Archive-File.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Schools and Libraries 4Q2014 Funding Year 2013 Authorizations - 2Q2014 Page 131 of 260

Universal Service Administrative Company Appendix SL28 Schools and Libraries 4Q2014 Funding Year 2013 Authorizations - 2Q2014 Page 131 of 260 Applicant Name City State Primary Authorized LUTHERAN HIGH SCHOOL SOUTH SAINT LOUIS MO 6,479.85 LUTHERAN HIGH SCHOOL- LA VERNE LA VERNE CA 1,550.11 LUTHERAN INTERPARISH SCHOOL WILLIAMSBURG IA 172.30 LUTHERAN SCHOOL ASSOCIATION HIGH SCHOOL DECATUR IL 1,229.80 LUTHERAN SCHOOL OF FLUSHING BAYSIDE NY 1,259.74 LUTHERAN SOUTH UNITY SCHOOL FORT WAYNE IN 1,494.68 LUTIE SCHOOL DISTRICT R 6 THEODOSIA MO 616.90 LUVERNE COMMUNITY SCHOOL DIST LU VERNE IA 1,789.20 LUVERNE SCHOOL DISTRICT 2184 LUVERNE MN 2,738.12 LUXEMBURG-CASCO SCHOOL DIST LUXEMBURG WI 12,946.13 LUZ ACADEMY OF TUCSON TUCSON AZ 18,300.02 LUZERNE COUNTY LIBRARY SYSTEM WILKES BARRE PA 9,483.36 LYCEE INTERNATIONAL OF LOS ANGELES- EDUCATION VAN NUYS CA 824.80 OFFICE LYCOMING COUNTY LIBRARY SYSTEM WILLIAMSPORT PA 6,997.25 LYFORD INDEP SCHOOL DISTRICT LYFORD TX 9,443.11 LYMAN SCHOOL DISTRICT 42-1 PRESHO SD 1,893.02 LYNCH PUBLIC SCHOOL DISTRICT LYNCH NE 3,697.89 LYNCHBURG CITY SCHOOL DISTRICT LYNCHBURG VA 55,661.77 LYNCHBURG-CLAY SCHOOL DISTRICT LYNCHBURG OH 65,886.93 LYND ELEMENTARY SCHOOL LYND MN 462.38 LYNDEN CHRISTIAN SCHOOL LYNDEN WA 3,730.62 LYNDEN SCHOOL DISTRICT 504 LYNDEN WA 10,970.33 LYNDON INSTITUTE, INC. LYNDON CENTER VT 24,173.43 LYNNFIELD SCHOOL DISTRICT LYNNFIELD MA 2,728.50 LYNWOOD UNIFIED SCHOOL DIST LYNWOOD CA 4,748.28 LYON COUNTY LIBRARY DISTRICT 1 ALLEN KS 211.12 LYON COUNTY SCHOOL DISTRICT EDDYVILLE KY 2,117.50 LYON COUNTY SCHOOL -

HIVED M VUMRA^ W C Other Professional Fees

OMB NO. 1545-0052 Form 990-PF Return of Private Foundation or Section 4947(a)(1) Nonexempt Charitable Trust DepartmentoftheTn^sury Treated as a Private Foundation Internal Revenue Service 00 Note: The foundation may be able to use a copy of this return to satisfy state reporting requirements. 2 6 For calendar year, 2006 , or tax year beginning , and ending Name of foundation mployer identification number Use the IRS TENSION ATTACH label. Otherwise , HE ADJMI-DWEK FAMILY FOUNDATION, INC. 13-3782816 print Number and shed (or P 0 box number if mail Is not delivered to street address) f mrs^^te g Telephone number ortype . 16TH 212-629_9600 /O ELI SERUYA, 500 SEVENTH AVENUE J V V V See Specific City or town , state, and ZIP code C If exemption applicationplacation .s pending, check hen: • O Instructions . ► EW YORK , NY 10 018 0 1 . Foreign organizations , check here Q 2. Foreign on,1za1dt1 mea p the e5% test,-.- ► ^ H Check typ e of or9anization X Section 501 (c)(3) exempt Private foundation here an attach computation -- . Q Section 4947(a)(1) nonexempt charitable trust 0 Other taxable private foundation E If private fou ndati on status was te rminated I Fair market value of all assets at end of year J Accounting method : Cash 0 Accrual under section 507(b)(1)(A), check here . (from Part 11, col. (c), line 16) 0 Other (specify) F If the foundation is in a 60-month termination Part 1, column (cq must be on cash basis.) ► $ 17 , 824 . ( under section 507 (b)( 1 6 , check here . -

2015 Department of the Treasury 0- Do Not Enter Social Security Numbers on This Form As It May Be Made Public

l efile GRAPHIC p rint - DO NOT PROCESS As Filed Data - DLN: 93491137035666 OMB No 1545-0052 Form 990-PF Return of Private Foundation or Section 4947(a)(1) Trust Treated as Private Foundation 2015 Department of the Treasury 0- Do not enter social security numbers on this form as it may be made public. Internal Revenue Serwce 0- Information about Form 990-PF and its instructions is at www.irs.gov/form990Pf . ' ' ' For calendar year 2015 , or tax year beginning 01 - 01-2015 , and ending 12-31-2015 Name of foundation A Employer identification number BETTY AND IRVING RUTHEN PRIVATE FOUNDATION INC 80-0590280 Number and street ( or P 0 box number if mail is not delivered to street address) BTelephone number (see instructions) 1217 EAST 27TH STREET (917) 913-1452 City or town, state or province, country, and ZIP or foreign postal code C If exemption application is pending, check here F BROOKLYN, NY 11210 G Check all that apply (Initial return (Initial return of a former public charity D 1. Foreign organizations , check here P. F (-Final return (Amended return 2. Foreign organizations meeting the 85% F (Address change (Name change P. test, check here and attach computation n ^.iicLr Ly Nc UI UI OIIIcauUii I- OCLLIUII JU± L ) ) CAciilpL NiivaLC IUUIIUOuUii E If private foundation status was terminated (Section 4947 (a)(1) nonexempt charitable trust (Other taxable private foundation under section 507(b)(1)(A), check here F IFair market value of all assets at end JAccounting method 17 Cash f Accrual F If the foundation is in a 60 - month termination of year (from Part II, col. -

Schools and Libraries 2Q2013 Funding Year 2011 Authorizations - 4Q2012 Page 1 of 111

Universal Service Administrative Company Appendix SL24 Schools and Libraries 2Q2013 Funding Year 2011 Authorizations - 4Q2012 Page 1 of 111 Applicant Name City State Primary Authorized 21ST CENTURY CHARTER SCHOOL @ COLORADO SPINGS COLORADA SPRINGS CO 17,164.80 21ST CENTURY CHARTER SCHOOL @ GARY GARY IN 30,457.62 A + ACADEMY CHARTER SCHOOL DALLAS TX 34,485.08 A B C UNIFIED SCHOOL DISTRICT CERRITOS CA 5,607.81 A SPECIAL PLACE SANTA ROSA CA 1,670.12 A.W. BROWN FELLOWSHIP CHARTER SCHOOL DALLAS TX 89,932.66 ABBE REGIONAL LIBRARY AIKEN SC 13,602.66 ABBEVILLE COUNTY LIBRARY ABBEVILLE SC 664.52 ABBEVILLE SENIOR HIGH SCHOOL ABBEVILLE LA 3,942.70 ABERDEEN PUBLIC LIBRARY ABERDEEN ID 134.58 ABERDEEN SCHOOL DISTRICT ABERDEEN MS 14,267.85 ABERDEEN SCHOOL DISTRICT 5 ABERDEEN WA 49,259.01 ABERDEEN SCHOOL DISTRICT 6-1 ABERDEEN SD 3,202.97 ABINGDON COMM SCHOOL DIST 217 ABINGDON IL 2,477.59 ABRAMS HEBREW ACADEMY YARDLEY PA 2,134.48 ABSECON PUBLIC SCHOOL DISTRICT ABSECON NJ 3,895.78 ABYSSINIAN DEVELOPMENT CORPORATION NEW YORK NY 16,485.45 ACADEMIA AVANCE LOS ANGELES CA 44,650.00 ACADEMIA CESAR CHAVEZ SAINT PAUL MN 229.50 ACADEMIA CRISTO DE LOS MILAGROS CAGUAS PR 1,495.58 ACADEMIA DEL CARMEN CAROLINA PR 2,931.26 ACADEMIA DEL ESPIRITU SANTO BAYAMON PR 5,788.80 Academia del Perpetuo Socorro Santruce PR 4,987.73 Academia del Sagrado Corazon Santurce PR 7,019.89 ACADEMIA DISCIPULOS DE CRISTO EN VEGA ALTA VEGA ALTA PR 1,144.80 ACADEMIA JULIO TORRES RODRIGUEZ, INC. -

Return Ii Or Nni72tinn Exam T from Inrnma

l efile GRAPHIC pi - DO NOT PROCESS I As Filed Data - I DLN: 93493319140438 OMB No 1545-0047 Return ii Or nni72tinn Exam t From Inrnma Tnv Form 990 W p Under section 501(c ), 527, or 4947 ( a)(1) of the Internal Revenue Code (except private foundations) 2017 Do not enter social security numbers on this form as it may be made public Department of the ► ► Information about Form 990 and its instructions is at www IRS gov/form990 Internal Reyemre Ser ice A For the 2017 calendar y ear, or tax y ear II inning 01-01-2017 . and ending 12-31-2017 C Name of organization B Check if applicable D Employer identification number AMERICAN FRIENDS OF q Address change YESHIVATH MEOR HATALMUD 13-3339942 q Name change Doing business as q Initial return q Final return/terminated C i eiepnone nurnuer q Amended return Number and street (or P 0 box if mail is not delivered to street address) Room/suite C/O M BROWN 138-46 76TH AVE q Application pending (212) 962-6100 City or town, state or province, country, and ZIP or foreign postal code FLUSHING, NY 11367 G Gross receipts $ 520,187 F Name and address of principal officer H(a) Is this a group return for MARTIN BRAUN 138-46 76TH AVE subordinates? No FLUSHING, NY 11367 H(b) Are all subordinates included? El Yes o I Tax-exempt status R 501(c)(3) q 501(c) ( ) A (insert no q 4947(a)(1) or El 527 If "No," attach a list ( see instructions ) H(c) Group exemption number J Website : ► ► q q q L Year of formation 1988 M State of legal domicile NY K Form of organization 9 Corporation Trust Association Other ► NLi^ Summary 1 Briefly describe the organization's mission or most significant activities EDUCATIONAL ASSISTANCE AND TALMUD RESEARCH w p 2 Check this box Po, El if the organization discontinued its operations or disposed of more than 25% of its net assets 3 Number of voting members of the governing body (Part VI, line 1a) . -

Welcome to the OJNA Journal the History of Jewish Nurses Goes Back Millen- Orthodox Jewish Nurses Association (OJNA) Sibilities for When Things Go Wrong

THE OJNA JOURNAL Issue 1 | Spring 2018 Welcome to The OJNA Journal The history of Jewish nurses goes back millen- Orthodox Jewish Nurses Association (OJNA) sibilities for when things go wrong. Many of us nia. One of the earliest mentions of Jewish nurses was founded by Rivka Pomerantz, BSN, RN, IB- will cross paths with men, women, and infants is that of Shifra and Puah, midwives who helped CLC. In its nine years of existence, OJNA, a non- who have experienced traumatic events related Jewish women when their people were enslaved profit, has hosted several conferences attended to pregnancy and birth. These conversations are in Egypt. Not only were the midwives caregivers, by hundreds of frum nurses, organized network- hard to have, and the topics are not frequently but they were patient advocates as well. Although ing dinners and educational events around the discussed. OJNA wishes to change that, and we ordered by Pharaoh to kill all newborn males nation, and grown to include over 1,700 mem- hope we have done so skillfully, accurately, and upon birth, the midwives argued that Jewish bers on its Facebook forum. with sensitivity. women were so skilled at delivering their babies, OJNA also recognizes the increased number of We look forward to your involvement in our they gave birth before the midwives made it to male nurses entering the profession. According journal, whether you are reading or writing. We the bedside. Commentaries say that for the act to the U.S. Census Bureau of 2016, only nine invite you to engage with us, to send us submis- of saving these children, God blessed Shifra and percent of nurses are male. -

****** I 2009-01-15

efile GRAPHIC rint - DO NOT PROCESS As Filed Data - DLN: 93493043004050 Return of Organization Exempt From Income Tax OMB NO 1545"0047 Form 990 "E DepartmentUnder section ofthe 501(c), benefit527, or Treasurytrust 4947(a)(1) or private foundation)of the Internal Open Revenue Code tg (except Public black lung Internalll-The organization Revenue may have to use a copy ofthisService return to satisfy state reporting Inspectign requirements A For the 2008 calendar year, Cor taxName year beginning of Orgamzatlon 07-01-2008 and ending D 06-30-2009 Employer identification number B Check if applicable Please Jewish Communal Fund I- Address change use IRS 2 3 - 7 1 7 4 1 8 3 label or I- Name change print or Doing Business As E Telephone number type. See I- Initial return Specific (212) 752-8277 Instruc Number and street (or P O box if mail is not delivered to street address) Room/suite , I- Termination tions. 575 MADISON AVENUE G Gross receipts $ 432,931,701 I- Amended return City or town, state or country, and ZIP + 4 NEW YORK, NY 10022 I- Application pending F Name and address ofPrincipal Officer H(a) Is this a group return for Sue Dickman Executive VP 575 Madison Avenue affiliates? I-Yes I7No NewYork,NY 10022 H( b) Are all affiliates included? I- Yes I- No 1 Tax-exempt Status I7 501(c) ( 3) 1 (insert no) I- 4947(a)(1) or I- 527 (If"No," attach a list See instructions) J Website: ll- WWWJEWISHCOIVIIVIUNALFUND ORG H(c) Group Exemption Number ll K Type of organization I7 Corporation I- trust I- association I- other ll L Year of Formation 1972 I M State of legal domicile NY IEIIII Summary 1 Briefly describe the organizationfs mission or most significant activities TO FACILITATE AND PROMOTE PHILANTHROPY 2 Check this box I- ifthe organization discontinued its operations or disposed of more than 25% ofits assets 3 Numberofvotingmembersofthegoverningbody(PartVI,line1a)3 . -

92Nd Street Y ACHDUS SUMMER PROGRAM ACHEINU DAY CAMP

92nd street y ACHDUS SUMMER PROGRAM ACHEINU DAY CAMP achim ACHVA ADAS YEREIM ADAS YEREIM - PARKSVILLE AGUDAH / BNOS / CHAYIL AGUDAH MIDWEST - BNOS, NAGEELA, SPARK Agudath Israel of Illinois Camps AHAVAS ISRAEL BNOS ISRAEL VIZNITZ AHUVIM AISHEL AVRAHAM / KESER AL HADERECH alpine acres AMERICAN CAMP ASSOCIATION,NY American Jewish Society for Service ARMON ESTATES ARUGADATH HARBOSEM ASHREINU ASSOCIATED CAMPS ATARA AVEER DAY CAMP Avnet Country Day School Avrachim BACHUREI CHEMED BAIS EZRA Bais Faiga Gratter Building BAIS FRUMA- MACHNE PERACH BAIS HILLEL KRASNA DAY CAMP Bais Meir/Camp Hilldale BAIS RIVKA DAY CAMP BAIS ROCHEL BAIS ROCHEL DAY CAMP BAIS ROCHEL RESORT BAIS SHLOMO ZALMAN Bais Simcha Day Camp Bais Tova BAIS TZIPORA DAY CAMP BAIS YAAKOV BAIS YAAKOV DC BAIS YAAKOV ACADEMY Bais Yaakov Bnos Rivka BAIS YAAKOV BP DAY CAMP Bais Yaakov of Brooklyn Bais Yaakov Ohel Sarah Bais Yakov D'Gur High School Bais Yisroel Bais Yitzchok BAR MITZVAH CHABAD BAS MIKROH Bayonne JCC Camp Kadimah BEAVER LAKE ESTATES DAY CAMP Be'er Hagola Institute BEER HATORAH BENI ZION DAY CAMP BERKSHIRE HILLS EMANUAL CAMPS Beth Chana BETH EL SUMMER SESSION BETH JACOB OF BORO PARK BETH JACOB SUMMER PROGRAM beth rivkah BETH RIVKY DAY CAMP Beth Tfiloh Camps Bike Across America for Zuuz Block and Hexter Camp Bnai Brith community camp B'nai Brith Perlman BNEI BELZ Bnei Shimon Yisroel BNOS / BNOSINU BNOS ACHDUS BNOS BELZ BNOS BELZ Bnos Margulia Viznitz Bnos Menachem Day Camp BNOS SANZ Bnos Satmar of Boro Park Bnos Shulamith BNOS SKWERE Bnos Spinka bnos square of williamsburg -

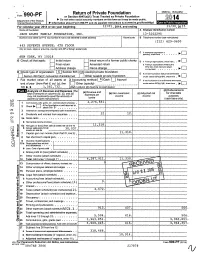

Form990-PF Or Section 4947(A)(1) Trust Treated As Private Foundation Do Not Enter Social Security Numbers on This Form As It May Be Made Public

l , Return of Private Foundation OMB No 1545-0052 Form990-PF or Section 4947(a)(1) Trust Treated as Private Foundation Do not enter social security numbers on this form as it may be made public. 2014 ' • Department of the Treasury ► Instructions is at www.irs.gov/four Internal Revenue Service ► Information about Form 990-PF and its separate For calendar y ear 2014 or tax y ear be g inning 12/01 , 2014 , and endin g 11/30, 20 15 Name of foundation A Employer identification number JACK ADJMI FAMILY FOUNDATION. INC, 13-3202295 Number and street ( or P 0 box number if mad is not delivered to street address) Room / suite B Telephone number (see instructions) (212) 629-9600 463 SEVENTH AVENUE, 4TH FLOOR City or town , state or province, country, and ZIP or foreign postal code q C If exemption application is . ► pending, check here - - • - - - NEW YORK, NY 10018 G Check all that apply: Initial return Initial return of a former public charity q D 1 Foreign organizations, check here. ► Final return Amended return 2 Foreign organ izations meeting the q 85% test, check here and attach . ► Address change9a Name change computation . H Check type of organization : X Section 501 (c)(3) exempt private foundation E If private foundation status was terminated Section ) nonexem t charitable trust Other taxable p rivate foundation q 4947( l )( 1 p under section 507(bx1XA), check here , ► I Fair market value of all assets at J Accountin9 method : X Cash Accrual F If the foundation is in a 60-month termination end of year (from Part 11, col. -

2014 0- Do Not Enter Social Security Numbers on This Form As It May Be Made Public

l efile GRAPHIC p rint - DO NOT PROCESS As Filed Data - DLN: 93491134031435 OMB No 1545-0052 Form 990-PF Return of Private Foundation or Section 4947(a)(1) Trust Treated as Private Foundation Department of the Treasury 2014 0- Do not enter social security numbers on this form as it may be made public. Internal Revenue Service 0- Information about Form 990-PF and its instructions is at www.irs.gov/form990pf . For calendar year 2014 , or tax year beginning 01 - 01-2014 , and ending 12-31-2014 Name of foundation A Employer identification number JACOB AND MIRIAM GHERMEZIAN FOUNDATION 80-0592321 Number and street (or P 0 box number if mail is not delivered to street address) Room/suite U ieiepnone number (see instructions) ONE MEADOWLANDS PLAZA 6TH FLOOR (201) 340-2900 City or town, state or province, country, and ZIP or foreign postal code C If exemption application is pending, check here F EAST RUTHERFORD, NJ 07073 G Check all that apply r'Initial return r'Initial return of a former public charity D 1. Foreign organizations, check here (- r Final return r'Amended return 2. Foreign organizations meeting the 850/, r-Address change r'Name change test, check here and attach computation F E If private foundation status was terminated H C heck type of organization Section 501(c)(3) exempt private foundation under section 507(b)(1)(A), check here F_ Section 4947(a)(1) nonexempt charitable trust r'Other taxable private foundation I Fair market value of all assets at end J Accounting method F Cash F Accrual F If the foundation is in a 60-month termination of year (from Part II, col. -

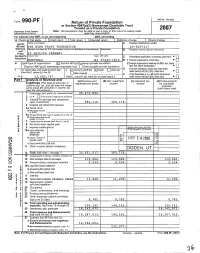

Form 990- P F 2007

,G OMB No 1545 0052 Form 990- P F Return of Private Foundation or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation 2007 Department of the Treasury Note : The foundation may be able to use a copy of this return to satisfy state Internal Revenue Service reporting requirements For calendar year 2007, or tax year beginnin g , 2007 , and ending G Check all that apply. Initial return Final return Amended return Address change r Name change Use the Name of foundation A Employer identificabon number IRS label. THE EZRA TRUST FOUNDATION 20-6557217 Otherwise, Number and street (or P 0 box number if mail is not delivered to street address) Room/suite B Telephone number (see the instructions) print or type. 25 PHILIPS PARKWAY See Specific City or town state ZIP code C If exemption application is pending, check here Instructions . MONTVALE NJ 07645-1810 D 1 Foreign organizations, check here H Check type of organization X Section 501 (c)(3) exempt private foundation 2 Foreign organizations meeting the 85% test, check q Section 4947(a)(1 ) nonexempt charitable trust Other taxable private foundation here and attach computation E If private foundation status was terminated Fair market value of all assets at end of year J Accounting method X Cash Accrual under section 507(b)(1)(A), check here (from Part II, column (c), fine 16) 11 Other (s pecify) _ _ _ _ _ _ _ _ _ _ _ _ _ F If the foundation is in a 60-month termination $ 12 , 665 , 747. -

Return of Private Foundation

Form 990iPF Return of Private Foundation OMB No 1545-0052 or Section 4947(a)(1) Nonexempt Charitable Trust Department of the Treasury Treated as a Private Foundation Internal Revenue Service Note: The foundation may be able to use a copy of this return to satisfy state reporting requirements. 2 00 6 For calendar year 2006 , or tax year beginning AUG 1, 2006 , and ending JUL 31 , 2007 r rhar4 all that annh, I 1 Initial return FT C,nnl reh. 11 e.., ndn, ret n n I T Ad dre ,.time I_^ nl^ ..tip Use the IRS Name of foundation A Employer Identification number label. Otherwise , T HE FISHOFF FAMILY FOUNDATION 13-3076576 print Number and street (or P O box number if mail is not deli red to street address) Room/suite B Telephone number or type . 3OO " 17 S 973-458-8070 See Specific City or town, state, and ZIP code O ^J '% C If exemption application is pending , check here O Instructions . ► L w^ , ^^ u 7 6 V q D 1. Foreign organizations, check here 2. Foreign organizations meeting the 85% test, H Check typea of organization X Section 501 ()()c 3 exempt private foundation check here and attach computation ► Section 4947(a)(1) nonexempt charitable trust = Other taxable private foundation E If private foundation status was terminated I Fair market value of all assets at end of year Accounting LX J method 0 Cash Accrual under section 507(b)(1 )(A), check here ► 0 (from Part Il, col (c), line 16) = Other (specify) F If the foundation is in a 60-month termination $ 6 , 750 , 238 .