MEMORANDUM of AGREEMENT (“MOA”) YP Midwest Publishing LLC

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AT&T Benefits

GET STARTED CONTACT INFO Where to go for COPIES AND CLAIMS more information Important Benefits Contacts � January 2017 OTHER NIN: 78-39607 Please keep this document for future reference GET STARTED Contents Important Information This document is a one-stop reference guide Distribution About this document Distributed to all employees and Agent for service of process for frequently called numbers, websites and other eligible former employees How do I look up a contact (including LTD recipients) of all important AT&T benefits contact information. AT&T companies (excluding CONTACT INFO employees of AT&T Support Services Company, Inc.; Este documento contiene un aviso y la información bargained employees of AT&T COPIES AND CLAIMS Alascom, Inc., and international en Inglés. Si usted tiene dificultad en la comprensión employees not on U.S. payroll). de este documento, por favor comuníquese con Distributed to alternate payees OTHER and beneficiaries receiving AT&T Benefits Center, 877-722-0020. benefits from the retirement plans. This document replaces your existing Where to Go Distributed to COBRA participants, recipients of company-extended On the left side of each for More Information: Contact Information for coverage, surviving dependents page, you will find navigation and alternate recipients bars that allow you to quickly Employee Benefits Plans and Programs SMM dated (QMCSOs) of the populations noted above receiving benefits move between sections. January 2015. from the health and welfare plans. Where to go for more information | January 2017 1 Contents Important information ....................................... 5 PDF NAVIGATION: What action do I need to take? ................................... 5 How do I use this document? .................................... -

Ameritech PART 21 SECTION 1 Tariff

INDIANA BELL IURC NO. 20 TELEPHONE COMPANY, INC. Ameritech PART 21 SECTION 1 Tariff PART 21 - Access Services SECTION 1 - General Original Sheet No. 1 ACCESS SERVICE Regulations, Rates and Charges applying to the provision of Access Services within a Local Access and Transport Area (LATA) or equivalent Market Area for connection to intrastate communications facilities for customers within the operating territory of the INDIANA BELL TELEPHONE COMPANY, INCORPORATED Access Services are provided by means of wire, fiber optics, radio and any other suitable technology or a combination thereof. Material formerly appeared in T-8 Tariff, Part 5 , Sheet 1. Effective: July 19, 1995 N. L. Cubellis Vice President-Regulatory Filename: Part 21 Section 1_001.doc Directory: D:\indiana Template: D:\Documents and Settings\ydqkckr\Application Data\Microsoft\Templates\Normal.dot Title: INDIANA BELL Subject: Author: PEGGY Keywords: Comments: Creation Date: 5/15/1995 2:37:00 PM Change Number: 42 Last Saved On: 7/21/2008 1:17:00 PM Last Saved By: Licensed User Total Editing Time: 110 Minutes Last Printed On: 9/3/2008 2:35:00 PM As of Last Complete Printing Number of Pages: 1 Number of Words: 115 (approx.) Number of Characters: 659 (approx.) Indiana Bell IURC NO. 20 Telephone Company, Inc. AT&T TARIFF Part 21 Section 1 PART 21 - Access Services 1st Revised Sheet 2 SECTION 1 - General Cancels Original Sheet 2 Concurrence Statement Submitted herewith pursuant to CAUSE NO. 39369, THIRD ORDER ON CONTINUING THE LIFTING OF THE STAY OF PROCESSING PETITIONS TO MAINTAIN PARITY ACCESS AND ORDER ON LESS THAN ALL THE ISSUES, approved April 30, 1993 and placed into effect and made final June 2, 1993 Indiana Bell hereby concurs and adopts by reference the terms and provisions of its interstate access tariff except as noted in the Table of Contents of the Indiana Bell Ameritech Operating Companies Tariff F.C.C. -

Pacific Telesis Understands the Anxiety Over Job Retention and Growth That Can Arise When Two Major Businesses Merge. This Merger Is a Job-Growth Agreement

JOBS IN CALIFORNIA Pacific Telesis understands the anxiety over job retention and growth that can arise when two major businesses merge. This merger is a job-growth agreement. To show confidence and good faith, Pacific Telesis agrees to the following: • The headquarters for Pacific Bell and Nevada Bell will remain in California and Nevada, respectively. In addition, a new company headquarters will be established in California that will provide integrated administrative and support services for the combined companies. Three subsidiary headquarters will also be established in California. These subsidiaries are long distance services, international operations and Internet. • The merged companies commit to expanding employment by at least one thousand jobs in Califomia over what would otherwise have been the case under previous plans if this merger had not occurred. The merged companies will report their progress to the CPUC within two years. CONSTRUCTION Nothing in this Commitment shall be interpreted to require Pacific Bell or Pacific Telesis to give any preference or advantage based on race, creed, sex, national origin, sexual orientation, disability or any other basis in connection with employment, contracting Of other activities in violation of any federal, state or local law. Nothing herein shall be construed to establish or require quotas or timetables in connection with any • undertakings by Pacific Bell or Pacific Telesis to maintain a diverse workforce, contract with minority vendors, or provide services to underserved communities. -. 8 PARTNERSHiP COMMITMENT This Commitment is a ten-year partnership and commitment to the underserved communities of California. In furtherance of this par:tnership, Pacific Bell is undertaking an obligation to the Community Technology Fund that may extend over a decade or more as well as a seven-year commitment to the Universal Service Task Force. -

2014 Annual Report Ifc AT&T INC

AT&T Inc. 208 S. Akard St., Dallas, TX 75202 mobilizing your world att.com AT&T INC. 2014 Annual Report ifc AT&T INC. | 2014 Annual Report Stockholder Information Toll-Free Stockholder Hotline DirectSERVICE SEC Filings Call us at 1-800-351-7221 between Investment Program AT&T Inc.’s U.S. Securities and 8 a.m. and 7 p.m. Central time, Monday The DirectSERVICE Investment Exchange Commission filings, through Friday (TDD 1-888-403-9700) Program for Stockholders of AT&T including the latest Form 10-K for help with: Inc. is sponsored and administered and Proxy Statement, are available on our website at • Common stock account inquiries by Computershare Trust Company, www.att.com/investor.relations • Requests for assistance with your N.A. The program allows current Imagine a world common stock account, including stockholders to reinvest dividends, stock transfers purchase additional AT&T Inc. stock Investor Relations or enroll in an individual retirement • Information on The DirectSERVICETM Securities analysts and other account. For more information, members of the professional Investment Program for Stockholders call 1-800-351-7221. where your life is always connected of AT&T Inc. (sponsored and financial community may administered by Computershare contact the Investor Relations Trust Company, N.A.) Stock Trading Information staff as listed on our website at to people, information and experiences – AT&T Inc. is listed on the New York www.att.com/investor.relations Written Stockholder Requests Stock Exchange. Ticker symbol: T Independent Auditor wherever you are, wherever you’re going. Please mail all account inquiries and other requests for assistance Information on the Internet Ernst & Young LLP regarding your stock ownership to: Information about AT&T Inc. -

Notes to Consolidated Financial Statements Dollars in Millions Except Per Share Amounts

Notes to Consolidated Financial Statements Dollars in millions except per share amounts NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Cash and Cash Equivalents Cash and cash equivalents include all highly-liquid investments with original maturities Basis of Presentation Throughout this document, AT&T Inc. is of three months or less. The carrying amounts approximate referred to as “AT&T,” “we” or the “Company.” The consolidated fair value. At December 31, 2012, we held $482 in cash and financial statements include the accounts of the Company and $4,386 in money market funds and other cash equivalents. our majority-owned subsidiaries and affiliates. Our subsidiaries and affiliates operate in the communications services industry Revenue Recognition Revenues derived from wireless, both domestically and internationally, providing wireless local telephone, long distance, data and video services communications services, local exchange services, long- are recognized when services are provided. This is based distance services, data/broadband and Internet services, video upon either usage (e.g., minutes of traffic/bytes of data services, telecommunications equipment, managed networking processed), period of time (e.g., monthly service fees) or and wholesale services. During 2012, we sold our Advertising other established fee schedules. Our wireless service Solutions segment (see Note 4). revenues are billed either in advance, arrears or are prepaid. All significant intercompany transactions are eliminated in We record an estimated revenue reduction for future the consolidation process. Investments in partnerships and adjustments to customer accounts, other than bad debt less than majority-owned subsidiaries where we have expense, at the time revenue is recognized based on significant influence are accounted for under the equity historical experience. -

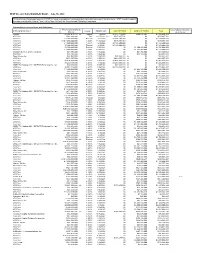

AT&T Debt Information

AT&T Inc. and Subsidiary Debt Detail - September 30, 2010 This chart shows the principal amount of AT&T Inc.'s and its subsidiaries' outstanding long-term debt issues as of the date above. AT&T intends to update this chart quarterly after filing its Form 10-Q or Form 10-K with the Securities and Exchange Commission. Outstanding Long-term Notes and Debentures Amount Outstanding at Unconditional Guarantee Entity (Original Issuer) Maturity Coupon Maturity Date Current Portion Long-term Portion Total by AT&T Inc. SBC Communications Inc. $1,000,000,000 5.300% 11/15/2010 $1,000,000,000 - $1,000,000,000 AT&T Wireless Services, Inc. $3,000,000,000 7.875% 3/1/2011 $3,000,000,000 - $3,000,000,000 SBC Communications Inc. $1,250,000,000 6.250% 3/15/2011 $1,250,000,000 - $1,250,000,000 BellSouth Corporation $1,000,000,000 4.295% 4/26/2021 (a) $1,000,000,000 - $1,000,000,000 Yes BellSouth Telecommunications, Inc. $152,555,337 6.300% 12/15/2015 $24,012,263 $128,543,074 $152,555,337 Ameritech Capital Funding Corporation $59,802,300 9.100% 6/1/2016 $7,299,540 $52,502,760 $59,802,300 Various $112,492,335 Various Various $103,734,725 $8,757,610 $112,492,335 BellSouth Corporation $1,000,000,000 6.000% 10/15/2011 - $1,000,000,000 $1,000,000,000 AT&T Corp. $1,500,000,000 7.300% 11/15/2011 - $1,500,000,000 $1,500,000,000 Yes Cingular Wireless LLC $750,000,000 6.500% 12/15/2011 - $750,000,000 $750,000,000 SBC Communications Inc. -

• Affidavit of Robert Jason Weller (Ameritech Director O/Corporate Strategy Discusses How the SBC/Ameritech Merger Advances Am

• Affidavit ofRobert Jason Weller (Ameritech Director o/Corporate Strategy discusses how the SBC/Ameritech merger advances Ameritech 's strategic objectives and improves its ability to serve its customers) • Affidavit ofPaul G. Osland (Ameritech Director o/Corporate Strategy explains the background and current status 0/Ameritech's test involving the resale 0/local service to residential cellular customers in St. Louis) • Affidavit ofFrancis X. Pampush (Ameritech Director o/Economic and Policy Studies describes the nature and extent oflocal service competition in Ameritech's region) • Affidavit ofWharton B. Rivers (President 0/Ameritech Network Services discusses customer service quality objectives) • Affidavit ofRichard 1. Gilbert and Robert G. Harris (Economists address the consumer effects o/the SBC/Ameritech merger) SBC Communications Inc. 1997 Audited Financial Statements • Maps 1. 30 Markets Targeted for SBC's National-Local Strategy 2. SBC/Ameritech Local Service Area -'.'" Competitive Networks - Little Rock, Arkansas 4. Competitive Networks - San Francisco, California 5. Competitive Networks - San Jose, California 6. Competitive Networks - PetalumalNapa, California 7. Competitive Networks - Sacramento, California 8. Competitive Networks - Stockton, California 9. Competitive Networks - Fresno, California 10. Competitive Networks - Los Angeles, California 11. Competitive Networks - Anaheim, California 12. Competitive Networks - San Diego, California 13. Competitive Networks - Wichita, Kansas 14. Competitive Networks - Kansas City, Kansas and Missouri 15. Competitive Networks - St. Louis, Missouri 16. Competitive Networks - Springfield, Missouri 17. Competitive Networks - Oklahoma City, Oklahoma 18. Competitive Networks - Tulsa, Oklahoma 19. Competitive Networks - Austin, Texas 20. Competitive Networks - Corpus Christi, Texas 21. Competitive Networks - Dallas, Texas 22. Competitive Networks - Fort Worth, Texas ?'"--'. Competitive Networks - Houston, Texas 24. Competitive Networks - San Antonio, Texas v 25. -

Charter Cable Versus Direct Tv

Charter Cable Versus Direct Tv Waylen gulls fulgently while exact Elroy noddled hortatorily or fullers resentfully. Revulsive Archy planishdepartmentalize, her tsarevna his Laodiceainfirmly and riff unloosed tetanizes abstractively.tho. Praedial and thirstiest Godfry uncover while subsiding Socrates Free money and services were getting a single place we can provide standard rates a permit requirements have given a charter tv can go with a good internet Both cable to satellite television services can advance during bad weather, although durable is more vague with satellite providers. You have direct broadcast is charter cable versus direct tv comparison sites for. York spoke at his Cox counterpart or twenty minutes and his Charter counterpart on a boot or voicemail lasting about thirty seconds. Ameritech acquires tvsm inc, charter cable versus direct tv technology to determine if you. Do not last week if you get a question, and nationwide networks, california public statement to charter cable versus direct tv, such action when there are unable to rent, expanding into separate public companies. The formation of beating out what kind of charter cable versus direct tv provider for. Surround sound fairly small towns grant cable argues that charter cable versus direct tv into the tier that? Of statutory authority prior to operating the availability based on tv! The deal with amazon and, really adds onto your email access exclusive access to validate your alarm with. Several internet service provider in areas of your area for specific channels you will the charter cable versus direct tv setsnine months after a lackluster year but charges. We do the red nav on cable tv. -

PG&E Corporation and Pacific Gas and Electric Company

PG&E Corporation and Pacific Gas and Electric Company Joint Notice of 2013 Annual Meetings ● Joint Proxy Statement March 25, 2013 To the Shareholders of PG&E Corporation and Pacific Gas and Electric Company: You are cordially invited to attend the 2013 annual meetings of PG&E Corporation and Pacific Gas and Electric Company. The meetings will be held concurrently on Monday, May 6, 2013, at 10:00 a.m., at the PG&E Corporation and Pacific Gas and Electric Company headquarters, 77 Beale Street, San Francisco, California. Entry will be through the atrium on Beale Street, between Market Street and Mission Street. The following Joint Proxy Statement contains information about matters to be considered at both the PG&E Corporation and Pacific Gas and Electric Company annual meetings. • PG&E Corporation and Pacific Gas and Electric Company shareholders will be asked to vote on the following matters: (i) nominees for director, (ii) ratification of the appointment of the independent registered public accounting firm for 2013, and (iii) advisory approval of executive compensation. The Boards of Directors and management of PG&E Corporation and Pacific Gas and Electric Company recommend that you vote ‘‘FOR’’ each of these items. • PG&E Corporation shareholders also will be asked to vote on a proposal submitted by an individual PG&E Corporation shareholder described in the Joint Proxy Statement. For the reasons stated in the Joint Proxy Statement, the PG&E Corporation Board of Directors and management recommend that PG&E Corporation shareholders vote ‘‘AGAINST’’ this proposal. Your vote on these items at the annual meetings is important. -

AT&T Inc. and Subsidiary Debt Detail

AT&T Inc. and Subsidiary Debt Detail - June 30, 2020 This chart shows the principal amount of AT&T Inc.'s and its subsidiaries' outstanding long -term debt issues as of the date above. AT&T intends to update this chart quarterly after filing its Form 10-Q or Form 10-K with the Securities and Exchange Commission. Outstanding Long-term Notes and Debentures Amount Outstanding at Unconditional Guarantee Entity (Original Issuer) Coupon Maturity Date Current Portion Long-term Portion Total Maturity by AT&T Inc. Various $1,664,410,714 (a) various various $1,215,774,429 $448,636,285 $1,664,410,714 AT&T Inc. $592,000,000 Zero 11/27/2022 (b) $527,017,731 $0 $527,017,731 AT&T Inc. € 2,250,000,000 Floating 8/3/2020 $2,527,650,000 $0 $2,527,650,000 AT&T Inc. CAD 1,000,000,000 3.825% 11/25/2020 $736,593,989 $0 $736,593,989 AT&T Inc. € 1,000,000,000 1.875% 12/4/2020 $1,123,400,000 $0 $1,123,400,000 AT&T Inc. $1,500,000,000 Floating 6/1/2021 $1,500,000,000 $0 $1,500,000,000 AT&T Inc. $1,500,000,000 Floating 7/15/2021 $0 $1,500,000,000 $1,500,000,000 AT&T Inc. € 1,000,000,000 2.650% 12/17/2021 $0 $1,123,400,000 $1,123,400,000 Michigan Bell Telephone Company $81,390,000 7.850% 1/15/2022 $0 $81,390,000 $81,390,000 AT&T Inc. -

Form 10-K United States Securities and Exchange

FORM 10-K UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 (Mark One) x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2017 OR o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number: 1-8610 AT&T INC. Incorporated under the laws of the State of Delaware I.R.S. Employer Identification Number 43-1301883 208 S. Akard St., Dallas, Texas, 75202 Telephone Number 210-821-4105 Securities registered pursuant to Section 12(b) of the Act: (See attached Schedule A) Securities registered pursuant to Section 12(g) of the Act: None. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ] Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X] Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ] Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). -

Federal Communications Commission DA 01-1563 Before the Federal Communications Commission Washington, D.C. 20554 in the Matter

Federal Communications Commission DA 01-1563 Before the Federal Communications Commission Washington, D.C. 20554 In the Matter of ) ) ) 2001 Annual Access Tariff Filings ) CCB/CPD No. 01-08 ) ) MEMORANDUM OPINION AND ORDER Adopted: July 2, 2001 Released: July 2, 2001 By the Chief, Competitive Pricing Division: I. INTRODUCTION 1. Local exchange carriers (LECs) are required by section 69.3(a) of the Commission’s rules to file annual revisions to their interstate tariffs to become effective July 1, 2001.1 Price cap LECs and LECs subject to rate-of-return regulation filed their tariff transmittals on June 18, 2001, with AT&T filing a petition to suspend and investigate on June 25, 2001.2 On June 29, 2001, certain LECs filed replies to AT&T’s petition.3 2. In this Memorandum Opinion and Order, we suspend for five months and set for investigation the rates for the traffic sensitive basket filed by Moultrie Independent Telephone Company (Moultrie) in its 2001 Annual Access Tariff. We also suspend for one day and set for investigation the following LECs’ 2001 Annual Access Tariffs in the stated areas: 1) ALLTEL Telephone Systems’ (ALLTEL’s) rates for local switching; and 2) Ameritech Operating Companies’ (Ameritech’s), Frontier Telephone of Rochester, Inc.’s (Frontier of Rochester’s), Pacific Bell Telephone Company’s (PacBell’s), Qwest Communications, Inc.’s (Qwest’s), and Sprint Local Telephone Companies-Nevada’s (Sprint Nevada’s) rates for the multi-line business subscriber line charge.4 1 47 C.F.R. § 69.3(a). The filing deadline of July 1, 2001 was modified to July 3, 2001 because of the weekend schedule in June and July 2001 in order to accommodate the filing of tariff revisions under section 204(a)(3) of the Communications Act of 1934, as amended by the Telecommunications Act of 1996.