In This Issue

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Gjoa Haven © Nunavut Tourism

NUNAVUT COASTAL RESOURCE INVENTORY ᐊᕙᑎᓕᕆᔨᒃᑯᑦ Department of Environment Avatiliqiyikkut Ministère de l’Environnement Gjoa Haven © Nunavut Tourism ᐊᕙᑎᓕᕆᔨᒃᑯᑦ Department of Environment Avatiliqiyikkut NUNAVUT COASTAL RESOURCE INVENTORY • Gjoa Haven INVENTORY RESOURCE COASTAL NUNAVUT Ministère de l’Environnement Nunavut Coastal Resource Inventory – Gjoa Haven 2011 Department of Environment Fisheries and Sealing Division Box 1000 Station 1310 Iqaluit, Nunavut, X0A 0H0 GJOA HAVEN Inventory deliverables include: EXECUTIVE SUMMARY • A final report summarizing all of the activities This report is derived from the Hamlet of Gjoa Haven undertaken as part of this project; and represents one component of the Nunavut Coastal Resource Inventory (NCRI). “Coastal inventory”, as used • Provision of the coastal resource inventory in a GIS here, refers to the collection of information on coastal database; resources and activities gained from community interviews, research, reports, maps, and other resources. This data is • Large-format resource inventory maps for the Hamlet presented in a series of maps. of Gjoa Haven, Nunavut; and Coastal resource inventories have been conducted in • Key recommendations on both the use of this study as many jurisdictions throughout Canada, notably along the well as future initiatives. Atlantic and Pacific coasts. These inventories have been used as a means of gathering reliable information on During the course of this project, Gjoa Haven was visited on coastal resources to facilitate their strategic assessment, two occasions: -

Tab 6 Estimating the Abundance Of

SUBMISSION TO THE NUNAVUT WILDLIFE MANAGEMENT BOARD FOR Information: X Decision: Issue: South Baffin Island Caribou Abundance Survey, 2012 and Proposed Management Recommendations Background: Caribou are a critical component of the boreal and arctic ecosystems. They are culturally significant to local communities and provide an important source of food. In some areas, there is still uncertainty on population trends because of the lack of scientific information due to difficult logistics and remoteness. This is particularly true for Baffin Island, where three sub-populations of Barrenground caribou (Rangifer tarandus groenlandicus) are hypothesized, though little is known about their abundance and trends over time (Ferguson and Gauthier 1992). In the past 60 years, only discrete portions of their range have been surveyed and no robust quantitative estimates at the sub-population level were ever derived. For over a decade Inuit from communities on northern Baffin Island, and more recently from across the entire island, have reported declines in caribou numbers, although no quantitative estimates are available. In total 10 communities, representing half of all Nunavummiut, traditionally or currently harvest Baffin Island caribou. At the same time, climate change, including increased arctic temperatures and precipitation, and anthropogenic activities connected to mineral exploration and mining are potentially negatively impacting caribou and their range. Due to the risk of these cumulative negative effects, and the importance of these caribou to communities, the Department of Environment undertook, in 2012, a quantitative caribou abundance aerial survey of South Baffin Island with the support of the NWMB and co- management partners. This area represents the most abundant area of caribou on Baffin Island. -

Mining, Mineral Exploration and Geoscience Contents

Overview 2020 Nunavut Mining, Mineral Exploration and Geoscience Contents 3 Land Tenure in Nunavut 30 Base Metals 6 Government of Canada 31 Diamonds 10 Government of Nunavut 3 2 Gold 16 Nunavut Tunngavik Incorporated 4 4 Iron 2 0 Canada-Nunavut Geoscience Office 4 6 Inactive projects 2 4 Kitikmeot Region 4 9 Glossary 2 6 Kivalliq Region 50 Guide to Abbreviations 2 8 Qikiqtani Region 51 Index About Nunavut: Mining, Mineral Exploration and by the Canadian Securities Administrators (CSA), the regulatory Geoscience Overview 2020 body which oversees stock market and investment practices, and is intended to ensure that misleading, erroneous, or This publication is a combined effort of four partners: fraudulent information relating to mineral properties is not Crown‑Indigenous Relations and Northern Affairs Canada published and promoted to investors on the stock exchanges (CIRNAC), Government of Nunavut (GN), Nunavut Tunngavik Incorporated (NTI), and Canada‑Nunavut Geoscience Office overseen by the CSA. Resource estimates reported by mineral (CNGO). The intent is to capture information on exploration and exploration companies that are listed on Canadian stock mining activities in 2020 and to make this information available exchanges must be NI 43‑101 compliant. to the public and industry stakeholders. We thank the many contributors who submitted data and Acknowledgements photos for this edition. Prospectors and mining companies are This publication was written by the Mineral Resources Division welcome to submit information on their programs and photos at CIRNAC’s Nunavut Regional Office (Matthew Senkow, for inclusion in next year’s publication. Feedback and comments Alia Bigio, Samuel de Beer, Yann Bureau, Cedric Mayer, and are always appreciated. -

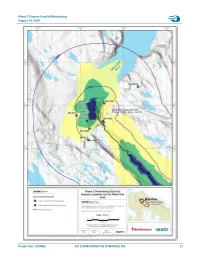

Phase 2 Passive Dustfall Monitoring August 14, 2019

Phase 2 Passive Dustfall Monitoring August 14, 2019 Project No: 19Y0006 EDI ENVIRONMENTAL DYNAMICS INC. 11 Mary River Project Phase 2 Proposal ECCC-FC1 ATTACHMENT 2: HUMAN HEALTH BASED DUSTFALL THRESHOLDS FOR MINE AND PORT SITE Date: October 15, 2019 To: Lou Kamermans, BIM From: Christine Moore, Intrinsik cc : Mike Setterington, EDI; Mike Lepage, RWDI, Richard Cook, KP; Sara Wallace and Dan Jarratt, Stantec Re: Human Health Based Dustfall Thresholds for Mine and Port Site – DRAFT V 3 While dustfall guidelines exist in several jurisdictions (such as Ontario and Alberta), they are generally based on soiling, as opposed to human health considerations. The Government of Nunavut is requesting that Project-specific dustfall guidelines protective of human health be developed for use within the Air Quality and Noise Abatement Management Plan (AQNAMP) to define rates which would be associated with management actions. Project-specific dustfall guidelines developed for consideration of human health within the Project area need to consider the model predictions for dustfall, in addition to the size of affected areas and potential exposure that could occur based on consumption rates for resources harvested within the area. These factors were used to define potential exposure scenarios. An additional consideration when developing dustfall rates protective of human health is the different geochemistry at the mine and port areas based on the existing site-specific geochemistry of the dustfall samples previously collected. As all rock and soil contain naturally occurring metals and metalloids (which will be referred to as metals), the dustfall generated from Project activities also contains metals. Iron is the most common metal in the dustfall, representing 4.43% of total dustfall at the Mine site, and 3.03% at the Port site. -

Technical Report

Project N Report NI 43-101 Technical Baffin Island-Mary River, Mary RiverIron OreTrucking o . 165926 Mary River, Baffin Island, Canada Mary River Iron Ore Trucking NI 43-101 Technical Report Prepared by: AMEC Americas Ltd. Prepared for: Baffinland George H. Wahl, P. Geo Iron Mines Corporation Rene Gharapetian, P. Eng. February 2010 James E. Jackson, P. Eng Project No. 165926 Vikram Khera, P. Eng VOLUME 1 Gregory G. Wortman, P. Eng REPORT Effective Date, January 13, 2011 IMPORTANT NOTICE This report was prepared as a National Instrument 43-101 Technical Re- port for Baffinland Iron Mines Corporation (BIM) by AMEC Americas Lim- ited (AMEC). The quality of information, conclusions, and estimates con- tained herein is consistent with the level of effort involved in AMEC’s ser- vices, based on: i) information available at the time of preparation, ii) data supplied by outside sources, and iii) the assumptions, conditions, and qualifications set forth in this report. This report is intended for use by (BIM) subject to the terms and conditions of its contract with AMEC. This contract permits (BIM) to file this report as a Technical Report with Cana- dian Securities Regulatory Authorities pursuant to National Instrument 43- 101, Standards of Disclosure for Mineral Projects. Except for the purposes legislated under provincial securities law, any other uses of this report by any third party is at that party’s sole risk. Baffinland Iron Mines Corporation Mary River Baffin Island Mary River Iron Ore Trucking NI 43-101 Technical Report TABLE OF CONTENTS 1.0 EXECUTIVE SUMMARY ............................................................................................. 1-1 1.1 Introduction and Scope of Work ...................................................................................... -

Socio-Economic Monitoring Report for the Mary River Project | Page Ii

2019 SOCIO-ECONOMIC MONITORING REPORT FOR THE MARY RIVER PROJECT PREPARED FOR Baffinland Iron Mines Corporation 2275 Upper Middle Road East, Suite 300 Oakville, Ontario L6H 0C3 Stratos Inc. 1404-1 Nicholas Street Ottawa, Ontario K1N 7B7 Tel: 613 241 1001 www.stratos-sts.com ᑐᓴᒐᒃᓴᖅ ᑐᑭᒧᐊᒃᑎᑦᑎᔨᑦᑎᓐᓂᑦ ᑲᔪᓰᓐᓇᖅᑐᒃᑯᑦ ᓴᓇᓂᕐᓄᑦ ᐹᕙᓐᓛᓐᑯᑦ ᐊᓕᐊᓇᐃᒍᓱᒃᐳᑦ ᓴᖅᑭᑦᑎᔪᓐᓇᕐᒪᑕ ᓄᓘᔮᖕᓂ ᐃᓅᓯᒃᑯᑦ ᓄᓇᕘᒥ ᑲᓇᑕᒥᓗ. ᐊᑎᓕᐅᓚᐅᖅᐳᒍᑦ ᓄᑖᓂᒃ ᐊᖏᖃᑎᒌᒍᑎᓂᒃ ᐃᓄᐃᑦ ᐱᕚᓪᓕᕈᑎᑎᒍᓪᓗ ᖃᐅᔨᓴᕐᓂᕐᓄᑦ ᐅᓂᒃᑳᕐᒥᒃ 2019ᒥ ᐅᓪᓗᖅᓯᐅᑎᑎᒍᑦ ᑎᒥᖏᓐᓄᑦ ᐱᕕᖃᖅᑎᑕᐅᓪᓗᑕ ᖃᖓᑕᓲᑎᒍᑦ ᐱᔨᑦᑎᕋᖅᑕᐅᓂᕐᓂᒃ, ᓂᕿᓄᑦ ᐊᕐᕌᒍᒧᑦ ᐊᕙᑎᓕᕆᔨᒃᑯᓐᓄᑦ, ᒪᓕᒃᖢᒋᑦ ᐱᓕᕆᓂᕐᒧᑦ ᐱᔪᓐᓇᐅᑎᒧᑦ ᓱᕈᖅᓴᕋᐃᑦᑐᓄᑦ, ᓄᓇᒃᑯᓪᓗ ᐅᓯᔭᐅᓂᕐᓄᑦ ᐃᖅᑲᓇᐃᔭᓕᕐᕕᖕᓂ ᓄᓇᓕᖕᓂ. ᒪᓕᒋᐊᓕᖏᑦ. ᓄᑖᖅ ᐊᖏᖃᑎᒌᒍᑎ ᖃᖓᑕᓱᒃᑯᑦ ᐅᓯᔭᐅᓂᕐᓄᑦ ᐅᑭᐅᖅᑕᖅᑐᒥ ᑯᐊᐸᑎᒃᑯᓐᓅᕗᖅ. ᑖᓐᓇ ᑳᓐᑐᕌᒃ ᐱᖃᖅᑎᑦᑎᕗᖅ ᐹᕙᓐᓛᓐᑯᓐᓂᒃ 2019 ᓇᓗᓇᐃᕈᑕᐅᕗᖅ ᑕᓪᓕᒪᓄᑦ ᐃᓗᐃᑦᑐᓄᑦ ᐊᕐᕌᒍᓄᑦ ᐊᑑᑎᖃᑦᑎᐊᖅᑐᒥᒃ ᐱᔨᑦᑎᕋᕐᓂᕐᒥᒃ ᐹᕙᓐᓛᓐᑯᓐᓄᑦ ᐱᓕᕆᓂᕐᒧᓪᓗ ᐊᐅᓚᓂᑦᑎᓐᓄᑦ ᓄᓘᔮᖕᓂ ᐱᓕᕆᔪᓂ. ᑖᓐᓇ ᑎᑭᑕᕗᑦ ᑕᑯᓯᒪᕗᖅ ᑭᓯᐊᓂᑦᑕᐅᖅ ᐱᕚᓪᓕᕈᑎᖃᖅᑎᑦᑎᒋᓪᓗᓂ ᑯᐊᐸᓄᑦ ᐃᓚᒋᔭᐅᔪᓄᑦ ᐹᕙᓐᓛᓐᑯᓐᓂᒃ ᑲᔪᓰᓇᖅᖢᑎᒃ ᐊᕕᒃᑐᖅᓯᒪᔪᒃᑯᑦ ᓴᓇᓂᕐᒥᓂᒃ ᓄᓘᔮᖕᓂ ᕿᑭᖅᑖᓘᑉ ᐅᐊᖕᓇᖓᓂᕐᒥᐅᓄᑦ ᐱᕚᓪᓕᕈᑎᒃᓴᖃᑲᐅᑎᒋᑎᖦᖢᒋᑦ ᓄᓇᓕᖕᓂ ᐱᓕᕆᓂᕐᒥᒃ ᐱᔪᒪᔭᖃᖅᓯᒪᓪᓗᑎᒡᓗ ᓯᕗᓂᕐᒥ ᐱᐅᔪᒃᑯᑦ ᐃᓅᓯᒃᑯᑦ ᑯᐊᐸᓄᑦ ᐊᑐᕐᓂᐊᕋᒥᒋᑦ ᓄᓇᓕᖕᒥᐅᓄᑦ ᐊᒃᓱᕉᑕᐅᔪᓄᑦ. ᓱᓕᒃᑲᓐᓂᕐᓗ, ᐱᕚᓪᓗᕐᑎᑎᒍᓪᓗ ᐱᕈᕐᓂᕐᓂᒃ ᐊᒡᒋᖅᑐᓂᒃ. 2019ᒥᑦ, ᐱᓕᕆᓂᖅ ᐹᕙᓐᓛᓐᑯᑦ ᖃᖓᑕᓲᒃᑯᑦ ᐅᓯᑲᖅᑕᖅᑎᒋᓪᓗᓂᒋᑦ, ᐅᑭᐅᖅᑕᖅᑐᒥ ᑯᐊᐸᑎᒃᑯᑦ ᐃᒪᐃᓯᒪᕗᖅ; ᐊᑑᑎᓕᖕᓂᒃ ᐃᑲᔪᕈᓐᓇᓚᐅᖅᐳᑦ ᐃᓕᓴᖅᓯᕕᒃ ᓴᓴᐃᐊᑎᒃᑯᓐᓄᑦ ᑲᖏᖅᑐᒑᐱᖕᒥ, ᓂᕿᑖᕐᕕᖕᓄᑦ ᑕᒪᒃᑮᓂ ᑲᖏᖅᑐᒑᐱᖕᒥ ᐃᒃᐱᐊᕐᔪᖕᒥᓗ • ᐱᖃᖅᑎᑦᑎᓚᐅᖅᑐᑦ ᐅᖓᑖᓂ $65 ᒥᓕᐊᓐ ᐃᖅᑲᓇᐃᔮᓄᑦ ᐱᖃᓯᐅᖦᖢᒍ ᖃᔪᖅᑐᕐᕕᒃ ᐃᖃᓗᖕᓂ. ᑐᓂᓯᔪᓐᓇᕐᓃᑦ ᑖᒃᑯᓂᖓ ᐊᑭᓕᖅᓲᑕᐅᓪᓗᑎᒃ ᐃᓄᖕᓄᑦ ᐱᓕᕆᔪᒧᑦ ᐃᖅᑲᓇᐃᔭᖅᑐᓄᑦ; ᐱᕚᓪᓕᕈᑎᓂᒃ ᑐᕌᑲᐅᑎᒋᕗᑦ ᐱᓕᕆᖃᑎᖃᕐᓂᕐᒥᑦ ᐹᕙᓐᓛᓐᑯᓐᓂᒃ ᓄᓘᔮᖕᓂ • ᑎᑭᓚᐅᖅᑐᑦ ᐅᖓᑖᓄᑦ 1.2 ᐱᓕᐊᓐ ᑳᓐᑐᕌᑎᒍᑦ ᐱᓕᕆᓂᕐᒧᑦ. ᐊᑎᓕᐅᖅᑕᐅᔪᑦ ᐱᓕᕆᖁᔭᐅᔪᓪᓗ ᐃᓄᐃᑦ ᑎᒥᖏᓐᓄᑦ; • ᑐᓂᓯᓚᐅᖅᑐᑦ $800,000 ᑲᓴᓂᒃ ᑮᓇᐅᔭᖃᖅᑎᑦᑎᓂᑦᑎᓐᓄᑦ ᓂᕆᐅᓇᖏᑦᑐᓄᑦ ᖃᓄᐃᑦᑐᓄᑦ, ᑭᖑᓪᓕᖅᐹᑦ ᐱᖓᓱᑦ ᑕᖅᑮᑦ 2019ᒥ ᑐᓂᓯᖃᑦᑕᕈᑎᑦᑎᓐᓄᓪᓗ 2016ᒥᑦ; ᐊᒻᒪᓗ ᐊᑐᖏᓐᓂᖅᓴᐅᓕᕐᕕᐅᓚᐅᖅᐳᖅ ᑳᓐᑐᕌᒃᑎᑎᒍᑦ -

In This Issue

Northern Mining News Volume 14, No. 12 December 2020 In this December 2020 issue: Mining benefits to NWT & Nunavut – the latest numbers on jobs and spending ............. 2 Breaking news! TMAC Resources Inc. to be acquired by Agnico Eagle .............................. 3 Mountain Province improving diamond prices, exceptional diamond recovered ............. 5 Sabina reports successful 2020 exploration season at Back River ..................................... 6 Sabina Gold & Silver updates construction accomplishments ........................................... 7 NorZinc hits multiple high-grade silver and zinc intercepts in drill program ..................... 8 Osisko Metals intersects 8.6 metres grading 15% Zn+Pb at Pine Point ............................. 8 Gold Terra reports Crestaurum drilling program results .................................................... 9 Vital Metals partners with Norwegian company REEtec .................................................. 11 Nighthawk reports gold intersects at Colomac ................................................................ 12 Exploration & development news briefs .......................................................................... 14 Member news releases ..................................................................................................... 16 Industry events ................................................................................................................. 17 Presentations ................................................................................................................... -

30160105.Pdf

C S A S S C C S Canadian Science Advisory Secretariat Secrétariat canadien de consultation scientifique Research Document 2009/008 Document de recherche 2009/008 An Ecological and Oceanographical Évaluation écologique et Assessment of the Alternate Ballast océanographique de la zone Water Exchange Zone in the Hudson alternative pour l’échange des eaux Strait Region de ballast de la région du détroit d'Hudson D.B. Stewart and K.L. Howland Fisheries and Oceans Canada Central and Arctic Region, Freshwater Institute 501 University Crescent Winnipeg, Manitoba R3T 2N6 This series documents the scientific basis for the La présente série documente les fondements evaluation of aquatic resources and ecosystems scientifiques des évaluations des ressources et in Canada. As such, it addresses the issues of des écosystèmes aquatiques du Canada. Elle the day in the time frames required and the traite des problèmes courants selon les documents it contains are not intended as échéanciers dictés. Les documents qu’elle definitive statements on the subjects addressed contient ne doivent pas être considérés comme but rather as progress reports on ongoing des énoncés définitifs sur les sujets traités, mais investigations. plutôt comme des rapports d’étape sur les études en cours. Research documents are produced in the official Les documents de recherche sont publiés dans language in which they are provided to the la langue officielle utilisée dans le manuscrit Secretariat. envoyé au Secrétariat. This document is available on the Internet at: Ce document est -

Covid Concern at Mary River Presumably Infected Individual Is Isolating, Health Officials Say No Reason for Nunavummiut to Worry About Spread

ᓄᕙᒡᔪᐊᕐᓇᕐᒧᑦ ᐃᓱᒫᓘᑕᐅᔪᖅ ᓄᓘᔭᕐᓂ ᐊᐃᑦᑐᖅᓯᒪᑐᐃᓐᓇᕆᐊᓕᒃ ᐃᓄᒃ ᐅᐸᒃᑕᐅᑦᑕᐃᓕᒪᔭᕆᐊᖃᖅᐳᖅ, ᐋᓐᓂᐊᖃᕐᓇᙱᑦᑐᓕᕆᔨᒃᑯᓐᓂ ᐱᓕᕆᔨᐅᔪᑦ ᐅᖃᖅᐳᑦ ᓄᓇᕗᒻᒥᐅᑦ ᐃᓱᒫᓗᒋᐊᖃᙱᓚᑦ ᐊᐃᑦᑐᐃᓂᐅᔪᒥ Covid concern at Mary River Presumably infected individual is isolating, health officials say no reason for Nunavummiut to worry about spread Volume 76 Issue 10 MONDAY, JULY 6, 2020 $.95 (plus GST) Nunavut Happy Nunavut Day! Day festivities to be indoors What does Nunavut Day mean to you? Iqalummiut march for mental health Sanirajak planning for bowhead hunt NNSL file photo Teresina Walland, then 2, laughs with delight as she holds her balloon animal aloft during Nunavut Day cele- brations in 2017. Publication mail Contract #40012157 "Liquor and cannabis outlets are easy to establish and maintain and the black market is thriving, yet treatment centres are too expensive?" 7 71605 00200 2 – Columnist Harry Maksagak questions the territory's priorities around liquor, page 9. 2 nunavutnews.com, Monday, July 6, 2020 kNKu W?9oxJ5, N[Z/su, JMw 6, 2020 `rNs/OsCh8i3j5 tu1Z5 Wdt1Q5 tu1Z5 W?9Oxt5ti3j5 tu1Z5 kNKu W?9oxJ5, N[Z/su, JMw 6, 2020 nunavutnews.com, Monday, July 6, 2020 3 Did we get it wrong? feature news êΩËîΩÇéíÇÀîᓄ á·∆¿ÖÀî Nunavut News is committed to getting facts and names right. With that goes a commitment to acknowledge mistakes and run corrections. If you spot an error in Nunavut News/North, call (867) 979- 5990 and ask to speak to an editor, or email editor- [email protected]. We'll get a correction or clarification in as soon as we can. NEWS Briefs ᐆᒪᔫᖃᑎᒥᓂᒃ ᐆᒪᕕᖃᖅᑐᒥ ᓇᓂᔭᐅᔪᖃᖅᐳᖅ ᑲᖏᖅᖠᓂᕐᒥ ᐊᐃᕕᐅᑉ ᐅᖃᖓᓂ ᐊᐃᕕᐅᑉ ᐅᖃᖓᓂ ᖃᐅᔨᓴᖅᑕᐅᓂᖓᓂ ᐆᒪᔫᖃᑎᒥᓂᒃ ᐆᒪᕕᖃᖅᑐᒥ ᖁᐱᕐᕈᖅ ᖁᐱᕐᕆᓐᓇᖅᑐᖃᖅᐳᖅ ᑲᖏᖅᖠᓂᕐᒥ, ᐋᓐᓂᐊᖃᕐᓇᙱᑦᑐᓕᕆᔨᒃᑯᑦ ᐅᖃᐅᔾᔨᕗᑦ ᓄᓇᖃᖅᑎᐅᔪᓂ. -

Mary River Project

Espoo Report Phase 2 Proposal – Mary River Project Baffinland Iron Mines Corporation Mary River Project NIRB File No. 08MN053 Mary River Project Espoo Report Phase 2 Proposal TABLE OF CONTENTS Table of Contents ........................................................................................................................................... i List of Tables ..................................................................................................................................................ii List of Figures .................................................................................................................................................ii Abbreviations and Acronyms ......................................................................................................................... iii Executive Summary ....................................................................................................................................... iv 1 Introduction ............................................................................................................................................1 1.1 Project Overview and Background ....................................................................................................1 1.2 Regulatory Context ...........................................................................................................................2 2 Project Description ..................................................................................................................................4 -

Assessment of the Mary River Project: Impacts and Benefits

Assessment of the Mary River Project: Impacts and Benefits By Dr John Loxley, FRSC, Department of Economics, University of Manitoba February 2019 Assessment of the Mary River Project Inuit Impact and Benefit Agreement Dr John Loxley, FRSC, Department of Economics, University of Manitoba1 Contents Executive Summary 3 A. Looking Backwards 7 1. Background to the Mary River Project 7 2. The Price of Iron Ore and Changing Output Goals 9 3. Forecasts of the Financial Viability of the Mary River Project 10 4. Inuit, the Environment and the Mary River Project 14 5. The Inuit Impact and Benefit Agreement 15 6. The Benefits Received by Inuit from Baffinland 17 7. The Minimum Inuit Employment Goals (MIEGs) 19 8. Failure to Meet MIEGs and Other Goals 19 9. Barriers to Employment 24 10. The Mary River IIBA Renegotiation 25 11. The Significance of Financial Benefits to Families and Communities 26 12. Meeting Indigenous Employment Targets and Delivering Other Benefits: Lessons from Other Resource Projects 27 Pilbara Mine, Australia 27 Voisey’s Bay, Newfoundland and Labrador 29 Diavik Diamond Mine, Northwest Territories 31 Agnico Eagle Mines, Nunavut 33 13. What Can We Learn from These Experiences? 35 B. Looking Forward: Medium Term 38 14. Forcing Employment and Other Goals by Regulating the Expansion of Output 38 15. A Financial Transfer Alternative to Employment Growth? A Dual Economy? 41 C. Looking Forward: Long Term 44 16. Implications for the Environment of 30 MT/a Output and Two Sea Outlets 46 17. Conclusion and a Recommended Way Forward 47 Bibliography 48 Appendix 1. Nunavut Institutions and Their Functions 55 1 The research assistance of Ms Elisabet Rodriguez Llorian is gratefully acknowledged. -

Attachment a Kiggavik Project Effects: Energy-Protein and Population Modeling of the Qamanirjuaq Caribou Herd

Attachment A Kiggavik Project Effects: Energy-Protein and Population Modeling of the Qamanirjuaq Caribou Herd AREVA Resources Canada Inc. Tier 2 Volume 6: Terrestrial Environment Kiggavik Project FEIS Attachment A: Kiggavik Project Effects: Energy- September 2014 Page A-1 Protein and Population Modeling of the Qamanirjuaq Caribou Herd Kiggavik Project Effects: Energy-Protein and Population Modeling of the Qamanirjuaq Caribou Herd PREPARED FOR: EDI ENVIRONMENTAL DYNAMICS INC. 2195 SECOND AVENUE WHITEHORSE, YT Y1A 3T8 867.393.4882 PREPARED BY: DON RUSSELL SHADOW LAKE ENVIRONMENTAL CONSULTANTS WHITEHORSE, YUKON 867.456.2695 SEPTEMBER, 2014 Kiggavik Project Effects: Energy-Protein and Population Modeling of the Qamanirjuaq Caribou Herd EXECUTIVE SUMMARY The Kiggavik mine project has the potential to disturb caribou. Based on requests from the Beverly- Qamanirjuaq Caribou Management Board, AREVA agreed to provide a Project and cumulative effects assessment on caribou. To predict potential impacts, an individual-based energy-protein (E-P) model was linked to a population model. Those tools were used to provide analysis of the expected range of fall body weights of cows and calves due to the substantial variability observed in the individual caribou encounters with zones of influence (ZOI) within the Qamanirjuaq caribou range. The key output indicators from the E-P model were the fall body weight of lactating cows and their calves. Those values provided inputs with respect to probability of pregnancy and over-winter calf mortality at the population scale. In “populating” both the energy-protein (E-P) model and the population model, the most appropriate and available data were used. For the E-P model, existing datasets on vegetation communities within the Qamanirjuaq’s herd range were augmented with generic data from the CircumArctic Rangifer Monitoring and Assessment (CARMA) network to quantify forage quality/quantity and seasonal diet.