The FIBI Group 2016 Corporate Social Responsibility Report 2 2016 Corporate Social Responsibility Report Table of Content

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HIVED M VUMRA^ W C Other Professional Fees

OMB NO. 1545-0052 Form 990-PF Return of Private Foundation or Section 4947(a)(1) Nonexempt Charitable Trust DepartmentoftheTn^sury Treated as a Private Foundation Internal Revenue Service 00 Note: The foundation may be able to use a copy of this return to satisfy state reporting requirements. 2 6 For calendar year, 2006 , or tax year beginning , and ending Name of foundation mployer identification number Use the IRS TENSION ATTACH label. Otherwise , HE ADJMI-DWEK FAMILY FOUNDATION, INC. 13-3782816 print Number and shed (or P 0 box number if mail Is not delivered to street address) f mrs^^te g Telephone number ortype . 16TH 212-629_9600 /O ELI SERUYA, 500 SEVENTH AVENUE J V V V See Specific City or town , state, and ZIP code C If exemption applicationplacation .s pending, check hen: • O Instructions . ► EW YORK , NY 10 018 0 1 . Foreign organizations , check here Q 2. Foreign on,1za1dt1 mea p the e5% test,-.- ► ^ H Check typ e of or9anization X Section 501 (c)(3) exempt Private foundation here an attach computation -- . Q Section 4947(a)(1) nonexempt charitable trust 0 Other taxable private foundation E If private fou ndati on status was te rminated I Fair market value of all assets at end of year J Accounting method : Cash 0 Accrual under section 507(b)(1)(A), check here . (from Part 11, col. (c), line 16) 0 Other (specify) F If the foundation is in a 60-month termination Part 1, column (cq must be on cash basis.) ► $ 17 , 824 . ( under section 507 (b)( 1 6 , check here . -

The Bedouin Population in the Negev

T The Since the establishment of the State of Israel, the Bedouins h in the Negev have rarely been included in the Israeli public e discourse, even though they comprise around one-fourth B Bedouin e of the Negev’s population. Recently, however, political, d o economic and social changes have raised public awareness u i of this population group, as have the efforts to resolve the n TThehe BBedouinedouin PPopulationopulation status of the unrecognized Bedouin villages in the Negev, P Population o primarily through the Goldberg and Prawer Committees. p u These changing trends have exposed major shortcomings l a in information, facts and figures regarding the Arab- t i iinn tthehe NNegevegev o Bedouins in the Negev. The objective of this publication n The Abraham Fund Initiatives is to fill in this missing information and to portray a i in the n Building a Shared Future for Israel’s comprehensive picture of this population group. t Jewish and Arab Citizens h The first section, written by Arik Rudnitzky, describes e The Abraham Fund Initiatives is a non- the social, demographic and economic characteristics of N Negev profit organization that has been working e Bedouin society in the Negev and compares these to the g since 1989 to promote coexistence and Jewish population and the general Arab population in e equality among Israel’s Jewish and Arab v Israel. citizens. Named for the common ancestor of both Jews and Arabs, The Abraham In the second section, Dr. Thabet Abu Ras discusses social Fund Initiatives advances a cohesive, and demographic attributes in the context of government secure and just Israeli society by policy toward the Bedouin population with respect to promoting policies based on innovative economics, politics, land and settlement, decisive rulings social models, and by conducting large- of the High Court of Justice concerning the Bedouins and scale social change initiatives, advocacy the new political awakening in Bedouin society. -

Domestically Owned Versus Foreign-Owned Banks in Israel

Domestic bank intermediation: domestically owned versus foreign-owned banks in Israel David Marzuk1 1. The Israeli banking system – an overview A. The structure of the banking system and its scope of activity Israel has a highly developed banking system. At the end of June 2009, there were 23 banking corporations registered in Israel, including 14 commercial banks, two mortgage banks, two joint-service companies and five foreign banks. Despite the spate of financial deregulation in recent years, the Israeli banking sector still plays a key role in the country’s financial system and overall economy. It is also highly concentrated – the five main banking groups (Bank Hapoalim, Bank Leumi, First International Bank, Israel Discount Bank and Mizrahi-Tefahot Bank) together accounted for 94.3% of total assets as of June 2009. The two largest groups (Bank Leumi and Bank Hapoalim) accounted for almost 56.8% of total assets. The sector as a whole and the large banking groups in particular are organised around the concept of “universal” banking, in which commercial banks offer a full range of retail and corporate banking services. Those services include: mortgages, leasing and other forms of finance; brokerage in the local and foreign capital markets; underwriting and investment banking; and numerous specialised services. Furthermore, until the mid-1990s, the banking groups were deeply involved in non-financial activities. However, a law passed in 1996 forced the banks to divest their controlling stakes in non-financial companies and conglomerates (including insurance companies). This development was part of a privatisation process which was almost completed in 2005 (with the important exception of Bank Leumi). -

From Deficits and Dependence to Balanced Budgets and Independence

From Deficits and Dependence to Balanced Budgets and Independence The Arab Local Authorities’ Revenue Sources Michal Belikoff and Safa Agbaria Edited by Shirley Racah Jerusalem – Haifa – Nazareth April 2014 From Deficits and Dependence to Balanced Budgets and Independence The Arab Local Authorities’ Revenue Sources Michal Belikoff and Safa Agbaria Edited by Shirley Racah Jerusalem – Haifa – Nazareth April 2014 From Deficits and Dependence to Balanced Budgets and Independence The Arab Local Authorities’ Revenue Sources Research and writing: Michal Belikoff and Safa Ali Agbaria Editing: Shirley Racah Steering committee: Samah Elkhatib-Ayoub, Ron Gerlitz, Azar Dakwar, Mohammed Khaliliye, Abed Kanaaneh, Jabir Asaqla, Ghaida Rinawie Zoabi, and Shirley Racah Critical review and assistance with research and writing: Ron Gerlitz and Shirley Racah Academic advisor: Dr. Nahum Ben-Elia Co-directors of Sikkuy’s Equality Policy Department: Abed Kanaaneh and Shirley Racah Project director for Injaz: Mohammed Khaliliye Hebrew language editing: Naomi Glick-Ozrad Production: Michal Belikoff English: IBRT Jerusalem Graphic design: Michal Schreiber Printed by: Defus Tira This pamphlet has also been published in Arabic and Hebrew and is available online at www.sikkuy.org.il and http://injaz.org.il Published with the generous assistance of: The European Union This publication has been produced with the assistance of the European Union. Its contents are the sole responsibility of Sikkuy and Injaz and can in no way be taken to reflect the views of the European Union. The Moriah Fund UJA-Federation of New York The Jewish Federations of North America Social Venture Fund for Jewish-Arab Equality and Shared Society The Alan B. -

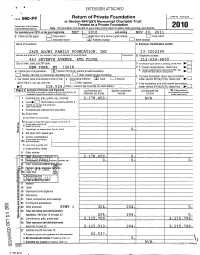

Form 990-PF Return of Private Foundation

d I EXTENSION ATTACHED Return of Private Foundation OMB No 1545-0052 Form 990-PF or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation Department of the Treasury 2010 Internal Revenue Service Note . The foundation may be able to use a copy of this return to satisfy state reporting requirements. For calendar year 2010 , or tax year beginning DEC 1, 2010 and ending NOV 3 0, 2011 G Check all that apply. Initial return Initial return of a former public charity Ej Final return 0 Amended return ® Address chanae Name change Name of foundation A Employer identification number JACK ADJMI FAMILY FOUNDATION INC 13-3202295 Number and street (or P O box number if mail is not delivered to street address) Room/swte B Telephone number 463 SEVENTH AVENUE , 4TH FLOOR 212-629-960 0 City or town, state, and ZIP code C If exemption application is pending, check here NEW YORK , NY 10 018 D 1- Foreign organizations, check here 2. Foreign organizations meeting the 85% test, H Check type of organization: Section 501(c)(3) exempt private foundation check here and attach computation charitable Other taxable foundation Section 4947(a )( 1 ) nonexem pt trust 0 private E If p rivate foundation status was terminated I Fair market value of all assets at end of year J Accounting method: ® Cash 0 Accrual under section 507(b)(1)(A), check here (from Part ll, col. (c), line 16) = Other (specify) F If the foundation is in a 60-month termination 111114 218 5 2 4 . (Part 1, column (d) must be on cash basis.) under section 507 b 1 B , check here Part I Analysis of Revenue and Expenses (a) Revenue and (b) Net investment (c) Adjusted net ( d) Disbursements (The total of amounts in columns (b) (c), and (d) may not for charitable purposes necessarily equal the amounts in column (a)) expenses per books income income (cash basis only) 1 Contributions, gifts, grants, etc., received 2 , 178 , 450. -

Glass-Steagall: the American Nightmare That Became the Israeli Dream

Fordham Journal of Corporate & Financial Law Volume 9, Number 2 2004 Article 7 Glass-Steagall: The American Nightmare that Became the Israeli Dream Ehud Ofer∗ ∗ Copyright c 2004 by the authors. Fordham Journal of Corporate & Financial Law is produced by The Berkeley Electronic Press (bepress). http://ir.lawnet.fordham.edu/jcfl GLASS-STEAGALL: THE AMERICAN NIGHTMARE THAT BECAME THE ISRAELI DREAM Ehud Ofer* INTRODUCTION This Note will examine the securities activities of banks in Israel. The relatively new legislation dealing with this aspect-Regulation of Investment Advice and Investment Portfolio Management Law (the "Law")-was enacted in 1995 as a lesson learned from the Share Regulation Affair of October 1983 (the "Share Regulation Affair" or the "Crisis of 1983"). In many ways in economic history, 1983 was for Israel what 1929 was for the United States. This Note will compare Israel's episode with the U.S. episode and will use the comparison to review the adequacy of the Israeli legislative response to the Crisis of 1983. The Law was enacted, primarily, based on American experience and legislation. This Note will compare the legislation enacted in both countries. To better understand the differences, this Note will introduce the unique financial market in Israel. Furthermore, this Note will present the recent legislative development in the United States (i.e., Gramm-Leach-Bliley Act) which repealed parts of the Depression-era Glass-Steagall Act. The Note will examine the necessity of Israeli "adjustments" to the Law due to this new development. * Ehud Ofer is a graduate of the LL.M. program in Banking, Corporate and Finance Law at Fordham University School of Law. -

Israeli Settler-Colonialism and Apartheid Over Palestine

Metula Majdal Shams Abil al-Qamh ! Neve Ativ Misgav Am Yuval Nimrod ! Al-Sanbariyya Kfar Gil'adi ZZ Ma'ayan Baruch ! MM Ein Qiniyye ! Dan Sanir Israeli Settler-Colonialism and Apartheid over Palestine Al-Sanbariyya DD Al-Manshiyya ! Dafna ! Mas'ada ! Al-Khisas Khan Al-Duwayr ¥ Huneen Al-Zuq Al-tahtani ! ! ! HaGoshrim Al Mansoura Margaliot Kiryat !Shmona al-Madahel G GLazGzaGza!G G G ! Al Khalsa Buq'ata Ethnic Cleansing and Population Transfer (1948 – present) G GBeGit GHil!GlelG Gal-'A!bisiyya Menara G G G G G G G Odem Qaytiyya Kfar Szold In order to establish exclusive Jewish-Israeli control, Israel has carried out a policy of population transfer. By fostering Jewish G G G!G SG dGe NG ehemia G AGl-NGa'iGmaG G G immigration and settlements, and forcibly displacing indigenous Palestinians, Israel has changed the demographic composition of the ¥ G G G G G G G !Al-Dawwara El-Rom G G G G G GAmG ir country. Today, 70% of Palestinians are refugees and internally displaced persons and approximately one half of the people are in exile G G GKfGar GB!lGumG G G G G G G SGalihiya abroad. None of them are allowed to return. L e b a n o n Shamir U N D ii s e n g a g e m e n tt O b s e rr v a tt ii o n F o rr c e s Al Buwayziyya! NeoG t MG oGrdGecGhaGi G ! G G G!G G G G Al-Hamra G GAl-GZawG iyGa G G ! Khiyam Al Walid Forcible transfer of Palestinians continues until today, mainly in the Southern District (Beersheba Region), the historical, coastal G G G G GAl-GMuGftskhara ! G G G G G G G Lehavot HaBashan Palestinian towns ("mixed towns") and in the occupied West Bank, in particular in the Israeli-prolaimed “greater Jerusalem”, the Jordan G G G G G G G Merom Golan Yiftah G G G G G G G Valley and the southern Hebron District. -

Figure 1.3 A

Bank Leumi Group Figure 1.3 A. Banking and finance in Israel Bank Leumi Le-Israel Ltd. (1) The structure of Israel's banking system and a Arab Israel Bank Ltd. (1) C. Capital market and financial companies investments in main investee companies , Leumi Mortgage Bank Ltd. (merged with Leumi Card Ltd.(5) Bank Hapoalim Group Bank Leumi Le-Israel Ltd. as of December Leumi Securities and Investments Ltd. (9) December 2012 Leumi Capital Market Services Ltd. (9) 31, 2012) (2) A. Banking and finance in Israel (1) Leumi Leasing and Investments Ltd. (3) The Bank Leumi Le-Israel Trust Co Ltd. (9) Bank Hapoalim Ltd. Leumi Finance Company Ltd. (4) Leumi Partners Ltd. (7)(9) Total assets: NIS 1,301 billion B. Banking and finance abroad (6) Leumi Industrial Development Bank Ltd. (7) D. Non-banking corporations Herfindahl index: H = 0.217 Bank Hapoalim (Switzerland) Ltd. Leumi Real Holdings Ltd. (7) The Israel Corporation Ltd. Bank Hapoalim (Luxembourg) Ltd. Leumi Financial Holdings Ltd. (7) CR 2 = 58% Bank Hapoalim (Cayman Islands) Ltd. B. Banking and finance abroad (6) Bank Hapoalim (Latin America) S.A. Bank Leumi (USA) Bank Pozitif Kredi Ve Kalkinma Bankasi A.S. (with Bank Leumi (UK) plc a holding in JSC Bank Pozitif) Leumi Private Bank S.A. C. Capital market and financial companies (9) Bank Leumi Luxembourg Isracard (5) Bank Leumi Romania Poalim Express Ltd. (5) Leumi International Investments NV Bank Leumi Group, Bank Hapoalim Group, Poalim Capital Markets Ltd. (8) Leumi Re Limited (9) 29% 29% Poalim Sahar Ltd. (9) The Bank Hapoalim Trust Co Ltd. -

Jerusalem Institute for Policy Research JERUSALEM FACTS and TRENDS

Jerusalem Institute for Policy Research JERUSALEM FACTS AND TRENDS Michal Korach, Maya Choshen Board of Directors Jerusalem Institute for Policy Research Dan Halperin, Chairman of the Board Ora Ahimeir Avraham Asheri Prof. Nava Ben-Zvi David Brodet Ruth Cheshin Raanan Dinur Prof. Hanoch Gutfreund Dr. Ariel Halperin Amb. Sallai Meridor Gil Rivosh Dr. Ehud Shapira Anat Tzur Lior Schillat, Director General Jerusalem: Facts and Trends 2021 The State of the City and Changing Trends Michal Korach, Maya Choshen Jerusalem Institute for Policy Research 2021 This publication was made possible through the generous support of our partners: The Jerusalem Institute for Policy Research | Publication no. 564 Jerusalem: Facts and Trends 2021 Michal Korach, Dr. Maya Choshen Assistance in Preparing this Publication: Omer Yaniv, Netta Haddad, Murad Natsheh,Yair Assaf-Shapira Graphic Design: Yael Shaulski Translation from Hebrew to English: Merav Datan © 2021, The Jerusalem Institute for Policy Research The Hay Elyachar House 20 Radak St., 9218604 Jerusalem www.jerusaleminstitute.org.il/en www.jerusaleminstitute.org.il Table of Contents About the Authors 8 Preface 9 Area Area 12 Population Population size 16 Geographical distribution 19 Population growth 22 Households 25 Population age 26 Marital status 32 Nature of religious identification 33 Socio-economic status 35 Metropolitan Jerusalem 41 Sources of Sources of population growth 48 Population Births 49 Mortality 51 Growth Natural increase 53 Aliya (Jewish immigration) 54 Internal migration 58 Migration -

Bank Hapoalim Annual Report 2012 Worldreginfo - F5fe760c-Cdf6-43Cc-95F4-Ba6e66f9c662 the Bank Hapoalim Group Major Subsidiaries & Affiliates

2012 Bank Hapoalim Annual Report 2012 WorldReginfo - f5fe760c-cdf6-43cc-95f4-ba6e66f9c662 The Bank Hapoalim Group Major Subsidiaries & Affiliates Commercial Banks Asset Management Bank Hapoalim B.M. Poalim Sahar Ltd. Bank Hapoalim (Switzerland) Ltd. PAM - Poalim Asset Management (UK) Ltd. Bank Hapoalim (Luxembourg) S.A. Poalim Asset Management (Ireland) Ltd. Hapoalim (Latin America) S.A. Bank Hapoalim (Cayman) Ltd. Financial Companies Bank Pozitif Kredi Ve Kalkinma Bankasi a.s. Isracard Ltd. JSC Bank Pozitiv Kazakhstan(1) Poalim Express Ltd. Investment House (1) 100% owned by Bank Pozitif Poalim Capital Markets - Investment House Ltd. Trust Companies Poalim Trust Services Ltd. Underwriting Companies Poalim I.B.I. Managing and Underwriting Ltd. Portfolio Management Peilim – Portfolio Management Company Ltd. Hapoalim Securities USA, Inc. Consolidated Financial Highlights 2012 2011 2012 2011 NIS millions USD millions* Total Assets 376,399 356,662 100,830 95,543 Net Profit 2,543 2,746 681 736 Credit to the Public 249,182 246,495 66,751 66,031 Deposits from the Public 271,411 256,417 72,706 68,689 Shareholders' Equity 26,755 23,819 7,167 6,381 * US dollar figures have been converted at the representative exchange rate prevailing on December 31, 2012, NIS 3.733 = USD 1.00 2 Bank Hapoalim B.M. and its Consolidated Subsidiaries WorldReginfo - f5fe760c-cdf6-43cc-95f4-ba6e66f9c662 Group Profile Israel’s leading financial institution Since its founding in 1921, Bank Hapoalim has played Internationally, Bank Hapoalim operates through a a pivotal role in the rapid growth of Israel’s economy. network of subsidiaries, branches and representative Today Hapoalim continues to be the leading financial offices in the United States, Europe, South America institution in Israel. -

Excluded, for God's Sake: Gender Segregation in Public Space in Israel

Israel Religious Action Center Israel Movement for Reform and Progressive Judaism ExcludEd, For God’s sakE: Gender Segregation and the Exclusion of Women in Public Space in Israel Second Annual Report – January 2012 ExcludEd, For God’s sakE: Gender Segregation and the Exclusion of Women in Public Space in Israel Second Annual Report – January 2012 Written by: Attorney Ruth Carmi, Attorney Ricky Shapira-Rosenberg consultation: Attorney Einat Hurwitz, Attorney Orly Erez-Lahovsky English translation: Shaul Vardi © Israel Religious Action Center, Israel Movement for Reform and Progressive Judaism Israel Religious Action Center 13 King David St., P.O. Box 31936, Jerusalem 91319 Telephone: 02-6203323 | Fax: 02-6256260 www.irac.org | [email protected] With special thanks to The New Israel Fund, the Nathan Cummings Foundation and the Leichtag Foundation for funding the English translation of this report IRAC’s work against gender segregation and the exclusion of women has been made possible by the support of the following people and organizations: The Kathryn Ames Foundation ARZA ARZA Canada ARZENU Claudia Bach TheBarat Family (the Arthur Barat Fellow for Justice) The Philip and Muriel Berman Foundation The Jacob and Hilda Blaustein Foundation Inc. The Claudine and Stephen Bronfman Family Foundation Canadian Friends of the World Union for Progressive Judaism The Donald and Carole Chaiken Foundation The Jewish Federation of Cleveland The Naomi and Nehemia Cohen Foundation The Cohen Family Foundation John and Noeleen Cohen The Eugene J. Eder Foundation -

Bank of Israel Annual Report of the Banks' Clearing House Committee

Bank of Israel Annual Report of the Banks' Clearing House Committee 2015 Annual Report of the Banks' Clearing House Committee, 2015 © Bank of Israel Passages may be cited provided source is specified. Typesetting and design by the Bank of Israel http://www.bankisrael.org.il 2 Annual Report of the Banks' Clearing House Committee, 2015 CONTENTS Preface ................................................................................................. 5 1. Main Developments in 2015 ..................................................................................... 7 A. The Banks' Clearing House Committee ................................................................. 7 B. The Lawyers Committee ...................................................................................... 17 C. The Subcommittee for Clearing Diamond Denominated Accounts ..................... 18 D. The Entity for the Resolution of Disputes between the Banks—Clarifiers Panel 18 2. The Banks’ Clearing House .................................................................................... 19 A. Banks' Clearing House Committee ...................................................................... 19 B. Paper-based (Checks) Clearing House ................................................................. 19 E. C. Masav (Automated Clearing House) ............................................................... 21 3. Statistical Data and Analysis of Trends .................................................................. 24 A. The Paper-based Clearing House ........................................................................