Amc on Jb Technical Swiss Equity Portfolio

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DWS (CH) II Small and Mid Caps Switzerland

Marketing Material DWS (CH) II Small and Mid Caps Switzerland Equity Funds - Europe - Regions/Countries August 2021 As at 31/08/2021 Fund Data Performance Investment Policy Performance - Share Class FD (in %) The goal of the sub-fund is primarily to achieve long-term growth in Swiss Francs through investment in a portfolio of stocks from Swiss issuers that are listed in a representative Swiss equities index of small and medium enterprises or the small and mid- cap subindex of a Swiss equities index (“the benchmark”). The investment strategy is based on a transparent and comprehensible investment process, focuses on stock selection. Fund Benchmark (since 09/08/2006): SPI EXTRA Total Return (RI) Past performance is no indication of current or future performance, and the performance data do not take account of the commissions and costs Fund Management's Comment incurred on the issue and redemption of units. For detailed comments on the fund and its corresponding markets please see the annual report. Cumulative performance (in %) - share class FD 1 m 1 y 3 y 5 y s. Inception YTD 3 y avg 5 y avg 2017 2018 2019 2020 CHF 3.0 42.7 36.1 77.7 421.8 29.6 10.8 12.2 29.9 -21.6 29.3 1.8 EUR 2.7 42.0 42.2 80.2 650.5 30.2 12.5 12.5 19.4 -18.6 33.7 2.2 BM IN CHF 2.5 34.9 39.1 90.5 284.2 23.7 11.6 13.8 29.7 -17.2 30.4 8.1 Further Characteristics (3 years) / VAR (1 year) - share class FD Volatility 18.36% Maximum Drawdown -21.26% VAR (99%/10 days) 7.23% Sharpe Ratio -- Information Ratio -0.16 Correlation Coefficient 0.97 Alpha -1.26% Beta 1.05 Tracking Error -

Corporate Governance

Business report Corporate governance Transparency is one of the key elements of good corporate governance, to which Sonova is committed. Good corporate governance is essential for Sonova and we strive for high standards in this field. What “good corporate governance” means is an evolving matter and we constantly monitor the latest changes to the requirements. Compliance is an integral element of our corporate culture and embedded in our core values. We therefore continued to strengthen the Sonova Group compliance program during the 2017/18 financial year, putting particular emphasis on integrating our acquired businesses into our compliance culture, designing new global compliance training, and updating our antibribery policy. Our continuing compliance efforts help us to live our values of ethical behavior and unquestionable integrity. At Sonova, corporate governance is based upon, and structured to conform with, relevant standards and practices. The company fulfils its legal duties under the Swiss Code of Obligations, the SIX Swiss Exchange Directive on Information relating to Corporate Governance, and the standards defined in the Swiss Code of Best Practice for Corporate Governance. This report describes the principles of corporate governance for the Sonova Group and provides background information on the Group’s executive officers and bodies as of March 31, 2018. All relevant documents can be accessed at the corporate governance section of the Sonova website: www.sonova.com/en/commitments/corporategovernance. For clarity and transparency, the compensation report is presented as a separate chapter of the annual report. Sonova Annual Report 2017/18 37 CORPORATE GOVERNANCE Group structure Operational group structure The Sonova Group is headquartered in Stäfa, Switzerland, and is active in over 100 countries. -

Julius Baer Multicooperation Annual Report 2005 As at June 30, 2005 (Audited)

Julius Baer Multicooperation Annual Report 2005 as at June 30, 2005 (audited) Subscriptions are only valid if made on the basis of the current Prospectus, the latest Annual Report and the latest Semi-Annual Report if published thereafter. The Articles of Association, the valid Prospectus and the Annual and Semi-Annual Reports may be obtained free of charge at the representative in Switzerland and the respective paying agent. Only the German version of the present Annual Report has been reviewed by the independent auditor. Consequently, the independent auditor's report only refers to the German version of the Report; other versions result from a conscientious translation made under the responsibility of the Board. In case of differences between the German version and the translation, the German version shall be the authentic text. AN INVESTMENT FUND DOMICILED IN LUXEMBOURG Representative in Switzerland: Julius Baer Investment Funds Services Ltd., Zurich Paying agent in Switzerland: Bank Julius Bär & Co. AG, Bahnhofstrasse 36, Postfach, CH - 8010 Zurich Paying agent in Germany: Bank Julius Bär (Deutschland) AG, Messe Turm, Friedrich-Ebert-Anlage 49, Postfach 15 01 52, D - 60061 Frankfurt on the Main Paying agent in Austria: Erste Bank der oesterreichischen Sparkassen AG, Graben 21, A - 1010 Vienna Contents Page Organisation and Management 4 Independent Auditor's Report 5 Notes to the Financial Statements 6 Julius Baer Multicooperation (Umbrella Fund) MCOO Julius Baer Multicooperation - Emerging Markets Value Stock Fund HESF Julius Baer Multicooperation -

Annual Report 2018 19 Table of Content

FINANCIAL REPORT Annual Report 2018 19 Table of content Letter to shareholders 2 Our product and service offering 6 Strategy and businesses 10 Corporate governance 36 Compensation report 60 Financial review 96 5 year key figures 104 Consolidated financial statements 105 Financial statements of Sonova Holding AG 175 Investor information 188 Corporate Responsibility Report 190 Letter to shareholders Dear shareholders, 2018/19 marked another year of solid financial performance, posting further record levels of sales and profits to which all three businesses contributed. Moreover – and as expected – growth accelerated from the first half-year to the second, driven by the launch of a number of innovative products and solutions. Sonova affirmed its leading position in audiological performance with the release of the Marvel™ technology platform. Marvel takes full advantage of the unique connectivity enabled by our SWORD™ (Sonova Wireless One Radio Digital) chip and combines it with the proven convenience of our rechargeable solutions. We also made significant progress in our retail business, which we have renamed “audiological care” for one simple reason: care is what we deliver. The expert service We have made significant provided by our hearing care professionals adds key value for the consumer. progress in implementing our strategy. Our cochlear implants business launched a series of innovative new products to strengthen its leading position in this expanding market. Robert Spoerry You will find details of these and other strategic initiatives in the “strategy and businesses” section of this report. The global market in which we operate is poised for further growth, as developed countries see increasing demand from the “baby boomer” generation and developing countries begin to bridge the gap in hearing care provision. -

FACTSHEET - AS of 29-Sep-2021 Solactive Switzerland 40 Equal Weight Index TR

FACTSHEET - AS OF 29-Sep-2021 Solactive Switzerland 40 Equal Weight Index TR HISTORICAL PERFORMANCE 6,000 5,000 4,000 3,000 2,000 1,000 Jan-2000 Jan-2005 Jan-2010 Jan-2015 Jan-2020 Solactive Switzerland 40 Equal Weight Index TR CHARACTERISTICS ISIN / WKN DE000SLA98V4 / SLA98V Base Value / Base Date 1000 Points / 03.03.1999 Bloomberg / Reuters SOCH40ET Index / .SOCH40ET Last Price 5520.10 Index Calculator Solactive AG Dividends Included Index Type Total Return Calculation 09:00am to 10:30pm (CET), every 60 seconds Index Currency CHF History Available daily back to 03.03.1999 Index Members 40 FACTSHEET - AS OF 29-Sep-2021 Solactive Switzerland 40 Equal Weight Index TR STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -6.87% -1.29% 6.88% 26.84% 16.30% 452.01% Performance (p.a.) - - - - - 7.86% Volatility (p.a.) 14.33% 11.91% 11.14% 12.42% 11.49% 18.86% High 5927.07 5927.07 5927.07 5927.07 5927.07 5927.07 Low 5498.67 5498.67 5111.72 4101.40 4734.43 549.01 Sharpe Ratio -4.04 -0.43 1.30 2.20 1.96 0.42 Max. Drawdown -7.23% -7.23% -7.23% -8.17% -7.23% -68.82% VaR 95 \ 99 -22.5% \ -33.9% -29.8% \ -57.3% CVaR 95 \ 99 -29.9% \ -44.8% -47.2% \ -78.4% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES CH 97.6% CHF 100.0% AT 2.4% TOP COMPONENTS AS OF 29-Sep-2021 Company Ticker Country Currency Index Weight (%) DUFRY AG DUFN SE Equity CH CHF 2.80% SWISSCOM AG SCMN SE Equity CH CHF 2.69% ALCON INC ALC SE Equity CH CHF 2.67% SONOVA HOLDING AG SOON SE Equity CH CHF 2.64% UBS GROUP AG UBSG SE Equity CH CHF 2.63% JULIUS BAER GRUPPE AG BAER SE Equity CH CHF 2.61% KUEHNE & NAGEL INTERNATIONAL AG KNIN SE Equity CH CHF 2.60% NESTLE SA NESN SE Equity CH CHF 2.60% SWISS LIFE HOLDING AG SLHN SE Equity CH CHF 2.60% CHOCOLADEFABRIKEN LINDT & SPRUENGLI AG LISP SE Equity CH CHF 2.60% FACTSHEET - AS OF 29-Sep-2021 Solactive Switzerland 40 Equal Weight Index TR DISCLAIMER © Solactive AG, 2021. -

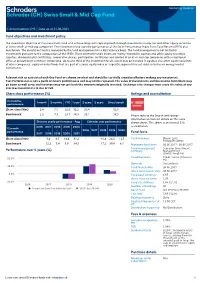

Fund Objectives and Investment Policy Share Class Performance

Fund objectives and investment policy The investment objective of this investment fund is to achieve long-term capital growth through investments in equities and other equity securities of Swiss small- or mid-cap companies. The investment fund uses the performance of the Swiss Performance Index Extra Total Return (SPIEX) as a benchmark. The investment fund is managed by the fund management on a discretionary basis. The fund management is not limited to investments pursuant to the composition of the SPIEX. The investment fund's assets are mainly invested in equities and other equity securities (equities, dividend rights certificates, cooperative shares, participation certificates and similar) of small or mid-cap companies with a registered office or predominant activity in Switzerland. Up to one-third of the investment fund's assets may be invested in equities and other equity securities of other companies, equity or index funds that are part of a Swiss equity index or a specific segment thereof, debt securities or money market instruments. Relevant risk as associated with this Fund are shown overleaf and should be carefully considered before making any investment. Past Performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall. Share class performance (%) Ratings and accreditation Cumulative 1 month 3 months YTD 1 year 3 years 5 years Since launch performance Share class (Net) 2,4 7,1 22,0 33,2 39,4 - 52,8 Benchmark 2,5 7,9 23,7 34,9 39,1 - 58,5 Please refer to the Source and ratings information section for details on the icons Discrete yearly performance - Aug Calendar year performance shown above. -

Switzerland Fund A-CHF for Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021

pro.en.xx.20210831.LU0054754816.pdf Switzerland Fund A-CHF For Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021 Strategy Fund Facts The Portfolio Managers are bottom-up investors who believe share prices are Launch date: 13.02.95 correlated to earnings, and that strong earners will therefore outperform. They look to Portfolio manager: Andrea Fornoni, Alberto Chiandetti invest in companies where the market underestimates earnings because their Appointed to fund: 01.03.18, 01.08.11 sustainability is not fully appreciated. They also look for situations where the impact Years at Fidelity: 7, 15 company changes will have on earnings has not been fully recognised by the market. Fund size: CHF366m They aim to achieve a balance of different types of companies, so they can deliver Number of positions in fund*: 36 performance without adding undue risk. Fund reference currency: Swiss Franc (CHF) Fund domicile: Luxembourg Fund legal structure: SICAV Management company: FIL Investment Management (Luxembourg) S.A. Capital guarantee: No Portfolio Turnover Cost (PTC): 0.01% Portfolio Turnover Rate (PTR): 28.92% *A definition of positions can be found on page 3 of this factsheet in the section titled “How data is calculated and presented.” Objectives & Investment Policy Share Class Facts • The fund aims to provide long-term capital growth with the level of income expected Other share classes may be available. Please refer to the prospectus for more details. to be low. • The fund will invest at least 70% in Swiss company shares. Launch date: 13.02.95 • The fund has the freedom to invest outside its principal geographies, market sectors, industries or asset classes. -

Julius Baer Multistock Société D'investissement À Capital Variable

Julius Baer Multistock Société d'Investissement à Capital Variable Annual Report as at 30 June 2011 (audited) Subscriptions are carried out solely on the basis of the current prospectus or the simplified prospectus, or the “key investor information”, as soon as it is available, in conjunction with the latest annual report and the latest semi-annual report if published thereafter. The articles of association, the valid prospectus and the simplified prospectus, the annual and semi-annual reports (or the “key investor information”, as soon as it is available), as well as the information based on the SFA guidelines on transparency with regard to management fees, may be obtained free of charge from the representative in Switzerland and/or from the respective paying agent. In case of differences between the German version and the translation, the German version shall be the authentic text. AN INVESTMENT FUND DOMICILED IN LUXEMBOURG Representative in Switzerland: Swiss & Global Asset Management AG, Hardstraße 201, CH - 8005 Zurich (new address from 19 September 2011) Paying agent in Switzerland: Bank Julius Bär & Co. AG, Bahnhofstraße 36, Postfach, CH - 8010 Zurich Paying and information agent in Germany (until 31 December 2010): Bank Julius Bär Europe AG, An der Welle 1, Postfach 15 02 52, D - 60062 Frankfurt am Main Paying agent in Germany (since 1 January 2011): Deka Bank Deutsche Girozentrale, Hahnstraße 55, D - 60528 Frankfurt am Main Information agent in Germany (since 1 January 2011): Swiss & Global Asset Management Kapital AG, Taunusanlage 15, D - 60325 Frankfurt am Main Paying agent in Austria: Erste Bank der oesterreichischen Sparkassen AG, Graben 21, A - 1010 Vienna Representative and paying agent in Liechtenstein: LGT Bank in Liechtenstein AG, Herrengasse 12, FL - 9490 Vaduz Trade and Companies Register number: R.C.S. -

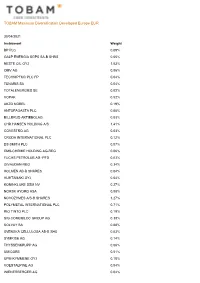

TOBAM Maximum Diversification Developed Europe EUR

TOBAM Maximum Diversification Developed Europe EUR 30/04/2021 Instrument Weight BP PLC 0.09% GALP ENERGIA SGPS SA-B SHRS 0.05% NESTE OIL OYJ 1.03% OMV AG 0.06% TECHNIPFMC PLC FP 0.04% TENARIS SA 0.04% TOTALENERGIES SE 0.02% VOPAK 0.52% AKZO NOBEL 0.19% ANTOFAGASTA PLC 0.05% BILLERUD AKTIEBOLAG 0.03% CHR HANSEN HOLDING A/S 1.41% COVESTRO AG 0.03% CRODA INTERNATIONAL PLC 0.12% DS SMITH PLC 0.07% EMS-CHEMIE HOLDING AG-REG 0.06% FUCHS PETROLUB AG -PFD 0.03% GIVAUDAN-REG 0.34% HOLMEN AB-B SHARES 0.04% HUHTAMAKI OYJ 0.04% KONINKLIJKE DSM NV 0.27% NORSK HYDRO ASA 0.08% NOVOZYMES A/S-B SHARES 1.27% POLYMETAL INTERNATIONAL PLC 0.71% RIO TINTO PLC 0.19% SIG COMBIBLOC GROUP AG 0.38% SOLVAY SA 0.08% SVENSKA CELLULOSA AB-B SHS 0.03% SYMRISE AG 0.14% THYSSENKRUPP AG 0.06% UMICORE 0.51% UPM-KYMMENE OYJ 0.18% VOESTALPINE AG 0.04% WIENERBERGER AG 0.04% TOBAM Maximum Diversification Developed Europe EUR 30/04/2021 Instrument Weight YARA INTERNATIONAL ASA 0.08% A P MOLLER - MAERSK A/S - A 0.06% A P MOLLER - MAERSK A/S - B 0.08% ACS ACTIVIDADES CONS Y SERV 0.07% ADDTECH AB-B SHARES 0.03% ADP 0.04% AENA SA 0.11% ALSTOM 0.17% ANDRITZ AG 0.03% ATLANTIA SPA 0.08% BELIMO HOLDING AG-REG 0.04% BUCHER INDUSTRIES AG-REG 0.04% BUNZL PLC 0.10% DEUTSCHE LUFTHANSA-REG 0.05% DIPLOMA PLC 0.04% DSV PANALPINA A/S 0.45% EASYJET PLC 0.20% ELIS SA 0.03% EPIROC AB-A 0.10% EPIROC AB-B 0.06% FERROVIAL SA 0.05% FLUGHAFEN ZURICH AG-REG 0.03% GEA GROUP AG 0.06% GEBERIT AG-REG 0.21% HAYS PLC 0.03% HOMESERVE PLC 0.04% HOWDEN JOINERY GROUP PLC 0.06% IMCD GROUP NV 0.07% IMI PLC 0.05% -

Fund Risk Management

FUND RISK MANAGEMENT Monthly Report Umbrella Cosmos Lux International Net Asset Value 11,496,391.95 Sub-fund CHF Currency CHF August 2019 Portfolio date 26/08/2019 FUND ID Fund name Cosmos Lux International TNA end of period 11,496,391.95 NAV end of period 117.48 Sub-fund name CHF TNA start of period 11,830,504.83 NAV start of period 120.89 ISIN LU0989373237 TNA Variation -2.82% NAV Variation -2.82% Currency CHF Benchmark SWISS MARKET INDEX Subscriptions 0.00 FUND RISK PROFILE Low Redemptions 0.00 RISK MANAGEMENT COMMENTS Stale price overview No stale price. Operational risk No material NAV error occurred during the period. No massive redemption occurred during the period. Risk Metrics: Scorecard reporting 4Cs (based on NAV date) Leverage Counterparty risk Concentration risk Liquidity risk . <100% NAV <5% or 10% <10% >90% liquid day Investment Compliance dashboard Type of breach Description Origin Start date Close Date Active/Passive Impact Regulator reporting UCITS 50 (2) (a) Persistent overdraft Start of warning period 14/01/2019 21/01/2019 WARNING N/A N/A Investment Compliance specific NA Total Expense Ratio - Internal limit 3% As of 28/06/2019 (Quarterly): Without transaction fees B CAP: 2.78% Portfolio Turnover As of 28/06/2019 (Quarterly): 26.02% Please note that PTR displayed is calculated on an annual basis as specified in the CSSF circular 03/122. VaR - Leverage NA Liquidity Risk No issue to report. Investment Manager comments 1 FUND RISK MANAGEMENT Monthly Report Umbrella Cosmos Lux International Net Asset Value 11,496,391.95 Sub-fund CHF Currency CHF August 2019 Portfolio date 26/08/2019 Regulatory main limit checks Check result Indicator Check result Indicator Issuer Exposure < 10% NAV 5.48% Cash Counterparty Exposure < 20% NAV 1.55% OECD Govt Bond Exposure < 35% NAV NA OTC Counterparty Exposure NA 5/40 Rule 10.55% Aggregated Group Exposure 5.48% Borrowing limit < 10% NAV NA Cover Rule (liquid assets vs. -

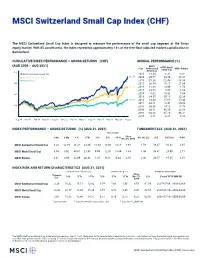

MSCI Switzerland Small Cap Index (CHF) (GROSS)

MSCI Switzerland Small Cap Index (CHF) The MSCI Switzerland Small Cap Index is designed to measure the performance of the small cap segment of the Swiss equity market. With 85 constituents, the index represents approximately 14% of the free float-adjusted market capitalization in Switzerland. CUMULATIVE INDEX PERFORMANCE — GROSS RETURNS (CHF) ANNUAL PERFORMANCE (%) (AUG 2006 – AUG 2021) MSCI Year Switzerland MSCI World MSCI Europe Small Cap Small Cap 400 MSCI Switzerland Small Cap 2020 13.34 6.32 -3.31 MSCI World Small Cap 361.59 2019 29.77 24.54 22.38 MSCI Europe 2018 -25.26 -12.48 -13.33 300 2017 36.54 18.11 21.04 271.92 2016 11.60 14.99 1.76 2015 13.70 0.86 -1.62 200 2014 8.62 14.32 5.38 2013 34.55 29.15 22.38 152.39 2012 14.34 15.65 17.40 2011 -24.11 -8.41 -10.22 100 2010 30.39 14.12 -5.79 2009 30.61 40.59 32.88 2008 -43.62 -45.10 -49.31 0 2007 8.61 -6.21 6.10 Aug 06 Nov 07 Feb 09 May 10 Aug 11 Nov 12 Feb 14 May 15 Aug 16 Nov 17 Feb 19 May 20 Aug 21 INDEX PERFORMANCE — GROSS RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr Dec 29, 2000 Div Yld (%) P/E P/E Fwd P/BV MSCI Switzerland Small Cap 3.20 10.19 36.21 23.49 11.64 13.96 14.06 8.93 1.56 59.37 30.08 2.95 MSCI World Small Cap 3.56 3.92 44.61 21.40 9.99 12.41 13.89 7.33 1.46 34.31 20.09 2.17 MSCI Europe 2.61 3.93 32.09 20.32 8.35 9.21 9.44 2.58 2.44 20.57 15.85 2.18 INDEX RISK AND RETURN CHARACTERISTICS (AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN Turnover Since 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr Dec 29, (%) Period YYYY-MM-DD (%) 2000 MSCI Switzerland Small Cap 3.38 18.32 15.11 13.82 0.74 1.00 1.06 0.55 61.59 2007-07-04—2009-03-09 MSCI World Small Cap 13.33 22.77 18.29 15.39 0.57 0.78 0.96 0.46 62.67 2007-06-19—2009-03-09 MSCI Europe 2.07 18.23 15.46 14.17 0.57 0.70 0.75 0.22 62.95 2007-07-16—2009-03-09 1 Last 12 months 2 Based on monthly gross returns data 3 Based on ICE LIBOR 1M The MSCI Switzerland Small Cap Index was launched on Jan 01, 2001. -

ANNUAL REPORT 2019 SEIZING OPPORTUNITIES Our Company Business Review Governance Compensation Financials

ANNUAL REPORT 2019 SEIZING OPPORTUNITIES Our Company Business Review Governance Compensation Financials WHO WE ARE SIG is a leading systems and solutions provider Contents for aseptic carton packaging. Our unique Our Company Compensation 03 Seizing opportunities 55 Letter from the Chairwoman of technology and outstanding innovation capacity 04 Letter from the Chairman and the Compensation Committee enable us to provide our customers with the Chief Executive Officer 56 Introduction 08 Market and industry review 56 Compensation governance end-to-end solutions for differentiated products, 10 Our business model 59 Compensation principles 11 Our strategy 60 Compensation framework for smarter factories and connected packs, all to 12 Our team the Board of Directors 13 Technology and innovation 63 Compensation framework for address the ever-changing needs of consumers. the Group Executive Board Business Review 70 Previous and discontinued 17 Regional review: compensation plans Founded in 1853, SIG is headquartered in 17 EMEA 70 Loans granted to members of Neuhausen, Switzerland. 20 APAC the Board of Directors or the 22 AMERICAS Group Executive Board 24 Responsible business review 71 Outlook for 2020 28 Key performance highlights 72 Report of the statutory auditor 29 Chief Financial Officer’s statement 34 Risk management Financials 73 Consolidated financial statements Governance 131 Financial statements 36 Board of Directors of the Company 38 Group Executive Board 40 Corporate Governance Report SIG 2019 Annual Report 02 Our Company Business Review Governance Compensation Financials SEIZING OPPORTUNITIES Our purpose We work in partnership with our customers to deliver food and beverages to consumers across the world in a safe, sustainable and affordable way.