The Case of Greece

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Best Wishes! Anna

Mail from Europe No. 18, 17 September 2015 Dear Anna, Alexis Tsipras has shown remarkable leadership qualities since he was elected. But how much credibility has he lost on the way between promises he was incapable of keeping? Is there any chance he can convince a majority that a government led by him would be best suited to steer the country through the next years? As the opinion polls in the final countdown to the snap elections in Greece next Sunday display a growing support for SYRIZA’s main contender New Democracy (ND), thus levelling ND’s and SYRIZA’s chances in the run, several observers hurried to argue that the star of Tsipras faded. It has been also argued that – given Tsipras’ inability to deliver on his anti-austerity promises – his credibility dwindled and he might not be able to lead SYRIZA to a victory in the elections. Well, not necessarily... Tsipras is a very bright politician who has come to an understanding that what really matters in politics is not what you have done but how you present what you have done. He made it evident during the televised debate last Monday. As the case of the third bailout program for Greece proves, Tsipras possesses the ability of turning his defeat into a virtue, and still benefit from it. Tsipras also remained unaffected by the attitude and contestable media interventions of Yanis Varoufakis that eventually led to a rupture in his government. The ousting of Varoufakis was done in a very skillful and well-coordinated framing of this event in the Greek tabloids. -

European Left Info Flyer

United for a left alternative in Europe United for a left alternative in Europe ”We refer to the values and traditions of socialism, com- munism and the labor move- ment, of feminism, the fem- inist movement and gender equality, of the environmental movement and sustainable development, of peace and international solidarity, of hu- man rights, humanism and an- tifascism, of progressive and liberal thinking, both national- ly and internationally”. Manifesto of the Party of the European Left, 2004 ABOUT THE PARTY OF THE EUROPEAN LEFT (EL) EXECUTIVE BOARD The Executive Board was elected at the 4th Congress of the Party of the European Left, which took place from 13 to 15 December 2013 in Madrid. The Executive Board consists of the President and the Vice-Presidents, the Treasurer and other Members elected by the Congress, on the basis of two persons of each member party, respecting the principle of gender balance. COUNCIL OF CHAIRPERSONS The Council of Chairpersons meets at least once a year. The members are the Presidents of all the member par- ties, the President of the EL and the Vice-Presidents. The Council of Chairpersons has, with regard to the Execu- tive Board, rights of initiative and objection on important political issues. The Council of Chairpersons adopts res- olutions and recommendations which are transmitted to the Executive Board, and it also decides on applications for EL membership. NETWORKS n Balkan Network n Trade Unionists n Culture Network Network WORKING GROUPS n Central and Eastern Europe n Africa n Youth n Agriculture n Migration n Latin America n Middle East n North America n Peace n Communication n Queer n Education n Public Services n Environment n Women Trafficking Member and Observer Parties The Party of the European Left (EL) is a political party at the Eu- ropean level that was formed in 2004. -

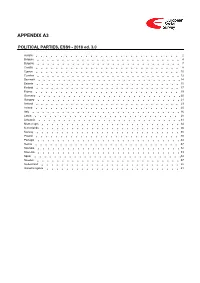

ESS9 Appendix A3 Political Parties Ed

APPENDIX A3 POLITICAL PARTIES, ESS9 - 2018 ed. 3.0 Austria 2 Belgium 4 Bulgaria 7 Croatia 8 Cyprus 10 Czechia 12 Denmark 14 Estonia 15 Finland 17 France 19 Germany 20 Hungary 21 Iceland 23 Ireland 25 Italy 26 Latvia 28 Lithuania 31 Montenegro 34 Netherlands 36 Norway 38 Poland 40 Portugal 44 Serbia 47 Slovakia 52 Slovenia 53 Spain 54 Sweden 57 Switzerland 58 United Kingdom 61 Version Notes, ESS9 Appendix A3 POLITICAL PARTIES ESS9 edition 3.0 (published 10.12.20): Changes from previous edition: Additional countries: Denmark, Iceland. ESS9 edition 2.0 (published 15.06.20): Changes from previous edition: Additional countries: Croatia, Latvia, Lithuania, Montenegro, Portugal, Slovakia, Spain, Sweden. Austria 1. Political parties Language used in data file: German Year of last election: 2017 Official party names, English 1. Sozialdemokratische Partei Österreichs (SPÖ) - Social Democratic Party of Austria - 26.9 % names/translation, and size in last 2. Österreichische Volkspartei (ÖVP) - Austrian People's Party - 31.5 % election: 3. Freiheitliche Partei Österreichs (FPÖ) - Freedom Party of Austria - 26.0 % 4. Liste Peter Pilz (PILZ) - PILZ - 4.4 % 5. Die Grünen – Die Grüne Alternative (Grüne) - The Greens – The Green Alternative - 3.8 % 6. Kommunistische Partei Österreichs (KPÖ) - Communist Party of Austria - 0.8 % 7. NEOS – Das Neue Österreich und Liberales Forum (NEOS) - NEOS – The New Austria and Liberal Forum - 5.3 % 8. G!LT - Verein zur Förderung der Offenen Demokratie (GILT) - My Vote Counts! - 1.0 % Description of political parties listed 1. The Social Democratic Party (Sozialdemokratische Partei Österreichs, or SPÖ) is a social above democratic/center-left political party that was founded in 1888 as the Social Democratic Worker's Party (Sozialdemokratische Arbeiterpartei, or SDAP), when Victor Adler managed to unite the various opposing factions. -

The Making of SYRIZA

Encyclopedia of Anti-Revisionism On-Line Panos Petrou The making of SYRIZA Published: June 11, 2012. http://socialistworker.org/print/2012/06/11/the-making-of-syriza Transcription, Editing and Markup: Sam Richards and Paul Saba Copyright: This work is in the Public Domain under the Creative Commons Common Deed. You can freely copy, distribute and display this work; as well as make derivative and commercial works. Please credit the Encyclopedia of Anti-Revisionism On-Line as your source, include the url to this work, and note any of the transcribers, editors & proofreaders above. June 11, 2012 -- Socialist Worker (USA) -- Greece's Coalition of the Radical Left, SYRIZA, has a chance of winning parliamentary elections in Greece on June 17, which would give it an opportunity to form a government of the left that would reject the drastic austerity measures imposed on Greece as a condition of the European Union's bailout of the country's financial elite. SYRIZA rose from small-party status to a second-place finish in elections on May 6, 2012, finishing ahead of the PASOK party, which has ruled Greece for most of the past four decades, and close behind the main conservative party New Democracy. When none of the three top finishers were able to form a government with a majority in parliament, a date for a new election was set -- and SYRIZA has been neck-and-neck with New Democracy ever since. Where did SYRIZA, an alliance of numerous left-wing organisations and unaffiliated individuals, come from? Panos Petrou, a leading member of Internationalist Workers Left (DEA, by its initials in Greek), a revolutionary socialist organisation that co-founded SYRIZA in 2004, explains how the coalition rose to the prominence it has today. -

Doers Dreamers Ors Disrupt &

POLITICO.EU DECEMBER 2018 Doers Dreamers THE PEOPLE WHO WILL SHAPE & Disrupt EUROPE IN THE ors COMING YEAR In the waves of change, we find our true drive Q8 is an evolving future proof company in this rapidly changing age. Q8 is growing to become a broad mobility player, by building on its current business to provide sustainable ‘fuel’ and services for all costumers. SOMEONE'S GOT TO TAKE THE LEAD Develop emission-free eTrucks for the future of freight transport. Who else but MAN. Anzeige_230x277_eTrucks_EN_181030.indd 1 31.10.18 10:29 11 CONTENTS No. 1: Matteo Salvini 8 + Where are Christian Lindner didn’t they now? live up to the hype — or did he? 17 The doers 42 In Germany, Has the left finally found its a new divide answer to right-wing nationalism? 49 The dreamers Artwork 74 85 Cover illustration by Simón Prades for POLITICO All illustrated An Italian The portraits African refugees face growing by Paul Ryding for unwelcome resentment in the country’s south disruptors POLITICO 4 POLITICO 28 SPONSORED CONTENT PRESENTED BY WILFRIED MARTENS CENTRE FOR EUROPEAN STUDIES THE EAST-WEST EU MARRIAGE: IT’S NOT TOO LATE TO TALK 2019 EUROPEAN ELECTIONS ARE A CHANCE TO LEARN FROM LESSONS OF THE PAST AND BRING NATIONS CLOSER TOGETHER BY MIKULÁŠ DZURINDA, PRESIDENT, WILFRIED MARTENS CENTRE FOR EUROPEAN STUDIES The East-West relationship is like the cliché between an Eastern bride and a Western man. She is beautiful but poor and with a slightly troubled past. He is rich and comfortable. The West which feels underappreciated and the East, which has the impression of not being heard. -

The Greek Austerity Myth Daniel Gros 10 February 2015

The Greek Austerity Myth Daniel Gros 10 February 2015 Since the victory of the anti-austerity Syriza party in Greece’s recent general election, the ‘Greek problem’ is again preoccupying markets and policy-makers throughout Europe. Some fear a return to the uncertainty of 2012, when many thought that a Greek default and exit from the eurozone were imminent. Then as now, many worry that a Greek debt crisis could destabilise – and perhaps even bring down – Europe’s monetary union. But this time really is different. One critical difference lies in economic fundamentals. Over the last two years, the eurozone’s other peripheral countries have proven their capacity for adjustment, by reducing their fiscal deficits, expanding exports, and moving to current-account surpluses, thereby negating the need for financing. Indeed, Greece is the only one that has consistently dragged its feet on reforms and sustained abysmal export performance. Providing an additional shield to the peripheral countries is the European Central Bank’s plan to begin purchasing sovereign bonds. Although the German government does not officially support quantitative easing, it should be grateful to the ECB for calming financial markets. Now Germany can take a tough stance on the new Greek government’s demands for a large- scale debt write-off and an end to austerity, without fearing the kind of financial-market turbulence that in 2012 left the eurozone with little choice but to bail out Greece. In fact, both of the Greek government’s demands are based on a misunderstanding. For starters, Syriza and others argue that Greece’s public debt, at a massive 170% of GDP, is unsustainable and must be cut. -

Being Greek and an Economist While Greece Is Burning! an Intimate Account of a Peculiar Tragedy Yanis Varoufakis

Being Greek and an Economist while Greece is Burning! An intimate account of a peculiar tragedy Yanis Varoufakis Abstract The crisis that erupted in Wall Street in the fall of 2008 has had some bizarre side effects. One of them was to push small, inconsequential Greece onto the front pages of the world’s leading newspapers and make it a permanent feature in the nightmares of peoples and policy-makers worldwide. Another was the paradox of amplifying Greek voices during the country’s economic implosion while, at once, denying them analytical authority over their pre- dicament. The paper is a personal account of this paradox as experienced by a Greek economist who also lives through another, more personal, paradox: despite his portrayal by the media as an “expert,” he has been advocating that economists, independently of their intelligence or personal ethics, belong to a sinister priesthood purveying thinly disguised (and heavily mathematized) superstition as scientific economics. Introduction As an economist who, atypically, looks up to historians, philologists, and anthropologists as species higher up on the evolutionary chain than us econ- omists, I am chuffed to be here tonight, especially in a humanities audience afflicted, either by choice or circumstance, by the same condition as myself: an inescapable Greek-ness. I shall try to repay your trust with an intimate story of a most peculiar condition, a story that unfolds at the intersection of multiple failures of which the Greek implosion is just one. Let me begin at the beginning. I arrived in Britain as a green-behind-the- ears Athenian radical, to study mathematical economics at Essex University. -

Information Guide Euroscepticism

Information Guide Euroscepticism A guide to information sources on Euroscepticism, with hyperlinks to further sources of information within European Sources Online and on external websites Contents Introduction .................................................................................................. 2 Brief Historical Overview................................................................................. 2 Euro Crisis 2008 ............................................................................................ 3 European Elections 2014 ................................................................................ 5 Euroscepticism in Europe ................................................................................ 8 Eurosceptic organisations ......................................................................... 10 Eurosceptic thinktanks ............................................................................. 10 Transnational Eurosceptic parties and political groups .................................. 11 Eurocritical media ................................................................................... 12 EU Reaction ................................................................................................. 13 Information sources in the ESO database ........................................................ 14 Further information sources on the internet ..................................................... 14 Copyright © 2016 Cardiff EDC. All rights reserved. 1 Cardiff EDC is part of the University Library -

Yanis Varoufakis, Adults in the Room: My Battle with Europe’S Deep Establishment

Review: Yanis Varoufakis, Adults in the Room: My battle with Europe’s Deep Establishment Marnie Holborow ill with his uncompromising exposé of the Troika austerity terror regime. His overall political conclusions, likewise, fail to carry through the logic of his portrayal of the un- democratic nature of the EU. He certainly gives in raw detail what Greece has suffered. When he became Fi- nance Minister, it had lost 25% of its GDP, its minimum wage reduced by 40%, its pen- sioners had seen their living standards drop by 25%, one million Greeks could not pay their electricity bills, many did not have the money to put food on the table. The island of Crete, whose inhabitants are renowned for their pride, experienced the highest number of suicides. The story of Lambros, a trans- lator who lost his job, his job and his family, Yanis Varoufakis, Adults in the Room: My battle with Eu- rope’s Deep Establishment, The Bodley Head, e18.99 stays with Varoufakis as Lambros implored him not to sell out like other governments did. The never-ending spiral of austerity policies, Varoufakis notes, has condemned The Dead-end of the EU and Greece to a social version of a Dickensian SYRIZA, as seen from the In- debtors’ prison and thrown away the key. side Varoufakis is new to establishment poli- tics and, with fresh eyes, he reveals the EU’s Yanis Varoufakis, in his new book, lays bare total distain for democracy. His account the rottenness of the EU for all to see. As the gives an inside story of the EU bureaucracy, new Greek Finance Minister, he landed right which has all the ghoulish goings-on of an into the bullying and fiscal waterboarding episode of Versailles. -

Another Europe Is Possible

October 2019 Another Europe Is Possible An Interview with Yanis Varoufakis As harsh austerity and xenophobic nationalist fester in Europe, Yanis Varoufakis discusses his antidote with Tellus Senior Fellow Allen White. What inspired your career trajectory from academic economist to prominent supranational activist? I went into politics because of the financial crisis of 2008. Had financial capitalism not imploded, I would have happily continued my quite obscure academic work at some university. The chain reaction of economic crises, financial bailouts, and the rise of what I call the Nationalist International that almost broke financial capitalism, and brought Greece severe hardship, had a profound impact on me. In the early to mid-2000s, I was beginning to feel that a crash was approaching. I could see that global financial imbalances were growing exponentially and that our generation or the next would be hampered by a systemic crisis. I left my cocoon writing about mathematical economics and moved from Sydney to Athens at the time Greece was becoming insolvent. I began writing about the current situation and appearing on TV, warning against covering up insolvency with bailouts. Through these appearances as well as writing about government’s role in averting the impending crisis, I drifted into politics. The second transition, from government to activism, was much simpler. Restructuring Greece’s debt was my top priority as Minister of Finance. The moment the Prime Minister surrendered to the austerity demands of the European Commission and accepted another loan without debt restructuring, resignation became the easiest decision of my life. Once I resigned, I was back in the streets, theaters, and town hall meetings setting up the Democracy in Europe Movement 2025 (DiEM25). -

Populism in France Gilles Ivaldi

Populism in France Gilles Ivaldi To cite this version: Gilles Ivaldi. Populism in France. Daniel Stockemer. Populism Around the World. A Comparative Perspective, Springer, pp.27-48, 2018, 978-3-319-96757-8. 10.1007/978-3-319-96758-5_3. halshs- 01889832 HAL Id: halshs-01889832 https://halshs.archives-ouvertes.fr/halshs-01889832 Submitted on 3 Apr 2019 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. Pre-print Populism in France Gilles Ivaldi, URMIS, CNRS-University of Nice [email protected] This is a pre-print version of: Ivaldi, Gilles, “Populism in France”, which has appeared as a book chapter in: Daniel Stockemer (ed.) Populism around the world: A Comparative Perspective, Cham: Springer, pp.27-48 (https://www.springer.com/us/book/9783319967578) Abstract This chapter examines the supply and demand sides of populism in France. It looks at the two main populist actors i.e. the Front National (FN) and La France Insoumise (LFI). The FN exemplifies the typical radical right populist organiZation, primarily mobiliZing grievances over immigration, while LFI shows a left-wing egalitarian and socially inclusive profile. Electoral support for populism in France is fuelled by economic instability and voter distrust of mainstream politics and of the EU. -

Party Formation at Supranational Level: the Case of Radical Left Parties

De Europa Vol. 3, No. 1 (2020), 101-117 ISSN 2611-853X www.deeuropa.unito.it Party Formation at Supranational Level: the Case of Radical Left Parties Fabio Sozzi Introduction The European Left (EL) was formed in 2004, over 30 years later than the European People’s Party (EPP) or the Party of European Socialist (PES). The first communist group appeared within the European Parliament (EP) in 1973 but it has taken 20 years to become a stable form of cooperation, whereas socialist, liberal and popular parties cooperate from the foundation of the EP. How can we explain these different steps forward in transnational cooperation of party families1? In literature, foundation and development of party politics at European level are shaped by institutional factors – i.e. electoral system, EP regulation, EU decision-making – (Delwit et al. 2004; Hix and Lord 1997; Gagatek 2008; Kreppel 2002). Certainly, European political institutions affect parties by constraining their range of strategic options, but why do we encounter different level of development among party families if they operate within the same institutional environment? Why have Socialists and Conservatives improved much more advanced party organizations at the EU level in comparison with Greens or Extreme Right? In this article we argue that to understand the variegate world of party organizations at the EU level it is necessary to look at resistances of or impulses by national parties to the creation of supranational party structures. The EU integration forces national parties to cooperate but “if “and “how” they cooperate depends on national party strategies. The timing and the organizational structure of both the European Parliamentary Groups (EPGs) and Political Parties at European Level (PPELs) are, in this perspective, political products of bargaining among national parties sharing similar ideological positions: they are “negotiated political order” (Daudi 1986).