Regional and Global Liquidity Arrangements

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Institution List „A“

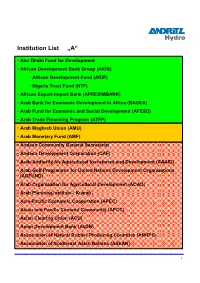

Institution List „A“ • Abu Dhabi Fund for Development • African Development Bank Group (AfDB) • African Development Fund (AfDF) • Nigeria Trust Fund (NTF) • African Export-Import Bank (AFREXIMBANK) • Arab Bank for Economic Development in Africa (BADEA) • Arab Fund for Economic and Social Development (AFESD) • Arab Trade Financing Program (ATFP) • Arab Maghreb Union (AMU) • Arab Monetary Fund (AMF) • Andean Community General Secretariat • Andean Development Corporation (CAF) • Arab Authority for Agricultural Investment and Development (AAAID) • Arab Gulf Programme for United Nations Development Organizations (AGFUND) • Arab Organization for Agricultural Development (AOAD) • Arab Planning Institute - Kuwait • Asia-Pacific Economic Cooperation (APEC) • Asian and Pacific Coconut Community (APCC) • Asian Clearing Union (ACU) • Asian Development Bank (AsDB) • Association of Natural Rubber Producing Countries (ANRPC) • Association of Southeast Asian Nations (ASEAN) 1 Institution List „B-C“ • Bank of Central African States (BEAC) • Central Bank of West African States (BCEAO) • Common Market for Eastern and Southern Africa (COMESA) • Baltic Council of Ministers • Bank for International Settlements (BIS) • Black Sea Trade and Development Bank (BSTDB) • Caribbean Centre for Monetary Studies (CCMS) • Caribbean Community (CARICOM) • Caribbean Development Bank (CDB) • Caribbean Regional Technical Assistance Centre (CARTAC) • Center for Latin American Monetary Studies (CEMLA) • Center for Marketing Information and Advisory Services for Fishery Products -

Development of Payment and Settlement System

CHAPTER 7 Development of Payment and Settlement System Khin Thida Maw This chapter should be cited as: Khin Thida Maw, 2012. “Development of Payment and Settlement System.” In Economic Reforms in Myanmar: Pathways and Prospects, edited by Hank Lim and Yasuhiro Yamada, BRC Research Report No.10, Bangkok Research Center, IDE- JETRO, Bangkok, Thailand. Chapter 7 Development of Payment and Settlement System Khin Thida Maw ______________________________________________________________________ Abstract The new government of Myanmar has proved its intention to have good relations with the international community. Being a member of ASEAN, Myanmar has to prepare the requisite measures to assist in the establishment of the ASEAN Economic Community in 2015. However, the legacy of the socialist era and the tight control on the banking system spurred people on to cash rather than the banking system for daily payment. The level of Myanmar’s banking sector development is further behind the standards of other regional banks. This paper utilizes a descriptive approach as it aims to provide the reader with an understanding of the current payment and settlement system of Myanmar’s financial sector and to recommend some policy issues for consideration. Section 1 introduces general background to the subject matter. Section 2 explains the existing domestic and international payment and settlement systems in use by Myanmar. Section 3 provides description of how the information has been collected and analyzed. Section 4 describes recent banking sector developments and points for further consideration relating to payment and settlement system. And Section 5 concludes with the suggestions and recommendation. ______________________________________________________________________ 1. Introduction Practically speaking, Myanmar’s economy was cash-based due to the prolonged decline of the banking system after nationalization beginning in the early 1960s. -

Executive Intelligence Review, Volume 24, Number 45, November 7

EIR Founder and Contributing Editor: Lyndon H. LaRouche, Jr. Editorial Board: Melvin Klenetsky, Lyndon H. LaRouche, Jr., Antony Papert, Gerald Rose, From the Associate Editor Dennis Small, Edward Spannaus, Nancy Spannaus, Jeffrey Steinberg, Webster Tarpley, William Wertz Associate Editor: Susan Welsh ll around the world, in the aftermath of the Black Monday stock Managing Editors: John Sigerson, A Ronald Kokinda market crash, people are telling EIR, “LaRouche was right!” “He’s a Science Editor: Marjorie Mazel Hecht prophet,” many have said. Actually, as Lyndon LaRouche said in an Special Projects: Mark Burdman Book Editor: Katherine Notley interview on Oct. 28, “I’m not a prophet. I’m just a scientist, and Advertising Director: Marsha Freeman I can tell you what the laws of the universe indicate will happen as a Circulation Manager: Stanley Ezrol result of what’s going on, or policies we have, and what the approxi- INTELLIGENCE DIRECTORS: mate timing might be of these consequences, depending on which Asia and Africa: Linda de Hoyos Counterintelligence: Jeffrey Steinberg, branch of the road we take.” Paul Goldstein Economics: Marcia Merry Baker, What everybody wants to know now, is 1) How did LaRouche William Engdahl know what was going to happen? and 2) What do we do now? How History: Anton Chaitkin Ibero-America: Robyn Quijano, Dennis Small do we prevent a vaporization of the world financial and monetary Law: Edward Spannaus system, which would cause untold human suffering? Russia and Eastern Europe: Rachel Douglas, Konstantin George To find out the answers to these questions, you have come to the United States: Kathleen Klenetsky right place. -

The Rise and Decline of Catching up Development an Experience of Russia and Latin America with Implications for Asian ‘Tigers’

Victor Krasilshchikov The Rise and Decline of Catching up Development An Experience of Russia and Latin America with Implications for Asian ‘Tigers’ ENTELEQUIA REVISTA INTERDISCIPLINAR The Rise and Decline of Catching up Development An Experience of Russia and Latin America with Implications for Asian `Tigers' by Victor Krasilshchikov Second edition, July 2008 ISBN: Pending Biblioteca Nacional de España Reg. No.: Pending Published by Entelequia. Revista Interdisciplinar (grupo Eumed´net) available at http://www.eumed.net/entelequia/en.lib.php?a=b008 Copyright belongs to its own author, acording to Creative Commons license: Attribution-NonCommercial-NoDerivs 2.5 made up using OpenOffice.org THE RISE AND DECLINE OF CATCHING UP DEVELOPMENT (The Experience of Russia and Latin America with Implications for the Asian ‘Tigers’) 2nd edition By Victor Krasilshchikov About the Author: Victor Krasilshchikov (Krassilchtchikov) was born in Moscow on November 25, 1952. He graduated from the economic faculty of Moscow State University. He obtained the degrees of Ph.D. (1982) and Dr. of Sciences (2002) in economics. He works at the Centre for Development Studies, Institute of World Economy and International Relations (IMEMO), Russian Academy of Sciences. He is convener of the working group “Transformations in the World System – Comparative Studies in Development” of European Association of Development Research and Training Institutes (EADI – www.eadi.org) and author of three books (in Russian) and many articles (in Russian, English, and Spanish). 2008 THE RISE AND DECLINE OF CATCHING UP DEVELOPMENT Entelequia.Revista Interdisciplinar Victor Krasilshchikov / 2 THE RISE AND DECLINE OF CATCHING UP DEVELOPMENT C O N T E N T S Abbreviations 5 Preface and Acknowledgements 7 PART 1. -

Law and Neoliberalism

INTRODUCTION_PURDY_GREWAL_BOOKPROOF (DO NOT DELETE) 1/9/2015 12:36 AM INTRODUCTION: LAW AND NEOLIBERALISM DAVID SINGH GREWAL* JEDEDIAH PURDY** “Neoliberalism” refers to the revival of the doctrines of classical economic liberalism, also called laissez-faire, in politics, ideas, and law. These revived doctrines have taken new form in new settings: the “neo-” means not just that they are back, but that they are also different, a new generation of arguments. What unites the two periods of economic liberalism is their political effect: the assertion and defense of particular market imperatives and unequal economic power against political intervention. Neoliberalism’s advance over the past few decades has reshaped most important domains of public and private life, and the law has been no exception. From constitutional doctrine to financial regulation to intellectual property and family law, market and market- mimicking approaches are now commonplace in our jurisprudence. While the term “neoliberalism” may be unfamiliar to some American legal audiences, it is a common part of the scholarly lexicons of many disciplines and is widely used elsewhere in the world, notably in Latin America and Europe. Some of the explanation for the term’s unfamiliarity may be parochialism.1 But in the United States in particular, neoliberalism’s political expression has proven less the reincarnation of a doctrine thought to be abandoned (classical liberalism) than the intensification of a familiar and longstanding “anti- regulatory” politics.2 Familiar as this political expression may be, it is our Copyright © 2014 by David Singh Grewal & Jedediah Purdy. This article is also available at http://lcp.law.duke.edu/. -

Pan-Asianism As an Ideal of Asian Identity and Solidarity, 1850–Present アジアの主体性・団結の理想としての汎アジア主 義−−1850年から今日まで

Volume 9 | Issue 17 | Number 1 | Article ID 3519 | Apr 25, 2011 The Asia-Pacific Journal | Japan Focus Pan-Asianism as an Ideal of Asian Identity and Solidarity, 1850–Present アジアの主体性・団結の理想としての汎アジア主 義−−1850年から今日まで Christopher W. A. Szpilman, Sven Saaler Pan-Asianism as an Ideal of Asian Attempts to define Asia are almost as old as the Identity and Solidarity,term itself. The word “Asia” originated in ancient Greece in the fifth century BC. It 1850–Present originally denoted the lands of the Persian Empire extending east of the Bosphorus Straits Sven Saaler and Christopher W. A. but subsequently developed into a general term Szpilman used by Europeans to describe all the lands lying to the east of Europe. (The point where This is a revised, updated and abbreviated Europe ended and Asia began was, however, version of the introduction to the two volume never clearly defined.) Often, this usage collection by the authors ofPan-Asianism. A connoted a threat, real or perceived, by Asia to Documentary History Vol. 1 covers the years Europe—a region smaller in area, much less 1850-1920; Vol. 2 covers the years 1850- populous, poorer, and far less significant than present, link. Asia in terms of global history. The economic and political power of Asia, the The term “Asia” arrived in East Asia relatively world’s largest continent, is increasing rapidly. late, being introduced by Jesuit missionaries in According to the latest projections, the gross the sixteenth century. The term is found, domestic products of China and India, the written in Chinese characters 亜細亜( ), on world’s most populous nations, will each Chinese maps of the world made around 1600 surpass that of the United States in the not-too- under the supervision of Matteo Ricci distant future. -

The Euro: It Can’T Happen

EUROPEAN ECONOMY Economic Papers 395| December 2009 The euro: It can’t happen. It’s a bad idea. It won’t last. US economists on the EMU, 1989 - 2002 Lars Jonung and Eoin Drea EUROPEAN COMMISSION Economic Papers are written by the Staff of the Directorate-General for Economic and Financial Affairs, or by experts working in association with them. The Papers are intended to increase awareness of the technical work being done by staff and to seek comments and suggestions for further analysis. The views expressed are the author’s alone and do not necessarily correspond to those of the European Commission. Comments and enquiries should be addressed to: European Commission Directorate-General for Economic and Financial Affairs Publications B-1049 Brussels Belgium E-mail: [email protected] This paper exists in English only and can be downloaded from the website ec.europa.eu/economy_finance/publications A great deal of additional information is available on the Internet. It can be accessed through the Europa server (ec.europa.eu) ISBN 978-92-79-14395-3 © European Communities, 2009 The euro: It can’t happen, It’s a bad idea, It won’t last. US economists on the EMU, 1989 - 2002 Lars Jonung and Eoin Drea November 10, 2009 Abstract: The purpose of this study is to survey how US economists, those with the Federal Reserve System and those at US universities, looked upon European monetary unification from the publication of the Delors Report in 1989 to the introduction of euro notes and coins in January 2002. Our survey of approximately 170 publications -

Completing the Eurozone Rescue: What More Needs to Be Done?

Completing the Eurozone Rescue: What More NeedstoBeDone? Rescue:WhatMore Completing theEurozone The Eurozone’s life-threatening crisis in May 2010 was halted when Eurozone Completing theEurozoneRescue: leaders and the ECB took strong measures in May. But these were palliatives not a cure. The Eurozone’s life-threatening crisis in May 2010 was halted Completing The crisis is not over, according to the dozen world-renowned economists whose when Eurozone leaders and the ECB took strong measures in views are containedMay. But in these this book. were The palliatives Eurozone notrescue a cure.needs to be completed. More needs to be done. The crisis is not over, according to the dozen world-renowned What MoreNeedstoBeDone? the Eurozone The Eurozoneeconomists ‘ship’ is holed whose below theviews waterline. are Thecontained ECB actions in are this keeping book. it The afl oat for now,Eurozone but this rescueis accomplished needs toby besomething completed. akin to More bailing needs the water to beas done. fast as it leaksThe in. EuropeanEurozone leaders ‘ship’ must is veryholed soon fibelow nd a way the to fi waterline.x the hole. The ECB Rescue: This book actionsgathers the are thinking keeping of ait dozenafloat world-class for now, economistsbut this is on accomplished what they by need to dosomething on banking-sector akin to clean bailing up, thefi scal water discipline, as fast structural as it leaks policies, in. andEuropean What More Needs to leaders must very soon find a way to fix the hole. more. This book gathers the thinking of a dozen world-class economists Be Done? on what they need to do on banking-sector clean up, fiscal discipline, structural policies, and more. -

1 European Monetary Unification and International Monetary Cooperation

c:\wp51\papers\cfr:12/16/96 European Monetary Unification and International Monetary Cooperation1 Barry Eichengreen and Fabio Ghironi University of California, Berkeley Revised, December 1996 Monetary affairs are not a leading sphere of U.S.-European cooperation. Were issues ranked by the extent of concerted and sustained cooperation, interest-rate and exchange-rate policy would surely fall behind security, financial-market regulation, and trade. Still, cooperation between the U.S. and Europe and among G-7 central banks and governments more generally has played a significant role on occasion, for example when the dollar soared in the mid-1980s and slumped in 1994, and during exceptional crises like the Mexican meltdown of 1995. European monetary unification, if and when it occurs, threatens to discourage even modest initiatives such as these. The European Central Bank (ECB) will assume tasks of the national central banks of the EU member states that participate in the monetary union. The Council of Ministers (in consultation with the ECB, the European Commission and the European Parliament) will make decisions regarding European participation in any new global exchange rate arrangement. European policymakers and others are understandably preoccupied by how these bodies will manage the monetary affairs of the newly-formed Euro zone, to the neglect of the implications for cooperation with the rest of the world. Many American observers essentially ignorant of the entire process. This development is unfortunate, for there is reason to think that EMU 1 The authors are John L. Simpson Professor of Economics and Political Science and Graduate Student in Economics at the University of California, Berkeley. -

THE IMF and EAST ASIA: a CHANGING REGIONAL FINANCIAL ARCHITECTURE Introduction

THE IMF AND EAST ASIA: A CHANGING REGIONAL FINANCIAL ARCHITECTURE The financial crises of 1997 and 1998 have had a profound effect on how East Asia sees the role of the IMF and its strategic interests relative to those of the United States in international finance. The crises have spurred demand for a regional financial architec- ture in East Asia – ranging from deeper policy dialogue and surveillance, a system of financial cooperation, and even talk of common exchange rate arrangements. This paper analyses the economic, strategic and chauvinistic motivations behind this, and evaluates the merit of some of these proposals. Regional policy dialogue and surveillance in East Asia are weak, and the strengthening that is occurring through the ASEAN+3 grouping is welcome and important. There is also a strong case to be made for regional financial cooperation to complement global arrangements. A regional arrangement can secure liquidity and financing support to respond to small or localised crises, and may be a more effective preventive measure than the IMF’s Contingent Credit Line facility. A regional arrangement would also boost policy dialogue and surveillance. But progress to date has been slow. Introduction The financial crises of 1997 and 1998 have had a profound effect on East Asia’s view of international financial and monetary arrangements, including the role of the International Monetary Fund in international policy dialogue and financial cooperation.1 There has been a tectonic shift in the policy landscape of the region.2 While there are differences between and within countries, no longer is East Asia content to rely almost exclusively on global forums, mechanisms and institutions; it now wants to develop a complementary regional structure. -

Nine Lives of Neoliberalism

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Plehwe, Dieter (Ed.); Slobodian, Quinn (Ed.); Mirowski, Philip (Ed.) Book — Published Version Nine Lives of Neoliberalism Provided in Cooperation with: WZB Berlin Social Science Center Suggested Citation: Plehwe, Dieter (Ed.); Slobodian, Quinn (Ed.); Mirowski, Philip (Ed.) (2020) : Nine Lives of Neoliberalism, ISBN 978-1-78873-255-0, Verso, London, New York, NY, https://www.versobooks.com/books/3075-nine-lives-of-neoliberalism This Version is available at: http://hdl.handle.net/10419/215796 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative -

Introduction Establishment

ACU 1974 INTRODUCTION OBJECTIVES Secretary General settlement periods by a decision taken by unanimous vote of all of the Directors. Asian Clearing Union (ACU) is the simplest form of • To provide a facility to settle payments, on a multilateral The Board is authorized to appoint a Secretary General payment arrangements whereby the participants settle basis, for current international transactions among for a term of three years. The Secretary General may Interest payments for intra-regional transactions among the the territories of participants; be reappointed and shall cease to hold office when the Interest shall be paid by net debtors and transferred to participating central banks on a multilateral basis. The Board so decides. • To promote the use of participants’ currencies net creditors on daily outstandings between settlement main objectives of a clearing union are to facilitate in current transactions between their respective Agent dates. The rate of interest applicable for a settlement payments among member countries for eligible territories and thereby effect economies in the use period will be the closing rate on the first working day transactions, thereby economizing on the use of foreign The Board of Directors may make arrangements with of the participants’ exchange reserves; of the last week of the previous calendar month offered exchange reserves and transfer costs, as well as a central bank or monetary authority of a participant by the Bank for International Settlements (BIS) for one promoting trade among the participating countries. The • To promote monetary cooperation among the to provide the necessary services and facilities for the month US dollar and Euro deposits.