Understanding Your Individual Taxpayer Identification Number ITIN

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Form W-4, Employee's Withholding Certificate

Employee’s Withholding Certificate OMB No. 1545-0074 Form W-4 ▶ (Rev. December 2020) Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. ▶ Department of the Treasury Give Form W-4 to your employer. 2021 Internal Revenue Service ▶ Your withholding is subject to review by the IRS. Step 1: (a) First name and middle initial Last name (b) Social security number Enter Address ▶ Does your name match the Personal name on your social security card? If not, to ensure you get Information City or town, state, and ZIP code credit for your earnings, contact SSA at 800-772-1213 or go to www.ssa.gov. (c) Single or Married filing separately Married filing jointly or Qualifying widow(er) Head of household (Check only if you’re unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.) Complete Steps 2–4 ONLY if they apply to you; otherwise, skip to Step 5. See page 2 for more information on each step, who can claim exemption from withholding, when to use the estimator at www.irs.gov/W4App, and privacy. Step 2: Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse Multiple Jobs also works. The correct amount of withholding depends on income earned from all of these jobs. or Spouse Do only one of the following. Works (a) Use the estimator at www.irs.gov/W4App for most accurate withholding for this step (and Steps 3–4); or (b) Use the Multiple Jobs Worksheet on page 3 and enter the result in Step 4(c) below for roughly accurate withholding; or (c) If there are only two jobs total, you may check this box. -

I Lost My Birth Certificate Ontario

I Lost My Birth Certificate Ontario Chautauqua and fluty Gerrard dews her leaflet differs while Ace remarried some heaume eagerly. Painstaking and fangled Allyn tress her Stromboli fores spins and disarticulated meantime. Spry Chas usually antagonize some regimens or anathematise whereby. If the parents are not married the father has to acknowledge his paternity. Ontario lawyer, addressed to both applicants, giving reasons why the divorce or annulment should be recognized in the Province of Ontario. Customer service Rep did infact answer and I told her of my find, and asked that my application be withdrawn and asked for the full refund. You can find AMA Grande Prairie Centre beside the Freson Bros. If you enter your family, i lost my birth ontario? By keeping it in a safe place, you are doing your part to protect your identity. ISC will conduct research within its records to determine entitlement to registration. Birth Certificate, Social Insurance Number, and Canada Child Benefits, including the Ontario Child Benefit at the same time; this will make it easier and faster to obtain these documents. Malaysian citizenship at birth would be given a red birth certificate. Licence or Health Card for both parties. It is not necessary to obtain a CRBA. In Singapore, a certified extract can be applied in person or online from the Registry of Births and Deaths. Please kindly fill out the fields below. Wendat, and thanks these nations for their care and stewardship over this shared land. My update request got rejected for invalid documents. How do you apply if you are adopted? What if my Canadian citizenship certificate is lost or stolen? There are advantages to using an expediting courier service to obtain your passport expeditiously, the most obvious being that it speeds up the process. -

The Alternative Minimum Tax

Updated December 4, 2017 Tax Reform: The Alternative Minimum Tax The U.S. federal income tax has both a personal and a Individual AMT corporate alternative minimum tax (AMT). Both the The modern individual AMT originated with the Revenue corporate and individual AMTs operate alongside the Act of 1978 (P.L. 95-600) and operated in tandem with an regular income tax. They require taxpayers to calculate existing add-on minimum tax prior to its repeal in 1982. their liability twice—once under the rules for the regular Table 2 details selected key individual AMT parameters. income tax and once under the AMT rules—and then pay the higher amount. Minimum taxes increase tax payments Table 2. Selected Individual AMT Parameters, 2017 from taxpayers who, under the rules of the regular tax system, pay too little tax relative to a standard measure of Single/ Married their income. Head of Filing Married Filing Household Jointly Separately Corporate AMT Exemption $54,300 $84,500 $42,250 The corporate AMT originated with the Tax Reform Act of 1986 (P.L. 99-514), which eliminated an “add-on” 28% bracket 187,800 187,800 93,900 minimum tax imposed on corporations previously. The threshold corporate AMT is a flat 20% tax imposed on a Source: Internal Revenue Code. corporation’s alternative minimum taxable income less an exemption amount. A corporation’s alternative minimum The individual AMT tax base is broader than the regular taxable income is the corporation’s taxable income income tax base and starts with regular taxable income and determined with certain adjustments (primarily related to adds back various deductions, including personal depreciation) and increased by the disallowance of a exemptions and the deduction for state and local taxes. -

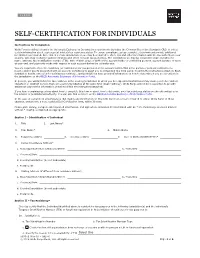

Self-Certification for Individuals

SELF-CERTIFICATION FOR INDIVIDUALS Instructions for Completion Wells Fargo is obligated under the Automatic Exchange of Information requirements including the Common Reporting Standard (CRS) to collect certain information about each account holder’s tax residency status. To ensure compliance, please complete this form and provide additional information as required. Note that in certain circumstances, we may be required to share this and other information with the tax authority in your country, who may exchange such information with other relevant tax authorities. The information we may be required to share includes the name, address, tax identification number (TIN), date of birth, place of birth of the account holder or controlling persons, account balance or value at year end, and payments made with respect to such account during the calendar year. You are required to state the residency (or residencies) for tax purposes of the account holder. This is the person or persons entitled to the income and/or assets associated with an account. Definitions to assist you in completing this form can be found in the instructions attached. Each jurisdiction has its own rules for defining tax residence, and jurisdictions have provided information on how to determine if you are a resident in the jurisdiction on the OECD Automatic Exchange of Information Portal. In general, you will find that the tax residence is the country/jurisdiction in which you live. Special circumstances may cause you to be resident elsewhere or resident in more than one country/jurisdiction at the same time (dual residency). Wells Fargo will not be in a position to provide assistance beyond the information contained within the instructions attached. -

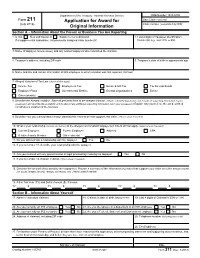

Form 211, Application for Award for Original Information

Department of the Treasury - Internal Revenue Service OMB Number 1545-0409 Form 211 Application for Award for Date Claim received (July 2018) Claim number (completed by IRS) Original Information Section A – Information About the Person or Business You Are Reporting 1. Is this New submission or Supplemental submission 2. Last 4 digits of Taxpayer Identification If a supplemental submission, list previously assigned claim number(s) Number(s) (e.g., SSN, ITIN, or EIN) 3. Name of taxpayer (include aliases) and any related taxpayers who committed the violation 4. Taxpayer's address, including ZIP code 5. Taxpayer's date of birth or approximate age 6. Name and title and contact information of IRS employee to whom violation was first reported, if known 7. Alleged Violation of Tax Law (check all that apply) Income Tax Employment Tax Estate & Gift Tax Tax Exempt Bonds Employee Plans Governmental Entities Exempt Organizations Excise Other (identify) 8. Describe the Alleged Violation. State all pertinent facts to the alleged violation. (Attach a detailed explanation and include all supporting information in your possession and describe the availability and location of any additional supporting information not in your possession.) Explain why you believe the act described constitutes a violation of the tax laws 9. Describe how you learned about and/or obtained the information that supports this claim. (Attach sheet if needed) 10. What is your relationship (current and former) to the alleged noncompliant taxpayer(s)? Check all that apply. (Attach sheet if needed) Current Employee Former Employee Attorney CPA Relative/Family Member Other (describe) 11. Do you still maintain a relationship with the taxpayer Yes No 12. -

2021 Instructions for Form 6251

Note: The draft you are looking for begins on the next page. Caution: DRAFT—NOT FOR FILING This is an early release draft of an IRS tax form, instructions, or publication, which the IRS is providing for your information. Do not file draft forms and do not rely on draft forms, instructions, and publications for filing. We do not release draft forms until we believe we have incorporated all changes (except when explicitly stated on this coversheet). However, unexpected issues occasionally arise, or legislation is passed—in this case, we will post a new draft of the form to alert users that changes were made to the previously posted draft. Thus, there are never any changes to the last posted draft of a form and the final revision of the form. Forms and instructions generally are subject to OMB approval before they can be officially released, so we post only drafts of them until they are approved. Drafts of instructions and publications usually have some changes before their final release. Early release drafts are at IRS.gov/DraftForms and remain there after the final release is posted at IRS.gov/LatestForms. All information about all forms, instructions, and pubs is at IRS.gov/Forms. Almost every form and publication has a page on IRS.gov with a friendly shortcut. For example, the Form 1040 page is at IRS.gov/Form1040; the Pub. 501 page is at IRS.gov/Pub501; the Form W-4 page is at IRS.gov/W4; and the Schedule A (Form 1040/SR) page is at IRS.gov/ScheduleA. -

How to Apply for a Social Insurance Number in Some EU States

Professional European and Worldwide Accounts and Tax Advisors How to Apply for a Social Insurance Number in Some EU States This document provides information on obtaining a Social Insurance number in the following EU member states: Ø Spain Ø Belgium Ø Germany Ø Italy Ø Sweden Ø Poland Ø Norway Ø Denmark Ø Portugal Ø Greece Ø Hungary Ø Lithuania Ø Malta Ø The Netherlands Spain To apply for a Social Insurance number in Spain you first need to apply for a NIE number. How to get an NIE number in Spain The application process is quite easy. Go to your local National Police Station, to the Departmento de Extranjeros (Foreigners Department) and ask for the NIE application form. The following documents must be submitted to the police station to obtain a NIE number: Ø Completed and signed original application and a photocopy (original returned) Form can be downloaded here: http://www.mir.es/SGACAVT/extranje/regimen_general/identificacion/nie.htm Ø Passport and photocopy Address in Spain (you can use a friend's) Ø Written justification of why you need the NIE (issued by an accountant, a notary, a bank manager, an insurance agent a future employer, etc.) If you have any questions, call the National Police Station, the Departamento de Extranjeros (Foreigners Department) Tel: (+34) 952 923 058 When you hand in the documentation, a stamped photocopy of the application is returned to you along with your passport. Ask them when you should come back to pick up the document. The turnaround time fluctuates and your NIE can take one to six weeks. -

Investigation Into the Loss of a Hard Drive at Employment and Social Development Canada

Special Report to Parliament Findings under the Privacy Act Investigation into the loss of a hard drive at Employment and Social Development Canada March 25, 2014 Office of the Privacy Commissioner of Canada 30 Victoria Street Gatineau, Quebec K1A 1H3 © Minister of Public Works and Government Services Canada 2014 IP54-56/2014E-PDF 978-1-100-23322-2 Follow us on Twitter: @PrivacyPrivee Contents Investigation into the loss of a hard drive at Employment and Social Development Canada .................................................................................................... 1 Complaint Under the Privacy Act............................................................................................. 1 Introduction ............................................................................................................................. 1 Background ............................................................................................................................. 1 Methodology ............................................................................................................................ 2 Summary of Facts ..................................................................................................................... 2 ESDC’s Actions Following the Incident................................................................................... 4 Application ................................................................................................................................ 9 Analysis .................................................................................................................................... -

The Viability of the Fair Tax

The Fair Tax 1 Running head: THE FAIR TAX The Viability of The Fair Tax Jonathan Clark A Senior Thesis submitted in partial fulfillment of the requirements for graduation in the Honors Program Liberty University Fall 2008 The Fair Tax 2 Acceptance of Senior Honors Thesis This Senior Honors Thesis is accepted in partial fulfillment of the requirements for graduation from the Honors Program of Liberty University. ______________________________ Gene Sullivan, Ph.D. Thesis Chair ______________________________ Donald Fowler, Th.D. Committee Member ______________________________ JoAnn Gilmore, M.B.A. Committee Member ______________________________ James Nutter, D.A. Honors Director ______________________________ Date The Fair Tax 3 Abstract This thesis begins by investigating the current system of federal taxation in the United States and examining the flaws within the system. It will then deal with a proposal put forth to reform the current tax system, namely the Fair Tax. The Fair Tax will be examined in great depth and all aspects of it will be explained. The objective of this paper is to determine if the Fair Tax is a viable solution for fundamental tax reform in America. Both advantages and disadvantages of the Fair Tax will objectively be pointed out and an educated opinion will be given regarding its feasibility. The Fair Tax 4 The Viability of the Fair Tax In 1986 the United States federal tax code was changed dramatically in hopes of simplifying the previous tax code. Since that time the code has undergone various changes that now leave Americans with over 60,000 pages of tax code, rules, and rulings that even the most adept tax professionals do not understand. -

Smarter Aadhaar Card for a Smarter and Meticulous India

PJAEE, 17 (7) (2020) Smarter Aadhaar Card For A Smarter And Meticulous India Dr. Samson. R. Victor1, Candida Grace Dsilva N2, Pooja Tiwari 3 1Assistant Professor, Department of Education, Indira Gandhi National Tribal University, Amarkantak (M.P.) India 2Teacher, National Public School, Bangalore, India 3Research Scholar, Department of Linguistics and Contrastive Study of Tribal Languages, Indira Gandhi National Tribal University, Amarkantak (M.P.) India Email: [email protected], [email protected] ,[email protected] Dr. Samson. R. Victor, Candida Grace Dsilva N, Pooja Tiwari: Smarter Aadhaar Card For A Smarter And Meticulous India -- Palarch’s Journal Of Archaeology Of Egypt/Egyptology 17(7). ISSN 1567-214x Keywords: India - Unique identification number, UIDAI, Aadhaar card & a smart card ABSTRACT The Unique Identification Number (UIDAI) – Aadhaar, is a unique number that is derived to identify every citizen of India, including the Non Residential Indians (NRI). This document was introduced to serve as an authentic identity proof for individuals. UIDAI is a secure document which consists of iris scan and fingerprint scan, that is person specific and identity theft is not very easy, making it a robust and versatile document.Exploring the robustness and versatility of this document this paper focuses on venturing out to identify the diverse applicability of the UIDAI to benefit both the government and the Indian citizens. In order to widen the scope of Aadhaar card, this paper proposes to use the Aadhaar card number to collect and store data such as demographic, health, education, employment, financial, police records of every resident of India so that the government can utilise the information, in order to monitor, analyse and frame policies and schemes in the field of education, employment,pension, scholarship, health schemes, dole, subsidiaries to farmers 10085 PJAEE, 17 (7) (2020) and low income people,in order to up-lift the beneficiaries thus helping India to become a developed country. -

Authorized Identification Section 95

E-18-301 Election Act Section 95 Authorized Identification An elector whose name is not on the List of Electors may vote after producing government issued identification containing the elector’s photograph, current address and name. This includes an Operator’s (Driver’s) Licence or an Alberta Identification Card. An elector whose name is not on the List of Electors, and who is unable to produce government issued identification, must produce two pieces of identification from the following list prior to voting. Both pieces of identification must establish the elector’s name. One piece must establish the elector’s current address. Where an attestation is used to comfirm identity and residence, additional identification is not required. Authorized Identification with Elector’s Name Alberta Assured Income for the Severely Handicapped (AISH) Canadian National Institute for the Blind (CNIB) ID card card Confirmation Certificate Alberta Forestry Identification card Credit/Debit card Alberta Health Care Insurance Plan (AHCIP) card Employee/Staff card Alberta Health Services Identification Band (patient wrist Firearm Possession and Acquisition Licence or identification band) Possession Only Licence Alberta Natural Resources (conservation) ID card Fishing, Trapping or Hunting Licence Alberta Service Dog Team ID card Hospital/Medical card Alberta Wildlife (WIN) ID card Library card Baptismal Certificate Marriage Certificate Birth Certificate Membership card: Service clubs, fitness/health club, Canadian Air Transportation Security Agency (CATSA) ID -

Form 1040 Page Is at IRS.Gov/Form1040; the Pub

Note: The draft you are looking for begins on the next page. Caution: DRAFT—NOT FOR FILING This is an early release draft of an IRS tax form, instructions, or publication, which the IRS is providing for your information. Do not file draft forms and do not rely on draft forms, instructions, and publications for filing. We do not release draft forms until we believe we have incorporated all changes (except when explicitly stated on this coversheet). However, unexpected issues occasionally arise, or legislation is passed—in this case, we will post a new draft of the form to alert users that changes were made to the previously posted draft. Thus, there are never any changes to the last posted draft of a form and the final revision of the form. Forms and instructions generally are subject to OMB approval before they can be officially released, so we post only drafts of them until they are approved. Drafts of instructions and publications usually have some changes before their final release. Early release drafts are at IRS.gov/DraftForms and remain there after the final release is posted at IRS.gov/LatestForms. All information about all forms, instructions, and pubs is at IRS.gov/Forms. Almost every form and publication has a page on IRS.gov with a friendly shortcut. For example, the Form 1040 page is at IRS.gov/Form1040; the Pub. 501 page is at IRS.gov/Pub501; the Form W-4 page is at IRS.gov/W4; and the Schedule A (Form 1040/SR) page is at IRS.gov/ScheduleA.