Compass Look of Success 2011

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

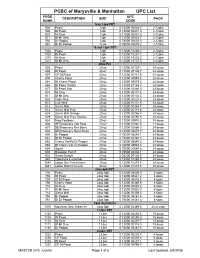

MASTER UPC June08

PCBC of Marysville & Manhattan UPC List PROD UPC DESCRIPTION SIZE PACK NUMB CODE 12oz 12pk PET 502 Pepsi 12pk 0 12000 00830 6 2-12pks 503 Dt Pepsi 12pk 0 12000 00831 3 2-12pks 510 Mt Dew 12pk 0 12000 00832 0 2-12pks 511 Dt Mt Dew 12pk 0 12000 00833 7 2-12pks 550 Dr Pepper 12pk 0 78000 00602 5 2-12pks 551 Dt Dr Pepper 12 pk 0 78000 00603 2 2-12pks 16.9oz 12pk PET 1302 Pepsi 12pk 0 12000 10200 4 2-12pks 1303 Dt Pepsi 12pk 0 12000 10201 1 2-12pks 1310 Mt Dew 12pk 0 12000 10203 5 2-12pks 1311 Dt Mt Dew 12pk 0 12000 10737 5 2-12pks 20oz Pet 602 Pepsi 20 oz 0 12000 00129 1 24 loose 603 Dt Pepsi 20 oz 0 12000 00130 7 24 loose 607 CF Dt Pepsi 20 oz 0 12000 00121 5 24 loose 690 Cherry Pepsi 20 oz 0 12000 00559 6 24 loose 691 Dt Cherry Pepsi 20 oz 0 12000 00579 4 24 loose 686 Dt Pepsi Vanilla 20 oz 0 12000 81189 0 24 loose 677 Dt Pepsi Max 20 oz 0 12000 01880 0 24 loose 610 Mt Dew 20 oz 0 12000 00131 4 24 loose 611 Dt Mt Dew 20 oz 0 12000 00134 5 24 loose 692 Code Red 20 oz 0 12000 00224 3 24 loose 618 Live Wire 20 oz 0 12000 81131 9 24 loose 613 Sierra Mist 20 oz 0 12000 00354 7 24 loose 612 Sierra Mist Free 20 oz 0 12000 20115 8 24 loose 628 Sierra Mist Orange 20 oz 0 12000 02786 4 24 loose 629 Sierra Mist Free Orange 20 oz 0 12000 02794 9 24 loose 634 Mug Rootbeer 20 oz 0 12000 00910 5 24 loose 636 DEWmocracy Volt Rasp 20 oz 0 12000 02862 5 24 loose 637 DEWmocracy Rev Berry 20 oz 0 12000 02866 3 24 loose 638 DEWmocracy Nova Straw 20 oz 0 12000 02870 0 24 loose 650 Dr Pepper 20 oz 0 78000 08240 1 24 loose 651 Dt Dr Pepper 20 oz 0 78000 08340 -

Cooler of Choice Flyer V2gj

The Cooler of Choice Program for * Free Cooler Refill Earn up to $200 Rebate in Products* on Bottle and Can Case Purchases made January 1, 2016 - December 31, 2016 To discover more about PepsiCo’s powerful portfolio of beverages, support services and cooler service plans, contact: Kuntesh Chokshi 972-567-5421 [email protected] www.pepsico.com Right Brands Right Size Right Flavors Right Planogram Helps Grow Revenue & Profits Serving the right beverages to your guests requires a complex web of interlocking distribution systems, and ever- shifting logistics. PepsiCo eliminates bottlenecks and ensures that the right choice of products arrive at your hotel as quickly and efficiently as possible. - Aggressive pricing - Free installation of branded pantry Pepsi cooler - Equipment service plan - Dedicated planning, consulting and support services - Powerful portfolio of beverage options including: Pepsi, Diet Pepsi, Pepsi MAX, Aquafina, Mountain Dew, Sierra Mist, SoBe, Gatorade, Ocean Spray juices, as well as Lipton and Starbucks ready-to-drink iced teas and coffees. * Terms, conditions and restrictions apply. The first 250 AAHOA franchisee properties to enroll in the PepsiCo beverage program will earn free cooler refill – up to $200.00 in PepsiCo products for the property. All Pepsi case purchases / product purchases must be purchased via Pepsi bottler and delivered via (DSD) and all other sources of distribution are not eligible for $200 of PepsiCo products refill. Free refills up to $200 will be issued 180 days after the first invoice and eligible property meeting the monthly ordering criteria of Pepsi. A completed W9 form is required from your property in order to qualify to receive the rebate. -

Nr. ALT Art.-Nr NEU Artikel Bezeichnung Aqua Top

Marken- Art.-Nr. Art.-Nr Artikel bezeichnung ALT NEU Bezeichnung Aqua Top 758 17632 AquaTop Zitrone PEC20x050 Bionade 3160 163 Bionade Joh.-Rosm. 12x033 Bionade 3166 8171 Bionade Zit.-Berga.24x033 Bionade 3167 7763 Bionade Streuobst 24x033 Bionade 3180 214 Bionade Kraeuter 24x033 Bionade 3182 6480 Bionade Litschi 24x033 Bionade 3183 6479 Bionade Holunder 24x033 Bionade 3184 6481 Bionade Ingwer-Oran24x033 Coca-Cola 482 215 CC Cola MW 20x050 Coca-Cola 484 207 CC Cola Light MW 20x050 Coca-Cola 494 1517 CC Coke Zero MW 20x050 Coca-Cola 504 219 CC Cola Light MW 24x033 Coca-Cola 505 450237 Mezzo Mix MW 24x033 Coca-Cola 506 450337 Sprite 24x033 Coca-Cola 507 870 CC Cola Automat-Fl.24x033 Coca-Cola 508 863 Fanta Orange 24x033 Coca-Cola 531 216 CC Cola PET 12x100 Coca-Cola 532 450197 Fanta Orange PET 12x100 Coca-Cola 533 542 Mezzo Mix PET 12x100 Coca-Cola 534 1279 Sprite PET 12x100 Coca-Cola 535 450098 CC Cola Light PET 12x100 Coca-Cola 546 820 CC Cola MW 24x020 Coca-Cola 569 450532 CC Coke Zero PET 12x100 Coca-Cola 591 450537 CC Coke Zero MW 24x033 Coca-Cola 785 11816 CC Cola PEC 12x050 Coca-Cola 786 11818 CC Cola Light PEC 12x050 Coca-Cola 787 11817 CC Coke Zero PEC 12x050 Coca-Cola 788 11820 Fanta Orange PEC 12x050 Coca-Cola 789 11821 Mezzo Mix PEC 12x050 Coca-Cola 790 8957 Sprite PEC 12x050 Coca-Cola 3606 796 CC Cola Light 24x020 Coca-Cola 5374 2623 CC Cola 20L POM BiB Coca-Cola 5375 2620 CC Cola Light 10L POM BiB Coca-Cola 5376 4445 CC Coke Zero 10L POM BiB Coca-Cola 5377 2617 Fanta 10L POM BiB Coca-Cola 5378 2616 Sprite 10L POM BiB Coca-Cola 5379 450619 Lift Apfelsch. -

Soft Drinks Pepsi Max Diet Pepsi Lemonade Orange Juice

Soft Drinks Fruit Shoots: 275ml Pepsi Max Blackcurrant or Orange Diet Pepsi Schwepps Tonic 125ml Lemonade Schwepps Diet Tonic 125ml Orange Juice & Lemonade Schwepps Ginger Ale 125ml Draught Orange Juice Schwepps Bitter Lemon 125ml Lime and Soda Schwepps Pineapple 200ml Blackcurrant and Soda Fevertree Elderflower Tonic Water 200ml Folkingtons Juices: 250ml Fentimans Non Alcoholic Ginger beer 275ml Apple, Cranberry, Elderflower, Orange, Tomato, Coke 330ml Mango, Pink Lemonade, Summer Berry Diet Coke 330ml J20 Juices: 275ml Coke Zero 330ml Apple & Mango, Orange & Passion Fruit Appletizer 275ml RedBull 250ml Beers On Tap Harvey's Best Mineral Water Guest Ales Still 330 ml Amstel Still 750 ml Birra Moretti Sparkling 330 ml Heineken Extra Cold Sparkling 750ml Guinness Super Chilled Bottled Beer Ciders Desperado Strongbow Cloudy Apple Peroni Orchard Thieves Corona Old Mout Fruit Cider 500ml Heineken 0.0% Harveys IPA Gin Crabbies Ginger beer Bombay Sapphire Sipsmith Rum Brighton Gin Bacardi Ungava (Canadian Gin) Malibu Hendrick’s Havana Club 3 Tanqueray 10 Captain Morgan Spiced Harley House Pure Sussex Gin Sailor Jerry Spiced Ableworths Bath Tub Gin The Kraken Dark Spiced Havana Club 7 Whisky Jack Daniel’s Brandy Bell’s Scotch Courvoisier Southern Comfort Three Barrels VSOP Jim Beam Rémy Martin Jameson Hennessy Red Stag Cherry Jack Daniel’s Honey The Best of the Rest Drambuie Aperol Gentleman Jack Archers Glenmorangie 10yr Campari Glenfiddich 12yr Disaronno Coffee Cazcabel Vodka Honey Cazcabel Smirnoff Jose Cuervo Tequila Gold Especial Absolute Raspberry Jose Cuervo Tequila Tradicional Silver Absolute Cherry Jägermeister Ciroc Pineapple Sambuca White / Black Tia Maria 50ml Port Thunder Taylor’s Late Bottled Vintage Port 50ml Tuaca Cockburns Fine Ruby Port 50ml Cointreau Tio Pepe Palomino Fino 50ml Grand Marnier Stones Ginger wine 50ml Sherry Baileys 50ml Cuesta Cream Sherry 50ml Cinzano Bianco 50ml Cuesta Blend of Amontillado Medium Dry Sherry 50ml Martini Dry / Rosso 50ml Pimm’s Original / Strawberry / Blackcurrant 50ml Chambord . -

Need to Adhere to School Vending Regulations? A

Q: Do any other facilities(besides Mack Pool) need to adhere to school vending regulations? A: No Q: Will any preference be given to proposals that propose adhering to school regulations for the other facilities? A: There is no specific evaluation criteria written in the RFP to provide preference to proposals that include this however this is something that we will take into consideration when reviewing proposals. Q: Is there a deposit or good faith fee required with the RFP? A: No. There is no upfront deposit or costs required for submitting an RFP. Q: What is the full service vending volume for all vending machines? A: We sold a total of 170 cases in 2012 with the following breakdown: Aquafina 37 Mt Dew 30 Mt Dew Dt 0 Pepsi 27 Pepsi Dt 24 Pepsi Max 7 Pepsi Next 2 Pepsi WildCherry 8 Sierra Mist 0 Sierra Mist Natural LL 0 Gatorade Blue Raz 8 Gatorade Fierce Grape 5 Gatorade Fruit Punch 4 Gatorade G2 Fruit Punch 5 Gatorade Glcr Frz 7 Gatorade Lemon Lime 5 Gatorade Orange 3 20oz 24P 35 Q: Please provide a breakdown between cans vs. bottles of soda/ice tea/lemonade sold. A: All unit sales are for bottles of soda/ice tea/lemonade. Q: Is Veterans Memorial Ice Arena open year round? A: No. Veterans Memorial Ice Arena is open from Mid September – Mid May. Q: Is the bag in the box volume numbers accurate? Can you please double check the numbers? A: The volume numbers listed in the RFP are taken from invoices received and paid for the 2012 season. -

Bristol-Products.Pdf

Dowser Pure 24/20oz Sport 24/25oz Pure 12/1 LTR Seltzer 24/20oz Dowser Pure 24/16.9oz Aquafina Water 24/20oz 15/1 LTR Aquafina Splash 24/20oz Pepsi Cola Grape / Wild Berry O.N.E. Coconut Water of Bristol 12/16.9oz Guava / Mango / Pineapple / Regular “Your Total Beverage Company” 12/1L Plain SoBe Life Water 12/20oz Pepsi Cola Pomegranate Cherry / Strawberry Kiwi / Pacific Coconut Water of Bristol O Calorie SoBe Life Water Fuji Apple Pear / YumBerry Pom / Black & Blue Berry / Strawberry “Your Total DragonFruit / Acai Raspberry / Blood Orange / Cherimoya Kiwi Beverage Company” Gatorade 24/20oz Fruit Punch / Glacier Freeze/ Lemon Lime / Orange / Fierce Grape / Cool Blue / Riptide Rush G2 Fruit Punch / G2 Grape 15/28oz Lemon Lime / Fruit Punch / Cool Blue / Orange / Frost Glacier Freeze / Frost Glacier Cherry / Fierce Grape / Lime Cucumber / Fierce Strawber- ry / Fierce Blue Cherry / Strawberry Lemonade / Fierce Melon / Fierce Green Apple / Citrus Cooler / Frost Riptide Rush / AM Tropical Man- go / Tangerine / Fierce Fruit Punch & Berry / G2 Fruit Punch / G2 Grape 24/24oz Sportcap Pepsi Fruit Punch / Cool Blue / Lemon Lime Waters 8/64oz Juice Fruit Punch / Orange / Lemon Lime Lipton Teas Every fountain need available including juices Energy Drinks Coffee www.PepsiColaofBristol.com 110 Corporate Drive Southington, CT 06489 Phone (860) 628-8200 Fax (860) 628-0822 www.PepsiColaofBristol.com PRICES EFFECTIVE 1/26/15 24/12oz Can Pure Leaf Mountain Dew AMP Pepsi / Diet Pepsi / CF Pepsi / Diet CF Pepsi / 12/18.5oz Bottles 12/16oz Cans Wild Cherry / Diet Pepsi Lime / Pepsi Throw- Sweet Lemon / Sweet no Lemon / Boost Original / Boost SF / back / Diet Wild Cherry / Pepsi Max / Mtn Dew / Raspberry / Unsweetened No Lem- Boost Grape / Focus Mixed Diet Mtn Dew / Code Red / Mtn Dew Whiteout / Berry / Boost Cherry Sierra Mist / Dt Sierra Mist / Mug Root Beer / on / Peach / Diet Peach / Diet Lem- Diet Mug Root Beer / Dr Pepper / Dt. -

Making Pepsi Max the Choice of a New Generation Once Again 2013- Present

Making Pepsi Max the choice of a new generation once again 2013- present Marketing Society Awards 2016: Long Term Marketing Excellence SUMMARY After years of heavy discounting and adapting big American TVCs,in 2012 Pepsi Max had lost relevance to the primary consumer (18 – 34s)1 and become the “Poor man’s Coke.” Coke on the other hand was a behemoth. Sales of single serve formats of regular Coca-Cola alone were 1.5 times bigger than the entire Pepsi Max cola business,2 and it had all of the benefits of being the market leader; bigger distribution3, four times the media spend4, nearly three times as many loyal buyers5 – and the virtuous circle of success being so big creates. This is a story about Pepsi’s transformational journey over the past three years to better engage with Millennials to surpass growth targets in a static cola market. This journey began with the brand boldly redirecting marketing spend away from the traditional TV advertising model to a content led approach to better engage with Millennials via the sugar free Pepsi Max brand. We’l tell the story of our creative marketing and investment decisions that encouraged Millennials to choose Pepsi Max as its cola for a new generation in the UK, creating the most subscribed to FMCG brand on Youtube and over the last three years, help defy a flat and mature category by creating an additional £76m in additional sales in the off-trade6 and Pepsi Max, our hero content brand, contributing £54m. BACKGROUND Cast your mind back to the 80s and 90s. -

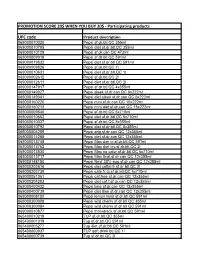

Participating Products UPC Code

PROMOTION SCORE 20$ WHEN YOU BUY 20$ - Participating products UPC code Product description 069000010020 Pepsi sf.dr.btl.QC 355ml 069000010785 Pepsi diet sf.dr.btl.QC 355ml 069000010129 Pepsi sf.dr.can.QC 473ml 069000009918 Pepsi sf.dr.btl.QC 591ml 069000019832 Pepsi diet sf.dr.btl.QC 591ml 069000009826 Pepsi sf.dr.btl.QC 1l 069000010631 Pepsi diet sf.dr.btl.QC 1l 069000002612 Pepsi sf.dr.btl.QC 2l 069000012611 Pepsi diet sf.dr.btl.QC 2l 069000147917 Pepsi sf.dr.btl.QC 4x355ml 069000149027 Pepsi sleek sf.dr.can.QC 6x222ml 069000149041 Pepsi diet sleek sf.dr.can.QC 6x222ml 069000160220 Pepsi mini sf.dr.can QC 15x222ml 069000160213 Pepsi mini diet sf.dr.can QC 15x222ml 069000009840 Pepsi sf.dr.btl.QC 6x710ml 069000010662 Pepsi diet sf.dr.btl.QC 6x710ml 069000010037 Pepsi sf.dr.btl.QC 8x355ml 069000010792 Pepsi diet sf.dr.btl.QC 8x355ml 069000004289 Pepsi orig.sf.dr.can QC 12x355ml 069000014288 Pepsi diet sf.dr.can QC 12x355ml 069000013748 Pepsi Max diet in.sf.dr.btl.QC 591ml 069000013762 Pepsi Max diet inv.sf.dr.btl.QC 2l 069000013830 Pepsi Max no calor.sf.dr.btl.QC 6x710ml 069000013717 Pepsi Max 0cal.sf.dr.can QC 12x355ml 069000148150 Pepsi Next 30%-sug.sf.dr.can QC 12x355ml 069000202616 Pepsi diet caffei.fr.sf.dr.btl.QC 2l 069000202739 Pepsi cafe.fr.di.sf.dr.btl.QC 6x710ml 069000051061 Pepsi caf.free sf.dr.can QC 12x355ml 069000204283 Pepsi diet caf.f.sf.dr.can QC 12x355ml 069000400432 Pepsi lime sf.dr.can QC 12x355ml 069000400739 Pepsi diet lime sf.dr.can QC 12x355ml 069000008102 Pepsi lemon twist sf.dr.btl.QC 591ml 069000300008 Pepsi -

Detailed List of Participating Products Pdf / 90.1 KB

Full list of participating products: DARE CARAMEL LATTE_500ML DARE DBL ESP NO ADDED SUGAR_500ML DARE DBL ESP NO ADDED SUGAR_500ML DARE DOUBLE ESPRESSO_500ML DARE DOUBLE ESPRESSO_500ML DARE ESPRESSO COFFEE_500ML DARE ESPRESSO ICED COFFEE_500ML DARE ICED COFFEE MOCHA_500ML DARE ICED COFFEE MOCHA_500ML DARE PEANUT BUTTER LATTE_500ML DARE TRIPLE ESPRESSO_500ML DARE TRIPLE ESPRESSO_500ML DARE VANILLA LATTE_500ML DARE VANILLA LATTE_500ML FRU_V BLUE_330ML FRU_V GREEN_330ML FRU_V SUGAR FREE_330ML G ACTIVE BERRY_600ML G ACTIVE GRAPE_600ML G ACTIVE MANGO_600ML GATORADE ARCTIC BLITZ_600ML GATORADE BERRY NO SUGAR_600ML GATORADE BLUE BOLT_600ML GATORADE FIERCE GRAPE_600ML GATORADE GLACIER FREEZE NO SGR_600ML GATORADE LEMON LIME_600ML GATORADE MANGO SLAM_600ML GATORADE ORANGE ICE_600ML GATORADE ORANGE NO SUGAR_600ML GATORADE STRAWBERRY_600ML GATORADE TIGER LIME_600ML GATORADE WATERMELON CHILL_600ML LEMONADE ZERO SUGAR_600ML MOUNTAIN DEW ENERGISED_600ML MOUNTAIN DEW NO SUGAR_600ML PEPSI MAX MANGO_600ML PEPSI MAX VANILLA_600ML PEPSI MAX_600ML PEPSI_600ML SCHWEPPES LEMONADE_600ML SCHWEPPES TRAD BRWN CRMY SODA_600ML SCHWEPPES TRAD RASPBERRY_600ML SCHWEPPES TRAD RED CRMY SODA_600ML SOLO LEMON_600ML SOLO ZERO SUGAR_600ML SUNKIST NO SUGAR_600ML SUNKIST_600ML WBC_COFFEE SML_237ML 4N20 SAUSAGE ROLL CH BAC KING S_180G 4N20 SAUSAGE ROLL HALAL_180G 4N20 SAUSAGE ROLL KING SIZE_180G CADBURY CURLY WURLY MEDIUM BAG_110G CADBURY FLAKE BITES MEDIUM BAG_150G EUROPE SUMMER ROLL BITESIZE_135G CADBURY TWIRL BITES_135G CAD TWIRL MINT BITES_135G CADBURY TWIRL CARAMILK BITES_110G -

Table of Beverage Acidity (Ph Values Are Excerpted from Research Published in the Journal of the Americal Dental Association, 2016

Table of Beverage Acidity (pH values are excerpted from research published in the Journal of the Americal Dental Association, 2016. Other research sources may give slightly different pH values but erosiveness categories are similar.) Sodas Extremely Erosive pH below 3.0 7UP Cherry 2.98 Canada Dry Ginger Ale 2.82 Coco-Cola Caffeine Free 2.34 Coca-Cola Cherry 2.38 Coca-Cola Classic 2.37 Coco-Cola Zero 2.96 Dr. Pepper 2.88 Hawaiian Punch 2.87 Pepsi 2.39 Pepsi Max 2.39 Pepsi Wild Cherry 2.41 Schweppes Tonic Water 2.54 Erosive pH 3.0-4.0 7UP 3.24 Diet 7UP 3.48 Diet Coke 3.10 Dr. Pepper Cherry 3.06 Dr Pepper Diet 3.20 Mountain Dew 3.22 Mountain Dew Diet 3.18 Diet Pepsi 3.02 Sierra Mist Diet 3.31 Sierra Mist 3.09 Sprite 3.24 Sprite Zero 3.14 Minimally Erosive pH above 4.0 A&W Root Beer 4.27 A&W Root Beer Diet 4.57 Barq's Root Beer 4.11 Canada Dry Club Soda 5.24 Energy Drinks Extremely Erosive pH below 3.0 5-Hour Energy Extra Strength 2.82 5-Hour Energy Lemon-Lime 2.81 Jolt Power Cola 2.47 Rockstar Energy Drink 2.74 Rockstar Recovery 2.84 Erosive pH 3.0-4.0 Fuel Energy Shots Lemon-Lime 3.97 Fuel Energy Shots Orange 3.44 Jolt Ultra Sugar Free 3.14 Monster Energy 3.48 Monster Hitman Energy Shot 3.44 Monster Low Carb 3.60 Redbul Regular 3.43 Redbull Shot 3.25 Redbull Sugar Free 3.39 Rockstar Energy Cola 3.14 Rockstar Sugar Free 3.15 Waters and Sports Drinks Extremely Erosive pH below 3.0 Gatorade Frost Riptide Rush 2.98 Gatorade Lemon Lime 2.97 Gatorade Orange 2.99 Powerade Lemon Lime 2.75 Powerade Orange 2.75 Powerade Zero Lemon Lime 2.92 Powerade -

How India Became Pepsi's Right Choice

STILL FIZZING > How India became Pepsi’s right choice half the turnover. A new clause said soft Twenty-five years ago, PepsiCo sowed its India entry through an agrarian route, drink concentrate could not rise beyond THE PEPSI CEOs 25 per cent per cent of the venture’s despite opposition from several powerful people, and became a brand to be reckoned turnover and it would also not be able to import ingredients. RAMESH VANGAL with. Surajeet Das Gupta looks at the strategies and the people who made it possible PepsiCo started rolling out its colas CEO-Beverages, PepsiCo India in June 1990. Within two to three years, (1989-1993) epsiCo thought it had a winner in Pepsi would be a good name. Vangal had places cold. Indians now have a per it sold over 20 million cases a year, Present : Chairman of Katra Group “Pepsi Era”. A bizarre rule in the fought for three years to secure permis- capita consumption of 22 bottles of soft though a much small brand compared P 1980s allowed multinationals to sion to launch his company’s drinks. He drinks each year, up from three in 1989. with Parle. In 1991, India faced a bal- Joined PepsiCo in 1985 and was given the task of use only hybrid brand names for their gave in when the minister said he could PepsiCo is trying to dislodge Coca-Cola ance of payments crisis and went in for setting up operations in India. Was confronted with products in India. For PepsiCo, Pepsi hold back the clearance. in drinks, though the gap is still large, economic restructuring, as suggested virulent opposition from cola king Ramesh Chauhan, Era seemed apt for creating history in A couple of years ago — in but is streets ahead of the competition by the International Monetary Fund. -

APM Phe DKP Asp‒Phe Mean Sample

Supplementary Table S1. Carry-over experiment for aspartame and its degradation products. APM Phe DKP Asp–Phe Mean sample low (L) 226.6 1.9 0.0 24.8 Mean sample high (H) 1882.0 1.7 60.3 136.7 Mean L-L 226.8 1.9 0.0 24.7 Mean L-H 226.0 1.8 0.0 24.7 3*SD L-L 23.80 0.63 0.00 1.21 Difference L-L - L-H 0.75 0.08 0.00 0.05 Carry over No * No No Concentrations in µmol/L. APM; Aspartame, Phe; phenylalanine, DKP; diketopiperazine, Asp–Phe; aspartylphenylalanine The mean and standard deviation of sample low after sample low (L-L: L2, L5, L6 en L7) and sample low after sample high (L-H: L3, L4, L8, L9 en L10) were calculated. Carry-over was considered present when mean L-H – mean L-L <3* SD of L-L. * Carry-over of Phe could not be calculated from these samples, as mean sample high was similar to mean sample low. Table S2. Aspartame, degradation products and total phenylalanine concentrations in 111 soft drinks from across Europe. Similar drinks are grouped and clustered. Country APM Phe DKP Asp-Phe Total Phe (µmol/L) (µmol/L) (µmol/L) (µmol/L) (µmol/L) Soft drink Mean (SD) A Fanta Exotic NL 368 8 4 15 395 Fanta Exotic BE 360 6 5 18 389 Fanta Lemon BE 0 2 0 0 2 Fanta Lemon FI 0 0.8 0 0 0.8 262 (225) B Fanta Orange FR 0 13 0 0 13 Fanta Orange TR 0 3 0 0 3 Fanta Orange DE 0 3 0 0 3 Fanta Orange NL 197 10 0.3 13 219 Fanta Orange BE 0 7 0 0 7 Fanta Orange FI 198 6 12 23 239 81 (115) Group Group A C Fanta No Sugar Lemon BE 594 5 16 29 644 Fanta No Sugar Orange BE 1040 8 21 35 1104 Fanta Zero Orange NL 950 10 21 38 1019 Fanta Zero Orange FI 934 8 53 71