Menadžment I Poslovna Kriza

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Customer Satisfaction of the Co-Branded Food Products on Croatian Market

Journal of Economics, Business and Management, Vol. 7, No. 4, November 2019 Customer Satisfaction of the Co-branded Food Products on Croatian Market Berislav Andrlic, Anton Devcic, and Mario Hak Abstract—This scientific paper describes the marketing II. SELECTING THE APPROPRIATE PARTNERS AND FOOD impact of co-branding and customer satisfaction on the food CO-BRANDING FORMATION PROCESS market due to it's rapid changing and internal and external marketing environment. New ways of branding strategies and The purpose of co-branding on food market is the selection new model of consumer behavior give rise to new or existing appropriate partners and that represents the first step towards branded food products on the market. Term co-branding is most development of activity. By careful selection, co-branding commonly found in food market as these type of business often negative aspects and risks can be minimized. Compatibility face economic problems operating in certain times or seasons between food brands is extremely important and that must be hence they need the assistance of other services to make their the starting point in the elimination process among potential operating costs relevant. The typical co-branding agreement involves two or more companies acting in cooperation to candidates. Partner selection is made accordingly to associate any of various logos, color schemes, or brand predetermined criteria, depending on the specific aim that identifiers to a specific product that is contractually designated should be accomplished and by the strategy that is to be for this purpose.In order to examine this scientific problem the applied. Just as every individual has his own strengths and following methods were used: analysis, synthesis, induction, weaknesses, so the brands have. -

Značaj Obiteljskog Poduzetništva - Primjer U Republici Hrvatskoj

Značaj obiteljskog poduzetništva - primjer u Republici Hrvatskoj Muratović, Anita Undergraduate thesis / Završni rad 2020 Degree Grantor / Ustanova koja je dodijelila akademski / stručni stupanj: The Polytechnic of Rijeka / Veleučilište u Rijeci Permanent link / Trajna poveznica: https://urn.nsk.hr/urn:nbn:hr:125:637084 Rights / Prava: In copyright Download date / Datum preuzimanja: 2021-10-02 Repository / Repozitorij: Polytechnic of Rijeka Digital Repository - DR PolyRi VELEUČILIŠTE U RIJECI Anita Muratović ZNAČAJ OBITELJSKOG PODUZETNIŠTVA – PRIMJERI U REPUBLICI HRVATSKOJ (završni rad) Rijeka, 2020. VELEUČILIŠTE U RIJECI Poslovni odjel Preddiplomski stručni studij Poduzetništvo RAST I RAZVOJ OBITELJSKOG PODUZETNIŠTVA – PRIMJERI U REPUBLICI HRVATSKOJ (završni rad) MENTOR STUDENT dr. sc. Davor Širola, prof. v.š. Anita Muratović MBS: 2423000087/16 Rijeka, rujan 2020. Sažetak Tijekom godina se više počelo govoriti o obiteljskom poduzetništvu u Hrvatskoj. Tek tijekom zadnjih 10 godina se više pažnje pridaje obiteljskim poduzećima i sve više se danas mladi upoznaju sa samim pojmom i načinom poslovanja obiteljskog poduzeća. Naravno ovakav tip poslovanja zaslužuje više posvećenosti, a da se što manje zanemari. U ovome radu su prikazana obiteljska poduzeća u Hrvatskoj i na koji način su ona postigla uspjeh. Razlika između svjetskih obiteljskih tvrtki i tvrtki u Hrvatskoj i načina na koji oni to prezentiraju. Kako uputiti svoje bližnje u samo poslovanje obiteljskih poduzeća, kako preuzeti poslovanje kasnije i na koji način su to tvrtke u Hrvatskoj -

FIMA Daily Insight

FIMA Daily Insight IN FOCUS - ZAGREB STOCK EXCHANGE January 8, 2013 Stocks on ZSE traded higher today. CROBEX increased 0.24% to ZSE STOCK MARKET 1,808.40 pts while blue chip CROBEX10 gained 0.21% to 1,010.86 pts. CROBEX Last 1.808,4 Regular stock turnover amounted to HRK 14.4 million. % daily 0,24% Integrated telecom HT (HTRA CZ) topped the liquidity board collecting % YTD 3,91% HRK 4.3 million in turnover. The price increased 0.9% to HRK 210.70. CROBEX10 last 1010,9 Fertilizers producer Petrokemija (PTKMRA CZ) also came to focus again % daily 0,21% with HRK 1.5 million in turnover while price gained 5.5% to HRK 240.0. % YTD 4,05% Petrokemija was in investors’ focus few months ago, after speculations on Government selling its share of 1.7 million shares (50.6% of capital). Stock Turnov er (HRK m) 14,37 A few days ago Mladen Pejnović, head of the State Office for State Total MCAP (HRK bn) 194,39 Property Management confirmed government’s plans to privatize Source: w w w .zse.hr Petrokemija. Auto-parts producer AD Plastik (ADPLRA CZ) came to focus trading in -4,0% -2,0% 0,0% 2,0% 4,0% 6,0% blocks. The price advanced 1% to HRK 115.99 on HRK 1.3 million in PTKM-R-A ATPL-R-A turnover. AD Plastik currently trades at P/E=7.7, P/S=0.7 and DDJH-R-A P/Bv=0.7. VPIK-R-A LKPC-R-A Tobacco and tourism Adris group preferred share (ADRSPA CZ) was VIRO-R-A KORF-R-A also in investors’ focus with HRK 0.7 million in turnover while price KNZM-R-A slipped 1.3% to HRK 262.20. -

Memorial of the Republic of Croatia

INTERNATIONAL COURT OF JUSTICE CASE CONCERNING THE APPLICATION OF THE CONVENTION ON THE PREVENTION AND PUNISHMENT OF THE CRIME OF GENOCIDE (CROATIA v. YUGOSLAVIA) MEMORIAL OF THE REPUBLIC OF CROATIA APPENDICES VOLUME 5 1 MARCH 2001 II III Contents Page Appendix 1 Chronology of Events, 1980-2000 1 Appendix 2 Video Tape Transcript 37 Appendix 3 Hate Speech: The Stimulation of Serbian Discontent and Eventual Incitement to Commit Genocide 45 Appendix 4 Testimonies of the Actors (Books and Memoirs) 73 4.1 Veljko Kadijević: “As I see the disintegration – An Army without a State” 4.2 Stipe Mesić: “How Yugoslavia was Brought Down” 4.3 Borisav Jović: “Last Days of the SFRY (Excerpts from a Diary)” Appendix 5a Serb Paramilitary Groups Active in Croatia (1991-95) 119 5b The “21st Volunteer Commando Task Force” of the “RSK Army” 129 Appendix 6 Prison Camps 141 Appendix 7 Damage to Cultural Monuments on Croatian Territory 163 Appendix 8 Personal Continuity, 1991-2001 363 IV APPENDIX 1 CHRONOLOGY OF EVENTS1 ABBREVIATIONS USED IN THE CHRONOLOGY BH Bosnia and Herzegovina CSCE Conference on Security and Co-operation in Europe CK SKJ Centralni komitet Saveza komunista Jugoslavije (Central Committee of the League of Communists of Yugoslavia) EC European Community EU European Union FRY Federal Republic of Yugoslavia HDZ Hrvatska demokratska zajednica (Croatian Democratic Union) HV Hrvatska vojska (Croatian Army) IMF International Monetary Fund JNA Jugoslavenska narodna armija (Yugoslav People’s Army) NAM Non-Aligned Movement NATO North Atlantic Treaty Organisation -

STATISTIČKA ANALIZA POSLOVANJA PODUZEĆA LEDO D.D. ZA RAZDOBLJE OD 2009. DO 2017. GODINE I USPOREDBA S ODABRANIM KONKURENTIM

STATISTIČKA ANALIZA POSLOVANJA PODUZEĆA LEDO d.d. ZA RAZDOBLJE OD 2009. DO 2017. GODINE I USPOREDBA S ODABRANIM KONKURENTIM Bazdarić, Karmen Master's thesis / Diplomski rad 2019 Degree Grantor / Ustanova koja je dodijelila akademski / stručni stupanj: University of Split, Faculty of economics Split / Sveučilište u Splitu, Ekonomski fakultet Permanent link / Trajna poveznica: https://urn.nsk.hr/urn:nbn:hr:124:081488 Rights / Prava: In copyright Download date / Datum preuzimanja: 2021-10-01 Repository / Repozitorij: REFST - Repository of Economics faculty in Split SVEUČILIŠTE U SPLITU EKONOMSKI FAKULTET DIPLOMSKI RAD STATISTIČKA ANALIZA POSLOVANJA PODUZEĆA LEDO d.d. ZA RAZDOBLJE OD 2009. DO 2017. GODINE I USPOREDBA S ODABRANIM KONKURENTIMA Mentor: Student: prof. dr. sc. Elza Jurun Karmen Bazdarić, univ.bacc.oec. Split, svibanj, 2019. SADRŽAJ: 1. UVOD ....... .......................................................................................................... 4 1.1. Problem istraživanja ....................................................................................................... 4 1.2. Predmet istraživanja ....................................................................................................... 4 1.3. Ciljevi istraživanja .......................................................................................................... 6 1.4. Istraživačke hipoteze ....................................................................................................... 6 1.5. Metode istraživanja ........................................................................................................ -

CEE Investment Opportunities: Slovenia & Croatia Investor

CEE investment opportunities: Slovenia & Croatia Investor Day Site visits Monday, 23 May 2016 Slovenia: Krka & Gorenje Timetable: 08:00– 17:15 Krka is among the top generic pharmaceutical companies in the world. Its business is the production and sale of prescription pharmaceuticals, non- prescription products and animal health products. 08:00 Departure from Hotel International (Zagreb) 10:00 Krka tour Gorenje is one of the leading European home 11:00 Departure from Krka appliance manufacturers with a history 13:00 Lunch break spanning more than 60 years. Home 14:00 Gorenje tour appliances under global brands Gorenje and 15:00 Departure from Gorenje Asko and six regional brands (Atag, Pelgrim, Upo, Mora, Etna and Körting) elevate the 17:15 Arrival at Hotel International (Zagreb) quality of life of users in 90 countries worldwide. Croatia: Podravka, Ledo & Atlantic Grupa Timetable: 08:00 – 16:45 Podravka produces the well-known Vegeta, as well as thousands of other products in its diverse catalogue. T h e Podravka brands are recognisable and a favourite in both Croatian and foreign markets. 08:00 Departure from Hotel International (Zagreb) 10:00 Podravka tour Ledo is the largest Croatian producer of 11:00 Departure from Podravka industrial-scale ice cream and the largest 13:00 Lunch break distributor of frozen foods. 14:00 Ledo tour Atlantic Grupa is one of the most dynamic 15:00 Departure from Ledo business systems in the region, with a 15:30 Atlantic Grupa tour significant portion of its business activities in 16:30 Departure from Atlantic Grupa the EU. 16:45 Arrival at Hotel International (Zagreb) For further details, please contact your WOOD sales representative or Karolina Drach-Kowalczyk at [email protected] . -

Porterov Model Pet Sila U Funkciji Analize I Planiranja

Porterov model pet sila u funkciji analize i planiranja Kusanić, Mateja Master's thesis / Specijalistički diplomski stručni 2019 Degree Grantor / Ustanova koja je dodijelila akademski / stručni stupanj: University of Zagreb, Faculty of Economics and Business / Sveučilište u Zagrebu, Ekonomski fakultet Permanent link / Trajna poveznica: https://urn.nsk.hr/urn:nbn:hr:148:995126 Rights / Prava: In copyright Download date / Datum preuzimanja: 2021-09-26 Repository / Repozitorij: REPEFZG - Digital Repository - Faculty of Economcs & Business Zagreb Sveučilište u Zagrebu Ekonomski fakultet – Zagreb Specijalistički diplomski stručni studij Ekonomike poduzetništva PORTEROV MODEL PET SILA U FUNKCIJI ANALIZE I PLANIRANJA Diplomski rad Mateja Kusanić Zagreb, rujan 2019. Sveučilište u Zagrebu Ekonomski fakultet – Zagreb Specijalistički diplomski stručni studij Ekonomike poduzetništva PORTEROV MODEL PET SILA U FUNKCIJI ANALIZE I PLANIRANJA ANALYSIS AND PLANNING BASED ON PORTER'S FIVE FORCES MODEL Diplomski rad Mateja Kusanić, 0067519672 Mentor: Dr. sc. Andrija Sabol Zagreb, rujan 2019. SAŽETAK Današnje tržište je dinamično i turbulentno stoga poduzeća moraju prilagođavati svoje poslovanje promjenama na tržištu kako bi bila uspješnija. Prilikom oblikovanja strategije cilj poduzeća je zauzeti željenu konkurentsku poziciju unutar industrije u kojoj djeluje. Strategija je temelj poslovnog odlučivanja svakog poduzeća jer bez dobrih temelja nema ni uspješnosti. Uspješna strategija mora biti u skladu s organizacijskom okolinom, odnosno njezinom misijom, vizijom i ciljevima. Ciljevi su ono što poduzeće želi postići, a strategija pomaže poduzeću kako to postići. Veoma značajan doprinos razvoju strategije dao je Michael Porter. Njegov model pet konkurentskih sila jedan je od najčešćih alata za identifikaciju glavnih konkurentskih sila na tržištu te procjenu njihove snage i važnosti. Iz tog razloga, Porterov model pet sila opisan je u ovom radu na primjeru poduzeća u industriji prehrambenih proizvoda u Hrvatskoj. -

Domestic Vs International Risk Diversification Possibilities in Southeastern Europe Stock Markets

Sinisa Bogdan, Suzana Baresa, and Zoran Ivanovic. 2016. Domestic vs International Risk Diversification Possibilities in Southeastern Europe Stock Markets. UTMS Journal of Economics 7 (2): 197–208. Preliminary communication (accepted August 27, 2016) DOMESTIC VS INTERNATIONAL RISK DIVERSIFICATION POSSIBILITIES IN SOUTHEASTERN EUROPEAN STOCK MARKETS Sinisa Bogdan Suzana Baresa Zoran Ivanovic1 Abstract Modern portfolio theory is one of the most important investment decision tools in finances. In 1952 Harry Markowitz set the foundations of the Modern portfolio theory, since than this theory was a backbone of many studies that dealt with investment decisions. This research applies mean-variance portfolio optimization on the international Southeastern Europe and domestic Croatian stock market exchange. Aim of this research is to compare risk diversification possibilities on the Southeastern European capital markets and on the Croatian Capital market. By analyzing nine stock market indices in the Southeastern Europe and twenty stocks from Zagreb Stock Exchange in the period of 36 months, results clearly show that internationally diversified portfolios offer better portfolio risk reduction than domestically diversified portfolios. Lowest achieved risk in international portfolio outperformed lowest achieved risk in domestic portfolio. Since risk is lower, returns are also much lower compared to domestic stock portfolios. Results of this research also report that domestic stock portfolios outperformed international portfolios at the risk level equal or higher than 0,97%, for the same risk, domestic portfolios offer greater returns. Keywords: Modern portfolio theory, portfolio optimization, stock portfolio, stock market indices, Zagreb stock exchange. Jel Classification: G11; C61 INTRODUCTION One of the investment theory assumptions is that investors should diversify their portfolios. -

Stoxx® Eu Enlarged Total Market Index

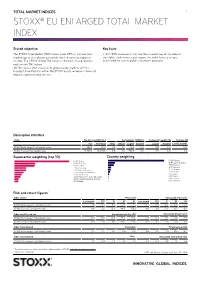

TOTAL MARKET INDICES 1 STOXX® EU ENLARGED TOTAL MARKET INDEX Stated objective Key facts The STOXX Total Market (TMI) Indices cover 95% of the free-float » With 95% coverage of the free-float market cap of the relevant market cap of the relevant investable stock universe by region or investable stock universe per region, the index forms a unique country. The STOXX Global TMI serves as the basis for all regional benchmark for a truly global investment approach and country TMI indices. All TMI indices offer exposure to global equity markets with the broadest diversification within the STOXX equity universe in terms of regions, currencies and sectors. Descriptive statistics Index Market cap (USD bn.) Components (USD bn.) Component weight (%) Turnover (%) Full Free-float Mean Median Largest Smallest Largest Smallest Last 12 months STOXX EU Enlarged Total Market Index 266.7 121.0 0.6 0.1 10.3 0.0 8.5 0.0 N/A STOXX Europe Total Market Index 12,763.5 10,020.5 9.5 2.6 250.9 0.0 2.5 0.0 3.0 Supersector weighting (top 10) Country weighting Risk and return figures1 Index returns Return (%) Annualized return (%) Last month YTD 1Y 3Y 5Y Last month YTD 1Y 3Y 5Y STOXX EU Enlarged Total Market Index 1.2 -3.4 6.4 0.1 1.7 14.7 -4.9 6.3 0.0 0.3 STOXX Europe Total Market Index 0.4 2.0 18.3 44.5 55.2 4.8 2.9 17.9 12.7 8.9 Index volatility and risk Annualized volatility (%) Annualized Sharpe ratio2 STOXX EU Enlarged Total Market Index 15.1 15.0 16.3 23.2 25.3 -0.1 -0.4 0.4 0.0 -0.0 STOXX Europe Total Market Index 11.0 11.1 11.5 20.0 21.6 -0.9 0.3 1.3 0.6 0.4 Index to benchmark Correlation Tracking error (%) STOXX EU Enlarged Total Market Index 0.7 0.7 0.7 0.8 0.9 10.3 10.7 11.9 12.3 12.7 Index to benchmark Beta Annualized information ratio STOXX EU Enlarged Total Market Index 1.0 0.9 1.0 1.0 1.0 0.8 -0.8 -0.8 -1.0 -0.6 1 For information on data calculation, please refer to STOXX calculation reference guide. -

Podravka Inc. Business Results for January – September 2020 Unaudited Content

koprivnica, 29th october 2020 Podravka Inc. business results for January – September 2020 unaudited Content 3 General information 5 Significant events in 1 – 9 2020 7 Operations of Podravka Inc. in conditions of COVID-19 disease 10 Key business highlights of Podravka Inc. in 1 – 9 2020 13 Share in 1 – 9 2020 16 Additional tables for 1 – 9 2020 19 Unconsolidated financial statements for 1 – 9 2020 27 Statement of liability 28 Contact podravka inc. business results for 1 – 9 2020 2 General information podravka inc. business results for 1 – 9 2020 3 General information Podravka prehrambena industrija Inc., Koprivnica, is incorporated in the Republic of Croatia. Today it is included in leading companies in industry operating in the area of South-Eastern, Central and Eastern Europe. The principal activity of the Company comprises production of a wide range of food products. The Company is headquartered in Koprivnica, Croatia, Ante Starčevića 32. The Company’s shares are listed on the Prime market of the Zagreb Stock Exchange. Management Board members as at 30 September 2020 president Marin Pucar member Ljiljana Šapina member Davor Doko member Hrvoje Kolarić member Marko Đerek The unaudited, unconsolidated financial statements have been prepared in accordance with In- ternational Financial Reporting Standards as adopted by the European Union (IFRS). podravka inc. business results for 1 – 9 2020 4 Significant events in 1 – 9 2020 5 podravka inc. business results for 1 – 9 2020 5 Dividend distribution As at 26th June 2020 the dividend was distributed to all shareholders recorded with the Central Depository and Clearing Company Inc. -

9Th - 11Th November 2014 Dubrovnik, Croatia

CENTRAL & SOUTHEAST EUROPEAN CONFERENCE OIL & GAS ARENA 2014 9th - 11th November 2014 Dubrovnik, Croatia www.infoarena.biz CENTRAL & SOUTHEAST EUROPEAN CONFERENCE Oil & Gas Arena 2014 9th - 11th November 2014, Dubrovnik, Croatia CENTRAL & SOUTHEAST EUROPEAN CONFERENCE Oil & Gas Arena 2014 9th - 11th November 2014, Dubrovnik, Croatia With recent developments in energy sector, Cen- tral-East and South-East Europe represent important region for the energy stability of European Union. Central-East Europe holds major oil and gas infra- structure and will stay in the future traditional cross- road for the European energy supply coming from the East. In the same time South-East Europe be- comes more and more important for the European energy sector in terms of alternative energy supply, but also in terms of new potential hydrocarbons re- serves and growth of their production in future. Both regions of Central-East and South-East Europe are also dominated with many small and medium sized national oil companies that play important role of their nation’s energy security. To fulfill this role, all these companies need to operate in a sustainable way and survive in today’s ever changing oil and gas industry. Therefore, many players and their state owners try to find answers for their future in strategic partnerships and joint ventures with bigger oil and gas players. But partnerships are not the only answer, companies also need to find ways to secure sustain- able operations by diversifying oil and gas supply for own market needs and by finding alternative streams of revenue. Central-East and South-East European Oil and Gas Arena 2014 will gather leading thought leaders from the oil and gas industry to show region’s perspective to the above trends with specific outlook for Croatia and neighboring countries. -

Curriculum Vitae

Curriculum vitae Personal information Name and surname Tomislav Kitonić Address Bojana 2, 43240 Čazma Telephone 091 / 238 5775 E-mail [email protected] Date and place of birth 18 September 1972, Bjelovar Work experience 2018 – present Jadran d.d. Bana Jelačića 16, 51260 Crikvenica 2018 – present Chairman of the Supervisory board About the company: the Jadran hotel company provides tourism and hospitality services in nine hotels and tourism complexes, with over 1250 rooms and 2500 beds in hotels, and in camps and campsites with 1700 spots 2015 – 2016 European Bank for Reconstruction and Development (EBRD) One Exchange Square, London EC2A 2JN, United Kingdom 2015 – 2016 Nominee Director for Pestova Shpk Pestova, Vučitrn 42000, Kosovo About the company: production of seed potatoes, growing potatoes for consumption and processing, and sale and distribution of potatoes and potato products (chips, etc.) 2012 – present Moslavina proizvodi d.o.o. Sišćani 31, 43245 Sišćani 2012 – present Co-owner (50%) About the company: production of electrical energy from renewable energy resources / biogas plants Significant investment projects implemented: 2019 Construction of a dairy farm and buildings for the receipt and storage of animal feed (Measure 4.1.1. – 3rd call in the Croatian rural development programme for the period 2015-2020) 2017 Construction of a manure lagoon (Measure 4.1.2. – 1st call in the Croatian rural development programme for the period 2015-2020) 2016 Construction of a 1 MW biogas plant for the production of electrical energy (Bojana II) 2014 Construction of a 1 MW biogas plant for the production of electrical energy (Bojana) 2003 – present Bik d.o.o.