Rail Industry Finance (UK)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cytundeb Diffiniadau

TO BE EXECUTED AS A DEED DEFINITIONS AGREEMENT SECRETARY OF STATE FOR TRANSPORT (1) and WELSH MINISTERS (2) 1 45763.11 THIS DEFINITIONS AGREEMENT is dated 2018 BETWEEN (1) THE SECRETARY OF STATE FOR TRANSPORT whose principal address is Great Minster House, 33 Horseferry Road, London SW1P 4DR (the “Secretary of State”); and (2) WELSH MINISTERS whose principal place of business is Crown Building, Cathays Park, Cardiff CF10 3NQ ("Welsh Ministers)" (including, as appropriate, Affiliates or subsidiaries of Welsh Ministers acting on its behalf), each a “Party” and together the “Parties”. WHEREAS: (A) The Secretary of State and Welsh Ministers propose to enter into a number of agreements (the “Wales & Borders Agreements”) in connection with Welsh Ministers acting as agent for the Secretary of State in respect of certain English services which are specified in a Welsh franchise agreement. (B) The Secretary of State and Welsh Ministers wish to set out in this Agreement, definitions of the terms used in the Wales & Borders Agreements. NOW IT IS AGREED as follows: 1. CONSTRUCTION AND INTERPRETATION In the Wales & Borders Agreements, except to the extent the context otherwise requires: (a) words and expressions defined in the Railways Act have the same meanings when used therein provided that, except to the extent expressly stated, “railway” shall not have the wider meaning attributed to it by Section 81(2) of the Act; (b) words and expressions defined in the Interpretation Act 1978 have the same meanings when used in the Wales & Borders Agreements; -

Accessible Travel Policy Document (Large Print

Accessible Travel Policy Great Northern GATWICK SOUTHERN ThamesLink EXPRESS WE’RE WITH YOU 1 Contents 3 A. Commitments to providing assistance 6 A.1 Booking and providing assistance 15 A.2 Information Provision 26 A.3 Ticketing & fares 30 A.4 Alternative accessible transport 32 A.5 Scooters & mobility aids 34 A.6 Delays, disruption and emergencies 36 A.7 Station facilities 38 A.8 Redress 39 B. Strategy and management 39 B.1 Strategy 39 B.2 Management arrangements 42 B.3 Monitoring & evaluation 46 B.4 Access improvements 48 B.5 Working with disabled customers, local communities and local authorities 51 B.6 Staff training 2 A. Commitments to providing assistance Govia Thameslink Railway (GTR) is the parent company for the following train companies. It runs the largest rail network in the country, operating services across the south-east of England under the following brands: Southern Extensive network from London to stations across Sussex and Surrey, the south coast and suburban ‘metro’ services across south London and to Milton Keynes via Watford Junction. Gatwick Express Direct services between London Victoria and Gatwick Airport (and some services towards Brighton). Thameslink Network of services linking many stations north of London such as Bedford, Cambridge, Peterborough, St Albans with destinations south of the River Thames via St Pancras International such as London Bridge, East Croydon, Sutton, Gatwick Airport, Brighton, Horsham and Rainham (Kent). Great Northern Services from London King’s Cross to Peterborough, King’s Lynn via Cambridge and suburban services from Moorgate towards Hertford North, Welwyn Garden City and Stevenage. -

The Connected Train

ascent Thought leadership from Atos white paper The Connected Train Your business technologists. Powering progress All around the world Atos is bringing connectivity to places where it has never been envisaged, delivering benefit to both business and user. We make sure that people have access to the right information no matter what their activity or context. Global rail is a major research area led by our experience in the UK where we have significant heritage and ‘on the ground’ vision. With travelers, operators and nation states demanding high bandwidth to improve passenger experience and drive business efficiencies we are defining a new economic and technical model that gives passengers free WiFi without the rail industry carrying operational cost. Furthermore we are focused on the true business benefit to all parties in the rail industry; revenue and margin drivers are at the core of our proposition. This paper outlines a blueprint for this service called The Connected Train. We examine the nature of the proposition by posing and answering a number of questions. Published in April 2014 © Atos, 2014, all rights reserved. The contents of this white paper is owned by Atos. You may not use or reproduce it in any type of media, unless you have been granted prior written consent thereto by a competent person authorized to represent Atos for such purpose. 2 Ascent / The Connected Train The Connected Train Contents 04 11 What is The Connected Train? How much bandwidth does a passenger need? 05 What is the value chain? 12 How much bandwidth -

Passengers Charter January 2021

Passenger’s Charter Our promise to keep our promises. Valid from January 2021 chilternrailways.co.uk Contents Getting in touch with us How to provide feedback Chiltern Railways Customer Services, Banbury ICC, Merton Street, Banbury, Oxfordshire OX16 4RN Getting in touch with us 1 Tel: 03456 005 165 Mondays to Fridays, 0830 to 1730. Introduction 2 Fax: 01926 729 914 How to find out information 2 www.chilternrailways.co.uk FREEPOST Chiltern Railways Online and by phone 2 Twitter: @chilternrailway Facebook: Chiltern Railways In person 2 Not all of the stations we call at are run Tickets 3 by Chiltern Railways. If the matter Buying in person 3 concerns one of the stations below, you should contact the relevant Train Buying online 3 Company. Buying by telephone 3 Stations from Widney Manor to Discounted tickets 3 Kidderminster inclusive (except Solihull and Birmingham Moor St which are run Oyster cards 3-4 by Chiltern), and from Claverdon to Stratford-upon-Avon inclusive are run by Ticket refunds 4-5 West Midlands Railway. Contact Penalty fares 5 their Customer Relations at Freepost WEST MIDLANDS RAIL Route network map 6 CUSTOMER RELATIONS Tel: 0333 311 0039 Train punctuality and reliability 7 www.westmidlandsrailway.com Void days compensation 7 Stations from Harrow-on-the-Hill to Useful information 7 Amersham inclusive and the ticket offices at South Ruislip and West Ruislip Accessibility assistance 7-8 are run by Transport for London; contact their Customer Services at 4th Floor, 14 Lost Property 8 Pier Walk, London, SE10 0ES Our staff 8 Tel: 0343 222 1234 www.tfl.gov.uk Our trains 9 Stations from Oxford to Heyford If your train is late 9-10 inclusive are run by Great Western Season Ticket renewal discount 10 Railway; contact their Customer Relations at Freepost RSKT-AHAZ-SLRH, Planned disruption/engineering works 10 Plymouth, PL4 6AB General information and other help 11 Tel: 0345 7000 125 11 www. -

Draft Portfolio Holder Decision Notice

PHD674 Ward(s): General DRAFT PORTFOLIO HOLDER DECISION NOTICE PROPOSED INDIVIDUAL DECISION BY THE PORTFOLIO HOLDER FOR HIGH QUALITY ENVIRONMENT) TOPIC – STAKEHOLDER CONSULTATION SOUTH WESTERN RAIL FRANCHISE PROCEDURAL INFORMATION The Access to Information Procedure Rules – Part 4, Section 22 of the Council’s Constitution provides for a decision to be made by an individual member of Cabinet. In accordance with the Procedure Rules, the Chief Operating Officer, the Chief Executive and the Chief Finance Officer are consulted together with Chairman and Vice Chairman of The Overview and Scrutiny Committee and any other relevant overview and scrutiny committee. In addition, all Members are notified. Five or more of these consulted Members can require that the matter be referred to Cabinet for determination. If you wish to make representation on this proposed Decision please contact the relevant Portfolio Holder and the following Democratic Services Officer by 5.00pm on Wednesday 10 February 2016. Contact Officers: Case Officer: Dan Massey, Tel: 01962 848534, Email: [email protected] Democratic Services Officer: Nancy Graham, Tel: 01962 848235, Email: [email protected] SUMMARY The South Western rail franchise is a vital part of the national rail network that serves a market extending from central and south west London to major towns and cities in Berkshire, Devon, Dorset, Hampshire, Surrey and Wiltshire; it also provides services on the Isle of Wight. The franchise area serves a diverse market providing connectivity that includes airports, ports, universities, sporting and cultural centres, theme parks and National Parks. The South Western rail franchise supports commuters, businesses, and local communities, as well as providing services for the tourist and leisure markets. -

Competitive Tendering of Rail Services EUROPEAN CONFERENCE of MINISTERS of TRANSPORT (ECMT)

Competitive EUROPEAN CONFERENCE OF MINISTERS OF TRANSPORT Tendering of Rail Competitive tendering Services provides a way to introduce Competitive competition to railways whilst preserving an integrated network of services. It has been used for freight Tendering railways in some countries but is particularly attractive for passenger networks when subsidised services make competition of Rail between trains serving the same routes difficult or impossible to organise. Services Governments promote competition in railways to Competitive Tendering reduce costs, not least to the tax payer, and to improve levels of service to customers. Concessions are also designed to bring much needed private capital into the rail industry. The success of competitive tendering in achieving these outcomes depends critically on the way risks are assigned between the government and private train operators. It also depends on the transparency and durability of the regulatory framework established to protect both the public interest and the interests of concession holders, and on the incentives created by franchise agreements. This report examines experience to date from around the world in competitively tendering rail services. It seeks to draw lessons for effective design of concessions and regulation from both of the successful and less successful cases examined. The work RailServices is based on detailed examinations by leading experts of the experience of passenger rail concessions in the United Kingdom, Australia, Germany, Sweden and the Netherlands. It also -

Monthly Operating Report Feb 2020

Transport for the North Monthly Operating Report February 2020 1 Contents Page Introduction Summary from the Chief Executive 3 Programme Summary Northern Powerhouse Rail (NPR) 4-6 Integrated & Smart Ticketing (IST) 6-8 Strategic Development Corridors (SDCs) 9-10 Strategic Rail 10-12 Operations Summary 12-15 Financial Performance Financial Update 16-17 Activity Dashboard 18 HR Update 19 KPIs (Key Performance 20-23 Indicators) 2 Introduction Summary from the Chief Executive February saw the escalation of the threat to Transport for the North’s operations from the Coronavirus and this has continued into March. In common with its Constituent Authorites, Transport for the North has undertaken a contingency planning exercise, based on existing business continuity arrangements, to address the challenges posed both by the virus itself, and the steps that might be taken to help control the outbreak. At the time of writing: • The Rail North Partnership, with TfN input, is working very closely with the two main northern train operating companies to continue to run services and mitigate against the impact of Coronavirus – passenger numbers have fallen significantly already as people choose not to travel; • TfN has moved to remote working (on 17 March) in line with Government guidance issued on the 16 March; and • TfN meetings such as the Board meeting on 29 April will be kept under review and moved to consultative conference calls if necessary The Oakervee Review was released on 11 February and on the same day Government announced the decision to complete HS2 in full. As part of the announcement, Government stated its intention to develop an Integrated Rail Plan for the Midlands and the North. -

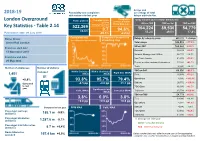

London Overground Key Statistics

Delays and 2018-19 Punctuality and complaints percentage of total with variance to last year delays attributed to: Complaints rate Complaints Delay minutes and % of total, attributed to: London Overground Trains planned answered within (per 100k NR-on-TOC TOC-on-Self TOC-on-TOC passenger journeys) 20 working days Key Statistics - Table 2.14 522,369 0.7 94.6% 164,224 89,536 54,779 +4.0% 53.2% 29.0% 17.8% Publication date: 09 July 2019 -60.5% -2.2 pp Complaints rate Complaints answered in Owner Group: Delays by category group 2018-19 % change (per 100k passenger journeys) 20 working days Arriva Rail London Total delays 308,539 +17.0% NR-on-TOC 164,224 +2.8% Franchise start date: External 28,249 +29.8% 13 November 2016 Network Management / Other 56,173 -19.3% Franchise end date: Non-Track Assets 41,872 +30.5% 25 May 2024 Severe weather, autumn & structures 17,226 +41.7% Track 20,641 -14.1% Number of employees Number of stations TOC-on-Self Within 5 minutes Within 10 minutes 89,536 +80.1% managed Right time (MAA) 1,451 (MAA) (MAA) Fleet 30,616 +53.2% 81 Operations 5,695 +181.4% +0.8% 93.8% 95.7% 79.4% Stations 26,772 +150.6% Compared -0.5 pp -0.8 pp +1.1 pp to last TOC Other 10,636 +16.7% year Significantly late CaSL (MAA) Cancelled (MAA) Traincrew 15,798 +100.4% (MAA) TOC-on-TOC 54,779 +0.9% 3.8% 0.0% 3.8% Fleet 19,080 -16.8% +0.8 pp +0.0 pp +0.8 pp Operations 6,921 +41.8% Compared to last year PPM MAA CaSL MAA Stations 4,586 -3.8% TOC Other 12,682 +12.8% Passenger journeys 188.1 m -0.9% (millions) Traincrew 11,510 +9.8% Passenger kilometres % Change on last year (millions) 1,287.6 m -0.7% Green - Less than last year Passenger train kilometres (millions) 8.7 m +6.4% Red - More than last year Route kilometres 167.4 km +0.0% Delay minute totals may differ from the sum of the aggregated operated categories due to other miscellaneous categories being included. -

Railway Study Association Program

The Hagestad Sandhouse Rail group presents….a Special Sandhouse Event Wednesday – Sept. 16, 2015 - 1:00 pm – 4:30 pm (followed by informal networking reception) Location: NU Transportation Center, Chambers Hall, 600 Foster, Evanston On Wednesday, Sept. 16, 2015, the Northwestern Transportation Center will host members of the Railway Study Association (RSA) - a group of British Railway and rail transit officers, suppliers, related professionals and academics associated with the London School of Economics - who will be visiting Chicago for a week long Study tour arranged by Michael Weinman (PTSI Transportation) – a fellow Sandhouse member. Sandhouse members are invited to join some or all of the presentations. RSVPs requested to: [email protected] British Rail / Sandhouse Program: 1:00 pm “ Railroad Safety in the United States” Professor Ian Savage, Associate Chair & Distinguished Senior Lecturer, Department of Economics, Northwestern University The presentation will look at the different types of contemporary safety challenges facing U.S. railroads and recent trends in the risks to employees, motorists at grade crossings, pedestrians and bystanders. It will also present some cross-modal risk comparisons. 1:45 pm “The Expansion of Intercity Bus Service in the United States and the Changing Dynamics of Bus/Rail Competition” - Joseph P. Schwieterman, Director Chaddick Institute for Metropolitan Development, and Professor, School for Public Service, De Paul University Schwieterman will discuss the recent revival of intercity bus service in the U.S. and how this is changing the competitive mix of services that are available. He will draw upon his analysis to show how the amount of service has grown since 2008 and illustrate the growing investments in express services between cities separated by 100 - 350 miles. -

John Self Obe

JOHN SELF OBE WWW.FCPWORLD.NET KEY SKILLS JOHN SELF has nearly 50 years experience in metro and railway Rail engineering, rolling operations, senior management, engineering and advisory roles. He stock, operations, rail joined London Underground as a trainee and rose through the ranks safety, benchmarking, PPPs, franchises, to become General Manager of some of the busiest lines. He then concessions moved to the national rail industry, as Director of Safety at the EMPLOYMENT Strategic Rail Authority, and then served as the first Chief Executive 2004-current Partner, First of the newly created Rail Safety and Standards Board. Recently, John has been Class Partnerships Ltd, UK advising Transport for London and private sector franchise bidders on the London 2003-2004 Interim Chief Overground and Crossrail projects and has assisted Eko Rail with development of Executive, Rail Safety and plans for the Lagos Metro. Standards Board, UK 2000-2003 Director, Safety, He has managed large operating budgets and diverse front line workforces, Strategic Rail Authority, UK delivering regular and reliable services, safely, while achieving significant 1997-2000 President, productivity improvements and efficiencies. CoMET From its formation, John was active in the educational activities of the Institution of 1966-2000 London Underground Limited, UK - Railway Operators, and is a former chair of the Education and Professional General Manager, Jubilee Development Committee and was Lead Tutor for the modules on safety and and East London Lines, engineering. -

Investor Report 01 01 16

Investor Report 1 July 2018 – 30 June 2019 1 Angel Trains Investor Report – 1 July 2011 to 30 June 2012 1 GENERAL OVERVIEW Angel Trains Group (the “Group”) performed strongly during the period with EBITDA at £412.1m, an increase of £1.3m on the corresponding previous 12 month period. The Group has maintained credit metrics consistent with the Baa2 credit rating throughout the period, following the rating affirmation by Moody’s during December 2018. At 30 June 2019 the Group owned 4,421 vehicles. During the period, new leases were entered into with nine franchises (including four franchise extensions), accounting for 1,802 vehicles (40.8%) of the Group’s existing portfolio. Between 2019 and 2022 a further 1,376 vehicles are due for re- lease; excluding those which are covered by Section 54 undertakings. During the same period an additional 120 new bi-mode vehicles will be delivered. At the period end, 96.6% of the Group’s portfolio was on lease. The off-lease vehicles are a small number of Class 317 and HST vehicles. All are life expired with no further economic value attributed to them. A small number of Class 442 vehicles are earmarked for disposal. 2 SIGNIFICANT BUSINESS DEVELOPMENTS 2.1 New significant business developments for the period ending 30 June 2019 New Trains There were no new train procurements during the period. However, focus on project management delivery continues with regards the following new trains: Angel Trains is procuring 24 x 5-car AT300 bi-mode intercity trains (Class 802), which will be manufactured by Hitachi Rail Europe and utilised by FirstGroup on the TransPennine Express (“TPE”) franchise and by First Hull Trains. -

A Quick Guide to the Railways

BRIEFING PAPER Number CBP 4128, 4 December 2018 A Quick Guide to the By Louise Butcher Railways Contents: 1. How do the railways work? 2. Funding 3. Train operating companies (TOCs) 4. Performance, reliability and default 5. Passenger rights and complaints 6. Compensation 7. Infrastructure: Network Rail 8. Rolling stock 9. Regulation 10. Fares 11. Station funding 12. Freight 13. Community Rail www.parliament.uk/commons-library | intranet.parliament.uk/commons-library | [email protected] | @commonslibrary 2 A Quick Guide to the Railways Contents Summary 3 1. How do the railways work? 4 2. Funding 6 3. Train operating companies (TOCs) 7 3.1 Franchises 7 3.2 Concession agreements 9 3.3 Open access 9 4. Performance, reliability and default 11 5. Passenger rights and complaints 12 6. Compensation 13 7. Infrastructure: Network Rail 14 8. Rolling stock 15 9. Regulation 16 10. Fares 17 11. Station funding 18 12. Freight 20 13. Community Rail 21 Cover page image copyright Crowds at Waterloo Station by Matthew Black. Licensed under CC BY 2.0 / image cropped. 3 Commons Library Briefing, 4 December 2018 Summary This paper provides a brief outline of the GB rail industry, including the bodies responsible for delivering services, how new schemes are chosen and financed. Following privatisation in 1993, British Rail was divided into two main parts: one part being the national rail infrastructure (track, signalling, bridges, tunnels, stations and depots) and the second being the operating companies whose trains run on that network. The infrastructure is owned by Network Rail which is regulated by the Office of Rail and Road (ORR).