Annual Report 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Corporate Information

THIS DOCUMENT IS IN DRAFT FORM. THE INFORMATION CONTAINED HEREIN IS INCOMPLETE AND IS SUBJECT TO CHANGE. THIS DOCUMENT MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT. CORPORATE INFORMATION Head Office, Registered Office and No. 177-1, Chuangxin Road Principal Place of Business in the PRC Hunnan District Shenyang Liaoning Province the PRC Principal Place of Business in Hong Kong 40/F, Dah Sing Financial Centre 248 Queen’s Road East Wanchai Hong Kong Company’s Website www.neusoftmedical.com (information on this website does not form part of this Document) Joint Company Secretaries Mr. LI Feng (李峰) No. 177-1, Chuangxin Road Hunnan District Shenyang Liaoning Province the PRC Mr. CHENG Ching Kit (鄭程傑) (ACS, ACG) 40/F, Dah Sing Financial Centre 248 Queen’s Road East Wanchai Hong Kong Authorized Representatives Mr. WU Shaojie (武少傑) No. 177-1, Chuangxin Road Hunnan District Shenyang Liaoning Province the PRC Mr. CHENG Ching Kit (鄭程傑) (ACS, ACG) 40/F, Dah Sing Financial Centre 248 Queen’s Road East Wanchai Hong Kong –91– THIS DOCUMENT IS IN DRAFT FORM. THE INFORMATION CONTAINED HEREIN IS INCOMPLETE AND IS SUBJECT TO CHANGE. THIS DOCUMENT MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT. CORPORATE INFORMATION Audit Committee Dr. YAO Haixin (姚海鑫)(Chairman) Dr. CHOI Koon Shum (蔡冠深) Mr. ZHAO JOHN HUAN (趙令歡) Dr. CHEN LIAN YONG (陳連勇) Dr. FENG Xiaoyuan (馮曉源) Remuneration and Appraisal Committee Dr. FENG Xiaoyuan (馮曉源) (Chairman) Mr. WU Shaojie (武少傑) Dr. CHEN LIAN YONG (陳連勇) Dr. -

China - Peoples Republic Of

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Voluntary - Public Date: 12/21/2010 GAIN Report Number: CH106012 China - Peoples Republic of Post: Guangzhou A Snapshot of Guangdong Wood Market Report Categories: Market Development Reports Approved By: Jorge, Sanchez Prepared By: Ursula Chen Report Highlights: General Information: Industry value In 2005, China surpassed Italy and became the number one exporter of furniture in the world. Total production value exceeded $79 billion in 2007, up 26 percent from $63 billion in 2006. Exports for 2007 were at $23 billion, a 30 at $18 billion. In the province of Guangdong, there are some 2,000 furniture factories. Begun in the 1990’s, Taiwan and Hong Kong furniture makers moved their plants and businesses here, and the province has assumed a leading role in furniture making ever since, known for highest capacity in producing, selling, moving and exporting furniture. It accounted for one-third of the country’s furniture production and almost half of the country’s total export volume. Of the $23 billion export value of the country in 2007, Guangdong furniture took up 44 percent at $9 billion. Guangdong is such an important market for U.S. woods that in 2009, United States exported $523 million worth of woods, mostly coming to South China. United States ranked as second largest sawn wood supplier to China according to China Forestry Research Institute data. Product types Both American logs and lumbers are available in South China and the most popular species are cherry, maple, red oak, white oak, and black walnut. -

SGS-Safeguards 04910- Minimum Wages Increased in Jiangsu -EN-10

SAFEGUARDS SGS CONSUMER TESTING SERVICES CORPORATE SOCIAL RESPONSIILITY SOLUTIONS NO. 049/10 MARCH 2010 MINIMUM WAGES INCREASED IN JIANGSU Jiangsu becomes the first province to raise minimum wages in China in 2010, with an average increase of over 12% effective from 1 February 2010. Since 2008, many local governments have deferred the plan of adjusting minimum wages due to the financial crisis. As economic results are improving, the government of Jiangsu Province has decided to raise the minimum wages. On January 23, 2010, the Department of Human Resources and Social Security of Jiangsu Province declared that the minimum wages in Jiangsu Province would be increased from February 1, 2010 according to Interim Provisions on Minimum Wages of Enterprises in Jiangsu Province and Minimum Wages Standard issued by the central government. Adjustment of minimum wages in Jiangsu Province The minimum wages do not include: Adjusted minimum wages: • Overtime payment; • Monthly minimum wages: • Allowances given for the Areas under the first category (please refer to the table on next page): middle shift, night shift, and 960 yuan/month; work in particular environments Areas under the second category: 790 yuan/month; such as high or low Areas under the third category: 670 yuan/month temperature, underground • Hourly minimum wages: operations, toxicity and other Areas under the first category: 7.8 yuan/hour; potentially harmful Areas under the second category: 6.4 yuan/hour; environments; Areas under the third category: 5.4 yuan/hour. • The welfare prescribed in the laws and regulations. CORPORATE SOCIAL RESPONSIILITY SOLUTIONS NO. 049/10 MARCH 2010 P.2 Hourly minimum wages are calculated on the basis of the announced monthly minimum wages, taking into account: • The basic pension insurance premiums and the basic medical insurance premiums that shall be paid by the employers. -

China Evergrande Group 中國恒大集團

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult your licensed securities dealer, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your securities in China Evergrande Group (中國恒大集團), you should at once hand this circular and the accompanying form of proxy to the purchaser or transferee or to the bank, licensed securities dealer, or other agent through whom the sale or transfer was effected for onward transmission to the purchaser or the transferee. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. CHINA EVERGRANDE GROUP 中 國 恒 大 集 團 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 3333) MAJOR TRANSACTION ACQUISITION OF SHARES IN CHINA VANKE CO. LTD. A letter from the Board is set out on pages 3 to 7 of this circular. 13 January 2017 CONTENTS Page Definitions .......................................................................... 1 Letter from the Board ............................................................... 3 Appendix I — Financial information of the Group ................................ I-1 Appendix II — Financial -

Fu Shou Yuan International Group Limited 福壽園國際集團有限公司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 1448)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. Fu Shou Yuan International Group Limited 福壽園國際集團有限公司 (incorporated in the Cayman Islands with limited liability) (Stock Code: 1448) VOLUNTARY ANNOUNCEMENT STRATEGIC COOPERATION AGREEMENTS This is a voluntary announcement made by Fu Shou Yuan International Group Limited (the “Company”, together with its subsidiaries, the “Group”) for keeping the shareholders of the Company and potential investors informed of the latest business development of the Group. The board of directors (the “Board”) of the Company is pleased to announce that, on December 19, 2014, the Company entered into strategic cooperation agreements with each of the People’s Government of Hunnan District of Shenyang City* (瀋陽市渾南區人民政府)(“Shenyang City Hunnan District Government”) (“Shenyang Strategic Cooperation”) and the People’s Government of Jinzhou City* in Liaoning Province (遼寧省錦州市人民政府)(“Jinzhou City Government”) (“Jinzhou Strategic Cooperation”), in relation to the further development and cooperation in the death care services industry in the respective cities. SHENYANG STRATEGIC COOPERATION Under the Shenyang Strategic Cooperation, among other things, the Shenyang City Hunnan District Government will source potential funeral services development projects for the Company, which they will in return (i) provide due diligence support and feasibility analysis (ii) source investment funding and introduce high-technology funeral equipments and (iii) structure innovative service system, implement the Company’s business objectives and management expertise. -

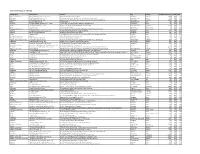

ATTACHMENT 1 Barcode:3800584-02 C-570-107 INV - Investigation

ATTACHMENT 1 Barcode:3800584-02 C-570-107 INV - Investigation - Chinese Producers of Wooden Cabinets and Vanities Company Name Company Information Company Name: A Shipping A Shipping Street Address: Room 1102, No. 288 Building No 4., Wuhua Road, Hongkou City: Shanghai Company Name: AA Cabinetry AA Cabinetry Street Address: Fanzhong Road Minzhong Town City: Zhongshan Company Name: Achiever Import and Export Co., Ltd. Street Address: No. 103 Taihe Road Gaoming Achiever Import And Export Co., City: Foshan Ltd. Country: PRC Phone: 0757-88828138 Company Name: Adornus Cabinetry Street Address: No.1 Man Xing Road Adornus Cabinetry City: Manshan Town, Lingang District Country: PRC Company Name: Aershin Cabinet Street Address: No.88 Xingyuan Avenue City: Rugao Aershin Cabinet Province/State: Jiangsu Country: PRC Phone: 13801858741 Website: http://www.aershin.com/i14470-m28456.htmIS Company Name: Air Sea Transport Street Address: 10F No. 71, Sung Chiang Road Air Sea Transport City: Taipei Country: Taiwan Company Name: All Ways Forwarding (PRe) Co., Ltd. Street Address: No. 268 South Zhongshan Rd. All Ways Forwarding (China) Co., City: Huangpu Ltd. Zip Code: 200010 Country: PRC Company Name: All Ways Logistics International (Asia Pacific) LLC. Street Address: Room 1106, No. 969 South, Zhongshan Road All Ways Logisitcs Asia City: Shanghai Country: PRC Company Name: Allan Street Address: No.188, Fengtai Road City: Hefei Allan Province/State: Anhui Zip Code: 23041 Country: PRC Company Name: Alliance Asia Co Lim Street Address: 2176 Rm100710 F Ho King Ctr No 2 6 Fa Yuen Street Alliance Asia Co Li City: Mongkok Country: PRC Company Name: ALMI Shipping and Logistics Street Address: Room 601 No. -

Vertical Metal F'ile Cabinets

Barcode:3827074-03 C-570-111 INV - Investigation - CHINESE EXPORTERS AND PRODUCERS OF VERTICAL METAL F'ILE CABINETS Best Beaufy Furniture Co., Ltd. Feel Life Co., Ltd. Lianping Industry Zone, Dalingshan Town Room 202, Deweisen Building Dongguan, Guangdon g, 523809 Nanshan District, Shenzhen Tel: +86 769-85623639 1sf ¡ +86 7 55-66867080-8096 Fax: +86 769-85628609 Fax: +86 755-86146992 Email: N/A Email : [email protected] Website: Website : www. feellife. com www. d gbestbeauty. company. weiku. com/ Fujian lvyer Industrial Co., Ltd. Chung \ilah Steel Furniture Factory Co., Yangxia Village, Guhuai Town Lrd. Changle, Fujian, 350207 Block A,7lF Chinaweal Centre Tel: +86 59128881270 414-424 Jaffe Road, Wanchai Fax: +86 59128881315 Hong Kong Email : nancy @flivyer. com Tel: +85 228930378 Website : www. ivyer.net. cnl Fax: +85 228387626 Email: N/A Fuzhou Nu Deco Crafts Co., Ltd. Website : http ://chungwah. com.hk/ 1306 Xinxing Building No. 41, Bayiqi Mid. Road Concept Furniture (Anhui) Co.' Ltd. Fuzhou, Fujian, 350000 Guangde Economic and Technical Tel: +86 591-87814422 Developm ent Zone, Guangde County P¿¡; +86 591-87814424 Anhui, Xuancheng, 242200 Email: [email protected] Tel: 865-636-0131 Website : http :/inu-deco.cnl Fax: 865-636-9882 Email: N/A Fuzhou Yibang Furniture Co., Ltd. Website: N/A No. 85-86 Building Changle Airport Industrial Zone Dong Guan Shing Fai X'urniture Hunan Town, Changle 2nd Industrial Area Fujian, Fuzhou, 350212 Shang Dong Administrative Dist. fsf; +86 591-28637056 Qishi, Dongguan, Guangdong, 523000 Fax: +86 591-22816378 Tel: +86 867592751816 Email: N/A Fax: N/A V/ebsite : htþs ://fi yb. -

Shop Direct Factory List Dec 18

Factory Factory Address Country Sector FTE No. workers % Male % Female ESSENTIAL CLOTHING LTD Akulichala, Sakashhor, Maddha Para, Kaliakor, Gazipur, Bangladesh BANGLADESH Garments 669 55% 45% NANTONG AIKE GARMENTS COMPANY LTD Group 14, Huanchi Village, Jiangan Town, Rugao City, Jaingsu Province, China CHINA Garments 159 22% 78% DEEKAY KNITWEARS LTD SF No. 229, Karaipudhur, Arulpuram, Palladam Road, Tirupur, 641605, Tamil Nadu, India INDIA Garments 129 57% 43% HD4U No. 8, Yijiang Road, Lianhang Economic Development Zone, Haining CHINA Home Textiles 98 45% 55% AIRSPRUNG BEDS LTD Canal Road, Canal Road Industrial Estate, Trowbridge, Wiltshire, BA14 8RQ, United Kingdom UK Furniture 398 83% 17% ASIAN LEATHERS LIMITED Asian House, E. M. Bypass, Kasba, Kolkata, 700017, India INDIA Accessories 978 77% 23% AMAN KNITTINGS LIMITED Nazimnagar, Hemayetpur, Savar, Dhaka, Bangladesh BANGLADESH Garments 1708 60% 30% V K FASHION LTD formerly STYLEWISE LTD Unit 5, 99 Bridge Road, Leicester, LE5 3LD, United Kingdom UK Garments 51 43% 57% AMAN GRAPHIC & DESIGN LTD. Najim Nagar, Hemayetpur, Savar, Dhaka, Bangladesh BANGLADESH Garments 3260 40% 60% WENZHOU SUNRISE INDUSTRIAL CO., LTD. Floor 2, 1 Building Qiangqiang Group, Shanghui Industrial Zone, Louqiao Street, Ouhai, Wenzhou, Zhejiang Province, China CHINA Accessories 716 58% 42% AMAZING EXPORTS CORPORATION - UNIT I Sf No. 105, Valayankadu, P. Vadugapal Ayam Post, Dharapuram Road, Palladam, 541664, India INDIA Garments 490 53% 47% ANDRA JEWELS LTD 7 Clive Avenue, Hastings, East Sussex, TN35 5LD, United Kingdom UK Accessories 68 CAVENDISH UPHOLSTERY LIMITED Mayfield Mill, Briercliffe Road, Chorley Lancashire PR6 0DA, United Kingdom UK Furniture 33 66% 34% FUZHOU BEST ART & CRAFTS CO., LTD No. 3 Building, Lifu Plastic, Nanshanyang Industrial Zone, Baisha Town, Minhou, Fuzhou, China CHINA Homewares 44 41% 59% HUAHONG HOLDING GROUP No. -

Lanzhou-Chongqing Railway Development – Resettlement Action Plan Monitoring Report No

Resettlement Monitoring Report Project Number: 35354 April 2010 PRC: Lanzhou-Chongqing Railway Development – Resettlement Action Plan Monitoring Report No. 1 Prepared by: CIECC Overseas Consulting Co., Ltd Beijing, PRC For: Ministry of Railways This report has been submitted to ADB by the Ministry of Railways and is made publicly available in accordance with ADB’s public communications policy (2005). It does not necessarily reflect the views of ADB. The People’s Republic of China ADB Loan Lanzhou—Chongqing RAILWAY PROJECT EXTERNAL MONITORING & EVALUATION OF RESETTLEMENT ACTION PLAN Report No.1 Prepared by CIECC OVERSEAS CONSULTING CO.,LTD April 2010 Beijing 10 ADB LOAN EXTERNAL Monitoring Report– No. 1 TABLE OF CONTENTS PREFACE 4 OVERVIEW..................................................................................................................................................... 5 1. PROJECT BRIEF DESCRIPTION .......................................................................................................................7 2. PROJECT AND RESETTLEMENT PROGRESS ................................................................................................10 2.1 PROJECT PROGRESS ...............................................................................................................................10 2.2 LAND ACQUISITION, HOUSE DEMOLITION AND RESETTLEMENT PROGRESS..................................................10 3. MONITORING AND EVALUATION .................................................................................................................14 -

W20 Burton Active Factory Report FLA Factory Updates

Burton Active Factory List - May 2019 Category(ies) Factory Name Address City Country Production Workers Female Male Apparel, Outerwear Bacgiang Bgg Garment Corporation 349 # Giap Hai Road # Dinh K Ward Bac Giang Vietnam 3500 80% 20% Outerwear Bin Hai Super Apparel Co.,Ltd. Private Enterprise Park, Bin Hai County, Dong Kan Town,Jiangsu Dong Kan Town China 280 90% 10% Outerwear Bo Hsing Enterprise Co. Ltd. Lot No2 National Way1a Hoa Phu Industrial Zone, Hoa Phu Ward.Long Ho Dist. Vinh Long Vietnam 1949 74% 26% Socks Calzificio Telemaco Srl Via Brentella 9 Trevignano/TV Italy 18 50% 50% Bindings Chongqing Metaline Plastic Co.,Limited 1 South Way, Banqiao Industrial Estate Rongchang District Chong Qing China 50 60% 40% Gloves CPCG International Co., Ltd. Phum Chhok, Khum Kok Rovieng, Sruk Chhoeung Brey Kampong Cham Cambodia 1040 85% 15% Boards Craig's Boards 152 Industrial Parkway Burlington United States 10 10% 90% Hardgood Accessories Dominator Wax 20 Privilege Street, Woonsocket Ri, 02895,Woonsocket,Rhode Island,Usa Woonsocket United States 6 33% 67% Helmets Dongguan Upmost Industrial Co. Ltd. No.268,Yinhebei Road, Xinan Village, Shijie Town Dongguan China 497 47% 53% Helmets Eon Sporting Goods Co Ltd Building A, Qisha Industrial Park, Qisha, Dongguan China 408 45% 55% Boards Freesport Corp 158 Haung Pu Jiang S. Rd. Kunshan Economic And Technical Development Zone Kunshan China 73 35% 65% Hardgood Accessories Fuko Inc. 799-2, Zhongshan Road, Shengan Dist Taichung Taiwan 285 68% 32% Hardgood Accessories G3 Genuine Guide Gear, Inc. 3771 Marine Way,Burnaby,Canada Burnaby Canada 31 26% 74% Apparel, Basic Fleece and Tees Gin-Sovann Fashion Limited Plov Lum, Krom 06, Phum Chres Sangkat Phnom Penh Thmey, Khan Sensok Phnom Penh Cambodia 860 91% 9% Headwear Greatmall Thien Phu Co., Ltd Zone 2 - An Phu - Thuan An \, Binh Duong,Vietnam Binh Duong Vietnam 107 86% 14% Headwear Hangzhou U-Jump Art & Crafts Co Ltd 31 Tangkang Road, Chongxian Street, Yuhang District Hangzhou China 285 80% 20% Basic Fleece and Tees Hialpesa S.A.: Hilanderia De Algodon Peruano S.A Av. -

Table of Codes for Each Court of Each Level

Table of Codes for Each Court of Each Level Corresponding Type Chinese Court Region Court Name Administrative Name Code Code Area Supreme People’s Court 最高人民法院 最高法 Higher People's Court of 北京市高级人民 Beijing 京 110000 1 Beijing Municipality 法院 Municipality No. 1 Intermediate People's 北京市第一中级 京 01 2 Court of Beijing Municipality 人民法院 Shijingshan Shijingshan District People’s 北京市石景山区 京 0107 110107 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Haidian District of Haidian District People’s 北京市海淀区人 京 0108 110108 Beijing 1 Court of Beijing Municipality 民法院 Municipality Mentougou Mentougou District People’s 北京市门头沟区 京 0109 110109 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Changping Changping District People’s 北京市昌平区人 京 0114 110114 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Yanqing County People’s 延庆县人民法院 京 0229 110229 Yanqing County 1 Court No. 2 Intermediate People's 北京市第二中级 京 02 2 Court of Beijing Municipality 人民法院 Dongcheng Dongcheng District People’s 北京市东城区人 京 0101 110101 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Xicheng District Xicheng District People’s 北京市西城区人 京 0102 110102 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Fengtai District of Fengtai District People’s 北京市丰台区人 京 0106 110106 Beijing 1 Court of Beijing Municipality 民法院 Municipality 1 Fangshan District Fangshan District People’s 北京市房山区人 京 0111 110111 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Daxing District of Daxing District People’s 北京市大兴区人 京 0115 -

Supplement of Evolution of Anthropogenic Air Pollutant Emissions in Guangdong Province, China, from 2006 to 2015

Supplement of Atmos. Chem. Phys., 19, 11701–11719, 2019 https://doi.org/10.5194/acp-19-11701-2019-supplement © Author(s) 2019. This work is distributed under the Creative Commons Attribution 4.0 License. Supplement of Evolution of anthropogenic air pollutant emissions in Guangdong Province, China, from 2006 to 2015 Yahui Bian et al. Correspondence to: Zhijiong Huang ([email protected]) and Junyu Zheng ([email protected]) The copyright of individual parts of the supplement might differ from the CC BY 4.0 License. Figure S1. The geographical location of Guangdong Province, China Figure S2. Government-designated industrial relocation parks in Guangdong province. Source: Li and Fung Centre Research (2008) Figure S3. Trends in the air pollutant emissions, per capita GPD, fuel consumption and vehicle population in the (a) PRD (b) NPRD (all the data are normalized to the year 2006). Figure S4. Comparison of emission trends of (a) SO2 (b) NOX (c) PM10 with ground-level/satellite measurements in the GD from 2006 to 2015. (All data are normalized to the year 2006). Figure S5. The spatial patterns of satellite observations in GD during 2006-2015. (a) SO2, (b) NO2, and (c) AOD. Figure S6. Source emission evolutions in the PRD and NPRD for (a)-(b) SO2, (c)-(d) NOX, (e)-(f) PM10, (g)-(h) PM2.5, (i)-(j) VOCs, (k)-(l) CO and (m)-(n) NH3 from 2006 to 2015. The stacked column graphs show the emission contributions by source-category and year (left axle). The point plots show the total annual emissions (right axle). Figure S7.