2019 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Steve Parmelee SENIOR COUNSEL

Steve Parmelee SENIOR COUNSEL Litigation Seattle [email protected] 206-883-2542 FOCUS AREAS EXPERIENCE Steve Parmelee is senior counsel in Wilson Sonsini Goodrich & Rosati's Seattle office. He Intellectual Property has over 25 years of experience in inter partes proceedings before the Patent Trial and Life Sciences Appeal Board (PTAB) of the U.S. Patent and Trademark Office (PTO). He has represented patent applicants in many patent interference proceedings at the PTAB. In addition, he has Litigation experience representing clients in the new post-grant trial proceedings that were enacted in Patents and Innovations the America Invents Act of 2011, including inter partes review (IPR) and covered business method (CBM) challenges to issued patents. Post-Grant Review Steve has acted as lead counsel in a number of patent interferences at the PTAB covering a wide range of technologies, including medical devices, photolithography, wireless security protocols, high-density recording media, and biotechnology. Notable cases include University of Washington v. Eli Lilly & Co., in which Steve represented the prevailing party in establishing the now-standard "two-way test" for declaring interferences, and Affymetrix v. Incyte, where he represented the prevailing party Affymetrix in a major gene array dispute. Steve has worked extensively on client patent portfolios in the areas of immunology, molecular biology, and infectious disease. He obtained patent protection for a licensee's immunotherapy product with sales of more than $1.3 billion per year, generating substantial royalties for the client. He also advises clients on freedom-to-operate issues and due diligence concerns prior to licensing, investments, or acquisitions. -

Printmgr File

NOTICE OF 2020 ANNUAL MEETING AND PROXY STATEMENT ANNUAL MEETING Friday, May 15, 2020 11:00 a.m. at Seattle Genetics Corporate Headquarters Building 3 21823 – 30th Drive SE Bothell, Washington 98021 Dear Fellow Shareholders: Seattle Genetics had a remarkable year in 2019 and entered 2020 as a multi-product oncology company. First, in collaboration with our partner Takeda, ADCETRIS® global sales exceeded $1 billion for the first time. ADCETRIS is an important medicine around the world for the treatment of patients with certain types of lymphoma. Second, we and our collaborator Astellas received FDA accelerated approval of PADCEVTM (enfortumab vedotin-ejfv) for adult patients with previously treated locally advanced or metastatic urothelial cancer, potentially changing the treatment paradigm for these patients with a high unmet need. The approval expanded our commercial portfolio and will diversify our revenues from product sales, adding to a strong ADCETRIS base. And third, we reported positive results from our tucatinib HER2CLIMB-01 pivotal trial, which supported marketing applications in the United States, Europe and other countries to treat patients with metastatic HER2-positive breast cancer. These submissions position tucatinib to be our third commercial product, if approved, and allow us to offer a new treatment option to thousands of patients globally who are in need of better therapies. In addition, we believe ADCETRIS, PADCEV and tucatinib have other therapeutic opportunities and are investing in broad development programs. We also continue to invest in research and development as it is the engine for our future growth. We are advancing a robust pipeline of new product candidates in clinical trials, with a focus on first-in-class or best-in-class targeted therapies for cancer. -

35 Years of Supporting Innovation 2015/2016 REPORT CEO’S Message

35 Years of Supporting Innovation 2015/2016 REPORT CEO’s Message Table of Contents Marking Washington Research Foundation’s 35th anniversary is a good opportunity to reflect on the depth of talent in our state and the importance of the work that we support. Grant Programs 1 We’ve had the privilege of working with Dr. Benjamin Hall [profile on page 2], whose yeast technology has improved Dr. Benjamin D. Hall Profile 2 the health of more than a billion people worldwide. We’ve supported some of the most exceptional young minds in the country through our partnership with the ARCS Foundation [see page 1]. We’ve given grants and made venture Grant Profiles 4 investments in some of the most innovative projects and startup companies to come out of our local, world-class research WRF Capital 8 institutions. Our focus on research in Washington means that we focus on some of the best researchers in the world. Tom Cable, Bill Gates Sr. and Hunter Simpson recognized this when they founded WRF in 1981. It was clear to Portfolio Company Profiles 9 them that the University of Washington and other local institutions were creating valuable intellectual property with the WRF Venture Center and potential to benefit the public and provide much-needed revenue for additional research. At the time, UW had neither WRF Research Services 12 the resources nor expertise to successfully license its inventions. WRF was created to fill that gap. Our activities have since expanded, and despite a lack of precedence to predict success, coupled with some lean early years, we Staff 13 have now earned more than $436 million in licensing revenue for the University of Washington and disbursed over Board of Directors 14 $66 million in grants to research institutions throughout the state. -

Signature , )9. I

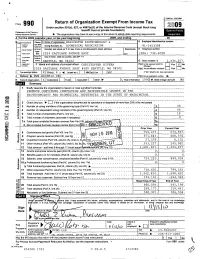

D 1 5 i OMB No 1545-0047 ,x Form Return of Organization Exempt From Income Tax Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung 2009 benefit trust or private foundation) Open to Public DePartme nt of the Treasu iniemai Revenue seivicery P The organization may have to use a copy of this retum to satisfy state reporting requirements Inspection A For the 2009 calendar year, or tax year beginning , 2009, and ending , 20 B chuck ii api-iiinbie Please C Nameoforganization WASHINGTON BIOTECHNOLOGY & D Employer ldentiflcatlon number Address use IRS change label or Doing Business As BIOMEDICAL ASSOCIATION 91-1453398 Name change pnnt or E Telephone number *VPS Initial retum See 2324Number EASTLAKE and street (or AVENUE P O box if mailEAST is not delivered to street address) IIIRoomlsurte (206) 732-6700 Specim: Terminated Instruc City or town, state or country, and ZIP + 4 Amended hons retum SEATTLE, WA 98 1 02 G Grossrecelpts S 1,434,257. Application FName and address of principal officer CHRISTOPHER RIVERA H(a) ls this a group retum for Yes X N9 pending altiliates? 2324 EASTLAKE AVENUE EAST #500 SEATTLE, WA 98102 H(b) Are all affiliates included? Yes N0 I Tax-exempt status X I501(c)( 6 ) 4 (insert no) I I4947(a)(1)or I I527 If *No," attach a list (see instructions) J Website: P WWW . WASHBIO . ORG HIC) Group exemption number b SummaryK Forrnoforganization X I Corporation I I TrustI I Association I I Other P I L Year of fomiation l990I M State of legal domicile WA 1 Bnefly descnbe the organization"s mission or most signiicant activities - - - PROMOTE CONTINUED INNOVATION AND RESPONSIBLE GROWTH IN THE BIUTECHNQEQQZ-1i1iI2-1?.1Q11IEI21913E-11599515155-EELF1113.5191?.9.F.1"f*.S.H.1.11Q1QI1- ...... -

August 2020 Asbmb Today 1 President’S Message

THE Careers ISSUE Connect your community with a virtual scientific event Interested in hosting a virtual event? The ASBMB is here to help. The ASBMB provides a platform to share scientific research and to discuss emerging topics and technologies in an interactive, virtual setting. When you host a virtual event with the ASBMB, your event will: n accommodate up to 500 attendees n be marketed to the ASBMB’s 11,000 members n reach the ASBMB’s network of journal authors and meeting attendees Learn more about how to submit your proposal at asbmb.org/meetings-events NEWS FEATURES PERSPECTIVES 2 30 66 PRESIDENT’S MESSAGE LEADERSHIP AFTER THE LONGEST MARCH, With challenges come opportunities ON THE CUTTING EDGE SCIENCE MARCHES ON An interview with Toni Antalis, 4 the ASBMB’s new president MEMBER UPDATE 69 34 BEING BLACK 10 JOB SEEKERS FEEL THE EFFECTS IN THE IVORY TOWER IN MEMORIAM OF THE PANDEMIC AND POLITICS 12 STUDENT CHAPTERS A virtual high school science fair Careers 13 42 How a research tech can work from NEWS home in the time of COVID-19 13 ASBMB launches industry advisory group 44 Grant writing tips for beginners 14 ASBMB receives NIH grant to promote faculty diversity 47 F(i/u)nding your next hypothesis 49 Illuminating leadership during crisis 16 51 My postdoc road was rocky — LIPID NEWS then the pandemic hit Organizing fat: Mechanisms of creating and organizing cellular lipid stores 53 How can labs reopen safely? 56 A year of unrest and grace — 18 reflections on my journey to tenure JOURNAL NEWS 18 How lipid droplets stay in shape 58 Think you’d like to move away 20 Sorting and secreting insulin from the bench? by expiration date 22 Proteomics reveals hallmarks of aging 60 Supporting Ph.D. -

James Kronstad Gives the 2010 Inaugural Neurological Infections

Oct 2010 Special Issue Editor: Dianne Langford, Ph.D. Associate Editor: Michael Nonnemacher, Ph.D. Assistant: Leslie Marshall, Ph.D. James Kronstad Gives the 2010 Inaugural Neurological Infections Lectureship Dianne Langford Ph.D., Philadelphia, PA he ISNV is proud to honor James Kronstad who will present the 2010 TNeurological Infections Lecture at the 10th International Symposium on NeuroVirology in Milan, Italy. Dr. Kronstad received a Ph.D. in Microbiology and Immunology from the University of Washington, which was followed by two years of postdoctoral studies with ZymoGenetics in Seattle and two years as a research biologist with the USDA at the University of Wisconsin. Currently, he is a Professor in the Department of Microbiology and Immunol - ogy at the University of British Columbia and serves as the Director of the Michael Smith Laboratories, an interdisciplinary research unit founded by the Nobel Prize-winning chemist Dr. Michael Smith. Dr. Kronstad is a Bur - roughs Wellcome Fund Scholar, a Fellow of the American Academy of Mi - crobiology, and a Fellow of the American Association for the Advancement of Science. In addition to these accomplishments, he previously served as chair of the NIH study section on AIDS, Opportunistic Infections, and Cancer (AOIC) (2008-2010). As a leader in the field of fungal pathogenesis, Dr. Kronstad has con - tributed significantly to our understanding of the virulence mechanisms of fungal pathogens, their responses to anti-fungal therapeutics and aspects of fungal co-infection with HIV. In addition, work from Kronstad’s laboratory has uncovered important fungal survival adaptations to the host environ - ment. Dr. Kronstad’s research program focuses on the molecular genetic and genomic analysis of virulence in the fungal pathogens Cryptococcus neoformans and Cryptococcus gattii. -

1 Early Recombinant Protein Therapeutics Pierre De Meyts1,2,3

3 1 Early Recombinant Protein Therapeutics Pierre De Meyts1,2,3 1Department of Cell Signalling, de Duve Institute, Catholic University of Louvain, Avenue Hippocrate 75, 1200, Brussels, Belgium 2De Meyts R&D Consulting, Avenue Reine Astrid 42, 1950, Kraainem, Belgium 3Global Research External Affairs, Novo Nordisk A/S, 2760, Måløv, Denmark 1.1 Introduction The successful purification of pancreatic insulin by Frederick Banting, Charles Best, and James Collip in the laboratory of John McLeod at the University of Toronto in the summer of 1921 [1–3], as reviewed in the magistral book of Bliss [4], ushered in the era of protein therapeutics. Banting and McLeod received the Nobel Prize in Physiology or Medicine in 1923. The discovery of insulin was truly a miracle for patients with Type 1 diabetes, for whom the only alternative to a quick death from ketoacidosis was the slow death by starvation on the low-calorie diet prescribed by Allen of the Rockefeller Institute [5–7]. Insulin went into immedi- ate industrial production (from bovine or porcine pancreata) from the Connaught laboratories of the University of Toronto and, under license from the University of Toronto by Eli Lilly and Co. in the United States, by the Danish companies Nordisk Insulin Laboratorium and Novo (who merged in 1989 as Novo Nordisk), and by the German company Hoechst (now Sanofi), all of which remain the major players in the insulin business today. Insulin also turned out to be a blessing for scientists interested in protein struc- ture. It was the first protein to be sequenced [8, 9], earning Fred Sanger his first Nobel Prize in 1958. -

KRIS RICHEY CURTIS Partner

KRIS RICHEY CURTIS Partner 2009 TO PRESENT Kinzer Partners, Seattle, Washington Partner Provides real estate brokerage and consulting services to corporate, not-for- profit, and life sciences/healthcare clients. Partial Client List Alaska Airlines // Fred Hutch // University of Washington // Intellectual Ventures Lab // Seattle Metropolitan Chamber of Commerce // City of Seattle // Seattle Cancer Care Alliance // Casey Family Programs // Gravity Payments // Princess Cruises // Omeros Corporation // Susman Godfrey L.L.P. // 206.442.1546 Altius Institute for Biomedical Sciences // PCC Natural Markets // SEIU [email protected] 2003 TO 2009 Jones Lang LaSalle (formerly The Staubach Company), Seattle, Washington LICENSES Senior Associate 2008-2009 Associate 2003-2008 Real Estate Salesperson, State of Washington Provided tenant representation and real estate strategy for corporate and life sciences clients EDUCATION Partial Client List University of Washington Seattle Biomedical Research Institute // Msnbc.com // GlaxoSmithKline Certificate in Commercial Real Keller Rohrback L.L.P // Princess Cruises // Washington State Biotech Estate and Biomedical Association // ZymoGenetics // Thrive by Five Washington University of Washington OneBeacon Insurance Business Advantage Certificate Program 2004 TO 2006 University of Colorado BA, Psychology with emphasis Regulome Corporation, Seattle, Washington in Neuroscience and Premedical Sciences, Summa Cum Laude and Business Development Phi Beta Kappa Managed investor relations, grant applications and analysis -

Formerly Pos TC Omm

Formerly pos TC omm re:Design The annual magazine for alumni and friends of the University of Washington Department of Human Centered Design & Engineering Summer 2009 Tracked Changes Message from the Chair Time of Transition 2008–2009 has been a dynamic year that will not soon be Features forgotten. It has been a year of transition. We have come through an incredible amount of change in a very short time, all the 03 TC to HCDE stronger and better for the experience. We have a new name, a new Beginning January 1, 2009, physical location, four new tenure track faculty, a new department UWTC became the Department chair, new degree programs, new curricula, and more students in of Human Centered Design & the entering class than ever before. As it was a time of beginnings Engineering. for our new faculty who taught their first classes, it is a time of endings for Tom Williams, who taught his last official HCDE class 06 PhD Student Thrives HCDE Chair Jan Spyridakis and will be retiring next autumn. The change of name from Technical Communication to Human Centered Design & in Academia Engineering (HCDE) was not undertaken lightly. A task force of our best and brightest Quan Zhou, now assistant professor at University of spent many days and nights working to find an elegant solution. And even after the name Wisconsin-Stout, receives great was official on January 1, 2009, we had a last-minute identity crisis over “to hyphen or not honor. to hyphen.” Alas and alack, most style guides state that you do not hyphenate proper nouns. -

Supporting Groundbreaking Research

Supporting Groundbreaking Research 2017 REPORT Washington Research Foundation operates at the intersection of academic research, technology development, public and private investment, philanthropy and industry. We have a strong track record of supporting innovation in the life sciences and engineering, from early research to commercial production. Grant Programs 1 Postdoctoral Fellowships 2 Researcher Profiles 3 Project Grant Profiles 4 WRF Capital 5 Portfolio Company Profiles 6 Licensing 8 Venture Center and Research Services 9 Staff and Board 10 Financials 11 Organizations funded Grant Programs by WRF since 1993 include: Washington Research Foundation (WRF) has provided nearly $80 million Trust and the Arnold & Mabel Beckman Foundation. UW Medicine ARCS Foundation in grants for research and scholarship since 1993. The Foundation’s and Fred Hutch will be the primary beneficiaries of the cryo-electron Benaroya Research Institute support of organizations including Fred Hutchinson Cancer Research microscope (cryo-EM) purchased with the grants, which provides Center, Institute for Systems Biology, the University of Washington (UW) researchers with superior images of cell, protein and virus structures Bloodworks Northwest and Washington State University (WSU) helps to keep these institutions for health care applications. Cryo-EM’s role in the observation of Fred Hutchinson Cancer Research Center at the cutting edge of world-class research and innovation. diseases and progression of therapies gained worldwide prominence Infectious Disease Research Institute WRF focuses its support on projects and researchers addressing major in 2017 with the awarding of the Nobel Prize in Chemistry to Jacques Institute for Systems Biology challenges in life sciences and enabling technologies, with the goal of Dubochet, Joachim Frank and Richard Henderson for their contributions Life Sciences Research Foundation accelerating the commercialization of groundbreaking products and to the technology’s development. -

01-044 University of Washington, School of Medicine, Associate Dean for Research and Graduate Education Records Inventory Access

UNlVERSllY U BRARIJES w UNIVERSITY of WASHI NGTON Spe ial Colle tions 118 University of Washington, School of Medicine, Associate Dean for Research and Graduate Education Records Inventory Accession No: 01-044 Special Collections Division University of Washington Libraries Box 352900 Seattle, Washington, 98195-2900 USA (206) 543-1929 This document forms part of the Preliminary Guide to the Records of the University of Washington School of Medicine, Associate Dean for Research and Graduate Education. To find out more about the history, context, arrangement, availability and restrictions on this collection, click on the following link: http://digital.lib.washington.edu/findingaids/permalink/UA27_01_08AssocDeanResearchGraduateEducation/ Special Collections home page: http://www.lib.washington.edu/specialcollections/ Search Collection Guides: http://digital.lib.washington.edu/findingaids/search University of Washington Libraries Manuscripts, Special Collections, University Archives UW. School of Medicine. Associate Dean for Research and Graduate Education. UW. SCHOOL OF MEDICINE. ASSOCIATE DEAN FOR RESEARCH AND GRADUATE EDUCATION 1984-1996 3 Cubic Feet Accession No. 01-044 Container list provided by the office at time of transfer CONTAINER LIST Box Dates 1 RESTRICTED Pharmacology Review 1988 Itinerary for Mr. Ed Long 1993 Ethics in Biomedical Research 1990 NIH Training Grant Tuition Shortfall 1995 BRSG Report to MSEC 1986 Economic Impact of Higher Education 1989 NIH Study Section Members 1994 Grant Review Changes at the NIH 1995 Dr. Huntsman Committee Assignments 1996 Lucy Tompkin’s Visit, Women in Medicine 1992 Women in Medicine Faculty Project 1992-93 Women in Medicine Faculty Project 1992-93 Women in Medicine Faculty Project Group 1992-93 IMCBP General 1984-89 IMCBP General 1984-89 IMCBP General 1984-89 2 RESTRICTED David Leaf/Ann Streissguth Inquiry 1984 Research Committee Review 1989 Annual Grant and Contract Expenditures 1994 NIH and Beyond,. -

Dissecting the Thrombopoietin Receptor: Functional Elements of the Mpl Cytoplasmic Domain (Tyrosine Phosphorylation͞thrombopoietin͞signal Transduction͞jak͞stat)

Proc. Natl. Acad. Sci. USA Vol. 94, pp. 2350–2355, March 1997 Cell Biology Dissecting the thrombopoietin receptor: Functional elements of the Mpl cytoplasmic domain (tyrosine phosphorylationythrombopoietinysignal transductionyJAKySTAT) JONATHAN G. DRACHMAN* AND KENNETH KAUSHANSKY Division of Hematology, University of Washington Medical Center, Box 357710, Seattle, WA 98195 Communicated by Seymour Klebanoff, University of Washington School of Medicine, Seattle, WA, December 24, 1996 (received for review December 5, 1996) ABSTRACT Thrombopoietin (TPO) acts through its re- box2) that are conserved among most members of the hema- ceptor, Mpl, to stimulate the proliferation and maturation of topoietic cytokine receptor superfamily and are critical for all megakaryocytes and their progenitors. The Mpl cytoplasmic aspects of receptor function (6–8). Box1, identified by two domain controls this process through assembly of an active spatially conserved proline residues (PXXP), is located be- signaling complex using various receptor docking sites. In this tween cytoplasmic residues 17 and 20 of Mpl. Box2 is more report, eight carboxyl truncations of the 121-aa murine Mpl imprecisely defined by a region with increased serine and cytoplasmic domain were tested for the ability to support glutamic acid content that extends between residues 46 and 64 growth of a cytokine-dependent cell line (BayF3) and for their and by a proposed core motif between residues 52 and 61 (9). capacity to induce TPO-stimulated tyrosine phosphorylation Be´nit et al. (9) have demonstrated that deletion of either box1 of specific signaling proteins. Point mutations of the five or box2 abolished the transforming potential of v-mpl. Simi- tyrosine residues in the cytoplasmic domain of the receptor larly, Gurney et al.