1Q09 Software Industry Equity Report.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Using the SAP Successfactors Adapter with Oracle Integration

Oracle® Cloud Using the SAP SuccessFactors Adapter with Oracle Integration E85521-12 August 2021 Oracle Cloud Using the SAP SuccessFactors Adapter with Oracle Integration, E85521-12 Copyright © 2017, 2021, Oracle and/or its affiliates. Primary Author: Oracle Corporation This software and related documentation are provided under a license agreement containing restrictions on use and disclosure and are protected by intellectual property laws. Except as expressly permitted in your license agreement or allowed by law, you may not use, copy, reproduce, translate, broadcast, modify, license, transmit, distribute, exhibit, perform, publish, or display any part, in any form, or by any means. Reverse engineering, disassembly, or decompilation of this software, unless required by law for interoperability, is prohibited. The information contained herein is subject to change without notice and is not warranted to be error-free. If you find any errors, please report them to us in writing. If this is software or related documentation that is delivered to the U.S. Government or anyone licensing it on behalf of the U.S. Government, then the following notice is applicable: U.S. GOVERNMENT END USERS: Oracle programs (including any operating system, integrated software, any programs embedded, installed or activated on delivered hardware, and modifications of such programs) and Oracle computer documentation or other Oracle data delivered to or accessed by U.S. Government end users are "commercial computer software" or "commercial computer software documentation" -

G-Tec Education Sap Learning

G-TEC EDUCATION ISO 9001:2015 CERTIFIED SAP LEARNING HUB - COURSE LIST SL.NO. COURSE NAME 1 1st Steps in SAP Learning Hub 2 A/R Credit Memos 3 ABAP Details 4 ABAP Development Learning Room 5 ABAP Dialog Prog.Using EnjoySAP Controls 6 ABAP Dictionary 7 ABAP Objects 8 ABAP Programming in Eclipse 9 ABAP Programming with SAP NetWeaver: 1. Start With an Overview 10 ABAP Programming with SAP NetWeaver: 2. Become Competent 11 ABAP Programming with SAP NetWeaver: 3. Stay Current 12 ABAP Workbench Concepts 13 ABAP Workbench Concepts – Part 1 14 ABAP Workbench Concepts – Part 2 15 ABAP Workbench Foundations 16 ABAP Workbench Fundamentals 17 ABAP Workbench Fundamentals – Part 1 18 ABAP Workbench Fundamentals – Part 2 19 Accounting 20 Accounting Customizing II: Special G/L Transactions, Document Parking, Validation & Substitution, Archiving 21 Additional Financial Accounting Configuration in SAP S/4HANA 22 Additional Financial Accounting Configuration in SAPS/4HANA 23 Additional SAP Business One Components 24 Add-On Administration 25 Add-On Certification 26 Add-On Licensing 27 Add-On Packaging 28 Advanced ABAP 29 Advanced ABAP Debugging 30 Advanced Extensibility with SAP Cloud SDK 31 Advanced Extensibility with SAP S/4HANA Cloud SDK 32 Advanced G/L Account Determination 33 Advanced SAP MII (Manufacturing Integration and Intelligence) 34 Advanced SAPUI5 Development G-TEC EDUCATION ISO 9001:2015 CERTIFIED SAP LEARNING HUB - COURSE LIST SL.NO. COURSE NAME 35 Advanced SAPUI5 Development - Exercises 36 Agile Project Delivery 37 Aiging report 38 Alerts -

System Availability Percentage

SERVICE LEVEL AGREEMENT FOR SAP CLOUD SERVICES 1. Service Level Agreement This Service Level Agreement for SAP Cloud Services sets forth the System Availability Service Level Agreement (“SLA”) for the productive version of the applicable SAP Cloud Services to which customer has subscribed (“SAP Cloud Services”) in an Order Form with SAP. This Service Level Agreement for SAP Cloud Services shall not apply to any SAP Cloud Service for which a System Availability SLA is explicitly set forth in the applicable Supplemental Terms and Conditions for such SAP Cloud Service or for which the applicability of the System Availability SLA is explicitly excluded in the Agreement. 2. Definitions “Downtime” means the Total Minutes in the Month during which the productive version of the applicable SAP Cloud Service is not available, except for Excluded Downtimes. “Month” means a calendar month. “Monthly Subscription Fees” means the monthly (or 1/12 of the annual fee) subscription fees paid for the Cloud Service which did not meet the System Availability SLA. “Total Minutes in the Month” are measured 24 hours at 7 days a week during a Month. “UTC” means Coordinated Universal Time standard. 3. System Availability SLA and Credits 3.1 Claim process, Reports Customer may claim a credit in the amount described in the table of Section 3.2 below in case of SAP’s failure to meet the System Availability SLA, which credit Customer may apply to a future invoice relating to the SAP Cloud Service that did not meet the System Availability SLA. Claims under this Service Level Agreement for SAP Cloud Services must be made in good faith and by submitting a support case within thirty (30) business days after the end of the relevant Month in which SAP did not meet the System Availability SLA. -

SAP Global Partner Summit Agenda

SAP Global Partner Summit Agenda Monday, May 6, 2019, Orlando, Florida, USA Orange County Convention Center, West Concourse, Hall F 7:30 a.m. Registration and Breakfast (Expert Demo Stations and Networking Open at 8:00 a.m.) 9:00 a.m. Opening Keynote: Next-Generation Partnerships in an X+O World Adaire Fox-Martin, Member of the Executive Board, SAP SE, Global Customer Operations Karl Fahrbach, Chief Partner Officer, SAP Arlen Shenkman, EVP Global Business Development and Ecosystems, SAP 10:00 a.m. Expert Demo Stations and Networking Breakout Theater 1 Breakout Theater 2 Breakout Theater 3 Breakout Theater 4 Microforum A Microforum B 10:30 a.m. The Intelligent Enterprise: Experience Matters to Your SAP PartnerEdge Accelerate Your Business Direct Integration 10:30 a.m. IBM Delivering Data-Driven Customer’s Customer Digital Experience Growth with SAP Qualified with SAP Solutions Businesses Partner-Packaged Solutions 11:00 a.m. HPE Intel Expert Demo Stations and Networking and Networking Stations Demo Expert 11:30 a.m. Why Experience Matters – The Best Build on SAP Customer Success with The Intelligent Enterprise for Generating Training and 11:30 a.m. Human Experiences Through SAP S/4HANA Cloud SMEs: A Small Company Can Leads Enablement Data-Driven Insights Do Big Things 12:00 p.m. Digital Enablement Microsoft 12:30 a.m. SAP and Partners Deliver Join SAP S/4HANA Movement: The Secrets to Driving More Next-Generation Cloud Partner 12:30 p.m. Tech Data on the Promise of the The First Step to the Intelligent Pipeline and Revenue Customer Experience with Business Valuation Intelligent Enterprise Enterprise SAP C/4HANA 1:00 p.m. -

SAP Customer Experience Implement the New-Generation CRM Using SAP Best Practices

SAP Customer Experience Implement the New-Generation CRM using SAP Best Practices January 2019 PUBLIC Legal disclaimer The information in this presentation is confidential and proprietary to SAP and may not be disclosed without the permission of SAP. This presentation is not subject to your license agreement or any other service or subscription agreement with SAP. SAP has no obligation to pursue any course of business outlined in this document or any related presentation, or to develop or release any functionality mentioned therein. This document, or any related presentation and SAP's strategy and possible future developments, products and or platforms directions and functionality are all subject to change and may be changed by SAP at any time for any reason without notice. The information in this document is not a commitment, promise or legal obligation to deliver any material, code or functionality. This document is provided without a warranty of any kind, either express or implied, including but not limited to, the implied warranties of merchantability, fitness for a particular purpose, or non- infringement. This document is for informational purposes and may not be incorporated into a contract. SAP assumes no responsibility for errors or omissions in this document, except if such damages were caused by SAP´s willful misconduct or gross negligence. All forward-looking statements are subject to various risks and uncertainties that could cause actual results to differ materially from expectations. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates, and they should not be relied upon in making purchasing decisions. -

Authorized Information Technology Schedule Pricelist General Purpose Commercial Information Technology Equipment, Software and Services

AUTHORIZED INFORMATION TECHNOLOGY SCHEDULE PRICELIST GENERAL PURPOSE COMMERCIAL INFORMATION TECHNOLOGY EQUIPMENT, SOFTWARE AND SERVICES SPECIAL ITEM NUMBERS OFFERED: Special Item No. 132-32, 132-33, 132-34, 132-40, 132-51 Note: All non-professional labor categories must be incidental to and used solely to support hardware, software and/or professional services, and cannot be purchased separately. ADVANTAGED SOLUTIONS, INC. 1455 PENNSYLVANIA AVE NW SUITE 800 WASHINGTON, DC 20004-3024 PHONE: 202-204-3083 Pricelist current through Modification #_PS-0066______, dated _02/11/2019_______. Products and ordering information in this Authorized Information Technology Schedule Pricelist are also available on the GSA Advantage! System (http://www.gsaadvantage.gov). General Services Administration Federal Acquisition Service Page 1 of 305 SPECIAL ITEM NUMBER 132-33 and 132-32- Perpetual Software License SubSIN Categorie(s): FSC/PSC Class 7030 ADP SOFTWARE • Ancillary Financial Systems Software • Application Software • Communications Software • Core Financial Mangement Software • Electronic Commerce (EC) Software • Large Scale Computers • Microcomputers • Operating System Software • Special Physical, Visual, Speech, and Hearing Aid Software. Provide specific information. • Utility Software SPECIAL ITEM NUMBER 132-34 Maintenance of Software as a Service SubSIN Categorie(s): FSC/PSC Class J070 MAINT/REPAIR/REBUILD OF EQUIPMENT- ADP EQUIPMENT/SOFTWARE/SUPPLIES/SUPPORT EQUIPMENT • Maintenance of Software SPECIAL ITEM NUMBER 132-40 CLOUD COMPUTING SERVICES -

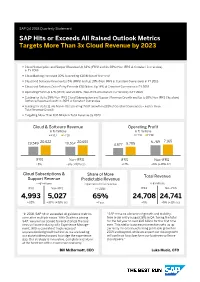

SAP Q4 2018 Quarterly Statement SAP Hits Or Exceeds All Raised Outlook Metrics Targets More Than 3X Cloud Revenue by 2023

SAP Q4 2018 Quarterly Statement SAP Hits or Exceeds All Raised Outlook Metrics Targets More Than 3x Cloud Revenue by 2023 ▪ Cloud Subscription and Support Revenue Up 32% (IFRS) and Up 38% (Non-IFRS at Constant Currencies) in FY 2018 ▪ Cloud Backlog Increased 30%, Exceeding €10 Billion at Year-End ▪ Cloud and Software Revenue Up 5% (IFRS) and Up 10% (Non-IFRS at Constant Currencies) in FY 2018 ▪ Cloud and Software Order Entry Exceeds €10 Billion, Up 14% at Constant Currencies in FY 2018 ▪ Operating Profit Up 17% (IFRS) and Up 10% (Non-IFRS at Constant Currencies) in FY 2018 ▪ Guiding for Up to 39% Non-IFRS Cloud Subscription and Support Revenue Growth and Up to 10% Non-IFRS Cloud and Software Revenue Growth in 2019 at Constant Currencies ▪ Guiding for Up to 11.5% Non-IFRS Operating Profit Growth in 2019 at Constant Currencies – Faster Than Total Revenue Growth ▪ Targeting More Than €35 Billion in Total Revenue by 2023 Cloud & Software Revenue Operating Profit in € millions in € millions FY17 FY18 FY17 FY18 20,622 20,655 6,769 7,165 19,549 19,552 4,877 5,705 IFRS Non-IFRS IFRS Non-IFRS +5% +6% (+10% cc) +17% +6% (+10% cc) Cloud Subscriptions & Share of More Total Revenue Support Revenue Predictable Revenue in € millions in percent of total revenue in € millions IFRS Non-IFRS FY 2018 IFRS Non-IFRS 4,993 5,027 65% 24,708 24,741 +32% +33% (+38% cc) +2 p.p. +5% +5% (+11% cc) “In 2018, SAP hit or exceeded all guidance metrics “SAP remains a beacon of growth and stability. -

SAP Group Entities Effective Date: May 25, 2021

SAP Group Entities Effective Date: May 25, 2021 REGION ENTITY COUNTRY GROUP ENTITY NAME APJ Australia Emarsys Emarsys Pty Ltd APJ Australia Qualtrics QAL Technologies Pty Ltd APJ Australia SAP SAP Australia Pty Ltd APJ Australia SAP Concur Concur Technologies (Australia) Pty. Limited APJ India SAP SAP India Private Limited APJ India SAP SAP Labs India Private Limited APJ India SAP Ariba Ariba India Private Limited APJ India SAP Ariba Ariba Technologies India Private Limited APJ India SAP Concur ClearTrip Private Limited APJ India SAP Concur Concur Technologies (India) Private Limited APJ India SAP Concur TRX Technologies India Private Limited APJ India SAP Sybase Sybase Software (India) Private Limited APJ Indonesia SAP PT SAP Indonesia APJ Japan Qualtrics Qualtrics Japan LLC APJ Japan SAP SAP Japan Co., Ltd. APJ Japan SAP Ariba Nihon Ariba K.K. APJ Japan SAP Concur Concur (Japan) Ltd. APJ Korea, South SAP SAP Korea Ltd. REGION ENTITY COUNTRY GROUP ENTITY NAME APJ Korea, South SAP SAP Labs Korea, Inc. APJ Malaysia SAP SAP Malaysia Sdn. Bhd. APJ Malaysia SAP Concur CNQR Operations Mexico S. de. R.L. de. C.V. APJ Myanmar SAP SAP System Application and Products Asia Myanmar Limited APJ New Zealand SAP SAP New Zealand Limited APJ Philippines SAP SAP Philippines, Inc. APJ Philippines SAP SuccessFactors SuccessFactors (Philippines), Inc. APJ Singapore Emarsys Emarsys Pte Ltd APJ Singapore Qualtrics QSL Technologies Pte. Ltd. APJ Singapore SAP SAP Asia Pte Ltd APJ Singapore SAP Ariba Ariba International Singapore Pte Ltd APJ Singapore SAP Concur Concur Technologies (Singapore) Pte Ltd APJ Taiwan, China SAP SAP Taiwan Co., Ltd. -

Sap Agm 2017

Annual General Meeting of Shareholders – May 10, 2017 CEO Speech – Bill McDermott The spoken word applies Guten Morgen Meine Damen und Herren. Willkommen in der SAP Arena. The video message you just watched tells a powerful story. Michael Dell built one of the most significant companies in the world. Now he is reinventing his company for the 21st century with SAP. For more than 350,000 customers in 193 countries, SAP is THE trusted innovator. As you will hear in my remarks today, SAP has never been a stronger company. We have never been more dedicated to serving our customers or creating value for our shareholders. From this position of immense strength, we will discuss the very bright future of SAP. This is especially important when you consider our unique past. SAP’s distinguished Chairman, Hasso Plattner, is a once-in-a-generation innovator. Together with his co-founders, he gave us a legacy of excellence that we work to honor each and every day. To help carry that legacy forward, I proudly welcome Adaire Fox-Martin and Jennifer Morgan to the Executive Board of SAP. Congratulations Adaire and Jen. -------- Dear Chairman, Dear Supervisory Board members, thank you for your continued confidence and support. Nothing that we achieve would be possible without SAP’s 85,571 employees. Please join me in thanking them for their outstanding work. (Applause) 1 Now let’s discuss our past, present and future. SAP’s record of success: 2010 – present I’ll begin by looking back. In 2010, we set out to make SAP the world’s most innovative growth company. -

SAP Successfactors Employee Central: the Comprehensive Guide 741 Pages, 2017, $89.95 ISBN 978-1-4932-1582-9

First-hand knowledge. Reading Sample Foundation objects are categories or structures for listings of data that are set up to be used across an entire company. This chapter will walk you through overviews, configuration, creation, and extension. “Foundation Objects” Contents Index The Authors Luke Marson, Murali Mazhavanchery, and Rebecca Murray SAP SuccessFactors Employee Central: The Comprehensive Guide 741 Pages, 2017, $89.95 ISBN 978-1-4932-1582-9 www.sap-press.com/4480 Chapter 7 Foundation Objects Foundation Objects are the building blocks of employee records within Employee Central. By creating a listing of data values from which to populate employee records, we are assured standardized data that is consistent and reportable. 7 Valid, consistent, and organized data is an absolute must for any organization look- ing to execute meaningful reports and simplify data entry processes. Having set val- ues to choose from when populating a field provides consistency. Organizing these set values and giving them characteristics of their own takes this process further. In Employee Central, we accomplish this task by utilizing Foundation Objects. In this chapter, we’ll introduce you to the Employee Central Foundation Objects, beginning by walking through an overview of key terms and differences between reg- ular Foundation Objects and MDF Foundation Objects (see Section 7.1). In Section 7.2, we’ll dive into the different categories to define Foundation Objects. Then, in Section 7.3, we’ll see how Foundation Objects work together through the use of associations and propagation. Section 7.4 will walk through the configuration of Foundation Ob- jects before we finally move on to the creation and extension processes in Section 7.5 and Section 7.6, respectively. -

Innovations in Professional Services Firms Engaged in Outsourcing of IT Services by Shridhar Waman Kulkarni

Innovations in Professional Services Firms engaged in outsourcing of IT Services by Shridhar Waman Kulkarni Submitted to the System Design and Management Program in partial fulfillment of the requirements for the degree of ARCHIVES Master of Science in Engineering and Management MASSACHUSETTS INSTITUTE at the OF TECHNOLOGY Massachusetts Institute of Technology SEP 2 3 2009 May 2009 LIBRARIES C Shridhar Kulkarni, 2009. All rights reserved. The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or in part. Signature of Author Shridhar W. Kulkarni System Design and Management Program May 2009 Certified by • I, / Dean P. Briggs Thesis Supervisor Program recto -Next Generation Stiitervices System, IS&T, MIT Accepted by ______ _____ ,..'£.y.Patrick Hale Director System Design and Management Program 1 of 128 / I Innovations in Professional Services Firms engaged in outsourcing of IT Services by Shridhar Waman Kulkarni Submitted to the System Design and Management Program in partial fulfillment of the requirements for the degree of Master of Science in Engineering and Management at the Massachusetts Institute of Technology Abstract The objective of this thesis is to understand the unique features of Professional Services Firms and the challenges associated with effective knowledge management in these firms. A framework is developed to analyze innovations in this industry, based on: type and process of innovation, readiness of the firm for the innovation, alignment criteria, and the effect of the marketplace. Many firms are attempting to implement a Web 2.0-based knowledge management tool to institutionalize the knowledge of their employees. -

SAP Capital Markets Day 2019 Presentation

Welcome to SAP Capital Markets Day 2019 Luka Mucic Bill McDermott Chief Financial Officer Chief Executive Officer Executive Board Member Rob Enslin Christian Klein President, Cloud Business Group Chief Operating Officer Executive Board Member Executive Board Member Jennifer Morgan President, Global Customer Operations Juergen Mueller Americas & Asia Pacific Japan Chief Technology Officer Executive Board Member Executive Board Member Alex Atzberger President, SAP Customer Experience © 2019 SAP SE or an SAP affiliate company. All rights reserved. ǀ PUBLIC 1 Agenda 09:30 – 09:35 am Welcome Stefan Gruber, Head of Investor Relations 09:35 – 10:05 am Strategy and Vision: Opportunity in Time of Disruption Bill McDermott, CEO 10:05 – 10:30 am Delivering the Intelligent Enterprise Christian Klein and Juergen Mueller, Executive Board Members 10:30 – 10:45 am Break 10:45 – 11:15 am SAP C/4HANA Shaking up CRM Alex Atzberger, President SAP Customer Experience 11:15 – 11:45 am Customer Perspective Hosted by Jennifer Morgan, Executive Board Member 11:45 am – 12:10 pm Charting the Course for 2023 Luka Mucic, CFO and Executive Board Member 12:10 – 12:55 pm Q&A 12:55 – 2:00 pm Buffet Lunch Reception 02:15 – 03:45 pm Breakout Sessions 03:45 – 04:30 pm Coffee and Networking © 2019 SAP SE or an SAP affiliate company. All rights reserved. ǀ PUBLIC 3 Safe Harbour Statement Any statements contained in this document that are not historical facts are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “project,” “predict,” “should” and “will” and similar expressions as they relate to SAP are intended to identify such forward-looking statements.