. Committees / Advisory Groups and Council 13 4. 12th Global Conference of Actuaries 32 5. Library 33 6. Analysis of Financial Statement 33 7. Acknowledgments 33 Financial Statement of Institute of Actuaries of India : 1. Auditor’s Report 34 2. Balance Sheet 35 3. Income & Expenditure Account 36 4. Schedules 37 5. Significant Accounting Policies 54 6. Notes to the Accounts 55 Financial Statement of Mortaility and Morbility Investigation Centre 56 2 / Annual Report & Accounts Institute of Actuaries of India NOTICE FOR THE 4TH ANNUAL GENERAL MEETING TO BE HELD ON 28.8.2010 UNDER SECTION 13 OF THE ACTUARIES ACT, 2006 TO: All Members of the Institute Annual General Meeting of the Institute in terms of Section 13 of the Actuaries Act, 2006 will be held as under : Date 28th August 2010 Time 4.30 P.M. Venue IAI office, G.S. Diwan Room Agenda Items: Agenda 1: Two minutes silence to condole death of the following members, information in respect of whom came to notice of the Institute after the last AGM on 28.8.2009 : Sr.No. -

Gripfill 60X40

1 The Global Consulting 1 Mergers & Acquisitions 0 2 Report 2011 GROWING & REALISING EQUITY VALUE IN CONSULTING FIRMS © Copyright Equiteq LLP 2011 www.equiteq.com Welcome to the Equiteq Global Consulting Mergers & Acquisitions Market Report 20 11 The report is aimed at people involved in consulting firm valuations, sales and acquisitions. If you are involved in the running of a consultancy business, or looking to sell and/or acquire, or are just interested in how much your firm could be worth in today’s market, then read on… © Copyright Equiteq LLP 2011 www.equiteq.com 01 The Global Consulting M&A Report 2011 Contents The Global Consulting M&A Report 2011 List of Charts 2 Predicting Synergy between Buyer and Seller 31 Introduction 3 Further Resources 33 Equiteq Analysis 4 About Equiteq 34 Summary on 2010 5 Disclaimer 35 Commentary on the Market 6 Appendix A – Sample Deal Details 36 Analysis of the Global Market 11 Appendix B – European Deals 60 Deal Volumes 11 Appendix C – North American Deals 79 Target and Bidder Countries 13 Appendix D – Asia Pacific Deals 97 Deal Values 15 Author Biographies 103 Revenue Multiples 17 EBITDA Multiples 19 Stock Market Review 21 Valuations 22 Share Price Index Movement 24 Building Equity Value in Consulting Firms 28 Understanding the Eight levers of Equity Value 29 Covering Europe, North America and Asia Pacific 02 List of Charts The Global Consulting M&A Report 2011 Figure 1 Index of Key Market Indicators by Year 6 Figure 17 EBITDA Multiple, 12-Month Moving Average 20 Figure 2 ‘Environmental Consulting’ Targets as Figure 18 Share Price Revenue Multiples by Sector 22 Proportion of Engineering Deals 7 Figure 19 Share Price EBITDA Multiples by Sector 23 Figure 3 Proportion of Deals in Healthcare 7 Figure 20 Share Price Movement in 2010 24 Figure 4 Investment Houses as Proportion of Bidders 9 Figure 21 Share Price Index, All Sectors 25 Figure 5 Volume of Sector M&A Intelligence 10 Figure 22 Share Price Index, Management Consulting 26 Figure 6 Deal Volumes by Region 11 Figure 23 Share Price Index. -

L2 Advice on Partial Internal Models CEIOPS-SEC-167-10 January 2010

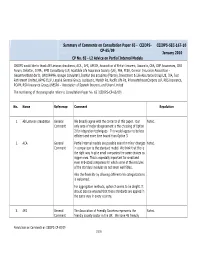

Summary of Comments on Consultation Paper 65 - CEIOPS- CEIOPS-SEC-167-10 CP-65/09 January 2010 CP No. 65 - L2 Advice on Partial Internal Models CEIOPS would like to thank AB Lietuvos draudimas, ACA , AFS, AMICE, Association of British Insurers, Assuralia, CEA, CNP Assurances, CRO Forum, Deloitte , DIMA , EMB Consultancy LLP, Equitable Life Assurance Society (UK), FEE, FFSA, German Insurance Association – Gesamtverband der D, GROUPAMA, Groupe Consultatif, Institut des actuaires (France), Investment & Life Assurance Group Ltd, IUA, Just Retirement Limited, KPMG ELLP, Legal & General Group, Lucida plc, Munich Re, Pacific Life Re, PricewaterhouseCoopers LLP, RBS Insurance, ROAM, RSA Insurance Group,UNESPA – Association of Spanish Insurers, and Unum Limited The numbering of the paragraphs refers to Consultation Paper No. 65 (CEIOPS-CP-65/09) No. Name Reference Comment Resolution 1. AB Lietuvos draudimas General We broadly agree with the contents of this paper. Our Noted. Comment only area of major disagreement is the choosing of Option 2 for integration techniques. This would appear to be less efficient and more time bound than Option 3. 2. ACA General Partial internal models are possible even for minor changes Noted. Comment in comparison to the standard model. We think that this is the right way to give small companies the same choices as bigger ones. This is especially important for small and even mid-sized companies for which some of the modules of the standard modules do not seem well fitted. Also the flexibility by allowing different risk categorizations is welcomed. For aggregation methods, option 2 seems to be alright. It should also be ensured that these standards are applied in the same way in every country. -

Cadenza Document

LISTE DES ORGANISMES AGREES CLASSES PAR PAYS ET PAR SECTEURS D'ACTIVITES 07/03/2011 ALLEMAGNE Début Fin Siren Nom Sigle Activité RD CP Ville Téléphone 2008 2010 EADS DEUTSCHLAND Automatique 81663 MUNICH 2009 2011 FLUITRONICS Automatique 47807 KREFELD 2009 2010 FOXBORO ECKARDT Automatique D-70376 STUTTGART FREUDENBERG ANALGEN UND 2008 2010 Automatique LAUDENBACH WERKZEIGTECHNIK 2009 2010 HARRER & KASSEN GMBH Automatique LANGEWRAND 2009 2010 HUMANTEC INDUSTRESYSTEME Automatique 86685 HUISHEIM 2008 2010 IMAR Automatique ST INGDBERT 2009 2010 SOMFY Automatique 72108 ROTTENBURG Automatique, Electronique, FREUDENBERG DICHTUNGS UND Génie Electronique, 2009 2010 FDS 69465 WEINHEIM SCHWINGUNGSTECHNICK Télécommunications, Informatique, Optique 2009 2010 ALGOMED Biologie 38486 KLOTZE NIEFERN- 2008 2010 EUROFINS GAB Biologie 75223 OSCHELBRONN Ebersberg - 2008 2010 EUROFINS MEDIGENOMICS Biologie 85560 ALLEMAGNE Ebersberg - 2011 2013 EUROFINS MEDIGENOMICS Biologie 85560 ALLEMAGNE CONSTANCE - 2009 2010 GATC BIOTECH Biologie 78464 ALLEMAGNE 2007 2009 GENEART GA Biologie 93053 REGENSHURG 2010 2012 GENEART GA Biologie 93053 REGENSHURG 2007 2009 GENOVAC Biologie 79111 FREIBURG 2010 2012 GENOVAC Biologie 79111 FREIBURG 2009 2010 HARLAN CYTOTEST CELL RESEARCH HARLAN CCR Biologie 64380 ROBDORF ALLEMAGNE Début Fin Siren Nom Sigle Activité RD CP Ville Téléphone INSTITUT FUER BIOLOGISCHE ANALYTIK 2009 2010 IBACON Biologie 64380 ROSSDORF UND CONSULTING 2009 2011 MICROCOAT BIOTECHNOLOGIE Biologie 82347 BERNRIED 2009 2011 MIKROLAB Biologie 28259 BREMEN PLANEGG 2008 2009 MORPHOSYS MOR-ABD Biologie 82152 MARTINSRIED PLANEGG 2010 2011 MORPHOSYS MOR-ABD Biologie 82152 MARTINSRIED 2009 2011 MPA EBERSWALDE Biologie 16225 EBERSWALDE 2007 2009 RCC CYTOTEST CELL RESEARCH Biologie D 64380 ROSSDORF R&D BIOTECHNOLOGY HEALTH & 2009 2011 HN-BP Biologie D- 33790 HALLE/WESTFALEN NUTRITION BIOPRODUCTS 2010 2011 VIBALOGICS Biologie 27472 Luxhaven 2007 2010 BAYER CROPSCIENCE Chimie MONHEIM COLOGNE - 2010 2011 BOLLIG & KEMPER Chimie 50827 ALLEMAGNE 2007 2009 EUROFINS DR.