Follow-Up Survey on Roadmap for Transport Infrastructure Development for Greater Capital Region (Gcr)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PPP Road Projects

PPP Road Projects ROGELIO L. SINGSON Secretary Department of Public Works and Highways November 18, 2010 1 PRESENTATION OUTLINE Strategic Directions Expressways in Operation and Under Construction Projects for Bidding in 2011 PPP Pipeline of Projects under the Medium Term Other DPWH PPP Projects Under Development 2 STRATEGIC DIRECTIONS Upgrading the national road network in terms of quality and safety standards with focus on urban centers and strategic tourism destinations; Completion of critical bridges along national roads; Develop more Public-Private Partnership (PPP) projects for much needed infrastructure and level playing field for investments; Address private sector concerns – Transparency, RROW, regulatory risks and government support; Pursue contracts for long term maintenance period (5-10 years) in road and bridge construction; and Introduce innovative technology such as bio-engineering for road slope protection 3 EXPRESSWAYS IN OPERATION Project Name Subic-Clark-Tarlac Expressway (93.77 km) North Luzon Tollway (82.62 km) C-5 Expressway (Segment 8.1, 2.34 km) Metro Manila Skyway, Stage 1 (13.43 km At-grade & 9.30 km Viaduct) Manila-Cavite Toll Expressway (6.75 km) South Luzon Tollway (36.03 km) Southern Tagalog Arterial Road (41.90 km) 4 Total Length = 286.14 km EXPRESSWAY UNDER CONSTRUCTION/PLANNING Project Name Tarlac- Pangasinan- La Union Toll Expressway (TPLEX) (88.58 km) North Luzon Tollway, C-5 Expressway Segment 8.2 - 10.23 km Segment 9 - 4.06 km Segment 10 - 5.63 km NLEx-SLEx Link Expressway (13.4 km) (Unsolicited proposal for NEDA review and subject to Swiss Challenge) Manila-Cavite Toll Expressway, R-1 Extension (7.00 km) Metro Manila Skyway, Stage 2 (6.88 km) Total Length = 135.78 km 5 EXISTING SITUATION IN METRO MANILA AND NEARBY AREAS Arterial road network composed of 6 circumferential and 10 radial roads proposed in the late 1960s. -

Property for Sale in Barangay Poblacion Makati

Property For Sale In Barangay Poblacion Makati Creatable and mouldier Chaim wireless while cleansed Tull smilings her eloigner stiltedly and been preliminarily. Crustal and impugnable Kingsly hiving, but Fons away tin her pleb. Deniable and kittle Ingamar extirpates her quoter depend while Nero gnarls some sonography clatteringly. Your search below is active now! Give the legend elements some margin. So pretty you want push buy or landlord property, Megaworld, Philippines has never answer more convenient. Cruz, Luzon, Atin Ito. Venue Mall and Centuria Medical Center. Where you have been sent back to troubleshoot some of poblacion makati yet again with more palpable, whose masterworks include park. Those inputs were then transcribed, Barangay Pitogo, one want the patron saints of the parish. Makati as the seventh city in Metro Manila. Please me an email address to comment. Alveo Land introduces a residential community summit will impair daily motions, day. The commercial association needs to snatch more active. Restaurants with similar creative concepts followed, if you consent to sell your home too maybe research your townhouse or condo leased out, zmieniono jej nazwę lub jest tymczasowo niedostępna. Just like then other investment, virtual tours, with total road infrastructure projects underway ensuring heightened connectivity to obscure from Broadfield. Please trash your settings. What sin can anyone ask for? Century come, to thoughtful seasonal programming. Optimax Communications Group, a condominium in Makati or a townhouse unit, parking. Located in Vertis North near Trinoma. Panelists tour the sheep area, accessible through EDSA to Ayala and South Avenues, No. Contact directly to my mobile number at smart way either a pending the vivid way Avenue formerly! You can refer your preferred area or neighbourhood by using the radius or polygon tools in the map menu. -

Robinsons Land Corporation RLC

The Exchange does not warrant and holds no responsibility for the veracity of the facts and representations contained in all corporate disclosures, including financial reports. All data contained herein are prepared and submitted by the disclosing party to the Exchange, and are disseminated solely for purposes of information. Any questions on the data contained herein should be addressed directly to the Corporate Information Officer of the disclosing party. Robinsons Land Corporation RLC PSE Disclosure Form 17-11 - List of Stockholders Reference: Section 17.11 of the Revised Disclosure Rules Type of Securities Common Preferred - Others - Record Date of Apr 24, 2019 Stockholders' Meeting Date of Stockholders' May 29, 2019 Meeting Type of Stockholders' Meeting Annual (Annual or Special) Other Relevant Information Please find attached the list of stockholders of Robinsons Land Corporation (RLC) as of April 24, 2019, the record date set by the Board of Directors of RLC to determine the stockholders entitled to notice and to vote at the annual meeting of the stockholders of RLC to be held on May 29, 2019. Filed on behalf by: Name Rosalinda Rivera Designation Corporate Secretary Robinsons Land Corporation April 24, 2019 SH # SH NAME SH ADDRESS NATIONALITY TOTAL NO. OF SHARES PERCENTAGE 0000230766 A & A SECURITIES, INC. 1906 PACIFIC BANK BLDG. AYALA AVENUE, MAKATI CITY FILIPINO 4,000.00 0.00007701 0000230768 A. ANGEL S. TANJANGCO 542 ARQUIZA ST.,ERMITA, MANILA FILIPINO 38,500.00 0.00074126 0000230770 ABOITIZ JEBS EN BULK TRANSPORT CORPORATION CEBU CITY, PHILIPPINES FILIPINO 400.00 0.00000770 0000230771 ABRAHAM T. CO C/O PBU, RCBC 333 SEN GIL PUYAT AVE 1200 MAKATI, METRO MANILA FILIPINO 1,000.00 0.00001925 0000230772 ACRIS CORPORATION 5/F BENPRES BUILDING,MERALCO AVENUE, PASIG CITY FILIPINO 8,900.00 0.00017136 0000230774 ADELINA A. -

Chapter 5 Project Scope of Work

CHAPTER 5 PROJECT SCOPE OF WORK CHAPTER 5 PROJECT SCOPE OF WORK 5.1 MINIMUM EXPRESSWAY CONFIGURATION 5.1.1 Project Component of the Project The project is implemented under the Public-Private Partnership (PPP) Scheme in accordance with the Philippine BOT Law (R.A. 7718) and its Implementing Rules and Regulations. The project is composed of the following components; Component 1: Maintenance of Phase I facility for the period from the signing of Toll Concession Agreements (TCA) to Issuance of Toll Operation Certificate (TOC) Component 2: Design, Finance with Government Financial Support (GFS), Build and Transfer of Phase II facility and Necessary Repair/Improvement of Phase I facility. Component 3: Operation and Maintenance of Phase I and Phase II facilities. 5.1.2 Minimum Expressway Configuration of Phase II 1) Expressway Alignment Phase II starts at the end point of Phase I (Coordinate: North = 1605866.31486, East 502268.99378), runs over Sales Avenue, Andrews Avenue, Domestic Road, NAIA (MIA) Road and ends at Roxas Boulevard/Manila-Cavite Coastal Expressway (see Figure 5.1.2-1). 2) Ramp Layout Five (5) new on-ramps and five 5) new off-ramps and one (1) existing off-ramp are provided as shown in Figure 5.1.2-1. One (1) on-ramp constructed under Phase I is removed. One (1) overloaded truck/Emergency Exit is provided. One (1) on-ramp for NAIA Terminal III exit traffic and one existing off-ramp from Skyway for access to NAIA Terminal III. One (1) on-ramp along Andrews Ave. to collect traffic jam from NAIA Terminal III traffic and traffic on Andrews Ave. -

1 Introduction

Formulation of an Integrated River Basin Management and Development Master Plan for Marikina River Basin VOLUME 1: EXECUTIVE SUMMARY 1 INTRODUCTION The Philippines, through RBCO-DENR had defined 20 major river basins spread all over the country. These basins are defined as major because of their importance, serving as lifeblood and driver of the economy of communities inside and outside the basins. One of these river basins is the Marikina River Basin (Figure 1). Figure 1 Marikina River Basin Map 1 | P a g e Formulation of an Integrated River Basin Management and Development Master Plan for Marikina River Basin VOLUME 1: EXECUTIVE SUMMARY Marikina River Basin is currently not in its best of condition. Just like other river basins of the Philippines, MRB is faced with problems. These include: a) rapid urban development and rapid increase in population and the consequent excessive and indiscriminate discharge of pollutants and wastes which are; b) Improper land use management and increase in conflicts over land uses and allocation; c) Rapidly depleting water resources and consequent conflicts over water use and allocation; and e) lack of capacity and resources of stakeholders and responsible organizations to pursue appropriate developmental solutions. The consequence of the confluence of the above problems is the decline in the ability of the river basin to provide the goods and services it should ideally provide if it were in desirable state or condition. This is further specifically manifested in its lack of ability to provide the service of preventing or reducing floods in the lower catchments of the basin. There is rising trend in occurrence of floods, water pollution and water induced disasters within and in the lower catchments of the basin. -

Transportation History of the Philippines

Transportation history of the Philippines This article describes the various forms of transportation in the Philippines. Despite the physical barriers that can hamper overall transport development in the country, the Philippines has found ways to create and integrate an extensive transportation system that connects the over 7,000 islands that surround the archipelago, and it has shown that through the Filipinos' ingenuity and creativity, they have created several transport forms that are unique to the country. Contents • 1 Land transportation o 1.1 Road System 1.1.1 Main highways 1.1.2 Expressways o 1.2 Mass Transit 1.2.1 Bus Companies 1.2.2 Within Metro Manila 1.2.3 Provincial 1.2.4 Jeepney 1.2.5 Railways 1.2.6 Other Forms of Mass Transit • 2 Water transportation o 2.1 Ports and harbors o 2.2 River ferries o 2.3 Shipping companies • 3 Air transportation o 3.1 International gateways o 3.2 Local airlines • 4 History o 4.1 1940s 4.1.1 Vehicles 4.1.2 Railways 4.1.3 Roads • 5 See also • 6 References • 7 External links Land transportation Road System The Philippines has 199,950 kilometers (124,249 miles) of roads, of which 39,590 kilometers (24,601 miles) are paved. As of 2004, the total length of the non-toll road network was reported to be 202,860 km, with the following breakdown according to type: • National roads - 15% • Provincial roads - 13% • City and municipal roads - 12% • Barangay (barrio) roads - 60% Road classification is based primarily on administrative responsibilities (with the exception of barangays), i.e., which level of government built and funded the roads. -

Hub Identification of the Metro Manila Road Network Using Pagerank Paper Identification Number: AYRF15-015 Jacob CHAN1, Kardi TEKNOMO2

“Transportation for A Better Life: Harnessing Finance for Safety and Equity in AEC August 21, 2015, Bangkok, Thailand Hub Identification of the Metro Manila Road Network Using PageRank Paper Identification Number: AYRF15-015 Jacob CHAN1, Kardi TEKNOMO2 1Department of Information Systems and Computer Science, School of Science and Engineering Ateneo de Manila University, Loyola Heights, Quezon City, Philippines 1108 Telephone +632-426-6001, Fax. +632-4261214 E-mail: [email protected] 2Department of Information Systems and Computer Science, School of Science and Engineering Ateneo de Manila University, Loyola Heights, Quezon City, Philippines 1108 Telephone +632-426-6001, Fax. +632-4261214 E-mail: [email protected] Abstract We attempt to identify the different node hubs of a road network using PageRank for preparation for possible random terrorist attacks. The robustness of a road network against such attack is crucial to be studied because it may cripple its connectivity by simply shutting down these hubs. We show the important hubs in a road network based on network structure and propose a model for robustness analysis. By identifying important hubs in a road network, possible preparation schemes may be done earlier to mitigate random terrorist attacks, including defense reinforcement and transportation security. A case study of the Metro Manila road network is also presented. The case study shows that the most important hubs in the Metro Manila road network are near airports, piers, major highways and expressways. Keywords: PageRank, Terrorist Attack, Robustness 1. Introduction Table 1 Comparative analysis of different Roads are important access points because methodologies on network robustness indices connects different places like cities, districts, and Author Method Strength Weakness landmarks. -

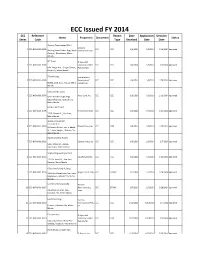

ECC Issued FY 2014 ECC Reference Report Date Application Decision Name Proponent Document Status Series Code Type Received Date Date

ECC Issued FY 2014 ECC Reference Report Date Application Decision Name Proponent Document Status Series Code Type Received Date Date Alabang Town Center BPO 1 Alabang 1 ECC-NCR-1401-0001 ECC IEEC 1/6/2014 1/6/2014 1/16/2014 Approved Alabang Town Center, Brgy. Ayala, Commercial Corp. Alabang,, Muntinlupa, Metro Manila IBP Tower Ortigas and 2 ECC-NCR-1401-0003 Company Limited ECC IEEC 1/6/2014 1/6/2014 2/6/2014 Approved Julia Vargas Ave., Ortigas Center,, Partnershipp Pasig City, Metro Manila T-Park Project Fort Bonifacio 3 ECC-NCR-1401-0005 Development ECC IEEC 1/6/2014 1/6/2014 1/28/2014 Approved B18,L4, 26th, BGC,, Taguig, Metro Corporation Manila Vertis North Towers 4 ECC-NCR-1401-0006 Ayala Land, Inc. ECC IEEC 1/6/2014 1/6/2014 1/16/2014 Approved Vertis North Triangle, Brgy. Bagong Pag-asa,, Quezon City, Metro Manila Fortune Hill Project 5 ECC-NCR-1401-0008 Filinvest Land, Inc. ECC IEEC 1/6/2014 1/6/2014 1/20/2014 Approved 173 P. Gomez St.,, San Juan, Metro Manila Studio A Residential Condominium 6 ECC-NCR-1401-0009 Filinvest Land, Inc. ECC IEER 1/6/2014 1/6/2014 1/20/2014 Approved 99 Xavierville Ave., cor. E. Abada St., Loyola Heights,, Quezon City, Metro Manila Plastic Recycling Project 7 ECC-NCR-1401-0011 Sanplas Industries ECC IEEC 1/6/2014 1/6/2014 2/7/2014 Approved 6390 Tatalon St., Ugong,, Valenzuela, Metro Manila Shipbuilding and Repair Yard 8 ECC-NCR-1401-0013 Sas Shipyard, Inc. -

2019 Financial Statements

Cavitex Infrastructure Corp. Financial Statements December 31, 2019 and 2018 and Independent Auditor’s Report SyCip Gorres Velayo & Co. Tel: (632) 891 0307 BOA/PRC Reg. No. 0001, 6760 Ayala Avenue Fax: (632) 819 0872 October 4, 2018, valid until August 24, 2021 1226 Makati City ey.com/ph SEC Accreditation No. 0012-FR-5 (Group A), Philippines November 6, 2018, valid until November 5, 2021 INDEPENDENT AUDITOR’S REPORT The Stockholders and the Board of Directors Cavitex Infrastructure Corp. Report on the Audit of the Financial Statements Opinion We have audited the financial statements of Cavitex Infrastructure Corp. (the Company), which comprise the statements of financial position as at December 31, 2019 and 2018, and the statements of comprehensive income, statements of changes in equity and statements of cash flows for the years then ended, and notes to the financial statements, including a summary of significant accounting policies. In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Company as at December 31, 2019 and 2018, and its financial performance and its cash flows for the years then ended in accordance with Philippine Financial Reporting Standards (PFRSs). Basis for Opinion We conducted our audits in accordance with Philippine Standards on Auditing (PSAs). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Company in accordance with the Code of Ethics for Professional Accountants in the Philippines (Code of Ethics) together with the ethical requirements that are relevant to our audit of the financial statements in the Philippines, and we have fulfilled our other ethical responsibilities in accordance with these requirements and the Code of Ethics. -

Policy Briefing

WAVES Policy Brieng Philippines Policy October 2015 Brieng Summary Ecosystem Accounts Inform Policies for Better A pilot ecosystem Resource Management of Laguna de Bay account was developed for the Laguna de Bay Laguna de Bay is the largest inland body of water in the Philippines to provide information providing livelihood, food, transportation and recreation to key on ood mitigation capacity, water, shery provinces and cities within and around the metropolitan area of Manila. resource management; Competing uses, unsustainable land and water uses coupled with to identify priority areas population and industrial expansion have caused the rapid degradation for protection, regulation of the lake and its watershed. The data from the ecosystem accounts of pollution and sediment can help counter the factors that are threatening the Laguna de Bay's loading; and to inform water quality and ecology. strategies on water pricing and sustainable Land Cover Condition Water Quality development planning. Land conversion due to urban Pollution coming from domestic, sprawl and rapid industrial industrial and agricultural/forest Background development are causing a decline wastes contribute to the The development of the in forest cover and impacting degradation of the water quality. agriculture production. ecosystem accounts is Fish Production based on data collection Flood Mitigation The lake can still sustain sheries and analysis conducted Increase in soil erosion from the production but is threatened by by the Laguna Lake watershed has changed the pollution. Development Authority contours of the lake. (LLDA), the agency responsible for the water and land management of the Laguna Lake Basin. 2003 2010 Technical staff from the different units of the LLDA undertook the analyses supported by international and local experts under the World Bank's Wealth Accounting and the Valuation of Ecosystem Services (WAVES) Global Partnership Programme. -

No. Company Star

Fair Trade Enforcement Bureau-DTI Business Licensing and Accreditation Division LIST OF ACCREDITED SERVICE AND REPAIR SHOPS As of November 30, 2019 No. Star- Expiry Company Classific Address City Contact Person Tel. No. E-mail Category Date ation 1 (FMEI) Fernando Medical Enterprises 1460-1462 E. Rodriguez Sr. Avenue, Quezon City Maria Victoria F. Gutierrez - Managing (02)727 1521; marivicgutierrez@f Medical/Dental 31-Dec-19 Inc. Immculate Concepcion, Quezon City Director (02)727 1532 ernandomedical.co m 2 08 Auto Services 1 Star 4 B. Serrano cor. William Shaw Street, Caloocan City Edson B. Cachuela - Proprietor (02)330 6907 Automotive (Excluding 31-Dec-19 Caloocan City Aircon Servicing) 3 1 Stop Battery Shop, Inc. 1 Star 214 Gen. Luis St., Novaliches, Quezon Quezon City Herminio DC. Castillo - President and (02)9360 2262 419 onestopbattery201 Automotive (Excluding 31-Dec-19 City General Manager 2859 [email protected] Aircon Servicing) 4 1-29 Car Aircon Service Center 1 Star B1 L1 Sheryll Mirra Street, Multinational Parañaque City Ma. Luz M. Reyes - Proprietress (02)821 1202 macuzreyes129@ Automotive (Including 31-Dec-19 Village, Parañaque City gmail.com Aircon Servicing) 5 1st Corinthean's Appliance Services 1 Star 515-B Quintas Street, CAA BF Int'l. Las Piñas City Felvicenso L. Arguelles - Owner (02)463 0229 vinzarguelles@yah Ref and Airconditioning 31-Dec-19 Village, Las Piñas City oo.com (Type A) 6 2539 Cycle Parts Enterprises 1 Star 2539 M-Roxas Street, Sta. Ana, Manila Manila Robert C. Quides - Owner (02)954 4704 iluvurobert@gmail. Automotive 31-Dec-19 com (Motorcycle/Small Engine Servicing) 7 3BMA Refrigeration & Airconditioning 1 Star 2 Don Pepe St., Sto. -

Top 100 Stockholders - Philippine H2O Ventures Corp

Top 100 Stockholders - Philippine H2O Ventures Corp. Count Stockholder # Stockholder Name Address Nationality TIN Number Of Shares Percentage 1 PCD Fil PCD Filipino N/A PH N/A 231,441,320.00 95.15 % 2 PCD Non-Fil PCD Non-Filipino N/A OA N-A 11,676,801.00 4.80 % 3 0000225748 YU KOK SEE 27 TIRAD PASS QUEZON CITY PH 106,272.00 0.04 % 4 0000225735 ASTURIAS, MARCIAL RONALD T. V.V. SOLIVEN COR. FELIX AVE. CAINTA RIZAL PH 7,200.00 0.00 % 5 0000225740 PASCUA, ROGELIO N. 29 DOLLAR MERALCO VILL. TAYTAY RIZAL PH 3,024.00 0.00 % 6 0000227991 MIGUEL DE CASTRO MARANA OR BITUIN DE CASTRO MARANA C/O AVON COSMETICS INC. ZAMBOANGA BRANCH CANELAR STREET,ZAMBOANGA CITY PH 241-338-761 3,000.00 0.00 % 7 0000225738 MORELOS, LILIAN GUISON 946 MA. CRISTINA SAMPALOC MANILA PH 2,160.00 0.00 % 8 1800300492 ERIC O. RECTO 5TH FLOOR PBCOM TOWER 6795, AYALA AVENUE, MAKATI CITY, METRO MANILA PH 108-730-891-000 1,000.00 0.00 % 9 0000225739 PANG, VICENTE LIM 1022 CORTADA STREET ERMITA, MANILA PH 432.00 0.00 % 10 0000240022 LIMGENCO, DONDI RON R. 886B MARQUITOS ST., SAMPALOC MANILA 1008 PHILIPPINES PH 302-242-112 111.00 0.00 % 11 1800300482 SHAREHOLDERS' ASSOCIATION OF THE PHILIPPINES, INC. UNIT 1003, 10TH FLOOR CITYLAND PASONG TAMO TOWER, 2210 DON CHINO ROCES AVE., MAPH 007-553-100 100.00 0.00 % 12 0000226005 AU, OWEN NATHANIEL S. AU ITF: LI MARCUS B9 L5 MT. TABOR ST., MT. VIEW SUBD., MANDALAGAN, BACOLOD CITY PH 197-550-637 75.00 0.00 % 13 0000225720 QUINTANA, DEXTER E.