Press Release Trent Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Trent Hypermarket Ties up with Future Consumer Enterprise Ltd to Retail a Wide Range of Products ~A First of Its Kind Tie-Up

Trent Hypermarket ties up with Future Consumer Enterprise Ltd to retail a wide range of products ~A first of its kind tie-up that aims to bring customers of Star Bazaar, a unique product-price proposition~ Mumbai, 3rd March, 2016: Star, a TATA & TESCO enterprise, has tied up with Future Consumer Enterprise Ltd. (FCEL), to launch a wide range of food and non-food products across Star Bazaar stores. Star Bazaar aims to launch close to 148 SKUs across 10 FCEL brands with a view to provide their customers a unique product price proposition. FCEL’s portfolio includes popular consumer brands in the food category like ‘Sunkist’, ‘Tasty Treat’, “Karmiq” “Desi Atta” and ‘Fresh & Pure’; while “Think Skin”, ‘Clean Mate’ and ‘Care Mate’ constitute the non-food category. The FCEL range will be made available across large format hypermarkets of Star Bazaar in its initial phase. While this alliance offers customers a unique advantage of accessing everyday products at a great price, the launch will also see exclusive offers and promotions for Star’s Club card loyalty members. This association aims to serve the customers an unmatched array of products and introduce services that will see the store as a one stop destination for all daily household needs. Speaking on the launch, Mr. Jamshed Daboo, Managing Director, Trent Hypermarket Ltd. said, “We are excited about our collaboration with Future Consumer Enterprise to retail their flagship brands. With this tie- up, we will be bringing our customers an extensive range of high quality food products and non-food merchandise. Our objective is to enhance our existing range and ensure we address the growing needs of customers to access unique products at affordable price points” Mr. -

Presentation Title ( Arial, Font Size 28 )

PresentationThe Tata Power Title (Company Arial, Font size Ltd. 28 ) Date, Venue, etc ..( Arial, January Font size 18 2013 ) …Message Box ( Arial, Font size 18 Bold) Disclaimer •Certain statements made in this presentation may not be based on historical information or facts and may be “forward looking statements”, including those relating to The Tata Power Company Limited’s general business plans and strategy, its future outlook and growth prospects, and future developments in its industry and its competitive and regulatory environment. Actual results may differ materially from these forward-looking statements due to a number of factors, including future changes or developments in The Tata Power Company Limited’s business, its competitive environment, its ability to implement its strategies and initiatives and respond to technological changes and political, economic, regulatory and social conditions in India. •This presentation does not constitute a prospectus, offering circular or offering memorandum or an offer to acquire any Shares and should not be considered as a recommendation that any investor should subscribe for or purchase any of The Tata Power Company Limited’s Shares. Neither this presentation nor any other documentation or information (or any part thereof) delivered or supplied under or in relation to the Shares shall be deemed to constitute an offer of or an invitation by or on behalf of The Tata Power Company Limited. •The Company, as such, makes no representation or warranty, express or implied, as to, and do not accept any responsibility or liability with respect to, the fairness, accuracy, completeness or correctness of any information or opinions contained herein. -

Titan Company Limited Jewellery Business Back on Track

Titan Company Limited Jewellery business back on track Powered by the Sharekhan 3R Research Philosophy Consumer Discretionary Sharekhan code: TITAN Result Update Update Stock 3R MATRIX + = - Summary Right Sector (RS) ü Titan’s standalone business recovered to 89% (consolidated recovered to 98%) with the jewellery business growing by 9% in Q2FY2021; watches and eyewear Right Quality (RQ) ü business recoveredto 56% and 61%, respectively. Consolidated OPM declined 433 bps to 6.9%, affected by hedging loss and lower operating leverge. Operating profit was down 40% to Rs. 313 crore. Right Valuation (RV) ü Higher demand during the festive season and improving wedding demand will help Titan post sustained recovery in the jewellery business going ahead. + Positive = Neutral - Negative We have fine-tuned our estimates for FY2021 to factor in lower-than-expected OPM. We have maintained them for FY2022/FY2023E. We maintain Buy with a Reco/View Change revised PT of Rs. 1,350. Reco: Buy Titan Company’s (Titan) consolidated revenue decreased by 2.3% to Rs. 4,553 crore as against our expectation of Rs. 4175.7 crore. This is including the gold-ingots sale of CMP: Rs. 1,218 Rs. 391 crore. Revenue of the jewellery business grew by 9%, while watches and eye wear businesses recovered to 56% and 61%, respectively, in Q2 (both the businesses Price Target: Rs. 1,350 á recovered to 70% each in September 2020). Operating profit margin (OPM) decreased by 433 bps to 6.9% as against our expectation of 7.5%. During the quarter, the company á Upgrade Maintain â Downgrade has recognised loss of Rs. -

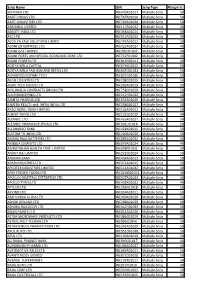

Scrip Name ISIN Scrip Type Margin % 3M INDIA LTD INE470A01017

Scrip Name ISIN Scrip Type Margin % 3M INDIA LTD INE470A01017 Multiple Scrip 50 AARTI DRUGS LTD INE767A01016 Multiple Scrip 50 AARTI INDUSTRIES LTD INE769A01020 Multiple Scrip 50 ABB INDIA LIMITED INE117A01022 Multiple Scrip 40 ABBOTT INDIA LTD INE358A01014 Multiple Scrip 50 ACC LTD INE012A01025 Multiple Scrip 40 ACCELYA KALE SOLUTIONS LIMITD INE793A01012 Multiple Scrip 50 ADANI ENTERPRISES LTD INE423A01024 Multiple Scrip 40 ADANI GAS LIMITED INE399L01023 Multiple Scrip 40 ADANI PORTS AND SPECIAL ECONOMIC ZONE LTD INE742F01042 Multiple Scrip 40 ADANI POWER LTD INE814H01011 Multiple Scrip 40 ADITYA BIRLA CAPITAL INE674K01013 Multiple Scrip 50 ADITYA BIRLA FASHION AND RETAIL LTD INE647O01011 Multiple Scrip 50 ADVANCED ENZYME TECH INE837H01020 Multiple Scrip 50 AEGIS LOGISTICS LTD INE208C01025 Multiple Scrip 50 AGRO TECH FOODS LTD INE209A01019 Multiple Scrip 50 AHLUWALIA CONTRACTS (INDIA) LTD INE758C01029 Multiple Scrip 50 AIA ENGINEERING LTD INE212H01026 Multiple Scrip 50 AJANTA PHARMA LTD INE031B01049 Multiple Scrip 50 AJMERA REALTY and INFRA INDIA LTD INE298G01027 Multiple Scrip 50 AKZO NOBEL INDIA LIMITED INE133A01011 Multiple Scrip 50 ALBERT DAVID LTD INE155C01010 Multiple Scrip 40 ALEMBIC LTD INE426A01027 Multiple Scrip 50 ALEMBIC PHARMACEUTICALS LTD INE901L01018 Multiple Scrip 50 ALLAHABAD BANK INE428A01015 Multiple Scrip 50 ALSTOM TD INDIA LTD INE200A01026 Multiple Scrip 50 AMARA RAJA BATTERIES LTD INE885A01032 Multiple Scrip 50 AMBUJA CEMENTS LTD INE079A01024 Multiple Scrip 40 AMRUTANJAN HEALTH CARE LIMITED INE098F01031 Multiple -

Presentation Title ( Arial, Font Size 28 )

PresentationThe Tata Power Title (Company Arial, Font size Ltd. 28 ) Date, Venue, etc ..( Arial, September Font size 18 ) 2013 …Message Box ( Arial, Font size 18 Bold) Disclaimer •Certain statements made in this presentation may not be based on historical information or facts and may be “forward looking statements”, including those relating to The Tata Power Company Limited‟s general business plans and strategy, its future outlook and growth prospects, and future developments in its industry and its competitive and regulatory environment. Actual results may differ materially from these forward-looking statements due to a number of factors, including future changes or developments in The Tata Power Company Limited‟s business, its competitive environment, its ability to implement its strategies and initiatives and respond to technological changes and political, economic, regulatory and social conditions in India. •This presentation does not constitute a prospectus, offering circular or offering memorandum or an offer to acquire any Shares and should not be considered as a recommendation that any investor should subscribe for or purchase any of The Tata Power Company Limited‟s Shares. Neither this presentation nor any other documentation or information (or any part thereof) delivered or supplied under or in relation to the Shares shall be deemed to constitute an offer of or an invitation by or on behalf of The Tata Power Company Limited. •The Company, as such, makes no representation or warranty, express or implied, as to, and do not accept any responsibility or liability with respect to, the fairness, accuracy, completeness or correctness of any information or opinions contained herein. -

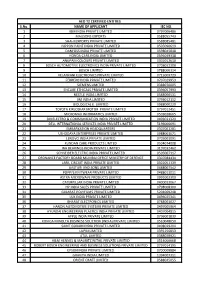

S.No. NAME of APPLICANT IEC NO. 1 IBM INDIA PRIVATE LIMITED 0797006486 2 MAGSONS EXPORTS 0588055743 3 SHAHI EXPORTS PRIVATE LIMI

AEO T2 CERTIFIED ENTITIES S.No. NAME OF APPLICANT IEC NO. 1 IBM INDIA PRIVATE LIMITED 0797006486 2 MAGSONS EXPORTS 0588055743 3 SHAHI EXPORTS PRIVATE LIMITED 0588085481 4 NIPPON PAINT INDIA PRIVATE LIMITED 0505090619 5 DANFOSS INDIA PRIVATE LIMITED 0598045848 6 HONDA CARS INDIA LIMITED 0595049338 7 ANUPAM COLOURS PRIVATE LIMITED 0301012610 8 BOSCH AUTOMOTIVE ELECTRONICS INDIA PRIVATE LIMITED 0708022308 9 BOSCH LIMITED 0788000314 10 VELANKANI ELECTRONICS PRIVATE LIMITED 0715009729 11 FERRERO INDIA PRIVATE LIMITED 0707029953 12 SIEMENS LIMITED 0388070005 13 ENCUBE ETHICALS PRIVATE LIMITED 0396057993 14 NESTLE INDIA LIMITED 0588000531 15 3M INDIA LIMITED 0793012112 16 BIOLOGICAL E. LIMITED 0988000229 17 TOYOTA KIRLOSKAR MOTOR PRIVATE LIMITED 0797012451 18 MICROMAX INFORMATICS LIMITED 0503028665 19 3M ELECTRO & COMMUNICATION INDIA PRIVATE LIMITED 0493021329 20 DELL INTERNATIONAL SERVICES INDIA PRIVATE LIMITED 5196000691 21 EMBARKATION HEADQUARTERS 0307061281 22 USHODAYA ENTERPRISES PRIVATE LIMITED 0988001071 23 LENOVO INDIA PRIVATE LIMITED 0705001091 24 KUNDAN CARE PRODUCTS LIMTED 0504074008 25 INA BEARINGS INDIA PRIVATE LIMITED 3197032462 26 SCHNEIDER ELECTRIC INDIA PRIVATE LIMITED 0595007317 27 ORDNANCE FACTORY BOARD MUMBAI OFFICE MINISTRY OF DEFENCE 0307084434 28 JABIL CIRCUIT INDIA PRIVATE LIMITED 0302051139 29 KASTURI AND SONS LIMITED 0488007542 30 POPPYS KNITWEAR PRIVATE LIMITED 0488013011 31 ASTRA MICROWAVE PRODUCTS LIMITED 0991002300 32 CATERPILLAR INDIA PRIVATE LIMITED 0400023067 33 HP INDIA SALES PRIVATE LIMITED 0798008300 34 GUJARAT -

Program Committee 6:30 Pm – 9:30 Pm Shoes

2862_AM_fin_prog_cover_v1.qxd 2/7/08 4:28 PM Page 1 Advanced Aromatics, LP Afton Chemicals Corporation Air Products and Chemicals, Inc. Albemarle Corporation Alon USA, LP American Ref Group, Inc. Arkema Ashland, Inc. Baker Petrolite Corporation Basell North America BASF Corporation BAYER BOC GROUP Border Refinin pany BP Chemicals BP p.l.c. Cabot Corporation Calcasieu Refining Company Calumet Lubricants Celanese Ltd. Chevron Corporation Chev Phillips Chemical Company LP CHS Inc. CITGO Petroleum Corporation Coffeyville Resources LLC ConocoPhillips Countrymark Co-op Ass Criterion Catalysts & Technologies Cross Oil Refining & Marketing, Inc. Cytec Industries Delek Inc.San Deltech Diego, Corporation CA The Dow Chemical pany E.I. DuPont de Nemours & Co. Eastman Chemical Company Enterprise Products Ergon, Inc. Exxon Mobil Corporation ExxonMobil Ch Co. Flying J Inc. Formosa Plastics Corporation, USA Frontier Oil Corporation Gary-Williams Energy Corporation GE Plastics GE Water & Pr Technologies Georgia Gulf Giant Industries, Inc. Grace Davison Hess Corporation Holly Corporation Honeywell Inc. HOVENSA LLC Hunt R Company Huntsman Company LLC INEOS Kinder Morgan Koch Industries Lion Oil Company Lubrizol Corporation Lyondell Chemical Com LYONDELL-CITGO Refining, LP Marathon Petroleum Company LLC Merichem Company Montana Refining Company Motiva Enterprises L Murphy Oil USA, Inc. Nalco Company National Cooperative Refinery Assoc. NOVA Chemicals Corporation Occidental Chemical Corporation Chlor Alkali Products Pasadena Refining System, Inc. Placid Refining Company PPG Industries, Inc. Rohm and Haas Company Safety-Klee Corporation Sasol North America Shell Chemical Company Sinclair Oil Corporation Solutia Inc. Sonneborn, Inc. South Hampton Resources Chemicals Suncor Energy Inc. Sunoco Inc. Tesoro Corporation Texas Petrochemicals LP TOTAL Trigeant, Ltd. U.S. -

Titan Company Limited Recovery in Jewellery Business to Drive Earnings Growth

Titan Company Limited Recovery in jewellery business to drive earnings growth Powered by the Sharekhan 3R Research Philosophy Consumer Discretionary Sharekhan code: TITAN Company Update Update Stock 3R MATRIX + = - Summary Right Sector (RS) ü We maintain our Buy recommendation on Titan with a revised PT of Rs. 1,910. It Right Quality (RQ) ü remains one of our top picks in the discretionary space due to a strong balance sheet and dominance in the branded jewellery space. Right Valuation (RV) ü The company expects strong recovery in pent-up demand especially in the jewellery + Positive = Neutral - Negative segment in H2FY2022; Ticket size is also expected to go up due to higher wedding spends shifted towards jewellery buying. What has changed in 3R MATRIX Titan has a market share of 5-6% in the jewellery market. Sustained new customer addition, strong safety standards followed by the company, omni channel platform, Old New and new product launches would help market share to improve ahead. RS Balance sheet strength will help it to compete well with strong regional and large players in the domestic market. RQ Titan Company Limited’s (Titan) market share in the jewellery market improved to 6% RV from 4% in the last four years. Improvement in market share is largely due to strong addition of new customers every year. Around 45% of sales of the jewellery business is Reco/View Change contributed by new customers. Uncertainty in business led by frequent lockdowns had huge impact on small jewellers cash flows. This led to large shift of customers to top Reco: Buy brands such as Tanishq (by Titan) in recent times. -

Titan Company Ltd January 18, 2019

Titan Company Ltd January 18, 2019 Analyst: Kunal Bhatia (022) 67141442 Associate: Nidhi Babaria (022) 67141450 : Initiating Coverage @ Dalal & Broacha ACCUMULATE Indian weddings to keep jewellery demand stable with ~6% CAGR: On an average it is estimated ~8- 10mn weddings happen in India with an average spend of Rs. ~2lac on Bridal Jewellery. Bridal Current Price 955 Jewellery account for 55% of domestic jewelry sales (as per world gold council report). Indian 52 Week Range 1,006/731 domestic bridal jewelry currently at Rs. 2,722bn is expected to grow to Rs. 3,570bn by FY23. Further, Target Price 1062 by FY23 the Industry expects i) 1.4% CAGR in gold volume ii) 3% CAGR in gold realization (last 33 years Upside 11% CAGR has been at 4.09% in USD) and iii) 5.6% CAGR in domestic jewelry. Titan will increase its wedding jewelry share to 50% by FY23 from 35% (of entire Plain Jewellery at 70%) in FY18. Key Share Data Tanishq to double its market share to 10% by FY23: This will be achieved through i) narrowing of Market M M Market Cap (Rs.bn) 852.18 making charges in unorganized and organized sector; due to compliance in Hallmarking and GST and Market Cap (US$ mn) 11975.63 ii) Increasing brand presence; Tanishq has guided to open 40-45 stores in FY19, with a target to reach 400 stores in 250 towns by FY23 from 253 stores in 150 towns currently (adding ~150 stores in 100 No of o/s shares (mn) 887 new towns over FY18-23).This would give ~8% CAGR in stores over FY18-FY23 (assuming new store Face Value 1 average area per store ~3972sq ft). -

212 2020 31 1503 27229 Jud

1 REPORTABLE IN THE SUPREME COURT OF INDIA CIVIL APPELLATE JURISDICTION CIVIL APPEAL NOs.440-441 0F 2020 TATA CONSULTANCY SERVICES LIMITED ¼ APPELLANT(S) VERSUS CYRUS INVESTMENTS PVT. LTD. AND ORS. ¼ RESPONDENT(S) WITH CIVIL APPEAL NOs.13-14 0F 2020 CIVIL APPEAL NOs.442-443 0F 2020 CIVIL APPEAL NOs.19-20 0F 2020 CIVIL APPEAL NOs.444-445 0F 2020 CIVIL APPEAL NOs.448-449 0F 2020 CIVIL APPEAL NOs.263-264 0F 2020 CIVIL APPEAL NO.1802 0F 2020 J U D G M E N T 1. Lis in the Appeals 1.1 Tata Sons (Private) Limited has come up with two appeals in Civil Appeal Nos.13-14 of 2020, challenging a final order dated 18-12-2019 passed by the National Company Law Appellate Tribunal (ªNCLATº for short) (i) holding as illegal, the proceedings of 2 the sixth meeting of the Board of Directors of TATA Sons Limited held on 24.10.2016 in so far as it relates to the removal of Shri Cyrus Pallonji Mistry (ªCPMº for short); (ii) restoring the position of CPM as the Executive Chairman of Tata Sons Limited and consequently as a Director of the Tata Companies for the rest of the tenure; (iii) declaring as illegal the appointment of someone else in the place of CPM as Executive Chairman; (iv) restraining Shri Ratan N. Tata (ªRNTº for short) and the nominees of Tata Trust from taking any decision in advance; (v) restraining the Company, its Board of Directors and Shareholders from exercising the power under Article 75 of the Articles of Association against the minority members except in exceptional circumstances and in the interest of the Company; and (vi) declaring as illegal, the decision of the Registrar of Companies for changing the status of Tata Sons Limited from being a public company into a private company. -

Sharekhan Special August 31, 2021

Sharekhan Special August 31, 2021 Index Q1FY2022 Results Review Automobiles • Capital Goods • Consumer Discretionary • Consumer Goods • Infrastructure/Cement/Logistics/Building Material • IT • Oil & Gas • Pharmaceuticals • Agri Inputs and Speciality Chemical • Miscellaneous • Visit us at www.sharekhan.com For Private Circulation only Q1FY2022 Results Review In-line quarter, healthy outlook Results Review Results Summary: After ending FY2021 on a strong note, Q1FY2022 earnings of broader indices showed a promising start (Nifty/ Sensex companies’ PAT rose 100%/66% y-o-y) in the new fiscal with strong growth momentum on low base. Management commentaries on earnings outlook remained positive, on improving economic activity post second COVID-19 wave and anticipation of strong demand revival. Demand recovery and ramp-up of vaccinations look encouraging. We expect economic activity to increase in the upcoming festive season. Nifty trades at 23x and 20x EPS based on FY2022E/FY2023E EPS, at a premium to mean average. Valuation gap between large and mid-caps has shrunk, we advise investors to focus on stocks with strong earnings growth potential with reasonable valuation. High-conviction investment ideas: o Large-caps: Infosys, ICICI Bank, M&M, L&T, UltraTech, SBI, HDFC Ltd, Godrej Consumer Products, Divis Labs and Titan. o Mid-caps: NAM India, BEL, Gland Pharma, Dalmia Bharat, Laurus Labs, Max Financial Services, LTI. o Small-caps: TCI Express, Kirloskar Oil, Suprajit Engineering, Repco Home Finance, PNC Infratech, Mahindra Lifespaces, Birlasoft. After ending FY2021 on a strong note, Q1FY2022 corporate earnings of broader indices showed a promising start with continued strong growth momentum on the low base of Q1FY2021, though it was along the expected lines. -

Group CHRO, Tata Sons

Tata Network Forums Global updates November 2017 S Padmanabhan Group CHRO, Tata Sons From the Desk of the Group CHRO, Tata Sons These are exciting times for the Tata group. Companies are increasingly coming together to leverage the Tata ecosystem to learn from each other, and deal with common issues. Tata Network Forums (TNFs) are increasingly playing an important role in enabling companies to come together and seek solutions to common issues. A case in point was the TNF MENA meeting which took place to address the diplomatic situation in the Gulf, when Arab nations cut off ties with Qatar. Tata companies came together at Dubai using the TNF MENA to understand the impact on their businesses and plan for mitigation measures. In the past six months, TNFs also enabled companies to seek knowledge and share best practices in various areas like Customer, HR, Ethics, Business Excellence, Digitisation, Communications, Corporate Responsibility and Sustainability. I must mention that the Tata Sustainability Group is increasingly utilising the TNF forum to spread its messages through the Tata Sustainability month celebrations and other workshops. Sustainability events featured in most TNFs across the world in the past two quarters. All these TNF events brought together many more Tata employees during these past few months, which is proof of the growing popularity of the TNFs. The reach and impact of TNF activities is gradually building, and I am sure that it will achieve greater heights in the coming times. As the Tata group celebrates its one-ness, TNFs will be able to connect many more employees and enable the proliferation of knowledge and best practices.